North America Interventional Cardiology Peripheral Vascular Devices Market

Marktgröße in Milliarden USD

CAGR :

%

USD

9,596.92 Million

USD

3.27 Million

2022

2029

USD

9,596.92 Million

USD

3.27 Million

2022

2029

| 2023 –2029 | |

| USD 9,596.92 Million | |

| USD 3.27 Million | |

|

|

|

|

Nordamerikanischer Markt für interventionelle Kardiologie und periphere Gefäßgeräte, nach Produkt ( Angioplastieballons , Stents, Katheter, Stentgrafts zur endovaskulären Aneurysma-Reparatur, Filter für die untere Hohlvene (IVC), Geräte zur Plaque-Modifikation, Zubehör und Geräte zur Veränderung des hämodynamischen Flusses), Typ (konventionell und Standard), Verfahren (Iliakalintervention, femoropopliteale Interventionen, Tibiainterventionen (unterhalb des Knies), periphere Angioplastie, arterielle Thrombektomie und periphere Atherektomie), Indikation ( periphere arterielle Verschlusskrankheit und Koronarintervention), Altersgruppe (Geriatrie, Erwachsene und Kinder), Endbenutzer (Krankenhäuser, ambulante Operationszentren , Pflegeeinrichtungen, Kliniken und andere), Vertriebskanal (Direktausschreibung, Drittanbieter und andere), Land (USA, Kanada und Mexiko), Branchentrends und Prognose bis 2029

Marktanalyse und Einblicke: Nordamerikanischer Markt für interventionelle Kardiologie und periphere Gefäßgeräte

