Asia Pacific Active Pharmaceutical Ingredient Api Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

64.56 Billion

USD

115.14 Billion

2024

2032

USD

64.56 Billion

USD

115.14 Billion

2024

2032

| 2025 –2032 | |

| USD 64.56 Billion | |

| USD 115.14 Billion | |

|

|

|

|

Segmentación del mercado de ingredientes farmacéuticos activos (IFA) de Asia-Pacífico, por molécula (molécula pequeña, molécula grande), tipo ( ingredientes farmacéuticos activos innovadores , ingredientes farmacéuticos activos genéricos innovadores), tipo de fabricante (fabricante de IFA propio, fabricante de IFA comercial), síntesis (ingredientes farmacéuticos activos sintéticos e ingredientes farmacéuticos activos biotecnológicos), síntesis química (paracetamol, artemisinina, saxagliptina, cloruro de sodio, ibuprofeno, losartán potásico, enoxaparina sódica, rufinamida, naproxeno, tamoxifeno, otros), tipo de medicamento ( medicamentos con receta , de venta libre), uso (clínico, investigación), potencia (ingredientes farmacéuticos activos de potencia baja a moderada, ingredientes farmacéuticos activos de potencia alta a muy alta), aplicación terapéutica (cardiología, SNC y neurología, oncología, ortopedia, endocrinología, neumología, gastroenterología, nefrología). Oftalmología y otras aplicaciones terapéuticas: tendencias del sector y previsiones hasta 2032

Tamaño del mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

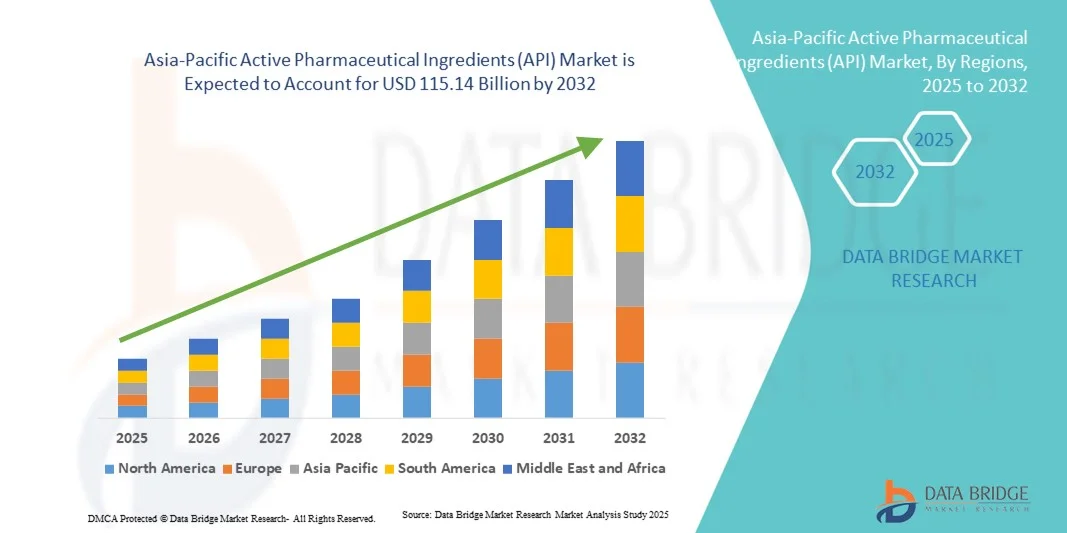

- El tamaño del mercado de ingredientes farmacéuticos activos (IFA) de Asia-Pacífico se valoró en 64.560 millones de dólares en 2024 y se espera que alcance los 115.140 millones de dólares en 2032 , con una tasa de crecimiento anual compuesta (TCAC) del 7,50% durante el período de pronóstico.

- El crecimiento del mercado se debe en gran medida a la creciente demanda de medicamentos eficaces y de alta calidad, impulsada por la creciente prevalencia de enfermedades crónicas e infecciosas, el envejecimiento de la población mundial y la creciente adopción de formulaciones terapéuticas avanzadas.

