North America X Ray Detectors Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.64 Billion

USD

2.67 Billion

2024

2032

USD

1.64 Billion

USD

2.67 Billion

2024

2032

| 2025 –2032 | |

| USD 1.64 Billion | |

| USD 2.67 Billion | |

|

|

|

|

Marktsegmentierung für Röntgendetektoren in Nordamerika nach Typ (Flachdetektor, Computerradiographiedetektoren, Zeilendetektoren, CCD-Detektoren (Charged Coupled Device), mobile Detektoren), Panelgröße (großflächige Flachdetektoren, kleinflächige Flachdetektoren), Tragbarkeit (tragbare Detektoren, stationäre Detektoren), System (neue digitale Röntgensysteme, nachrüstbare Röntgensysteme), Anwendung (medizinische Anwendungen, zahnmedizinische Anwendungen, Sicherheitsanwendungen, veterinärmedizinische Anwendungen, industrielle Anwendungen), Endbenutzer (Krankenhäuser, Diagnoselabore, Erstausrüster (OEMs), Kliniken, Intensivstationen) – Branchentrends und Prognose bis 2032

Röntgendetektor Marktgröße

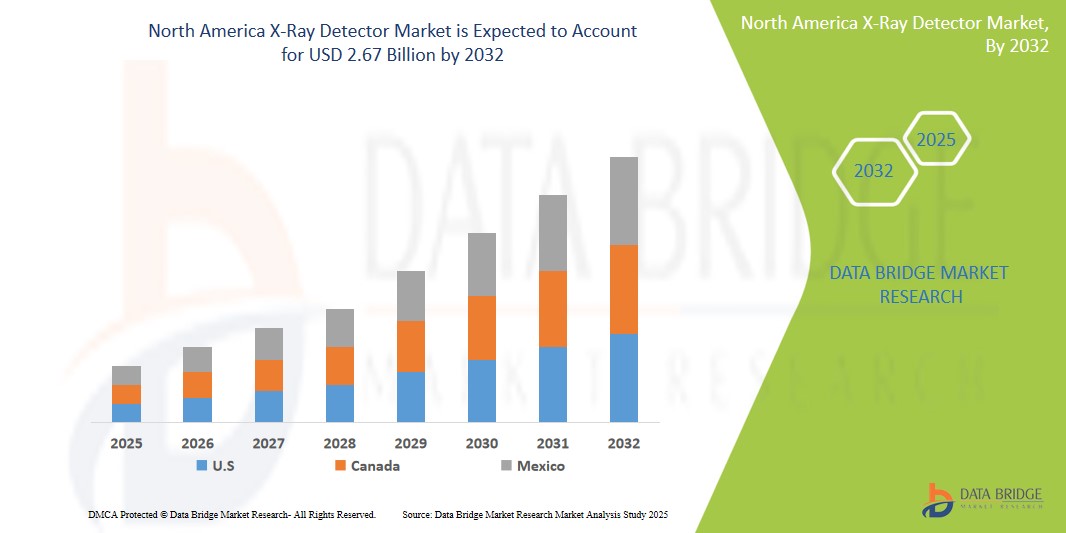

- Der nordamerikanische Markt für Röntgendetektoren wurde im Jahr 2024 auf 1,64 Milliarden US-Dollar geschätzt und soll bis 2032 2,67 Milliarden US-Dollar erreichen , bei einer CAGR von 6,21 % im Prognosezeitraum.

- Das Marktwachstum wird größtenteils durch die zunehmende geriatrische Bevölkerung in Nordamerika, die steigende Prävalenz chronischer Krankheiten wie Krebs und Herz-Kreislauf-Erkrankungen und die wachsende Nachfrage nach frühzeitiger und genauer diagnostischer Bildgebung vorangetrieben.

- Darüber hinaus treiben technologische Fortschritte bei Röntgendetektoren, wie die Entwicklung von Flachbilddetektoren und digitalen Röntgensystemen, das Marktwachstum voran. Diese zusammenlaufenden Faktoren beschleunigen die Einführung von Röntgendetektoren in verschiedenen medizinischen Anwendungen und fördern so das Branchenwachstum erheblich.

