Asia Pacific Immunoassay Reagents And Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

8.24 Billion

USD

12.84 Billion

2025

2033

USD

8.24 Billion

USD

12.84 Billion

2025

2033

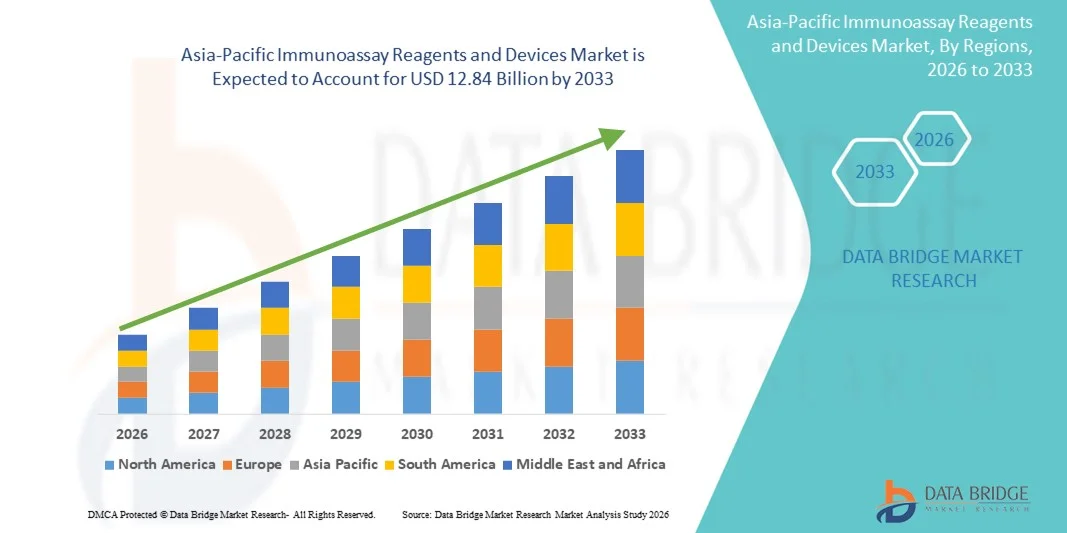

| 2026 –2033 | |

| USD 8.24 Billion | |

| USD 12.84 Billion | |

|

|

|

|

Segmentación del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico, por producto (reactivos, kits y analizadores), plataforma (inmunoensayos de quimioluminiscencia, inmunoensayos de fluorescencia, inmunoensayos enzimáticos, radioinmunoensayos y otros), técnica (ensayos inmunoabsorbentes ligados a enzimas, pruebas rápidas, inmunospot ligado a enzimas, Western blot, inmuno-PCR y otras técnicas), tipo de muestra (sangre, orina, saliva y otras), aplicación (enfermedades infecciosas, oncología y endocrinología, trastornos óseos y minerales, cardiología, hematología y cribado sanguíneo, trastornos autoinmunes, toxicología, cribado neonatal y otras aplicaciones), usuario final (hospitales, laboratorios clínicos, empresas farmacéuticas y biotecnológicas, bancos de sangre, laboratorios de investigación y académicos, entre otros): tendencias de la industria y pronóstico hasta 2033.

Tamaño del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

- El tamaño del mercado de reactivos y dispositivos de inmunoensayo de Asia-Pacífico se valoró en USD 8.24 mil millones en 2025 y se espera que alcance los USD 12.84 mil millones para 2033 , con una CAGR del 5,7% durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente prevalencia de enfermedades infecciosas y crónicas, una mayor demanda de tecnologías de diagnóstico avanzadas y continuas innovaciones de productos en reactivos, kits y plataformas de inmunoensayo que respaldan la toma de decisiones clínicas oportuna y precisa.

- Además, la expansión de la infraestructura de atención médica, la mayor adopción de diagnósticos basados en inmunoensayos en hospitales y laboratorios clínicos, y el enfoque creciente en la detección temprana de enfermedades y soluciones de atención médica personalizadas están impulsando una fuerte adopción de reactivos y dispositivos de inmunoensayos en países clave de Asia y el Pacífico, como China, India, Japón y el Sudeste Asiático, consolidando los sistemas de inmunoensayos como herramientas críticas dentro de los flujos de trabajo de diagnóstico regionales.

