North America Menstrual Cramps Treatment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.39 Billion

USD

4.21 Billion

2024

2032

USD

2.39 Billion

USD

4.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.39 Billion | |

| USD 4.21 Billion | |

|

|

|

|

Marktsegmentierung für die Behandlung von Menstruationsbeschwerden in Nordamerika nach Typ (primäre Dysmenorrhoe, sekundäre Dysmenorrhoe), Behandlungsart (Medikament, Therapie, Operation, sonstige), Verschreibungsart (rezeptfrei, verschreibungspflichtig), Verabreichungsweg (oral, parenteral, Implantate, sonstige), Endverbraucher (Krankenhäuser, Fachzentren, ambulante chirurgische Zentren, sonstige), Vertriebskanal (Apotheken, Einzelhandel, Direktausschreibung, sonstige), Land (USA, Kanada, Mexiko), Branchentrends und Prognose bis 2032

Marktgröße für die Behandlung von Menstruationsbeschwerden

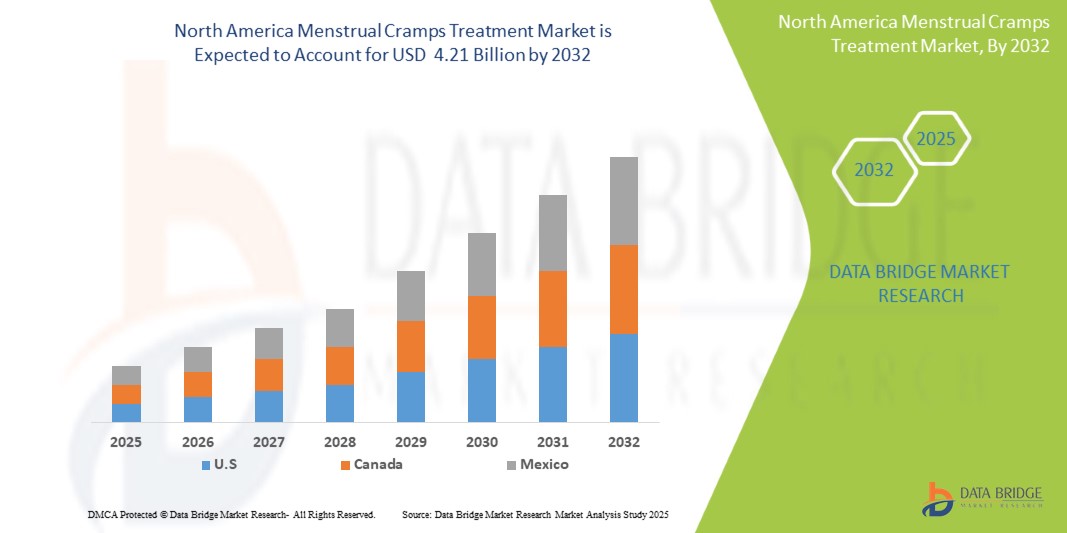

- Der nordamerikanische Markt für die Behandlung von Menstruationsbeschwerden hatte im Jahr 2024 einen Wert von 2,39 Milliarden US-Dollar und wird voraussichtlich bis 2032 4,21 Milliarden US-Dollar erreichen , bei einer CAGR von 7,6 % im Prognosezeitraum.

- Das Wachstum des nordamerikanischen Marktes für die Behandlung von Menstruationsbeschwerden wird größtenteils durch die zunehmende Verbreitung von Dysmenorrhoe und das steigende Bewusstsein für Menstruationsgesundheit vorangetrieben, was zu einer höheren Nachfrage nach wirksamen Behandlungsmöglichkeiten in der gesamten Region führt.

- Darüber hinaus führt die steigende Nachfrage der Verbraucher nach sicheren, effizienten und leicht verfügbaren Lösungen zur Linderung von Menstruationsbeschwerden dazu, dass verschiedene Behandlungsmethoden, darunter rezeptfreie Medikamente und fortschrittliche nicht-pharmakologische Methoden, als moderne Alternative etabliert werden. Diese zusammenlaufenden Faktoren beschleunigen die Akzeptanz von Lösungen zur Behandlung von Menstruationsbeschwerden und fördern damit das Wachstum der Branche erheblich.

Marktanalyse zur Behandlung von Menstruationsbeschwerden

- Behandlungen von Menstruationsbeschwerden, die Linderung von Schmerzen und Beschwerden im Zusammenhang mit der Menstruation bieten, sind aufgrund ihrer erwiesenen Wirksamkeit, der vielfältigen Verabreichungsmöglichkeiten und der zunehmenden Betonung einer personalisierten Betreuung ein immer wichtigerer Bestandteil der Gesundheitsvorsorge für Frauen in Nordamerika.

