North America Meat Poultry And Seafood Processing Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

5.57 Billion

USD

8.36 Billion

2024

2032

USD

5.57 Billion

USD

8.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 8.36 Billion | |

|

|

|

|

Marktsegmentierung für Maschinen zur Fleisch-, Geflügel- und Fischverarbeitung in Nordamerika nach Maschinentyp (Portioniermaschinen, Frittiermaschinen, Filtermaschinen, Beschichtungsmaschinen, Kochmaschinen, Räuchermaschinen, Schlacht-/Schlachtmaschinen, Kühlmaschinen, Hochdruckverarbeitungsanlagen, Massagegeräte u. a.), Verarbeitungsprozess (Zerkleinerung, Vergrößerung, Homogenisierung, Mischen u. a.), Betriebsart (automatisch, halbautomatisch, manuell), Anwendung (frisch verarbeitet, roh gekocht, vorgegart, roh fermentiert, getrocknet, gepökelt, gefroren u. a.), Funktion (Schneiden, Mischen, Zartmachen, Füllen, Marinieren, Zerkleinern, Mahlen, Räuchern, Schlachten & Entfedern, Entbeinen & Häuten, Ausweiden, Filetieren u. a.), Art der verarbeiteten Produkte (Fleisch, Geflügel und Fisch) – Branchentrends und Prognose bis 2032

Wie groß ist der nordamerikanische Markt für Fleisch-, Geflügel- und Fischverarbeitungsanlagen und wie hoch ist seine Wachstumsrate?

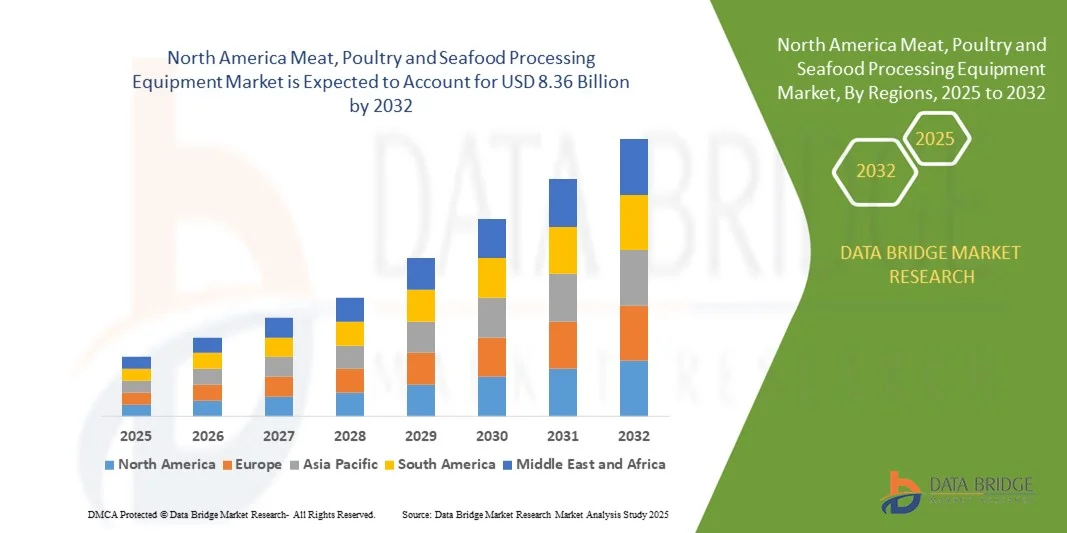

- Der Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten in Nordamerika hatte im Jahr 2024 einen Wert von 5,57 Milliarden US-Dollar und wird voraussichtlich bis 2032 auf 8,36 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 5,2 % im Prognosezeitraum entspricht.

- Der steigende Konsum von verarbeiteten Fleisch-, Geflügel- und Fischprodukten sowie die wachsende Zahl von Fast-Food- und Restaurantketten führen zu einer erhöhten Nachfrage nach qualitativ hochwertigeren Fleisch- und Fischverarbeitungsprodukten. Auch technologische Fortschritte im Anlagenbau, insbesondere in der Fleisch-, Geflügel- und Fischverarbeitung, haben den Marktwert aktuell gesteigert.

