North America Premium Chocolate Market, By Type (Milk Chocolate, Dark Chocolate and White Chocolate), Product Type (Regular/Plain Chocolate and Filled Chocolate), Inclusion (With Inclusions Chocolates and Regular/No Inclusions Chocolates), Nature (Conventional, And Organic), Category (Standard Premium, and Super Premium), Cocoa Content (50-60%, 71-80%, 61-70%, 81-90%, and 91-100%), Flavor (Flavor, Classic/Regular), Packaging (Plastic Wrap, Gift Boxes/Assorted, Pouches, Board Box, Sachets, and Others), Distribution Channel (Store Based Retailers And Non-Store Retailers) - Industry Trends and Forecast to 2030.

North America Premium Chocolate Market Analysis and Size

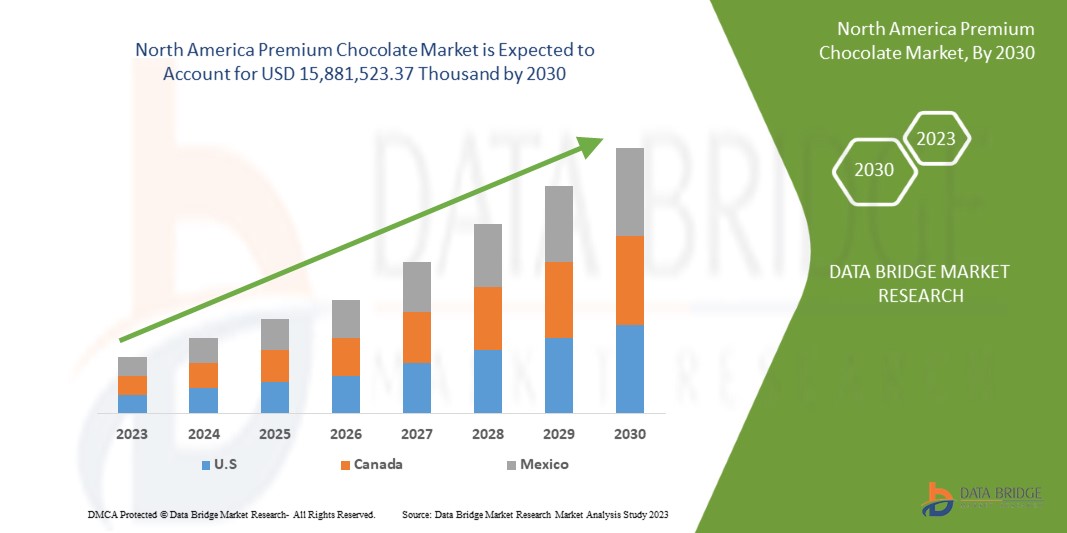

North America premium chocolate market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.1% in the forecast period of 2023 to 2030 and is expected to reach USD 15,881,523.37 thousand by 2030. The major factor driving the growth of the Premium Chocolate Market is the rise in demand for highly luxurious chocolates.

Premium chocolates are known to have more cocoa content compared to regular ones. It comes in varieties like infused with nuts, fruits, and sometimes alcohol. The presence of all these ingredients gives the premium chocolates a better and more luxurious feel. Customers can get a smoother and richer taste.

The North America premium chocolate market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Thousand and Pricing in USD |

|

Segments Covered |

By Type (Milk Chocolate, Dark Chocolate, And White Chocolate), Product Type (Regular/Plain and Filled), Inclusion (With Inclusion Chocolates and Regular and No Inclusions Chocolate), Nature (Conventional and Organic), Category (Standard Premium and Super Premium), Cocoa Content (50-60%, 71-80%, 61-70%, 81-90%, and 91-100%), Flavor (Flavor and Classic/Regular), Packaging (Plastic Wrap, Gift Boxes/Assorted, Pouches, Board Box, Sachets, and Others), Distribution Channel (Store Based Retailers and Non-Store Retailers) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Mars, Incorporated und seine Tochtergesellschaften (Virginia), Mondelēz International (USA), THE HERSHEY COMPANY (USA), Ferrero (Italien), Nestlé (Schweiz), General Mills, Inc. (USA), Meiji Holdings Co., Ltd. (Japan), Chocoladefabriken Lindt & Sprüngli AG (Schweiz), Barry Callebaut (Schweiz), The Kraft Heinz Company (USA), Cargill, Incorporated. (USA), Cloetta AB (Schweden), ORION CORP. (Korea), Ghirardelli Chocolate Company (eine Tochtergesellschaft von Lindt & Sprüngli AG) (USA), Ezaki Glico Co., Ltd. (Japan), MORINAGA & CO., LTD (Japan) und Arcor (Argentinien) unter anderem. |