- Además, los continuos avances en biotecnología , junto con la expansión de las actividades de I+D farmacéutica y la creciente externalización de la fabricación de principios activos farmacéuticos (API) a regiones con costes más competitivos, están acelerando la adopción de soluciones de API, impulsando así significativamente el crecimiento del sector.

Análisis del mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

- El mercado de principios farmacéuticos activos (API) desempeña un papel fundamental en la industria farmacéutica, al ser el componente clave responsable de los efectos terapéuticos de los medicamentos utilizados en diversas áreas terapéuticas, como la oncología, las enfermedades cardiovasculares y los trastornos infecciosos. El mercado está experimentando un fuerte dinamismo debido a los avances tecnológicos en síntesis, la creciente demanda de productos biológicos y el mayor interés en los API de alta potencia (HPAPI).

- La creciente demanda de principios activos farmacéuticos (API) se debe principalmente al aumento de la prevalencia de enfermedades crónicas y relacionadas con el estilo de vida, la expansión del sector de los medicamentos genéricos y la tendencia de las empresas farmacéuticas a subcontratar la producción de API a fabricantes especializados para lograr eficiencia en costos y garantizar la calidad.

- China dominó el mercado de ingredientes farmacéuticos activos (API) con la mayor cuota de ingresos, un 41,6%, en 2024, gracias a una base de fabricación farmacéutica bien establecida, una sólida infraestructura de I+D y la presencia de importantes actores del mercado.

- Se prevé que India sea la región de mayor crecimiento en el mercado de ingredientes farmacéuticos activos (API) durante el período de pronóstico, debido a la expansión de las capacidades de fabricación, las iniciativas gubernamentales favorables y la creciente demanda de genéricos asequibles.

- El segmento clínico dominó la mayor cuota de ingresos, con un 68 % en 2024, impulsado por el uso de principios activos farmacéuticos (API) en hospitales, clínicas especializadas y programas de tratamiento de pacientes en múltiples áreas terapéuticas.

Alcance del informe y segmentación del mercado de ingredientes farmacéuticos activos (API)

|

Atributos |

Información clave del mercado de ingredientes farmacéuticos activos (API) |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Principales actores del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de datos de valor añadido |

Además de los datos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado elaborados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, epidemiología de pacientes, análisis de proyectos en desarrollo, análisis de precios y marco regulatorio. |

Tendencias del mercado de ingredientes farmacéuticos activos (API) en Asia-Pacífico

Expansión de la fabricación de productos biológicos : principios activos farmacéuticos (API) y principios activos farmacéuticos especializados

- Una tendencia clara y en auge en el mercado de los principios activos farmacéuticos (API) es el cambio que va más allá de los API tradicionales de moléculas pequeñas hacia los API biológicos, peptídicos, oligonucleótidos y otros API especializados de alto valor.

- Por ejemplo, en 2023, una importante empresa china de principios activos farmacéuticos (API) anunció la puesta en marcha de una nueva línea de producción de API biológicos para fármacos oncológicos.

- El segmento de principios activos farmacéuticos (API) de moléculas pequeñas sintéticas sigue liderando en términos de cuota de mercado, pero el impulso de crecimiento se está desplazando hacia los API biológicos complejos.

- Muchos fabricantes de principios activos farmacéuticos (API) están invirtiendo en la adquisición o reconversión de plantas para la fabricación de API biológicos u otros API complejos/de alta potencia, lo que les permite obtener mayores márgenes y diferenciarse en un mercado de genéricos saturado.

- Las tendencias de externalización están evolucionando: las empresas farmacéuticas globales buscan cada vez más no solo grandes volúmenes de API, sino también alianzas para la fabricación de API especializadas y biosimilares en Asia-Pacífico.

- Los avances tecnológicos —como la fabricación continua, los sistemas de expresión mejorados y la ampliación de escala de los bioprocesos— están facilitando la producción de principios activos farmacéuticos especializados en la región.

- Los gobiernos y los responsables políticos regionales están apoyando la fabricación de productos biológicos y de principios activos farmacéuticos de alta gama (por ejemplo, mediante incentivos), lo que refuerza aún más este cambio hacia la especialización.

- En general, esta tendencia refleja una transformación del mercado de API, pasando de la fabricación a granel basada en el coste y el volumen a modelos de producción de API más complejos, diferenciados y de alto valor.

