North America Sleep Disorder Treatment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

7.46 Billion

USD

14.43 Billion

2025

2033

USD

7.46 Billion

USD

14.43 Billion

2025

2033

| 2026 –2033 | |

| USD 7.46 Billion | |

| USD 14.43 Billion | |

|

|

|

|

Marktsegmentierung für die Behandlung von Schlafstörungen in Nordamerika nach Art (Schlaflosigkeit, Schlafapnoe, Restless-Legs-Syndrom (RLS), Narkolepsie und andere), Behandlung (pharmakologische Therapie, mechanische Therapie, Unterkieferprotrusionsschienen, Hypoglossusnervenstimulator, chirurgische Eingriffe und andere), Verabreichungsweg (oral, parenteral und andere), Arzneimitteltyp (Markenpräparate und Generika), Zielgruppe (Kinder und Erwachsene), Endnutzer (Krankenhäuser, Fachkliniken, häusliche Pflege, ambulante Operationszentren und andere), Vertriebskanal (Direktvergabe, Krankenhausapotheke, Einzelhandelsapotheke, Online-Apotheke und andere) – Branchentrends und Prognose bis 2033

Marktgröße für die Behandlung von Schlafstörungen in Nordamerika

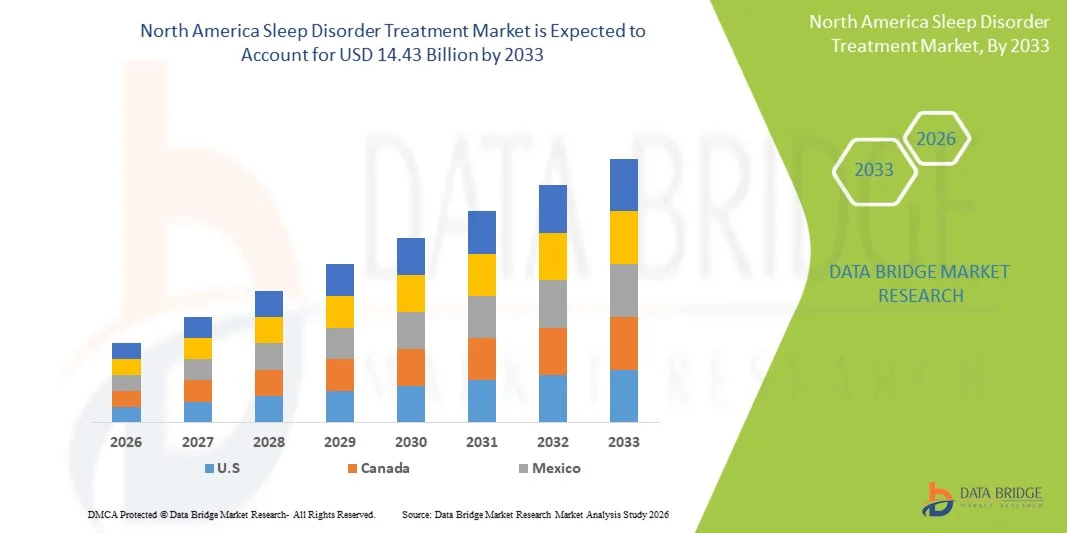

- Der nordamerikanische Markt für die Behandlung von Schlafstörungen hatte im Jahr 2025 einen Wert von 7,46 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 14,43 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,60 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung von Schlafstörungen, das steigende Bewusstsein für die Bedeutung eines gesunden Schlafs und die wachsende Nutzung fortschrittlicher Diagnose- und Therapietechnologien sowohl im häuslichen als auch im klinischen Bereich angetrieben.

- Darüber hinaus treibt die steigende Nachfrage der Verbraucher nach personalisierten, effektiven und nicht-invasiven Lösungen für das Schlafmanagement die Nutzung von Behandlungsmethoden für Schlafstörungen voran und steigert damit das Wachstum der Branche erheblich.

Analyse des nordamerikanischen Marktes für die Behandlung von Schlafstörungen

- Intelligente Geräte und Therapielösungen für Schlafstörungen, die Diagnose- und Behandlungsunterstützung für verschiedene Schlafstörungen wie Schlaflosigkeit, Schlafapnoe und Narkolepsie bieten, sind aufgrund ihrer Benutzerfreundlichkeit, ihrer Möglichkeiten zur Fernüberwachung und ihrer Integration in digitale Gesundheitsökosysteme zunehmend unverzichtbare Bestandteile moderner Gesundheits- und häuslicher Pflegesysteme.