|

Im Bericht behandelte Datenpunkte |

Neben den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Marktdefinition

Premium-Schokolade ist eine Schokoladensorte, die einen höheren Kakaoanteil als normale Schokoladenmilch hat. Das kann sich auf verschiedene Dinge beziehen, wie zum Beispiel die hohe Kakaomenge in der Tafel, ob sie aus Fairtrade- und nachhaltigen Quellen stammt, ob sie andere Zutaten wie Himbeerstücke oder Alkohol enthält und ob die Verpackung edler wirkt. Sie wird außerdem aus Vollmilch statt Magermilch hergestellt und hat einen höheren Fettgehalt. Premium-Schokoladenmilch hat einen intensiveren Geschmack und eine dickere Konsistenz als normale Schokoladenmilch.

Dynamik des nordamerikanischen Premium-Schokoladenmarktes

TREIBER

- Die Beliebtheit veganer, biologischer und glutenfreier Schokolade nimmt zu.

Das Bewusstsein für den Konsum veganer, biologischer und glutenfreier Schokolade hat sich bei Verbrauchern auf der ganzen Welt langsam entwickelt. Vegane Schokolade trägt zur Verbesserung der Gehirnfunktion bei und gilt als viel gesünder als die herkömmliche Schokolade. Sie wird aus pflanzlichen Zutaten anstelle von Milchprodukten, Eiern und Gelatine hergestellt, was bedeutet, dass sie weniger Fett, weniger Kalorien und kein Cholesterin enthält.

Der Konsum von Kakaoprodukten hat erhebliche gesundheitliche Vorteile mit sich gebracht, was das Wachstum des Marktes für Premium-Schokoladenprodukte ankurbeln dürfte. Zu den gesundheitlichen Vorteilen zählen unter anderem eine Senkung des Bluthochdrucks, eine Verringerung des chronischen Müdigkeitssyndroms und Schutz vor Sonnenbrand. Kakao ist außerdem reich an Polyphenolen, die dabei helfen, das Körpergewebe vor oxidativem Stress und damit verbundenen Krankheiten wie Krebs und Entzündungen zu schützen.

Kakaopulver wird zur Herstellung veganer Schokolade verwendet und stammt aus ungerösteten Kakaobohnen. Da diese Bohnen während der Verarbeitung nicht stark erhitzt werden, bleiben alle Vitamine und Mineralien erhalten. Vegane Schokolade enthält außerdem keine Milch und ist daher reich an Ballaststoffen, Proteinen und Antioxidantien.

Vegane Schokolade enthält Anandamid und Rohkakao, die sich an die Rezeptoren in Ihrem Gehirn binden und Ihnen ein Gefühl von Glück und Frieden vermitteln. Vegane Schokolade hilft, den Blutdruck zu senken. Neben der Senkung des Blutdrucks hat vegane Schokolade weitere Eigenschaften, die Ihr Risiko für Herzinfarkt und Schlaganfall senken können. Neben der positiven Wirkung von Kakao auf altersbedingten geistigen Verfall kann seine Wirkung auf das Gehirn auch die Stimmung und die Symptome von Depressionen verbessern.

Eine glutenfreie Ernährung ist eine Alternative für Menschen mit Zöliakie. Der Verzehr von Gluten führt zu Entzündungen und Schäden im Darm, was zu verschiedenen Gesundheitsproblemen wie Vitaminmangel, Anämie und Osteoporose führen kann. Ungesüßte, reine dunkle Schokolade aus gerösteten Kakaobohnen enthält von Natur aus kein Gluten. Daher ist glutenfreie Schokolade aufgrund ihrer gesundheitlichen Vorteile eine schmackhafte und gesunde Alternative zu normaler Schokolade.

Der Verzehr veganer, biologischer und glutenfreier Schokoladenprodukte kann helfen, Herz- und Blutdruckerkrankungen vorzubeugen. Daher wird erwartet, dass das zunehmende Bewusstsein für die gesundheitlichen Auswirkungen von Kakaoprodukten den nordamerikanischen Markt für Premiumschokolade ankurbeln wird.

- Große Nachfrage nach Premium-Schokolade in der Weihnachtszeit.

Die saisonale Nachfrage spielt eine wichtige Rolle beim Verkauf von Premium-Schokolade. Auf dem nordamerikanischen Markt spielt das Verschenken von Schokolade eine große Rolle, was zu einer Zunahme in den Festtagen führt, insbesondere zu Ostern, Valentinstag, Weihnachten und anderen. Der wachsende Einfluss des Online-Einzelhandels gilt auch als einer der Hauptgründe für den Anstieg des Verkaufs von saisonaler Schokolade. Die Verwestlichung der Kultur hat die Millennials auf die Geschenkkultur aufmerksam gemacht.

