Markt für Snackpellets in Nordamerika nach Typ (Cracker, Chips , Puffs und andere), Form (laminiert, mit Matrizenoberfläche, gelatiniert, gestanzt, Matrizenabstand, dreidimensionale und zweidimensionale Form), Gestalt (rund, oval, ringförmig, dreieckig, quadratisch, sternförmig und andere), Zutaten (Kartoffeln, Mais , Reis, Tapioka, Mehrkorn und andere), Verarbeitungsmethode (fettige Snackpellets und nicht fettende Snackpellets), Art (biologisch und konventionell), Technik (Einschneckenextruder und Doppelschneckenextruder), Marke (Marken- und Eigenmarke), Geschmack (einfach und aromatisiert), Anwendung (Haushalt und gewerblich), Vertriebskanal (direkt und indirekt) – Branchentrends und Prognose bis 2029

Marktanalyse und Einblicke

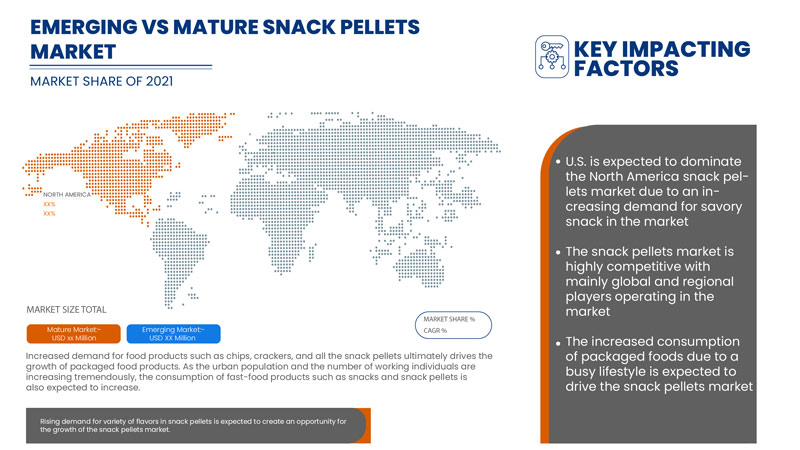

Der nordamerikanische Markt für Snackpellets verzeichnet aufgrund der wachsenden Lebensmittel- und Getränkeindustrie und der steigenden Nachfrage nach einer Vielzahl von Geschmacksrichtungen sowie verpackten Lebensmitteln in unterschiedlichen Formen ein deutliches Wachstum. Der steigende Verbrauch von Snackpellets oder verpackten Lebensmitteln aufgrund hektischer Lebenspläne fördert auch das Wachstum des nordamerikanischen Marktes für Snackpellets. Es wird jedoch erwartet, dass schwankende Rohstoffpreise das Marktwachstum des Marktes für Snackpellets im Prognosezeitraum bremsen werden.

