Asia Pacific Aluminum Casting Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

46.73 Billion

USD

88.45 Billion

2024

2032

USD

46.73 Billion

USD

88.45 Billion

2024

2032

| 2025 –2032 | |

| USD 46.73 Billion | |

| USD 88.45 Billion | |

|

|

|

|

Segmentación del mercado de fundición de aluminio en Asia-Pacífico por proceso (fundición en molde desechable y fundición en molde no desechable), fuente (primaria [aluminio virgen] y secundaria [aluminio reciclado]), aplicación (colectores de admisión, carcasas de cárter de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, transferencia de calor y otros), usuario final (automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros): tendencias del sector y previsiones hasta 2032.

Tamaño del mercado de fundición de aluminio de Asia-Pacífico

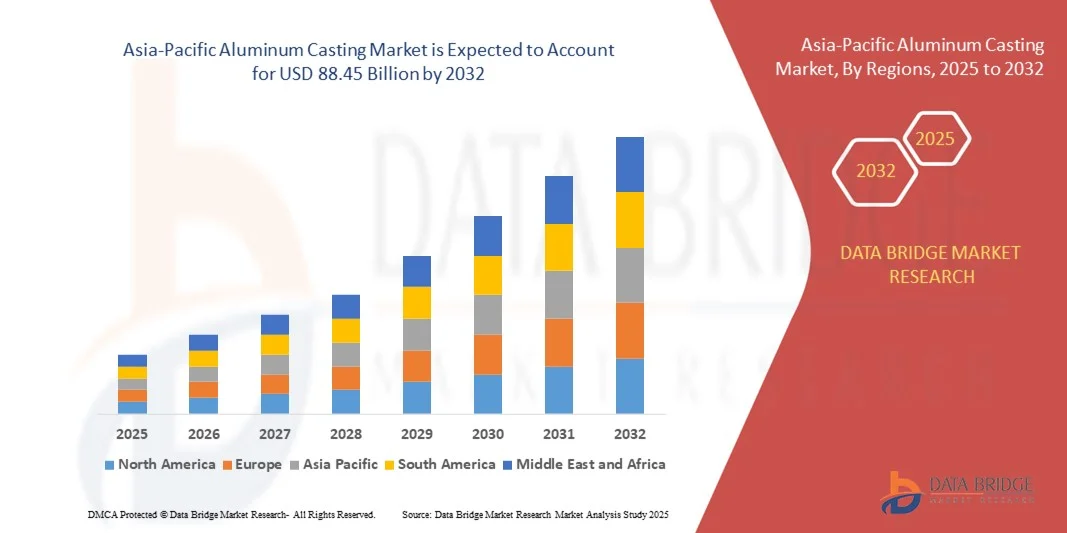

- El tamaño del mercado de fundición de aluminio de Asia-Pacífico se valoró en 46.730 millones de dólares en 2024 y se prevé que alcance los 88.450 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 8,30% durante el período de previsión.

- La expansión del mercado está impulsada principalmente por la rápida industrialización y el creciente uso de materiales ligeros en los sectores automotriz, aeroespacial y de la construcción, lo que aumenta la demanda de soluciones de fundición de aluminio.

- Además, los avances en las tecnologías de fundición, el aumento de las inversiones en infraestructura y un fuerte enfoque en la eficiencia energética están impulsando la adopción de productos de aluminio fundido, acelerando significativamente el crecimiento general del mercado.

Análisis del mercado de fundición de aluminio en Asia-Pacífico

- Las piezas fundidas de aluminio, que proporcionan componentes ligeros, duraderos y resistentes a la corrosión, son cada vez más esenciales en los sectores de la automoción, la industria aeroespacial, la construcción y la maquinaria industrial debido a su relación resistencia-peso, flexibilidad de diseño y beneficios en materia de eficiencia energética.