- Die steigende Nachfrage nach Behandlungslösungen für Schlafstörungen wird in erster Linie durch die zunehmende Verbreitung schlafbezogener Gesundheitsprobleme, das wachsende Bewusstsein der Verbraucher für die Schlafgesundheit und die steigende Präferenz für personalisierte und nicht-invasive Therapien angetrieben.

- Die USA dominierten 2025 den nordamerikanischen Markt für die Behandlung von Schlafstörungen mit einem Umsatzanteil von rund 42,5 %. Dies ist auf eine gut ausgebaute Gesundheitsinfrastruktur, die hohe Akzeptanz fortschrittlicher Diagnose- und Therapiegeräte, die starke Präsenz wichtiger Marktteilnehmer und das hohe Bewusstsein der Verbraucher für die Bedeutung von Schlafgesundheit zurückzuführen. Das Land verzeichnet ein deutliches Wachstum bei der Inanspruchnahme von Behandlungen für Schlafstörungen in Krankenhäusern, Kliniken und der häuslichen Pflege.

- Kanada dürfte im Prognosezeitraum das am schnellsten wachsende Land im nordamerikanischen Markt für die Behandlung von Schlafstörungen sein und eine geschätzte durchschnittliche jährliche Wachstumsrate (CAGR) von rund 9,1 % verzeichnen. Treiber dieser Entwicklung sind steigende Investitionen in die Gesundheitsinfrastruktur, die zunehmende Verbreitung von Schlafstörungen, die verstärkte Nutzung digitaler und häuslicher Schlafüberwachungslösungen sowie die wachsende Verfügbarkeit spezialisierter Schlaftherapiekliniken.

- Das Segment der Erwachsenen erzielte 2025 mit 72,5 % den größten Marktanteil, was auf die hohe Prävalenz von Schlafapnoe, Schlaflosigkeit und RLS in der erwachsenen Bevölkerung zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für die Behandlung von Schlafstörungen in Nordamerika

|

Attribute |

Wichtige Markteinblicke in die Behandlung von Schlafstörungen in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Trends auf dem nordamerikanischen Markt für die Behandlung von Schlafstörungen

„ Zunehmende Nutzung fortschrittlicher und nicht-invasiver Therapien “

- Ein bedeutender Trend auf dem nordamerikanischen Markt für die Behandlung von Schlafstörungen ist die zunehmende Anwendung fortschrittlicher therapeutischer Interventionen und nicht-invasiver Behandlungsoptionen, darunter CPAP-Geräte (Continuous Positive Airway Pressure), orale Apparaturen und digitale Therapien.

- Diese Ansätze gewinnen zunehmend an Bedeutung, da Patienten und Gesundheitsdienstleister nach effektiven Lösungen mit verbesserter Therapietreue, höherem Komfort und größerer Bequemlichkeit suchen.

- Beispielsweise berichteten im Jahr 2024 mehrere Schlafkliniken in den USA und Kanada von einer höheren Patientennachfrage nach tragbaren Schlafüberwachungsgeräten und Heimtestkits, was einen breiteren Trend hin zu einer personalisierten und zugänglichen Behandlung von Schlafstörungen widerspiegelt.

- Kontinuierliche technologische Verbesserungen, wie z. B. intelligente CPAP-Geräte mit Adhärenzüberwachung, Fernüberwachung und datengestützter Therapieoptimierung, steigern die Behandlungseffektivität und die Patientenzufriedenheit.

- Darüber hinaus fördert das wachsende öffentliche Bewusstsein für die Gesundheitsrisiken unbehandelter Schlafstörungen, einschließlich kardiovaskulärer Komplikationen, Stoffwechselstörungen und psychischer Probleme, die Anwendung nicht-invasiver und patientenfreundlicher Behandlungsmethoden in der gesamten Region.

Marktdynamik der Schlafstörungsbehandlung in Nordamerika

Treiber

„Zunehmende Verbreitung von Schlafstörungen und wachsende Investitionen im Gesundheitswesen“

- Der nordamerikanische Markt für die Behandlung von Schlafstörungen wird hauptsächlich durch die zunehmende Verbreitung von Erkrankungen wie obstruktiver Schlafapnoe (OSA), Schlaflosigkeit, Restless-Legs-Syndrom und Narkolepsie angetrieben.