- Zu den Faktoren, die das Wachstum des Marktes hemmen, zählen hohe Kapitalinvestitionen und der langsame Austausch von Geräten aufgrund ihrer längeren Lebensdauer.

Was sind die wichtigsten Erkenntnisse zum Markt für Maschinen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten?

- Die zunehmende Automatisierung in der Lebensmittelverarbeitungsindustrie kann die beste Chance für den Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten darstellen.

- Hohe Maschinenkosten, eine schwache Infrastruktur in Entwicklungsländern und ein übermäßiger Wasserverbrauch bei der Verarbeitung und der Reinigung von Rohrleitungen können eine Bedrohung für den Markt darstellen.

- Die USA dominierten 2025 den nordamerikanischen Markt für Fleisch-, Geflügel- und Fischverarbeitungsanlagen und erzielten mit 42,6 % den größten Umsatzanteil. Treiber dieser Entwicklung waren die rasche Industrialisierung, die hohe Automatisierungsrate und die steigenden Investitionen in fortschrittliche Lebensmittelverarbeitungstechnologien.

- Der kanadische Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten wird voraussichtlich mit einer Wachstumsrate von 11,2 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die steigende Nachfrage nach verarbeiteten und gefrorenen Fleisch-, Geflügel- und Meeresfrüchteprodukten sowie staatliche Initiativen zur Modernisierung des Lebensmittelverarbeitungssektors.

- Das Segment der Schneide- und Portioniermaschinen dominierte den Markt im Jahr 2025 mit einem Marktanteil von 42,8 %, angetrieben durch die steigende Nachfrage nach präzisem Schneiden, Portionskontrolle und automatisiertem Trimmen in großtechnischen Fleisch- und Fischverarbeitungsbetrieben.

Berichtsumfang und Marktsegmentierung für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung

|

Attribute |

Wichtigste Markteinblicke in Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und den regulatorischen Rahmen. |

Was ist der wichtigste Trend auf dem Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten?

Automatisierungs- und nachhaltige Verarbeitungstechnologien

- Ein wichtiger Trend auf dem Markt für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung ist die rasche Einführung von Automatisierung und nachhaltigen Verarbeitungssystemen. Diese Systeme sind darauf ausgelegt, die Effizienz zu steigern, Abfall zu reduzieren und die Lebensmittelsicherheit zu verbessern. Der zunehmende Fokus auf energieeffiziente Betriebsabläufe und hygienisches Design treibt die Hersteller zu umweltbewussten Innovationen an.

- Unternehmen integrieren zunehmend Robotik, KI -basierte Inspektionssysteme und IoT-fähige Überwachungssysteme, um Entbeinungs-, Schneide- und Verpackungsprozesse zu optimieren, Präzision zu gewährleisten und menschliche Fehler zu reduzieren.

- Darüber hinaus gewinnt der Einsatz von wassersparenden und abfallreduzierenden Technologien zunehmend an Bedeutung, da die Verarbeiter bestrebt sind, Nachhaltigkeitsvorschriften zu erfüllen und die Betriebskosten zu senken.

- Ein bemerkenswertes Beispiel ist die GEA Group Aktiengesellschaft (Deutschland), die ihre Sustainable Processing Line eingeführt hat. Diese integriert intelligente Automatisierung, effiziente Kühl- und Abfallverwertungssysteme, um die Fleisch- und Fischproduktion zu optimieren.

- Dieser Wandel hin zu intelligenten, umweltfreundlichen und energiesparenden Lösungen transformiert die Branche und fördert Investitionen in Anlagen der nächsten Generation, die Produktivität, Sicherheit und Nachhaltigkeit in Einklang bringen.

Was sind die wichtigsten Einflussfaktoren auf den Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten?