Verschiedene Hersteller von saisonaler Schokolade bringen zu solchen besonderen Anlässen eine breite Palette handgefertigter Schokolade mit neuen Geschmacksrichtungen und Verpackungsvarianten auf den Markt. Sie verfolgen auch eine integrierte Marketingkommunikation über verschiedene andere Formen von Social-Media-Plattformen, um die Popularität ihrer saisonalen Schokoladenangebote zu steigern. Dies trägt dazu bei, weltweit auf saisonale Schokolade aufmerksam zu machen.

Die veränderten Vorlieben und die Akzeptanz von Schokolade und ihrer attraktiven Verpackung, die Übernahme der Geschenkkultur, gleichbleibende Qualität, der durch die Urbanisierung bedingte Wohlstand junger Menschen und ein hohes verfügbares Einkommen treiben den Markt der Premium-Schokoladenkultur an.

Faktoren wie die Kaufkraft der Millennials, der boomende E-Commerce-Sektor, der Aufschwung im Geschenkartikelmarkt sowie der Einfluss der Verwestlichung und unkonventioneller Ansätze von Einzelhandelsmarken dürften den nordamerikanischen Premium-Schokoladenmarkt antreiben.

GELEGENHEITEN

- Kontinuierlicher Fokus auf die Entwicklung neuer aromatisierter und einzigartiger Schokoladen

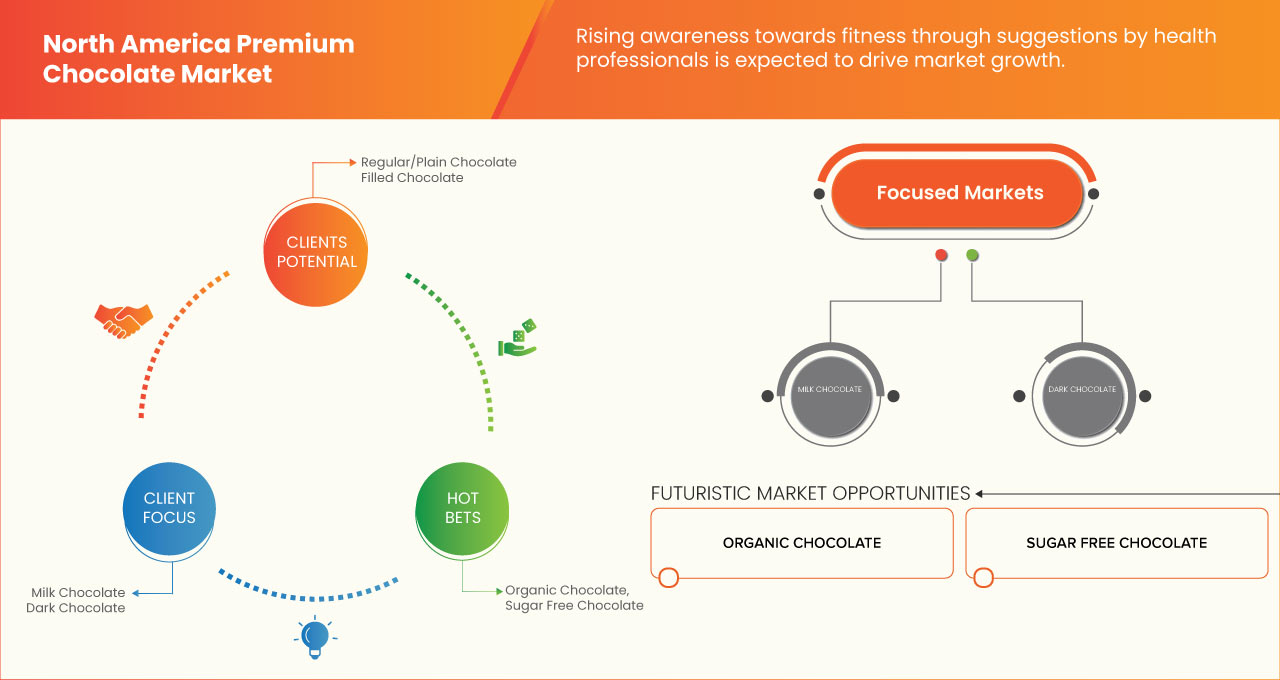

Der aufkommende Trend zu Clean-Label- und Bioprodukten zur Erhaltung der allgemeinen Gesundheit und des Wohlbefindens hat zu einer rasanten Steigerung der Nachfrage nach Premium- oder Spezialschokolade geführt. Die Einführung einzigartiger Geschmacksrichtungen und Aromen gilt als Schlüsselfaktor, der die Aufmerksamkeit der Kunden erregt.

