Asia Pacific Aluminum Foil Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

37.73 Billion

USD

97.50 Billion

2024

2032

USD

37.73 Billion

USD

97.50 Billion

2024

2032

| 2025 –2032 | |

| USD 37.73 Billion | |

| USD 97.50 Billion | |

|

|

|

Segmentación del mercado de papel de aluminio de Asia-Pacífico, por producto (envoltorios de papel de aluminio, bolsas, blísters, tubos plegables, bandejas/contenedores, cápsulas, tapas laminadas, bolsas revestidas de papel de aluminio, láminas de chocolate, sellos redondos de papel de aluminio, otros), tipo (impreso, sin imprimir), grosor (0,07 MM, 0,09 MM, 0,2 MM, 0,4 MM), usuario final (alimentos, productos farmacéuticos, cosméticos, aislamiento, electrónica, muestreo geoquímico, componentes automotrices, otros): tendencias de la industria y pronóstico hasta 2032

Análisis del mercado del papel de aluminio

El papel de aluminio se utiliza en una amplia gama de productos en todo el mundo. Debido a la creciente concienciación sobre la contaminación que generan los plásticos en el medio ambiente, los clientes pueden utilizar papel de aluminio tanto en hornos tradicionales como en hornos con ventilador, lo que les brinda la opción de utilizarlo en ambos. También protegen las muestras de roca de los solventes orgánicos formando un sello.

Tamaño del mercado del papel de aluminio

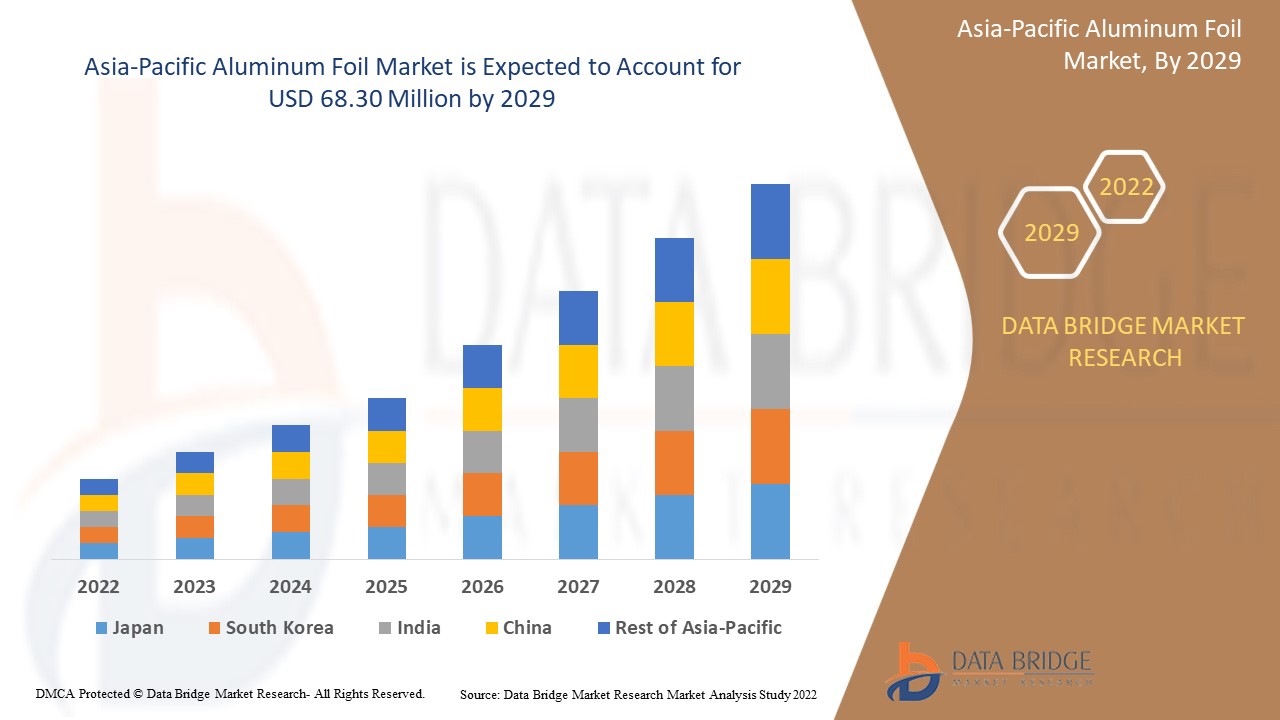

El tamaño del mercado de papel de aluminio de Asia-Pacífico se valoró en USD 37,73 mil millones en 2024 y se proyecta que alcance los USD 97,50 mil millones para 2032, con una CAGR del 12,6% durante el período de pronóstico de 2025 a 2032.