Dinámica del mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

Conductor

Aumento de la demanda de producción y subcontratación de API rentables

- El mercado global de ingredientes farmacéuticos activos (API) en Asia-Pacífico está impulsado significativamente por las compañías farmacéuticas y los fabricantes por contrato que buscan suministros de API de alta calidad y menor costo.

- Por ejemplo, en 2023, un fabricante líder indio de principios activos farmacéuticos (API) amplió su capacidad de producción para satisfacer la creciente demanda de las compañías farmacéuticas mundiales.

- La prevalencia de enfermedades crónicas, el envejecimiento de la población y el aumento del gasto sanitario mundial están impulsando la demanda tanto de principios activos farmacéuticos (API) genéricos como innovadores.

- Las iniciativas gubernamentales en varios países de Asia-Pacífico están fortaleciendo la producción nacional, reduciendo la dependencia de las importaciones y mejorando el papel de la cadena de suministro global.

- Los menores costes de fabricación, la amplia mano de obra cualificada y la infraestructura química/bioprocesadora consolidada en países clave de Asia-Pacífico están atrayendo una mayor externalización de la producción de principios activos farmacéuticos (API) por parte de empresas farmacéuticas occidentales.

- La expansión de los principios activos biológicos y especializados (por ejemplo, para oncología e inmunología) está creando nuevas necesidades de fabricación y abastecimiento, lo que impulsa aún más el crecimiento del mercado de principios activos de la región.

- Muchas compañías farmacéuticas están trasladando partes de su cadena de suministro de principios activos farmacéuticos (API) a la región Asia-Pacífico para lograr una mayor eficiencia en costos, una comercialización más rápida y ventajas regulatorias.

- Los múltiples factores mencionados anteriormente, en conjunto, respaldan un fuerte impulso de crecimiento en el mercado de API en toda la región de Asia-Pacífico y a nivel mundial.

Restricción/Desafío

Complejidad regulatoria, riesgos en la cadena de suministro y presión sobre los precios

- Los estrictos requisitos reglamentarios en materia de calidad, seguridad y prácticas de fabricación de los principios activos farmacéuticos (API) suponen importantes costes y cargas de cumplimiento.

- Por ejemplo, en 2022, una importante empresa farmacéutica europea sufrió retrasos debido a inspecciones regulatorias adicionales de principios activos farmacéuticos (API).

- Las vulnerabilidades persistentes de la cadena de suministro —como la dependencia de materias primas específicas, los centros de producción en un solo país o las interrupciones derivadas de acontecimientos geopolíticos o logísticos— limitan la fiabilidad.

- La importante presión a la baja sobre los precios de los principios activos farmacéuticos (API), especialmente los genéricos, reduce la rentabilidad de los fabricantes y puede desalentar la inversión en capacidad o innovación.

- Las preocupaciones ambientales, de salud y seguridad, así como la necesidad de modernizar la fabricación con procesos químicos más ecológicos o procesos biotecnológicos más controlados, aumentan los gastos de capital y los costos operativos.

- La fragmentación de las normas de calidad globales y la disparidad de los regímenes de inspección entre países complican el abastecimiento global y dificultan la armonización.

- Para los productores de API más pequeños, la combinación de presiones regulatorias, de costos y de precios de mercado puede limitar la capacidad de escalar o invertir en API especializados/biológicos.

- Estos desafíos deben gestionarse para lograr un crecimiento sostenido del mercado; las empresas y los reguladores deben coordinarse en materia de calidad, resiliencia y estructuras de costos.

Alcance del mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

El mercado está segmentado en función de la molécula, el tipo, el tipo de fabricante, la síntesis, la síntesis química, el tipo de fármaco, el uso, la potencia y la aplicación terapéutica.