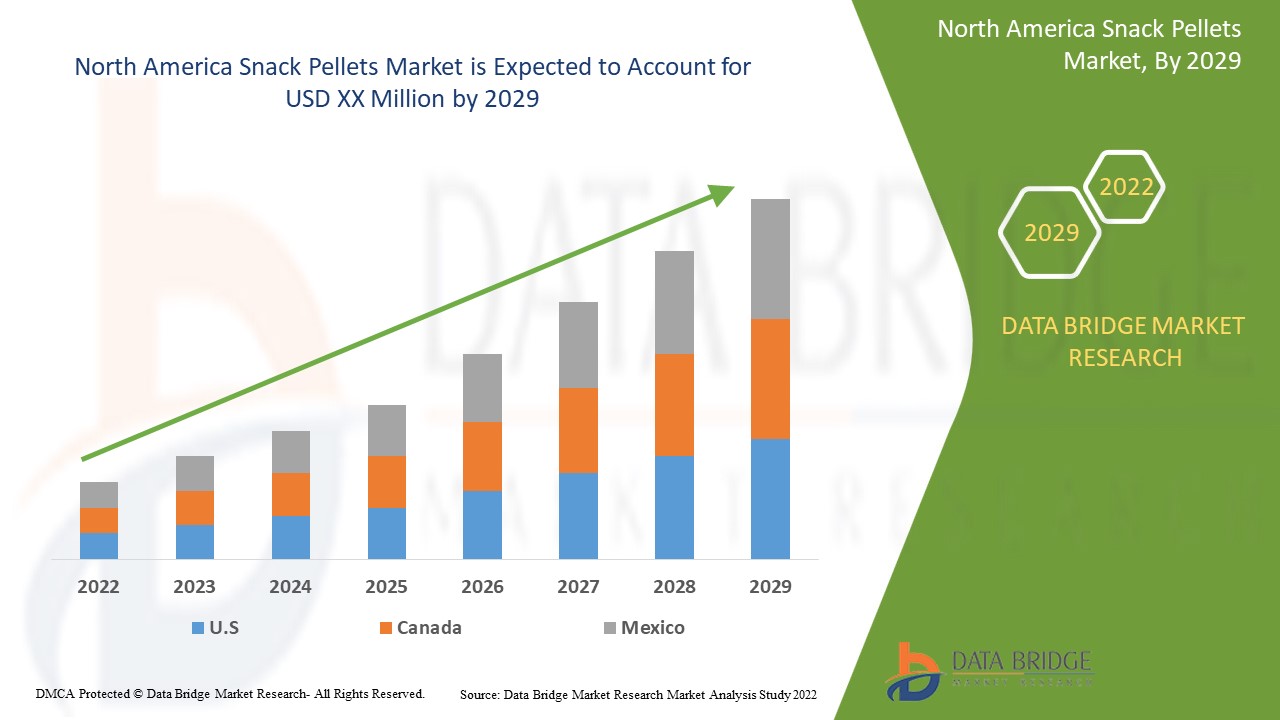

Laut einer Analyse von Data Bridge Market Research wird der nordamerikanische Markt für Snackpellets im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 5,9 % wachsen.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historisches Jahr |

2020 (anpassbar auf 2019–2015) |

|

Quantitative Einheiten |

Umsatz in Mio. USD |

|

Abgedeckte Segmente |

Nach Typ (Cracker, Chips, Puffs und andere), Form (laminiert, mit Matrizenoberfläche, gelatiniert, gestanzt, Matrizenabstand, dreidimensionaler und zweidimensionaler), Gestalt (rund, oval, ringförmig, dreieckig, quadratisch, sternförmig und andere), Zutaten (Kartoffel, Mais, Reis, Tapioka, Mehrkorn und andere), Verarbeitungsmethode (fettige Snackpellets und nicht fettende Snackpellets), Art ( biologisch und konventionell), Technik (Einschneckenextruder und Doppelschneckenextruder), Marke (Marken- und Handelsmarke), nach Geschmack (pur und mit Geschmack), Anwendung (Haushalt und gewerblich), Vertriebskanal (direkt und indirekt) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

BACH SNACKS SAL, Calbee, JR Short Snack Products, GRUPO MICHEL, LC America, Inc., Almounajed Food Industries, Chhajed Foods Pvt. Ltd, Fiorentini Alimentari SpA, Gustinos, Productos Alimenticios La Moderna SA de CV, Le Caselle SPA, mafin, Palmex, Universal Robina Corporation, JLM Global Foods, Limagrain – Ingrédients, Quality Pellets, Pellsnack Products GmbH, BFY BRANDS, Attaybat, TTK, Intersnack Group GmbH & Co. KG, Leng-d'Or, YUPI SAS, unter anderem |

Marktdefinition

Snackpellets sind eine halbfertige Zutat, d. h., sobald sie vom Hersteller hergestellt wurden, sind sie bereit, von den Kunden zu ihren innovativen Fertigprodukten verarbeitet zu werden. Snackpellets sind eine vielseitige, innovative Möglichkeit, die Snackkategorie aufzumischen. Für Snackmarken gibt es viele Vorteile, Pellets in ihr Portfolio aufzunehmen. Es können neue und trendige, luftgepoppte/ölfreie Grundstoffe verwendet werden. Snackpellets können auch ohne Gewürze verwendet werden. Snackpellets behalten den Geschmack gut. Es gibt sie in verschiedenen Arten, Geschmacksrichtungen und Formen.

