La sincronización y el uso compartido de archivos empresariales (EFSS) es crucial para las empresas modernas, ya que permite una colaboración fluida y una mayor productividad entre equipos distribuidos. Respalda la creciente tendencia del trabajo remoto al brindar acceso seguro a archivos desde cualquier lugar. EFSS garantiza la seguridad y el cumplimiento de los datos mediante cifrado y controles de acceso, mientras que el control de versiones mantiene la integridad de los archivos. La administración de archivos centralizada simplifica el acceso y el uso compartido en toda la organización. La escalabilidad y la integración con otras herramientas hacen que EFSS se adapte a las necesidades comerciales en evolución, desempeñando un papel fundamental en la optimización de los flujos de trabajo y la mejora de la eficiencia general.

Acceder al informe completo @https://www.databridgemarketresearch.com/reports/global-enterprise-file-synchronization-and-sharing-market

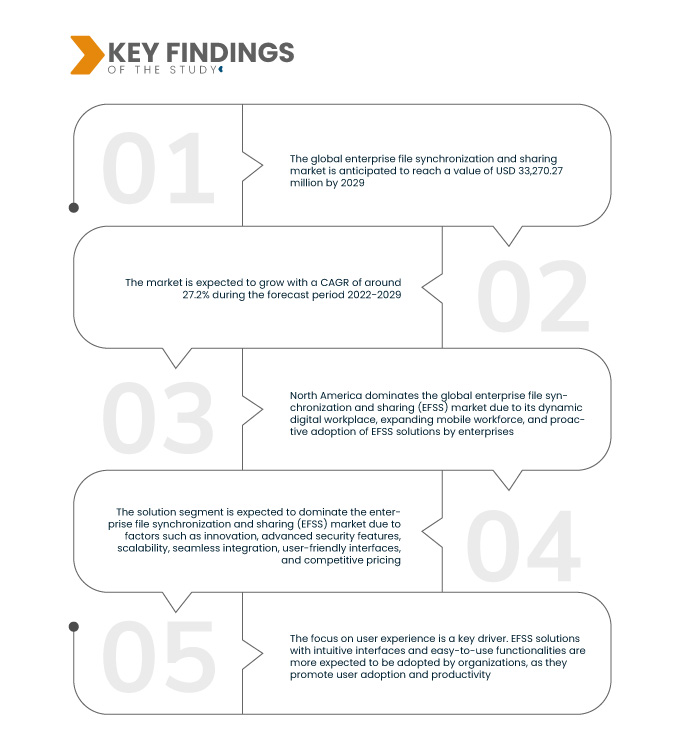

Data Bridge Market Research analiza que el Mercado global de sincronización e intercambio de archivos empresariales Se espera que alcance el valor de 33.270,27 millones de dólares para 2029, lo que equivale a 4.854,667 millones de dólares en 2021, con una tasa compuesta anual del 27,2% durante el período previsto 2022-2029. El cumplimiento de las normas de protección de datos y los estándares de la industria está impulsando la adopción de soluciones EFSS. Estas herramientas suelen incluir funciones que ayudan a las organizaciones a cumplir con los requisitos normativos al proporcionar pistas de auditoría, controles de acceso y prácticas seguras para compartir archivos.

Hallazgos clave del estudio

Se espera que el aumento de la prevalencia de fuerzas laborales remotas y distribuidas impulse la tasa de crecimiento del mercado

La creciente prevalencia de fuerzas de trabajo remotas y distribuidas es un impulsor fundamental para el mercado de sincronización e intercambio de archivos empresariales (EFSS). Con el cambio hacia acuerdos de trabajo flexibles, ha aumentado la demanda de herramientas de colaboración eficientes. Las soluciones EFSS desempeñan un papel crucial al facilitar el intercambio y la sincronización de archivos sin problemas, lo que permite a los empleados colaborar de manera efectiva independientemente de sus ubicaciones físicas. Estas herramientas garantizan que los equipos puedan acceder, actualizar y compartir archivos en tiempo real, fomentando un entorno de trabajo cohesivo y productivo en la era del trabajo remoto.