- Por molécula

Según el tipo de molécula, el mercado de principios activos farmacéuticos (API) de Asia-Pacífico se segmenta en moléculas pequeñas y grandes. El segmento de moléculas pequeñas dominó el mercado con una cuota de ingresos del 62 % en 2024, impulsado por su uso consolidado en la producción farmacéutica, su facilidad de síntesis y su eficacia clínica demostrada. Las moléculas pequeñas se utilizan ampliamente en medicamentos con y sin receta en diversas áreas terapéuticas, como cardiología, sistema nervioso central, oncología y tratamientos gastrointestinales. Su producción rentable, su escalabilidad y su compatibilidad con los métodos convencionales de administración de fármacos las convierten en la opción preferida de los fabricantes. El vencimiento de numerosas patentes y el desarrollo de medicamentos genéricos refuerzan aún más su dominio. Además, las moléculas pequeñas se benefician de cadenas de suministro maduras, una amplia aceptación regulatoria y la disponibilidad de materias primas. Este segmento también experimenta una sólida adopción debido a la creciente demanda de tratamientos para enfermedades crónicas y la producción a gran escala. Los principales centros farmacéuticos de Asia-Pacífico, como China e India, siguen fortaleciendo sus capacidades de fabricación, lo que aumenta su cuota de mercado. La integración con los sistemas sanitarios tradicionales y las líneas de investigación clínica establecidas respaldan aún más la prevalencia de las moléculas pequeñas.

Se prevé que el segmento de macromoléculas experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 21,5 %, entre 2025 y 2032, impulsada por la creciente demanda de productos biológicos, anticuerpos monoclonales y proteínas recombinantes. Las macromoléculas son cada vez más utilizadas en terapias complejas, como las oncológicas, las autoinmunes y los tratamientos para enfermedades raras. Los rápidos avances en biotecnología, la expansión de las líneas de investigación biofarmacéuticas y los incentivos gubernamentales para los productos biológicos aceleran este crecimiento. La mejora de los procesos de fabricación, la reducción de costes en la producción de productos biológicos y la creciente adopción por parte de hospitales y clínicas especializadas impulsan aún más el potencial del mercado. El creciente énfasis en la medicina personalizada, los biosimilares y las terapias avanzadas respalda el crecimiento del segmento. Las colaboraciones estratégicas entre empresas biotecnológicas e institutos de investigación mejoran el acceso y la innovación. El segmento se beneficia del aumento de los ensayos clínicos, las aprobaciones regulatorias de productos biológicos y la creciente concienciación sobre las terapias dirigidas en la región de Asia-Pacífico. La expansión de la infraestructura biotecnológica en los mercados emergentes también favorece su adopción.

- Por tipo

Según su tipo, el mercado se segmenta en API innovadoras y API genéricas innovadoras. El segmento de API innovadoras dominó el mercado en 2024 con una cuota de ingresos del 58%, debido a la alta demanda de nuevas terapias, fármacos patentados y formulaciones especializadas. Las compañías farmacéuticas están invirtiendo fuertemente en I+D para desarrollar nuevas entidades químicas y terapias dirigidas, particularmente en oncología, sistema nervioso central y enfermedades cardiovasculares. Las aprobaciones regulatorias, los ensayos clínicos en curso y las colaboraciones con organizaciones de investigación refuerzan su dominio. Las API innovadoras también se benefician de mayores márgenes y un posicionamiento estratégico en áreas terapéuticas competitivas. Este segmento cuenta con el respaldo de una sólida infraestructura sanitaria, un creciente interés gubernamental en las enfermedades raras y complejas, y marcos regulatorios sólidos para la protección de la propiedad intelectual. Además, la creciente demanda en los mercados emergentes y la expansión de hospitales y clínicas especializadas consolidan aún más su posición en el mercado. La innovación continua en el diseño, el desarrollo y las plataformas de administración de fármacos garantiza la adopción sostenida de API innovadoras en toda la región de Asia-Pacífico.

Se prevé que el segmento de principios activos farmacéuticos (API) genéricos e innovadores experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22 %, entre 2025 y 2032, impulsada por la creciente adopción de genéricos, las políticas sanitarias sensibles a los costos y el vencimiento de patentes. Los API genéricos ofrecen alternativas asequibles a los medicamentos de marca, satisfaciendo la creciente demanda en los mercados emergentes. Los fabricantes están ampliando su capacidad productiva, mejorando sus redes de distribución y recurriendo a la fabricación por contrato para respaldar este rápido crecimiento. Las colaboraciones estratégicas con hospitales, farmacias y proveedores de atención médica aceleran aún más la penetración en el mercado. El aumento de las iniciativas gubernamentales para mejorar el acceso a los medicamentos, junto con los avances tecnológicos en la fabricación, contribuyen a una adopción más rápida. La expansión de la cobertura de seguros y los programas de salud pública también impulsan el consumo de API genéricos.