Análisis del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

- Los reactivos y dispositivos de inmunoensayo, que permiten la detección y cuantificación precisa de biomoléculas en muestras clínicas, son componentes cada vez más vitales de los flujos de trabajo de diagnóstico modernos en hospitales, laboratorios y entornos de investigación debido a su alta sensibilidad, rápido tiempo de respuesta y compatibilidad con plataformas automatizadas.

- La creciente demanda de productos de inmunoensayo se ve impulsada principalmente por la creciente prevalencia de enfermedades infecciosas y crónicas, el enfoque creciente en el diagnóstico temprano y la creciente adopción de tecnologías de diagnóstico avanzadas en las instituciones de atención médica.

- China dominó el mercado de inmunoensayos de Asia-Pacífico con la mayor participación en los ingresos del 24,8 % en 2025, caracterizada por una infraestructura de atención médica bien establecida, una alta adopción de automatización de laboratorio y una fuerte presencia de actores clave de la industria.

- Se espera que India sea el país de más rápido crecimiento en el mercado de inmunoensayos de Asia y el Pacífico durante el período de pronóstico debido a la expansión de la infraestructura de atención médica, el aumento de las iniciativas gubernamentales para la detección de enfermedades y el aumento de los ingresos disponibles.

- El segmento de inmunoensayo de quimioluminiscencia dominó el mercado de inmunoensayo de Asia-Pacífico con una participación de mercado del 40,9 % en 2025, impulsado por su alta sensibilidad, amplio rango dinámico e integración perfecta con sistemas de laboratorio automatizados.

Alcance del informe y segmentación del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

|

Atributos |

Análisis clave del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico |

|

Segmentos cubiertos |

|

|

Países cubiertos |

Asia-Pacífico

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de canalización, análisis de precios y marco regulatorio. |

Tendencias del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

Integración de plataformas multiplex y automatizadas

- Una tendencia significativa y en aceleración en el mercado de inmunoensayos de Asia-Pacífico es la creciente adopción de plataformas de inmunoensayos multiplex y sistemas automatizados, que permiten la detección simultánea de múltiples biomarcadores y reducen los errores de manipulación manual en los laboratorios clínicos.

- Por ejemplo, la tecnología Luminex xMAP integra inmunoensayos multiplex con manejo automatizado de muestras, lo que permite pruebas de alto rendimiento para hospitales y centros de investigación.

- La automatización y la multiplexación mejoran la eficiencia del flujo de trabajo, reducen los tiempos de respuesta y minimizan los errores humanos, mejorando así la productividad del laboratorio y la confiabilidad de los resultados.

- La integración perfecta de las plataformas de inmunoensayo con los sistemas de gestión de información de laboratorio (LIMS) permite el monitoreo centralizado del procesamiento de muestras, el control de calidad y los informes de datos, agilizando las operaciones del laboratorio.

- Está surgiendo la tendencia de los diagnósticos basados en la nube, lo que permite la monitorización remota, el análisis de datos en tiempo real y la integración con redes hospitalarias para tomar decisiones clínicas más rápidas.

- El creciente enfoque en la medicina personalizada está impulsando la demanda de inmunoensayos capaces de detectar simultáneamente múltiples biomarcadores específicos de enfermedades, lo que permite planes de tratamiento personalizados.

- Esta tendencia hacia soluciones de diagnóstico más automatizadas, de alto rendimiento e integradas está cambiando las expectativas en los laboratorios clínicos, impulsando a empresas como Abbott y Siemens Healthineers a desarrollar plataformas que combinen pruebas multiplex con informes digitales.

- La demanda de sistemas de inmunoensayo que ofrecen automatización de alto rendimiento y capacidad multiplex está creciendo rápidamente en hospitales, centros de diagnóstico e institutos de investigación, a medida que la eficiencia y la precisión en las pruebas se convierten en prioridades críticas.

Dinámica del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

Conductor

Aumento de la prevalencia de enfermedades crónicas e infecciosas

- La creciente incidencia de enfermedades crónicas como diabetes, cáncer y enfermedades infecciosas como la hepatitis y la COVID-19 es un factor importante para la mayor adopción de reactivos y dispositivos de inmunoensayo.

