Asia Pacific Anti Friction Coating Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

466.95 Million

USD

890.24 Million

2025

2033

USD

466.95 Million

USD

890.24 Million

2025

2033

| 2026 –2033 | |

| USD 466.95 Million | |

| USD 890.24 Million | |

|

|

|

|

Segmentación del mercado de recubrimientos antifricción en Asia-Pacífico, por producto (MOS₂, PTFE, grafito, FEP, PFA y disulfuro de tungsteno), naturaleza (base solvente y base agua), aplicación (autopartes, elementos de transmisión de potencia, rodamientos, componentes de municiones, componentes y actuadores de válvulas, entre otros), uso final (automotriz, aeroespacial, marítimo, construcción, atención médica, entre otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de recubrimientos antifricción en Asia-Pacífico

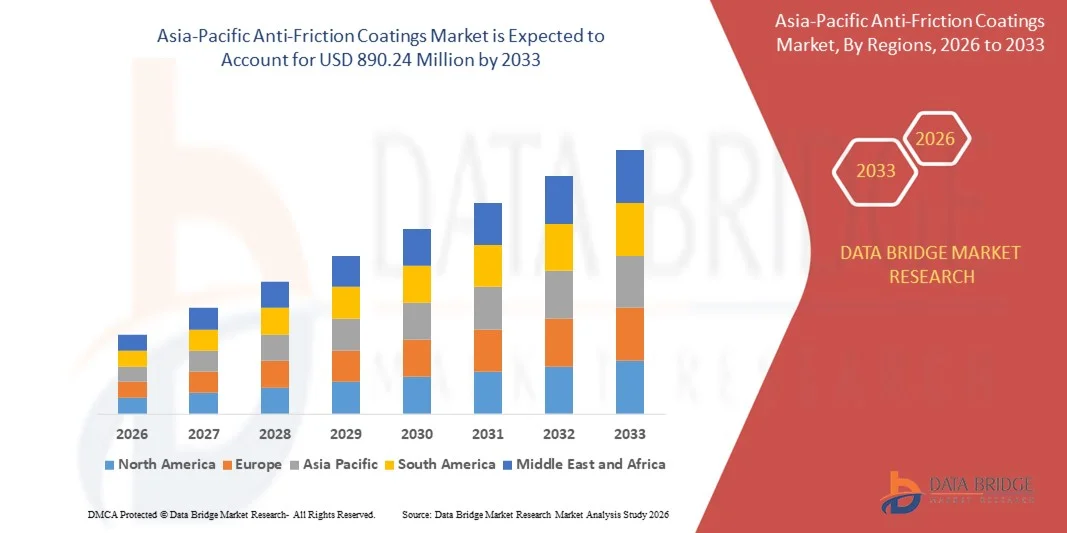

- El tamaño del mercado de recubrimientos antifricción de Asia-Pacífico se valoró en USD 466,95 millones en 2025 y se espera que alcance los USD 890,24 millones para 2033 , con una CAGR del 8,4 % durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente demanda de una mayor durabilidad de los componentes, eficiencia energética y menor desgaste en los sectores automotriz, industrial, aeroespacial y de atención médica, donde los recubrimientos antifricción desempeñan un papel fundamental para minimizar las pérdidas mecánicas y extender la vida útil del equipo.

- Además, el creciente enfoque en la eficiencia operativa, los menores costos de mantenimiento y el cumplimiento de estrictos estándares ambientales y de rendimiento está acelerando la adopción de soluciones avanzadas de recubrimiento antifricción, lo que apoya significativamente la expansión general del mercado.

Análisis del mercado de recubrimientos antifricción en Asia-Pacífico

- Los recubrimientos antifricción, diseñados para reducir la fricción de la superficie, el desgaste y la degradación del material, se han vuelto esenciales en las aplicaciones modernas de fabricación e ingeniería debido a su capacidad para mejorar el rendimiento, la confiabilidad y la vida útil de los componentes críticos que operan en condiciones exigentes.

- La creciente demanda de estos recubrimientos se debe principalmente a la creciente automatización industrial, los avances en las tecnologías de recubrimiento y la expansión del uso de materiales livianos y de alto rendimiento en las principales industrias de uso final, lo que refuerza la trayectoria de crecimiento constante del mercado.