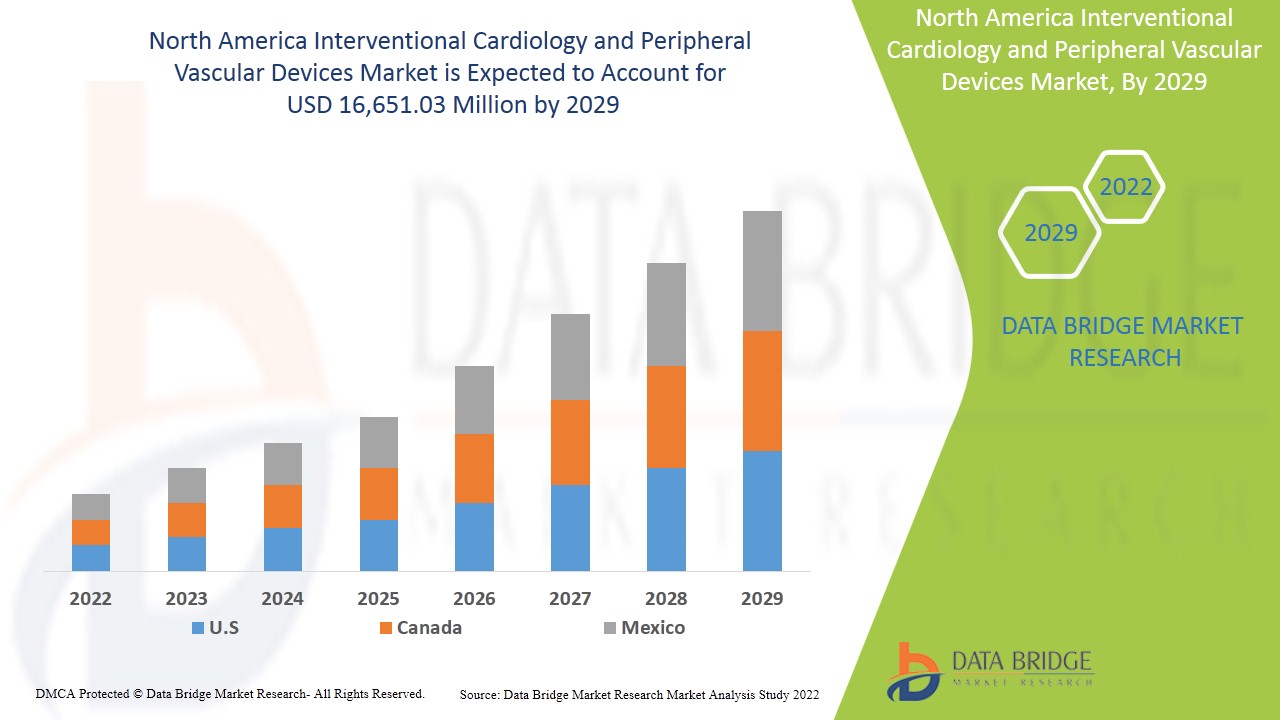

Für den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte wird im Prognosezeitraum 2022 bis 2029 ein Marktwachstum erwartet. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,7 % wächst und von 9.596,92 Millionen USD im Jahr 2021 auf 16.651,03 Millionen USD im Jahr 2029 ansteigen dürfte. Die zunehmende Verbreitung von koronaren Herzkrankheiten , ischämischen Herzkrankheiten und Gefäßerkrankungen sowie das gestiegene Bewusstsein für die rechtzeitige Behandlung und Nutzung der Geräte sind wahrscheinlich die Haupttreiber, die die Nachfrage des Marktes im Prognosezeitraum ankurbeln.

Der Begriff interventionelle Kardiologie bezeichnet einen medizinischen Bereich innerhalb der Kardiologie und der peripheren Gefäßchirurgie. Er nutzt erweiterte, konventionelle und fortgeschrittene Diagnosetechniken zur Beurteilung von Blutfluss und Druck in den Koronararterien und Herzkammern sowie technische Verfahren und Medikamente zur Behandlung von Anomalien, die die Funktion des Herz-Kreislauf-Systems beeinträchtigen. Die interventionelle Kardiologie und periphere Gefäßchirurgie werden eingesetzt, da sie eine sitzende Lebensweise ermöglichen. Sie reduzieren die Komplikationen chronischer Herzerkrankungen wie koronarer Herzkrankheit, ischämischer Herzkrankheit und Gefäßerkrankungen.

Koronare Herzkrankheiten sind die häufigste Todesursache bei Frauen. Das Wissen über Herz- und Gefäßerkrankungen kann zu einem gesunden Lebensstil beitragen. Ein angemessenes Bewusstsein für Symptome und deren Risikofaktoren kann dazu beitragen, die Belastung der Bevölkerung durch veränderbare Risikofaktoren zu reduzieren und Präventions- und Kontrollstrategien zu entwickeln. Das Bewusstsein für die Symptome von Herz-Kreislauf- und Gefäßerkrankungen ermöglicht eine rechtzeitige Behandlung.

Die treibenden Kräfte für das Wachstum des nordamerikanischen Marktes für interventionelle Kardiologie und periphere Gefäßchirurgie sind die zunehmende Prävalenz von Koronararterienerkrankungen, ischämischen Herzkrankheiten und Gefäßerkrankungen, das gestiegene Bewusstsein für die rechtzeitige Behandlung und Anwendung der Geräte, technologische Fortschritte in der Kardiologie und bei peripheren Gefäßchirurgiegeräten, das gestiegene Interesse an nicht-invasiver Chirurgie und günstige Erstattungsrichtlinien. Hemmend für den Markt dürften jedoch die steigenden Gerätekosten, die mit deren Anwendung verbundenen Risiken, die Zunahme von Produktrückrufen und die Verfügbarkeit alternativer Behandlungsmethoden sein. Strategische Initiativen von Marktteilnehmern, steigende Gesundheitsausgaben und verstärkte Forschungs- und Entwicklungsaktivitäten sowie der wachsende Anteil geriatrischer Patienten könnten dem nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßchirurgie hingegen Wachstumschancen eröffnen. Der Bedarf an qualifiziertem Fachwissen, die fehlende Krankenhausinfrastruktur und behördliche Genehmigungen können den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßchirurgie vor Herausforderungen stellen.

Der nordamerikanische Marktbericht für interventionelle Kardiologie und periphere Gefäßgeräte enthält Details zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, dem Einfluss nationaler und lokaler Marktteilnehmer, analysiert Chancen hinsichtlich neuer Umsatzfelder, Änderungen der Marktregulierung, Produktzulassungen, strategischen Entscheidungen, Produkteinführungen, geografischer Expansion und technologischen Innovationen. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analysten-Briefing. Unser Team unterstützt Sie bei der Entwicklung einer umsatzwirksamen Lösung, um Ihr gewünschtes Ziel zu erreichen.

Nordamerika: Marktumfang und Marktgröße für interventionelle Kardiologie und periphere Gefäßgeräte

Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist in sieben Segmente unterteilt: Produkt, Typ, Verfahren, Indikation, Altersgruppe, Endbenutzer und Vertriebskanal.