- Das zunehmende Bewusstsein für den Zusammenhang zwischen Schlafstörungen und der allgemeinen Gesundheit hat Patienten dazu veranlasst, aktiv medizinische Hilfe in Anspruch zu nehmen.

- Darüber hinaus unterstützen der Ausbau der Gesundheitsinfrastruktur und höhere Investitionen in Schlafmedizinkliniken, Forschung und digitale Therapien das Marktwachstum.

- Beispielsweise setzen Krankenhäuser und spezialisierte Schlafzentren in den USA und Kanada umfassende Diagnoseinstrumente und Therapiemanagementsysteme ein, die eine Früherkennung und personalisierte Behandlungspläne ermöglichen.

- Darüber hinaus tragen die alternde Bevölkerung und Lebensstilfaktoren wie Übergewicht, Stress und Urbanisierung zu einer höheren Nachfrage nach wirksamen Behandlungen von Schlafstörungen bei und führen zu einem stetigen Wachstum sowohl im klinischen Bereich als auch in der häuslichen Pflege.

- Verbesserte Versicherungsdeckung und Erstattungspolitiken für Schlafdiagnostik und -therapie ermutigen ebenfalls mehr Patienten, eine Behandlung in Anspruch zu nehmen, was die allgemeine Marktakzeptanz in Nordamerika stärkt.

Zurückhaltung/Herausforderung

„ Hohe Behandlungskosten und Probleme mit der Patienten-Compliance “

- Trotz der steigenden Nachfrage steht der Markt vor Herausforderungen im Zusammenhang mit den hohen Kosten fortschrittlicher Therapien und der Therapietreue der Patienten.

- Geräte wie CPAP-Geräte, Mundschienen und Lösungen zur kontinuierlichen Überwachung erfordern oft erhebliche Vorabinvestitionen, was die Zugänglichkeit für preissensible Patienten einschränkt.

- Zudem bleibt die Therapietreue der Patienten ein entscheidender Faktor, da Unbehagen, mangelnde Aufklärung oder die Komplexität der Behandlungspläne zu einer unregelmäßigen Anwendung der Therapie führen und somit die Behandlungseffektivität verringern können.

- Unterschiede in den Gesundheitspolitiken, der Versicherungsdeckung und der Kostenerstattung zwischen den Bundesstaaten können ebenfalls Hindernisse für eine breite Anwendung darstellen, insbesondere bei nicht-invasiven oder neueren Therapietechnologien.

- Ein Bericht der American Sleep Apnea Association aus dem Jahr 2023 hob beispielsweise hervor, dass fast 30 % der Patienten, denen eine CPAP-Therapie verschrieben wurde, diese innerhalb der ersten sechs Monate aufgrund von Beschwerden oder Unannehmlichkeiten abbrachen. Dies verdeutlicht die Auswirkungen von Problemen bei der Therapietreue auf das Marktwachstum.

- Die Bewältigung dieser Herausforderungen durch Patientenaufklärung, erschwingliche Behandlungsoptionen und verbesserte Überwachung der Therapietreue ist unerlässlich für ein nachhaltiges Wachstum des nordamerikanischen Marktes für die Behandlung von Schlafstörungen.

Umfang des nordamerikanischen Marktes für die Behandlung von Schlafstörungen

Der Markt ist segmentiert nach Art, Behandlung, Verabreichungsweg, Arzneimitteltyp, Bevölkerungsgruppe, Endverbraucher und Vertriebskanal.

• Nach Typ

Basierend auf der Art der Schlafstörung ist der nordamerikanische Markt für die Behandlung von Schlafstörungen in Schlaflosigkeit, Schlafapnoe, Restless-Legs-Syndrom (RLS), Narkolepsie und Sonstige unterteilt. Das Segment Schlafapnoe dominierte 2025 mit einem Umsatzanteil von rund 42,7 %, was auf die weltweit hohe Prävalenz der obstruktiven Schlafapnoe zurückzuführen ist. Die zunehmende Anwendung der CPAP-Therapie (kontinuierlicher positiver Atemwegsdruck), das wachsende Bewusstsein für die damit verbundenen kardiovaskulären Risiken und Fortschritte bei Überwachungsgeräten tragen maßgeblich zu dieser Marktführerschaft bei. Die wachsende Zahl älterer Menschen und steigende Adipositasraten spielen dabei eine wichtige Rolle. Krankenversicherungsschutz und die Unterstützung durch Krankenhäuser verbessern den Zugang für Patienten. Die Integration mit Smart-Geräten fördert die Therapietreue. Forschungsinitiativen zur Früherkennung stärken die Akzeptanz der Behandlung. Die zunehmende Nutzung von häuslicher Pflege erweitert die Reichweite. Verbesserungen der regionalen Gesundheitsinfrastruktur festigen die Marktführerschaft. Staatliche Programme und Kampagnen zur Sensibilisierung der Öffentlichkeit unterstützen ein nachhaltiges Wachstum.