- China dominó el mercado de recubrimientos antifricción en 2025, debido a su amplia base de fabricación, producción automotriz a gran escala y fuerte presencia de fabricación de maquinaria pesada y equipos industriales en múltiples provincias.

- Se espera que India sea la región de más rápido crecimiento en el mercado de recubrimientos antifricción durante el período de pronóstico debido a la rápida expansión de la fabricación de automóviles, la producción de equipos industriales y el desarrollo de infraestructura.

- El segmento de PTFE dominó el mercado con un 56,22 % en 2025, gracias a sus excelentes propiedades de baja fricción, resistencia química y amplia aplicabilidad en componentes automotrices, industriales y aeroespaciales. Los recubrimientos de PTFE son los preferidos para mejorar el rendimiento, reducir el desgaste y prolongar la vida útil de maquinaria crítica, especialmente en aplicaciones que requieren lubricación constante y resistencia a entornos operativos agresivos.

Alcance del informe y segmentación del mercado de recubrimientos antifricción

|

Atributos |

Recubrimientos antifricción: Perspectivas clave del mercado |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de importación y exportación, descripción general de la capacidad de producción, análisis del consumo de producción, análisis de tendencias de precios, escenario de cambio climático, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de recubrimientos antifricción en Asia-Pacífico

Creciente adopción de recubrimientos antifricción respetuosos con el medio ambiente

- Una tendencia significativa en el mercado de recubrimientos antifricción es la creciente adopción de soluciones de recubrimiento ecológicas y bajas en COV, impulsada por el endurecimiento de las normativas ambientales y el aumento de los compromisos de sostenibilidad en los sectores automotriz, industrial y aeroespacial. Los fabricantes están adoptando activamente formulaciones a base de agua, con control de PFAS y con reducción de disolventes para cumplir con los marcos regulatorios y, al mismo tiempo, mantener el rendimiento y la durabilidad del recubrimiento.

- Por ejemplo, DuPont ha ampliado su cartera de recubrimientos avanzados de baja fricción con perfiles ambientales mejorados que contribuyen a la reducción de emisiones y al cumplimiento de las cambiantes regulaciones químicas mundiales. Estos avances permiten a los usuarios finales cumplir los objetivos de sostenibilidad sin comprometer la resistencia al desgaste ni la reducción de la fricción.

- Los fabricantes de automóviles integran cada vez más recubrimientos antifricción ecológicos para mejorar la eficiencia del combustible y reducir las pérdidas mecánicas, a la vez que cumplen con los mandatos de reducción de emisiones. Esta tendencia está reforzando el papel de los recubrimientos sostenibles en las plataformas de vehículos y sistemas de propulsión de nueva generación.

- Los fabricantes de equipos industriales también priorizan los recubrimientos respetuosos con el medio ambiente para mejorar la seguridad en el trabajo y cumplir con los requisitos de cumplimiento normativo industrial más estrictos. Esto está acelerando la adopción de recubrimientos lubricantes sólidos avanzados y a base de agua en entornos de fabricación a gran escala.

- El sector aeroespacial está incorporando progresivamente recubrimientos antifricción respetuosos con el medio ambiente para equilibrar los requisitos de diseño ligero con la durabilidad y el cumplimiento normativo. Este cambio refuerza la demanda de recubrimientos que ofrezcan una larga vida útil y reduzcan el impacto ambiental.

- En general, el creciente énfasis en la sostenibilidad, la alineación regulatoria y la optimización del rendimiento está posicionando a los recubrimientos antifricción respetuosos con el medio ambiente como una tendencia clave que configura el desarrollo futuro del mercado.

Dinámica del mercado de recubrimientos antifricción en Asia-Pacífico

Conductor

Creciente demanda de mayor durabilidad de los componentes y eficiencia energética

- La creciente demanda de una mayor durabilidad y eficiencia energética de los componentes en aplicaciones automotrices, de maquinaria industrial y aeroespaciales es un importante impulsor del mercado de recubrimientos antifricción. Estos recubrimientos reducen significativamente el desgaste superficial, las pérdidas por fricción y el consumo de energía, lo que favorece una mayor vida útil de los equipos y una mayor eficiencia operativa.

- Por ejemplo, Parker Hannifin aplica tecnologías avanzadas de recubrimiento antifricción para mejorar la durabilidad y la eficiencia de los componentes de movimiento y control utilizados en equipos industriales y móviles. Estas aplicaciones ayudan a reducir la frecuencia de mantenimiento y las pérdidas de energía en condiciones de operación de alta carga.

