En los últimos años, empresas de todos los sectores han reconocido que una gestión eficaz de riesgos no es solo una necesidad de cumplimiento, sino un imperativo estratégico para el éxito a largo plazo. Incidentes de gran repercusión, como crisis financieras, brechas de ciberseguridad y desastres naturales, han puesto de manifiesto las devastadoras consecuencias de una gestión de riesgos inadecuada. Esta mayor concienciación ha impulsado a las organizaciones a priorizar la gestión de riesgos como un componente fundamental de sus operaciones, lo que ha impulsado la demanda de soluciones y servicios integrales, lo que se espera impulse el crecimiento del mercado.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-risk-management-market

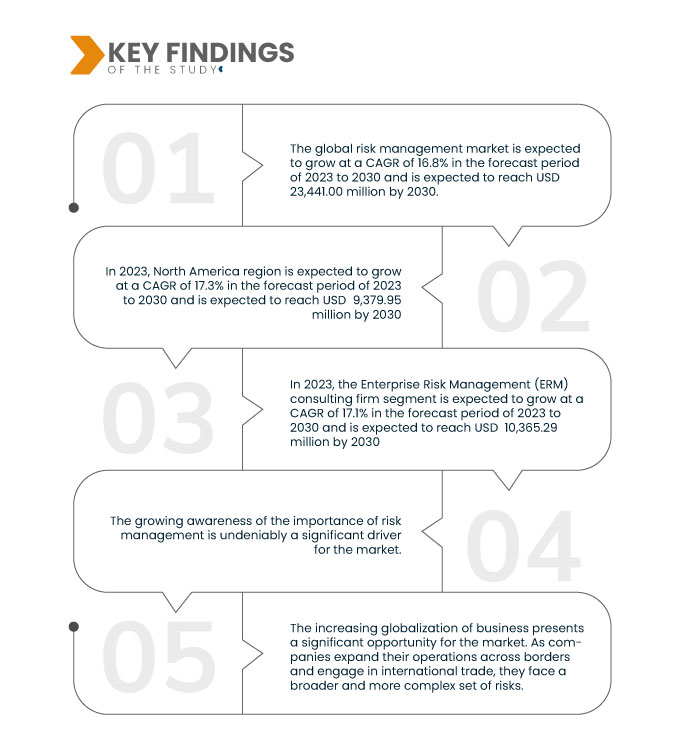

Data Bridge Market Research analiza que se espera que el mercado global de gestión de riesgos crezca a una tasa de crecimiento anual compuesta (CAGR) del 16,8 % durante el período de pronóstico de 2023 a 2030, alcanzando los 23 441 millones de dólares en 2030 y los 6864,95 millones de dólares en 2022. Se espera que el creciente enfoque en cuestiones ambientales, sociales y de gobernanza (ESG) genere oportunidades de crecimiento del mercado.

Principales hallazgos del estudio

Creciente complejidad del entorno empresarial

La creciente complejidad del panorama empresarial contemporáneo es un impulsor convincente del crecimiento del mercado. En el actual entorno empresarial interconectado y en rápida evolución, las organizaciones se enfrentan a una compleja red de riesgos que abarca desafíos financieros, operativos, regulatorios, tecnológicos y de reputación. Las empresas se enfrentan a un abanico cada vez mayor de amenazas e incertidumbres potenciales a medida que avanza la globalización y la digitalización. Esta mayor complejidad requiere estrategias y herramientas sofisticadas de gestión de riesgos que ayuden a las empresas a identificar, evaluar y mitigar eficazmente estos riesgos.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2023 a 2030

|

Año base

|

2022

|

Años históricos

|

2021 (Personalizable para 2015 – 2020)

|

Unidades cuantitativas

|

Ingresos en millones de USD

|

Segmentos cubiertos

|

Tipo de riesgo (riesgo financiero y crediticio, riesgo operacional, riesgo de cumplimiento, riesgo legal, riesgo estratégico y riesgo de seguridad), tipo de empresa (empresa independiente de consultoría en gestión de riesgos de propiedad y accidentes asegurables/ingeniería de riesgos, empresa de consultoría en gestión de riesgos empresariales (ERM) y empresa de consultoría en gestión de riesgos logísticos y de transporte), tamaño de la empresa (grandes y pequeñas y medianas empresas), sector vertical (BFSI, TI y telecomunicaciones, comercio minorista, atención médica, energía y servicios públicos, fabricación, gobierno y defensa, transporte y logística, y otros).

