Asia Pacific And Us Warehouse Management System Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

1.06 Billion

USD

3.79 Billion

2024

2032

USD

1.06 Billion

USD

3.79 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 3.79 Billion | |

|

|

|

|

Segmentación del mercado de sistemas de gestión de almacenes en Asia-Pacífico y EE. UU. por componentes (grúas, sistemas automatizados de almacenamiento y recuperación, robots, transportadores y sistemas de clasificación, vehículos guiados automáticos, entre otros), funciones (recepción y almacenamiento, control de inventario, gestión de patios y muelles, asignación de espacios, selección, gestión de personal y tareas, envíos, entre otros), oferta (software y servicios), implementación (nube/SaaS y local), tipo de nivel (SGA avanzado, SGA intermedio y SGA básico), usuario final (comercio electrónico, alimentación y bebidas, logística de terceros, electricidad y electrónica, automoción, metales y maquinaria, atención médica, productos químicos, entre otros): tendencias y pronóstico del sector hasta 2032.

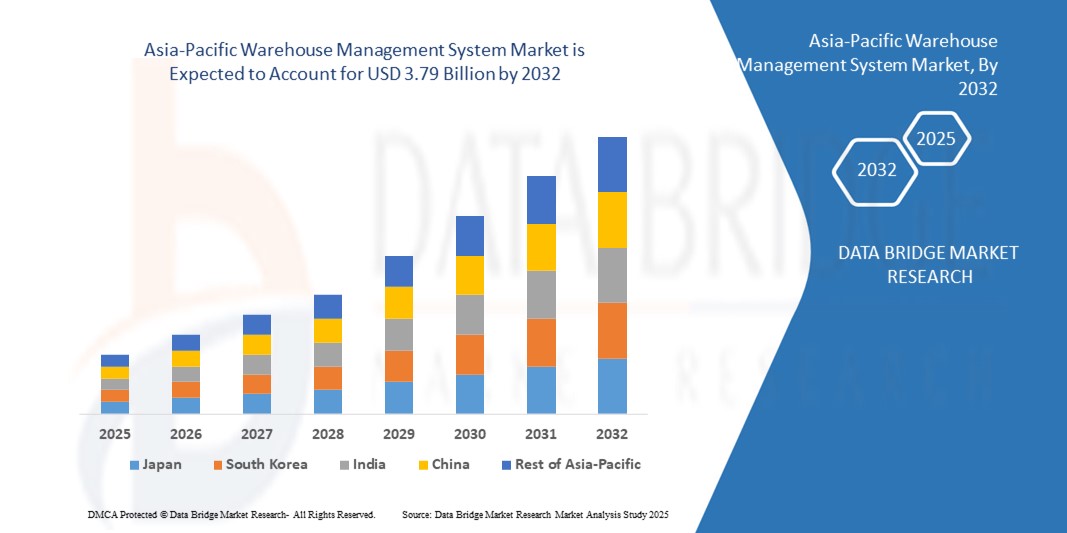

Tamaño del mercado de sistemas de gestión de almacenes de Asia-Pacífico

- El tamaño del mercado del sistema de gestión de almacenes de Asia-Pacífico se valoró en USD 1.06 mil millones en 2024 y se espera que alcance los USD 3.79 mil millones para 2032 , a una CAGR del 17,30% durante el período de pronóstico y el tamaño del mercado del sistema de gestión de almacenes de EE. UU. se valoró en USD 991,8 millones en 2024 y se espera que alcance los USD 3506,54 millones para 2032 , a una CAGR del 17,1% durante el período de pronóstico

- El crecimiento del mercado está impulsado en gran medida por la creciente adopción de automatización, robótica y tecnologías de cadena de suministro digital en almacenes y centros de distribución, lo que conduce a una mayor eficiencia operativa, menores costos laborales y una mejor gestión del inventario.

