North America Parenteral Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

10.39 Billion

USD

17.71 Billion

2025

2033

USD

10.39 Billion

USD

17.71 Billion

2025

2033

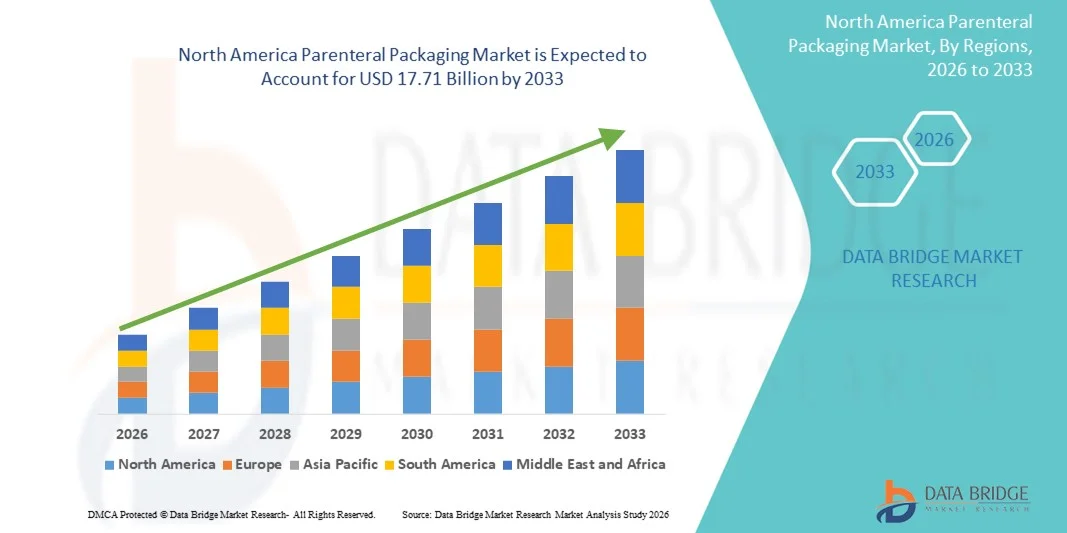

| 2026 –2033 | |

| USD 10.39 Billion | |

| USD 17.71 Billion | |

|

|

|

|

Marktsegmentierung für parenterale Verpackungen in Nordamerika nach Produkttyp (Ampullen, Fertigspritzen, Vials, Flaschen, Kartuschen, Beutel, gebrauchsfertige Systeme u. a.), Verpackungsart (kleinvolumige und großvolumige parenterale Verpackungen), Auftragsart (kundenspezifische und Standardaufträge), Dosierungsart (Einzeldosis und Mehrfachdosierung), Vertriebskanal (Direktvertrieb, Apotheken/Medizinproduktehändler, E-Commerce u. a.), Therapiegebieten (Kardiologie/Stoffwechselerkrankungen, Gynäkologie/Geburtshilfe, Dermatologie, Endokrinologie und Stoffwechselerkrankungen, Gastroenterologie, Ophthalmologie, Schmerztherapie, seltene Erkrankungen, Infektionskrankheiten u. a.) und Endverbraucher (Pharmazeutische Hersteller, Krankenhäuser, Apotheken, Kliniken, ambulante Dienste, Auftragsforschungsinstitute u. a.) – Branchentrends und Prognose bis 2033

Marktgröße für parenterale Verpackungen in Nordamerika

- Der nordamerikanische Markt für parenterale Verpackungen hatte im Jahr 2025 einen Wert von 10,39 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 17,71 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,9 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach sicheren, effizienten und fortschrittlichen Arzneimittelverabreichungssystemen sowie durch technologische Fortschritte bei Verpackungsmaterialien wie Glas, Polymeren und cyclischen Olefinpolymeren angetrieben, die eine verbesserte Arzneimittelstabilität und Patientensicherheit ermöglichen.

- Darüber hinaus treibt die zunehmende Produktion und Verabreichung von Impfstoffen, Biologika und hochwirksamen Injektionspräparaten den Bedarf an zuverlässigen, sterilen und skalierbaren parenteralen Verpackungslösungen voran. Diese zusammenwirkenden Faktoren beschleunigen die Einführung innovativer Verpackungsformate und fördern so das Wachstum der Branche erheblich.