- La creciente demanda de fundición de aluminio se debe principalmente al cambio de la industria automotriz hacia materiales ligeros para mejorar la eficiencia del combustible, al aumento de la producción aeroespacial y a la expansión de los proyectos de infraestructura en las economías emergentes.

- China dominó el mercado de fundición de aluminio de Asia-Pacífico con la mayor cuota de ingresos, un 38,7%, gracias a sus instalaciones de fabricación a gran escala, una sólida producción automotriz nacional e importantes inversiones en automatización industrial, con actores clave centrados en tecnologías de fundición avanzadas y componentes de alta precisión para satisfacer la creciente demanda.

- Se prevé que India sea la región de mayor crecimiento en el mercado de fundición de aluminio de Asia-Pacífico durante el período de pronóstico debido a la rápida industrialización, el aumento de la producción automotriz y el creciente desarrollo de infraestructura.

- El segmento de moldeo por inyección de consumibles dominó el mercado con una cuota de ingresos del 57,4 % en 2024, impulsado por su flexibilidad para producir componentes complejos e intrincados para aplicaciones en la industria automotriz, aeroespacial y de maquinaria industrial.

Alcance del informe y segmentación del mercado de fundición de aluminio en Asia-Pacífico

|

Atributos |

Información clave del mercado de fundición de aluminio |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Principales actores del mercado |

• China Zhongwang Holdings (China) |

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de cuota de mercado de marcas, encuestas a consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Tendencias del mercado de fundición de aluminio en Asia-Pacífico

Avances en la fundición de aluminio ligera y de alto rendimiento

- Una tendencia significativa y en auge en el mercado de fundición de aluminio de Asia-Pacífico es la adopción de aleaciones de aluminio avanzadas, ligeras y de alto rendimiento, diseñadas para mejorar la relación resistencia-peso y aumentar la eficiencia energética en aplicaciones automotrices, aeroespaciales e industriales.

- Por ejemplo, los fabricantes de automóviles utilizan cada vez más bloques de motor y componentes de chasis de aluminio fundido a presión para reducir el peso de los vehículos, mejorar la eficiencia del combustible y cumplir con las normas de emisiones más estrictas. Del mismo modo, las empresas aeroespaciales aprovechan las fundiciones de aluminio de precisión para componentes estructurales que requieren tanto durabilidad como ligereza.

- Las innovaciones tecnológicas en los procesos de fundición, como la fundición a presión asistida por vacío, la fundición semisólida y los enfoques híbridos de fabricación aditiva, permiten una mayor precisión, una menor pérdida de material y mejores propiedades mecánicas. Estos avances permiten a los fabricantes producir geometrías complejas manteniendo el rendimiento y la fiabilidad.

- La integración de componentes de aluminio fundido en vehículos eléctricos (VE) e infraestructuras de energías renovables, como carcasas de turbinas eólicas y marcos de paneles solares, subraya aún más la versatilidad del material y su creciente importancia en aplicaciones industriales sostenibles.

- Esta tendencia hacia la fabricación de piezas de aluminio fundido ligeras, de alto rendimiento y tecnológicamente avanzadas está transformando las expectativas de diseño y fabricación en múltiples industrias. En consecuencia, empresas como Constellium, Alcoa y China Zhongwang están invirtiendo en I+D para desarrollar aleaciones de aluminio y procesos de fundición innovadores que cumplan con los estándares industriales en constante evolución.

- La demanda de componentes de aluminio fundido con propiedades mecánicas superiores y menor peso está creciendo rápidamente en los sectores automotriz, aeroespacial, de la construcción e industrial, impulsada por regulaciones más estrictas, objetivos de sostenibilidad y la necesidad de optimizar el rendimiento.

Dinámica del mercado de fundición de aluminio en Asia-Pacífico

Conductor

El crecimiento de la demanda está impulsado por la expansión de los sectores automotriz, aeroespacial e industrial.

- La creciente demanda de componentes ligeros, duraderos y resistentes a la corrosión en los sectores de la automoción, la industria aeroespacial y la maquinaria industrial es un importante motor para el mercado de fundición de aluminio de Asia-Pacífico.