- Por ejemplo, en marzo de 2025, Roche Diagnostics lanzó nuevos kits de inmunoensayo automatizados para la detección de COVID-19 e influenza en India y China, impulsando el crecimiento del mercado en entornos clínicos de alta demanda.

- A medida que los proveedores de atención médica priorizan la detección temprana y el monitoreo de enfermedades, las plataformas de inmunoensayo brindan alta sensibilidad y especificidad para tomar decisiones clínicas oportunas y precisas.

- Además, las iniciativas de atención sanitaria del gobierno que promueven diagnósticos preventivos y programas de detección temprana están aumentando la demanda de soluciones de pruebas de inmunoensayo en hospitales y laboratorios.

- La expansión de las cadenas de diagnóstico privadas y las redes de laboratorios en Asia-Pacífico está impulsando la demanda de sistemas de inmunoensayo confiables y de alto rendimiento.

- La creciente inversión en investigación y desarrollo por parte de actores regionales y globales para nuevos reactivos de inmunoensayo y dispositivos portátiles está respaldando el crecimiento del mercado.

- La conveniencia de las pruebas de alto rendimiento, los tiempos de respuesta reducidos y la integración con la infraestructura de laboratorio existente son factores clave que impulsan la adopción de inmunoensayos en Asia-Pacífico.

Restricción/Desafío

Altos costos y barreras de cumplimiento normativo

- Las preocupaciones en torno al alto costo de los sistemas de inmunoensayo avanzados y de los reactivos plantean un desafío importante para una adopción más amplia, en particular en países en desarrollo con presupuestos de atención médica limitados.

- Por ejemplo, los laboratorios más pequeños del sudeste asiático pueden tener dificultades para invertir en CLIA o plataformas multiplex a pesar de sus ventajas, lo que limita la penetración del mercado en regiones sensibles a los precios.

- Abordar los estrictos requisitos regulatorios para los dispositivos de diagnóstico y obtener aprobaciones en varios países aumenta el tiempo de comercialización y la complejidad operativa para los fabricantes.

- Además, la necesidad de personal calificado para operar plataformas de inmunoensayo sofisticadas y mantener el equipo es un desafío para los centros de diagnóstico más pequeños.

- La escasa conciencia entre las clínicas más pequeñas y los proveedores de atención sanitaria rurales sobre los beneficios de las tecnologías de inmunoensayo avanzadas puede ralentizar las tasas de adopción.

- Las limitaciones de la cadena de suministro de reactivos y consumibles especializados en algunos países de Asia y el Pacífico pueden obstaculizar el despliegue oportuno de dispositivos de inmunoensayo.

- Si bien los precios de los kits básicos de inmunoensayo están disminuyendo gradualmente, los sistemas automatizados y multiplex avanzados siguen siendo caros, lo que restringe el acceso en las regiones de menores ingresos.

- Superar estos desafíos mediante soluciones rentables, apoyo regulatorio e iniciativas de capacitación será crucial para el crecimiento sostenido del mercado en toda la región de Asia y el Pacífico.

Análisis del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

El mercado está segmentado en función del producto, la plataforma, la técnica, el tipo de muestra, la aplicación y el usuario final.

- Por producto

Según el producto, el mercado se segmenta en reactivos, kits y analizadores. Este segmento dominó el mercado en 2025, impulsado por la demanda recurrente de reactivos y kits de ensayo de alta calidad en hospitales, laboratorios clínicos e institutos de investigación. Los reactivos y kits son esenciales para todas las plataformas y técnicas de inmunoensayo, garantizando resultados fiables y reproducibles. Este dominio se sustenta en innovaciones continuas, como los kits multiplex y de alta sensibilidad para la detección de diversas enfermedades. Los hospitales prefieren los kits estandarizados para el cumplimiento normativo y la consistencia de los resultados diagnósticos. Además, la alta prevalencia de enfermedades infecciosas y crónicas en Asia-Pacífico impulsa un consumo sostenido. Las principales empresas se centran en ampliar sus carteras de reactivos, reforzando aún más la cuota de mercado de este segmento.