|

Países cubiertos

|

EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Bélgica, Rusia, Suiza, Dinamarca, Suecia, Finlandia, Turquía, Polonia, Noruega, resto de Europa, China, Japón, Corea del Sur, India, Taiwán, Australia, Indonesia, Tailandia, Malasia, Singapur, Nueva Zelanda, Filipinas, Vietnam, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Arabia Saudita, Emiratos Árabes Unidos, Irán, Sudáfrica, Egipto, Irak, Israel, Qatar, Kuwait, Jordania y resto de Medio Oriente y África.

|

Actores del mercado cubiertos

|

Risk Logic Inc (EE. UU.), RISKPARTNER (EE. UU.), RiskVersity (EE. UU.), JVB & Co. (India), Cymune (India), Riskinsight Consulting Pvt. Ltd (India), Risk Solutions International (EE. UU.), LEA (Argentina), Riskpro India Ventures Private Limited (India), ICON Risk (EE. UU.), ERM EXCHANGE (EE. UU.) y CEERISK (Reino Unido), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos del mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye un análisis en profundidad de expertos, análisis de importación/exportación, análisis de precios, análisis de consumo de producción y análisis pestle.

|

Análisis de segmentos

El mercado global de gestión de riesgos está segmentado en cuatro segmentos notables, que se basan en el tipo de riesgo, el tipo de empresa, el tamaño de la empresa y la vertical.

- Según el tipo de riesgo, el mercado se segmenta en riesgo de cumplimiento, riesgo financiero y crediticio, riesgo de seguridad, riesgo operacional, riesgo estratégico y riesgo legal.

Se espera que en 2023, el segmento de riesgo de cumplimiento domine el mercado.

Se espera que en 2023, el segmento de riesgo de cumplimiento domine el mercado con una participación de mercado del 33,09 % debido a la creciente complejidad de las regulaciones, las fuertes sanciones financieras por incumplimiento y la importancia crítica de preservar la reputación y la confianza en el entorno empresarial actual.

- Sobre la base del tipo de empresa, el mercado se segmenta en empresas consultoras independientes de ingeniería de riesgos y gestión de riesgos de propiedad y accidentes asegurables, empresas consultoras de gestión de riesgos empresariales (ERM) y empresas consultoras de gestión de riesgos logísticos y de transporte.

Se espera que en 2023, el segmento de empresas de consultoría de gestión de riesgos empresariales (ERM) domine el mercado.

Se espera que en 2023, el segmento de empresas de consultoría de Gestión de Riesgos Empresariales (ERM) domine el mercado con una participación de mercado del 43,41 %, ya que las empresas buscan su experiencia para evaluar, diseñar estrategias y mitigar los riesgos de manera integral, especialmente en un mundo cada vez más interconectado e incierto donde un enfoque holístico del riesgo es crucial para el éxito a largo plazo.

- Según el tamaño de la empresa, el mercado se segmenta en grandes empresas y pequeñas y medianas empresas. En 2023, se prevé que el segmento de grandes empresas domine el mercado con una participación del 67,84 %.

- Según el sector vertical, el mercado se segmenta en BFSI, TI y telecomunicaciones, salud, comercio minorista, manufactura, gobierno y defensa, transporte y logística, energía y servicios públicos, entre otros. En 2023, se espera que el segmento BFSI domine el mercado con una participación del 31,06 %.

Actores principales

Data Bridge Market Research analiza a RISKPARTNER (EE. UU.), LEA (Argentina), RiskVersity (EE. UU.), ERM EXCHANGE (EE. UU.), CEERISK (Reino Unido) como los principales actores del mercado.