- Además, la creciente demanda de visibilidad en tiempo real, seguimiento preciso del inventario y operaciones de almacén optimizadas por parte de los sectores del comercio electrónico, el comercio minorista, la manufactura y la logística de terceros está consolidando los sistemas de gestión de almacenes como una solución crucial para las cadenas de suministro modernas. Estos factores convergentes están acelerando la adopción de sistemas de gestión de almacenes, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de sistemas de gestión de almacenes en Asia-Pacífico

- Los sistemas de gestión de almacenes son soluciones de software que permiten a las empresas gestionar y optimizar las operaciones de almacén, incluyendo el control de inventario, el cumplimiento de pedidos, la recepción y el almacenamiento, la preparación de pedidos, los envíos y la gestión del personal. Estos sistemas se integran con plataformas de automatización, robótica y planificación de recursos empresariales para mejorar la eficiencia y la precisión de las operaciones de almacén.

- La creciente demanda de sistemas de gestión de almacenes se ve impulsada principalmente por el crecimiento del comercio electrónico y la venta minorista omnicanal, la creciente complejidad de las cadenas de suministro, el aumento de los costes laborales y la necesidad de un procesamiento de pedidos más rápido y preciso. Las empresas adoptan cada vez más soluciones WMS basadas en la nube, con inteligencia artificial y accesibles desde dispositivos móviles para lograr agilidad operativa y competitividad.

- China dominó el mercado de sistemas de gestión de almacenes en 2024, debido a su sector de comercio electrónico en rápido crecimiento, la expansión de su base de fabricación y la creciente adopción de soluciones de automatización y cadena de suministro digital.

- Se espera que Asia-Pacífico sea el país de más rápido crecimiento en el mercado de sistemas de gestión de almacenes durante el período de pronóstico debido a

- El segmento de servicios dominó el mercado con una cuota de mercado del 81,41 % en 2024, debido a la creciente demanda de soluciones de implementación, personalización, formación y mantenimiento que garanticen una integración fluida y un rendimiento óptimo de los sistemas de gestión de almacenes. Las empresas priorizan los servicios profesionales para reducir los riesgos de implementación, mejorar la eficiencia operativa y aprovechar al máximo el potencial de las capacidades avanzadas del software. Además, la creciente complejidad de las operaciones de almacén y la necesidad de soporte y actualizaciones continuas contribuyen aún más al predominio del segmento de servicios en el mercado.

Alcance del informe y segmentación del mercado de sistemas de gestión de almacenes

|

Atributos |

Perspectivas clave del mercado del sistema de gestión de almacenes |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

A NOSOTROS |

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis experto en profundidad, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle. |

Tendencias del mercado de sistemas de gestión de almacenes en Asia-Pacífico

Integración de IA y robótica para automatizar las operaciones del almacén

- La integración de la inteligencia artificial y la robótica en los sistemas de gestión de almacenes está mejorando rápidamente la eficiencia operativa y la escalabilidad. Estas tecnologías permiten a los almacenes aumentar la velocidad, la precisión y la productividad, a la vez que minimizan las tareas que requieren mucha mano de obra y los errores humanos en entornos logísticos complejos.

- Por ejemplo, GreyOrange ha implementado robots avanzados impulsados por IA para automatizar las operaciones de clasificación y selección en almacenes de marcas como Flipkart. Esto ilustra cómo la robótica y la IA están transformando las funciones del almacén y redefiniendo los estándares de precisión de pedidos y eficiencia de procesamiento.

- Los sistemas de gestión de almacenes con IA se utilizan cada vez más para el análisis predictivo, lo que ayuda a pronosticar la demanda, optimizar la ubicación del inventario y agilizar el procesamiento de pedidos. Estas capacidades ofrecen un gran valor a las empresas que buscan equilibrar la rápida evolución de los mercados con el control de costes y la calidad del servicio.

- La integración robótica facilita flujos de trabajo optimizados mediante sistemas de picking automatizados, brazos robóticos para paletización y vehículos autónomos guiados para la manipulación de materiales. En conjunto, estas soluciones reducen significativamente los tiempos de ciclo y mejoran la flexibilidad para gestionar la demanda estacional o fluctuante.

