Nordamerikanischer Markt für organische Solarzellen (OPV) nach Typ (Bilayer Membrane Heterojunction, Schottky-Typ und andere), Material (Polymer und kleine Moleküle), Anwendung (BIPV und Architektur, Unterhaltungselektronik, tragbare Geräte , Automobil, Militär und Geräte und andere), physische Größe (mehr als 140 x 100 mm² und weniger als 140 x 100 mm²), Endbenutzer (gewerblich, industriell, privat und andere), Branchentrends und Prognose bis 2030.

Marktanalyse und -größe für organische Solarzellen (OPV) in Nordamerika

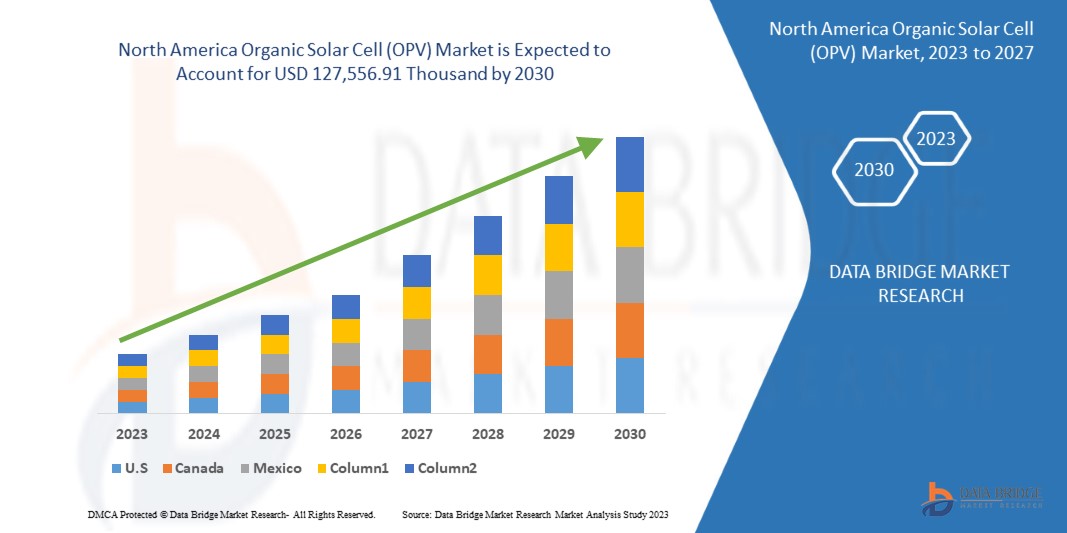

Der nordamerikanische Markt für organische Solarzellen (OPV) dürfte im Prognosezeitraum 2023 bis 2030 deutlich wachsen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2023 bis 2030 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 10,3 % wächst und bis 2030 voraussichtlich 127.556,91 Tausend USD erreichen wird. Der Hauptfaktor für das Wachstum des Marktes für organische Solarzellen (OPV) ist die steigende Beliebtheit von Produkten für organische Solarzellen (OPV) unter den organischen Solarzellen und das wachsende Bewusstsein für die Eigenschaften von Produkten für organische Solarzellen (OPV).

Organische Solarzellen (OSCs), die als Solarzellen der dritten Generation eingestuft werden und organisches Polymermaterial als lichtabsorbierende Schicht verwenden, sind eine der neuesten Photovoltaiktechnologien (PV). Organische Photovoltaik-Solarzellen (OPV) streben danach, eine energiesparende und erdreiche Photovoltaiklösung (PV) anzubieten.

Der nordamerikanische Marktbericht für organische Solarzellen (OPV) enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und dem Einfluss inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Umsatzquellen, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analystenbriefing. Unser Team hilft Ihnen bei der Entwicklung einer umsatzwirksamen Lösung, um Ihr gewünschtes Ziel zu erreichen.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2020 – 2015) |

|

Quantitative Einheiten |

Umsatz in Tausend USD |

|

Abgedeckte Segmente |

Nach Typ (Bilayer Membrane Heterojunction, Schottky-Typ und andere), Material (Polymer und kleine Moleküle), Anwendung (BIPV und Architektur, Unterhaltungselektronik, tragbare Geräte, Automobil, Militär und Geräte und andere), physische Größe (mehr als 140 x 100 mm im Quadrat und weniger als 140 x 100 mm im Quadrat), Endbenutzer (kommerziell, industriell, privat und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co, Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation und Flask, unter anderem |