- Por tipo de fabricante

Según el tipo de fabricante, el mercado se divide en fabricantes de API propios y fabricantes de API comerciales. El segmento de fabricantes propios dominó el mercado con una cuota de ingresos del 55 % en 2024, ya que la producción interna de API permite a las empresas farmacéuticas mantener el control de calidad, reducir costes y garantizar el cumplimiento normativo. Los fabricantes propios se benefician de la I+D integrada, las redes de distribución consolidadas y las formulaciones patentadas. Este segmento experimenta una fuerte demanda en áreas terapéuticas de alto valor, como la oncología y el sistema nervioso central. La estabilidad del suministro, la integración vertical y el posicionamiento estratégico en el mercado respaldan su continuo dominio.

Se prevé que el segmento de fabricantes de principios activos farmacéuticos (API) para uso comercial experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 21,8 %, entre 2025 y 2032, impulsada por la creciente tendencia a la externalización, las oportunidades de fabricación por contrato y la demanda global de API. Los fabricantes para uso comercial ofrecen capacidad de producción flexible, soluciones rentables y API especializados. La expansión a mercados emergentes y el aumento de la actividad de ensayos clínicos impulsan el crecimiento del segmento. El creciente interés de las pequeñas empresas biotecnológicas y las empresas emergentes que externalizan la producción de API acelera aún más su adopción. Además, los avances en las tecnologías de fabricación y el apoyo regulatorio a la fabricación por contrato mejoran la competitividad y el atractivo del segmento para las compañías farmacéuticas globales.

- Por síntesis

Según su síntesis, el mercado se segmenta en principios activos farmacéuticos (API) sintéticos y biotecnológicos. El segmento de API sintéticos representó la mayor cuota de ingresos, con un 60 % en 2024, gracias a sus procesos de producción consolidados, menores costes de fabricación y amplia aplicabilidad en fármacos orales, inyectables y tópicos. El dominio de este segmento se ve reforzado por sólidas cadenas de suministro, un profundo conocimiento de la normativa y su compatibilidad con múltiples áreas terapéuticas, lo que lo convierte en la opción preferida para los fabricantes farmacéuticos. Además, la infraestructura madura, la disponibilidad constante de materias primas y la perfecta integración con los procesos farmacéuticos convencionales consolidan aún más su posición de liderazgo. La amplia adopción de API sintéticos tanto en medicamentos de marca como genéricos, junto con los continuos avances tecnológicos, garantiza un crecimiento sostenido y un liderazgo de mercado permanente.

Se prevé que el segmento de principios activos farmacéuticos (API) biotecnológicos experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 23 %, entre 2025 y 2032, impulsada por el rápido desarrollo de productos biológicos, proteínas recombinantes y anticuerpos monoclonales. El aumento de las inversiones en I+D biofarmacéutica, la creciente adopción hospitalaria y los incentivos gubernamentales para la innovación biotecnológica aceleran este crecimiento. El segmento se ve respaldado por el incremento de los ensayos clínicos, un mejor acceso a terapias avanzadas y una mayor concienciación sobre la medicina personalizada. Las colaboraciones estratégicas entre empresas farmacéuticas y biotecnológicas fortalecen aún más la penetración en el mercado. Los centros biotecnológicos emergentes en Asia-Pacífico mejoran la capacidad de producción y la accesibilidad económica de los API biológicos.

- Mediante síntesis química

Según su síntesis química, el mercado se segmenta en paracetamol, artemisinina, saxagliptina, cloruro de sodio, ibuprofeno, losartán potásico, enoxaparina sódica, rufinamida, naproxeno, tamoxifeno y otros. El segmento del paracetamol dominó el mercado con la mayor cuota de ingresos, un 44 % en 2024, impulsado por su amplio uso en analgésicos, antipiréticos y medicamentos combinados. La alta demanda en medicamentos de venta libre, hospitales y clínicas refuerza su dominio. El paracetamol se beneficia de procesos de fabricación establecidos, bajos costos de producción y amplias redes de distribución. Su compatibilidad con formulaciones pediátricas y para adultos, así como su integración en terapias combinadas, garantiza una adopción constante en el mercado. La demanda global sostenida, la sólida aprobación regulatoria y el creciente gasto en atención médica en Asia-Pacífico respaldan su continuo dominio. Además, los fabricantes aprovechan las economías de escala y las eficientes cadenas de suministro para mantener la producción.