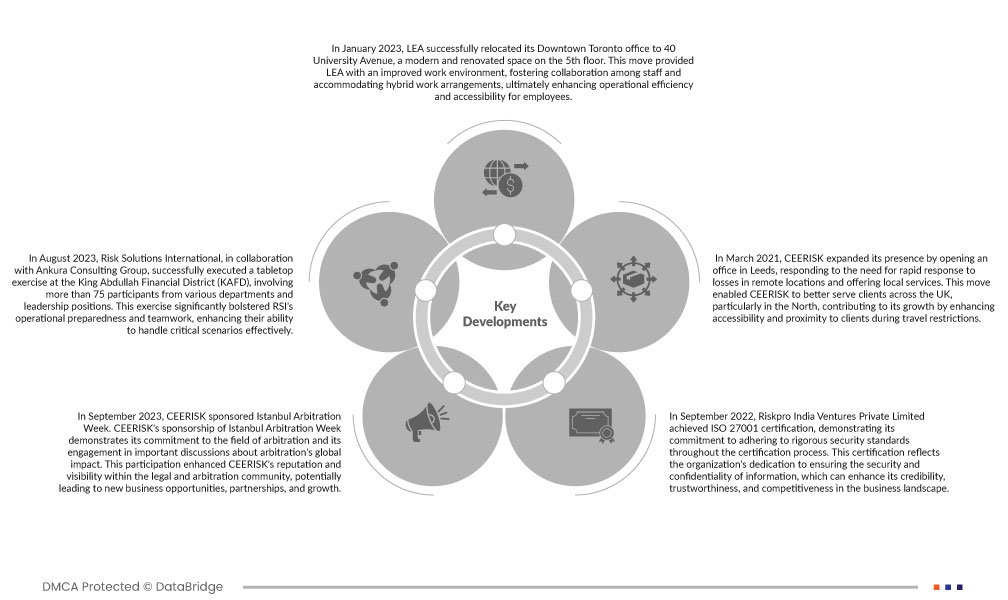

Desarrollo reciente

- En enero de 2023, LEA trasladó con éxito su oficina del centro de Toronto a 40 University Avenue, un espacio moderno y renovado en la quinta planta. Esta mudanza proporcionó a LEA un mejor entorno de trabajo, fomentando la colaboración entre el personal y facilitando la colaboración híbrida, lo que en última instancia mejoró la eficiencia operativa y la accesibilidad para los empleados.

- En agosto de 2023, Risk Solutions International, en colaboración con Ankura Consulting Group, realizó con éxito un simulacro de simulación en el Distrito Financiero Rey Abdullah (KAFD), con la participación de más de 75 participantes de diversos departamentos y puestos de liderazgo. Este ejercicio reforzó significativamente la preparación operativa y el trabajo en equipo de RSI, mejorando su capacidad para gestionar escenarios críticos con eficacia.

- En septiembre de 2023, CEERISK patrocinó la Semana del Arbitraje de Estambul. Este patrocinio demuestra su compromiso con el arbitraje y su participación en debates cruciales sobre su impacto global. Esta participación fortaleció la reputación y la visibilidad de CEERISK en la comunidad jurídica y de arbitraje, lo que podría generar nuevas oportunidades de negocio, alianzas y crecimiento.

- En septiembre de 2022, Riskpro India Ventures Private Limited obtuvo la certificación ISO 27001, lo que demuestra su compromiso con el cumplimiento de rigurosos estándares de seguridad durante todo el proceso de certificación. Esta certificación refleja la dedicación de la organización a garantizar la seguridad y la confidencialidad de la información, lo que puede mejorar su credibilidad, fiabilidad y competitividad en el sector empresarial.

- En marzo de 2021, CEERISK amplió su presencia con la apertura de una oficina en Leeds, respondiendo a la necesidad de una respuesta rápida ante pérdidas en zonas remotas y ofreciendo servicios locales. Esta decisión permitió a CEERISK prestar un mejor servicio a sus clientes en todo el Reino Unido, especialmente en el norte, lo que contribuyó a su crecimiento al mejorar la accesibilidad y la proximidad a los clientes durante las restricciones de viaje.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado global de gestión de riesgos son EE. UU., Canadá, México, Alemania, Reino Unido, Francia, Italia, España, Países Bajos, Bélgica, Rusia, Suiza, Dinamarca, Suecia, Finlandia, Turquía, Polonia, Noruega, resto de Europa, China, Japón, Corea del Sur, India, Taiwán, Australia, Indonesia, Tailandia, Malasia, Singapur, Nueva Zelanda, Filipinas, Vietnam, resto de Asia-Pacífico, Brasil, Argentina, resto de Sudamérica, Arabia Saudita, Emiratos Árabes Unidos, Irán, Sudáfrica, Egipto, Irak, Israel, Qatar, Kuwait, Jordania y resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge:

Se estima que América del Norte será la región dominante en el período de pronóstico 2023-2030.

Se espera que la región de América del Norte domine el mercado debido a su extensa industria de servicios financieros, su estricto entorno regulatorio y su alto conocimiento de las prácticas de gestión de riesgos, lo que la convierte en un centro importante para los servicios y soluciones de gestión de riesgos.

Se estima que Europa será la región de más rápido crecimiento en el mercado global de gestión de riesgos en el período de pronóstico 2023-2030.

Se prevé que Europa crezca durante el período de pronóstico debido a sus estrictos sistemas regulatorios en diversos sectores. Estos requisitos suelen exigir que las organizaciones cuenten con procesos y tecnologías integrales de gestión de riesgos para garantizar el cumplimiento normativo. Como resultado, existe una creciente demanda de soluciones y servicios de gestión de riesgos.

Para obtener información más detallada sobre el informe de mercado de gestión de riesgos, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-risk-management-market