Marktanalyse für Röntgendetektoren

- Der nordamerikanische Markt für Röntgendetektoren ist ein wichtiger Bestandteil der medizinischen Bildgebungsbranche. Er umfasst Geräte, die Röntgenphotonen erfassen und in elektrische Signale umwandeln, um digitale Bilder zu erzeugen. Diese Detektoren sind wichtige Komponenten in verschiedenen diagnostischen und therapeutischen Anwendungen, darunter Radiographie, Fluoroskopie, Mammographie und Computertomographie (CT). Der Markt wird durch technologische Fortschritte, die zunehmende Verbreitung chronischer Krankheiten und die steigende Nachfrage nach fortschrittlichen Bildgebungsverfahren angetrieben.

- Die steigende Nachfrage nach Röntgendetektoren ist vor allem auf die zunehmende Anzahl diagnostischer Bildgebungsverfahren, die zunehmende Verbreitung digitaler Radiographie und die steigende Nachfrage nach tragbaren und mobilen Röntgensystemen zurückzuführen.

- Die USA dominieren den Markt für Röntgendetektoren in Nordamerika mit dem größten Umsatzanteil von 84,31 % im Jahr 2025. Kennzeichnend für den Markt sind eine gut ausgebaute Gesundheitsinfrastruktur, hohe Gesundheitsausgaben und die Präsenz führender Marktteilnehmer.

- Die USA werden im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land im nordamerikanischen Röntgendetektormarkt sein. Grund hierfür sind die steigende Nachfrage nach fortschrittlicher diagnostischer Bildgebung, steigende Gesundheitsausgaben und die starke Verbreitung digitaler Röntgensysteme in Krankenhäusern und Diagnosezentren. Führende Hersteller, die in Produktinnovationen und KI-gestützte Bildgebungslösungen investieren, tragen zusätzlich zum Marktwachstum bei.

- Es wird erwartet, dass Flachdetektoren den nordamerikanischen Röntgendetektormarkt im Jahr 2025 mit einem Marktanteil von 41,5 % dominieren werden. Dies ist auf ihre hohe Bildqualität, schnellere Verarbeitungszeiten, geringere Strahlenbelastung und die breite Integration in stationäre und mobile Röntgensysteme zurückzuführen. Die zunehmende Bevorzugung digitaler gegenüber analogen Systemen im klinischen Umfeld verstärkt die Dominanz der Flachdetektoren.

Berichtsumfang und Marktsegmentierung für Röntgendetektoren

|

Eigenschaften |

Wichtige Markteinblicke für Röntgendetektoren |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Röntgendetektoren

„ Integration von künstlicher Intelligenz (KI) und maschinellem Lernen (ML) in die Röntgenbildgebung für eine verbesserte Diagnostik “

- Übergang von analoger zu digitaler Radiographie: Ein wichtiger Trend auf dem nordamerikanischen Röntgendetektormarkt ist der anhaltende Übergang von der traditionellen analogen (filmbasierten) Radiographie zur digitalen Radiographie (DR). Die digitale Radiographie bietet zahlreiche Vorteile, darunter schnellere Bildaufnahme, verbesserte Bildqualität, geringere Strahlenbelastung und effizientere Arbeitsabläufe.

- Beispielsweise erfassen digitale Detektoren, wie beispielsweise Flachbilddetektoren, Röntgenbilder elektronisch, sodass keine Filmentwicklung mehr erforderlich ist. Dieser Wandel treibt die Nachfrage nach digitalen Röntgendetektoren in Krankenhäusern, Kliniken und Diagnosezentren voran.

- Ein weiterer wichtiger Trend ist die zunehmende Verbreitung von Flachbilddetektoren (FPDs). Flachbilddetektoren bieten im Vergleich zu anderen Detektortechnologien eine bessere Bildqualität, höhere Empfindlichkeit und schnellere Bilderfassung.