Marktdefinition

Organische Solarzellen oder organische Photovoltaik sind mehrschichtige Photovoltaikgeräte aus organischen Verbindungen, die Sonnenenergie in Elektrizität umwandeln. Eine organische Solarzelle wird aus kohlenstoffbasiertem Material und organischer Elektronik anstelle von Silizium als Halbleiter hergestellt. Organische Zellen werden auch als Kunststoff-Solarzellen oder Polymer-Solarzellen bezeichnet. Im Gegensatz zu kristallinen Silizium-Solarzellen werden organische Solarzellen aus Verbindungen hergestellt, die in Tinte aufgelöst und auf Kunststoffe gedruckt werden können. Dies verleiht den organischen Solarzellen unter anderem die Eigenschaft der Flexibilität, des geringen Gewichts und der einfachen Einbindung in Orte oder Strukturen.

Die Technologie für organische Solarzellen befindet sich noch in der Entwicklung. Die Effizienz der Stromumwandlung organischer Solarzellen reicht nicht an die Effizienz anorganischer Silizium-Solarzellen heran. Aber die OPVs bieten ein breites Spektrum potenzieller Anwendungen und es könnte nicht lange dauern, bis sie zur allgemein verwendeten Technologie werden. Im Vergleich zu anorganischen Solarzellen sind OPVs einfach herzustellen, billig in der Produktion und physikalisch vielseitig einsetzbar. Das Funktionsprinzip organischer Solarzellen ist das gleiche wie bei monokristallinen und polykristallinen Silizium-Solarzellen. Sie erzeugen Strom durch den Photovoltaikeffekt in drei einfachen Schritten, wie:

- Bei der Lichtabsorption werden Elektronen aus dem halbleitenden Polymermaterial herausgeschlagen

- Der Fluss der losen Elektronen bildet einen elektrischen Strom

- Der Strom wird erfasst und auf Drähte übertragen

Die Vielseitigkeit der OPV ist auf die Vielfalt der organischen Materialien zurückzuführen, die für Absorber, Akzeptoren und Schnittstellen entwickelt und synthetisiert werden. Organische Solarzellen finden Anwendung in der Automobilindustrie, in Dachpaneelen, in gebäudeintegrierter Photovoltaik (BIPV), in der Unterhaltungselektronik und in anderen Bereichen.

Marktdynamik für organische Solarzellen (OPV) in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Chancen, Beschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