- Los fabricantes de automóviles recurren cada vez más a los recubrimientos antifricción para mejorar el ahorro de combustible y prolongar la vida útil de los componentes del motor y la transmisión. Esta demanda está directamente relacionada con estándares de eficiencia más estrictos y la necesidad de reducir el coste total de propiedad.

- En la automatización industrial y los sistemas de transmisión de potencia, los recubrimientos desempeñan un papel fundamental para minimizar el tiempo de inactividad y mejorar la eficiencia mecánica. Esto impulsa su adopción sistemática en la fabricación de alta precisión y la maquinaria pesada.

- Los sectores de la salud y los dispositivos médicos también contribuyen a este impulso, ya que los recubrimientos duraderos y de baja fricción mejoran la fiabilidad y el rendimiento de los instrumentos quirúrgicos y los dispositivos implantables. El enfoque continuo en la eficiencia, la fiabilidad y la optimización del ciclo de vida continúa reforzando este impulso, impulsando un crecimiento constante del mercado en múltiples industrias de uso final.

Restricción/Desafío

Altos costos de producción y procesos de aplicación complejos

- El mercado de recubrimientos antifricción se enfrenta a desafíos relacionados con los altos costos de producción y los complejos procesos de aplicación que requieren equipos especializados, mano de obra cualificada y entornos de procesamiento controlados. Estos factores incrementan los gastos de fabricación y limitan la flexibilidad de costos para los proveedores de recubrimientos.

- Por ejemplo, CARL BECHEM GMBH utiliza técnicas avanzadas de formulación y aplicación para ofrecer recubrimientos antifricción de alto rendimiento para usos industriales y automotrices. Estos procesos de precisión incrementan los costos operativos y dificultan la reducción de costos a gran escala.

- Lograr un espesor, una adhesión y un rendimiento de recubrimiento consistentes suele implicar procesos de aplicación y curado de varios pasos. Estos requisitos prolongan los plazos de producción y aumentan la complejidad general de la fabricación.

- El uso de materias primas especializadas y lubricantes sólidos contribuye aún más a la volatilidad de los costos y a los desafíos de la cadena de suministro. Los fabricantes deben equilibrar el rendimiento de los materiales con la viabilidad económica.

- En conjunto, los altos costos y la complejidad técnica continúan desafiando la adopción generalizada, obligando a los participantes de la industria a invertir en optimización de procesos y tecnologías de aplicación rentables para sostener el crecimiento a largo plazo.

Alcance del mercado de recubrimientos antifricción en Asia-Pacífico

El mercado está segmentado en función del producto, la naturaleza, la aplicación y el uso final.

- Por producto

Según el producto, el mercado se segmenta en MOS2, PTFE, grafito, FEP, PFA y disulfuro de tungsteno. El segmento de PTFE registró la mayor cuota de mercado en 2025, gracias a sus excelentes propiedades de baja fricción, resistencia química y amplia aplicabilidad en componentes automotrices, industriales y aeroespaciales. Los recubrimientos de PTFE son los preferidos para mejorar el rendimiento, reducir el desgaste y prolongar la vida útil de maquinaria crítica, especialmente en aplicaciones que requieren lubricación constante y resistencia a entornos operativos agresivos.

Se prevé que el segmento MOS2 experimente el mayor crecimiento entre 2026 y 2033, impulsado por su superior capacidad de carga y estabilidad a altas temperaturas, lo que lo hace ideal para aplicaciones de alto rendimiento en motores de automóviles, componentes de transmisión de potencia y maquinaria industrial. Los recubrimientos MOS2 son especialmente populares por reducir la fricción en condiciones extremas, mejorar la eficiencia operativa y minimizar los costos de mantenimiento en sistemas expuestos a alta presión y cargas térmicas fluctuantes.

- Por naturaleza

En función de su naturaleza, el mercado se segmenta en base solvente y base agua. El segmento base agua tuvo la mayor participación en 2025, impulsado por las crecientes regulaciones ambientales y la preferencia por soluciones de recubrimiento ecológicas. Los recubrimientos base agua ofrecen menores emisiones de COV, mayor seguridad en el trabajo y cumplimiento de las normas de sostenibilidad, lo que los hace cada vez más adecuados para operaciones de recubrimiento industriales y automotrices a gran escala.