Für das Segment Narkolepsie wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 15,4 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind verbesserte Diagnosemöglichkeiten und die zunehmende Anerkennung seltener Schlafstörungen. Biopharmazeutische Unternehmen investieren in neuartige Therapien und gezielte Gentherapien. Verstärkte klinische Studien und Forschungsgelder fördern die Entwicklung neuer Behandlungsansätze. Aufklärungsprogramme für Ärzte verbessern die Diagnose und die Anwendung von Therapien. Die Zusammenarbeit mit spezialisierten Kliniken erleichtert den Patientenzugang. Erweiterte Patientenschulungen verbessern die Therapietreue. Die Einführung innovativer Behandlungen gegen Tagesschläfrigkeit treibt das Marktwachstum an. Online-Apotheken ermöglichen einen schnellen Zugang zu Therapien. Die zunehmende Anerkennung von Kindern und Jugendlichen fördert die Akzeptanz von Behandlungen. Die technologische Integration in die Überwachung verbessert die Behandlungseffizienz.

• Durch Behandlung

Basierend auf den Behandlungsmethoden ist der Markt in medikamentöse Therapie, mechanische Therapie, Unterkieferprotrusionsschienen, Hypoglossusnervenstimulation, chirurgische Eingriffe und Sonstiges unterteilt. Das Segment der medikamentösen Therapie erzielte 2025 mit rund 46,5 % den größten Marktanteil. Treiber dieses Wachstums sind die weitverbreitete Anwendung von Schlafmitteln, Sedativa und wachheitsfördernden Medikamenten bei Schlaflosigkeit, Narkolepsie und Restless-Legs-Syndrom. Die gute Verfügbarkeit von Marken- und Generika-Medikamenten, die Präferenz von Ärzten und etablierte Behandlungsprotokolle tragen zur Marktführerschaft bei. Versicherungsschutz und Maßnahmen zur Förderung der Patientenadhärenz steigern den Umsatz. Globale Forschungsprojekte gewährleisten kontinuierliche Innovationen. Zulassungen neuerer Medikamente verbessern die Marktdurchdringung. Die Integration in die Telemedizin erleichtert die Patientenüberwachung. Ein wachsendes Bewusstsein für Schlafhygiene fördert die Akzeptanz der Therapie. Partnerschaften zwischen Pharmaunternehmen und Kliniken optimieren den Vertrieb. Die alternde Bevölkerung erhöht die Nachfrage nach Behandlungen chronischer Schlafstörungen.

Für das Segment der Hypoglossusnervenstimulatoren wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 16,2 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die zunehmende Verbreitung minimalinvasiver Eingriffe bei obstruktiver Schlafapnoe. Technologische Fortschritte bei implantierbaren Geräten verbessern deren Wirksamkeit und Komfort. FDA-Zulassungen und CE-Kennzeichnungen erweitern die weltweite Verfügbarkeit. Die Weiterbildung von Fachärzten steigert die Anwendungshäufigkeit. Das wachsende Bewusstsein für chirurgische Alternativen zur CPAP-Therapie fördert das Wachstum. Erweiterte Erstattungspolitiken in entwickelten Märkten unterstützen die Akzeptanz. Positive Ergebnisse klinischer Studien stärken das Vertrauen. Krankenhäuser und spezialisierte Zentren fördern aktiv die Implantation. Kooperationen mit Geräteherstellern beschleunigen die Kommerzialisierung. Die Geräteüberwachung durch vernetzte Technologien verbessert die Behandlungsergebnisse.