Alcance del informe y segmentación del mercado

|

Métrica de informe

|

Detalles

|

|

Período de pronóstico

|

2022 a 2029

|

|

Año base

|

2021

|

|

Años históricos

|

2020 (Personalizable para 2014-2019)

|

|

Unidades Cuantitativas

|

Ingresos en millones de dólares, volúmenes en unidades, precios en dólares

|

|

Segmentos cubiertos

|

Oferta (solución y servicios), por modelo de implementación (local y en la nube), tamaño de la organización (grandes empresas y pequeñas y medianas empresas (PYME)), accesibilidad (escritorio, dispositivos móviles, web, Linux y otros), aplicación (colaboración soporte, seguridad, sistema de gestión de contenido empresarial, almacenamiento y copia de seguridad empresarial, movilidad empresarial, gestión de documentos empresariales, virtualización de la nube y otros), usuario final (banca, servicios financieros y seguros (BFSI), atención médica y ciencias biológicas, gobierno y sector público, TI y Telecomunicaciones, Comercio Minorista y Comercio electrónico, Educación, Medios y Entretenimiento, Aeroespacial y Defensa, Legal, Transporte y Logística, Manufactura y Otros)

|

|

Países cubiertos

|

EE.UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, resto de Europa, China, Japón, India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas , resto de Asia-Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, resto de Medio Oriente y África, Brasil, Argentina y resto de América del Sur.

|

|

Actores del mercado cubiertos

|

IBM Corporation (EE.UU.), Axway (Francia), Citrix Systems, Inc. (EE.UU.), Google (EE.UU.), Microsoft (EE.UU.), Dropbox, Inc. (EE.UU.), Micro Focus (Reino Unido), Nextcloud GmbH (Alemania), Open Text Corporation (Canadá), Qnext Corp. (Canadá), Thru, Inc. (EE.UU.), VMware, Inc. (EE.UU.), Thomson Reuters (Canadá), FileCloud (EE.UU.), Ziff Davis, Inc. (EE.UU.), Seafile Ltd. (China), Files.com (EE. UU.), ACCELLION (EE. UU.), Egnyte, Inc. (EE. UU.), Intralinks, Inc. (EE. UU.), Box (EE. UU.), ownCloud GmbH (Alemania), MyWorkDrive LLC. (EE.UU.), CTERA Networks Ltd. (Israel), 25. DryvIQ (EE.UU.)

|

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos del mercado, como el valor de mercado, la tasa de crecimiento, los segmentos de mercado, la cobertura geográfica, los actores del mercado y el escenario del mercado, el informe de mercado elaborado por el equipo de investigación de mercado de Data Bridge incluye análisis de expertos en profundidad, análisis de importación/exportación y análisis de precios. , análisis de consumo de producción y análisis de mortero.

|

Análisis de segmentos:

El mercado global de sincronización e intercambio de archivos empresariales está segmentado según la oferta, el modelo de implementación, el tamaño de la organización, la accesibilidad, la aplicación y el usuario final.

- Según la oferta, el mercado global de sincronización e intercambio de archivos empresariales se segmenta en soluciones y servicios. En 2022, se espera que el segmento de soluciones domine el mercado global de sincronización e intercambio de archivos empresariales debido a su énfasis en la innovación, funciones de seguridad avanzadas, integración perfecta y una interfaz fácil de usar con una participación de mercado del 69,73%.

En 2022, se espera que el segmento de soluciones del segmento de ofertas domine el mercado global de sincronización e intercambio de archivos empresariales durante 2022-2029.

Se prevé que el segmento de soluciones domine el mercado de sincronización e intercambio de archivos empresariales (EFSS) debido a factores como la innovación, funciones de seguridad avanzadas, escalabilidad, integración perfecta, interfaces fáciles de usar y precios competitivos. Un fuerte énfasis en abordar las necesidades empresariales, brindar una excelente atención al cliente y establecer el reconocimiento de la marca contribuye aún más al dominio.

- Según el modelo de implementación, el mercado global de sincronización e intercambio de archivos empresariales se segmenta en local y en la nube. En 2022, se espera que el segmento de la nube domine el mercado global de sincronización e intercambio de archivos empresariales debido a su escalabilidad, accesibilidad y rentabilidad con una participación de mercado del 67,28%.

- Según el tamaño de la organización, el mercado global de sincronización e intercambio de archivos empresariales se segmenta en grandes empresas y pequeñas y medianas empresas (PYMES). En 2022, se espera que el segmento de grandes empresas domine el mercado global de sincronización e intercambio de archivos empresariales con una participación de mercado del 65,36%. Domina debido a las complejas necesidades de colaboración del mercado, los estrictos requisitos de seguridad y las capacidades de escalabilidad e integración que brindan las soluciones EFSS, abordando los desafíos únicos de estas organizaciones.