Darüber hinaus führen Unternehmen ihre Produkte mit innovativen Ideen ein, um ihre Position auf dem nordamerikanischen Premium-Schokoladenmarkt zu sichern.

Um die Verbraucherbasis zu vergrößern, wird die Einführung aromatisierter und verbesserter Schokoladentexturen potenzielle Chancen für Premium-Schokoladenhersteller schaffen. Die Unternehmen sollten lokale und saisonale Aromen einführen, um Verbraucher auf der ganzen Welt anzusprechen, und dabei sowohl auf Gesundheit als auch auf Geschmack achten. Dies könnte einen ganz neuen Bereich für Geschmacksinnovationen eröffnen, der voraussichtlich eine Chance für den Markt schaffen wird.

- Steigender Trend zum Online-Vertrieb

E-Commerce definiert kommerzielle Aktivitäten auf der ganzen Welt neu. Im Laufe der Jahre hat sich der E-Commerce tiefgreifend weiterentwickelt. Schokolade hat so viele gesundheitliche Vorteile, und der starke Wunsch, Schokolade mit innovativen Geschmacksrichtungen zu versehen, treibt den Verkauf der Schokolade in die Höhe. Der Vertriebskanal war früher ausschließlich der Handel, der hauptsächlich ohne die Nutzung elektronischer Medien auskam, aber mit der zunehmenden Internetnutzung ändern sich die Vertriebskanäle. Da das Internet weiterhin das tägliche Leben beeinflusst, ist E-Commerce für das Wachstum jedes Marktes notwendig und hilft, ein Geschäft über seinen physischen Standort hinaus auszudehnen.

Der Online-Vertriebskanal kommt dem Hersteller zugute, indem er die Bereitschaft der Online-Kunden ausnutzt, neue Produkte auszuprobieren. Starke Werbe- und Marketingkampagnen für vegane, glutenfreie und zuckerarme Schokolade auf den Online-Seiten werden den Schokoladenverkauf steigern. E-Commerce ist auch bei den Verbrauchern ein Hit, da Online-Plattformen auf Festivals und für Stammkunden sowie sogar bei Großbestellungen zahlreiche Angebote bieten.

Die zunehmende Digitalisierung und die Migration der Verbraucher zu Online-Vertriebskanälen werden das Wachstum des elektronischen Handels weiter vorantreiben und den steigenden Trend zu Online-Vertriebskanälen begünstigen, der voraussichtlich Chancen für den Markt schaffen wird.

EINSCHRÄNKUNGEN/HERAUSFORDERUNGEN

- Schwankende Rohstoffpreise

Der Preis für Schokolade hat sich geändert, aber die meisten Verbraucher waren sich dessen nicht bewusst. Die Preisvolatilität von Schokolade wird in erster Linie durch das Angebot an Schokoladentreibern beeinflusst. Der Hauptbestandteil der Schokoladenproduktion ist Kakao, der in einer Vielzahl von Produkten verwendet wird. Zur Herstellung von Schokolade werden auch andere Zutaten wie Zucker, Milchprodukte, Nüsse, Maissüßstoffe und Energie benötigt. Der Rohstoffmarkt, der den Preis basierend auf Angebot und Nachfrage festlegt und zu unterschiedlichen Volatilitäten der Rohstoffpreise führen kann, ist in erster Linie für die Preise dieser Rohstoffe verantwortlich.

Kakaopulver und Kakaobutter sind die beiden Bestandteile von Kakao, aus denen Schokolade hergestellt wird. Da Kakaobutter für die Herstellung von gehaltvolleren Schokoladen verwendet wird und in dünnen Schokoladensüßwaren verwendet wird, ist sie bei weitem die begehrtere der beiden Zutaten. Da sie jedoch schwieriger und teurer herzustellen ist, wird jede Unterbrechung der Kakaoversorgung letztendlich zu negativen Folgen führen und die Verbraucherpreise in die Höhe treiben. Die schwankenden Preise für die Produktionsrohstoffe dürften das Wachstum von Premiumschokolade auf dem Markt bremsen.