Se prevé que el segmento de la artemisinina experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 21,5 %, entre 2025 y 2032, impulsada por la creciente demanda de terapias antipalúdicas y el aumento de la investigación en nuevos derivados. Los programas gubernamentales que promueven el tratamiento de la malaria y las iniciativas de salud global contribuyen a este crecimiento. La expansión de la fabricación por contrato y el aumento de las inversiones biofarmacéuticas en el sudeste asiático aceleran aún más su adopción. La relevancia de la artemisinina en las terapias combinadas y la continua I+D para mejorar su eficacia favorecen una rápida penetración en el mercado. Las alianzas con instituciones de investigación, el mayor acceso a los mercados emergentes y los avances tecnológicos en los métodos de producción también refuerzan el crecimiento del segmento.

- Por tipo de medicamento

Según el tipo de fármaco, el mercado se divide en medicamentos con receta y medicamentos de venta libre. El segmento de medicamentos con receta representó la mayor cuota de ingresos, con un 65 % en 2024, impulsado por la alta prevalencia de enfermedades crónicas, el creciente gasto sanitario y la adopción de terapias especializadas en cardiología, oncología y el sistema nervioso central. Los principios activos farmacéuticos (API) de prescripción se benefician de altos estándares regulatorios, líneas de investigación clínica consolidadas y sólidas redes de distribución en hospitales y farmacias. Este segmento se ve reforzado por un mayor enfoque en la investigación, nuevas terapias protegidas por patentes y la creciente demanda de medicina personalizada. La integración en los sistemas de salud, la cobertura de seguros y las clínicas especializadas garantizan su continua adopción. Las fuertes inversiones en I+D, la disponibilidad de API de alta calidad y la experiencia avanzada en formulación mantienen su liderazgo.

Se prevé que el segmento de medicamentos de venta libre experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 20,8 %, entre 2025 y 2032. Este crecimiento se debe al aumento de la automedicación, la mayor concienciación sobre el cuidado de la salud y las iniciativas gubernamentales para mejorar el acceso a los medicamentos de venta libre. La preferencia de los consumidores por la comodidad, la rentabilidad y la disponibilidad inmediata impulsa el crecimiento del segmento. La expansión de las redes de farmacias minoristas, los canales de venta en línea y las plataformas de comercio electrónico acelera aún más su adopción. La creciente demanda de analgésicos, remedios para el resfriado y vitaminas también contribuye a este rápido crecimiento. Los fabricantes están innovando en el envasado y las formulaciones para aumentar el atractivo para el consumidor.

- Por uso

Según su uso, el mercado se segmenta en clínico y de investigación. El segmento clínico representó la mayor cuota de ingresos, con un 68 % en 2024, impulsado por el uso de principios activos farmacéuticos (API) en hospitales, clínicas especializadas y programas de tratamiento de pacientes en diversas áreas terapéuticas. La adopción clínica se ve respaldada por una sólida infraestructura sanitaria, una creciente población de pacientes y la mayor prevalencia de enfermedades crónicas. Los API en aplicaciones clínicas garantizan alta calidad, cumplimiento de las normas regulatorias y resultados terapéuticos consistentes. La colaboración entre compañías farmacéuticas y hospitales refuerza aún más este liderazgo. La expansión del acceso a la atención médica en los países de Asia-Pacífico, la integración de terapias avanzadas y la adopción de protocolos de tratamiento estandarizados mejoran la penetración en el mercado.

