La emulsión de cera es una mezcla estable que comprende pequeñas partículas de cera dispersas uniformemente en agua con la ayuda de emulsionantes . Esta formulación otorga a las emulsiones de cera diversas propiedades ventajosas, convirtiéndolas en aditivos versátiles en múltiples industrias. En recubrimientos y pinturas, sirven como aditivos efectivos, proporcionando beneficios como una mejor resistencia al rayado, repelencia al agua y efectos mateantes. El sector del papel y el embalaje utiliza emulsiones de cera para mejorar el brillo de la superficie, la capacidad de impresión y la resistencia a la humedad de los productos de papel. Además, en la construcción, se utilizan como repelentes de agua, agentes de curado y aditivos en formulaciones de mortero y hormigón, mejorando la durabilidad y el rendimiento. Las industrias textiles emplean emulsiones de cera para impartir suavidad y repelencia al agua a las telas. Además, las emulsiones de cera son esenciales en los cosméticos , facilitando la formulación de cremas, lociones y otros productos de cuidado personal. Con sus diversas aplicaciones y beneficios funcionales, las emulsiones de cera juegan un papel crucial en la mejora de las propiedades y el rendimiento de diversos materiales en todas las industrias.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/north-america-wax-emulsion-market

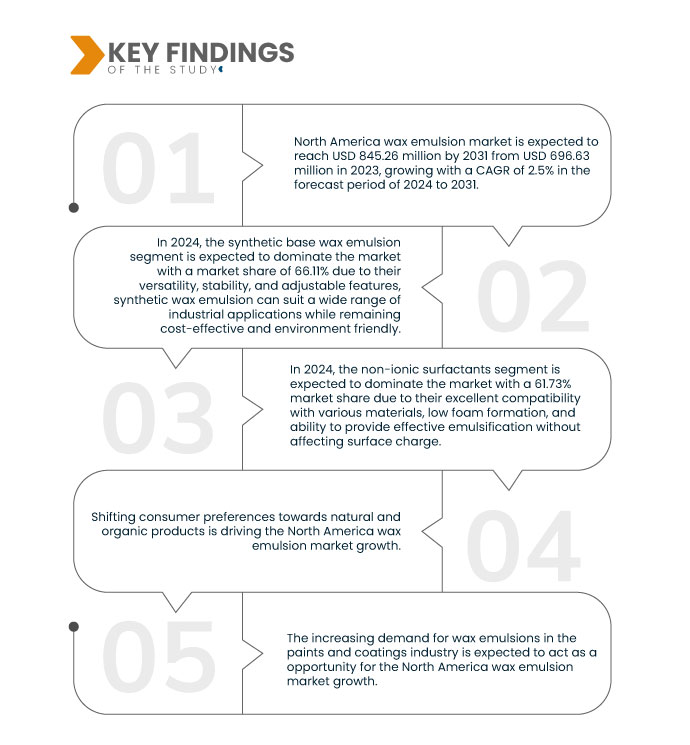

Data Bridge Market Research analiza que se espera que el mercado de emulsiones de cera de América del Norte crezca con una CAGR del 2,5% de 2024 a 2031 y se espera que alcance los USD 845,26 millones para 2031 desde USD 696,63 millones en 2023.

Principales hallazgos del estudio

Aumento de la demanda de diversas industrias de uso final

Las emulsiones de cera ofrecen diversas ventajas que responden a las cambiantes necesidades de las industrias de uso final. Por ejemplo, en el sector de pinturas y recubrimientos, se utilizan para mejorar el rendimiento de los recubrimientos, como la resistencia al rayado, el brillo, la adhesión y la durabilidad. Asimismo, se emplean en el acabado textil para añadir cualidades como suavidad, repelencia al agua y resistencia a las arrugas. Su capacidad para satisfacer las necesidades específicas de la industria las convierte en componentes esenciales en diversos procesos de producción.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Base de material (emulsión de cera de base sintética y emulsión de cera de base natural), emulsionante (tensioactivos no iónicos, tensioactivos aniónicos y tensioactivos catiónicos), industria del usuario final ( pinturas y recubrimientos , textiles , cosméticos, adhesivos y selladores, construcción y carpintería, industria alimentaria y otros).

|

Países cubiertos

|

Estados Unidos, Canadá y México

|

Actores del mercado cubiertos

|

H&R GROUP (Alemania), PMC Group, Inc. (Reino Unido), Repsol (España), Michelman, Inc. (EE. UU.), Henry Company (EE. UU.), Micro Powders, Inc. (EE. UU.), CHT Germany GmbH (Alemania), Nanjing Tianshi New Material Technologies Co., Ltd (China), Paraffinwaxco, Inc. (Irán), BASF SE (Alemania), The Lubrizol Corporation (EE. UU.), Hexion (EE. UU.), ALTANA (Alemania), Sasol Limited (Sudáfrica), SHAMROCK (EE. UU.) y Wacker Chemie AG (Alemania), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis de déficit de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado de emulsiones de cera de América del Norte está segmentado en tres segmentos notables según la base del material, el emulsionante y la industria del usuario final.

- Sobre la base del material base, el mercado de emulsión de cera de América del Norte se segmenta en emulsión de cera de base sintética y emulsión de cera de base natural.

En 2024, se espera que el segmento de emulsiones de cera de base sintética domine el mercado de emulsiones de cera de América del Norte.

En 2024, se espera que el segmento de emulsión de cera de base sintética domine el mercado con una participación de mercado del 66,11% debido a su versatilidad, estabilidad y características ajustables, la emulsión de cera sintética puede adaptarse a una amplia gama de aplicaciones industriales sin dejar de ser rentable y respetuosa con el medio ambiente.

