La expansión del sector minorista subraya la necesidad crucial de integrar los sistemas de Identificación por Radiofrecuencia (RFID) y Vigilancia Electrónica de Artículos (EAS). La combinación de RFID, que facilita la gestión del inventario en tiempo real y mejora la eficiencia operativa, con EAS, que proporciona protección antirrobo, garantiza soluciones integrales de seguimiento y seguridad de activos . Esta integración optimiza la visibilidad del inventario, reduce las roturas de stock, minimiza las pérdidas por robo y agiliza los procesos de caja. Al aprovechar RFID para un seguimiento preciso del inventario y EAS para la prevención de robos, los minoristas pueden mejorar la satisfacción del cliente, aumentar las ventas y mantener una ventaja competitiva en el dinámico panorama minorista.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/mexico-rfid-and-electronic-article-surveillance-systems-market

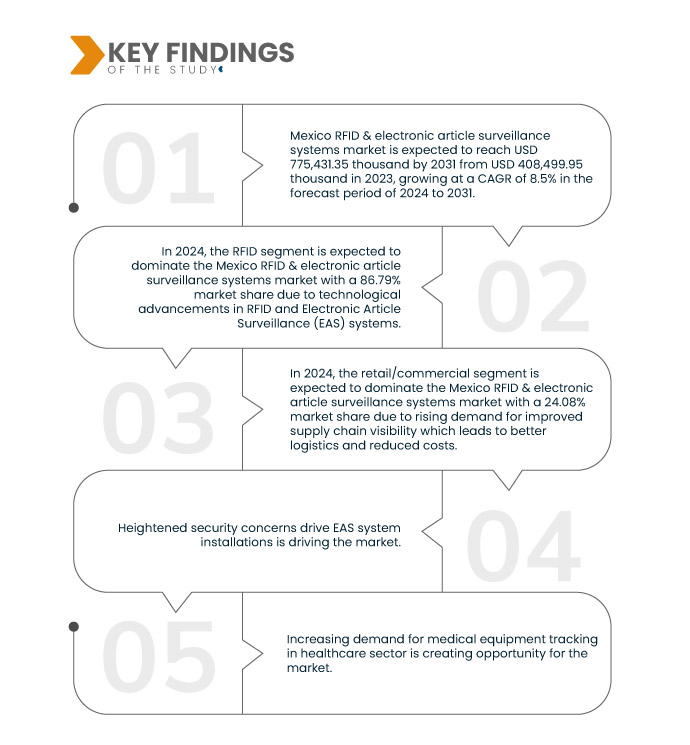

Data Bridge Market Research analiza que se espera que el mercado de sistemas de vigilancia electrónica de artículos y RFID de México alcance un valor de USD 775,431.35 mil para 2031 desde 408,499.95 mil en 2023, creciendo a una CAGR de 8.5% durante el período de pronóstico 2024 a 2031.

La necesidad de mejorar la gestión de inventarios y las medidas de seguridad en sectores como el comercio minorista, la logística y la sanidad está impulsando la adopción de las tecnologías RFID y EAS, y los requisitos de cumplimiento normativo incentivan a las empresas a invertir en estos sistemas para garantizar la transparencia y la trazabilidad de sus operaciones. Además, la creciente prevalencia del robo y la falsificación está impulsando la demanda de soluciones antirrobo robustas proporcionadas por los sistemas EAS. Asimismo, los avances tecnológicos, como la integración de RFID con el IoT y las plataformas en la nube, están ampliando las capacidades y aplicaciones de estos sistemas, impulsando aún más el crecimiento del mercado.

Principales hallazgos del estudio

Creciente conciencia sobre la seguridad y la prevención de pérdidas

La creciente concienciación sobre la seguridad y la prevención de pérdidas representa una oportunidad significativa para el mercado de sistemas RFID y de Vigilancia Electrónica de Artículos (EAS). A medida que las empresas y organizaciones son cada vez más conscientes de los riesgos asociados al robo, la pérdida de inventario y el acceso no autorizado, aumenta la demanda de soluciones de seguridad eficaces. La tecnología RFID, con su capacidad para rastrear y monitorear activos en tiempo real, desempeña un papel crucial en la mejora de las medidas de seguridad. Mediante la implementación de sistemas RFID, las empresas pueden mejorar la visibilidad del inventario, prevenir robos y optimizar los procesos de seguridad, reduciendo así las pérdidas y protegiendo activos valiosos.