- Por ejemplo, en 2024, Hyundai Wia amplió su producción de fundición de aluminio de alta precisión para componentes de motores y chasis de automóviles, en respuesta a la creciente demanda de vehículos de bajo consumo. Se prevé que iniciativas similares por parte de los principales actores del mercado aceleren el crecimiento del mismo durante el período de pronóstico.

- A medida que los fabricantes buscan mejorar la eficiencia energética, reducir el peso de los vehículos y cumplir con las normativas medioambientales más estrictas, las piezas fundidas de aluminio ofrecen propiedades mecánicas superiores y una mayor flexibilidad de diseño en comparación con los materiales tradicionales.

- Además, la expansión de proyectos de infraestructura, la producción de maquinaria industrial y las instalaciones de energía renovable en las economías emergentes está impulsando la adopción de componentes de aluminio fundido debido a su resistencia, ligereza y durabilidad.

- El creciente uso del aluminio en vehículos eléctricos (VE), estructuras aeroespaciales y equipos industriales, junto con el aumento de las inversiones en tecnologías de fundición de precisión, está impulsando el crecimiento del mercado tanto en los mercados maduros como en los emergentes.

Restricción/Desafío

Altos costes de producción y complejidad técnica

- Los elevados costes iniciales de producción y las complejidades técnicas asociadas a los procesos avanzados de fundición de aluminio suponen importantes obstáculos para su adopción generalizada en el mercado. Las aleaciones de aluminio requieren un control preciso durante la fusión, la fundición y el postprocesamiento, lo que hace que la instalación y el mantenimiento de líneas de producción de alta calidad requieran una gran inversión de capital.

- Por ejemplo, la inversión en tecnologías de fundición a presión asistida por vacío o fundición semisólida puede resultar prohibitiva para los fabricantes más pequeños, lo que limita su capacidad para competir con empresas más grandes y consolidadas.

- Garantizar la calidad constante, la precisión dimensional y el rendimiento mecánico es fundamental, ya que las piezas fundidas defectuosas pueden provocar retiradas de productos o fallos en aplicaciones automotrices y aeroespaciales. Empresas como Alcoa, Constellium y China Zhongwang hacen hincapié en un control de calidad riguroso, la optimización de procesos y el desarrollo de aleaciones avanzadas para mitigar estos desafíos.

- Además, las fluctuaciones en los precios de las materias primas y los costos de la energía pueden aumentar los gastos de producción, lo que afecta aún más el acceso al mercado para los fabricantes más pequeños o sensibles a los precios.

- Abordar estos desafíos mediante la innovación tecnológica, métodos de producción rentables y alianzas estratégicas es vital para el crecimiento sostenido y una mayor adopción de piezas fundidas de aluminio en diversas industrias.

Alcance del mercado de fundición de aluminio de Asia-Pacífico

El mercado de fundición de aluminio de Asia Pacífico se segmenta en función del proceso, la fuente, la aplicación y el usuario final.

- Por proceso

Según el proceso, el mercado de fundición de aluminio de Asia-Pacífico se divide en fundición en molde desechable y fundición en molde no desechable. El segmento de fundición en molde desechable dominó el mercado con una cuota de ingresos del 57,4 % en 2024, gracias a su flexibilidad para producir componentes complejos e intrincados para aplicaciones en la industria automotriz, aeroespacial y de maquinaria industrial. Este proceso permite una fundición de alta precisión y se adapta a distintos volúmenes de producción, lo que lo hace ideal tanto para la producción en masa como para componentes especializados.

Se prevé que la fundición en moldes no consumibles experimente la mayor tasa de crecimiento anual compuesto (TCAC) del 18,9 % entre 2025 y 2032, gracias a su capacidad para ofrecer un acabado superficial superior, precisión dimensional y menores requisitos de posprocesamiento. El aumento de las inversiones en tecnologías de fundición de alta precisión y la creciente demanda de componentes duraderos y ligeros en las industrias emergentes están impulsando la adopción de la fundición en moldes no consumibles en toda la región.