- Esta tendencia también se está expandiendo a las pequeñas y medianas empresas, donde se está adoptando la integración de IA y robótica en la nube para alcanzar la misma eficiencia operativa que los grandes minoristas. Esta democratización de la automatización avanzada de almacenes está abriendo nuevas vías para una mayor penetración en el mercado.

- En conclusión, la fusión de la IA y la robótica en los sistemas de gestión de almacenes está transformando el funcionamiento de los almacenes. Al permitir la automatización, la precisión y la inteligencia en tiempo real, estos avances impulsan a la industria hacia infraestructuras de cadena de suministro más inteligentes y preparadas para el futuro.

Dinámica del mercado de sistemas de gestión de almacenes en Asia-Pacífico

Conductor

Creciente demanda de visibilidad del inventario en tiempo real y un cumplimiento de pedidos más rápido

- La creciente demanda de visibilidad del inventario en tiempo real, sumada a la presión por cumplir con los pedidos con rapidez, es un factor clave que impulsa la adopción de sistemas de gestión de almacenes. Las empresas buscan sistemas que les permitan rastrear, gestionar y optimizar el inventario con precisión, a la vez que facilitan un procesamiento de pedidos fluido.

- Por ejemplo, Manhattan Associates ha desarrollado soluciones avanzadas de WMS que permiten a los minoristas obtener información de inventario en tiempo real, tanto en centros de distribución como en tiendas. Su implementación con importantes marcas minoristas ejemplifica la importancia de WMS para garantizar experiencias de cumplimiento de clientes más rápidas y eficientes.

- La visibilidad en tiempo real garantiza que las discrepancias de stock se minimicen y se maximice la precisión de los pedidos. Esto permite a las empresas reducir los pedidos pendientes, evitar costosas roturas de stock y mejorar la satisfacción del cliente gracias a la disponibilidad fiable de los productos.

- El auge del comercio minorista omnicanal está incrementando aún más la demanda de sistemas de gestión de almacenes. Dado que los clientes esperan entregas al día siguiente o incluso el mismo día, las empresas necesitan sistemas que coordinen el inventario en múltiples canales para ofrecer un cumplimiento unificado.

- En resumen, la creciente importancia de la velocidad y la precisión en el cumplimiento de pedidos convierte la visibilidad en tiempo real en una necesidad estratégica para las empresas modernas. Por ello, los sistemas de gestión de almacenes se han convertido en herramientas esenciales para lograr una ventaja competitiva en mercados de alta demanda.

Restricción/Desafío

Altos costos y complejidad de la implementación del sistema

- La elevada inversión inicial y la complejidad asociadas a la implementación de sistemas de gestión de almacenes siguen siendo un desafío importante para las organizaciones. Los costos relacionados con las licencias de software, la infraestructura de hardware, la personalización y la integración pueden ser considerables para muchas empresas.

- Por ejemplo, las empresas que adoptan SAP Extended Warehouse Management suelen reportar plazos de implementación extensos y altos costos de consultoría y capacitación. Esto demuestra la gran cantidad de recursos que se requieren para la transición de los procesos de almacén tradicionales a plataformas WMS totalmente optimizadas.

- Las dificultades de integración aumentan la complejidad, ya que el WMS debe integrarse fluidamente con sistemas ERP, plataformas de gestión de pedidos y sistemas de gestión de transporte. Garantizar la compatibilidad y un flujo de datos fluido entre múltiples plataformas suele prolongar los plazos de los proyectos y aumentar los costes.

- Además, capacitar al personal del almacén para operar y gestionar eficazmente soluciones WMS avanzadas requiere tiempo e inversión, lo que genera ralentizaciones temporales de la productividad durante las fases de transición. Esto se vuelve especialmente difícil para las empresas que gestionan grandes volúmenes a diario.

- En última instancia, la combinación de barreras de costo y complejidad ralentiza la adopción a gran escala, especialmente para las pequeñas y medianas empresas. El desarrollo de soluciones en la nube más rentables, interfaces intuitivas y estrategias de implementación modulares será fundamental para reducir estas limitaciones y ampliar las oportunidades de adopción global.