- Steigende Kosten der Lieferkette

Die Preisvolatilität von Schokolade wird in erster Linie durch das Angebot an Schokolade beeinflusst. Der Hauptbestandteil der Schokoladenproduktion ist Kakao, der in einer Vielzahl von Produkten verwendet wird. Weitere Zutaten, die für die Herstellung von Schokoladenprodukten benötigt werden, sind Zucker, Milchprodukte, Nüsse, Maissüßstoffe und Energie. Der Preis basiert auf Angebot und Nachfrage und kann zu unterschiedlichen Preisvolatilitäten führen, was in erster Linie für die Preise dieser Rohstoffe verantwortlich ist. Der Prozess, durch den Kakao zur Zutat für Waren wird, die in den Supermarktregalen verkauft werden, ist kompliziert. In verschiedenen Phasen des Produktionszyklus wird Kakao, der von einer Reihe von Landwirten, hauptsächlich Kleinbauern, angebaut wird, miteinander vermischt. Da die meisten Lieferkettenrisiken auf der Ebene der einzelnen Farmen entstehen, ist es aufgrund dieser Vermischung schwierig, den Kakao zu diesen Standorten zurückzuverfolgen. Darüber hinaus führt die Komplexität dieser Lieferkette zu Ungleichheiten in der gesamten Wertschöpfungskette.

Darüber hinaus sind die größten Probleme in den Kakaolieferketten die Ausweitung der Kakaoproduktion in geschützte Waldreservate und der Einsatz von Kinderarbeit. Da mit einer Zunahme von Schädlingen, Krankheiten und Dürren zu rechnen ist, stellt der Klimawandel auch eine Bedrohung für die langfristige Überlebensfähigkeit der Kakaoindustrie dar.

Die Unterbrechung der Lieferkette führt zu steigenden Preisen in der Lieferkette, was das Marktwachstum im Prognosezeitraum voraussichtlich in Frage stellen wird.

Jüngste Entwicklungen

- 10. Februar 2023: Morinaga Nutritional Foods, Inc. (eine Tochtergesellschaft) gab die Übernahme von Turtle Island Foods Holdings, Inc. bekannt. Turtle Island Foods ist ein Hersteller von pflanzlichen Lebensmitteln. Durch diese Übernahme wird Turtle Islands Foods eine vollständige Tochtergesellschaft von Morinaga Nutritional Foods, Inc. Dies bietet die Möglichkeit, nahrhafte Schokoladen für den Premium-Schokoladenmarkt zu entwickeln.

- Im Jahr 2021 investierten Lindt und Sprüngli rund 80,95 Millionen US-Dollar in den Ausbau ihrer Kakaomassefabrik in Olten. Sie gilt als die grösste und bedeutendste Kakaomassefabrik im nordamerikanischen Produktionsnetzwerk.

Umfang des nordamerikanischen Premium-Schokoladenmarktes

Der nordamerikanische Markt für Premium-Schokolade ist in neun bemerkenswerte Segmente unterteilt, basierend auf Typ, Produkttyp, Einschluss, Art, Kategorie, Kakaogehalt, Geschmack, Verpackung und Vertriebskanal. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung zentraler Marktanwendungen zu treffen.

TYP

- Vollmilchschokolade

- Dunkle Schokolade

- Weiße Schokolade

Nach Art ist der Markt in Milchschokolade, dunkle Schokolade und weiße Schokolade segmentiert.

PRODUKTTYP

- Normal/Einfarbig

- Gefüllt

Auf der Grundlage des Produkttyps wird der Markt in normal/unbedruckt und gefüllt segmentiert.

AUFNAHME

- Mit Inklusion Pralinen und regulären

- Schokolade ohne Einschlüsse

Auf der Grundlage der Einschlüsse wird der Markt in Schokolade mit Einschlüssen und normale Schokolade ohne Einschlüsse segmentiert.

NATUR

- Konventionell

- Organisch

Auf der Grundlage der Natur wird der Markt in konventionell und biologisch segmentiert.

KATEGORIE

- Standard-Premium

- Super Premium

Auf der Grundlage der Kategorie ist der Markt in Standard Premium und Super Premium segmentiert.

KAKAOGEHALT

- 50-60 %

- 71 – 80 %

- 61 – 70 %

- 81 – 90 %

- 91 – 100 %

Auf der Grundlage des Kakaogehalts ist der Markt in 50–60 %, 71–80 %, 61–70 %, 81–90 % und 91–100 % segmentiert.

GESCHMACK

- Geschmack

- Klassisch/Normal

Auf der Grundlage des Geschmacks wird der Markt in die Geschmacksrichtungen klassisch/normal segmentiert.