- Por fuente

Según su origen, el mercado de fundición de aluminio de Asia-Pacífico se divide en aluminio primario (aluminio virgen) y secundario (aluminio reciclado). El segmento de aluminio primario dominó el mercado con una cuota de ingresos del 61,3 % en 2024, impulsado por su alta pureza, propiedades mecánicas consistentes e idoneidad para componentes críticos de la industria automotriz y aeroespacial. El aluminio primario garantiza una excelente relación resistencia-peso y fiabilidad, lo que lo convierte en la opción preferida para aplicaciones de alto rendimiento.

Se prevé que el segmento del aluminio secundario experimente la mayor tasa de crecimiento anual compuesto (TCAC) del 19,4 % entre 2025 y 2032, debido a la creciente conciencia ambiental, la rentabilidad y las iniciativas cada vez mayores para la fabricación sostenible. El uso de aluminio reciclado se está expandiendo rápidamente en aplicaciones de automoción, construcción y electrodomésticos, impulsado por las prácticas de economía circular y las regulaciones que promueven la reducción de la huella de carbono en el sector manufacturero.

- Mediante solicitud

Según su aplicación, el mercado de fundición de aluminio de Asia-Pacífico se segmenta en colectores de admisión, carcasas de cárter de aceite, piezas estructurales, piezas de chasis, culatas, bloques de motor, transmisiones, ruedas y frenos, sistemas de transferencia de calor y otros. El segmento de bloques de motor dominó el mercado con una cuota de ingresos del 35,8 % en 2024, impulsado por la alta demanda de componentes ligeros y térmicamente eficientes en vehículos automotores y comerciales. Los bloques de motor fabricados con aleaciones de aluminio ofrecen importantes mejoras en la eficiencia del combustible y una gestión térmica optimizada, lo que contribuye al cumplimiento de las estrictas normativas sobre emisiones.

Se prevé que el segmento de ruedas y frenos experimente la mayor tasa de crecimiento anual compuesto (TCAC) del 21,2 % entre 2025 y 2032, impulsada por la tendencia de la industria automotriz hacia el uso de piezas fundidas ligeras para mejorar el rendimiento, la seguridad y la eficiencia energética de los vehículos. El aumento de la producción de vehículos eléctricos y la demanda de componentes automotrices de alta gama refuerzan aún más esta tendencia.

- Por el usuario final

Según el usuario final, el mercado de fundición de aluminio de Asia-Pacífico se segmenta en automoción, construcción, industria, electrodomésticos, aeroespacial, electrónica y electricidad, herramientas de ingeniería y otros. El segmento de automoción dominó el mercado con una cuota de ingresos del 48,6 % en 2024, impulsado por el aumento de la producción de vehículos de pasajeros, vehículos comerciales y vehículos eléctricos, que utilizan ampliamente componentes de aluminio fundido para reducir el peso y mejorar la eficiencia.

Se prevé que el segmento industrial experimente la mayor tasa de crecimiento anual compuesto (TCAC) del 20,5 % entre 2025 y 2032, impulsada por la creciente demanda de piezas de aluminio fundido duraderas para maquinaria, infraestructura de energías renovables y equipos de fabricación. La expansión de la industrialización, el aumento de las inversiones en fábricas inteligentes y la creciente adopción de componentes de aluminio de precisión favorecen el rápido crecimiento de este sector.

Análisis regional del mercado de fundición de aluminio en Asia-Pacífico

- China dominó el mercado de fundición de aluminio con la mayor cuota de ingresos, un 38,7%, en 2024, impulsada por la rápida industrialización, la expansión de los sectores automotriz y aeroespacial y la creciente demanda de componentes ligeros y de alto rendimiento.