Analyse des nordamerikanischen Marktes für parenterale Verpackungen

- Parenterale Verpackungen, darunter Vials, Fertigspritzen, Ampullen und gebrauchsfertige Systeme, werden aufgrund ihrer Fähigkeit, die Sterilität von Arzneimitteln zu erhalten, eine genaue Dosierung zu gewährleisten und die Verabreichung von Biologika und Spezialarzneimitteln zu unterstützen, zu einem entscheidenden Bestandteil der modernen pharmazeutischen Herstellung und Gesundheitsversorgung.

- Die steigende Nachfrage nach parenteralen Verpackungen wird in erster Linie durch das Wachstum injizierbarer Therapien, die zunehmende Verbreitung chronischer und infektiöser Krankheiten sowie die wachsende Präferenz für vorgefüllte und gebrauchsfertige Formate angetrieben, die die Patientensicherheit, die betriebliche Effizienz und die Einhaltung regulatorischer Standards verbessern.

- Die USA dominierten 2025 den Markt für parenterale Verpackungen aufgrund eines gut etablierten Pharma- und Biotechnologiesektors, der frühen Einführung fortschrittlicher parenteraler Verpackungsformate und der starken Nachfrage nach Biologika und injizierbaren Therapien.

- Kanada dürfte im Prognosezeitraum aufgrund der steigenden Produktion von Biologika und Impfstoffen, des Ausbaus der Gesundheitsinfrastruktur und der zunehmenden Nutzung vorgefüllter und gebrauchsfertiger Verpackungsformate das am schnellsten wachsende Land im Markt für parenterale Verpackungen sein.

- Das Segment der Vials dominierte den Markt mit einem Marktanteil von 43,3 % im Jahr 2025. Dies ist auf ihre weitverbreitete Verwendung in injizierbaren Formulierungen und ihre hohe Kompatibilität mit automatisierten Abfüll- und Verschließsystemen zurückzuführen. Pharmahersteller bevorzugen Vials aufgrund ihrer Fähigkeit, Sterilität und lange Haltbarkeit zu gewährleisten und somit die Sicherheit und Wirksamkeit injizierbarer Arzneimittel sicherzustellen. Die Dominanz wird zusätzlich durch die breite Anwendung von Vials bei Impfstoffen, Biologika und therapeutischen Injektionspräparaten gestützt, was die Nachfrage in Krankenhäusern und Kliniken weiter steigert. Vials bieten zudem Flexibilität für Einzeldosis- und Mehrdosenformulierungen und erfüllen so vielfältige klinische und kommerzielle Anforderungen.

Berichtsumfang und Marktsegmentierung für parenterale Verpackungen

|

Attribute |

Parenterale Verpackung – Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Trends auf dem nordamerikanischen Markt für parenterale Verpackungen

Zunehmende Akzeptanz von vorgefüllten und gebrauchsfertigen parenteralen Systemen

- Ein bedeutender Trend im Markt für parenterale Verpackungen ist die zunehmende Nutzung vorgefüllter und gebrauchsfertiger Systeme. Dies wird durch den wachsenden Bedarf an patientenorientierter Arzneimittelverabreichung und betrieblicher Effizienz im Gesundheitswesen bedingt. Diese Formate verbessern die Dosierungsgenauigkeit, reduzieren Medikationsfehler und vereinfachen die Anwendung in Krankenhäusern, Kliniken und der häuslichen Pflege.

- Beispielsweise liefern BD (Becton, Dickinson and Company) und Terumo Pharmaceutical Solutions hochwertige Fertigspritzen und gebrauchsfertige Polymerspritzen, die häufig für Impfstoffe, Biologika und Spezialinjektionspräparate eingesetzt werden. Solche Lösungen verbessern die Arzneimittelsicherheit, optimieren klinische Arbeitsabläufe und stärken die Zuverlässigkeit der Hersteller in verschiedenen Märkten.