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado del papel de aluminio |

|

Segmentación |

|

|

Países cubiertos |

Japón, China, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, Resto de Asia-Pacífico. |

|

Actores clave del mercado |

Amcor PLC (Suiza), Constantia Flexibles (Austria), Coppice Alupack Limited (Reino Unido), Aditya Birla management corporation Pvt ltd (Bombay), Eurofoil (Luxemburgo), Hulamin Limited (Sudáfrica), Novelis Aluminium (EE. UU.), Tetra Pak SA (Suiza), RUSAL (Rusia), Wyda Packaging (Pty) LTD (Sudáfrica), Alufoil Products Pvt Ltd (India), Assan Aluminyum Sanavi ve Ticaret AS (Estambul), Constellium SE (Francia), Norsk Hydro ASA (Noruega), Reynolds Consumer Products (EE. UU.), Raviraj Foils Ltd (India), Zhangjiagang Goldshine Aluminum Foil Co. (China), Alibérico (España) |

|

Oportunidades de mercado |

|

Definición del mercado del papel de aluminio

El papel de aluminio es un componente clave de los laminados y se encuentra comúnmente en los envases de alimentos. Ofrece una función de barrera más alta contra la humedad, el oxígeno y otros gases, así como contra los olores volátiles y la luz, que cualquier material laminado de plástico. El papel de aluminio también se utiliza para fabricar envases esterilizados. Los papeles de aluminio ofrecen muchas ventajas a las industrias de envasado y alimentación y al consumidor, entre ellas, la facilidad de uso y la reciclabilidad.

Dinámica del mercado del papel de aluminio

Conductores

- Aumentan las iniciativas gubernamentales para concienciar a los consumidores

Debido al aumento de las actividades gubernamentales para crear conciencia sobre la seguridad alimentaria, el mercado está siendo impulsado por una mayor demanda de papel de aluminio por parte de usuarios finales como alimentos, productos farmacéuticos y cosméticos.

- Normas y reglamentos estrictos en materia de seguridad alimentaria

El progreso de la industria del papel de aluminio para uso doméstico se debe a las regulaciones gubernamentales hacia la seguridad alimentaria y los estándares de calidad, que alientan a los fabricantes a crear soluciones de envasado efectivas que eviten la contaminación de los alimentos.

- Aumentar la demanda del comercio electrónico

Es probable que la dinámica cambiante de la industria minorista impulse la demanda de diferentes productos minoristas, lo que impulsará positivamente el crecimiento de los productos envasados listos para usar. Además, el desarrollo del segmento de comercio electrónico ha hecho que los consumidores pasen de las tiendas minoristas a las tiendas en línea. Es probable que la industria alimentaria en línea siga siendo un mercado de consumo clave para los productos de papel de aluminio.

- Demanda creciente de productos biológicos

Se espera que el desarrollo de la biotecnología y la creciente demanda de productos biológicos impulsen la demanda de papel de aluminio en productos como polvos, líquidos y tabletas en el país.

Oportunidades

- Aumento de las innovaciones de productos

Para el ritmo de crecimiento del mercado, el creciente número de innovaciones de productos mejoraría las perspectivas de nuevos mercados. El aluminio es un material reciclable que representa una oportunidad lucrativa para los fabricantes, ya que el aumento de las tasas de recolección y recuperación del producto significa un menor precio de producción y una mayor rentabilidad.

- Demanda de producción de paquetes ligeros

El uso de láminas de aluminio acompañadas de películas flexibles para producir envases livianos ha aumentado de manera considerable, lo que probablemente ofrecerá nuevas oportunidades para los vendedores del mercado en el corto plazo. Estos envases se pueden utilizar para envasar alimentos, café y pescado.

Restricciones/ Desafíos

El mercado mundial está creciendo enormemente. Sin embargo, existen algunas dificultades que impiden su crecimiento. Entre ellas, se encuentran la falta de técnicas de envasado adecuadas y el hecho de que algunos países siguen aferrados a los métodos tradicionales. Debido al cambio en el estilo de vida de las personas, todavía hay una gran parte del mundo que no tiene suficiente dinero para comprar alimentos envasados. Estas son las principales limitaciones del mercado que obstaculizarán su ritmo de crecimiento.