- Los fabricantes de la región dan prioridad a las piezas fundidas de aluminio por sus ventajas en cuanto a relación resistencia-peso, resistencia a la corrosión y rentabilidad, lo que las hace ideales para aplicaciones en vehículos, maquinaria y proyectos de infraestructura.

- Esta adopción generalizada se ve respaldada además por la creciente urbanización, el aumento de los ingresos disponibles y las iniciativas gubernamentales que promueven tecnologías de fabricación avanzadas, estableciendo a Asia-Pacífico como un centro clave para la producción e innovación en fundición de aluminio tanto en los mercados nacionales como en los de exportación.

Perspectivas del mercado de fundición de aluminio en China

En 2024, el mercado chino de fundición de aluminio representó la mayor cuota de ingresos en la región Asia-Pacífico, impulsado por el rápido crecimiento de los sectores automotriz, electrónico y de maquinaria industrial del país. La creciente urbanización, el desarrollo de infraestructura y la expansión de la producción de vehículos eléctricos son factores clave que impulsan la demanda. La sólida base manufacturera de China, los avances tecnológicos en los procesos de fundición y la disponibilidad de mano de obra y materias primas a precios competitivos fomentan el crecimiento del mercado. Además, las iniciativas gubernamentales que apoyan la manufactura avanzada y las prácticas de producción sostenibles, incluido el uso de aluminio reciclado, están contribuyendo a la adopción generalizada de componentes de aluminio fundido tanto en el mercado interno como en el de exportación.

Perspectivas del mercado japonés de fundición de aluminio

El mercado japonés de fundición de aluminio experimenta un crecimiento sostenido gracias al énfasis que el país pone en componentes ligeros y de alta precisión para aplicaciones en los sectores automotriz, aeroespacial y electrónico. El enfoque de Japón en la eficiencia energética, la sostenibilidad y las tecnologías de fabricación avanzadas impulsa la adopción de piezas de aluminio fundido, especialmente para bloques de motor, componentes estructurales y carcasas electrónicas. El creciente número de vehículos inteligentes y eléctricos, junto con la automatización en la producción industrial, favorece aún más la expansión del mercado. Asimismo, el envejecimiento de la población japonesa influye en la demanda de componentes de aluminio duraderos y fáciles de usar para electrodomésticos y soluciones de movilidad.

Perspectivas del mercado de fundición de aluminio en la India

El mercado indio de fundición de aluminio está preparado para un sólido crecimiento durante el período de pronóstico, impulsado por la rápida industrialización, el aumento de la producción automotriz y la expansión de proyectos de infraestructura. La creciente clase media del país y el aumento de los ingresos disponibles están impulsando la demanda de vehículos y electrodomésticos, sectores que utilizan piezas de aluminio fundido. India también está experimentando una adopción tecnológica en los procesos de fundición, como la fundición a presión y la fundición en arena, lo que mejora la eficiencia y la calidad del producto. Las iniciativas gubernamentales para promover la manufactura nacional y los programas "Hecho en India" están acelerando aún más el crecimiento del mercado tanto en el mercado interno como en las exportaciones.

Perspectivas del mercado de fundición de aluminio en Corea del Sur

El mercado de fundición de aluminio de Corea del Sur experimenta un crecimiento sostenido, impulsado por la fuerte demanda de los sectores automotriz, electrónico y de maquinaria industrial. El enfoque de Corea del Sur en materiales ligeros para mejorar la eficiencia del combustible, junto con los avances tecnológicos en los procesos de fundición de aluminio, favorece la expansión del mercado. El énfasis del país en la ingeniería de precisión y la innovación en componentes industriales, sumado al auge de los vehículos eléctricos y la electrónica conectada, impulsa su adopción. Además, la presencia de importantes fabricantes nacionales y las colaboraciones estratégicas con empresas globales fortalecen la competitividad de Corea del Sur en el mercado regional de fundición de aluminio.