- Die Verwendung vorgefüllter und gebrauchsfertiger Systeme nimmt in Impfprogrammen und im Management chronischer Erkrankungen rasant zu, da hier die Minimierung von Vorbereitungszeit und Kontaminationsrisiko von entscheidender Bedeutung ist. Parenterale Verpackungen etablieren sich damit als Schlüsselfaktor für eine sicherere und effizientere Gesundheitsversorgung.

- Pharmahersteller integrieren zunehmend fortschrittliche Abfüll- und Versiegelungstechnologien, um die großtechnische Produktion von vorgefüllten und gebrauchsfertigen Systemen zu unterstützen und so das Marktwachstum weiter anzukurbeln.

- Krankenhäuser und ambulante Versorgungseinrichtungen bevorzugen diese Formate aufgrund der einfachen Handhabung, des geringeren Lagerbedarfs und der Kompatibilität mit automatisierten Abgabesystemen.

- Der zunehmende Fokus auf Biologika und hochwirksame injizierbare Therapien verstärkt die Nachfrage nach vorgefüllten und gebrauchsfertigen Verpackungen, da diese Formate die Produktintegrität gewährleisten, die Sterilität erhalten und strenge regulatorische Standards erfüllen.

Marktdynamik für parenterale Verpackungen in Nordamerika

Treiber

Steigende Nachfrage nach Biologika und injizierbaren Therapien

- Die steigende Produktion und der zunehmende Verbrauch von Biologika, Impfstoffen und hochwirksamen Injektionspräparaten sind ein wesentlicher Treiber für den Markt für parenterale Verpackungen, da diese Therapien sichere, sterile und zuverlässige Verpackungslösungen erfordern, die die Stabilität und Wirksamkeit der Arzneimittel gewährleisten.

- Gerresheimer und SCHOTT Pharma bieten beispielsweise spezielle Vials und polymerbasierte Fertigsysteme für empfindliche Formulierungen an, darunter mRNA-Impfstoffe und monoklonale Antikörper. Diese Lösungen verbessern die Produktsicherheit, erleichtern den großflächigen Vertrieb und unterstützen die effiziente Anwendung in Klinik und häuslicher Pflege.

- Die zunehmende Verbreitung chronischer Erkrankungen, Infektionskrankheiten und Spezialtherapien veranlasst Gesundheitsdienstleister, injizierbare Behandlungen einzusetzen, wodurch die Nachfrage nach hochwertigen parenteralen Verpackungen steigt.

- Pharmaunternehmen investieren in innovative Verpackungslösungen, um die strengen globalen regulatorischen Anforderungen zu erfüllen und gleichzeitig Patientensicherheit, betriebliche Effizienz und minimalen Arzneimittelverlust zu gewährleisten.

- Die Integration automatisierter Abfüll-, Versiegelungs- und Inspektionstechnologien ermöglicht es Herstellern, die Produktion effizient zu skalieren, wachsende Entwicklungspipelines für Biologika zu unterstützen und die Nachfrage nach gebrauchsfertigen und vorgefüllten Formaten zu decken.

Zurückhaltung/Herausforderung

Hohe Herstellungs- und Regulierungskosten

- Der Markt für parenterale Verpackungen steht aufgrund der hohen Kosten für die Herstellung steriler, qualitativ hochwertiger Verpackungssysteme, die den strengen regulatorischen Standards in verschiedenen Regionen entsprechen, vor erheblichen Herausforderungen.

- Beispielsweise investieren Unternehmen wie Terumo Pharmaceutical Solutions und BD hohe Summen in fortschrittliche Sterilisations-, Inspektions- und Qualitätskontrollverfahren, um die Anforderungen globaler Arzneibücher zu erfüllen, was die Betriebskosten und die Komplexität erhöht.

- Die Gewährleistung von Arzneimittelstabilität, Sterilität und Kompatibilität mit empfindlichen Biologika erfordert fortschrittliche Materialien, Präzisionstechnik und Spezialausrüstung, was die Produktionskosten weiter erhöht und die Kostenflexibilität einschränkt.

- Die sich ständig weiterentwickelnde regulatorische Landschaft in den verschiedenen Ländern erhöht den Aufwand für die Einhaltung der Vorschriften und erfordert kontinuierliche Überwachung, Tests und Dokumentation, um die Marktzulassung aufrechtzuerhalten.