- Der weltweit steigende Konsum proteinreicher Lebensmittel und die wachsende Nachfrage nach verarbeiteten Fleisch- und Fischprodukten sind die wichtigsten Treiber des Marktwachstums. Verbraucher suchen nach bequemen, sicheren und hygienisch verarbeiteten Lebensmitteln, was die Modernisierung der Produktionsanlagen vorantreibt.

- Beispielsweise erweiterte Marel (Island) im Jahr 2025 seine Produktpalette um automatisierte Portionierungs- und Schneidesysteme, die die Ausbeutegenauigkeit und Produktkonsistenz in der Geflügel- und Fischverarbeitung verbessern.

- Die Branche profitiert zudem von staatlichen Investitionen in Lebensmittelsicherheitsvorschriften und Exportinfrastruktur, was die Nachfrage nach fortschrittlichen Verarbeitungsmaschinen fördert.

- Darüber hinaus hat der Aufstieg von Fertiggerichten und Tiefkühlprodukten die Modernisierung der Anlagen zur Verbesserung von Verpackung, Kühlung und Lagerung beschleunigt.

- Innovationen wie KI-gestützte Sortiersysteme, hygienische Förderbänder und Vakuumiertechnologien verbessern die Produktqualität weiter, verlängern die Haltbarkeit und treiben die Marktexpansion in industriellen und kommerziellen Segmenten voran.

Welcher Faktor bremst das Wachstum des Marktes für Verarbeitungsanlagen für Fleisch, Geflügel und Meeresfrüchte?

- Hohe Investitions- und Wartungskosten stellen weiterhin große Herausforderungen dar, die die Verbreitung, insbesondere bei kleinen und mittleren Verarbeitungsbetrieben, einschränken. Geräte wie automatische Entbeinungsmaschinen und Vakuumfüllanlagen erfordern erhebliche Vorabinvestitionen.

- Beispielsweise erhöhten im Jahr 2025 steigende Preise für Edelstahl und elektronische Bauteile die Herstellungskosten von Anlagen für wichtige Akteure wie BAADER (Deutschland) und JBT Corporation (USA), was sich negativ auf die Gewinnmargen auswirkte.

- Darüber hinaus können komplexe Reinigungs- und Desinfektionsanforderungen die Ausfallzeiten verlängern und die Produktionseffizienz beeinträchtigen.

- Umwelt- und Energievorschriften fordern Unternehmen zudem dazu auf, ihre Systeme kontinuierlich zu modernisieren, um geringere Emissionen und einen reduzierten Wasserverbrauch zu erzielen.

- Trotz dieser Hürden begegnen Unternehmen wie die GEA Group Aktiengesellschaft und Key Technology (USA) diesen Problemen mit modularen, energieeffizienten und leicht zu reinigenden Designs. Die Balance zwischen Kosten, Compliance und Nachhaltigkeit bleibt entscheidend für langfristiges Wachstum und Wettbewerbsfähigkeit am Markt.

Wie ist der Markt für Maschinen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten segmentiert?

Der Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten ist segmentiert nach Anlagentyp, Verfahren, Betriebsweise, Anwendung, Funktion und Art des verarbeiteten Produkts.

- Nach Gerätetyp

Basierend auf der Gerätetyp ist der Markt in Portionieranlagen, Frittieranlagen, Filteranlagen, Beschichtungsanlagen, Kochanlagen, Räucheranlagen, Schlachtanlagen, Kühlanlagen, Hochdruckverarbeitungsanlagen (HPP), Massageanlagen und Sonstiges unterteilt. Das Segment der Schneide- und Portionieranlagen dominierte den Markt im Jahr 2025 mit einem Marktanteil von 42,8 %. Treiber dieser Entwicklung war die steigende Nachfrage nach präzisem Schneiden, Portionskontrolle und automatisiertem Trimmen in großen Fleisch- und Fischverarbeitungsbetrieben. Diese Systeme steigern die Effizienz, minimieren Abfall und gewährleisten eine gleichbleibende Produktqualität.