Se prevé que el segmento de investigación experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22,2 %, entre 2025 y 2032, impulsada por el aumento de las inversiones en I+D, la actividad de ensayos clínicos y la financiación gubernamental para el descubrimiento de nuevos fármacos. Las instituciones académicas, las organizaciones de investigación por contrato y las empresas biotecnológicas dependen cada vez más de los principios activos farmacéuticos (API) para terapias experimentales. El creciente interés en la medicina personalizada, las enfermedades raras y las nuevas formulaciones favorece aún más su adopción. La expansión de la infraestructura de laboratorio, la disponibilidad de API de alta pureza y la innovación colaborativa impulsan el crecimiento del segmento. Las alianzas estratégicas entre la industria farmacéutica y las instituciones de investigación mejoran el desarrollo de la cartera de productos en desarrollo.

- Por potencia

En función de su potencia, el mercado se segmenta en principios activos farmacéuticos (API) de potencia baja a moderada y API de potencia alta a muy alta. El segmento de API de potencia baja a moderada dominó el mercado con una cuota de ingresos del 61 % en 2024, debido a su uso generalizado en terapias comunes como analgésicos, fármacos cardiovasculares y antiinfecciosos. La eficiencia en la fabricación, la rentabilidad y las cadenas de suministro consolidadas refuerzan este dominio. Los API de potencia baja a moderada son los preferidos para la producción a gran escala y su amplia aplicabilidad terapéutica. El conocimiento de la normativa, los procesos de producción escalables y la integración en terapias combinadas favorecen aún más su adopción. El crecimiento del mercado se ve impulsado por la creciente demanda hospitalaria y farmacéutica, así como por la existencia de importantes centros de producción regionales.

Se prevé que el segmento de principios activos farmacéuticos (API) de alta potencia experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 23,5 %, entre 2025 y 2032, impulsada por el crecimiento en oncología, el sistema nervioso central (SNC) y terapias especializadas que requieren fármacos de baja dosis y alta eficacia. Los estrictos estándares de fabricación, las instalaciones especializadas y el aumento de las alianzas de fabricación por contrato contribuyen al crecimiento del segmento. El creciente interés en el tratamiento de enfermedades raras, los productos biológicos y la medicina de precisión favorece la adopción de API de alta potencia. La expansión de la infraestructura de fabricación especializada, las tecnologías de contención avanzadas y el creciente número de aprobaciones regulatorias aceleran la penetración del segmento. El fuerte interés del mercado en nuevas terapias dirigidas y el desarrollo de la cartera de productos clínicos refuerzan aún más el crecimiento.

- Mediante aplicación terapéutica

Según su aplicación terapéutica, el mercado se segmenta en cardiología, sistema nervioso central y neurología, oncología, ortopedia, endocrinología, neumología, gastroenterología, nefrología, oftalmología y otras aplicaciones terapéuticas. El segmento de oncología dominó el mercado con la mayor cuota de ingresos, un 32 % en 2024, impulsado por la creciente prevalencia del cáncer, las terapias dirigidas avanzadas y la alta adopción de productos biológicos. Los principios activos oncológicos se benefician de sólidas líneas de I+D, apoyo gubernamental y colaboración con hospitales especializados e institutos de investigación. Las aprobaciones regulatorias para tratamientos novedosos, la alta demanda de pacientes y los regímenes de múltiples fármacos refuerzan aún más su dominio. El aumento de la inversión en terapias oncológicas, la intensa actividad de ensayos clínicos y la integración de la medicina de precisión impulsan su adopción en toda la región de Asia-Pacífico.

Se prevé que el segmento de neurología y sistema nervioso central (SNC) experimente la tasa de crecimiento anual compuesto (TCAC) más rápida, del 22 %, entre 2025 y 2032, impulsada por la creciente prevalencia de trastornos neurológicos, la mayor demanda de terapias innovadoras y el creciente apoyo gubernamental al tratamiento de enfermedades raras. La expansión de los centros de investigación, los ensayos clínicos y la adopción de principios activos farmacéuticos (API) para el SNC en hospitales aceleran el crecimiento del segmento. El desarrollo de nuevas terapias con moléculas pequeñas y grandes, la creciente concienciación sobre la salud mental y la integración de tecnologías de salud digital favorecen aún más su adopción. Las alianzas entre empresas farmacéuticas e institutos de investigación especializados en neurología refuerzan la expansión del mercado.

Análisis regional del mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

- Se prevé que el mercado de ingredientes farmacéuticos activos (API) de Asia Pacífico experimente el mayor crecimiento anual compuesto (CAGR) durante el período de pronóstico de 2025 a 2032.