- Die Skalierung der Produktion bei gleichzeitiger Aufrechterhaltung gleichbleibender Qualität, Vermeidung von Verunreinigungen und Einhaltung gesetzlicher Standards bleibt eine entscheidende Herausforderung, die die Rentabilität beeinträchtigt und die Möglichkeiten der Hersteller einschränkt, die Preise zu senken oder die Kapazität rasch zu erweitern.

Marktumfang für parenterale Verpackungen in Nordamerika

Der Markt ist segmentiert nach Art, Verpackungsart, Bestellart, Dosierungsart, Vertriebskanal, Therapiegebieten und Endverbraucher.

- Nach Typ

Basierend auf der Art der Verpackung ist der Markt für parenterale Verpackungen in Ampullen, Fertigspritzen, Vials, Flaschen, Kartuschen, Beutel, gebrauchsfertige Systeme und Sonstiges unterteilt. Das Segment der Vials dominierte den Markt mit dem größten Umsatzanteil im Jahr 2025. Dies ist auf ihre weitverbreitete Verwendung in injizierbaren Formulierungen und ihre hohe Kompatibilität mit automatisierten Abfüll- und Verschließsystemen zurückzuführen. Pharmahersteller bevorzugen Vials aufgrund ihrer Fähigkeit, Sterilität und lange Haltbarkeit zu gewährleisten und somit die Sicherheit und Wirksamkeit injizierbarer Arzneimittel sicherzustellen. Die Dominanz wird zusätzlich durch die breite Anwendung von Vials bei Impfstoffen, Biologika und therapeutischen Injektionspräparaten gestützt, was die Nachfrage in Krankenhäusern und Kliniken erhöht. Vials bieten zudem Flexibilität für Einzeldosis- und Mehrdosenformulierungen und erfüllen so vielfältige klinische und kommerzielle Anforderungen.

Das Segment der Fertigspritzen wird voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach patientenorientierter Arzneimittelverabreichung und einfacher Selbstverabreichung. So erweitern beispielsweise Unternehmen wie Becton Dickinson ihr Angebot an Fertigspritzen, um Therapien mit Biologika und monoklonalen Antikörpern zu unterstützen. Fertigspritzen reduzieren Dosierungsfehler, erhöhen den Komfort und verbessern die Patienten-Compliance, wodurch sie in der häuslichen Pflege zunehmend bevorzugt werden. Auch in Schwellenländern steigt ihre Anwendung aufgrund der kostengünstigen Herstellung und der geringeren Medikamentenverschwendung. Die Kombination aus Sicherheit, Komfort und regulatorischer Akzeptanz treibt das rasante Wachstum dieses Segments voran.

- Nach Verpackungsart

Basierend auf der Verpackungsart ist der Markt in parenterale Verpackungen mit kleinem und großem Volumen unterteilt. Parenterale Verpackungen mit kleinem Volumen hatten 2025 den größten Marktanteil, bedingt durch ihre breite Anwendung bei Impfstoffen, Insulin und Biologika, die eine präzise Dosierung erfordern. Kleinere Behältnisse gewährleisten ein geringeres Kontaminationsrisiko und ermöglichen eine kontrollierte Verabreichung im klinischen und ambulanten Bereich. Krankenhäuser und ambulante Versorgungszentren bevorzugen kleinere Volumenformate aufgrund ihrer einfacheren Handhabung, Lagerung und schnellen Verabreichung. Das Segment profitiert zudem von technologischen Fortschritten bei Glas- und Polymermaterialien, die die Arzneimittelstabilität und die Integrität der Verpackung verbessern.

Großvolumige parenterale Verpackungen dürften das schnellste Wachstum verzeichnen, bedingt durch die steigende Nachfrage nach intravenösen Flüssigkeiten, parenteraler Ernährung und hochdosierten Biologika. So konzentriert sich beispielsweise Fresenius Kabi auf den Ausbau seines Sortiments an Großvolumenbeuteln für Infusionstherapien, um Krankenhäuser und den häuslichen Pflegebereich zu bedienen. Großvolumige Verpackungen verbessern die Effizienz bei der Verabreichung großer Medikamentenmengen und reduzieren die Häufigkeit von Dosierungsinterventionen. Das Wachstum im Bereich der Behandlung chronischer Erkrankungen und der Intensivmedizin treibt die Nachfrage zusätzlich an. Die Skalierbarkeit und Eignung für den Krankenhauseinsatz treiben die rasante Expansion dieses Segments voran.