- Die steigende Nachfrage nach Behandlungen gegen Menstruationsbeschwerden in den USA, Kanada und Mexiko ist vor allem auf die hohe Prävalenz von Dysmenorrhoe, das steigende Bewusstsein für Menstruationsgesundheit und eine starke Präferenz für wirksame und bequeme Lösungen zur Schmerzlinderung zurückzuführen.

- Die Vereinigten Staaten haben einen bedeutenden Anteil am nordamerikanischen Markt für die Behandlung von Menstruationsbeschwerden und machen 75 % des regionalen Umsatzes aus. Dies wird durch hohe Gesundheitsausgaben, einen breiten Versicherungsschutz und die weite Verbreitung sowohl verschreibungspflichtiger als auch rezeptfreier Medikamente unterstützt.

- Auch in Kanada und Mexiko ist ein stetiges Wachstum zu verzeichnen. Dies ist auf den verbesserten Zugang zu Gesundheitsdienstleistungen, verstärkte Aufklärungskampagnen für Verbraucher zum Thema Frauengesundheit und eine wachsende weibliche Bevölkerung zurückzuführen, die nach zuverlässigen Behandlungsmöglichkeiten sucht.

- Das Medikamentensegment – und hier vor allem nichtsteroidale Antirheumatika (NSAR) – wird voraussichtlich den nordamerikanischen Markt für die Behandlung von Menstruationsbeschwerden dominieren und 60 % des gesamten Marktanteils ausmachen. Grund hierfür ist ihr guter Ruf hinsichtlich Wirksamkeit, Erschwinglichkeit und breiter Verfügbarkeit als Erstlinientherapie bei Dysmenorrhoe.

Berichtsumfang und Marktsegmentierung zur Behandlung von Menstruationsbeschwerden

|

Eigenschaften |

Markteinblicke für Smart Lock Key |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends zur Behandlung von Menstruationsbeschwerden

„ Personalisiertes Schmerzmanagement durch KI-gestützte digitale Gesundheitslösungen “

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für die Behandlung von Menstruationsbeschwerden ist die zunehmende Integration von künstlicher Intelligenz (KI) und digitalen Gesundheitsplattformen. Diese Technologiefusion verbessert den Benutzerkomfort und die Kontrolle über ihre Schmerzmanagementstrategien erheblich.

- Beispielsweise integrieren sich KI-gestützte Perioden-Tracking-Apps wie Flo und Clue nahtlos in von Nutzerinnen gemeldete Symptome und Zyklusdaten aus der Vergangenheit. So können sie Periode, Eisprung und fruchtbare Phasen präziser vorhersagen und bieten oft personalisierte Einblicke in die Behandlung der damit verbundenen Beschwerden. Ebenso integrieren sich tragbare Geräte, die Technologien wie TENS (Transkutane Elektrische Nervenstimulation) oder Wärmetherapie nutzen, in Smart-Apps und bieten so anpassbare Schmerzlinderungsprogramme.

- Die Integration von KI in die Behandlung von Menstruationsbeschwerden ermöglicht Funktionen wie das Erlernen von Schmerzmustern der Nutzerin, um optimale Behandlungszeitpunkte vorzuschlagen und intelligentere Warnmeldungen basierend auf der Schwere der Symptome bereitzustellen. Einige digitale Therapeutika nutzen KI beispielsweise, um die Schmerzlinderungsempfehlungen im Laufe der Zeit zu verbessern und intelligente Warnmeldungen zu senden, wenn ungewöhnliche oder starke Schmerzmuster erkannt werden. Darüber hinaus bieten digitale Gesundheitsplattformen Nutzern die Möglichkeit, Symptome, Medikamenteneinnahme und Lebensstilfaktoren einfach zu verfolgen und so ihre individuelle Menstruationsgesundheit besser zu verstehen und zu steuern.

- Die nahtlose Integration KI-gestützter Lösungen in umfassendere digitale Gesundheitsökosysteme ermöglicht eine zentrale Kontrolle verschiedener Aspekte des Menstruationswohlbefindens. Über eine einzige Schnittstelle können Nutzerinnen ihre Schmerzlinderungsstrategien zusammen mit Stimmungstracking, Aktivitätsniveau und anderen Gesundheitsdaten verwalten und so einen einheitlichen und automatisierten Ansatz für das Menstruationsgesundheitsmanagement schaffen.