Marktdynamik für Snackpellets in Nordamerika

Treiber

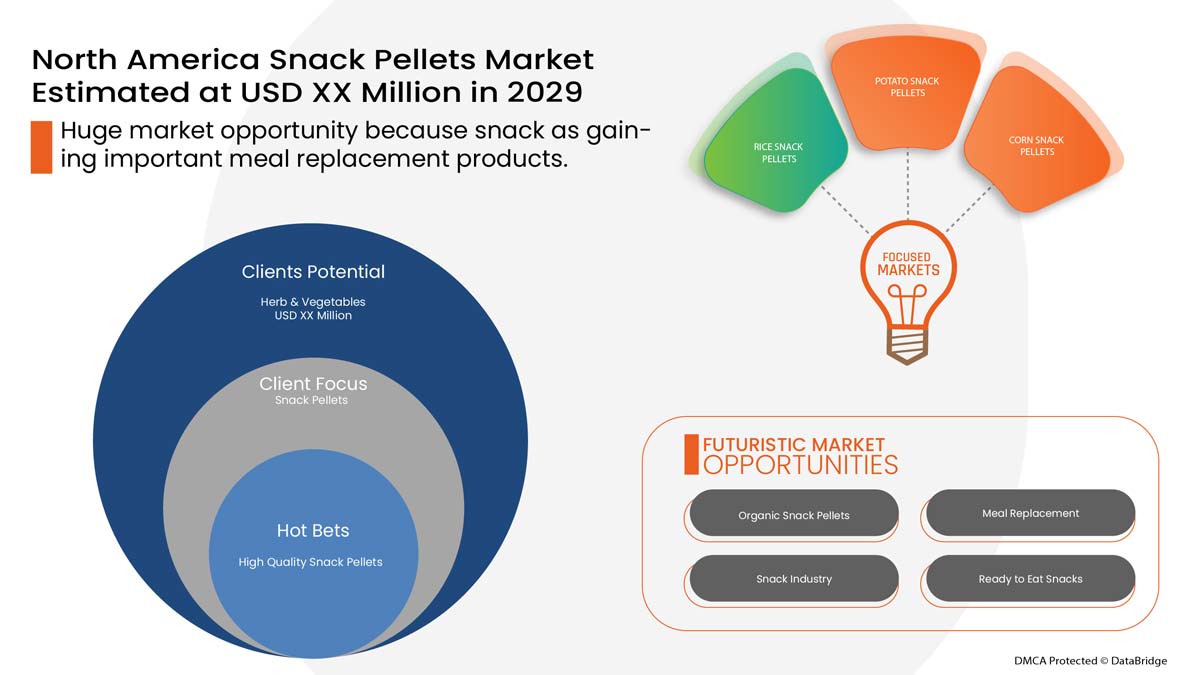

- Zunehmender Ersatz von Mahlzeiten durch gesunde Snacks

Als Snack bezeichnet man im Allgemeinen jedes Nahrungsmittel, das zwischen den Hauptmahlzeiten gegessen wird. Viele Menschen essen im Laufe des Tages mindestens einmal einen Snack, und es gibt mehrere Gründe, warum Verbraucher Snacks bevorzugen, da sie einen Energieabfall verspüren, den ein kleiner Bissen beheben kann. Außerdem freuen sie sich darauf, den Geschmack bestimmter Snacks zu erleben. Ein weiterer wichtiger Grund ist der geschäftige Lebensstil der Verbraucher, der es ihnen ermöglicht, auf Snacks umzusteigen, um mindestens eine Mahlzeit zu ersetzen. Menschen bevorzugen gesunde Snackpellets, da sie voller Nährstoffe sind und den Hunger der Verbraucher stillen.

Daher wird erwartet, dass die Nachfrage nach Snack-Pellets auf dem Markt aufgrund der wachsenden erwerbstätigen Bevölkerung, des steigenden verfügbaren Pro-Kopf-Einkommens, der steigenden Pro-Kopf-Ausgaben für Fertiggerichte, der sich ändernden Geschmacksvorlieben der Menschen und des veränderten Lebensstils wohlhabender Verbraucher wachsen wird.

- Verfügbarkeit verschiedener Geschmacksrichtungen bei Chips und Crackern

Die steigende Nachfrage der Verbraucher nach schmackhaften Chips und Crackern in Verbindung mit der steigenden Nachfrage nach Fertiggerichten ist einer der Hauptgründe für die hohe Nachfrage nach herzhaften Snacks wie Chips und Crackern. Daher erfüllen die Hersteller diese Nachfrage der Verbraucher, indem sie ständig neue Geschmacksrichtungen für Chips und Cracker auf Kartoffel- und Getreidebasis auf den Markt bringen. Darüber hinaus nutzen die Hersteller dies als Marketingstrategie und bringen neue Produkte auf den Markt. Der oben genannte Faktor dürfte die Nachfrage auf dem Markt ankurbeln.

Gelegenheiten

- Die Entstehung gesunder Snackpellets

Gesunde Snacks sind kein kurzlebiger Trend mehr, sondern aufgrund des gestiegenen Gesundheitsbewusstseins für Verbraucher unverzichtbar geworden. Um den hohen Erwartungen und Anforderungen der Verbraucher gerecht zu werden, entwickeln Hersteller gesunde Snackpellets mit einem verbesserten Nährwertprofil. Darüber hinaus sind Verbraucher besorgt über das breite Spektrum gesundheitlicher Probleme, die mit der Immunität und verschiedenen Krankheiten zusammenhängen. Daher entscheiden sich Verbraucher für Bio-Lebensmittel und Lebensmittel auf Getreidebasis, um ihre Gesundheit zu erhalten. Daher bringen Hersteller von Snackpellets Bio- und gesunde Snackpellets auf den Markt, um Verbraucher anzulocken.

Einschränkungen/Herausforderungen

- Schwankende Rohstoffpreise

Steigende Rohstoffpreise wirken sich auf die gesamte Lieferkette aus, vom Hersteller über die Vertriebskanäle bis hin zum Marketingunternehmen und vor allem auf Verbraucher mit geringem Einkommen. Steigen die Rohstoffpreise, steigen auch die Preise des fertigen Produkts. Dies ist der größte hemmende Faktor für den Markt für Snackpellets. Die für Snackpellets benötigten Rohstoffe sind Kartoffeln, Mais, Reis, Tapioka, Mehrkorn und andere. Steigende Preise für diese Rohstoffe dürften das Wachstum des Marktes für Snackpellets behindern, da es für Hersteller von Snackpellets angesichts der schwankenden Preise schwierig ist, Rohstoffe wie Kartoffeln, Reis, Tapioka und andere zu kaufen.

Auswirkungen von COVID-19 auf den nordamerikanischen Markt für Snackpellets

Nach COVID-19 ist die Nachfrage nach Snackpellets in der Region Nordamerika aufgrund von Änderungen im Kaufverhalten der Verbraucher und einer allmählichen Verlagerung hin zu verpackten Lebensmitteln gestiegen. Durch die Aufhebung vieler strenger Vorschriften und Beschränkungen sind Hersteller und Produzenten in der Lage, die Nachfrage nach Snackpellets in der Region zu erfüllen. Darüber hinaus ermöglichen die zunehmend vollen Arbeitspläne den Verbrauchern, auf Snacks umzusteigen, die ihren Hunger stillen können, was voraussichtlich das Marktwachstum vorantreiben wird.