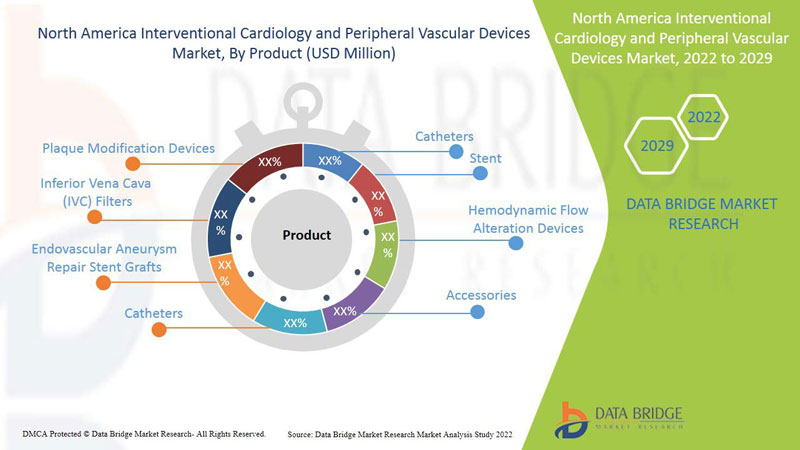

- Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist produktbezogen in Angioplastieballons, Stents, Katheter, Stentgrafts zur endovaskulären Aneurysma-Reparatur, Filter für die untere Hohlvene (IVC), Geräte zur Plaque-Modifikation, Zubehör und Geräte zur hämodynamischen Flussänderung unterteilt. Im Jahr 2022 wird das Segment der Angioplastieballons voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren. Dies ist auf die Zunahme peripherer arterieller Erkrankungen, das erhöhte Risiko einer sitzenden Lebensweise, den technologischen Fortschritt bei Angioplastieballons und die bestehenden Erstattungsrichtlinien im US-Gesundheitswesen für die Behandlung von Herzerkrankungen zurückzuführen.

- Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist nach Typ in konventionelle und Standardgeräte unterteilt. Im Jahr 2022 wird das konventionelle Segment voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren. Dies ist auf die steigende Prävalenz von Herz-Kreislauf-Erkrankungen wie Koronararterienerkrankungen und Erkrankungen der Halsschlagadern zurückzuführen, und die Verfügbarkeit und Präferenz konventioneller interventioneller Kardiologie- und peripherer Gefäßgeräte bei Ärzten und Kardiologen in Krankenhäusern in den USA und Kanada ist groß.

- Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist nach Verfahren in Beckeneingriffe, femoropopliteale Eingriffe, Tibiaeingriffe (unterhalb des Knies), periphere Angioplastie, arterielle Thrombektomie und periphere Atherektomie unterteilt. Aufgrund des technologischen Fortschritts der letzten zehn Jahre mit fortschrittlichen peripheren Angioplastiegeräten wird das Segment der peripheren Angioplastie voraussichtlich im Jahr 2022 den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren.

- Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist je nach Indikation in die Bereiche periphere arterielle Verschlusskrankheit und Koronarintervention unterteilt. Im Jahr 2022 wird das Segment periphere arterielle Verschlusskrankheit voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren, da periphere arterielle Verschlusskrankheiten zunehmen, die Zahl älterer Menschen zunimmt und die Zahl der Produktzulassungen zunimmt.

- Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte ist nach Altersgruppen in Geriatrie, Erwachsene und Pädiatrie unterteilt. Im Jahr 2022 wird das geriatrische Segment voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren. Geriatrie ist anfälliger für verschiedene Gefäßerkrankungen und bietet in den USA Erstattungsprogramme wie Medicare zur Behandlung älterer Menschen zu minimalen Kosten.

- Basierend auf dem Endverbraucher ist der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte in Krankenhäuser, ambulante Operationszentren, Pflegeeinrichtungen, Kliniken und andere segmentiert. Im Jahr 2022 wird das Krankenhaussegment voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte dominieren, da chronische Herzerkrankungen wie Koronararterienerkrankungen und Gefäßerkrankungen zunehmen, die Zahl der Operationen zunimmt, moderne Krankenhauseinrichtungen verfügbar sind und das Bewusstsein für die Behandlung chronischer Herzerkrankungen in Krankenhäusern steigt.

- Basierend auf den Vertriebskanälen ist der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte in Direktausschreibungen, Drittanbieter und andere unterteilt. Im Jahr 2022 wird das Segment der Drittanbieter voraussichtlich den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte aufgrund steigender Kundenpräferenzen, niedriger Beschaffungspreise und geringerer Kosteneinsparungen dominieren.