• Auf dem Weg der Verabreichung

Basierend auf der Verabreichungsart ist der Markt in orale, parenterale und sonstige Darreichungsformen unterteilt. Das orale Segment dominierte 2025 mit einem Umsatzanteil von 51,3 %. Gründe hierfür sind die einfache Anwendung, die hohe Patienten-Compliance und die weit verbreitete orale Pharmakotherapie bei Schlaflosigkeit und Narkolepsie. Die einfache Selbstverabreichung zu Hause und die breite Verfügbarkeit oraler Darreichungsformen stärken die Marktführerschaft. Die Vertrautheit der Ärzte mit Dosierung und standardisierten Protokollen verbessert die Verschreibungsraten. Zulassungen neuerer oraler Präparate erweitern die Behandlungsmöglichkeiten. Die Integration in die Telemedizin erleichtert die Überwachung der Therapietreue. Die Verfügbarkeit von Generika senkt die Kostenbarrieren. Die Präferenz der Patienten für nicht-invasive Therapien fördert die Akzeptanz. Aufklärungskampagnen im Gesundheitswesen steigern die Inanspruchnahme. Der Bedarf an Behandlung chronischer Schlafstörungen unterstützt die Langzeitanwendung. Vertriebsnetze verbessern den Zugang in allen Regionen.

Das Segment der parenteralen Therapien wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 14,8 % am schnellsten wachsen. Treiber dieses Wachstums sind spezialisierte Injektionstherapien für Narkolepsie und das Restless-Legs-Syndrom (RLS). Zunehmende klinische Studien mit Biologika und zielgerichteten Therapien fördern die Anwendung. Die Krankenhausverwaltung gewährleistet eine kontrollierte Behandlung. Innovationen bei den Applikationsgeräten verbessern den Patientenkomfort. Die Kostenerstattung unterstützt die Therapieakzeptanz. Spezialisierte Kliniken konzentrieren sich auf die Injektionsverabreichung hochwirksamer Medikamente. Zulassungen erweitern die Indikationen. Die Anwendung bei Kindern und älteren Patienten nimmt zu. Die Integration mit Überwachungsgeräten unterstützt die Therapietreue. Ein wachsendes Bewusstsein unter Ärzten fördert die Anwendung.

• Nach Arzneimitteltyp

Basierend auf der Art der Medikamente ist der Markt in Markenprodukte und Generika unterteilt. Das Segment der Markenprodukte dominierte 2025 mit einem Marktanteil von 57,1 %. Treiber dieser Entwicklung war die hohe Akzeptanz patentierter Therapien gegen Schlafapnoe, Schlaflosigkeit und Narkolepsie, die durch klinische Studien belegt sind. Globale Pharmaunternehmen bewerben ihre Marken aktiv. Die Kostenübernahme durch die Krankenversicherung trägt zur Bezahlbarkeit bei. Die Präferenz der Ärzte und Marketinginitiativen stärken die Marktführerschaft. Die Einführung von Medikamenten der nächsten Generation verbessert die Wirksamkeit. Die Integration von Telemedizin verbessert die Therapietreue. Zulassungen gewährleisten Sicherheit und Vertrauen. Patientenschulungen fördern die Compliance. Forschungs- und Entwicklungsprojekte sichern die Produktdifferenzierung. Marktexklusivität fördert Investitionen.

Für den Generika-Sektor wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,9 % das schnellste Wachstum erwartet. Treiber dieses Wachstums sind auslaufende Patente und die zunehmende Kostenbewusstseinsrate in Schwellenländern. Staatliche Initiativen und günstige Erstattungsregelungen fördern die Akzeptanz von Generika. Krankenhäuser und Apotheken führen vermehrt Generika. Das steigende Bewusstsein der Patienten verringert die Abhängigkeit von Markenmedikamenten. Der Vertrieb über den Einzelhandel und online erweitert die Reichweite. Kosteneffiziente Therapien verbessern die Therapietreue. Kooperationsprogramme zwischen Regierungen und Kliniken verbessern den Zugang zu Medikamenten. Die Expansion von Online-Apotheken beschleunigt das Wachstum.

• Nach Bevölkerungstyp

Basierend auf der Bevölkerungsgruppe ist der Markt in Kinder und Erwachsene unterteilt. Das Segment der Erwachsenen erzielte 2025 mit 72,5 % den größten Marktanteil, bedingt durch die hohe Prävalenz von Schlafapnoe, Schlaflosigkeit und Restless-Legs-Syndrom (RLS) in dieser Bevölkerungsgruppe. Steigende Adipositasraten, Lebensstilfaktoren und die alternde Bevölkerung tragen maßgeblich zu dieser Dominanz bei. Klinik- und ambulante Behandlungen konzentrieren sich größtenteils auf Erwachsene. CPAP-Geräte, Unterkieferprotrusionsschienen und medikamentöse Therapien werden häufig eingesetzt. Aufklärungskampagnen richten sich an Erwachsene. Die Kostenübernahme durch die Krankenversicherung deckt die Behandlung chronischer Erkrankungen ab. Telemedizinische Überwachung verbessert die Therapietreue. Ältere Menschen benötigen langfristige Betreuung. Betriebliche Gesundheitsprogramme steigern die Nachfrage.