Die gestiegene Nachfrage nach Snackpellets mit unterschiedlichen Geschmacksrichtungen ermöglicht es den Herstellern, innovative und aromatisierte Snackpellets auf den Markt zu bringen, was letztendlich die Nachfrage nach Snackpellets steigert und voraussichtlich zum Marktwachstum beitragen wird.

Jüngste Entwicklungen

- Im Dezember 2019 gab PepsiCo, ein führendes Unternehmen der Lebensmittel- und Getränkeindustrie, die Übernahme von BFY Brands bekannt, einem privaten Unternehmen, das in ganz Nordamerika Snacks herstellt. Diese Übernahme hat das Produktportfolio des Unternehmens erweitert und ihm geholfen, mehr Umsatz zu erzielen.

- Im März 2020 wurde laut Food Business News erwartet, dass die Umsätze der Unternehmen, die verpackte Lebensmittel wie Snacks und Snack-Pellets im US-Einzelhandel herstellen, im Zeitraum von März bis Mai 2020 durchschnittlich um 15 bis 30 % wachsen würden.

Marktumfang für Snackpellets in Nordamerika

Der nordamerikanische Markt für Snackpellets ist in elf wichtige Segmente unterteilt, basierend auf Typ, Form, Gestalt, Zutaten, Verarbeitungsmethode, Art, Technik, Marke, Geschmack, Anwendung und Vertriebskanal. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Typ

- Cracker

- Chips

- Züge

- Sonstiges

Nach Typ ist der nordamerikanische Markt für Snackpellets in Cracker, Chips, Puffs und Sonstiges unterteilt.

Bilden

- Laminiert

- Sterben konfrontiert

- Gelatiniert

- Gestanzt

- Die Distanz

- Dreidimensional

- Zweidimensional

Auf Grundlage der Form ist der nordamerikanische Markt für Snackpellets in die Segmente laminiert, gestanzt, gelatiniert, gestanzt, Matrizenabstand, dreidimensionale und zweidimensionale Form unterteilt.

Form

- Runden

- Oval

- Ring

- Dreieckig

- Quadrat

- Stern

- Sonstiges

Auf Grundlage der Form ist der nordamerikanische Markt für Snackpellets in rund, oval, ringförmig, dreieckig, quadratisch, sternförmig und andere unterteilt.

Zutaten

- Kartoffel

- Mais

- Reis

- Tapioka

- Mehrkorn

- Sonstiges

Auf der Grundlage der Zutaten ist der nordamerikanische Markt für Snackpellets in Kartoffeln, Mais, Reis, Tapioka, Mehrkorn und andere unterteilt.

Verarbeitungsmethode

- Fettiges Snackpellet

- Nicht fettende Snackpellets

Auf Grundlage der Verarbeitungsmethode ist der nordamerikanische Markt für Snackpellets in fettige und nicht fettende Snackpellets segmentiert.

Natur

- Organisch

- Konventionell

Auf der Grundlage der Natur ist der nordamerikanische Markt für Snackpellets in biologisch und konventionell unterteilt.

Technik

- Einschneckenextruder

- Doppelschneckenextruder

Auf der Grundlage der Technik ist der nordamerikanische Markt für Snackpellets in Einschneckenextruder und Doppelschneckenextruder segmentiert.

Marke

- Gebrandmarkt

- Eigenmarke

Auf der Grundlage der Marke ist der nordamerikanische Markt für Snackpellets in Marken- und Eigenmarken unterteilt.

Geschmack

- Schmucklos

- Geschmack

Auf der Grundlage des Geschmacks ist der nordamerikanische Markt für Snackpellets in die Sorten „ohne Geschmack“ und „ohne Geschmack“ segmentiert.

Anwendung

- Haushalt

- Kommerziell

Auf Grundlage der Anwendung ist der nordamerikanische Markt für Snackpellets in Haushalts- und Gewerbeprodukte segmentiert.

Vertriebskanal

- Direkt

- Indirekt

Auf der Grundlage der Vertriebskanäle ist der nordamerikanische Markt für Snackpellets in direkt und indirekt unterteilt.

Nordamerika Snack Pellets Markt Regionale Analyse/Einblicke

Der nordamerikanische Markt für Snackpellets wird analysiert und auf Grundlage der oben genannten Hinweise werden Einblicke in die Marktgröße und Trends bereitgestellt.

Die im Bericht über die nordamerikanischen Snackpellets-Märkte abgedeckten Länder sind die USA, Kanada und Mexiko.