- Nach Auftragsart

Basierend auf der Auftragsart wird der Markt für parenterale Verpackungen in kundenspezifische und Standardaufträge unterteilt. Standardaufträge dominierten den Markt im Jahr 2025, getrieben durch die pharmazeutische Massenproduktion und routinemäßige Injektionspräparate. Standardisierte Verpackungen gewährleisten eine schnellere Produktion, niedrigere Kosten und eine einfachere Einhaltung regulatorischer Vorgaben für Pharmahersteller. Diese Aufträge decken eine konstante Marktnachfrage und erleichtern das globale Lieferkettenmanagement. Das Segment profitiert von der breiten Anwendung bei Impfstoffen, Biologika und niedermolekularen Arzneimitteln, was die Effizienz in Produktion und Vertrieb steigert.

Kundenspezifische Bestellungen werden voraussichtlich das schnellste Wachstum verzeichnen, bedingt durch die steigende Nachfrage nach personalisierter Medizin und Spezialbiologika, die maßgeschneiderte Verpackungslösungen erfordern. So bietet beispielsweise West Pharmaceutical Services individuelle Verpackungslösungen an, die spezifische Anforderungen an die Arzneimittelverträglichkeit und die regulatorischen Vorgaben erfüllen. Kundenspezifische Verpackungen verbessern die Patientensicherheit, reduzieren Arzneimittelverluste und unterstützen Nischentherapiegebiete. Pharmaunternehmen entscheiden sich zunehmend für kundenspezifische Formate, um Produkte zu differenzieren und den spezifischen Bedürfnissen der Endverbraucher gerecht zu werden. Das Wachstum dieses Segments wird durch die wachsende Pipeline an Biologika und Spezialarzneimitteln beschleunigt.

- Nach Dosierungsart

Basierend auf der Darreichungsform ist der Markt in Einzeldosis- und Mehrfachdosierungsverpackungen unterteilt. Einzeldosisverpackungen dominierten den Markt im Jahr 2025 aufgrund ihrer höheren Sicherheit, des geringeren Kontaminationsrisikos und der einfacheren Anwendung im ambulanten Bereich. Einzeldosisformate werden häufig für Impfstoffe, Insulin und hochwirksame Biologika eingesetzt, da sie eine genaue Dosierung und minimalen Materialverlust gewährleisten. Krankenhäuser und Kliniken bevorzugen Einzeldosisverpackungen, um die Handhabung zu vereinfachen und Fehler bei der Medikamentenverabreichung zu reduzieren. Technologische Fortschritte bei Materialien und Versiegelungssystemen stärken die Marktführerschaft dieses Segments zusätzlich.

Mehrfachdosierungen dürften aufgrund der steigenden Nachfrage nach kosteneffizienten Lösungen für die Behandlung großer Patientenzahlen und die Verabreichung im Krankenhaus das schnellste Wachstum verzeichnen. Beispielsweise unterstützen die Mehrdosen-Vialsysteme von BD das Management chronischer Erkrankungen und Massenimpfprogramme. Mehrfachdosierungsformate reduzieren den Lagerbedarf und die Gesamtbehandlungskosten bei gleichzeitiger Aufrechterhaltung von Sterilität und Wirksamkeit. Dieses Segment findet zunehmend Anwendung in der Intensivmedizin und bei groß angelegten therapeutischen Anwendungen und treibt so das Marktwachstum voran.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvertrieb, Apotheken/Apotheken, E-Commerce und Sonstige unterteilt. Der Direktvertrieb dominierte den Markt im Jahr 2025, bedingt durch enge Geschäftsbeziehungen zwischen Pharmaherstellern und Krankenhäusern, Kliniken und Auftragsforschungsinstituten. Der Direktvertrieb gewährleistet die Produktintegrität, die Einhaltung der Kühlkette und die termingerechte Lieferung wichtiger parenteraler Arzneimittel. Hersteller nutzen den Direktvertrieb zudem, um die Kontrolle über Preise, Qualität und regulatorische Vorgaben zu behalten.