Este informe sobre el mercado del papel de aluminio proporciona detalles de los nuevos desarrollos recientes, regulaciones comerciales, análisis de importación y exportación, análisis de producción, optimización de la cadena de valor, participación de mercado, impacto de los actores del mercado nacional y localizado, analiza las oportunidades en términos de bolsillos de ingresos emergentes, cambios en las regulaciones del mercado, análisis estratégico del crecimiento del mercado, tamaño del mercado, crecimientos del mercado por categorías, nichos de aplicación y dominio, aprobaciones de productos, lanzamientos de productos, expansiones geográficas, innovaciones tecnológicas en el mercado. Para obtener más información sobre el mercado del papel de aluminio, comuníquese con Data Bridge Market Research para obtener un informe de analista; nuestro equipo lo ayudará a tomar una decisión de mercado informada para lograr el crecimiento del mercado.

Alcance del mercado de láminas de aluminio en Asia y el Pacífico

El mercado del papel de aluminio está segmentado en función de los productos, tipos, espesores y usuarios finales. El crecimiento entre estos segmentos le ayudará a analizar los segmentos de crecimiento reducido de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para ayudarlos a tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

Productos

- Envoltorios de papel aluminio

- Bolsas

- Paquetes blíster

- Tubos colapsables

- Bandejas/Contenedores

- Cápsulas

- Tapas laminadas

- Bolsas forradas con papel de aluminio

- Láminas de chocolate

- Sellos redondos de aluminio

- Otros

Tipo

- Impreso

- Sin imprimir

Espesor

- 0,07 mm

- 0,09 mm

- 0,2 mm

- 0,4 mm

Usuario final

- Alimento

- Productos farmacéuticos

- Productos cosméticos

- Aislamiento

- Electrónica

- Muestreo geoquímico

- Componentes automotrices

- Otros

Análisis regional del mercado del papel de aluminio

Se analiza el mercado del papel de aluminio y se proporcionan información y tendencias del tamaño del mercado por país, productos, tipos, grosor y usuario final como se menciona anteriormente.

Los países cubiertos en el informe del mercado de papel de aluminio son Japón, China, India, Corea del Sur, Australia y Nueva Zelanda, Singapur, Malasia, Tailandia, Indonesia, Filipinas, resto de Asia-Pacífico,

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en la regulación del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos como el análisis de la cadena de valor ascendente y descendente, las tendencias técnicas y el análisis de las cinco fuerzas de Porter, los estudios de casos son algunos de los indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, la presencia y disponibilidad de marcas globales y sus desafíos enfrentados debido a la competencia grande o escasa de las marcas locales y nacionales, el impacto de los aranceles nacionales y las rutas comerciales se consideran al proporcionar un análisis de pronóstico de los datos del país.

Cuota de mercado del papel de aluminio

El panorama competitivo del mercado del papel de aluminio proporciona detalles por competidor. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia global, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos, y el dominio de las aplicaciones. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en relación con el mercado del papel de aluminio.

Los líderes del mercado de papel de aluminio que operan en el mercado son:

- Amcor PLC (Suiza)

- Constantia Flexibles (Austria)

- Coppice Alupack Ltd. (Reino Unido)

- Corporación de gestión Aditya Birla Pvt Ltd (India)

- Eurofoil (Luxemburgo)

- Hulamin Limited (Sudáfrica)

- Aluminio Novelis (EE. UU.)

- Tetra Pak Internacional SA (Suiza)

- RUSAL (Rusia)

- Wyda Packaging (Pty) LTD (Sudáfrica)

- Productos de aluminio Pvt Ltd (India)

- Assan Aluminyum Sanavi ve Ticaret AS (Estambul)

- Constellium SE (Francia)

- Norsk Hydro ASA (Noruega)

- Productos de consumo Reynolds (Estados Unidos)

- Raviraj Foils Ltd (India)

- Papel de aluminio Zhangjiagang Goldshine (China)

- Alibérico (España)

Últimos avances en el mercado del papel de aluminio

- En noviembre de 2021, ProAmpac declaró que su empresa matriz, IFP Investments Limited, había desarrollado Irish Flexible Packaging y Fispak. Se trata de productores y proveedores con sede en Irlanda de envases flexibles y sostenibles que atienden a los mercados de pescado, productos lácteos, panadería, carne y queso en Irlanda y en todo el mundo.

- En septiembre de 2021, Flex Films, la división de fabricación de películas de la empresa de envases flexibles Uflex, lanzó su película de alta barrera BOPET F-UHB-M. La película está prevista para sustituir al papel de aluminio en aplicaciones de envases flexibles para resolver las tareas de la industria que tienen una integridad débil, disponibilidad de material, alto precio del material, entre otras. Estas alternativas en el mercado pueden llevar a la producción de alimentos a sustituir el papel de aluminio para envasar los productos, lo que se espera que desafíe el crecimiento del mercado.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.