- Sobre la base del emulsionante, el mercado de emulsiones de cera de América del Norte se segmenta en surfactantes no iónicos, surfactantes aniónicos y surfactantes catiónicos.

En 2024, se espera que el segmento de surfactantes no iónicos domine el mercado de emulsiones de cera de América del Norte.

Se espera que en 2024, el segmento de surfactantes no iónicos domine el mercado con una participación de mercado del 61,73% debido a su excelente compatibilidad con diversos materiales, baja formación de espuma y capacidad para proporcionar una emulsificación efectiva sin afectar la carga superficial.

- Según la industria de consumo final, el mercado norteamericano de emulsiones de cera se segmenta en pinturas y recubrimientos, textiles, cosméticos, adhesivos y selladores, construcción y carpintería, industria alimentaria, entre otros. En 2024, se prevé que el segmento de pinturas y recubrimientos domine el mercado con una cuota de mercado del 31,27 %.

Actores principales

Data Bridge Market Research reconoce a las siguientes empresas como los principales actores en el mercado de emulsiones de cera de América del Norte, que incluye a BASF SE (Alemania), Sasol Limited (Sudáfrica), Hexion (EE. UU.), Michelman, Inc. (EE. UU.) y ALTANA (Alemania).

Desarrollos del mercado

- En junio de 2023, Michelman, Inc. obtuvo la prestigiosa distinción de ser la primera ganadora del Premio a la Excelencia de Innovation Research Interchange (IRI) por Ciudadanía Corporativa. Este reconocimiento reconoce la dedicación de Michelman a la sostenibilidad, no solo en sus operaciones, sino también por su influyente papel en la promoción de prácticas sostenibles en diversos sectores, como la impresión digital, el embalaje, los compuestos, los textiles técnicos, la agricultura y los recubrimientos arquitectónicos. La entrega del Premio a la Excelencia IRI tuvo lugar el 24 de mayo de 2023, durante la Cena de Premios IRI celebrada en Filadelfia. El premio reconoció el compromiso de Michelman con la sostenibilidad, contribuyendo a una imagen positiva y una mejor reputación. Este reconocimiento podría atraer a clientes, socios e inversores con conciencia ambiental.

- En abril de 2022, WACKER presentó su línea "Sólidos y Concentrados" para abordar la creciente tendencia en la industria cosmética hacia productos sólidos o concentrados para el cuidado capilar y personal. Las formulaciones presentadas en su stand destacaron el importante papel de las siliconas, en particular BELSIL DADM 3240 E, en la mejora de las propiedades de estos productos concentrados o sólidos, libres de agua. En estas formulaciones, la emulsión de silicona de WACKER actúa como ingrediente activo en productos para el cuidado capilar. La fase oleosa de estos productos contiene dos tipos de siliconas: polímero cruzado de amodimeticona y dimeticona. A través de la emulsión, se forma una red flexible que envuelve las fibras capilares para nutrirlas y ofrecer una protección duradera. Esta formulación de la empresa representó un paso adelante en la creación de nuevos productos para el cuidado capilar y contribuirá a aumentar los ingresos de la empresa.

- En abril de 2022, Shamrock anunció la expansión de una gama de aditivos de cera de origen biológico sostenibles. Estos aditivos especiales de alto rendimiento reflejan la dedicación de la empresa al reciclaje y al fomento de la economía circular con productos sostenibles y respetuosos con el medio ambiente.

- En noviembre de 2021, el Grupo H&R anunció una inversión de 200 millones de MYR (48 millones de USD) en una planta de fabricación de productos especializados en Lumut, Perak. H&R es la refinería y comercializadora sostenible líder a nivel mundial de plastificantes especiales, aceites extensores, suavizantes y ceras. El proyecto se ejecutará tentativamente en tres fases, con una capacidad diseñada de 150.000 toneladas anuales. Las fases I y II se dedicarán a la producción de plastificantes especiales, aceites blancos y emulsiones de cera a partir de recursos minerales, sintéticos y renovables. Esto fortalecerá la presencia de la compañía en el país.

- En enero de 2020, PMC Group, Inc. y Lanxess Organometallics GmbH finalizaron la adquisición de la línea de productos de especialidades de organoestaño de Lanxess por parte de PMC Groupthink. La transacción, anunciada inicialmente el 13 de noviembre de 2019, se completó con éxito el 30 de diciembre de 2019. Esta adquisición abarca las líneas de productos de catalizadores de organoestaño, especialidades de organoestaño e intermedios de Lanxess a nivel mundial. Con la incorporación de las especialidades de organoestaño de Lanxess, PMC Group, Inc. puede diversificar su cartera de productos y ofrecer una gama más amplia de soluciones a sus clientes. Esta diversificación podría abrir nuevos mercados y segmentos de clientes para PMC Group, Inc.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado de emulsión de cera de América del Norte son EE. UU., Canadá y México.

Según el análisis de investigación de mercado de Data Bridge

Se espera que EE. UU. domine el mercado de emulsiones de cera de América del Norte

Se espera que EE. UU. domine el mercado norteamericano de emulsiones de cera debido a la creciente demanda de las industrias usuarias finales y a los avances tecnológicos. El aumento de las actividades de construcción e infraestructura, así como la creciente demanda de la industria del embalaje, también impulsan el crecimiento del mercado en el país.

Para obtener información más detallada sobre el informe del mercado de emulsiones de cera de América del Norte, haga clic aquí: https://www.databridgemarketresearch.com/reports/north-america-wax-emulsion-market