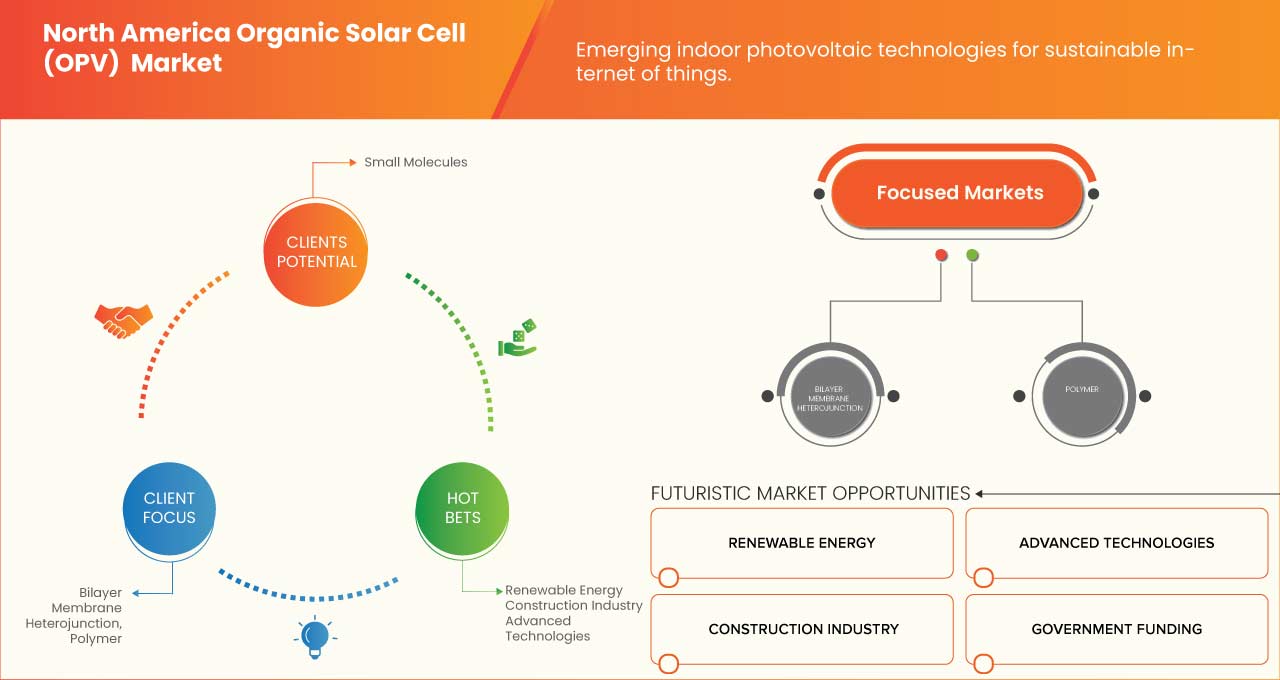

- Steigendes Bewusstsein für die Nutzung erneuerbarer Energien zur Stromerzeugung

Das kontinuierliche Bevölkerungswachstum und der zunehmende Aufschwung des Industriesektors, gepaart mit dem Wachstum der Infrastrukturentwicklung, führen zu einem deutlichen Anstieg des Strombedarfs in Nordamerika. Die Länder investieren massiv in Stromerzeugungsressourcen, indem sie neue Kraftwerke installieren, um den Energiebedarf für eine ungehinderte Entwicklung zu decken. Dies hat zu erhöhter Umweltverschmutzung und Umweltgefahren geführt. Da sich der Fokus auf den Klimaschutz verlagert, werden zunehmend erneuerbare Energiequellen zur Stromerzeugung eingesetzt, und die Nutzung von Solarenergie zur Stromerzeugung ist eine der führenden Technologien in Nordamerika.

- Starke Nachfrage nach gebäudeintegrierten Photovoltaikprodukten (BIPV)

Gebäudeintegrierte Photovoltaik (BIPV) bezieht sich auf Materialien, die beim Bauen verwendet werden, um die herkömmlichen Baumaterialien in Dächern, Oberlichtern und Fassaden usw. zu ersetzen. Bei BIPV verfügen die Gebäude über eine äußere Strukturschicht, die ebenfalls Strom für den Eigenverbrauch oder die Einspeisung ins Netz erzeugt. BIPV-Anwendungen werden häufig für Gewerbe- und Industriegebäude eingesetzt. Die Verwendung von OPV hat gegenüber Silizium-Solarzellen erhebliche Vorteile, da sie zu Kosteneinsparungen führt. Sie sind leicht, flexibel und optisch transparent. Dies hat zu einer zunehmenden Verwendung von organischer Photovoltaik als Material in BIPV-Anwendungen geführt.

Organische Photovoltaik ist dünn und flexibel und kann in die Seitenwände von Gebäuden integriert werden, wo sie herkömmliche Glasfenster ersetzt. Dadurch steht eine große Fläche zur Absorption von Sonnenenergie zur Verfügung. OPC-Oberlichter werden mit ultradünnen organischen Solarzellen integriert, die Tageslicht durchlassen und gleichzeitig Strom erzeugen.

Gelegenheiten

- Zunehmende Anwendung in Heimwerkerprojekten und Gadgets

In den letzten Jahren wurde intensiv an der Entwicklung organischer Solarzellen geforscht, um deren Effizienz zu steigern und sie flexibler und dünner zu machen. Die erzielten Ergebnisse sind lobenswert. Die Forscher konnten einen Wirkungsgrad (PCE) von über 10 % erreichen. Die jüngsten Entwicklungen haben zu einer Verbesserung der Flexibilität, der mechanischen Biegestabilität und der guten Formbarkeit geführt. Dies hat zu Anwendungen organischer Solarzellen in Bereichen wie der Stromerzeugung in tragbarer Elektronik und kleinen Projekten geführt.