Es wird erwartet, dass die USA den nordamerikanischen Markt für Snackpellets in Bezug auf Marktanteil und Marktumsatz dominieren und ihre Dominanz im Prognosezeitraum weiter ausbauen werden. Dies ist auf die wachsende Nachfrage nach Snackpellets zur Erfüllung der Verbrauchernachfrage zurückzuführen. Snacks sind ein wichtiger Bestandteil der Ernährung der Menschen. In der Region bevorzugen die Menschen den ganzen Tag über Snacks, was das Marktwachstum voraussichtlich vorantreiben wird.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Marktvorschriften, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neu- und Ersatzverkäufe, demografische Daten des Landes, Krankheitsepidemiologie und Import- und Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Darüber hinaus werden bei der Prognoseanalyse der Länderdaten die Präsenz und Verfügbarkeit von Herstellern sowie deren Herausforderungen aufgrund der hohen Konkurrenz durch lokale und inländische Marken und die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile für Snackpellets in Nordamerika

The North America snack pellets market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the North America snack pellets market.

Some of the key players in the North America snack pellets market are BACH SNACKS SAL, Calbee, J.R. Short Snack Products, GRUPO MICHEL, LC America, Inc., Almounajed Food Industries, Chhajed Foods Pvt. Ltd, Fiorentini Alimentari S.p.A., Gustinos, Productos Alimenticios La Moderna S.A. de C.V., Le Caselle SPA, mafin, Palmex, Universal Robina Corporation, JLM Global Foods, Limagrain – Ingrédients, Quality Pellets, Pellsnack Products GmbH, BFY BRANDS, Attaybat, TTK, Intersnack Group GmbH & Co. KG, Leng-d'Or, YUPI SAS, among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs. Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SNACK PELLETS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 LABELING & CLAIMS:

4.3 NEW PRODUCT LAUNCH STRATEGY

4.3.1 OVERVIEW

4.3.2 NUMBER OF PRODUCT LAUNCHES

4.3.2.1 LINE EXTENSION

4.3.2.2 NEW PACKAGING

4.3.2.3 RE-LAUNCHED

4.3.2.4 NEW FORMULATION

4.3.3 DIFFERENTIAL PRODUCT OFFERING

4.3.4 MEETING CONSUMER REQUIREMENT

4.3.5 PACKAGE DESIGNING

4.3.6 PRICING ANALYSIS

4.3.7 PRODUCT POSITIONING

4.3.8 CONCLUSION

4.4 FACTORS INFLUENCING THE PURCHASE

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE:

4.6 PROMOTIONAL ACTIVITIES

4.7 SHOPPING BEHAVIOUR AND DYNAMICS: NORTH AMERICA SNACKS PELLETS MARKET

4.7.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.7.2 RESEARCH

4.7.3 IMPULSIVE

4.7.4 ADVERTISEMENT:

4.7.4.1 TELEVISION ADVERTISEMENT

4.7.4.2 ONLINE ADVERTISEMENT

4.7.4.3 IN-STORE ADVERTISEMENT

4.7.4.4 OUTDOOR ADVERTISEMENT

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND DISTRIBUTION

4.8.3 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASED CONSUMPTION OF PACKAGED FOODS DUE TO A BUSY LIFESTYLE

5.1.2 INCREASE IN DEMAND FOR SAVORY SNACKS

5.1.3 INCREASING REPLACEMENT OF MEALS WITH HEALTHY SNACKS

5.1.4 AVAILABILITY OF VARIOUS FLAVOURS IN CHIPS AND CRACKERS

5.2 RESTRAINTS

5.2.1 HEALTH PROBLEMS ASSOCIATED WITH THE HIGHER CONSUMPTION OF PROCESSED POTATO SNACKS

5.2.2 FLUCTUATING PRICES OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 EMERGENCE OF HEALTHY SNACK PELLETS

5.3.2 GOVERNMENT INITIATIVES AND INVESTMENT IN THE PROCESSED INDUSTRY OR SNACK PELLET INDUSTRY

5.3.3 AVAILABILITY OF A WIDE VARIETY OF FORMS, FLAVOURS, AND TASTES IN MULTIGRAIN SNACK PELLETS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH POTATO CHIPS MACHINES

