La creciente demanda de electrónica de consumo impulsa el mercado global de sustratos de vidrio. Entre los factores clave se encuentra la necesidad de pantallas de alta resolución en smartphones, tablets y televisores, lo que ha impulsado la adopción de sustratos de vidrio avanzados. Estos sustratos son compatibles con innovaciones como la tecnología OLED, las pantallas curvas y las gafas de realidad aumentada (RA). Los dispositivos wearables también contribuyen a esta demanda, ya que requieren sustratos de vidrio duraderos y ligeros. El crecimiento del mercado se ve impulsado aún más por las colaboraciones entre empresas de electrónica de consumo y fabricantes de sustratos de vidrio para satisfacer las cambiantes demandas tecnológicas y mantener la competitividad. En general, la evolución de la electrónica de consumo impulsa la innovación en materiales y procesos de sustratos de vidrio, lo que define la trayectoria de la industria.

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-glass-substrate-market

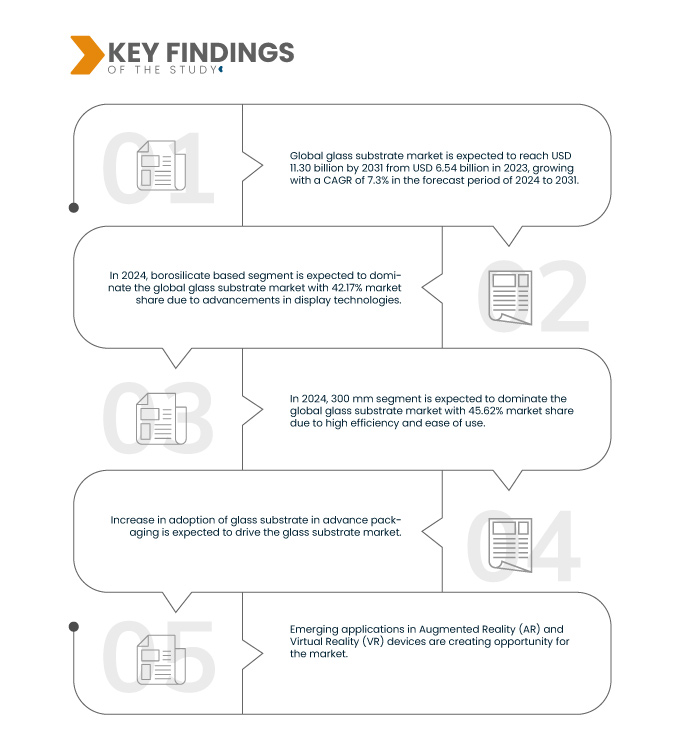

Data Bridge Market Research analiza que se espera que el mercado global de sustrato de vidrio alcance los USD 11,30 mil millones para 2031, desde USD 6,54 mil millones en 2023, creciendo con una CAGR del 7,3% en el período de pronóstico de 2024 a 2031.

La adopción de la demanda se debe al crecimiento del sector de la electrónica de consumo. Esto se debe a la necesidad de pantallas de alta resolución en teléfonos inteligentes , tabletas y televisores, lo que ha impulsado una mayor adopción de sustratos de vidrio avanzados. Como resultado, organizaciones de diversos sectores invierten cada vez más en soluciones de sustrato de vidrio para modernizar sus plantas de fabricación y obtener una ventaja competitiva en el mercado.

Principales hallazgos del estudio

Avances en las tecnologías de visualización

Los avances en la tecnología de visualización explican la creciente demanda de sustratos de vidrio. Con la evolución de tecnologías de visualización como los OLED, las pantallas curvas y la realidad aumentada , existe una mayor necesidad de sustratos de vidrio especializados para respaldar estas innovaciones. Además, la demanda de resoluciones más altas y formatos más delgados en dispositivos como teléfonos inteligentes, tabletas y televisores exige el uso de sustratos de vidrio avanzados. A medida que los fabricantes se esfuerzan por satisfacer estas demandas tecnológicas y las preferencias de los consumidores, recurren a la colaboración con proveedores de sustratos de vidrio para desarrollar y producir sustratos que cumplan con los estrictos requisitos de las aplicaciones de visualización modernas.

En el mercado actual, el sustrato de vidrio es un componente crucial que impulsa los avances tecnológicos en diversas industrias. Su versatilidad y durabilidad lo hacen indispensable en aplicaciones que abarcan desde la electrónica de consumo, como teléfonos inteligentes y televisores, hasta las energías renovables, como los paneles solares fotovoltaicos. Con la creciente demanda de pantallas de alta resolución, pantallas táctiles y dispositivos ópticos avanzados, la importancia de los sustratos de vidrio sigue creciendo. Además, las innovaciones en los procesos y materiales de fabricación de vidrio están ampliando su potencial en campos emergentes como la biotecnología y los sensores automotrices. En general, el sustrato de vidrio desempeña un papel fundamental en el desarrollo de tecnologías de vanguardia y en la transformación del panorama de las industrias modernas.