Se espera que el segmento de analizadores experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente adopción de sistemas automatizados de inmunoensayo en los laboratorios de diagnóstico. Los analizadores reducen los errores humanos, mejoran el rendimiento y permiten el análisis simultáneo de múltiples muestras. Los hospitales urbanos y las cadenas privadas de diagnóstico están invirtiendo fuertemente en sistemas de alto rendimiento para mejorar la eficiencia. Países emergentes como India, Indonesia y Vietnam están adoptando plataformas automatizadas para reducir los plazos de entrega y mejorar la precisión. Además, los fabricantes están introduciendo analizadores compactos y asequibles para laboratorios más pequeños. La creciente tendencia a integrar analizadores con sistemas digitales de gestión de datos acelera aún más su adopción.

- Por plataforma

Según la plataforma, el mercado se segmenta en inmunoensayos de quimioluminiscencia (CLIA), inmunoensayos de fluorescencia (FIA), inmunoensayos enzimáticos (EIA), radioinmunoensayos (RIA) y otros. El segmento de inmunoensayos de quimioluminiscencia (CLIA) dominó el mercado en 2025 con una cuota de mercado del 40,9% debido a su alta sensibilidad, amplio rango dinámico y compatibilidad con sistemas automatizados. Las plataformas CLIA se utilizan ampliamente en hospitales y laboratorios de investigación para oncología, enfermedades infecciosas y pruebas hormonales. Su capacidad para manejar grandes volúmenes de muestras y entregar resultados rápidos las hace muy preferidas. La fuerte presencia de actores globales como Abbott y Roche refuerza su dominio. Los hospitales y laboratorios clínicos confían en las plataformas CLIA para realizar pruebas que cumplen con las normativas. El segmento se beneficia de la I+D continua y la adopción de sistemas CLIA multiplex.

Se espera que el segmento FIA experimente el mayor crecimiento durante el período de pronóstico, impulsado por su idoneidad para el diagnóstico en el punto de atención y aplicaciones de investigación especializada. FIA ofrece alta especificidad, capacidad de multiplexación y compatibilidad con plataformas miniaturizadas. La creciente investigación biotecnológica y la demanda de diagnósticos portátiles en Asia-Pacífico están acelerando su adopción. Países como China, India y Japón están invirtiendo en plataformas basadas en FIA. La adaptabilidad de FIA para la detección rápida de enfermedades aumenta su atractivo en el mercado. El creciente conocimiento sobre las pruebas multiplexadas impulsa el crecimiento en los laboratorios clínicos y de investigación.

- Por técnica

Según la técnica, el mercado se segmenta en ELISA, pruebas rápidas, ELISPOT, Western blot, inmuno-PCR y otras técnicas. El segmento ELISA dominó el mercado en 2025 debido a su amplio uso en el diagnóstico clínico rutinario, su alta reproducibilidad y su rentabilidad. ELISA es el método preferido para el cribado de enfermedades infecciosas, las pruebas hormonales y aplicaciones de investigación. Sus protocolos estandarizados y las aprobaciones regulatorias lo hacen popular en hospitales y laboratorios. Es compatible con múltiples tipos de muestras y plataformas. Las pruebas de alto rendimiento con ELISA contribuyen a la eficiencia en laboratorios con alta demanda. Los fabricantes globales y regionales continúan ampliando la oferta de ELISA para diversas aplicaciones.

Se espera que el segmento de pruebas rápidas experimente el mayor crecimiento durante el período de pronóstico, impulsado por la creciente demanda de diagnósticos en el punto de atención y pruebas domiciliarias. Las pruebas rápidas proporcionan resultados rápidos con una preparación mínima de la muestra. Son adecuadas para la detección urgente de enfermedades infecciosas en zonas rurales o con recursos limitados. Sus formatos portátiles las hacen convenientes para clínicas y pruebas de campo. La concienciación sobre la detección rápida de enfermedades está creciendo en los países emergentes de Asia y el Pacífico. Los fabricantes están innovando con kits de pruebas rápidas de alta sensibilidad, impulsando su adopción en hospitales y centros de diagnóstico.