Auf dem Markt besteht eine steigende Nachfrage nach tragbaren und tragbaren elektronischen Geräten der Zukunft, wie Smartwatches oder biometrischen Sensoren, die leichte, flexible und effiziente Stromerzeugungsressourcen nutzen. Dies hat aufgrund ihrer wünschenswerten Eigenschaften spannende Möglichkeiten für organische Solarzellen als Stromquellen der nächsten Generation eröffnet. Daher werden in Nordamerika viele Forschungsaktivitäten unternommen, um organische Solarzellen weiterzuentwickeln und ihren PCE und ihre Flexibilität zu erhöhen.

- Klimawandel rückt immer stärker in den Fokus der Regierungen

Die Erwärmung Nordamerikas, die durch vom Menschen verursachte Treibhausgasemissionen und Verschiebungen und Veränderungen der Wettermuster aufgrund des ständig veränderten Ökosystems verursacht wird, führt zu beschleunigten Klimaveränderungen in allen Regionen Nordamerikas. Sie verlangsamt sich nicht und hat enorme Auswirkungen auf das menschliche Wohlbefinden und die Armut auf der ganzen Welt. Laut der Weltbank könnte der Klimawandel bis zu 132 Millionen Menschen in die Armut treiben. Es gibt eine Bewegung auf der ganzen Welt, und die großen Regierungen erkennen und ergreifen Maßnahmen, um weitere Schäden am Ökosystem der Welt zu vermeiden.

Einschränkungen/Herausforderungen

- Höhere Einrichtungskosten für OPV-Systeme

Es wurde großer Wert darauf gelegt, die Einführung von Solarstromsystemen, wie organischen Photovoltaiksystemen, zu beschleunigen, um gebäudeintegrierte Photovoltaiksysteme zu entwickeln. Doch trotz dieser Bemühungen ist die Integration von BIPV-Designs (gebäudeintegrierte Photovoltaik) in die Gebäudeplanung geringer als bei Gebäuden mit rackmontierten organischen Solarzellensystemen. Dies erhöht die Kosten für die Integration der Designvorimplementierung zusätzlich. Dies erweist sich als erheblicher hemmender Faktor für den Markt.

Obwohl die Nutzung erneuerbarer Energien gefördert wird und mit zunehmender Aufmerksamkeit auf den Klimawandel zunimmt, ist die Nutzung von Solarenergie in den meisten Regionen der Welt uneinheitlich. Diese Uneinheitlichkeit wird auf das Einkommen der Menschen zurückgeführt.

- Niedrige Wirkungsgrade organischer Solarzellen

Der Wirkungsgrad einer Solarzelle gibt an, wie viel Lichtenergie die Zelle in Elektrizität umwandeln kann. Organische Solarzellen bieten zunehmend mehr Möglichkeiten, da sie flexibel sind und sich an jede Oberfläche anpassen können, beispielsweise an ein Autodach oder an die Außenseite tragbarer Elektronik. Die größte Hürde, die die Kommerzialisierung dieser Technologie verhindert hat, ist der im Vergleich zu anorganischen Silizium-Solarzellen relativ geringe Wirkungsgrad.

Jüngste Entwicklung

- Im Januar 2023 wurde der Novaled GmbH bekannt gegeben, dass sie im Jahr 2022 die Auszeichnung „Corporate Health Excellence Award“ gewonnen hat. Dies wird dem Unternehmen helfen, unter den Mitbewerbern besser wahrgenommen zu werden.

Marktumfang für organische Solarzellen (OPV) in Nordamerika

Der nordamerikanische Markt für organische Solarzellen (OPV) wird nach Typ, Material, Anwendung, physikalischer Größe und Endverbraucher kategorisiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse wichtiger Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, um strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Typ

- Doppelschichtmembran-Heteroübergang

- Schottky-Typ

- Sonstiges

Auf der Grundlage des Typs wird der nordamerikanische Markt für organische Solarzellen (OPV) in drei Segmente unterteilt: Bilayer Membrane Heterojunction, Schottky-Typ und andere.

Material

- Polymer

- Kleine Moleküle

Auf der Grundlage des Materials wird der nordamerikanische Markt für organische Solarzellen (OPV) in zwei Segmente unterteilt: Polymere und kleine Moleküle.

Anwendung

- BIPV und Architektur

- Unterhaltungselektronik

- Tragbare Geräte

- Automobilindustrie

- Militär & Geräte

- Sonstiges

Auf der Grundlage der Anwendung wird der nordamerikanische Markt für organische Solarzellen (OPV) in sechs Segmente unterteilt: BIPV und Architektur, Unterhaltungselektronik, tragbare Geräte, Automobil, Militär und Geräte und Sonstiges.