Se prevé que el segmento de recubrimientos a base de solventes experimente el mayor crecimiento entre 2026 y 2033, impulsado por su alta adhesión, alto rendimiento en condiciones adversas y su idoneidad para aplicaciones industriales y automotrices críticas. Los recubrimientos a base de solventes siguen siendo los preferidos donde se requiere durabilidad y una resistencia operativa extrema, especialmente en aplicaciones con altas temperaturas, cargas pesadas y entornos corrosivos.

- Por aplicación

Según su aplicación, el mercado se segmenta en autopartes, componentes de transmisión de potencia, rodamientos, componentes de munición, componentes de válvulas y actuadores, entre otros. El segmento de autopartes mantuvo la mayor cuota de mercado en 2025 debido a la creciente demanda de componentes ligeros y de alto rendimiento y a los estrictos estándares de eficiencia automotriz. Los recubrimientos antifricción mejoran el consumo de combustible, reducen el desgaste y mejoran la fiabilidad de los sistemas automotrices, lo que permite intervalos de servicio más largos y un mejor rendimiento del vehículo.

Se prevé que el segmento de transmisión de potencia experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente automatización industrial y la demanda de cajas de engranajes y maquinaria de alta eficiencia. Los recubrimientos reducen la fricción, mejoran la eficiencia energética y minimizan el tiempo de inactividad, lo que los hace cruciales en las operaciones industriales modernas, donde la productividad y la fiabilidad son prioridades clave.

- Por uso final

Según el uso final, el mercado se segmenta en automoción, aeroespacial, marítimo, construcción, salud y otros. El segmento automotriz registró la mayor participación en los ingresos en 2025, impulsado por el crecimiento de la producción de vehículos, la adopción de tecnologías de bajo consumo de combustible y la prioridad de reducir los costos de mantenimiento. Los recubrimientos antifricción mejoran el rendimiento del motor, la vida útil de los componentes y la eficiencia general del vehículo, contribuyendo a una mayor durabilidad y a la reducción de las pérdidas operativas.

Se prevé que el segmento aeroespacial experimente el mayor crecimiento entre 2026 y 2033, impulsado por la creciente necesidad de componentes ligeros y de alto rendimiento capaces de soportar temperaturas y tensiones extremas. Los recubrimientos proporcionan lubricación superior, resistencia al desgaste y eficiencia energética, aspectos fundamentales para aplicaciones aeroespaciales que requieren alta fiabilidad y largos ciclos de vida operativos.

Análisis regional del mercado de recubrimientos antifricción en Asia-Pacífico

- China dominó el mercado de recubrimientos antifricción con la mayor participación en los ingresos en 2025, impulsada por su vasta base de fabricación, producción automotriz a gran escala y fuerte presencia de fabricación de maquinaria pesada y equipos industriales en múltiples provincias.

- El fuerte crecimiento de la automatización industrial, la rápida expansión de la fabricación de automóviles y vehículos eléctricos y la demanda continua de transmisión de potencia, cojinetes y componentes industriales refuerzan el liderazgo de China en el consumo de revestimiento antifricción en diversas industrias de uso final.

- La presencia de grandes fabricantes nacionales de recubrimientos, extensas cadenas de suministro industriales y una alta adopción en los sectores de automoción, electrónica y maquinaria siguen consolidando la posición dominante de China. Las inversiones continuas en instalaciones de fabricación avanzadas, tecnologías de ingeniería de superficies y procesos industriales energéticamente eficientes refuerzan aún más la penetración en el mercado de los principales clústeres industriales.

Análisis del mercado de recubrimientos antifricción en Japón

Se prevé un crecimiento sostenido del mercado japonés de recubrimientos antifricción entre 2026 y 2033, gracias a su avanzado ecosistema de fabricación y a su fuerte énfasis en la ingeniería de precisión y los estándares de calidad. Los fabricantes japoneses de automóviles y productos electrónicos recurren cada vez más a recubrimientos antifricción de alto rendimiento para respaldar sistemas de producción justo a tiempo y componentes de alta fiabilidad. La creciente demanda de los sectores de la automoción, la robótica y la maquinaria industrial mantiene el uso constante de recubrimientos. Los continuos avances en la ciencia de los materiales y las tecnologías de tratamiento de superficies refuerzan el crecimiento estable del mercado. La prioridad de Japón en la eficiencia operativa, la durabilidad y la fiabilidad de los productos respalda su sólida posición regional.