- Impulsado por la creciente urbanización, el aumento de los ingresos disponibles y los avances tecnológicos en países como China, Japón e India.

- La creciente base de fabricación farmacéutica de la región, las iniciativas gubernamentales de apoyo y el enfoque en los genéricos asequibles están creando un entorno favorable para la expansión del mercado.

Análisis del mercado chino de ingredientes farmacéuticos activos (API):

El mercado chino de ingredientes farmacéuticos activos (API) dominó el mercado de API en 2024, con la mayor cuota de ingresos (41,6%), gracias a una sólida base de fabricación farmacéutica, una infraestructura de I+D robusta y la presencia de los principales actores del mercado. El crecimiento de la clase media, la rápida urbanización y la adopción de tecnología impulsan aún más el mercado de API. Además, la gran capacidad de producción nacional, los incentivos gubernamentales para la producción farmacéutica y la creciente demanda de genéricos son factores clave que sustentan el dominio de China en el mercado.

Análisis del mercado de ingredientes farmacéuticos activos (API) en India:

Se prevé que el mercado de ingredientes farmacéuticos activos (API) en India sea el de mayor crecimiento durante el período de pronóstico, debido a la expansión de su capacidad de producción, las iniciativas gubernamentales favorables y la creciente demanda de genéricos asequibles. El aumento de la inversión extranjera, el sólido potencial exportador y las crecientes oportunidades de fabricación por contrato también impulsan el crecimiento de India. El enfoque del país en la producción rentable y la fabricación escalable de API atrae a empresas farmacéuticas globales que buscan proveedores en India.

Cuota de mercado de ingredientes farmacéuticos activos (API) en Asia-Pacífico

La industria de ingredientes farmacéuticos activos (API) está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Cipla (India)

- Laboratorios Dr. Reddy's (India)

- Industrias farmacéuticas Sun (India)

- Aurobindo Pharma (India)

- Hanwha Chemical (Corea del Sur)

- Toyama Chemical (Japón)

- Daiichi Sankyo (Japón)

- Hetero Labs (India)

- Lupin Limited (India)

Últimos avances en el mercado de ingredientes farmacéuticos activos (API) de Asia-Pacífico

- En mayo de 2025, Xellia Pharmaceuticals, el último fabricante europeo de ingredientes clave para antibióticos, anunció el cierre de su mayor fábrica en Copenhague, lo que supuso la pérdida de 500 puestos de trabajo. La empresa alegó una competencia insostenible y planes para trasladar parte de la producción a China. Esta decisión pone de manifiesto las dificultades que afrontan los fabricantes farmacéuticos europeos para mantener su competitividad frente a sus homólogos asiáticos.

- En octubre de 2025, la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) lanzó un programa piloto para agilizar el proceso de revisión de medicamentos genéricos fabricados y probados íntegramente en Estados Unidos. Esta iniciativa busca impulsar la producción nacional de medicamentos y reducir la dependencia de fuentes extranjeras para obtener ingredientes farmacéuticos activos.

- En septiembre de 2025, Symbiotec Pharmalab, líder mundial en la producción de ingredientes farmacéuticos activos para corticosteroides y hormonas, anunció sus planes para lanzar una oferta pública inicial (OPI) en los próximos 12 meses. La compañía aspira a una valoración de aproximadamente 1.000 millones de dólares para fortalecer su posición en el mercado farmacéutico especializado.

- En junio de 2025, los precios de los principios farmacéuticos activos (API) en India cayeron drásticamente, aliviando la presión sobre la industria farmacéutica del país. Se espera que la disminución de los costos de los API reduzca los gastos de producción de los fabricantes de medicamentos, aumente la rentabilidad y estabilice la cadena de suministro dentro del sector.

- En octubre de 2025, Dr. Reddy's Laboratories informó que la Administración de Alimentos y Medicamentos de los Estados Unidos (FDA) emitió un Formulario 483 con dos observaciones tras inspeccionar su planta de fabricación de principios activos farmacéuticos (API) en Middleburgh, Nueva York. La empresa planea abordar estas observaciones en consulta con la FDA para garantizar el cumplimiento de las normas regulatorias.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.