Physische Größe

- Mehr als 140*100 MM Quadrat

- Weniger als 140*100 MM Quadrat

Auf Grundlage der physikalischen Größe wird der nordamerikanische Markt für organische Solarzellen (OPV) in zwei Segmente unterteilt: größer als 140 x 100 mm im Quadrat und kleiner als 140 x 100 mm im Quadrat.

Endbenutzer

- Kommerziell

- Industrie

- Wohnen

- Sonstiges

Auf der Grundlage des Endbenutzers wird der nordamerikanische Markt für organische Solarzellen (OPV) in vier Segmente unterteilt: gewerblich, industriell, privat und sonstiges.

Nordamerika Organische Solarzellen (OPV) Markt – Regionale Analyse/Einblicke

Der nordamerikanische Markt für organische Solarzellen (OPV) ist nach Typ, Material, Anwendung, physischer Größe und Endbenutzer segmentiert.

Die Länder auf dem nordamerikanischen Markt für organische Solarzellen (OPV) sind die USA, Kanada und Mexiko. Die USA dominieren den nordamerikanischen Markt für organische Solarzellen (OPV) in Bezug auf Marktanteil und Marktumsatz aufgrund des wachsenden Bewusstseins für die Eigenschaften der organischen Solarzellenprodukte (OPV) in dieser Region.

Der Länderabschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunktanalysen der nachgelagerten und vorgelagerten Wertschöpfungsketten, technische Trends, Porters Fünf-Kräfte-Analyse und Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile organischer Solarzellen (OPV) in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Marktes für organische Solarzellen (OPV) bietet Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den nordamerikanischen Markt für organische Solarzellen (OPV).

Zu den bekanntesten Akteuren auf dem nordamerikanischen Markt für organische Solarzellen (OPV) zählen unter anderem Eni SpA, TOSHIBA CORPORATION, ARMOR, Tokyo Chemicals Industry Co. Ltd, Merck KGaA, Alfa Aesar, Thermo Fisher Scientific, Heliatek, Solarmer Energy Inc., SUNEW, Epishine, Lumtec, Borun New Material Technology Co., Ltd, Novaled GmbH, Ningbo Polycrown Solar Tech Co., Ltd, SHIFENG TECHNOLOGY CO., LTD., Solaris Chem Inc., MORESCO Corporation, NanoFlex Power Corporation und Flask.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION

5.1.2 SURGE IN DEMAND FOR BUILDING INTEGRATED PHOTOVOLTAIC PRODUCTS (BIPV)

5.1.3 GOVERNMENT INITIATIVES AND TAX BENEFITS FOR THE APPLICATION OF ALTERNATE ENERGY RESOURCE

5.1.4 ADVANTAGES OF OPVS OVER SILICON SOLAR CELLS AND SIMPLICITY IN THE MANUFACTURING PROCESS

5.1.5 INCREASING SOLAR ADOPTION IN RESIDENTIAL AREAS

5.2 RESTRAINTS

5.2.1 HIGHER SETUP COST OF OPV SYSTEMS

5.2.2 CUSTOM TARIFFS OVER SOLAR PANELS AND SOLAR CELLS BY MULTIPLE GOVERNMENTS

5.3 OPPORTUNITIES

5.3.1 INCREASING APPLICATIONS IN DIY PROJECTS AND GADGETS

5.3.2 INCREASING GOVERNMENT FOCUS ON CLIMATE CHANGE

5.3.3 INCREASING FOCUS ON THE DEVELOPMENT OF TANDEM ORGANIC CELLS

5.3.4 EMERGING INDOOR PHOTOVOLTAIC TECHNOLOGIES FOR SUSTAINABLE INTERNET OF THINGS

5.4 CHALLENGES

5.4.1 LOW-EFFICIENCY RATES OF ORGANIC SOLAR CELLS

5.4.2 STABILITY PROBLEMS IN ORGANIC SOLAR CELL

6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE

6.1 OVERVIEW

6.2 BILAYER MEMBRANE HETEROJUNCTION

6.3 SCHOTTKY TYPE

6.4 OTHERS

7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 POLYMER

7.3 SMALL MOLECULES

8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BIPV & ARCHITECTURE

8.3 CONSUMER ELECTRONICS

8.4 WEARABLE DEVICES

8.5 AUTOMOTIVE

8.6 MILITARY & DEVICE

8.7 OTHERS

9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE

9.1 OVERVIEW

9.2 MORE THAN 140*100 MM SQUARE

9.3 LESS THAN 140*100 MM SQUARE

10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL

10.2.1 COMMERCIAL, BY COMMERCIAL TYPE

10.2.1.1 PUBLIC INSTITUTIONS

10.2.1.2 GOVERNMENT AGENCIES

10.2.1.3 RESEARCH INSTITUTIONS

10.2.1.4 OTHERS

10.2.2 COMMERCIAL, BY TYPE

10.2.2.1 BILAYER MEMBRANE HETEROJUNCTION

10.2.2.2 SCHOTTKY TYPE

10.2.2.3 OTHERS

10.3 INDUSTRIAL

10.3.1 INDUSTRIAL, BY TYPE

10.3.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.3.1.2 SCHOTTKY TYPE

10.3.1.3 OTHERS

10.4 RESIDENTIAL

10.4.1 RESIDENTIAL, BY TYPE

10.4.1.1 BILAYER MEMBRANE HETEROJUNCTION

10.4.1.2 SCHOTTKY TYPE

10.4.1.3 OTHERS

10.5 OTHERS

11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 BUSINESS ACQUISITION & EXPANSION

12.3 COLLABORATION & PARTNERSHIP

12.4 ACQUISITION

12.5 AGREEMENT & CERTIFICATION

12.6 RECOGNITION & PRODUCT LAUNCH

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 ENI SPA (2022)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 TOSHIBA CORPORATION (2022)

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ARMOR

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 TOKYO CHEMICAL INDUSTRY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 MERCK KGAA (2022)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ALFA AESAR, THERMO FISHER SCIENTIFIC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 BORUN NEW MATERIAL TECHNOLOGY CO., LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 EPISHINE

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 FLASK

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 HELIATEK

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 LUMTEC

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 MORESCO CORPORATION (2022)

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 NANOFLEX POWER CORPORATION (2022)

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 NINGBO POLYCROWN SOLAR TECH CO, LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 NOVALED GMBH

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 SHIFENG TECHNOLOGY CO., LTD.

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 SOLARIS CHEM INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 SOLARMER ORGANIC OPTOELECTRONICS TECHNOLOGY (BEIJING) CO., LTD.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 SUNEW

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 IMPORT DATA ON PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 2 EXPORT DATA OF PHOTOSENSITIVE SEMICONDUCTOR DEVICES, INCL. PHOTOVOLTAIC CELLS, WHETHER OR NOT ASSEMBLED IN ...; HS CODE – 854140 (USD THOUSAND)

TABLE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA BILAYER MEMBRANE HETEROJUNCTION IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION , 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SCHOTTKY TYPE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA POLYMER IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA SMALL MOLECULES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA BIPV & ARCHITECTURE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA CONSUMER ELECTRONICS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA WEARABLE DEVICES IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA AUTOMOTIVE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA MILITARY & DEVICE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE , 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA MORE THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA LESS THAN 140*100 MM SQUARE IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN ORGANIC SOLAR CELL (OPV) MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 41 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 42 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 50 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY COMMERCIAL TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO COMMERCIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO INDUSTRIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO RESIDENTIAL IN ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA ORGANIC SOLAR CELL MARKET

FIGURE 2 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: SEGMENTATION

FIGURE 14 INCREASING AWARENESS TOWARDS THE USE OF RENEWABLE ENERGY FOR POWER GENERATION IS EXPECTED TO DRIVE THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN THE FORECAST PERIOD

FIGURE 15 2 WHEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET

FIGURE 17 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY TYPE, 2022

FIGURE 18 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY MATERIAL, 2022

FIGURE 19 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY APPLICATION, 2022

FIGURE 20 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY PHYSICAL SIZE, 2022

FIGURE 21 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET, BY END USER, 2022

FIGURE 22 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY SNAPSHOT (2022)

FIGURE 23 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022)

FIGURE 24 EUROPE ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2023 & 2030)

FIGURE 25 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY COUNTRY (2022 & 2030)

FIGURE 26 NORTH AMERICA ORGANIC SOLAR CELL (OPV) MARKET: BY TYPE (2023-2030)

FIGURE 27 NORTH AMERICA HEAVY METALS TESTING MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.