- Auch die Entwicklung flexibler und tragbarer Röntgendetektoren gewinnt an Bedeutung und ermöglicht deren Einsatz in einem breiteren Anwendungsspektrum, darunter in der Point-of-Care-Diagnostik und der mobilen Bildgebung. Der Markt verzeichnet eine wachsende Nachfrage nach drahtlosen digitalen Röntgensystemen, die mehr Flexibilität und Benutzerfreundlichkeit bieten.

- Fortschritte in der Detektortechnologie, wie die Entwicklung von Direktkonversionsdetektoren und CMOS-Detektoren, verbessern die Bildauflösung und reduzieren die Strahlendosis. Die Integration von künstlicher Intelligenz (KI) und maschinellem Lernen (ML) in die Röntgenbildgebung steigert die diagnostische Genauigkeit und Effizienz.

- Der zunehmende Fokus auf Dosisreduzierung in der Röntgenbildgebung treibt die Entwicklung von Detektoren mit höherer Empfindlichkeit und geringerem Strahlungsbedarf voran. Die steigende Nachfrage nach mobilen Röntgensystemen, insbesondere in der Notfall- und Intensivmedizin, fördert den Einsatz tragbarer Röntgendetektoren.

Marktdynamik für Röntgendetektoren

Treiber

„Die alternde Bevölkerung steigert die Nachfrage nach fortschrittlicher Röntgendetektortechnologie“

- Steigende geriatrische Bevölkerung: Die zunehmende geriatrische Bevölkerung in Nordamerika ist ein wichtiger Treiber für das Wachstum des Röntgendetektormarktes

- Laut dem US Census Bureau wird beispielsweise die Zahl der über 65-Jährigen in den kommenden Jahren voraussichtlich deutlich steigen. Ältere Menschen sind anfälliger für verschiedene chronische Krankheiten wie Osteoporose, Arthritis und Herz-Kreislauf-Erkrankungen, die häufig Röntgenaufnahmen zur Diagnose und Überwachung erfordern.

- Die zunehmende Verbreitung chronischer Krankheiten wie Krebs, Herz-Kreislauf-Erkrankungen und Atemwegserkrankungen treibt die Nachfrage nach Röntgenbildgebungsverfahren an, was wiederum das Wachstum des Röntgendetektormarktes ankurbelt.

- Die zunehmende Verbreitung digitaler Röntgensysteme in Krankenhäusern und Kliniken ersetzt herkömmliche filmbasierte Systeme und treibt die Nachfrage nach digitalen Röntgendetektoren voran.

- Technological advancements in X-ray detector technology, such as the development of flat-panel detectors, CMOS detectors, and direct conversion detectors, are improving image quality, reducing radiation dose, and enhancing workflow efficiency, driving market growth.

- The growing demand for mobile X-ray systems, particularly in emergency departments, intensive care units, and point-of-care settings, is boosting the adoption of portable X-ray detectors.

- Increasing awareness about the benefits of early and accurate diagnosis is driving the demand for advanced X-ray imaging techniques, which in turn fuels the growth of the X-ray detector market.

Restraint/Challenge

“High Cost of Digital Radiography Systems”

- The high cost of digital radiography systems, including flat-panel detectors, can be a significant barrier to adoption, particularly for smaller hospitals and clinics with budget constraints.

- For instance, the initial investment for a digital radiography system can be substantially higher than that for a traditional film-based system. This cost factor can limit the widespread adoption of digital X-ray detectors, especially in developing regions or smaller healthcare facilities.

- Reimbursement policies and budget constraints in healthcare facilities can also hinder market growth.

- The complexity of integrating digital radiography systems with existing hospital infrastructure and workflows can pose a challenge.

- The need for trained personnel to operate and maintain digital radiography equipment can also be a limiting factor.

- Regulatory requirements and safety concerns related to radiation exposure can create challenges for market players.

X-Ray Detector Market Scope

The market is segmented on the basis type, panel size, portability, system, application and end user.