- Sobre la base de la accesibilidad, el mercado global de sincronización e intercambio de archivos empresariales se segmenta en escritorio, dispositivos móviles, web, Linux y otros. En 2022, se espera que la computadora de escritorio domine el mercado global de sincronización e intercambio de archivos empresariales con una participación de mercado del 39,04%. La familiaridad y versatilidad de las plataformas de escritorio contribuyen a su dominio en el mercado de EFSS, ya que satisfacen diversas necesidades organizacionales en diversas industrias.

En 2022, se espera que el segmento de escritorio del segmento de accesibilidad domine el mercado global de sincronización e intercambio de archivos empresariales durante 2022-2029.

Se prevé que el segmento de escritorio domine el mercado de sincronización e intercambio de archivos empresariales (EFSS) debido a su papel de larga data como espacio de trabajo principal para los profesionales de negocios. Las soluciones de escritorio ofrecen funciones sólidas, integración perfecta con los flujos de trabajo existentes y seguridad mejorada, lo que las convierte en la opción preferida para las empresas que buscan colaboración y sincronización eficiente de archivos. Además, la familiaridad y versatilidad de las plataformas de escritorio contribuyen a su dominio en el mercado de EFSS, ya que satisfacen diversas necesidades organizativas en diversas industrias.

- Según la aplicación, el mercado global de sincronización e intercambio de archivos empresariales se segmenta en soporte de colaboración, seguridad, sistema de gestión de contenido empresarial, almacenamiento y copia de seguridad empresarial, movilidad empresarial, gestión de documentos empresariales, virtualización de la nube y otros. En 2022, se espera que el apoyo a la colaboración domine el mercado debido a su creciente demanda de comunicación fluida y trabajo en equipo dentro de las empresas con una tasa compuesta anual del 28,6% en el período previsto de 2022 a 2029.

- Según el usuario final, el mercado global de sincronización e intercambio de archivos empresariales se ha segmentado en banca, servicios financieros y seguros (BFSI), atención médica y ciencias de la vida, gobierno y sector público, TI y telecomunicaciones, venta minorista y comercio electrónico, educación, medios. y entretenimiento, aeroespacial y defensa, legal, transporte y logística, manufactura y otros. En 2022, se espera que la banca, los servicios financieros y los seguros (BFSI) dominen el mercado con una participación de mercado del 28,5%. Domina el mercado debido al mayor énfasis del sector en la gestión segura de documentos, los requisitos de cumplimiento y la necesidad de una colaboración eficiente.

Principales actores

Data Bridge Market Research reconoce que las siguientes empresas como los principales actores del mercado global de sincronización e intercambio de archivos empresariales son IBM Corporation (EE. UU.), Axway (Francia), Citrix Systems, Inc. (EE. UU.), Google ( EE. UU.), Microsoft (EE. UU.), Dropbox, Inc. (EE. UU.), Micro Focus (Reino Unido), Nextcloud GmbH (Alemania)