Además, el mercado de sistemas de Vigilancia Electrónica de Artículos (EAS) se beneficiará del creciente énfasis en la prevención de pérdidas. Los sistemas EAS, que utilizan etiquetas y sistemas de detección para prevenir robos en entornos minoristas, se están convirtiendo en herramientas indispensables para los minoristas que buscan proteger su mercancía. Con el auge de la delincuencia organizada minorista y el robo interno, existe una creciente necesidad de soluciones EAS robustas que puedan disuadir eficazmente el hurto y las pérdidas. Como resultado, se prevé un aumento en la demanda de tecnologías EAS avanzadas, incluyendo sistemas basados en RFID, lo que representa oportunidades lucrativas para que los actores del mercado innoven y satisfagan las cambiantes necesidades de seguridad de los minoristas y las empresas.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en miles de USD

|

Segmentos cubiertos

|

Ofertas (hardware, software y servicios), tipo (sistemas de vigilancia electrónica de artículos y RFID), tamaño de la organización (grandes, pequeñas y medianas), aplicación (control de acceso, seguimiento de activos, seguimiento de personal, gestión de joyas, etc.), usuarios finales (minorista/comercial, logística y transporte, automoción, industria, atención médica, aeroespacial, tecnología de la información (TI), defensa, educación, ganadería, deportes, fauna silvestre, etc.), canal de venta (indirecto y directo).

|

Estados cubiertos

|

Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas, and Rest of Mexico

|

Actores del mercado cubiertos

|

Checkpoint Systems, Inc (EE. UU.), AVERY DENNISON CORPORATION (EE. UU.), Johnson Controls (EE. UU.), Zebra Technologies Corp (EE. UU.), HID Global Corporation, parte de ASSA ABLOY (EE. UU.), Honeywell International Inc. (EE. UU.), Dahua Technology (China), Amersec sro (República Checa), Datalogic SpA (Italia) y Gunnebo AB (Suecia), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos

El mercado de sistemas de vigilancia electrónica de artículos y RFID de México se clasifica en seis segmentos notables que se basan en la oferta, el tipo, el tamaño de la organización, la aplicación, los usuarios finales y el canal de ventas.

- Con base en las ofertas, el mercado mexicano de sistemas de vigilancia electrónica de artículos y RFID se segmenta en hardware, software y servicio.

En 2024, se espera que el segmento de hardware domine el mercado mexicano de sistemas de vigilancia electrónica de artículos y RFID.

Se espera que en 2024, el segmento de hardware domine el mercado de sistemas de vigilancia electrónica de artículos y RFID en México con un 49.36% debido a que los componentes de hardware como etiquetas RFID, lectores, antenas y sistemas EAS forman la columna vertebral de estas tecnologías y sirven como infraestructura fundamental para la implementación .

- Según el tipo, el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos se segmenta en sistemas RFID y de vigilancia electrónica de artículos. En 2024, se espera que el segmento RFID domine el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos con una participación de mercado del 86.79%.

- Según el tamaño de la organización, el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos se segmenta en grandes, pequeñas y medianas empresas. En 2024, se espera que el segmento de grandes empresas domine el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos con una participación de mercado del 62.66%.

- En función de su aplicación, el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos se segmenta en control de acceso, rastreo de activos, rastreo de personal, gestión de joyas, entre otros. En 2024, se prevé que el segmento de control de acceso domine el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos con una participación de mercado del 44.85%.

- Con base en los usuarios finales, el mercado mexicano de sistemas de vigilancia electrónica de artículos y RFID está segmentado en comercio minorista/comercial, logística y transporte, automotriz, industrial, atención médica, aeroespacial, tecnología de la información (TI), defensa, educación, ganadería, deportes, vida silvestre y otros.

En 2024, se espera que el segmento minorista/comercial domine el mercado de sistemas de vigilancia electrónica de artículos y RFID en México.

Se espera que en 2024, el segmento minorista/comercial domine el mercado de sistemas de vigilancia electrónica de artículos y RFID en México con una participación de mercado del 24.08%.

- Según el canal de venta, el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos se segmenta en indirecto y directo. En 2024, se espera que el segmento indirecto domine el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos con una participación de mercado del 56.07%.

Actores principales

Data Bridge Market Research analiza a Checkpoint Systems, Inc. – Una división de CCL Industries Inc (EE. UU.), AVERY DENNISON CORPORATION (EE. UU.), Johnson Controls (EE. UU.), Zebra Technologies Corp (EE. UU.), HID Global Corporation, parte de ASSA ABLOY (EE. UU.) como los principales actores que operan en el mercado.