- By Type

On the basis of type, the North America X-ray detector market is segmented into flat panel detector, computed radiography detectors, line scan detectors, charged coupled device (CCD) detectors and mobile detectors. The Flat Panel Detectors (FPDs) segment dominates the largest market revenue share of 41.5% in 2025, due to their advanced imaging capabilities, lower radiation exposure, and faster image acquisition. They are widely used in general radiography, fluoroscopy, and dental imaging. FPDs offer better spatial resolution and workflow efficiency, making them a preferred choice in modern healthcare settings.

The Mobile detectors segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, owing to their rising use in point-of-care diagnostics, especially in intensive care units, emergency rooms, and during intraoperative procedures. These detectors enhance patient comfort and reduce transportation-related risks. Continued technological innovation, including wireless and lightweight detector designs, will further drive adoption. Computed radiography and CCD detectors, while still in use, are gradually being replaced by newer, more efficient digital solutions.

- By Panel Size

On the basis of Panel Size, market is segmented into large-area flat-panel detectors and small-area flat-panel detectors. The Large-area detectors segment are anticipated to account for the largest market share in 2025, primarily due to their extensive use in comprehensive radiographic procedures such as chest X-rays, orthopedic imaging, and full-body trauma scans. These detectors provide broad anatomical coverage with a single exposure, improving efficiency in high-volume imaging centers. Hospitals and large diagnostic facilities favor these systems for their ability to handle complex diagnostic needs with reduced scan times.

The Small-Area Flat-Panel Detectors segment is expected to witness the fastest CAGR from 2025 to 2032, their compact size and precision make them ideal for dental, extremity, and pediatric imaging applications. Additionally, the increasing focus on minimally invasive and highly targeted diagnostic techniques is boosting demand for small-area detectors, particularly in specialized clinics and mobile imaging units. Innovations in resolution and image quality continue to support market expansion.

- By Portability

On the basis of portability, the North America X-ray detector market is segmented into portable detectors and fixed detectors. The Portable detectors segment driven by the rising adoption of mobile imaging solutions in hospitals, ICUs, emergency departments, and during surgeries. These detectors provide flexibility, allowing imaging to be conducted at the patient's bedside, reducing the need for transport and thereby improving patient safety and workflow efficiency. The demand for wireless, lightweight, and battery-operated detectors is increasing, particularly in field applications, ambulatory care, and home healthcare settings.

The Fixed Detectors segment is projected to witness the fastest CAGR from 2025 to 2032, continue to play a critical role in radiology departments, diagnostic laboratories, and large hospitals where stationary systems are preferred for high throughput and advanced imaging capabilities. Fixed detectors offer consistency, precision, and are often integrated into automated workflows for mass screening. The combination of portability and image quality innovations is expected to further shift market preference toward mobile solutions over the coming years.

- By System

Der nordamerikanische Markt für Röntgendetektoren ist systembezogen in neue digitale Röntgensysteme und Retrofit-Röntgensysteme unterteilt. Die neuen digitalen Röntgensysteme werden voraussichtlich 2025 aufgrund ihrer hohen Bildauflösung, schnellen Bildverarbeitung und vollständigen Integration in PACS (Picture Archiving and Communication Systems) den Markt dominieren. Diese Systeme werden im Rahmen der digitalen Transformation in Krankenhäusern und Diagnosezentren weit verbreitet eingesetzt und verbessern die Diagnosegenauigkeit und die Produktivität der Arbeitsabläufe. Der Übergang von der analogen zur digitalen Radiographie wird durch den Bedarf an schnellerer Diagnose, reduzierter Strahlenbelastung der Patienten und verbesserten Möglichkeiten zum Datenaustausch beschleunigt.

Das Segment der Retrofit-Röntgensysteme wird voraussichtlich von 2025 bis 2032 die höchste jährliche Wachstumsrate verzeichnen, da Gesundheitsdienstleister nach kostengünstigen Möglichkeiten zur Aufrüstung bestehender analoger Systeme suchen. Retrofit ermöglicht Einrichtungen die Modernisierung ihrer Geräte ohne vollständigen Systemaustausch, was insbesondere für kleine und mittelgroße Kliniken mit Budgetbeschränkungen von Vorteil ist. Beide Systeme tragen dazu bei, den Zugang zu effizienten Bildgebungstechnologien zu erweitern.