Das Segment der Hochdruckverarbeitungsanlagen (HPP) wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) verzeichnen. Treiber dieser Entwicklung ist die zunehmende Nutzung nicht-thermischer Konservierungstechnologien zur Verbesserung der Haltbarkeit und zur Gewährleistung keimfreier Fleisch- und Fischprodukte, ohne dabei den Nährwert oder die Textur zu beeinträchtigen.

- Durch Prozess

Basierend auf den Verarbeitungsprozessen wird der Markt für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung in die Segmente Zerkleinerung, Vergrößerung, Homogenisierung, Mischen und Sonstiges unterteilt. Das Segment Zerkleinerung dominierte den Markt im Jahr 2025 mit einem Marktanteil von 49,5 %, da Mahlen, Schneiden und Zerkleinern entscheidende erste Schritte der Fleischverarbeitung darstellen und eine gleichmäßige Textur und Produktuniformität bei Würsten, Frikadellen und Fischprodukten gewährleisten. Die Effizienz moderner Zerkleinerungssysteme trägt zur Optimierung von Durchsatz und Qualität bei.

Im Segment der Mischtechnik wird von 2026 bis 2033 voraussichtlich das schnellste jährliche Wachstum (CAGR) erwartet, getrieben durch die steigende Nachfrage nach Fleischmischungen, Marinaden und verarbeiteten Meeresfrüchten. Moderne Vakuum- und Paddelmischer werden zunehmend eingesetzt, um eine gleichmäßige Verteilung der Zutaten, einen gleichbleibenden Geschmack und eine verbesserte Produktstabilität zu gewährleisten.

- Nach Betriebsart

Basierend auf der Betriebsart ist der Markt in automatische, halbautomatische und manuelle Systeme unterteilt. Das Segment der automatischen Systeme dominierte den Markt im Jahr 2025 mit einem Marktanteil von 56,7 %. Treiber dieser Entwicklung ist die zunehmende Automatisierung, die dazu beiträgt, Arbeitskosten zu senken, die Produktionseffizienz zu steigern und die Einhaltung von Hygienevorschriften zu gewährleisten. Automatisierte Systeme integrieren Robotik, Sensoren und Software, um komplexe Aufgaben wie das Entbeinen und Verpacken präzise auszuführen.

Das Segment der halbautomatischen Systeme wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen, da kleine und mittlere Verarbeitungsbetriebe die Vorteile der Automatisierung mit Wirtschaftlichkeit in Einklang bringen wollen. Halbautomatische Systeme bieten Flexibilität, geringere Betriebskomplexität und Anpassungsfähigkeit an unterschiedliche Produktionsgrößen.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt für Maschinen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten in folgende Segmente unterteilt: Frisch verarbeitet, roh gekocht, vorgegart, roh fermentiert, getrocknetes Fleisch, Pökelwaren, Tiefkühlprodukte und Sonstiges. Das Segment „Frisch verarbeitet“ hielt 2025 mit 51,2 % den größten Marktanteil. Dies ist auf den hohen Konsum von minimal verarbeiteten Fleisch- und Meeresfrüchteprodukten wie Würstchen, Nuggets und Frikadellen zurückzuführen, die moderne Schneide-, Misch- und Beschichtungsmaschinen erfordern. Die Nachfrage wird durch die Präferenz der Verbraucher für frisch schmeckende, küchenfertige Gerichte gestützt.

Das Segment Tiefkühlprodukte wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen, angetrieben durch die weltweit steigende Beliebtheit von Tiefkühlfisch und -fertiggerichten. Verbesserungen bei Gefriertechnologien und der Kühlkettenlogistik ermöglichen eine längere Haltbarkeit sowie den Erhalt von Textur und Geschmack.

- Nach Funktion

Basierend auf der Funktion wird der Markt in Schneiden, Mischen, Zartmachen, Füllen, Marinieren, Tranchieren, Mahlen, Räuchern, Schlachten und Entfedern, Entbeinen und Häuten, Ausnehmen, Filetieren und Sonstiges unterteilt. Das Segment Schneiden und Tranchieren dominierte den Markt im Jahr 2025 mit einem Marktanteil von 46,4 %, da es eine Kernfunktion in nahezu allen Fleisch- und Fischverarbeitungsbetrieben darstellt. Die Nachfrage nach Präzisionsschneidesystemen wird durch das Bedürfnis nach gleichmäßiger Dicke, Abfallreduzierung und Erhalt der Produktqualität angetrieben.