Cuota de mercado de fundición de aluminio en Asia-Pacífico

La industria de la fundición de aluminio está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

• China Zhongwang Holdings (China)

• Constellium (Países Bajos)

• Hyundai Wia (Corea del Sur)

• Gränges (Suecia)

• Corporación Alcoa (EE. UU.)

• Grupo de Aluminio Shandong Jinbao (China)

• Sumitomo Light Metal Industries (Japón)

• Corporación UACJ (Japón)

• Novelis Inc. (EE. UU.)

• Grupo Hongqiao (China)

• Tecnologías AAC (China)

• Aluminio Hefei Hongsheng (China)

• India Foils Ltd. (India)

• Indal Aluminum (India)

• AMAG Austria Metall (Austria)

• Aluminio Bahréin (Alba) (Bahréin)

• Eckart GmbH (Alemania)

• Grupo Metalcorp (EAU)

• Trimet Aluminium SE (Alemania)

• Corporación Aleris (EE. UU.)

¿Cuáles son los últimos avances en el mercado de fundición de aluminio de Asia-Pacífico?

- En abril de 2023, China Zhongwang Holdings Ltd., fabricante líder de piezas fundidas de aluminio de alta precisión, lanzó un proyecto de expansión estratégica en la provincia de Jiangsu con el objetivo de aumentar la capacidad de producción de componentes para la industria automotriz y aeroespacial. Esta iniciativa subraya el compromiso de la compañía con el aprovechamiento de tecnologías de fundición avanzadas y procesos ecológicos, fortaleciendo su posición en el mercado de fundición de aluminio de Asia-Pacífico, un sector en rápido crecimiento. Mediante la integración de técnicas de fabricación de vanguardia, China Zhongwang busca satisfacer la creciente demanda regional y global de componentes de aluminio ligeros y de alto rendimiento.

- En marzo de 2023, Hitech Castings India Pvt. Ltd. presentó una nueva línea de bloques de motor y componentes de chasis de aluminio diseñados para vehículos eléctricos e híbridos. Esta innovadora línea de productos se centra en la reducción de peso sin comprometer la integridad estructural, respondiendo así a la creciente demanda de soluciones automotrices sostenibles y de bajo consumo. Este avance subraya el compromiso de Hitech Castings con la innovación y su papel como motor de crecimiento en el mercado de fundición de aluminio de Asia-Pacífico.

- En marzo de 2023, Samsung Aerospace Components, en Corea del Sur, puso en marcha una moderna planta de fundición de aluminio para el suministro de piezas estructurales y de motor para aplicaciones aeroespaciales. La planta incorpora tecnologías de fundición de precisión y sistemas automatizados de control de calidad, lo que pone de manifiesto el compromiso de Samsung con la producción de componentes de aluminio de alto rendimiento y refuerza la posición de Corea del Sur como actor clave en el mercado de fundición de aluminio de Asia-Pacífico.

- En febrero de 2023, Japan Aluminum Foundry Co., Ltd. anunció una alianza estratégica con importantes fabricantes de equipos originales (OEM) del sector automotriz para la fabricación de colectores de admisión, carcasas de transmisión y piezas estructurales. Esta colaboración se centra en mejorar el rendimiento y la eficiencia de combustible de los vehículos mediante soluciones de aluminio ligero, lo que refleja el continuo énfasis de Japón en la ingeniería de precisión y la fabricación sostenible en el sector de la fundición de aluminio de Asia-Pacífico.

- En enero de 2023, Indian Castings & Alloys Pvt. Ltd. inauguró una nueva planta dedicada a la producción de llantas de aluminio, bloques de motor y componentes de transferencia de calor para aplicaciones automotrices e industriales. Equipada con tecnologías de fundición avanzadas y rigurosos protocolos de control de calidad, la planta refleja el compromiso de la empresa con la innovación, la eficiencia operativa y el fortalecimiento de su presencia en el creciente mercado de fundición de aluminio de Asia-Pacífico.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.