- Nach Anwendung

Basierend auf der Anwendung in medizinischen, zahnmedizinischen, Sicherheits-, Veterinär- und industriellen Anwendungen. Das Segment Medizinische Anwendungen erzielte 2025 den größten Marktanteil, unterstützt durch die zunehmende Verbreitung chronischer Krankheiten, eine alternde Bevölkerung und den Bedarf an präzisen, nicht-invasiven Diagnoseinstrumenten. Röntgendetektoren sind ein wesentlicher Bestandteil der Diagnose von orthopädischen Verletzungen, Lungenerkrankungen, Krebs und Herz-Kreislauf-Erkrankungen. Die zunehmende Nutzung digitaler Bildgebung im ambulanten und stationären Bereich steigert die Nachfrage.

Der Bereich Dentalanwendungen wird voraussichtlich von 2025 bis 2032 aufgrund des steigenden Bewusstseins für Mundgesundheit und des Wachstums der kosmetischen Zahnmedizin die höchste durchschnittliche jährliche Wachstumsrate (CAGR) verzeichnen. Sicherheitsanwendungen gewinnen aufgrund erhöhter Sicherheitsmaßnahmen insbesondere an Flughäfen und Grenzübergängen an Bedeutung. Veterinärmedizinische Anwendungen nehmen aufgrund der Nachfrage nach hochwertiger Bildgebung in der Tierpflege zu. Industrielle Anwendungen, darunter zerstörungsfreie Prüfungen und Qualitätssicherung in Fertigung und Bauwesen, werden voraussichtlich deutlich wachsen, da die Branchen Sicherheit, Compliance und Betriebseffizienz durch fortschrittliche Bildgebungslösungen priorisieren.

- Nach Endbenutzer

Der nordamerikanische Markt für Röntgendetektoren ist nach Endnutzern in Krankenhäuser, Diagnoselabore, Erstausrüster (OEMs), Kliniken und Intensivstationen unterteilt. Das Krankenhaussegment hält 2025 den größten Marktanteil, da dort viele bildgebende Verfahren eingesetzt werden, eine fortschrittliche Diagnoseinfrastruktur verfügbar ist und radiologische Arbeitsabläufe integriert sind. Krankenhäuser spielen zudem eine zentrale Rolle in der Akutversorgung, der Krebsvorsorge und der Traumabehandlung und sind daher wichtige Anwender digitaler Röntgendetektortechnologien. Diagnoselabore werden voraussichtlich stark wachsen, angetrieben durch die steigende Nachfrage nach ambulanten Bildgebungsdiensten und dezentralen Diagnoselösungen.

Das Kliniksegment wird voraussichtlich von 2025 bis 2032 das schnellste Wachstum verzeichnen und seine Bildgebungskapazitäten erweitern, um Vor-Ort-Diagnostik anzubieten. Intensivstationen stellen aufgrund des dringenden Bedarfs an Bildgebung am Krankenbett bei lebensbedrohlichen Erkrankungen ein wachstumsstarkes Segment dar. Darüber hinaus treiben OEMs weiterhin technologische Innovationen voran und arbeiten mit Gesundheitsdienstleistern zusammen, um maßgeschneiderte, integrierte Bildgebungslösungen zu entwickeln, die auf verschiedene klinische und betriebliche Anforderungen zugeschnitten sind.

Regionale Analyse des Röntgendetektormarktes

- Die USA dominieren den Markt für Röntgendetektoren mit dem größten Umsatzanteil von 84,31 % im Jahr 2024. Dies ist auf die zunehmende Integration digitaler Radiographie in Gesundheitseinrichtungen und die steigende Nachfrage nach fortschrittlicher diagnostischer Bildgebung zurückzuführen. Die zunehmende Zahl chronischer Erkrankungen und die starke Betonung einer frühzeitigen und präzisen Diagnose beflügeln den Markt weiter.