Das Segment Entbeinen und Häuten dürfte von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, getrieben durch den Bedarf an hocheffizienten Systemen, die den manuellen Arbeitsaufwand minimieren, die Ausbeute steigern und die Hygiene verbessern, insbesondere in der Geflügel- und Fischverarbeitung.

- Nach Art der verarbeiteten Produkte

Basierend auf der Art der verarbeiteten Produkte ist der Markt in Fleisch, Geflügel und Meeresfrüchte unterteilt. Das Segment Fleisch dominierte den Markt im Jahr 2025 mit einem Marktanteil von 54,9 %, was auf den steigenden Konsum von verarbeiteten Fleischprodukten wie Wurst, Speck und Schinken, insbesondere in Nordamerika, zurückzuführen ist. Fleischverarbeitungsanlagen benötigen hochentwickelte Systeme zum Zerkleinern, Pökeln und Verpacken, um Sicherheit und Qualität zu gewährleisten.

Das Segment Meeresfrüchte wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen, gestützt durch die steigende weltweite Nachfrage nach verarbeitetem Fisch, Garnelen und Schalentieren. Zunehmende Exporte von Meeresfrüchten sowie technologische Fortschritte beim Filetieren und Gefrieren treiben die Automatisierung und den Kapazitätsausbau in Meeresfrüchteverarbeitungsbetrieben weltweit voran.

Welche Region hält den größten Anteil am Markt für Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten?

- Die USA dominierten 2025 den nordamerikanischen Markt für Fleisch-, Geflügel- und Fischverarbeitungsanlagen und erzielten mit 42,6 % den größten Umsatzanteil. Treiber dieser Entwicklung waren die rasche Industrialisierung, die hohe Automatisierungsrate und die steigenden Investitionen in fortschrittliche Lebensmittelverarbeitungstechnologien.

- Die starke Produktionsbasis des Landes, verbunden mit dem regulatorischen Fokus auf Lebensmittelsicherheit und Qualitätsstandards, begünstigt die umfassende Produktion und Nutzung moderner Anlagen zur Verarbeitung von Fleisch, Geflügel und Meeresfrüchten. Führende in- und ausländische Unternehmen investieren in energieeffiziente, automatisierte und rückverfolgbare Systeme und treiben so den Markt voran.

- Insgesamt hat die Führungsrolle der USA in den Bereichen Innovation, Infrastruktur und Technologieeinführung sie zum dominierenden Land auf dem nordamerikanischen Markt für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung gemacht.

Einblick in den kanadischen Markt für Fleisch-, Geflügel- und Fischverarbeitungsanlagen

Der kanadische Markt für Maschinen zur Fleisch-, Geflügel- und Fischverarbeitung wird voraussichtlich mit 11,2 % das schnellste Wachstum verzeichnen. Treiber dieses Wachstums sind die steigende Nachfrage nach verarbeiteten und tiefgekühlten Fleisch-, Geflügel- und Fischprodukten sowie staatliche Initiativen zur Modernisierung der Lebensmittelverarbeitung. Kanadische Hersteller investieren verstärkt in automatisierte Schneide-, Entbeinungs-, Marinier- und Verpackungslösungen, um die betriebliche Effizienz zu steigern und die Einhaltung der Lebensmittelsicherheitsvorschriften zu gewährleisten. Nachhaltigkeitsmaßnahmen wie energieeffiziente Kühlung und reduzierter Wasserverbrauch tragen zusätzlich zum Wachstum bei. Kanadas Fokus auf Innovation, Automatisierung und Qualitätssicherung positioniert das Land als wichtigen Wachstumsmotor in Nordamerika.