5.4.2 SUPPLY CHAIN DISRUPTION DUE TO COVID-19

6 NORTH AMERICA SNACK PELLETS MARKET, BY TYPE

6.1 OVERVIEW

6.2 CHIPS

6.3 PUFFS

6.4 CRACKERS

6.5 OTHERS

7 NORTH AMERICA SNACK PELLETS MARKET, BY FORM

7.1 OVERVIEW

7.2 TRIDIMENSIONAL

7.3 TWO DIMENSIONAL

7.4 LAMINATED

7.5 DIE DISTANCE

7.6 GELATINIZED

7.7 DIE FACED

7.8 PUNCHED

8 NORTH AMERICA SNACK PELLETS MARKET, BY BRAND

8.1 OVERVIEW

8.2 BRANDED

8.3 PRIVATE LABEL

9 NORTH AMERICA SNACK PELLETS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 COMMERCIAL

9.3 HOUSEHOLD

10 NORTH AMERICA SNACK PELLETS MARKET, BY PROCESSING METHOD

10.1 OVERVIEW

10.2 REASY SNACK PELLET

10.3 NON-GREASY SNACK PELLET

10.3.1 HOT AIR BAKING

10.3.2 REGULAR BAKED OR ROASTED

11 NORTH AMERICA SNACK PELLETS MARKET, BY NATURE

11.1 OVERVIEW

11.2 CONVENTIONAL

11.3 ORGANIC

12 NORTH AMERICA SNACK PELLETS MARKET, BY FLAVOR

12.1 OVERVIEW

12.2 FLAVOR

12.2.1 TOMATO

12.2.2 BBQ

12.2.3 CHEESE

12.2.4 CHOCOLATE

12.2.5 CARAMELIZED

12.2.6 HONEY

12.2.7 HERB

12.2.8 BLACK PEPPER

12.2.9 SALSA

12.2.10 CHILE

12.2.11 LEMON

12.2.12 MINT

12.2.13 JALAPENOS

12.2.14 GARLIC

12.2.15 CHIPOTLE

12.2.16 OTHERS

12.3 PLAIN

13 NORTH AMERICA SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 INDIRECT

13.2.1 STORE-BASED RETAILING

13.2.1.1 CONVENIENCE STORES

13.2.1.2 SUPERMARKETS/HYPERMARKETS

13.2.1.3 SPECIALTY STORES

13.2.1.4 WHOLESALERS

13.2.1.5 GROCERY STORES

13.2.1.6 OTHERS

13.2.2 NON-STORE RETAILING

13.2.2.1 ONLINE RETAILERS

13.2.2.2 VENDING MACHINE

13.3 DIRECT

14 NORTH AMERICA SNACK PELLETS MARKET, BY TECHNIQUE

14.1 OVERVIEW

14.2 SINGLE-SCREW EXTRUDER

14.3 TWIN-SCREW EXTRUDER

15 NORTH AMERICA SNACK PELLETS MARKET, BY SHAPE

15.1 OVERVIEW

15.2 OVAL

15.3 ROUND

15.4 SQUARE

15.5 RING

15.6 TRIANGULAR

15.7 STAR

15.8 OTHERS

16 NORTH AMERICA SNACK PELLETS MARKET, BY INGREDIENTS

16.1 OVERVIEW

16.2 MULTIGRAIN

16.3 POTATO

16.4 CORN

16.5 RICE

16.6 TAPIOCO

16.7 OTHERS

17 NORTH AMERICA SNACKS PELLETS MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA SNACK PELLETS MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 INTERSNACK GROUP GMBH & CO. KG

20.1.1 COMPANY SNAPSHOT

20.1.2 COMPANY SHARE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 THE LORENZ BAHLSEN SNACK-WORLD GMBH & CO KG GERMANY

20.2.1 COMPANY SNAPSHOT

20.2.2 COMPANY SHARE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 BFY BRANDS

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENTS

20.4 MAFIN

20.4.1 COMPANY SANPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENTS

20.5 PRODUCTOS ALIMENTICIOS LA MODERNA S.A. DE C.V.

20.5.1 COMPANY SANPSHOT

20.5.2 COMPANY SHARE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENTS

20.6 AKKEL GROUP.

20.6.1 COMPANY SANPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENTS

20.7 ALMOUNAJED FOOD INDUSTRIES

1.7.1 COMPANY SNAPSHOT 189

20.7.1 PRODUCT PORTFOLIO

20.7.2 RECENT DEVELOPMENT

20.8 AL-QASRAWI

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 ATTAYBAT

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 BACH SNACKS SAL

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 BAG SNACKS

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 RECENT DEVELOPMENT

20.12 CALBEE

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENTS

20.13 CHHAJED FOODS PVT. LTD

20.13.1 COMPANY SANPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENTS

20.14 CRUNCHY FOOD FZE

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENT

20.15 DALMAZA FOOD INDUSTRIES CO. (DAFICO)

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENT

20.16 FIORENTINI ALIMENTARI S.P.A.

20.16.1 COMPANY SANPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 GUSTINOS

20.17.1 COMPANY SANPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 J.R. SHORT SNACK PRODUCTS

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 JEDNOŚĆ SP. Z O. O

20.19.1 COMPANY SANPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JLM NORTH AMERICA FOODS

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENT

20.21 JOPELLETS

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT UPDATE

20.22 KABIR FOODS

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 LC AMERICA, INC.