Desarrollos del mercado

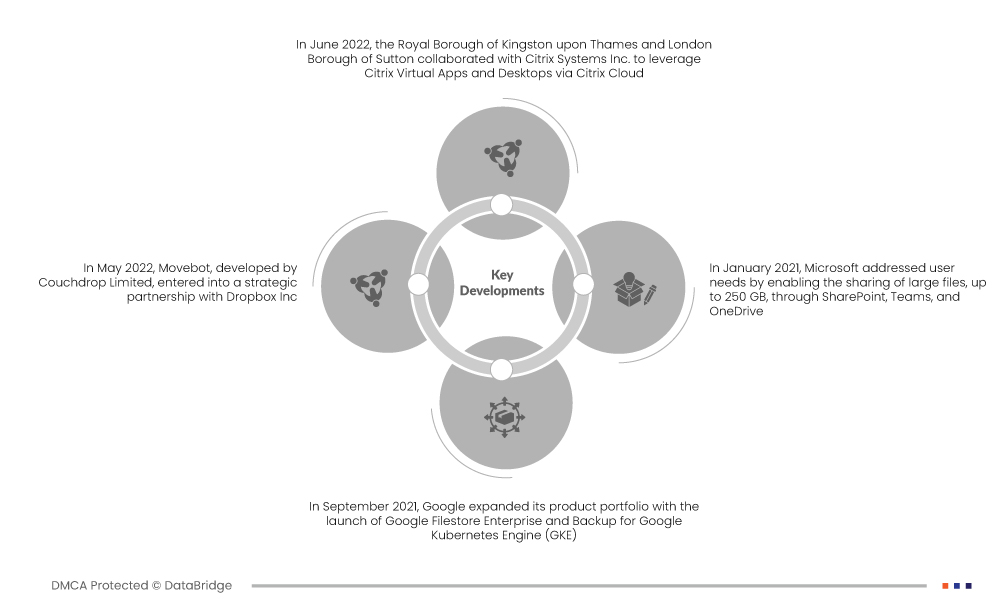

- En junio de 2022, el distrito real de Kingston upon Thames y el distrito londinense de Sutton colaboraron con Citrix Systems Inc. para aprovechar Citrix Virtual Apps and Desktops a través de Citrix Cloud. Esta asociación estratégica permitió a más de 5000 empleados acceder de forma remota a recursos, atendiendo a más de 400 000 electores. La implementación mostró la efectividad de las soluciones de Citrix para permitir capacidades de trabajo remoto flexibles y eficientes.

- En mayo de 2022, Movebot, desarrollado por Couchdrop Limited, celebró una asociación estratégica con Dropbox Inc. Esta colaboración estableció a Movebot como el proveedor de soluciones de migración de datos preferido de Dropbox, lo que permite a usuarios individuales, de equipos y empresariales migrar datos de forma segura y rápida desde otras nubes a Caja desplegable. El acuerdo global subraya la posición de Movebot como actor clave para facilitar la migración de datos sin problemas dentro de entornos de nube.

- En septiembre de 2021, Google amplió su cartera de productos con el lanzamiento de Google Filestore Enterprise y Backup para Google Kubernetes Engine (GKE). Estas ofertas tienen como objetivo facilitar la migración fluida de las necesidades comunes de archivos NAS desde las instalaciones a la nube, permitiendo a las empresas escalar sin la necesidad de una reconstrucción extensa. Esta medida refuerza el compromiso de Google de mejorar su presencia en el mercado y satisfacer los requisitos empresariales en evolución.

- En enero de 2021, Microsoft abordó las necesidades de los usuarios al permitir compartir archivos grandes, de hasta 250 GB, a través de SharePoint, Teams y OneDrive. Además, la introducción de una función de sincronización diferencial agiliza el proceso de sincronización actualizando únicamente los cambios realizados en los archivos. Este enfoque centrado en el usuario no sólo satisface las demandas de los clientes sino que también mejora el atractivo de Microsoft, atrayendo una base de clientes más amplia.

Análisis Regional

Geográficamente, los países cubiertos en el informe del mercado global de sincronización e intercambio de archivos empresariales son EE. UU., Canadá, México, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Bélgica, Rusia, Italia, España, Turquía, el resto de Europa, China, Japón. India, Corea del Sur, Singapur, Malasia, Australia, Tailandia, Indonesia, Filipinas, resto de Asia Pacífico, Arabia Saudita, Emiratos Árabes Unidos, Sudáfrica, Egipto, Israel, resto de Medio Oriente y África, Brasil, Argentina y resto de América del Sur.

Según el análisis de investigación de mercado de Data Bridge:

América del Norte es la región dominante en el Mercado global de sincronización e intercambio de archivos empresariales. durante el período de previsión 2022-2029

América del Norte domina el mercado global de sincronización e intercambio de archivos empresariales (EFSS) debido al dinámico lugar de trabajo digital de la región y a la creciente fuerza laboral móvil. Las empresas de América del Norte han mostrado una postura proactiva al implementar ampliamente soluciones EFSS, contribuyendo significativamente al crecimiento del mercado. La capacidad de respuesta de la región a los avances tecnológicos, como la adopción generalizada de dispositivos móviles, la computación en la nube y el Internet de las cosas (IoT), ha impulsado aún más la demanda de herramientas EFSS.

Para obtener información más detallada sobre el Informe de mercado global de sincronización e intercambio de archivos empresariales, haga clic aquí –https://www.databridgemarketresearch.com/reports/global-enterprise-file-synchronization-and-sharing-market