VERPACKUNG

- Plastikfolie

- Geschenkboxen/Sortiert

- Beutel

- Bretterbox

- Sachets

- Sonstiges

Auf der Grundlage der Verpackung ist der Markt in Plastikfolien, Geschenkboxen/-sortimente, Beutel, Kartons, Sachets und Sonstiges segmentiert.

VERTRIEBSKANAL

- Ladenbasierter Einzelhändler

- Nicht-stationäre Einzelhändler

Auf der Grundlage der Vertriebskanäle wird der Markt in stationären Einzelhandel und nicht stationären Einzelhandel segmentiert.

Regionale Analyse/Einblicke zum nordamerikanischen Premium-Schokoladenmarkt

Der nordamerikanische Markt für Premiumschokolade ist nach Art, Produkttyp, Einschluss, Beschaffenheit, Kategorie, Kakaogehalt, Geschmack, Verpackung und Vertriebskanal segmentiert.

Die Länder auf dem nordamerikanischen Premium-Schokoladenmarkt sind die USA, Kanada und Mexiko.

Die USA dominieren den nordamerikanischen Markt für Premium-Schokolade hinsichtlich Marktanteil und Umsatz aufgrund des wachsenden Bewusstseins für die Eigenschaften der Alkylierungstechnologien in dieser Region.

Der Länderabschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunktanalysen der nachgelagerten und vorgelagerten Wertschöpfungsketten, technische Trends, Porters Fünf-Kräfte-Analyse und Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Competitive Landscape and North America Premium Chocolate Market Share Analysis

North America premium chocolate market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America premium chocolate market.

Some of the major players operating in the North America premium chocolate market are Mars, Incorporated and its Affiliates, Mondelēz International, THE HERSHEY COMPANY, Ferrero, Nestlé, General Mills, Inc., Meiji Holdings Co., Ltd., Lindt & Sprungli AG, Barry Callebaut, The Kraft Heinz Company, Cargill, Incorporated., Cloetta AB, ORION CORP., Ghirardelli Chocolate Company (A Subsidiary of Lindt & Sprüngli AG), Ezaki Glico Co., Ltd., MORINAGA & CO., LTD, Arcor among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PREMIUM CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 GRADE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF HAZELNUT CONTENT FOR TOP NORTH AMERICA PREMIUM CHOCOLATE BRANDS

4.2 BRAND COMPARATIVE ANALYSIS

4.2.1 FERRERO

4.2.2 NESTLE

4.2.3 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG

4.3 FACTORS INFLUENCING BUYING DECISION

4.3.1 PACKAGING FACTOR

4.3.2 TASTE

4.3.3 HEALTH

4.3.4 BRAND LOYALTY

4.3.5 GENDER AND AGE

4.3.6 INCOME

4.4 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.4.1 RISING CONSUMER PREFERENCE TOWARD DARK AND VEGAN CHOCOLATE

4.4.2 CONSUMERS ARE INTERESTED IN NEW INNOVATIVE FLAVOURS AND TEXTURE

4.4.3 RISING DEMAND FOR PREMIUM CHOCOLATES FOR GIFTING PURPOSES

4.4.4 FUTURE PERSPECTIVE

4.5 MEETING CONSUMER REQUIREMENT

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 RAW MATERIAL PROCUREMENT & MANUFACTURING

4.6.2 DISTRIBUTION

4.6.3 END-USERS

4.7 SHOPPING BEHAVIOR AND DYNAMICS

4.7.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.7.2 RESEARCH

4.7.3 IMPULSIVE

4.7.4 ADVERTISEMENT

4.7.5 TELEVISION ADVERTISEMENT

4.7.6 ONLINE ADVERTISEMENT

4.7.7 IN-STORE ADVERTISEMENT

4.7.8 OUTDOOR ADVERTISEMENT

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.2 LINE EXTENSION

4.8.3 NEW PACKAGING

4.8.4 RE-LAUNCHED

4.8.5 NEW FORMULATION

4.8.6 DIFFERENTIAL PRODUCT OFFERING

4.8.7 PACKAGE DESIGNING

4.8.8 PRICING ANALYSIS

4.9 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN THE POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATES

5.1.2 HIGH DEMAND FOR PREMIUM CHOCOLATES IN FESTIVE SEASONS

5.1.3 DEMAND FOR PREMIUM CHOCOLATES OWING TO THE SHIFT TOWARDS A HEALTHY LIFESTYLE

5.1.4 USE OF PREMIUM CHOCOLATE IN THE BAKING INDUSTRY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF RAW MATERIALS