Das Segment Kinder wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 12,7 % am schnellsten wachsen. Treiber dieses Wachstums sind die zunehmende Anerkennung von Schlafstörungen bei Kindern und spezialisierte Interventionen. Kinderkliniken und -krankenhäuser setzen altersgerechte Therapien ein. Das gestiegene Bewusstsein der Eltern und proaktive Vorsorgeuntersuchungen verbessern die Diagnosequoten. Zulassungen für Medikamente und Geräte für Kinder fördern deren Anwendung. Gesundheitsinitiativen in Schulen und Gemeinden stärken das Bewusstsein. Die Nutzung von CPAP-Geräten für Kinder nimmt stetig zu. Spezialisierte Lösungen für die häusliche Pflege von Kindern werden immer häufiger eingesetzt. Telemedizin erleichtert die Überwachung. Kooperationen zwischen Pharmaunternehmen und Kinderzentren beschleunigen den Zugang zu diesen Therapien.

• Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Krankenhäuser, Fachkliniken, häusliche Pflege, ambulante Operationszentren und Sonstige unterteilt. Das Segment der Krankenhäuser dominierte 2025 mit einem Umsatzanteil von 48,6 %, was auf die Verfügbarkeit multidisziplinärer Schlafzentren, Diagnoselabore und Einrichtungen zur Therapieverwaltung zurückzuführen ist. Krankenhäuser bieten Zugang zu einem breiten Spektrum an Interventionen und Behandlungen. Versicherungsschutz und Erstattungspolitiken fördern die Inanspruchnahme von Krankenhausleistungen. Die Integration mit Telemedizin verbessert die Patientennachsorge. Forschungsinitiativen im Krankenhausumfeld erweitern das Behandlungsspektrum. Die Schulung des medizinischen Personals unterstützt die Anwendung neuer Verfahren. Krankenhäuser bieten sowohl Leistungen für Erwachsene als auch für Kinder an. Partnerschaften mit Geräteherstellern stärken die Leistungsfähigkeit. Hohe Patientenzahlen sichern die Marktführerschaft.

Der Bereich der häuslichen Pflege wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 15,8 % am schnellsten wachsen. Treiber dieser Entwicklung ist die steigende Nachfrage nach CPAP-Therapie und Telemonitoring-Geräten für den Heimgebrauch. Mehr Komfort für Patienten, Kosteneffizienz und die Möglichkeit zur Überwachung der Therapietreue fördern die Akzeptanz. Die Kostenübernahme für Heimtherapien durch die Krankenkassen verbessert die Zugänglichkeit. Anbieter häuslicher Pflege bieten Schulungen und Unterstützung an. Die Integration von Telemedizin gewährleistet eine kontinuierliche Überwachung. Die alternde Bevölkerung und chronisch kranke Patienten treiben die Nachfrage nach häuslicher Pflege an. Online-Apotheken und die Direktlieferung von Geräten an Patienten erweitern die Reichweite. Kooperationen mit Medizintechnikunternehmen verbessern das Serviceangebot. Der pandemiebedingte Trend hin zur häuslichen Pflege beschleunigt das Wachstum.

• Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvertrieb, Krankenhausapotheke, Einzelhandelsapotheke, Online-Apotheke und Sonstige unterteilt. Das Segment der Krankenhausapotheken dominierte 2025 mit einem Umsatzanteil von 54,2 %. Dies ist auf die kontrollierte Versorgung mit verschreibungspflichtigen Medikamenten und die Integration in krankenhausbasierte Schlaflabore zurückzuführen. Die direkte ärztliche Verschreibung gewährleistet die sachgemäße Anwendung. Kostenerstattung und Versicherungsschutz fördern die Präferenz für Krankenhausapotheken. Der Zugang zu Spezialmedikamenten unterstützt die Marktführerschaft. Die Integration in die Patientenakten sichert die Therapietreue. Eine effiziente Lieferkette fördert die Akzeptanz. Die Vertrautheit der Ärzte mit den Medikamenten verstärkt die Anwendung. Multichannel-Krankenhausnetzwerke erweitern die Reichweite. Krankenhausapotheken halten einen Vorrat für die Therapie chronischer Erkrankungen vor. Die behördliche Aufsicht gewährleistet die Sicherheit.