- Por tipo de muestra

Según el tipo de muestra, el mercado se segmenta en sangre, orina, saliva y otros. El segmento de sangre dominó en 2025, representando la mayor participación en los ingresos, debido a su amplia aplicabilidad en la detección de enfermedades infecciosas, biomarcadores oncológicos, trastornos endocrinos y enfermedades autoinmunes. Las muestras de sangre son estándar en hospitales y laboratorios y son compatibles con la mayoría de las plataformas de inmunoensayo. Las directrices clínicas establecidas y su alta confiabilidad refuerzan aún más su dominio. Las pruebas de sangre facilitan el cribado de gran volumen y el cumplimiento normativo. Los fabricantes de reactivos y analizadores priorizan los kits de sangre. Los hospitales prefieren las muestras de sangre por su reproducibilidad y utilidad clínica comprobada.

Se espera que el segmento de la saliva experimente el mayor crecimiento durante el período de pronóstico, impulsado por la adopción de pruebas no invasivas y diagnósticos en el punto de atención. Los inmunoensayos basados en saliva reducen el riesgo de infección y ofrecen comodidad a pacientes pediátricos y geriátricos. Entre las aplicaciones emergentes se incluye la detección de biomarcadores orales para enfermedades sistémicas. Países como India, China y Japón están adoptando cada vez más las pruebas basadas en saliva. La creciente concienciación e investigación sobre el diagnóstico de saliva impulsan la expansión del mercado. Los fabricantes están desarrollando inmunoensayos portátiles y sensibles basados en saliva, lo que impulsa su adopción en clínicas y laboratorios.

- Por aplicación

Según la aplicación, el mercado se segmenta en enfermedades infecciosas, oncología y endocrinología, trastornos óseos y minerales, cardiología, hematología y cribado sanguíneo, trastornos autoinmunes, toxicología, cribado neonatal, entre otros. El segmento de enfermedades infecciosas dominó el mercado en 2025 debido a la alta prevalencia de infecciones virales y bacterianas y a las iniciativas gubernamentales de cribado a gran escala. Hospitales y laboratorios dependen de plataformas de inmunoensayo para realizar pruebas rápidas y precisas de enfermedades infecciosas. Los programas de salud pública en China, India y el Sudeste Asiático refuerzan la demanda. El alto volumen de pacientes y la frecuencia de las pruebas de cribado contribuyen al dominio del segmento. La introducción continua de nuevos ensayos para enfermedades infecciosas fortalece la presencia en el mercado. Fabricantes globales suministran activamente reactivos y kits para las pruebas de enfermedades infecciosas.

Se espera que el segmento de oncología y endocrinología experimente el mayor crecimiento durante el período de pronóstico, impulsado por el aumento de la incidencia del cáncer, la mayor detección de trastornos hormonales y la concienciación sobre el diagnóstico preventivo. Hospitales y laboratorios especializados adoptan soluciones de inmunoensayo para la detección temprana de enfermedades y el tratamiento personalizado. La expansión de la infraestructura sanitaria en los países emergentes de Asia-Pacífico acelera la adopción. Las iniciativas de investigación para el descubrimiento de biomarcadores también impulsan la demanda. Las plataformas multiplex para pruebas de oncología y endocrinología mejoran la eficiencia. La creciente inversión de actores locales e internacionales en estas áreas de enfermedades impulsa el crecimiento del segmento.

- Por el usuario final

Según el usuario final, el mercado se segmenta en hospitales, laboratorios clínicos, empresas farmacéuticas y biotecnológicas, bancos de sangre, laboratorios de investigación y académicos, entre otros. El segmento hospitalario dominó en 2025 debido al gran volumen de pacientes, los diagnósticos rutinarios continuos y la infraestructura de laboratorio consolidada. Los hospitales dependen de sistemas de inmunoensayo para enfermedades infecciosas, oncología, cardiología y pruebas endocrinas. El alto rendimiento y la integración con analizadores automatizados contribuyen a la eficiencia. La preferencia de los hospitales por los kits estandarizados refuerza su dominio en el segmento. El cumplimiento normativo y la precisión son fundamentales en los entornos hospitalarios. Los proveedores globales y regionales se centran en soluciones hospitalarias para mantener su cuota de mercado.