Nordamerika Interventionelle Kardiologie und periphere Gefäßgeräte Markt – Länderebene Analyse

Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte wird analysiert und es werden Informationen zur Marktgröße nach Produkt, Typ, Verfahren, Indikation, Altersgruppe, Endbenutzer und Vertriebskanal bereitgestellt.

Die im nordamerikanischen Marktbericht für interventionelle Kardiologie und periphere Gefäßgeräte abgedeckten Länder sind die USA, Kanada und Mexiko.

- Im Jahr 2022 werden die USA voraussichtlich dominieren, da sie den größten Verbrauchermarkt mit hohem BIP darstellen. Darüber hinaus haben die USA die höchsten Haushaltsausgaben weltweit und bieten Handelsabkommen mit mehreren Ländern an, was sie zum größten Markt für Konsumgüter macht. Die Patientenzahl steigt, wichtige Marktteilnehmer sind präsent und der technologische Fortschritt in der Region nimmt zu.

Der Länderteil des Berichts enthält zudem Informationen zu einzelnen marktbeeinflussenden Faktoren und regulatorischen Änderungen im Inland, die sich auf aktuelle und zukünftige Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzteilverkäufe, Länderdemografie, Regulierungsvorschriften und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte für die Prognose der Marktentwicklung einzelner Länder. Auch die Präsenz und Verfügbarkeit nordamerikanischer Marken sowie die Herausforderungen aufgrund starker oder geringer Konkurrenz durch lokale und inländische Marken sowie der Einfluss verschiedener Vertriebskanäle werden bei der Prognoseanalyse der Länderdaten berücksichtigt.

Das Wachstumspotenzial für interventionelle Kardiologie und periphere Gefäßgeräte in Schwellenländern und die strategischen Initiativen der Marktteilnehmer schaffen neue Möglichkeiten auf dem nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte

Der nordamerikanische Markt für interventionelle Kardiologie und periphere Gefäßgeräte bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das branchenspezifische Wachstum im Bereich der interventionellen Kardiologie und peripheren Gefäßgeräte, die Auswirkungen von Fortschritten in diesem Bereich sowie Änderungen der regulatorischen Rahmenbedingungen und deren Unterstützung für den Markt für interventionelle Kardiologie und periphere Gefäßgeräte. Die Daten sind für den Zeitraum 2019 bis 2021 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile für interventionelle Kardiologie und periphere Gefäßgeräte in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Marktes für interventionelle Kardiologie und periphere Gefäßgeräte bietet detaillierte Informationen nach Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Finanzdaten, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz und Technologie-Lebenslinienkurve. Die oben genannten Datenpunkte beziehen sich ausschließlich auf den Fokus des Unternehmens im Markt für interventionelle Kardiologie und periphere Gefäßgeräte.

Zu den großen Unternehmen, die Geräte für die interventionelle Kardiologie und periphere Gefäße anbieten, gehören unter anderem Medtronic, BD., Cordis., Abbott., Boston Scientific Corporation, Cook, Cardiovascular Systems, Inc., AngioDynamics., Edwards Lifesciences Corporation., Biosensors International Group, Ltd., OrbusNeich Medical Company Limited, Merit Medical Systems., Terumo Medical Corporation, B. Braun Melsungen AG, MicroPort Scientific Corporation, Lepu Medical Technology (Beijing) Co., Ltd. und Koninklijke Philips NV.

DBMR-Analysten kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Die strategischen Initiativen der Marktteilnehmer sowie neue technologische Fortschritte in der interventionellen Kardiologie und bei peripheren Gefäßgeräten in Nordamerika schließen die Lücke in der Behandlung chronischer Wunden.

Zum Beispiel,

- Im Januar 2022 gab OrbusNeich Medical Co. Ltd. die Markteinführung seines neuen Produkts „Scoreflex NC“ bekannt und erhielt die Zulassung (Premarket Approval, PMA) der US-amerikanischen Food and Drug Administration (FDA). Bei diesem Produkt handelt es sich um einen Dilatationskatheter für stenotische Koronararterienstenosen. Damit erweitert OrbusNeich sein Produktangebot.