Das Segment der Online-Apotheken wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 16,3 % am schnellsten wachsen. Treiber dieser Entwicklung sind die zunehmende Digitalisierung, die Integration von Telemedizin und die Lieferung von Medikamenten gegen Schlafstörungen nach Hause. Der Wunsch der Patienten nach Bequemlichkeit fördert Online-Käufe. E-Apotheken-Plattformen erweitern ihre geografische Reichweite. Digitale Rezepte und automatisierte Lieferungen verbessern die Therapietreue. Aufklärungskampagnen unterstützen die Nutzung von Online-Therapien. Kostenvorteile locken Patienten an. Die rasche Expansion in Schwellenländern beschleunigt die Akzeptanz. Technologische Integration verbessert die Patientenüberwachung. Kooperationen mit Krankenhäusern stärken die Glaubwürdigkeit. Online-Kanäle verbessern den Zugang zu Marken- und Generika-Medikamenten.

Regionale Analyse des nordamerikanischen Marktes für die Behandlung von Schlafstörungen

- Der US-amerikanische Markt für die Behandlung von Schlafstörungen in Nordamerika konnte den größten Anteil innerhalb Nordamerikas verzeichnen, was auf die rasche Einführung fortschrittlicher Diagnoseinstrumente, therapeutischer Geräte und Lösungen zur Schlafüberwachung zu Hause zurückzuführen ist.

- Das wachsende Bewusstsein für Schlafstörungen, die zunehmende Verbreitung von Erkrankungen wie Schlafapnoe und Schlaflosigkeit sowie die starke Präsenz führender Marktteilnehmer sind Schlüsselfaktoren für das Wachstum.

- Krankenhäuser, spezialisierte Schlafkliniken und Anbieter häuslicher Pflege integrieren zunehmend innovative Technologien, um die Behandlungsergebnisse für die Patienten zu verbessern und so die Gesamtnachfrage auf dem Markt zu steigern.

Einblick in den Markt für die Behandlung von Schlafstörungen in Kanada und Nordamerika

Der kanadische Markt für die Behandlung von Schlafstörungen in Nordamerika wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen und eine geschätzte durchschnittliche jährliche Wachstumsrate (CAGR) von rund 9,1 % erreichen. Dieses Wachstum wird durch steigende Investitionen in die Gesundheitsinfrastruktur, die zunehmende Verbreitung von Schlafstörungen und die wachsende Nutzung digitaler und häuslicher Schlafüberwachungslösungen angetrieben. Das expandierende Netzwerk spezialisierter Schlaftherapiekliniken, unterstützt durch staatliche Initiativen und den Fokus auf Prävention, trägt maßgeblich zum Marktwachstum in Kanada bei.

Marktanteil der Schlafstörungsbehandlung in Nordamerika

Die Branche für die Behandlung von Schlafstörungen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Philips Respironics (Niederlande)

- Fisher & Paykel Healthcare (Neuseeland)

- Invacare Corporation (USA)

- SomnoMed (Australien)

- Inspire Medical Systems (USA)

- Respicardia (US)

- Itamar Medical (Israel)

- Zephyr Sleep Technologies (USA)

- Actelion Pharmaceuticals (Schweiz)

- Teva Pharmaceutical Industries (Israel)

- GlaxoSmithKline (UK)

- Novartis (Schweiz)

- Johnson & Johnson (USA)

- Koninklijke DSM (Niederlande)

- Sleep Number Corporation (USA)

- Apex Medical (Taiwan)

- Medtronic (USA)

- BMC Medical (China)

- SomniFix (USA)

Neueste Entwicklungen auf dem nordamerikanischen Markt für die Behandlung von Schlafstörungen

- Im Dezember 2024 genehmigte die US-amerikanische Arzneimittelbehörde FDA Zepbound (Tirzepatid), einen von Eli Lilly entwickelten GLP-1-Rezeptoragonisten, als erstes Medikament speziell zur Behandlung von mittelschwerer bis schwerer obstruktiver Schlafapnoe (OSA) bei übergewichtigen Erwachsenen. Es zeigte signifikante Reduktionen der Apnoe-Episoden sowie positive Effekte auf die Gewichtsabnahme. Diese Zulassung bedeutete eine bedeutende Erweiterung der pharmakologischen Behandlungsmöglichkeiten für OSA, die bisher von gerätebasierten Therapien wie CPAP dominiert wurden, und bot Ärzten eine neue systemische Therapie zur Behandlung der zugrunde liegenden metabolischen Ursachen der Schlafapnoe, insbesondere bei übergewichtigen Patienten.