Se espera que el segmento de laboratorios de investigación y académicos experimente el mayor crecimiento durante el período de pronóstico, impulsado por el aumento de la investigación biotecnológica, la financiación gubernamental y la adopción de técnicas avanzadas de inmunoensayo para el descubrimiento de biomarcadores. La expansión de las iniciativas de investigación en China, India y Corea del Sur está generando una fuerte demanda. Los laboratorios requieren plataformas de alta sensibilidad para ensayos experimentales. Los sistemas multiplex y automatizados se utilizan cada vez más en la investigación académica. La inversión en capacitación e instrumentación avanzada impulsa aún más su adopción. Las colaboraciones en I+D farmacéutica impulsan la demanda de inmunoensayos en este segmento.

Análisis regional del mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

- China dominó el mercado de inmunoensayos de Asia-Pacífico con la mayor participación en los ingresos del 24,8 % en 2025, caracterizada por una infraestructura de atención médica bien establecida, una alta adopción de automatización de laboratorio y una fuerte presencia de actores clave de la industria.

- Los proveedores de atención médica de la región priorizan las plataformas de inmunoensayo rápidas, confiables y de alto rendimiento para detectar enfermedades infecciosas, biomarcadores oncológicos y trastornos endocrinos.

- Esta adopción generalizada se ve respaldada además por las iniciativas gubernamentales para la detección temprana de enfermedades, la creciente prevalencia de enfermedades crónicas e infecciosas y la fuerte presencia de fabricantes de inmunoensayos nacionales e internacionales, que establecen los sistemas de inmunoensayos como una herramienta fundamental en hospitales, laboratorios clínicos y centros de investigación.

Perspectiva del mercado de inmunoensayos en China

El mercado chino de reactivos y dispositivos de inmunoensayo captó la mayor participación en los ingresos, con un 24,8 %, en 2025, impulsado por la gran población de pacientes del país, la expansión de la infraestructura hospitalaria y de laboratorios clínicos, y las crecientes iniciativas gubernamentales para la detección temprana de enfermedades. Los profesionales sanitarios priorizan cada vez más las plataformas avanzadas de inmunoensayo para la detección de enfermedades infecciosas, la oncología y el diagnóstico endocrino. La sólida presencia de fabricantes de inmunoensayos, tanto nacionales como internacionales, junto con los avances tecnológicos en sistemas automatizados y de alto rendimiento, impulsa aún más la expansión del mercado. Además, la creciente concienciación sobre la atención médica preventiva y la introducción continua de reactivos y kits innovadores impulsan su adopción en hospitales e institutos de investigación.

Perspectivas del mercado de inmunoensayos en Japón

El mercado japonés de inmunoensayos está cobrando impulso gracias a la avanzada infraestructura sanitaria del país, el gran enfoque en la medicina preventiva y la creciente demanda de automatización en las pruebas diagnósticas. Los hospitales y laboratorios japoneses priorizan la alta sensibilidad y precisión de las plataformas de inmunoensayos para oncología, enfermedades infecciosas y análisis hormonales. La integración de analizadores automatizados y la generación de informes digitales de datos mejora la eficiencia y la fiabilidad del flujo de trabajo. Además, el envejecimiento de la población y la creciente prevalencia de enfermedades crónicas impulsan el crecimiento de los sistemas de inmunoensayos. La continua I+D por parte de los fabricantes y la adopción de ensayos multiplex y de quimioluminiscencia impulsan la expansión del mercado en entornos de diagnóstico tanto residenciales como comerciales.

Perspectivas del mercado de inmunoensayos en India

El mercado indio de reactivos y dispositivos de inmunoensayo representó la mayor cuota de mercado en ingresos en Asia-Pacífico en 2025, impulsado por la rápida urbanización, la creciente concienciación sobre la salud y la creciente adopción de tecnologías de diagnóstico avanzadas. Hospitales, laboratorios clínicos y cadenas de diagnóstico invierten cada vez más en plataformas de inmunoensayo de alto rendimiento para la detección de enfermedades infecciosas, oncología y trastornos endocrinos. El impulso hacia una infraestructura sanitaria inteligente, la expansión de las redes privadas de diagnóstico y la disponibilidad de reactivos y kits rentables son factores clave que impulsan el mercado. Además, las crecientes iniciativas gubernamentales en materia de salud preventiva y el aumento de la financiación para investigación y desarrollo impulsan el crecimiento sostenido del mercado.