Alcance del mercado de sistemas de gestión de almacenes en Asia-Pacífico

El mercado está segmentado en función de componentes, funciones, oferta, implementación, tipo de nivel y usuario final.

- Por componentes

En función de sus componentes, el mercado de sistemas de gestión de almacenes se segmenta en grúas, sistemas automatizados de almacenamiento y recuperación, robots, transportadores y sistemas de clasificación, vehículos guiados automatizados, entre otros. El segmento de sistemas automatizados de almacenamiento y recuperación dominó la mayor cuota de mercado en 2024, impulsado por su eficiencia en la automatización de los procesos de almacenamiento y recuperación, minimizando al mismo tiempo los costes laborales y los errores humanos. Los almacenes recurren cada vez más a los sistemas automatizados de almacenamiento y recuperación para lograr un almacenamiento de alta densidad, una gestión de pedidos más rápida y una integración fluida con la infraestructura existente. La capacidad de gestionar diversos tipos de productos y optimizar el uso del espacio refuerza aún más su preferencia entre los almacenes de gran escala y de comercio electrónico.

Se prevé que el segmento de vehículos de guiado automático experimente el mayor crecimiento entre 2025 y 2032, impulsado por su creciente adopción en la manipulación automatizada de materiales y la intralogística. Los vehículos de guiado automático ofrecen soluciones de transporte flexibles y autónomas dentro de los almacenes, reduciendo la dependencia del trabajo manual y optimizando el flujo de trabajo. Su compatibilidad con la robótica y el software de sistemas de gestión de almacenes (SGA) los hace especialmente adecuados para operaciones de gran volumen y diseños de almacén dinámicos, lo que impulsa la demanda en los sectores de la logística y la fabricación.

- Por funciones

En función de sus funciones, el mercado de sistemas de gestión de almacenes se segmenta en recepción y almacenamiento, control de inventario, gestión de patios y muelles, asignación de plazas, picking, gestión de personal y tareas, envíos, entre otros. El segmento de control de inventario registró la mayor cuota de mercado en 2024, gracias a su papel fundamental para garantizar niveles de stock precisos, reducir el exceso o la rotura de stock y facilitar la visibilidad del almacén en tiempo real. Las funciones avanzadas de gestión de inventario, como el código de barras, el seguimiento por radiofrecuencia y la integración con sistemas de planificación de recursos empresariales (ERP), han hecho de esta función algo indispensable para los almacenes modernos que buscan eficiencia operativa y reducción de costes.

Se prevé que el segmento de picking experimente la tasa de crecimiento anual compuesta más rápida entre 2025 y 2032, impulsado por la creciente necesidad de un procesamiento de pedidos más rápido y preciso en los sectores del comercio electrónico y el comercio minorista. Las soluciones de picking automatizadas y semiautomatizadas, a menudo integradas con robótica e inteligencia artificial, reducen los errores de picking, optimizan la asignación de personal y mejoran el rendimiento, convirtiéndolo en un área funcional de alto crecimiento en las operaciones de almacén.

- Ofreciendo

En función de la oferta, el mercado de sistemas de gestión de almacenes se segmenta en software y servicios. El segmento de servicios dominó la mayor cuota de mercado en ingresos, con un 81,41%, en 2024, gracias a la creciente demanda de soluciones de implementación, personalización, formación y mantenimiento que garantizan una integración fluida y un rendimiento óptimo de los sistemas de gestión de almacenes. Las empresas priorizan los servicios profesionales para reducir los riesgos de implementación, mejorar la eficiencia operativa y aprovechar al máximo el potencial de las capacidades avanzadas del software. Además, la creciente complejidad de las operaciones de almacén y la necesidad de soporte y actualizaciones continuas contribuyen aún más al predominio del segmento de servicios en el mercado.

Se proyecta que el segmento de software experimentará el mayor crecimiento entre 2025 y 2032, impulsado por la creciente necesidad de visibilidad en tiempo real, automatización y toma de decisiones basada en datos en los almacenes. El software de Sistema de Gestión de Almacenes (SGA) permite un control centralizado del inventario, la gestión de pedidos y la optimización del flujo de trabajo, proporcionando información práctica que mejora la eficiencia operativa y reduce los costos operativos.