Análisis del mercado de recubrimientos antifricción en India

Se proyecta que India registrará la tasa de crecimiento anual compuesta (TCAC) más rápida en el mercado de recubrimientos antifricción de Asia Pacífico durante el período 2026-2033, impulsada por la rápida expansión de la fabricación de automóviles, la producción de equipos industriales y el desarrollo de infraestructura. La creciente adopción de recubrimientos antifricción en componentes automotrices, sistemas de transmisión de potencia y maquinaria pesada está acelerando la demanda del mercado. Las inversiones en corredores industriales, clústeres manufactureros y capacidades avanzadas de ingeniería de superficies están mejorando la penetración del mercado en todas las regiones. El crecimiento de las exportaciones, el mayor enfoque en la eficiencia energética y el énfasis en la reducción de los costos de mantenimiento impulsan aún más la adopción. Estos factores posicionan a India como el mercado de recubrimientos antifricción de más rápido crecimiento en la región de Asia Pacífico.

Cuota de mercado de recubrimientos antifricción en Asia-Pacífico

La industria de recubrimientos antifricción está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- DuPont (EE. UU.)

- Parker Hannifin Corp (EE. UU.)

- CARL BECHEM GMBH (Alemania)

- ASV Mutichemie Private Limited (India)

- Whitmore Manufacturing LLC (EE. UU.)

- FUCHS LUBRITECH GmbH (Alemania)

- Lubrizol Corporation (EE. UU.)

- Klüber Lubrication (Alemania)

- Royal DSM NV (Países Bajos)

- Evonik Industries AG (Alemania)

Últimos avances en el mercado de recubrimientos antifricción en Asia-Pacífico

- En enero de 2026, SSG anunció el establecimiento de una planta de recubrimientos médicos en Costa Rica con una inversión a largo plazo superior a los $10 millones para la adquisición de terrenos y la construcción de instalaciones dedicadas, una medida que se espera que mejore significativamente su capacidad de producción de recubrimientos antifricción especializados al tiempo que fortalece su presencia en el segmento de la atención médica, mejora la eficiencia de la cadena de suministro y respalda la creciente demanda de soluciones de recubrimiento biocompatibles y de alta precisión.

- En mayo de 2025, PPG Industries presentó una nueva generación de recubrimientos antifricción sin cobre y de fricción ultrabaja, en consonancia con sus continuos esfuerzos de expansión de la capacidad de fabricación. Se prevé que este desarrollo refuerce el liderazgo de la compañía en el mercado al cumplir con estrictas normativas ambientales, apoyar los objetivos de sostenibilidad y abordar los crecientes requisitos de rendimiento en aplicaciones aeroespaciales, industriales y automotrices.

- En abril de 2025, Orion Industries presentó soluciones avanzadas de recubrimiento antifricción diseñadas para aplicaciones aeroespaciales y de defensa, destacando el cambio de la industria hacia tecnologías de alta durabilidad y resistencia al desgaste que reducen la fricción en condiciones operativas extremas, extienden la vida útil de los componentes y mejoran la confiabilidad en entornos críticos y de alto estrés.

- En mayo de 2021, DuPont lanzó la grasa MOLYKOTE G-1079, un recubrimiento antifricción con reducción de ruido, diseñado específicamente para aplicaciones de contacto deslizante en actuadores, incluidos los vehículos eléctricos de nueva generación. La nueva formulación mejora el rendimiento tanto en movimientos rápidos con cargas elevadas como en movimientos lentos con cargas reducidas, lo que mejora la eficiencia operativa y la longevidad de los componentes. Esta innovación fortalece la cartera de productos de DuPont y se espera que impulse las ventas en el mercado al satisfacer la creciente demanda de lubricantes avanzados de alto rendimiento en los sectores automotriz e industrial.

- En abril de 2021, Whitmore Manufacturing, LLC presentó Lustor, un sistema escalable de almacenamiento y dispensación de lubricantes. Esta unidad compacta y duradera prolonga la vida útil de los lubricantes y se adapta a prácticamente cualquier ubicación industrial, ofreciendo mayor eficiencia y facilidad de uso. Este desarrollo facilita la optimización operativa para clientes industriales y fortalece la presencia de Whitmore Manufacturing en el mercado, contribuyendo positivamente al crecimiento de los ingresos y a la adopción de soluciones de lubricación avanzadas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.