- Dieser Trend zu intelligenteren, intuitiveren und vernetzten Schmerzmanagementsystemen verändert die Erwartungen der Nutzerinnen an die Linderung von Menstruationsbeschwerden grundlegend. Daher entwickeln Unternehmen KI-gestützte digitale Gesundheitslösungen mit Funktionen wie automatischen, personalisierten Empfehlungen zur Schmerzlinderung basierend auf gemeldeten Symptomen und der Integration in andere Wellness-Apps.

- Die Nachfrage nach Behandlungen gegen Menstruationsbeschwerden, die eine nahtlose Integration von KI und digitaler Gesundheit bieten, wächst auf dem nordamerikanischen Markt rasant, da Verbraucher zunehmend Wert auf Komfort, personalisierte Betreuung und umfassende Selbstmanagementfunktionen legen.

Marktdynamik für die Behandlung von Menstruationsbeschwerden

Treiber

„ Wachsender Bedarf aufgrund der zunehmenden Häufigkeit von Dysmenorrhoe und des gestiegenen Gesundheitsbewusstseins “

- Die zunehmende Häufigkeit von Menstruationsbeschwerden (Dysmenorrhoe) bei Frauen sowie das zunehmende Bewusstsein und die offene Diskussion rund um die Menstruationsgesundheit sind wichtige Gründe für die steigende Nachfrage nach wirksamen Behandlungsmöglichkeiten für Menstruationsbeschwerden.

- So haben Unternehmen in den letzten Jahren innovative nicht-pharmakologische Lösungen wie tragbare Wärmetherapiegeräte oder TENS-Geräte eingeführt, die eine bequeme und medikamentenfreie Schmerzlinderung ermöglichen sollen. Solche Fortschritte wichtiger Unternehmen dürften das Wachstum der Branche für die Behandlung von Menstruationsbeschwerden im Prognosezeitraum vorantreiben.

- Da sich viele Menschen der Auswirkungen von Menstruationsschmerzen auf ihren Alltag immer mehr bewusst werden und nach besseren Linderungs- und Behandlungsmöglichkeiten suchen, bieten moderne Behandlungsmethoden fortschrittliche Funktionen wie gezielte Schmerzlinderung, personalisierte Ansätze und reduzierte Nebenwirkungen und stellen damit eine überzeugende Alternative oder Ergänzung zu herkömmlichen Methoden dar.

- Darüber hinaus machen die wachsende Popularität ganzheitlicher Gesundheitsansätze und der Wunsch nach umfassendem Wohlbefinden die Behandlung von Menstruationsbeschwerden zu einem integralen Bestandteil dieser umfassenderen Gesundheitsstrategien und ermöglichen eine nahtlose Integration mit Änderungen des Lebensstils und Selbstpflegepraktiken.

- Die bequeme Verfügbarkeit rezeptfreier Medikamente, die Verfügbarkeit vielfältiger Therapieoptionen und die Möglichkeit, die Symptome durch benutzerfreundliche digitale Gesundheitsanwendungen zu behandeln, sind Schlüsselfaktoren für die Verbreitung von Behandlungen gegen Menstruationsbeschwerden. Der Trend zum Selbstmanagement und die zunehmende Verfügbarkeit vielfältiger Behandlungsmöglichkeiten tragen zusätzlich zum Marktwachstum bei.

Einschränkung/Herausforderung

„ Bedenken hinsichtlich Nebenwirkungen und Stigmatisierung der Behandlungen “

- Bedenken hinsichtlich möglicher Nebenwirkungen pharmazeutischer Behandlungen und des gesellschaftlichen Stigmas, das mit Menstruationsbeschwerden einhergeht, stellen eine erhebliche Hürde für eine breitere Marktdurchdringung dar. Da die Behandlung von Menstruationsbeschwerden oft Medikamente oder Therapien umfasst, können Nebenwirkungen auftreten oder die Betroffenen zögern, aufgrund von Datenschutzbedenken Hilfe in Anspruch zu nehmen. Dies weckt bei potenziellen Konsumenten Bedenken hinsichtlich der Sicherheit und Eignung dieser Optionen.

- So hat beispielsweise das öffentliche Bewusstsein für die möglichen Nebenwirkungen bestimmter Medikamente oder die wahrgenommene Invasivität mancher Therapien dazu geführt, dass manche Verbraucher zögern, herkömmliche Behandlungslösungen in Anspruch zu nehmen.