Dem E-Commerce wird das schnellste Wachstum prognostiziert, unterstützt durch die zunehmende Nutzung digitaler Plattformen für die pharmazeutische Beschaffung. So bieten beispielsweise die Online-Vertriebskanäle von McKesson Krankenhäusern und Apotheken einen einfachen Zugang zu parenteralen Verpackungsprodukten. E-Commerce bietet Komfort, schnellere Auftragsabwicklung und eine höhere Produkttransparenz, insbesondere in Schwellenländern. Die Expansion des Online-Pharmahandels und von B2B-Beschaffungslösungen beschleunigt das Wachstum dieses Segments.

- Nach Therapiegebieten

Basierend auf den Therapiegebieten ist der Markt in folgende Segmente unterteilt: Herz-Kreislauf/Stoffwechselerkrankungen, Geburtshilfe/Gynäkologie, Dermatologie, Endokrinologie und Stoffwechselerkrankungen, Gastroenterologie, Ophthalmologie, Schmerztherapie, seltene Erkrankungen, Infektionskrankheiten und Sonstige. Infektionskrankheiten dominierten den Markt im Jahr 2025, angetrieben durch die hohe Nachfrage nach Impfstoffen und injizierbaren Antibiotika in Industrie- und Schwellenländern. Krankenhäuser, Kliniken und Impfprogramme bevorzugen parenterale Darreichungsformen, um eine schnelle Wirksamkeit und kontrollierte Dosierung zu gewährleisten. Das Segment profitiert von staatlichen Impfinitiativen und dem weltweit zunehmenden Fokus auf die Behandlung von Infektionskrankheiten.

Bei seltenen Erkrankungen wird das schnellste Wachstum erwartet, angetrieben durch die zunehmende Entwicklung von Orphan-Arzneimitteln und Spezialbiologika, die eine präzise parenterale Verabreichung erfordern. Novartis hat beispielsweise seine parenteralen Lösungen für Therapien seltener Erkrankungen erweitert und unterstützt die Verabreichung im Krankenhaus und zu Hause. Der wachsende Fokus auf zielgerichtete Therapien und personalisierte Medizin treibt die Nachfrage nach injizierbaren Darreichungsformen mit geringem Volumen und hoher Wirksamkeit an. Das Wachstum dieses Segments wird durch regulatorische Anreize und verstärkte Investitionen in die Entwicklung neuer Therapien für seltene Erkrankungen beschleunigt.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Pharmahersteller, Krankenhäuser, Apotheken, Kliniken, ambulante Dienste, Auftragsforschungsinstitute und Sonstige unterteilt. Krankenhäuser dominierten den Markt im Jahr 2025 aufgrund hoher Patientenzahlen und des weitverbreiteten Einsatzes parenteraler Arzneimittel in der Intensivmedizin, Chirurgie und ambulanten Behandlung. Krankenhäuser benötigen verschiedene Verpackungsformate für Einzeldosis-, Mehrdosen- und Großvolumentherapien unter Einhaltung der Sterilität und regulatorischen Vorgaben. Das Segment profitiert zudem von der raschen Einführung fortschrittlicher Verpackungstechnologien und automatisierter Abgabesysteme.

Pharmahersteller dürften aufgrund der zunehmenden Auslagerung von Verpackungsanforderungen und der Ausweitung der Produktion von Biologika und Impfstoffen das schnellste Wachstum verzeichnen. So hat beispielsweise Pfizer seine Produktionskapazitäten für parenterale Verpackungen deutlich ausgebaut, um die weltweite Impfstoffnachfrage effizient zu decken. Hersteller bevorzugen zunehmend vorgefüllte Spritzen, Vials und gebrauchsfertige Systeme, um Produktion und Vertrieb zu optimieren. Der Fokus auf hochwertige, skalierbare Verpackungslösungen für neue Arzneimittelentwicklungen beschleunigt das Wachstum in diesem Segment.