Einblick in den mexikanischen Markt für Fleisch-, Geflügel- und Fischverarbeitungsanlagen

Der mexikanische Markt für Maschinen zur Fleisch-, Geflügel- und Fischverarbeitung wächst stetig. Treiber dieser Entwicklung sind der steigende Inlandsverbrauch verarbeiteter Proteinprodukte und die wachsende Exportnachfrage in die USA und andere lateinamerikanische Länder. Mexikanische Hersteller setzen moderne Schlacht-, Schneide-, Verpackungs- und Portionieranlagen ein, um Hygienestandards zu erfüllen und die Produktivität zu steigern. Staatliche Förderprogramme zur Modernisierung von Verarbeitungsbetrieben sowie zunehmende Investitionen in die Kühlketteninfrastruktur beschleunigen die Marktdurchdringung zusätzlich. Dank seiner strategischen Lage, seiner qualifizierten Arbeitskräfte und seiner wachsenden Industriebasis trägt Mexiko maßgeblich zur Stärkung des nordamerikanischen Marktes für Maschinen zur Fleisch-, Geflügel- und Fischverarbeitung bei.

Welche sind die führenden Unternehmen auf dem Markt für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung?

Die Branche der Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Equipamientos Cárnicos, SL (Spanien)

- BRAHER INTERNACIONAL, SA (Spanien)

- RZPO (Polen)

- Minerva Omega Group srl (Italien)

- GEA Group Aktiengesellschaft (Deutschland)

- RISCO SpA (Italien)

- PSS SVIDNÍK, as (Slowakei)

- Metalbud (Polen)

- BAADER (Deutschland)

- JBT Corporation (USA)

- Marel (Island)

- Schlüsseltechnologie (USA)

- Illinois Tool Works Inc. (USA)

- Die Middleby Corporation (USA)

- Bettcher Industries, Inc. (USA)

- BIZERBA (Deutschland)

Welche aktuellen Entwicklungen gibt es auf dem nordamerikanischen Markt für Anlagen zur Fleisch-, Geflügel- und Fischverarbeitung?

- Im Februar 2025 ging JBT Marel eine strategische Allianz mit Ace Aquatec ein und ernannte das Unternehmen zum bevorzugten Lieferanten von Betäubungslösungen für Fisch in Lebensmittelverarbeitungsmaschinen. Diese Zusammenarbeit stärkt JBT Marels Position im Bereich der nachhaltigen Fischverarbeitung und erweitert das Portfolio an innovativen Maschinen.

- Im Januar 2025 übernahm das US-amerikanische Unternehmen JBT die Firma Marel vollständig und gründete die neue JBT Marel Corporation. Durch diesen Zusammenschluss entsteht ein weltweit führender Anbieter von Lebensmittelverarbeitungstechnologien, der Effizienz und Innovation in verschiedenen Lebensmittelsektoren steigert.

- Im November 2024 gab Fortifi Food Processing Solutions die Übernahme des geistigen Eigentums, der Kundenbeziehungen, ausgewählter Lagerbestände und des Anlagevermögens der JWE-BANSS GmbH (Deutschland), einem führenden Hersteller von Proteinverarbeitungsanlagen, bekannt. Diese Akquisition stärkt Fortifis Expertise in der Fleischverarbeitung und festigt seine Marktpräsenz in Nordamerika.

- Im Juli 2024 brachte Ross Industries die Membranentkernungsmaschine AMS 400 auf den Markt, eine speziell für handwerkliche und mittelständische Fleischverarbeitungsbetriebe entwickelte Lösung zur Verbesserung der betrieblichen Effizienz und der Endproduktqualität. Diese Produkteinführung unterstreicht das Bestreben von Ross Industries, den sich wandelnden Automatisierungsbedarf kleiner und mittlerer Lebensmittelproduzenten zu decken.

- Im März 2024 wurde Fortifi Food Processing Solutions offiziell als einheitliche globale Plattform für Marken im Bereich Lebensmittelverarbeitung und -automatisierung gegründet, die auf fünf Kontinenten tätig sind. Diese Gründung markiert einen strategischen Schritt hin zu integrierten Lösungen für die Verarbeitung von Proteinen, Milchprodukten sowie Obst und Gemüse.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.