- Um das Vertrauen der Verbraucher zu gewinnen, ist es entscheidend, diese Bedenken durch fundierte Forschung, eine klare Kommunikation von Nutzen und Risiken sowie die Entwicklung gezielterer Therapien auszuräumen. Unternehmen betonen ihre strengen klinischen Studien und Patientenunterstützungsprogramme, um potenzielle Käufer zu beruhigen. Zudem können die relativ hohen Kosten mancher fortgeschrittener oder langfristiger Behandlungsschemata oder unzureichende Erstattungsrichtlinien für preisbewusste Verbraucher, insbesondere für diejenigen, die eine spezialisierte Behandlung wünschen, ein Hindernis darstellen. Während einfache rezeptfreie Schmerzmittel erschwinglich sind, sind Premium-Produkte wie fortschrittliche tragbare Geräte oder personalisierte Therapiepläne oft teurer.

- Zwar verbessert sich der Zugang zu verschiedenen Behandlungsmethoden, doch die wahrgenommene Belastung durch die kontinuierliche Behandlung oder die Präferenz für nicht-pharmakologische Alternativen können eine breite Akzeptanz noch immer behindern, insbesondere bei denjenigen, die natürlichere oder weniger invasive Ansätze suchen.

- Für ein nachhaltiges Marktwachstum ist es von entscheidender Bedeutung, diese Herausforderungen durch eine verbesserte Patientenaufklärung, transparente Informationen zu Behandlungsergebnissen und die Entwicklung erschwinglicherer und zugänglicherer Therapieoptionen zu bewältigen.

Marktumfang der Behandlung von Menstruationsbeschwerden

Der Markt ist nach Typ, Behandlungsart, Verschreibungsart, Verabreichungsweg, Endbenutzer und Vertriebskanal segmentiert.

Nach Typ

Der nordamerikanische Markt für die Behandlung von Menstruationsbeschwerden ist in primäre und sekundäre Dysmenorrhoe unterteilt. Das Segment der primären Dysmenorrhoe wird voraussichtlich im Jahr 2025 mit 68 % den größten Marktanteil halten, was auf die hohe Prävalenz bei heranwachsenden und jungen Frauen zurückzuführen ist. Zunehmende Aufklärungskampagnen und ein verbesserter Zugang zu rezeptfreien Medikamenten tragen zur Nachfrage nach wirksamen Behandlungen für primäre Menstruationsbeschwerden bei. Dieses Segment wird voraussichtlich von 2025 bis 2032 mit einer durchschnittlichen jährlichen Wachstumsrate von 6,5 % wachsen.

Nach Behandlungsart

: Der Markt ist in Medikamente, Therapie, Chirurgie und andere Behandlungsarten unterteilt. Das Medikamentensegment, insbesondere nichtsteroidale Antirheumatika (NSAR), erzielte 2025 den größten Marktanteil. Dies spiegelt ihre etablierte Rolle als Erstlinientherapie, ihre Erschwinglichkeit und ihre breite Verfügbarkeit wider. Das Therapiesegment, einschließlich Wärmetherapie und transkutane elektrische Nervenstimulation (TENS), wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, angetrieben durch das wachsende Verbraucherinteresse an nicht-pharmakologischen Schmerzbehandlungslösungen.

Nach Verschreibungsart

: Der Markt ist in rezeptfreie und verschreibungspflichtige Medikamente unterteilt. Das OTC-Segment dominiert den Markt, unterstützt durch die weit verbreitete Verwendung von NSAR und Schmerzmitteln ohne Rezept und die starke Marktdurchdringung in Apotheken. Auch das verschreibungspflichtige Segment wächst, angetrieben durch die Nachfrage nach Hormontherapien und gezielten Behandlungen für sekundäre Dysmenorrhoe.

Nach Verabreichungsweg

: Der Markt umfasst orale, parenterale und implantierbare Medikamente sowie weitere Verabreichungswege. Das orale Segment erzielte 2025 den größten Umsatzanteil, was auf die einfache Anwendung, den schnellen Wirkungseintritt und die Vertrautheit der Verbraucher mit oralen Schmerzmitteln zurückzuführen ist. Es wird erwartet, dass das Implantatsegment stetig wächst, da hormonelle Intrauterinpessare zur Langzeitbehandlung von Dysmenorrhoe immer beliebter werden.