Perspectivas del mercado de inmunoensayos en Corea del Sur

El mercado de inmunoensayos de Corea del Sur está en constante expansión, impulsado por el alto gasto sanitario, las instalaciones de laboratorio tecnológicamente avanzadas y el sólido apoyo gubernamental a los programas de detección temprana de enfermedades. Hospitales y laboratorios clínicos están adoptando sistemas de inmunoensayo automatizados y de alto rendimiento para el diagnóstico de enfermedades infecciosas, oncología y análisis hormonal. El creciente interés en la medicina personalizada y el descubrimiento de biomarcadores está impulsando la adopción de plataformas de inmunoensayos multiplexados y de alta sensibilidad. Además, la presencia de fabricantes líderes a nivel mundial y la continua innovación en reactivos y kits impulsan aún más el crecimiento del mercado. El énfasis de Corea del Sur en un diagnóstico eficiente y preciso posiciona a los sistemas de inmunoensayos como una herramienta esencial en los entornos sanitarios y de investigación.

Cuota de mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico

La industria de reactivos y dispositivos de inmunoensayo de Asia-Pacífico está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- Abbott (EE. UU.)

- Bio Rad Laboratories, Inc. (EE. UU.)

- Beckman Coulter, Inc. (EE. UU.)

- Fapon Biotech Inc. (China)

- Autobio Diagnostics Co., Ltd. (China)

- Corporación Sysmex (Japón)

- Fujirebio (Japón)

- Siemens Healthineers AG (Alemania)

- Thermo Fisher Scientific Inc. (EE. UU.)

- BIOMÉRIEUX (Francia)

- Danaher (Estados Unidos)

- Qiagen (Países Bajos)

- Quidel Corporation (EE. UU.)

- BD (EE. UU.)

- PerkinElmer (Estados Unidos)

- Luminex Corporation (EE. UU.)

- Bio Techne Corporation (EE. UU.)

- Randox Laboratories Ltd. (Reino Unido)

- Diagnóstico Snibe (China)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

¿Cuáles son los desarrollos recientes en el mercado de reactivos y dispositivos de inmunoensayo en Asia-Pacífico?

- En agosto de 2025, las empresas farmacéuticas y de diagnóstico chinas cambiaron significativamente a proveedores nacionales de reactivos de inmunoensayo como Shanghai Titan Scientific y Nanjing Vazyme Biotech para reducir costos y acortar los tiempos de entrega en medio de desafíos de suministro relacionados con aranceles, lo que indica una tendencia de localización en el abastecimiento de reactivos que fortalece las cadenas de suministro de inmunoensayo de APAC.

- En julio de 2025, Fapon anunció planes para presentar su analizador de inmunoensayo y química clínica de acceso abierto Shine mT8000 en la reunión ADLM 2025, un sistema versátil de alto rendimiento que integra pruebas de bioquímica e inmunoensayo que apunta a modernizar los flujos de trabajo de laboratorio en toda la región.

- En enero de 2024, Fujirebio Holdings y Agappe Diagnostics iniciaron una colaboración estratégica para desarrollar y fabricar reactivos y analizadores de inmunoensayo CLIA basados en cartuchos, lo que permitió a Agappe ofrecer una solución completa de quimioluminiscencia con reactivos producidos localmente y expandir las capacidades de inmunoensayo en India.

- En noviembre de 2023, Fapon presentó sus soluciones ampliadas de inmunoensayo y diagnóstico, incluido el sistema totalmente automatizado Shine i8000/9000 CLIA, en el evento MEDICA 2023, reforzando su presencia y oferta de productos para pruebas de inmunoensayo en APAC y más allá.

- En julio de 2023, Fapon lanzó su último analizador de inmunoensayo de quimioluminiscencia de alto rendimiento, el Shine i8000/9000, que ofrece hasta 900 pruebas por hora para satisfacer la creciente demanda de diagnóstico en los laboratorios clínicos de la región de Asia y el Pacífico, lo que marca una importante expansión del producto para el diagnóstico de inmunoensayo.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.