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 LE CASELLE SPA

20.24.1 COMPANY SANPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENTS

20.25 LENG-D'OR

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT DEVELOPMENT

20.26 LIMAGRAIN - INGRÉDIENTS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 MATARILE

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

20.28 MCFILLS ENTERPRISES PVT. LTD.

20.28.1 COMPANY SNAPSHOT

20.28.2 PRODUCT PORTFOLIO

20.28.3 RECENT DEVELOPMENT

20.29 GRUPO MICHEL

20.29.1 COMPANY SNAPSHOT

20.29.2 PRODUCT PORTFOLIO

20.29.3 RECENT DEVELOPMENT

20.3 NOBLE AGRO FOOD PRODUCTS PRIVATE LIMITED

20.30.1 COMPANY SANPSHOT

20.30.2 PRODUCT PORTFOLIO

20.30.3 RECENT DEVELOPMENT

20.31 NUTRADIA

20.31.1 COMPANY SNAPSHOT

20.31.2 PRODUCT PORTFOLIO

20.31.3 RECENT DEVELOPMENT

20.32 ORIENTAL FOOD INDUSTRIES SDN. BHD.

20.32.1 COMPANY SANPSHOT

20.32.2 REVENUE ANALYSIS

20.32.3 PRODUCT PORTFOLIO

20.32.4 RECENT DEVELOPMENTS

20.33 PALMEX

20.33.1 COMPANY SANPSHOT

20.33.2 PRODUCT PORTFOLIO

20.33.3 RECENT DEVELOPMENTS

20.34 PELLSNACK PRODUCTS GMBH

20.34.1 COMPANY SNAPSHOT

20.34.2 PRODUCT PORTFOLIO

20.34.3 RECENT DEVELOPMENT

20.35 POL-FOODS SP. Z O.O.

20.35.1 COMPANY SNAPSHOT

20.35.2 PRODUCT PORTFOLIO

20.35.3 RECENT DEVELOPMENT

20.36 POPCHIPS

20.36.1 COMPANY SNAPSHOT

20.36.2 PRODUCT PORTFOLIO

20.36.3 RECENT UPDATE

20.37 QUALITY PELLETS

20.37.1 COMPANY SNAPSHOT

20.37.2 PRODUCT PORTFOLIO

20.37.3 RECENT DEVELOPMENT

20.38 ROGER&ROGER

20.38.1 COMPANY SANPSHOT

20.38.2 PRODUCT PORTFOLIO

20.38.3 RECENT DEVELOPMENTS

20.39 GUANGDONG YUSHENG FOOD INDUSTRIES CO., LTD.

20.39.1 COMPANY SNAPSHOT

20.39.2 PRODUCT PORTFOLIO

20.39.3 RECENT DEVELOPMENT

20.4 SIBELL

20.40.1 COMPANY SNAPSHOT

20.40.2 PRODUCT PORTFOLIO

20.40.3 RECENT DEVELOPMENTS

20.41 SNACK CREATIONS LTD.

20.41.1 COMPANY SANPSHOT

20.41.2 PRODUCT PORTFOLIO

20.41.3 RECENT DEVELOPMENTS

20.42 SNACKLETS

20.43 SOLINO GROUP

20.43.1 COMPANY SNAPSHOT

20.43.2 PRODUCT PORTFOLIO

20.43.3 RECENT DEVELOPMENT

20.44 TTK

20.44.1 COMPANY SNAPSHOT

20.44.2 REVENUE ANALYSIS

20.44.3 PRODUCT PORTFOLIO

20.44.4 RECENT DEVELOPMENT

20.45 UNIVERSAL ROBINA CORPORATION

20.45.1 COMPANY SNAPSHOT

20.45.2 REVENUE ANALYSIS

20.45.3 PRODUCT PORTFOLIO

20.45.4 RECENT DEVELOPMENTS

20.46 V.AL.IN. SRL

20.46.1 COMPANY SNAPSHOT

20.46.2 PRODUCT PORTFOLIO

20.46.3 RECENT DEVELOPMENT

20.47 VIJAY INDUSTRIES

20.47.1 COMPANY SNAPSHOT

20.47.2 PRODUCT PORTFOLIO

20.47.3 RECENT DEVELOPMENT

20.48 VMF (VAN MARCKE FOODS) CONTINENTAL SNACKS

20.48.1 COMPANY SNAPSHOT

20.48.2 PRODUCT PORTFOLIO

20.48.3 RECENT DEVELOPMENT

20.49 YUPI SAS

20.49.1 COMPANY SNAPSHOT

20.49.2 PRODUCT PORTFOLIO

20.49.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NUTRITIONAL BENEFITS OF HEALTHY SNACK PELLETS:

TABLE 2 FLAVORS AND INGREDIENTS OF MULTIGRAIN PELLETS

TABLE 3 NORTH AMERICA SNACK PELLETS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CHIPS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA PUFFS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CRACKERS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA SNACK PELLETS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TRIDIMENSIONAL IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TWO DIMENSIONAL IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA LAMINATED IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DIE DISTANCE IN NORTH AMERICA SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA GELATINIZED IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA DIE FACED IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PUNCHED IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

NOTE: PERCENTAGE IN THE FIGURE REPRESENT CAGR OF THE SEGMENT 84

TABLE 16 NORTH AMERICA SNACK PELLETS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA BRANDED IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA PRIVATE-LABEL IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