Nach Endnutzer

: Der Markt ist in Krankenhäuser, Fachzentren, ambulante Operationszentren und weitere segmentiert. Krankenhäuser erwirtschafteten den größten Umsatzanteil, was auf die hohe Anzahl an Konsultationen und Behandlungen im ambulanten und stationären Krankenhausbereich zurückzuführen ist. Fachzentren werden voraussichtlich stark wachsen, da gynäkologische Kliniken zunehmend maßgeschneiderte Behandlungspläne und minimalinvasive Eingriffe anbieten.

Nach Vertriebskanal:

Das Vertriebskanalsegment umfasst Apotheken, Einzelhandel, Direktvertrieb und weitere. Apotheken bleiben der wichtigste Vertriebskanal, unterstützt durch starke OTC-Medikamentenverkäufe und die Erfüllung von Rezepten. Der Einzelhandel, einschließlich E-Commerce-Plattformen, verzeichnet aufgrund der Verbraucherpräferenz für bequemen Zugang und Lieferung nach Hause ein starkes Wachstum.

Regionale Marktanalyse zur Behandlung von Menstruationsbeschwerden

- Nordamerika wird voraussichtlich einen bedeutenden Marktanteil im Markt für die Behandlung von Menstruationsbeschwerden halten, was auf die hohe Prävalenz von Dysmenorrhoe bei Frauen und eine gut ausgebaute Gesundheitsinfrastruktur zurückzuführen ist. Die USA tragen maßgeblich zu diesem Markt bei, unterstützt durch ein steigendes Bewusstsein, einen starken Versicherungsschutz und ein breites Angebot an rezeptfreien und verschreibungspflichtigen Behandlungen. Auch Kanada und Mexiko verzeichnen dank des verbesserten Zugangs zu Gesundheitsdiensten für Frauen und der zunehmenden Aufklärung über Menstruationspflege ein stetiges Wachstum.

- Verbraucherinnen in der Region legen großen Wert auf wirksame Schmerzlinderung, Komfort und die Möglichkeit, aus verschiedenen Behandlungsmöglichkeiten, darunter nicht-pharmakologische Therapien und fortschrittliche Medikamente, wählen zu können. Die Bereitschaft, proaktiv nach medizinischen Lösungen für Menstruationsbeschwerden zu suchen, wächst. Dies wird durch gezielte Aufklärungskampagnen und Initiativen, die Menstruationsgesundheit als wesentlichen Aspekt des allgemeinen Wohlbefindens positionieren, zusätzlich gefördert.

- Diese weitverbreitete Akzeptanz wird außerdem durch hohe Gesundheitsausgaben, eine technikaffine Bevölkerung und die wachsende Popularität des E-Commerce und des Apothekeneinzelhandels unterstützt, wodurch sich eine umfassende Behandlung von Menstruationsbeschwerden in den nordamerikanischen Ländern als bevorzugter Ansatz etabliert hat.

Markteinblick in die Behandlung von Menstruationsbeschwerden in den USA:

Die USA sind der dominierende Markt für die Behandlung von Menstruationsbeschwerden in Nordamerika und erzielen mit 75 % den größten Umsatzanteil. Das Wachstum wird durch das hohe Bewusstsein für Menstruationsgesundheit, die breite Verfügbarkeit rezeptfreier und verschreibungspflichtiger Medikamente sowie einen soliden Versicherungsschutz vorangetrieben. Verbraucher legen zunehmend Wert auf wirksame Schmerzlinderungslösungen, sowohl pharmazeutische als auch nicht-pharmakologische, unterstützt durch ein starkes Apothekennetz und wachsende E-Commerce-Plattformen. Öffentliche Gesundheitsinitiativen, arbeitgeberfinanzierte Wellnessprogramme und die Integration der Menstruationsgesundheit in umfassendere Gesundheitsrichtlinien für Frauen kurbeln die Marktnachfrage zusätzlich an.

Markteinblick in die Behandlung von Menstruationsbeschwerden in Kanada:

Kanada nimmt eine bedeutende Position auf dem nordamerikanischen Markt für die Behandlung von Menstruationsbeschwerden ein. Dies wird durch steigende Investitionen im Gesundheitswesen, eine allgemeine Krankenversicherung und ein wachsendes öffentliches Bewusstsein für Menstruationsgesundheit begünstigt. Der gleichberechtigte Zugang zu Menstruationsprodukten und Aufklärung rückt zunehmend in den Fokus, was indirekt die Nachfrage nach Schmerzbehandlungslösungen fördert. Der Markt profitiert von einer Mischung aus traditionellen Medikamenten, alternativen Therapien und einem steigenden Interesse an ganzheitlichen und nachhaltigen Optionen zur Linderung von Menstruationsbeschwerden.