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Tipo (a base de borosilicato, a base de sílice fundida/cuarzo, silicio y otros), diámetro de oblea (300 mm, 200 mm, 150 mm, 125 mm, más de 300 mm y hasta 100 mm), aplicación (encapsulado de oblea, soporte de sustrato e intercalador TGV), uso final (electrónica, aplicaciones ópticas, aeroespacial y defensa, automoción y energía solar, y medicina).

|

Países cubiertos

|

EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, Resto de Europa, China, Japón, India, Corea del Sur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Filipinas, Taiwán, Resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, Resto de Oriente Medio y África, Brasil, Argentina y Resto de Sudamérica.

|

Actores del mercado cubiertos

|

Avanstrate Inc. (Japón), SCHOTT (Alemania), Corning Incorporated (EE. UU.), AGC Inc. (Japón), HOYA Corporation (Japón), Dongxu Group Co., Ltd. (China), Irico Group New Energy Company Limited (China), TECNISCO, LTD (Japón), Nippon Electric Glass Co., Ltd. (Japón ) , Plan Optik AG (Alemania), Ohara Inc. (Japón), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado global de sustrato de vidrio está segmentado en cuatro segmentos notables, que se basan en el tipo, la aplicación, el diámetro de la oblea y el uso final.

- Según el tipo, el mercado global de sustratos de vidrio se segmenta en a base de borosilicato, a base de sílice/cuarzo fundido, silicio y otros.

Se espera que en 2024, el segmento basado en borosilicato domine el mercado mundial de sustratos de vidrio.

Se espera que en 2024, el segmento basado en borosilicato domine el mercado con una participación de mercado del 42,17 % debido a su alta eficiencia y productividad en todas las industrias.

- Sobre la base del diámetro de la oblea, el mercado global de sustrato de vidrio se segmenta en 300 mm, 200 mm, 150 mm, 125 mm, más de 300 mm y hasta 100 mm.

Se espera que en 2024, el segmento de 300 mm domine el mercado mundial de sustratos de vidrio.

Se espera que en 2024, el segmento de 300 mm domine el mercado mundial de sustrato de vidrio con un 45,62 % debido a su relación calidad-precio y facilidad de uso.

- Según su aplicación, el mercado global de sustratos de vidrio se segmenta en empaquetado de obleas, soporte de sustrato e intercalador TGV. Se prevé que en 2024, el segmento de empaquetado de obleas domine el mercado global de sustratos de vidrio con una cuota de mercado del 51,96 %.

- Según el uso final, el mercado global de sustratos de vidrio se segmenta en electrónica, aplicaciones ópticas, aeroespacial y defensa, automoción y energía solar, y medicina. Se prevé que en 2024, el segmento de electrónica domine el mercado global de sustratos de vidrio con una cuota de mercado del 38,68 %.

Actores principales

Data Bridge Market Research analiza a AvanStrate Inc. (Japón), SCHOTT (Alemania), Corning Incorporated (EE. UU.), AGC Inc. (Japón) y HOYA Corporation (Japón) como los principales actores que operan en el mercado.