Regionale Analyse des nordamerikanischen Marktes für parenterale Verpackungen

- Die USA dominierten den Markt für parenterale Verpackungen mit dem größten Umsatzanteil im Jahr 2025, angetrieben durch einen etablierten Pharma- und Biotechnologiesektor, die frühe Einführung fortschrittlicher parenteraler Verpackungsformate und die starke Nachfrage nach Biologika und injizierbaren Therapien.

- Bundesvorschriften und Qualitätsstandards für sterile Verpackungen, die Herstellung von Biologika und die Impfstoffproduktion festigen die führende Position des Landes in der Region. Die Präsenz bedeutender Anbieter von parenteralen Verpackungslösungen, kontinuierliche technologische Fortschritte bei Fertigspritzen, Ampullen und gebrauchsfertigen Systemen sowie der Ausbau von Krankenhaus- und Kliniknetzwerken stärken das Marktwachstum in städtischen und vorstädtischen Gesundheitseinrichtungen.

- Die zunehmende Verbreitung automatisierter Abfüll- und Inspektionssysteme, die wachsende Nachfrage nach hochwirksamen Injektionspräparaten und der steigende Fokus auf Patientensicherheit gewährleisten, dass die USA ihre dominierende regionale Rolle während des gesamten Prognosezeitraums beibehalten.

Einblick in den kanadischen Markt für parenterale Verpackungen

Kanada wird voraussichtlich von 2026 bis 2033 das schnellste durchschnittliche jährliche Wachstum (CAGR) im nordamerikanischen Markt für parenterale Verpackungen verzeichnen. Gründe hierfür sind die steigende Produktion von Biologika und Impfstoffen, der Ausbau der Gesundheitsinfrastruktur und die zunehmende Nutzung vorgefüllter und gebrauchsfertiger Verpackungen. Kanadische Pharmahersteller setzen vermehrt auf automatisierte Abfüll-, Versiegelungs- und Inspektionstechnologien, um die Produktionseffizienz zu steigern und die Stabilität der Medikamente zu gewährleisten. Der Ausbau von Krankenhäusern, Kliniken und ambulanten Versorgungseinrichtungen sowie Partnerschaften zwischen lokalen Herstellern und globalen Anbietern von Verpackungslösungen beschleunigen die landesweite Einführung fortschrittlicher parenteraler Systeme. Der zunehmende Fokus auf Patientensicherheit, Einhaltung regulatorischer Vorgaben und betriebliche Effizienz positioniert Kanada als den am schnellsten wachsenden Markt in der Region.

Einblick in den mexikanischen Markt für parenterale Verpackungen

Mexiko wird voraussichtlich von 2026 bis 2033 ein stetiges Wachstum verzeichnen. Treiber dieses Wachstums sind die zunehmenden Kapazitäten in der pharmazeutischen Produktion, das steigende Bewusstsein für injizierbare Therapien und die schrittweise Einführung fortschrittlicher parenteraler Verpackungslösungen. Staatliche Initiativen zur Förderung der Impfstoffproduktion, der Herstellung von Biologika und des Ausbaus der Gesundheitsinfrastruktur tragen zu einer kontinuierlichen Marktexpansion bei. Die Präsenz regionaler Verpackungslieferanten, wachsende Krankenhaus- und Kliniknetzwerke sowie eine verbesserte Kühlkettenlogistik erhöhen die Verfügbarkeit und Zuverlässigkeit parenteraler Verpackungsprodukte. Mexikos zunehmender Fokus auf Patientensicherheit, betriebliche Effizienz und die Einhaltung internationaler Qualitätsstandards unterstützt das stetige Wachstum während des gesamten Prognosezeitraums.