Markteinblick in die Behandlung von Menstruationsbeschwerden in Mexiko:

Der Markt für Menstruationsbeschwerden in Mexiko wächst stetig. Dies wird durch den Ausbau der Gesundheitsinfrastruktur, das steigende Bewusstsein für Menstruationsbeschwerden und Bemühungen zur Reduzierung der Stigmatisierung von Menstruationsbeschwerden unterstützt. Mit dem verbesserten Zugang zu Gesundheitsdienstleistungen greifen Verbraucher zunehmend auf pharmazeutische und nicht-medikamentöse Lösungen zurück. Staatliche und nichtstaatliche Initiativen zur Förderung der Frauengesundheit und Menstruationshygiene tragen neben der zunehmenden Urbanisierung und den steigenden verfügbaren Einkommen zusätzlich zum Marktwachstum bei.

Marktanteil der Behandlung von Menstruationsbeschwerden

Die Smart-Lock-Branche wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Bayer AG (Leverkusen, Deutschland)

- GlaxoSmithKline plc (London, Vereinigtes Königreich)

- Pfizer Inc. (New York, USA)

- Teva Pharmaceuticals USA, Inc. (Parsippany, New Jersey, USA)

- Color Seven Co., Ltd. (Seoul, Südkorea)

- Beurer GmbH (Ulm, Deutschland)

- Mylan NV (Canonsburg, Pennsylvania, USA)

- Boehringer Ingelheim International GmbH (Ingelheim am Rhein, Deutschland)

- PMS4PMS, LLC (Informationen zum Hauptsitz nicht ohne weiteres verfügbar)

- Sanofi (Paris, Frankreich)

- Nobelpharma Co., Ltd. (Informationen zum Hauptsitz nicht ohne weiteres verfügbar)

- ObsEva (Genf, Schweiz)

- Myovant Sciences Ltd. (Basel, Schweiz)

- AbbVie Inc. (Nord-Chicago, Illinois, USA)

- BioElectronics Corporation (Frederick, Maryland, USA)

- LIVIA (Informationen zum Hauptsitz nicht ohne weiteres verfügbar)

- Alvogen (Pine Brook, New Jersey, USA)

- Cumberland Pharmaceuticals Inc. (Nashville, Tennessee, USA)

- Lupin Pharmaceuticals, Inc. (Baltimore, Maryland, USA)

- Janssen Pharmaceuticals, Inc. (Titusville, New Jersey, USA)

- Sun Pharmaceutical Industries Ltd. (Mumbai, Indien)

Neueste Entwicklungen auf dem nordamerikanischen Markt für die Behandlung von Menstruationsbeschwerden

- Im März 2025 brachte Samphire Neuroscience, ein Pionier der Neurotechnologie, Nettle™ offiziell auf den Markt, sein CE-zertifiziertes Gehirngerät zur Linderung sowohl psychischer als auch physischer Menstruationsbeschwerden. Diese Initiative unterstreicht das Engagement des Unternehmens, innovative, nicht-pharmakologische Schmerzlinderungslösungen anzubieten, die auf die wachsende nordamerikanische Nachfrage nach alternativem und technologiebasiertem Menstruationsmanagement zugeschnitten sind. Mit seiner Expertise in der transkraniellen Gleichstromstimulation (tDCS) lindert Samphire Neuroscience nicht nur Beschwerden, sondern stärkt auch seine Position im schnell wachsenden Markt für Femtech und digitale Therapeutika.

- Im Jahr 2024 konzentrierte sich die Bayer AG weiterhin strategisch auf die Weiterentwicklung der Behandlung von Endometriose-assoziierten Beckenschmerzen, einer bedeutenden Ursache für sekundäre Dysmenorrhoe in Nordamerika. Dieses anhaltende Engagement, das sich in der kontinuierlichen Forschung und Vermarktung von Produkten wie Visanne widerspiegelt, unterstreicht das Engagement des Unternehmens, wirksame medizinische Lösungen für komplexe gynäkologische Schmerzzustände zu entwickeln. Mithilfe ihrer umfangreichen Forschungs- und Entwicklungskapazitäten und ihrer etablierten pharmazeutischen Expertise befasst sich die Bayer AG nicht nur mit chronischen Schmerzen, sondern stärkt auch ihre führende Position im sich schnell entwickelnden Bereich der Frauengesundheit.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.