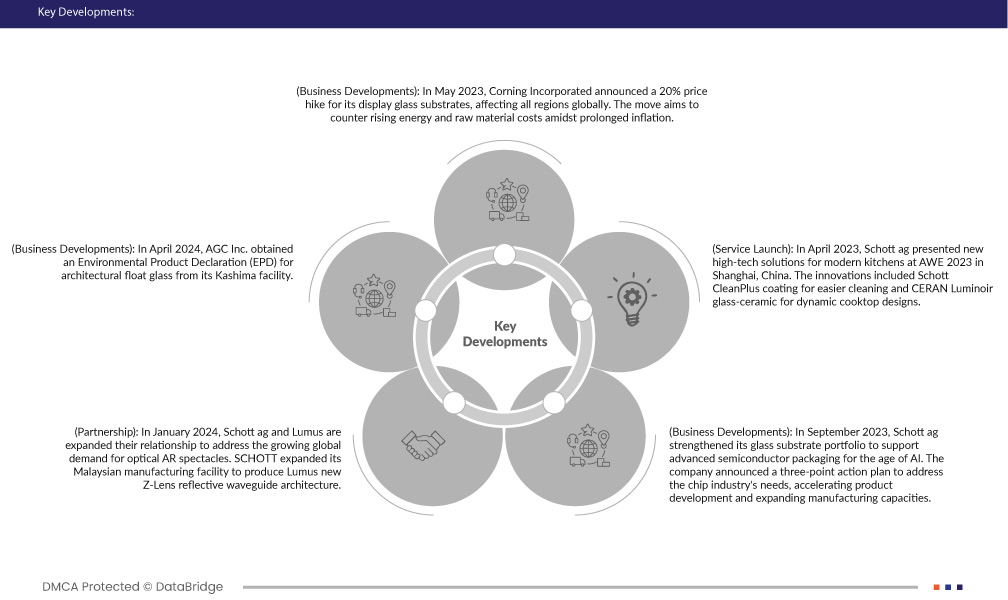

Desarrollo del mercado

- En abril de 2024, AGC Inc. obtuvo una Declaración Ambiental de Producto (DAP) para vidrio flotado arquitectónico en sus instalaciones de Kashima. SuMPO validó la DAP midiendo los efectos ambientales desde la adquisición de las materias primas hasta la fabricación. Esto facilita a los compradores la evaluación objetiva del impacto ambiental. Los productos con certificación DAP contribuyen a la obtención de certificaciones de construcción ecológica como LEED y cumplen con la legislación de construcción. En consonancia con la adquisición de DAP, la reducción del impacto ambiental es un componente clave del objetivo a medio plazo de AGC. Esta acción promueve el abastecimiento y la compra sostenibles, lo que mejora las posibilidades de expansión de AGC en el sector de la construcción.

- En enero de 2024, Schott y Lumus ampliaron su colaboración para abordar la creciente demanda global de gafas ópticas de RA. SCHOTT amplió su planta de fabricación en Malasia para producir la nueva arquitectura de guía de ondas reflectante Z-Lens de Lumus. La colaboración tenía como objetivo apoyar todas las etapas del desarrollo de productos de electrónica de consumo, desde el prototipo hasta la fabricación a gran escala, haciendo que las gafas ópticas de RA sean más accesibles para el público general.

- En mayo de 2023, Corning Incorporated anunció un aumento del 20 % en el precio de sus sustratos de vidrio para pantallas, que afectó a todas las regiones del mundo. La medida busca contrarrestar el aumento de los costos de la energía y las materias primas en un contexto de inflación prolongada. Ante la creciente demanda de vidrio para pantallas, impulsada por la recuperación del sector y las tendencias estacionales, Corning prevé un mayor crecimiento. Este ajuste estratégico posiciona a Corning para mejorar sus ingresos y obtener perspectivas de expansión en el mercado, en un contexto de dinámicas cambiantes.

- En abril de 2023, Schott presentó nuevas soluciones de alta tecnología para cocinas modernas en la feria AWE 2023 de Shanghái, China. Entre las innovaciones se encontraban el revestimiento Schott CleanPlus para una limpieza más sencilla y la vitrocerámica CERAN Luminoir para diseños dinámicos de placas de cocción. Estos productos recibieron una atención positiva y premios, lo que demuestra el compromiso de Schott AG de dar forma al futuro de los electrodomésticos de cocina.

- En febrero de 2019, HOYA Corporation inició la construcción de una nueva planta para sustratos de vidrio para discos duros. La fábrica, con una inversión de 30 000 millones de yenes (270,5 millones de dólares estadounidenses), ubicada en Laos, está prevista para principios de 2020. Esta medida amplía la capacidad de producción de HOYA para satisfacer la demanda de discos duros de última generación. Este avance posiciona a HOYA para el crecimiento en un contexto de creciente preferencia por los sustratos de vidrio en discos duros de alta capacidad frente al aluminio.

Análisis regional

Geográficamente, los países cubiertos en el informe del mercado global de sustrato de vidrio son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, resto de Europa, China, Japón, India, Corea del Sur, Malasia, Australia y Nueva Zelanda, Tailandia, Indonesia, Filipinas, Taiwán, resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, resto de Medio Oriente y África, Brasil, Argentina y resto de Sudamérica.

Según el análisis de investigación de mercado de Data Bridge:

Se espera que América del Norte sea la región dominante y de más rápido crecimiento en el mercado mundial de sustratos de vidrio.

Se espera que América del Norte sea la región dominante y de más rápido crecimiento en el mercado global de sustrato de vidrio debido a la presencia de actores clave, avances tecnológicos sólidos y una alta demanda impulsada por industrias como la electrónica, la automotriz y la atención médica.

Para obtener información más detallada sobre el informe del mercado global de sustrato de vidrio, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-glass-substrate-market