5.2.2 AVAILABILITY OF VARIOUS SUBSTITUTE

5.3 OPPORTUNITIES

5.3.1 CONTINUOUS FOCUS ON DEVELOPING NEW FLAVORED AND UNIQUE CHOCOLATES

5.3.2 RISING TREND OF ONLINE DISTRIBUTION

5.4 CHALLENGES

5.4.1 RISING COST OF SUPPLY CHAIN

5.4.2 RULES AND REGULATIONS ASSOCIATED WITH PREMIUM CHOCOLATES

6 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY REGION

6.1 NORTH AMERICA

6.1.1 U.S.

6.1.2 CANADA

6.1.3 MEXICO

7 NORTH AMERICA PREMIUM CHOCOLATE MARKET: COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

7.2 ACQUISITION

7.3 NEW PRODUCT DEVELOPMENT

7.4 FACILITY EXPANSION

7.5 NEW APPOINTMENT

8 SWOT ANALYSIS

9 COMPANY PROFILES

9.1 MARS, INCORPORATED AND ITS AFFILIATES

9.1.1 COMPANY SNAPSHOT

9.1.2 COMPANY SHARE ANALYSIS

9.1.3 PRODUCT PORTFOLIO

9.1.4 RECENT UPDATES

9.2 MONDELĒZ INTERNATIONAL

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 COMPANY SHARE ANALYSIS

9.2.4 PRODUCT PORTFOLIO

9.2.5 RECENT DEVELOPMENT

9.3 THE HERSHEY COMPANY

9.3.1 COMPANY SNAPSHOT

9.3.2 REVENUE ANALYSIS

9.3.3 COMPANY SHARE ANALYSIS

9.3.4 PRODUCT PORTFOLIO

9.3.5 RECENT DEVELOPMENT

9.4 FERRERO

9.4.1 COMPANY SNAPSHOT

9.4.2 COMPANY SHARE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT UPDATES

9.5 NESTLÉ

9.5.1 COMPANY SNAPSHOT

9.5.2 REVENUE ANALYSIS

9.5.3 COMPANY SHARE ANALYSIS

9.5.4 PRODUCT PORTFOLIO

9.5.5 RECENT DEVELOPMENT

9.6 ARCOR

9.6.1 COMPANY SNAPSHOT

9.6.2 REVENUE ANALYSIS

9.6.3 PRODUCT PORTFOLIO

9.6.4 RECENT DEVELOPMENT

9.7 BARRY CALLEBAUT

9.7.1 COMPANY SNAPSHOT

9.7.2 REVENUE ANALYSIS

9.7.3 PRODUCT PORTFOLIO

9.7.4 RECENT UPDATES

9.8 CARGILL, INCORPORATED

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT UPDATES

9.9 CHOCOLADEFABRIKEN LINDT & SPRÜNGLI AG (2022)

9.9.1 COMPANY SNAPSHOT

9.9.2 REVENUE ANALYSIS

9.9.3 PRODUCT PORTFOLIO

9.9.4 RECENT DEVELOPMENT

9.1 CLOETTA AB

9.10.1 COMPANY SNAPSHOT

9.10.2 REVENUE ANALYSIS

9.10.3 PRODUCT PORTFOLIO

9.10.4 RECENT DEVELOPMENT

9.11 EZAKI GLICO CO., LTD.

9.11.1 COMPANY SNAPSHOT

9.11.2 REVENUE ANALYSIS

9.11.3 PRODUCT PORTFOLIO

9.11.4 RECENT DEVELOPMENT

9.12 GENERAL MILLS, INC.

9.12.1 COMPANY SNAPSHOT

9.12.2 REVENUE ANALYSIS

9.12.3 PRODUCT PORTFOLIO

9.12.4 RECENT DEVELOPMENT

9.13 GHIRARDELLI CHOCOLATE COMPANY

9.13.1 COMPANY SNAPSHOT

9.13.2 PRODUCT PORTFOLIO

9.13.3 RECENT DEVELOPMENT

9.14 MEIJI HOLDINGS CO., LTD.

9.14.1 COMPANY SNAPSHOT

9.14.2 REVENUE ANALYSIS

9.14.3 PRODUCT PORTFOLIO

9.14.4 RECENT DEVELOPMENT

9.15 MORINAGA & CO., LTD.

9.15.1 COMPANY SNAPSHOT

9.15.2 REVENUE ANALYSIS

9.15.3 PRODUCT PORTFOLIO

9.15.4 RECENT DEVELOPMENT

9.16 ORION CORP.

9.16.1 COMPANY SNAPSHOT

9.16.2 REVENUE ANALYSIS

9.16.3 PRODUCT PORTFOLIO

9.16.4 RECENT DEVELOPMENTS

9.17 THE KRAFT HEINZ COMPANY

9.17.1 COMPANY SNAPSHOT

9.17.2 REVENUE ANALYSIS

9.17.3 PRODUCT PORTFOLIO

9.17.4 RECENT DEVELOPMENT

10 QUESTIONNAIRE

11 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 ESTIMATED HAZELNUT CONTENT FOR TOP NORTH AMERICA PREMIUM CHOCOLATE COMPANIES