- Por Despliegue

Según su implementación, el mercado de sistemas de gestión de almacenes se segmenta en nube o software como servicio (SaaS) y local. El segmento local registró la mayor cuota de mercado en 2024 debido a la preferencia de las grandes empresas por un mayor control sobre la seguridad de los datos, la personalización y los requisitos de cumplimiento. Las soluciones de sistemas de gestión de almacenes locales ofrecen a las organizaciones la flexibilidad de integrarse con la infraestructura de tecnología de la información existente y cumplir con las estrictas normas regulatorias en sectores sensibles como el sanitario y el químico.

Se prevé que el segmento de la nube o software como servicio experimente la tasa de crecimiento anual compuesta más rápida entre 2025 y 2032, impulsada por la creciente adopción de soluciones flexibles, escalables y rentables. Un sistema de gestión de almacenes basado en la nube permite el acceso en tiempo real desde múltiples ubicaciones, reduce los costos iniciales de infraestructura y facilita una rápida implementación, lo que lo hace muy atractivo para pequeñas y medianas empresas y operaciones de comercio electrónico con múltiples ubicaciones que buscan agilidad y transformación digital.

- Por tipo de nivel

Según el tipo de nivel, el mercado de sistemas de gestión de almacenes se segmenta en sistemas avanzados, intermedios y básicos. El segmento de sistemas avanzados de gestión de almacenes registró la mayor cuota de mercado en 2024, gracias a sus completas funciones, como análisis basados en inteligencia artificial, integración de automatización y monitorización del rendimiento en tiempo real. Los grandes almacenes y las operaciones de comercio electrónico prefieren sistemas avanzados de gestión de almacenes para optimizar flujos de trabajo complejos, mejorar la precisión y optimizar la visibilidad de la cadena de suministro en múltiples nodos.

Se prevé que el segmento de Sistemas de Gestión de Almacenes Intermedios experimente el mayor crecimiento entre 2025 y 2032, impulsado por la creciente adopción entre las empresas medianas que buscan un equilibrio entre coste y sofisticación funcional. Los Sistemas de Gestión de Almacenes Intermedios ofrecen capacidades modulares, fácil integración y suficiente automatización, lo que permite a las empresas en crecimiento mejorar la eficiencia de sus almacenes sin grandes inversiones iniciales.

- Por el usuario final

Según el usuario final, el mercado de sistemas de gestión de almacenes se segmenta en comercio electrónico, alimentación y bebidas, logística de terceros, electrónica, automoción, metales y maquinaria, salud, productos químicos, entre otros. El segmento de comercio electrónico registró la mayor cuota de mercado en 2024, impulsado por el crecimiento exponencial del comercio minorista en línea y la necesidad de un procesamiento de pedidos más rápido y sin errores. Un sistema de gestión de almacenes eficiente permite a los operadores de comercio electrónico gestionar grandes volúmenes de pedidos en lotes pequeños, optimizar la rotación de inventario y satisfacer las expectativas de los consumidores con entregas en el mismo día o al día siguiente.

Se prevé que el segmento de logística de terceros experimente la tasa de crecimiento anual compuesta más rápida entre 2025 y 2032, impulsada por la creciente externalización de servicios de almacenamiento y distribución. Los proveedores de logística de terceros recurren cada vez más a los Sistemas de Gestión de Almacenes (SGA) para ofrecer soluciones logísticas escalables, integradas y tecnológicamente avanzadas, lo que les permite gestionar múltiples clientes, garantizar entregas puntuales y mejorar la eficiencia operativa en sus redes.

Análisis regional del mercado de sistemas de gestión de almacenes de Asia-Pacífico

- China dominó el mercado de sistemas de gestión de almacenes con la mayor participación en los ingresos en 2024, impulsada por su sector de comercio electrónico en rápido crecimiento, la expansión de su base de fabricación y la creciente adopción de soluciones de automatización y cadena de suministro digital.