Desarrollo del mercado

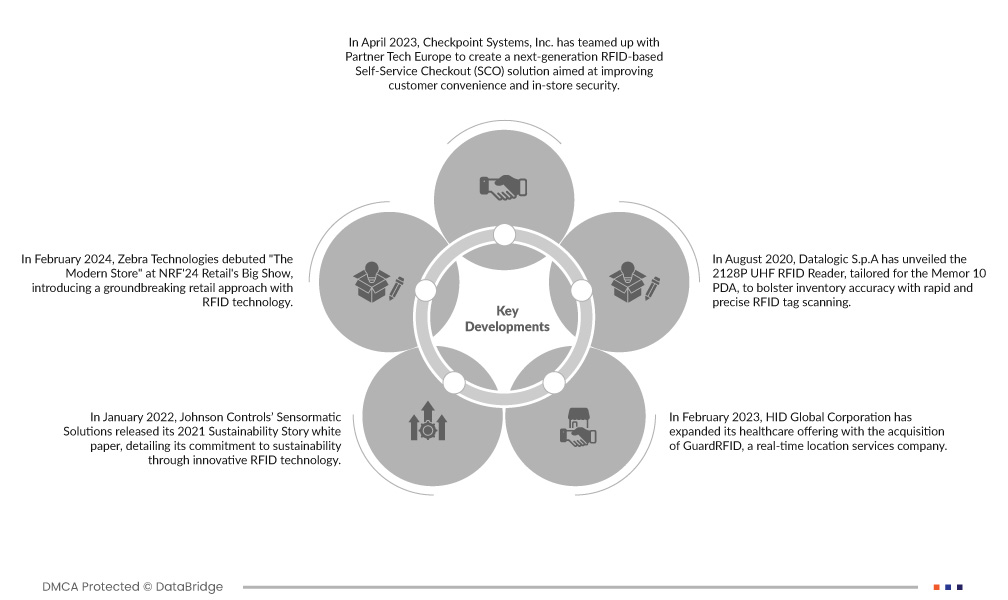

- En abril de 2023, Checkpoint Systems, Inc. se asoció con Partner Tech Europe para crear una solución de caja de autoservicio (SCO) de última generación basada en RFID, destinada a mejorar la comodidad del cliente y la seguridad en las tiendas. Esta colaboración refuerza la presencia de Checkpoint Systems, Inc. en el mercado RFID al integrar su tecnología en sistemas SCO avanzados. La nueva solución mejora la experiencia del cliente, aumenta la prevención de pérdidas y proporciona datos de compra precisos, impulsando así las ventas y la eficiencia operativa de los minoristas.

- En febrero de 2024, Zebra Technologies presentó "La Tienda Moderna" en la feria NRF'24 Retail's Big Show, presentando un enfoque innovador para el comercio minorista con tecnología RFID. Esta innovación optimiza la gestión de inventario, personaliza las interacciones con los clientes y optimiza las operaciones de la tienda con funciones como el autopago y perfiles de usuario personalizados. Al integrar la tecnología RFID en los entornos minoristas, Zebra consolida su reputación de ofrecer soluciones avanzadas que mejoran la eficiencia operativa, la precisión y la experiencia del cliente. El éxito de "La Tienda Moderna" fortalece la posición de Zebra en el mercado y amplía su impacto en el sector de la tecnología para el comercio minorista.

- En enero de 2022, Sensormatic Solutions de Johnson Controls publicó su informe técnico "Historia de Sostenibilidad 2021", en el que detalla su compromiso con la sostenibilidad a través de la innovadora tecnología RFID. Sus sistemas de Vigilancia Electrónica de Artículos (EAS) ahora consumen un 50 % menos de energía, y la solución de Inteligencia de Inventario, que aprovecha la tecnología RFID, reduce los residuos y las emisiones de carbono en la cadena de suministro. Este enfoque en la sostenibilidad beneficia tanto a minoristas como a compradores, garantizando operaciones eficientes, un menor consumo de energía y experiencias de compra fluidas.

- En febrero de 2023, HID Global Corporation amplió su oferta de servicios de salud con la adquisición de GuardRFID, una empresa de servicios de localización en tiempo real. Esta adquisición fortalece la presencia de HID en el sector de RFID activo y RTLS, permitiéndole ofrecer soluciones innovadoras para la seguridad infantil, la prevención de la intimidación del personal, el rastreo de activos y la atención a pacientes deambulantes. La adquisición fortalece la capacidad de HID para proteger a los pacientes y al personal en centros de salud, posicionándolos como líderes del sector.

- En agosto de 2020, Datalogic SpA presentó el lector RFID UHF 2128P, diseñado específicamente para la PDA Memor 10, para optimizar la precisión del inventario con un escaneo rápido y preciso de etiquetas RFID. Este avance amplía las capacidades RFID de Datalogic SPA, lo que permite un rendimiento superior en la lectura de etiquetas. Con la introducción del lector RFID UHF 2128P, Datalogic mejora la precisión y la eficiencia del inventario para sus clientes. Características clave como la máxima potencia de salida, el amplio rango de lectura y el software de deduplicación de etiquetas optimizan los procesos de gestión de inventario, posicionando a Datalogic como proveedor líder de soluciones RFID de vanguardia en sectores como el comercio minorista, el transporte y la logística, la fabricación y la sanidad.

Análisis regional

Geográficamente, los estados cubiertos en el informe del mercado de sistemas de vigilancia electrónica de artículos y RFID de México son Jalisco, Oaxaca, Chihuahua, Coahuila de Zaragoza, Sonora, Zacatecas y el resto de México.

Según el análisis de investigación de mercado de Data Bridge:

Se espera que Jalisco sea el estado dominante y de más rápido crecimiento en el mercado de sistemas de vigilancia electrónica de artículos y RFID en México.

Jalisco domina el mercado mexicano de sistemas RFID y de vigilancia electrónica de artículos gracias a su importante centro de tecnología e innovación. El estado alberga un ecosistema próspero de empresas tecnológicas, instituciones de investigación y personal cualificado, lo que fomenta un entorno propicio para el desarrollo y la adopción de sistemas RFID y EAS.

Para obtener información más detallada sobre el mercado mexicano de sistemas de vigilancia electrónica de artículos y RFID, haga clic aquí: https://www.databridgemarketresearch.com/reports/mexico-rfid-and-electronic-article-surveillance-systems-market