Marktanteil für parenterale Verpackungen in Nordamerika

Die Branche für parenterale Verpackungen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- SCHOTT AG (Deutschland)

- Smithers (USA)

- WILCO AG (Schweiz)

- Genesis Packaging Technologies (USA)

- Baxter (USA)

- RONDO BURGDORF AG (Schweiz)

- ISOVOLTA AG (Österreich)

- NNO (Dänemark)

- Tekni-Plex, Inc (USA)

- Catalent, Inc. (USA)

- Wipak-Gruppe (Finnland)

- ProAmpac (USA)

- Nolato AB (Schweden)

- SiO2 Materialwissenschaft (USA)

Neueste Entwicklungen auf dem nordamerikanischen Markt für parenterale Verpackungen

- Im Dezember 2023 kündigte SCHOTT Pharma die Erweiterung seiner Geschäftstätigkeit durch den Bau einer neuen Produktionsstätte in Serbien an. Diese strategische Investition zielt darauf ab, die Produktionskapazität des Unternehmens deutlich zu erhöhen, um die weltweit steigende Nachfrage nach parenteralen Verpackungen zu decken. Die Entwicklung soll die Effizienz der Lieferkette verbessern, Lieferzeiten verkürzen und die Wettbewerbsposition von SCHOTT auf wichtigen internationalen Märkten stärken. Die neue Anlage unterstreicht zudem das Engagement des Unternehmens, die wachsenden Pharma- und Biotech-Sektoren mit hochwertigen und zuverlässigen Verpackungslösungen zu unterstützen.

- Im Jahr 2023 führte Gerresheimer Vials aus cyclischem Olefinpolymer (COP) ein, die speziell für empfindliche Biologika, einschließlich mRNA-basierter Arzneimittel, entwickelt wurden. Diese Vials bieten eine erhöhte Arzneimittelsicherheit durch überlegene chemische Stabilität und reduzierte Wechselwirkungen mit hochwirksamen Formulierungen und gewährleisten so die Integrität von Therapeutika der nächsten Generation. Die Innovation trägt dem wachsenden Bedarf an fortschrittlichen Materialien für parenterale Verpackungen Rechnung und ermöglicht es Pharmaunternehmen, Herausforderungen im Zusammenhang mit der Verabreichung von Biologika und Impfstoffen zu bewältigen. Mit dieser Markteinführung stärkt Gerresheimer seine Position als führender Anbieter technologisch fortschrittlicher Verpackungslösungen auf dem Weltmarkt.

- BD (Becton, Dickinson and Company) brachte 2023 eine vorgefüllte Spülspritze mit integrierter Desinfektionseinheit auf den Markt, die die Medikamentenverabreichung im klinischen Bereich vereinfachen soll. Die Lösung verbessert die Anwendungssicherheit durch Minimierung des Kontaminationsrisikos bei Injektionen und erhöht die Effizienz durch weniger Vorbereitungsschritte. Diese Innovation erweitert das Portfolio von BD im Bereich parenteraler Verpackungen und unterstützt medizinische Fachkräfte bei der Bereitstellung sichererer und zuverlässigerer Therapien, insbesondere in stark frequentierten Krankenhäusern und ambulanten Einrichtungen.

- Terumo Pharmaceutical Solutions (TPS) brachte 2022 eine gebrauchsfertige Polymerspritze speziell für die Herstellung von Biotech-Arzneimitteln in großen Mengen auf den Markt. Diese Entwicklung adressiert zentrale Herausforderungen der Branche, wie die Aufrechterhaltung der Arzneimittelstabilität, die Gewährleistung der Sterilität und die Handhabung komplexer biologischer Formulierungen. Die Lösung bietet Pharmaherstellern eine robuste und skalierbare Verpackungsoption, stärkt die Position von TPS im wettbewerbsintensiven Segment der biopharmazeutischen Verpackungen und ermöglicht eine effizientere Produktion fortschrittlicher injizierbarer Therapien.

- Die SCHOTT AG begann 2021 mit dem Bau eines zweiten Schmelzofens für pharmazeutische Glasrohre, um ihre Produktionskapazität zu erweitern. Diese Erweiterung dient der Deckung der steigenden Nachfrage nach hochwertigen parenteralen Glasverpackungen, insbesondere für Impfstoffe, Biologika und Injektionspräparate. Die zusätzlichen Kapazitäten ermöglichen es SCHOTT, globale Pharmakunden noch besser zu bedienen und gleichzeitig ihre langfristige Wachstumsstrategie im Gesundheitssektor zu unterstützen. Die Initiative unterstreicht die kontinuierlichen Investitionen des Unternehmens in die Infrastruktur, um Zuverlässigkeit, Präzision und Skalierbarkeit bei Glasverpackungslösungen zu gewährleisten.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.