- Las sólidas inversiones en infraestructura de almacenamiento, junto con el impulso del gobierno a la logística inteligente y las iniciativas de la Industria 4.0, refuerzan el liderazgo de China en el mercado regional.

- La presencia de los principales proveedores nacionales de tecnología de almacenamiento, las colaboraciones con proveedores de soluciones globales y la introducción de sistemas de gestión de almacenamiento rentables pero tecnológicamente avanzados continúan consolidando

Análisis del mercado de sistemas de gestión de almacenes en Japón

Se prevé que el mercado japonés de sistemas de gestión de almacenes experimente un crecimiento sostenido entre 2025 y 2032, impulsado por sus avanzados sectores de fabricación y logística, así como por su fuerte énfasis en la eficiencia operativa y la transformación digital. Las empresas japonesas adoptan cada vez más soluciones de almacenamiento automatizado, robótica y sistemas de software integrados para optimizar las operaciones de almacén. La demanda de sistemas de gestión de almacenes compactos, multifuncionales y altamente eficientes está en aumento debido a la limitación del espacio de almacenamiento y los elevados costes laborales. Las continuas inversiones en investigación y desarrollo, así como las colaboraciones entre proveedores de soluciones japoneses y empresas tecnológicas globales, refuerzan las perspectivas de crecimiento sostenido del mercado. El enfoque de Japón en la innovación, la fiabilidad y la optimización de la cadena de suministro refuerza su sólido posicionamiento regional.

Perspectivas del mercado de sistemas de gestión de almacenes en India

Se proyecta que el mercado indio de sistemas de gestión de almacenes registrará la tasa de crecimiento anual compuesta más rápida de la región Asia-Pacífico durante el período 2025-2032, impulsado por la rápida expansión del comercio electrónico, el aumento de las actividades manufactureras y la creciente adopción de la automatización y las soluciones de gestión de almacenes en la nube. La creciente concienciación sobre la eficiencia operativa, la optimización de costes y la gestión digital de la cadena de suministro está acelerando su adopción entre las pequeñas y medianas empresas. La demanda de sistemas de gestión de almacenes asequibles, escalables y fáciles de implementar es especialmente fuerte entre las empresas emergentes. La expansión de las redes minoristas y logísticas, el rápido crecimiento del comercio electrónico y las iniciativas gubernamentales que promueven la infraestructura digital están mejorando la accesibilidad de los productos. El creciente enfoque de India en la modernización de los almacenes garantiza su consolidación como el mercado de mayor crecimiento de la región.

Perspectiva del mercado de sistemas de gestión de almacenes de EE. UU.

Se prevé que el mercado estadounidense de sistemas de gestión de almacenes experimente un crecimiento sostenido entre 2025 y 2032, impulsado por los continuos avances tecnológicos, el aumento de la inversión en almacenes automatizados y un fuerte enfoque en la transformación digital. Las empresas priorizan las soluciones basadas en software que permiten el análisis predictivo, la previsión de la demanda y la gestión inteligente del inventario. La continua colaboración entre proveedores de tecnología estadounidenses y proveedores globales, junto con políticas de apoyo que promueven la logística inteligente, refuerzan las perspectivas de crecimiento sostenido. El enfoque del país en la innovación, la eficiencia operativa y la resiliencia de la cadena de suministro respalda su sólido posicionamiento regional en el mercado de sistemas de gestión de almacenes.

Cuota de mercado de los sistemas de gestión de almacenes en Asia-Pacífico

La industria de sistemas de gestión de almacenes está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Blue Yonder Group, Inc. (EE. UU.)

- Oracle Corporation (EE. UU.)

- SAP SE (Alemania)

- Infor (EE. UU.)

- Manhattan Associates (EE. UU.)

- Tecsys Inc. (Canadá)

- SENKO Co., Ltd. (Japón)

- Softeon (EE. UU.)

- Accelogix LLC (EE. UU.)

- Datex Corporation (EE. UU.)