Durch Zusammenarbeit, Joint Ventures und andere Strategien der Marktteilnehmer wird der Unternehmensmarkt im Bereich interventionelle Kardiologie und periphere Gefäßgeräte gestärkt, was den Unternehmen auch den Vorteil bietet, ihr Angebot für den nordamerikanischen Markt für interventionelle Kardiologie und periphere Gefäßgeräte zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN PREVALENCE OF CHRONIC DISEASES, SUCH AS CORONARY ARTERY DISEASE, ISCHEMIC HEART DISEASE AND VASCULAR DISEASES

6.1.2 AWARENESS AMONG THE POPULATION ABOUT THE TREATMENT AND USE OF THE DEVICES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.1.4 FAVORABLE REIMBURSEMENT POLICIES

6.1.5 INCREASED INTEREST FOR MINIMALLY INVASIVE PROCEDURES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.2 RISKS OBSERVED WHILE USING INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 AVAILABILITY OF ALTERNATE TREATMENTS

6.3 OPPORTUNITIES

6.3.1 GROWING GERIATRIC POPULATION

6.3.2 RISING HEALTHCARE EXPENDITURE

6.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.4 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES & REGULATIONS

6.4.2 LACK OF HOSPITAL INFRASTRUCTURE

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ANGIOPLASTY BALLOONS

8.2.1 OLD/NORMAL BALLOONS

8.2.2 DRUG ELUTING BALLOONS

8.2.3 CUTTING AND SCORING BALLOONS

8.3 STENT

8.3.1 ANGIOPLASTY STENTS

8.3.2 CORONARY STENTS

8.3.2.1 BARE-METAL STENTS

8.3.2.2 DRUG-ELUTING STENTS (DES)

8.3.2.3 BIO ABSORBABLE STENTS

8.3.3 PERIPHERAL STENTS

8.3.4 OTHERS

8.4 CATHETERS

8.4.1 ANGIOGRAPHY CATHETERS

8.4.2 GUIDING CATHETERS

8.4.3 OTHERS

8.5 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

8.5.1 ABDOMINAL AORTIC ANEURYSM

8.5.2 THORACIC AORTIC ANEURYSM

8.6 INFERIOR VENA CAVA (IVC) FILTERS

8.6.1 RETRIEVABLE FILTERS

8.6.2 PERMANENT FILTERS

8.7 PLAQUE MODIFICATION DEVICES

8.7.1 THROMBECTOMY DEVICES

8.7.2 ATHERECTOMY DEVICES

8.8 HEMODYNAMIC FLOW ALTERATION DEVICES

8.8.1 EMBOLIC PROTECTION DEVICES

8.8.2 CHRONIC TOTAL OCCLUSION DEVICES

8.9 OTHERS AND ACCESSORIES

8.9.1 GUIDEWIRES

8.9.2 INTRODUCER SHEATHS

8.9.3 BALLOON INFLATION DEVICES

8.9.4 VASCULAR CLOSURE DEVICES

8.9.5 OTHERS

9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 STENTS

9.2.2 CATHETERS

9.2.3 GUIDEWIRES

9.2.4 VASCULAR CLOSURE DEVICES (VCD)

9.2.5 OTHERS

9.3 ADVANCED

9.3.1 BALLOON CATHETERS

9.3.2 STENT GRAFTS

10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 PERIPHERAL ANGIOPLASTY

10.2.1 ANGIOPLASTY BALLOONS

10.2.2 STENT

10.2.3 CATHETERS

10.2.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.2.5 INFERIOR VENA CAVA (IVC) FILTERS

10.2.6 PLAQUE MODIFICATION DEVICES

10.2.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.2.8 OTHERS AND ACCESSORIES

10.3 ILIAC INTERVENTION

10.3.1 ANGIOPLASTY BALLOONS

10.3.2 STENT

10.3.3 CATHETERS

10.3.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.3.5 INFERIOR VENA CAVA (IVC) FILTERS

10.3.6 PLAQUE MODIFICATION DEVICES

10.3.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.3.8 OTHERS AND ACCESSORIES

10.4 TIBIAL (BELOW-THE-KNEE) INTERVENTIONS

10.4.1 ANGIOPLASTY BALLOONS

10.4.2 STENT

10.4.3 CATHETERS

10.4.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.4.5 INFERIOR VENA CAVA (IVC) FILTERS

10.4.6 PLAQUE MODIFICATION DEVICES

10.4.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.4.8 OTHERS AND ACCESSORIES

10.5 ARTERIAL THROMBECTOMY

10.5.1 ANGIOPLASTY BALLOONS

10.5.2 STENT

10.5.3 CATHETERS

10.5.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.5.5 INFERIOR VENA CAVA (IVC) FILTERS

10.5.6 PLAQUE MODIFICATION DEVICES

10.5.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.5.8 OTHERS AND ACCESSORIES