- Im Januar 2024 brachte ResMed das AirMini AutoSet Travel CPAP-Gerät auf den Markt, ein kompaktes und leichtes Gerät zur Schlafapnoe-Therapie, das speziell für Vielreisende entwickelt wurde. Dies stellt einen strategischen Schritt hin zu portableren und benutzerfreundlicheren Technologien zur Behandlung von Schlafstörungen dar, die die Therapietreue auch außerhalb des gewohnten häuslichen Umfelds fördern. Die Einführung des AirMini spiegelt den Branchentrend hin zu Miniaturisierung und Benutzerfreundlichkeit in der Behandlung chronischer Schlafstörungen wider.

- Im Juni 2024 kündigte Philips eine bedeutende neue CPAP-Plattform mit verbesserter Patientenüberwachung und cloudbasierter Datenaustauschfunktion an. Diese Plattform optimiert die Fernbehandlung von Patienten und verbessert die langfristige Therapietreue durch integrierte Telemedizinfunktionen, wodurch die Gerätetherapie den Trends im digitalen Gesundheitswesen entspricht. Die Markteinführung verdeutlichte, wie Konnektivität und Datenanalyse in die Infrastruktur der Schlaftherapie integriert werden, um die ärztliche Betreuung und die Einbindung der Patienten zu unterstützen.

- Im September 2025 erhielt Airway Management die FDA-Zulassung für Nylon flexTAP®, die erste digital gedruckte, einpunktige Mittellinien-Mundschiene zur Behandlung leichter bis mittelschwerer obstruktiver Schlafapnoe. Dank der patentierten Vertex-Technologie bietet sie verbesserten Tragekomfort und höhere therapeutische Wirksamkeit und erweitert die Behandlungsalternativen zu CPAP. Diese Zulassung stärkte das Segment der Mundschienen und bietet Patienten zusätzliche, nicht-invasive Therapien, die mit herkömmlichen Geräten konkurrieren.

- Im Februar 2025 gab Huxley Medical die FDA-Zulassung für seinen Heim-Schlafapnoe-Test SANSA mit Mobilfunk-Datenübertragung bekannt. Dadurch entfällt die Abhängigkeit von Bluetooth oder Smartphone-Apps zur Übertragung der Diagnosedaten, was die Durchführung von Schlafuntersuchungen zu Hause vereinfacht und den Zugang für unterversorgte Patientengruppen verbessert. Diese Innovation unterstützt den Trend hin zu dezentraler, patientenzentrierter Diagnostik im Bereich der Schlafstörungen.

- Im März 2025 erhielt ResMed die FDA-Zulassung für sein neues adaptives Servo-Ventilator-Gerät, eine Schlafapnoe-Therapieplattform der nächsten Generation. Diese wurde für Patienten mit komplexeren Atemwegsbedürfnissen entwickelt, verbessert die Therapiegenauigkeit und erweitert die Behandlungsmöglichkeiten für Personen, die auf herkömmliche CPAP- oder BiPAP-Geräte nicht ausreichend ansprechen. Diese Geräteentwicklung unterstreicht die kontinuierliche Innovation im Bereich therapeutischer Hardware, die ungedeckte Bedürfnisse bei schweren Schlafstörungen adressiert und das Marktwachstum für solche Geräte stärkt.

- Im Januar 2025 präzisierten Medicare und Medicaid ihre Richtlinien zur Kostenerstattung, sodass Zepbound in Medicare Teil D und möglicherweise auch in Medicaid-Pläne zur Behandlung von obstruktiver Schlafapnoe (OSA) aufgenommen werden kann. Dies verbessert den Zugang älterer und einkommensschwacher Patienten zu dieser neuen medikamentösen Option für mittelschwere bis schwere Schlafapnoe erheblich. Diese Entwicklung ermöglichte breitere Erstattungswege durch die Krankenkassen, die für die praktische Anwendung neuartiger Therapien gegen Schlafstörungen jenseits der herkömmlichen Geräteversorgung entscheidend sind und Millionen von Versicherten den Zugang eröffnen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.