- Made4net (EE. UU.)

- CAMELOT 3PL SOFTWARE (Alemania)

- ShipBob, Inc. (EE. UU.)

- JAPAN LOGISTIC SYSTEMS CORP. (Japón)

- Synergy Logistics Ltd (Reino Unido)

- Honeywell International Inc. (EE. UU.)

- IBM Corporation (EE. UU.)

- Corporación NEC (Japón)

- Cisco Systems, Inc. (EE. UU.)

- Extensiv (EE. UU.)

- La Corporación Raymond (EE.UU.)

Últimos avances en el mercado de sistemas de gestión de almacenes de Asia-Pacífico y EE. UU.

- En marzo de 2024, Made4net presentó su sistema de gestión de almacenes WarehouseExpert y sus soluciones integrales para la ejecución de la cadena de suministro en MODEX 2024. La demostración destacó la integración del sistema con tecnologías de robótica y automatización, destacando su capacidad para mejorar la velocidad y la eficiencia de las cadenas de suministro. Este desarrollo subraya la creciente tendencia a incorporar la automatización en los sistemas de gestión de almacenes para mejorar la eficiencia operativa y satisfacer las demandas de las cadenas de suministro modernas.

- En noviembre de 2023, Blue Yonder, proveedor líder de soluciones para la cadena de suministro, anunció la adquisición de Doddle, una empresa tecnológica especializada en logística de primera y última milla. Esta adquisición permite a Blue Yonder ofrecer una solución logística más completa, abordando los desafíos de optimizar la logística de primera y última milla, que históricamente han sido difíciles de gestionar. Al integrar la tecnología de Doddle en su conjunto actual de capacidades de comercio y devoluciones, Blue Yonder busca construir cadenas de suministro integrales más sostenibles y rentables.

- En noviembre de 2023, Epicor, líder mundial en software empresarial específico para cada sector, anunció la adquisición de Elite EXTRA, proveedor líder de soluciones de entrega de última milla basadas en la nube. Esta adquisición amplía la capacidad de Epicor para ayudar a sus clientes de diversas industrias a simplificar la logística de última milla y competir de forma más eficaz en un mercado hipercompetitivo. Al integrar las soluciones de Elite EXTRA, Epicor busca mejorar su oferta en las industrias de "fabricación, transporte y venta", brindando a sus clientes capacidades avanzadas de entrega de última milla.

- En febrero de 2021, The Raymond Corporation anunció el lanzamiento de una nueva transapiladora automatizada como complemento a su oferta de soluciones intralogísticas. Esta transapiladora automatizada, equipada con un software de gestión de pedidos, se integra completamente con los sistemas de gestión de almacenes para optimizar el rendimiento y eliminar errores. Este desarrollo ofrece a las empresas una solución flexible para instalaciones de almacenamiento de alta densidad y alta selectividad, diversificando su cartera de automatización con nuevos productos.

- En marzo de 2021, Extensiv lanzó una suite mejorada de paquetería con funcionalidades ampliadas para impulsar una mayor eficiencia y un almacén sin papel para proveedores de logística externos que ofrecen comercio electrónico y logística omnicanal. La solución ayuda a las empresas a optimizar y gestionar eficientemente la funcionalidad de paquetería, reduciendo el tiempo de embalaje y aumentando la rentabilidad. Al integrar esta suite en sus sistemas de gestión de almacenes, las empresas pueden optimizar sus procesos de embalaje y envío, lo que se traduce en una mayor eficiencia operativa.

- En mayo de 2025, Körber Supply Chain anunció el lanzamiento de un módulo avanzado de sistema de gestión de almacenes con análisis predictivo basado en IA. El nuevo módulo permite a los almacenes pronosticar la demanda, optimizar la asignación de inventario y gestionar proactivamente los cuellos de botella operativos. Este desarrollo consolida la posición de Körber en el mercado, permitiendo a los clientes mejorar la productividad de sus almacenes, reducir los costes operativos y optimizar los niveles de servicio en cadenas de suministro cada vez más complejas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.