10.6 PERIPHERAL ATHERECTOMY

10.6.1 ANGIOPLASTY BALLOONS

10.6.2 STENT

10.6.3 CATHETERS

10.6.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.6.5 INFERIOR VENA CAVA (IVC) FILTERS

10.6.6 PLAQUE MODIFICATION DEVICES

10.6.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.6.8 OTHERS AND ACCESSORIES

10.7 FEMOROPOPLITEAL INTERVENTIONS

10.7.1 ANGIOPLASTY BALLOONS

10.7.2 STENT

10.7.3 CATHETERS

10.7.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.7.5 INFERIOR VENA CAVA (IVC) FILTERS

10.7.6 PLAQUE MODIFICATION DEVICES

10.7.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.7.8 OTHERS AND ACCESSORIES

11 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION

11.1 OVERVIEW

11.2 PERIPHERAL ARTERIAL DISEASE

11.2.1 ATHEROSCLEROSIS

11.2.2 ABDOMINAL AORTIC ANEURYSM

11.2.3 LOWER EXTREMITY PERIPHERAL ARTERIAL DISEASE

11.2.4 SUPRA-INGUINAL ARTERIAL DISEASE

11.2.5 INFRA-INGUINAL ARTERIAL DISEASE

11.2.6 INFRA-POPLITEAL DISEASE

11.2.7 UPPER EXTREMITY OCCLUSIVE DISEASE

11.2.8 CAROTID ARTERY DISEASE

11.2.9 OTHERS

11.3 CORONARY INTERVENTION

11.3.1 ISCHEMIC HEART DISEASE

11.3.2 THORACIC AORTIC ANEURYSM

11.3.3 VALVE DISEASE

11.3.4 PERCUTANEOUS VALVE REPAIR OR REPLACEMENT

11.3.5 CONGENITAL HEART ABNORMALITIES

11.3.6 OTHERS

12 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 PEDIATRIC

13 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 PRIVATE

13.2.2 PUBLIC

13.3 AMBULATORY SURGICAL CENTERS

13.4 NURSING FACILITIES

13.5 CLINICS

13.6 OTHERS

14 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY DISTRIBUTORS

14.3 DIRECT TENDER

14.4 OTHERS

15 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BOSTON SCIENTIFIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.1.6 ACQUSITION

18.2 CORDIS.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.2.6 PRODUCT LAUNCHES

18.3 ABBOTT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.3.6 PRODUCT LAUNCHES

18.4 BD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 TERUMO CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.5.6 PARTNERSHIP

18.5.7 PRODUCT LAUNCH

18.6 ANGIODYNAMICS.(2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 B. BRAUN MELSUNGEN AG (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CARDIOVASCULAR SYSTEMS, INC. (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 COOK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.10.4 EXPANSION

18.10.5 PRODUCT LAUNCHES

18.11 EDWARDS LIFESCIENCES CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 KONINKLIJKE PHILIPS N.V.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.12.5 PRODUCT UPDATES

18.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD. (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 MEDTRONIC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.14.5 COLLABORATION

18.14.6 PRODUCT LAUNCH

18.15 MERIT MEDICAL SYSTEM

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 MICROPORT SCIENTIFIC CORPORATION.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.16.4.1 PRODUCT APPROVALS

18.17 ORBUSNEICH MEDICAL COMPANY LIMITED

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 PRODUCT LAUNCH

18.18 SMT

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 TELEFLEX INCORPORATED.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.19.5 ACQUISITIONS

18.2 W. L. GORE & ASSOCIATES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STENT IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GERIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ADULTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PEDIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA NURSING FACILITIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CLINICS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIRECT TENDER IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 99 U.S. ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 100 U.S. FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 103 U.S. ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 104 U.S. PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 105 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 106 U.S. PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 U.S. CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 109 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 U.S. HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 CANADA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 CANADA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 126 CANADA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 127 CANADA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 128 CANADA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 130 CANADA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 131 CANADA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 132 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 135 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 136 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 CANADA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 MEXICO INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 MEXICO OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MEXICO CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 153 MEXICO ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 156 MEXICO PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 157 MEXICO ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 159 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 160 MEXICO PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 161 MEXICO CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 162 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 163 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MEXICO HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED PREVALENCE OF CHRONIC CARDIAC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN NON-INVASIVE SURGERIES AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

FIGURE 15 NORTH AMERICA PREVALENCE AND DISABILITY RATE OF ISCHEMIC HEART DISEASE (IHD) IN 2021

FIGURE 16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2021

FIGURE 25 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2021

FIGURE 29 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT (2021-2029)

FIGURE 49 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.