- Die robuste Gesundheitsinfrastruktur des Landes, die günstigen Erstattungsrichtlinien (einschließlich der Übernahme digitaler Bildgebung durch Medicare und Medicaid) und die Einführung KI-integrierter Radiologielösungen tragen maßgeblich zu seiner führenden Marktposition bei. Nationale Screening-Programme und Bildgebungsrichtlinien fördern die breite Nutzung digitaler Röntgensysteme zusätzlich.

- Darüber hinaus fördert die Präsenz wichtiger Branchenakteure wie GE Healthcare, Varex Imaging und Carestream Health kontinuierliche Innovationen in der Flachbilddetektortechnologie (FPD), bei drahtlosen Detektoren und bei mobilen Bildgebungssystemen, die auf verschiedene klinische Anforderungen zugeschnitten sind.

- Die zunehmende Nutzung tragbarer und drahtloser Röntgendetektoren in der Notaufnahme, auf Intensivstationen und in ambulanten Zentren unterstützt den Trend zur Point-of-Care-Bildgebung, verbessert die diagnostische Effizienz und die Patientenergebnisse im gesamten US-amerikanischen Gesundheitswesen.

Markteinblick in Röntgendetektoren in Kanada

The Canada X-Ray Detector market is projected to expand at a substantial CAGR throughout the forecast period driven by increasing investments in healthcare infrastructure, rising awareness about the benefits of early diagnosis, and the growing geriatric population. The Canadian healthcare system's emphasis on universal access to healthcare services and the adoption of advanced medical technologies are supporting market growth. Additionally, government initiatives to improve cancer screening programs and the increasing prevalence of chronic diseases are fueling the demand for X-ray detectors in Canada.

Mexico X-Ray Detector Market Insight

The Mexico X-Ray Detector market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing healthcare expenditure, rising awareness about the importance of diagnostic imaging, and improving healthcare infrastructure. The market is characterized by a growing demand for digital radiography systems and increasing investments in modernizing healthcare facilities. However, challenges such as limited access to advanced healthcare technologies and a shortage of trained personnel are hindering market growth to some extent.

X-Ray Detector Market Share

The X-Ray Detector industry is primarily led by well-established companies, including:

- Varex Imaging Corporation (U.S.)

- Canon Medical Systems Corporation (Japan)

- Carestream Health (U.S.)

- Fujifilm Holdings Corporation (Japan)

- Konica Minolta, Inc. (Japan)

- Teledyne Technologies Incorporated (U.S.)

- Hamamatsu Photonics K.K. (Japan)

- Thales Group (France)

- Pixium Vision (France)

- Rayence Inc. (South Korea)

Latest Developments in North America X-Ray Detector Market

- In March 2024, Varex Imaging launched advanced flat-panel detectors in March 2024, offering enhanced image quality and faster acquisition speeds. These detectors are optimized for digital radiography and fluoroscopy, supporting improved clinical workflows and diagnostic precision across various imaging environments.

- In February 2024, Canon Medical introduced a portable digital radiography system with a lightweight, durable flat-panel detector. Designed for emergency departments and ICUs, it enables rapid imaging at the point of care, enhancing diagnostic flexibility and mobility.

- In January 2024, Carestream Health unveiled a new CMOS-based X-ray detector in January 2024. With ultra-high resolution and low radiation dose, it targets mammography and other specialized imaging areas to boost diagnostic accuracy and patient safety.

- In December 2024, Fujifilm partnered with a leading AI firm in December 2023 to co-develop an AI-powered X-ray imaging solution. This integration enhances automated image analysis and diagnostic efficiency, revolutionizing radiology with intelligent interpretation capabilities.

- In November 2023, Konica Minolta launched a wireless digital radiography system designed to improve hospital workflow efficiency. The system features enhanced connectivity and is aimed at streamlining imaging procedures in both clinical and hospital settings.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.