TABLE 2 REGULATORY COVERAGE

TABLE 3 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 U.S. PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 U.S. PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 U.S. PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 36 U.S. WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 U.S. INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 U.S. ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 51 U.S. OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 52 U.S. INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 U.S. PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 54 U.S. PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 55 U.S. PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 56 U.S. PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 57 U.S. FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 U.S. PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 59 U.S. PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 60 U.S. STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 CANADA PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 CANADA PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 CANADA PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 65 CANADA WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 66 CANADA INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 CANADA ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 68 CANADA ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 69 CANADA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 70 CANADA HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 71 CANADA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 72 CANADA PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 73 CANADA CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 74 CANADA CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 75 CANADA RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 76 CANADA RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 79 CANADA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 83 CANADA PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 85 CANADA PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 86 CANADA FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 CANADA PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 88 CANADA PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 89 CANADA STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 CANADA NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 MEXICO PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 MEXICO PREMIUM CHOCOLATE MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO PREMIUM CHOCOLATE MARKET, BY INCLUSION, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO WITH INCLUSIONS CHOCOLATES IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 MEXICO INFUSED NUTS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO ALMOND IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO ALMOND IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO HAZELNUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO PEANUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO PEANUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 102 MEXICO CASHEW IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 103 MEXICO CASHEW IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 104 MEXICO RAISINS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 105 MEXICO RAISINS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 106 MEXICO PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 107 MEXICO PISTACHIOS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 108 MEXICO OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY FORM, 2021-2030 (USD THOUSAND)

TABLE 109 MEXICO OTHER NUTS IN PREMIUM CHOCOLATE MARKET, BY CONTENT, 2021-2030 (USD THOUSAND)

TABLE 110 MEXICO INFUSED FRUITS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 MEXICO PREMIUM CHOCOLATE MARKET, BY NATURE, 2021-2030 (USD THOUSAND)

TABLE 112 MEXICO PREMIUM CHOCOLATE MARKET, BY CATEGORY, 2021-2030 (USD THOUSAND)

TABLE 113 MEXICO PREMIUM CHOCOLATE MARKET, BY COCOA CONTENT, 2021-2030 (USD THOUSAND)

TABLE 114 MEXICO PREMIUM CHOCOLATE MARKET, BY FLAVOR, 2021-2030 (USD THOUSAND)

TABLE 115 MEXICO FLAVOR IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 MEXICO PREMIUM CHOCOLATE MARKET, BY PACKAGING, 2021-2030 (USD THOUSAND)

TABLE 117 MEXICO PREMIUM CHOCOLATE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 118 MEXICO STORE BASED RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 MEXICO NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 MEXICO NON-STORE RETAILERS IN PREMIUM CHOCOLATE MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA PREMIUM CHOCOLATE MARKET

FIGURE 2 NORTH AMERICA PREMIUM CHOCOLATE MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PREMIUM CHOCOLATE MARKET : DROC ANALYSIS

FIGURE 4 NORTH AMERICA PREMIUM CHOCOLATE MARKET : NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PREMIUM CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PREMIUM CHOCOLATE MARKET: THE GRADE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA PREMIUM CHOCOLATE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PREMIUM CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PREMIUM CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PREMIUM CHOCOLATE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA PREMIUM CHOCOLATE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA PREMIUM CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA PREMIUM CHOCOLATE MARKET : SEGMENTATION

FIGURE 14 THE RISE IN POPULARITY OF VEGAN, ORGANIC, AND GLUTEN FREE CHOCOLATE ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA PREMIUM CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE MILK CHOCOLATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PREMIUM CHOCOLATE MARKET IN 2023 & 2030

FIGURE 16 SUPPLY CHAIN OF THE NORTH AMERICA PREMIUM CHOCOLATE MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PREMIUM CHOCOLATE MARKET

FIGURE 18 NORTH AMERICA PREMIUM CHOCOLATE MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA PREMIUM CHOCOLATE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA PREMIUM CHOCOLATE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA PREMIUM CHOCOLATE MARKET: BY TYPE (2023 - 2030)

FIGURE 23 NORTH AMERICA PREMIUM CHOCOLATE MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.