NOTE: PERCENTAGE IN THE FIGURE REPRESENT CAGR OF THE SEGMENT 88

TABLE 19 NORTH AMERICA SNACK PELLETS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL IN NORTH AMERICA SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA HOUSEHOLD IN NORTH AMERICA SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SNACK PELLETS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA CONVENTIONAL IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ORGANIC IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA FLAVOR IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA FLAVOR IN SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA PLAIN IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INDIRECT IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA NON-STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA DIRECT IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA SNACK PELLETS MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA SINGLE-SCREW EXTRUDER IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TWIN-SCREW EXTRUDER IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA SNACK PELLETS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA OVAL IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ROUND IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SQUARE IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA RING IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TRIANGULAR IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA STAR IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA OTHERS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA SNACK PELLETS MARKET, BY INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MULTIGRAIN IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA POTATO IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CORN IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA RICE IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TAPIOCO IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN SNACK PELLETS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SNACK PELLETS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SNACK PELLETS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SNACK PELLETS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SNACK PELLETS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SNACK PELLETS MARKET, BY INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SNACK PELLETS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA SNACK PELLETS MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA SNACK PELLETS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA FLAVOR IN SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA SNACK PELLETS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA NON-STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 74 U.S. SNACK PELLETS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.S. SNACK PELLETS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 76 U.S. SNACK PELLETS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. SNACK PELLETS MARKET, BY INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 78 U.S. SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 79 U.S. NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 80 U.S. SNACK PELLETS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 81 U.S. SNACK PELLETS MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 82 U.S. SNACK PELLETS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 83 U.S. SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 84 U.S. FLAVOR IN SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 85 U.S. SNACK PELLETS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 86 U.S. SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 U.S. INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 U.S. STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 U.S. NON-STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 CANADA SNACK PELLETS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 CANADA SNACK PELLETS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 92 CANADA SNACK PELLETS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 93 CANADA SNACK PELLETS MARKET, BY INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 94 CANADA SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 95 CANADA NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 96 CANADA SNACK PELLETS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 97 CANADA SNACK PELLETS MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 98 CANADA SNACK PELLETS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 99 CANADA SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 100 CANADA FLAVOR IN SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 101 CANADA SNACK PELLETS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 CANADA SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 CANADA INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 CANADA STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 105 CANADA NON-STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 MEXICO SNACK PELLETS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MEXICO SNACK PELLETS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 108 MEXICO SNACK PELLETS MARKET, BY SHAPE, 2020-2029 (USD MILLION)

TABLE 109 MEXICO SNACK PELLETS MARKET, BY INGREDIENTS, 2020-2029 (USD MILLION)

TABLE 110 MEXICO SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 111 MEXICO NON-GREASY SNACK PELLET IN SNACK PELLETS MARKET, BY PROCESSING METHOD, 2020-2029 (USD MILLION)

TABLE 112 MEXICO SNACK PELLETS MARKET, BY NATURE, 2020-2029 (USD MILLION)

TABLE 113 MEXICO SNACK PELLETS MARKET, BY TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 114 MEXICO SNACK PELLETS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 115 MEXICO SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 MEXICO FLAVOR IN SNACK PELLETS MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 MEXICO SNACK PELLETS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MEXICO SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 119 MEXICO INDIRECT IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 MEXICO STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 MEXICO NON-STORE-BASED RETAILING IN SNACK PELLETS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA SNACK PELLETS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SNACK PELLETS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SNACK PELLETS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SNACK PELLETS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SNACK PELLETS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SNACK PELLETS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SNACK PELLETS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SNACK PELLETS MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 NORTH AMERICA SNACK PELLETS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA SNACK PELLETS MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE FIGURE NORTH AMERICA SNACK PELLETS MARKET AND IS GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASE IN DEMAND FOR SAVORY SNACKS IS DRIVING THE NORTH AMERICA SNACK PELLETS MARKET IN THE FORECAST PERIOD.

FIGURE 13 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SNACK PELLETS MARKET IN 2022 & 2029

FIGURE 14 NORTH AMERICA SNACK PELLETS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS OF NORTH AMERICA SNACK PELLETS MARKET

FIGURE 16 VALUE CHAIN ANALYSIS OF NORTH AMERICA SNACK PELLETS MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SNACK PELLETS MARKET

FIGURE 18 NORTH AMERICA SNACK PELLETS MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA SNACK PELLETS MARKET, BY FORM, 2021

FIGURE 20 NORTH AMERICA SNACK PELLETS MARKET, BY BRAND, 2021

FIGURE 21 NORTH AMERICA SNACK PELLETS MARKET, BY APPLICATION, 2021

FIGURE 22 NORTH AMERICA SNACK PELLETS MARKET: BY PROCESSING METHOD, 2021

FIGURE 23 NORTH AMERICA SNACK PELLETS MARKET: BY NATURE, 2021

FIGURE 24 NORTH AMERICA SNACK PELLETS MARKET: BY FLAVOR, 2021

FIGURE 25 NORTH AMERICA SNACK PELLETS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA SNACK PELLETS MARKET: BY TECHNIQUE, 2021

FIGURE 27 NORTH AMERICA SNACK PELLETS MARKET: BY SHAPE, 2021

FIGURE 28 NORTH AMERICA SNACK PELLETS MARKET: BY INGREDIENTS, 2021

FIGURE 29 NORTH AMERICA SNACK PELLETS MARKET: SNAPSHOT (2021)

FIGURE 30 NORTH AMERICA SNACK PELLETS MARKET: BY COUNTRY (2021)

FIGURE 31 NORTH AMERICA SNACK PELLETS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 NORTH AMERICA SNACK PELLETS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 NORTH AMERICA SNACK PELLETS MARKET: BY TYPE (2022 & 2029)

FIGURE 34 NORTH AMERICA SNACK PELLETS MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.