North America Industrial X Ray Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.18 Billion

USD

2.19 Billion

2024

2032

USD

1.18 Billion

USD

2.19 Billion

2024

2032

| 2025 –2032 | |

| USD 1.18 Billion | |

| USD 2.19 Billion | |

|

|

|

|

Marktsegmentierung für industrielle Röntgenstrahlen in Nordamerika nach Bildgebungsverfahren (digitale Radiographie und filmbasierte Radiographie), Anwendung (Luftfahrtindustrie, Verteidigung und Militär, Energieerzeugungsindustrie, Automobilindustrie, Fertigungsindustrie, Lebensmittel- und Getränkeindustrie und andere), Modalität (2D, 3D und Hybrid), Bereich (Mikrofokus-Röntgen, Hochenergie-Röntgen und andere), Quelle (Kobalt-59, Iridium-192 und andere), Vertriebskanal (indirekter Kanal und direkter Kanal), Produkttyp (Röntgenverbrauchsmaterialien, Röntgeninstrumente und Röntgendienstleistungen) – Branchentrends und Prognose bis 2032

Marktgröße für industrielle Röntgenstrahlen in Nordamerika

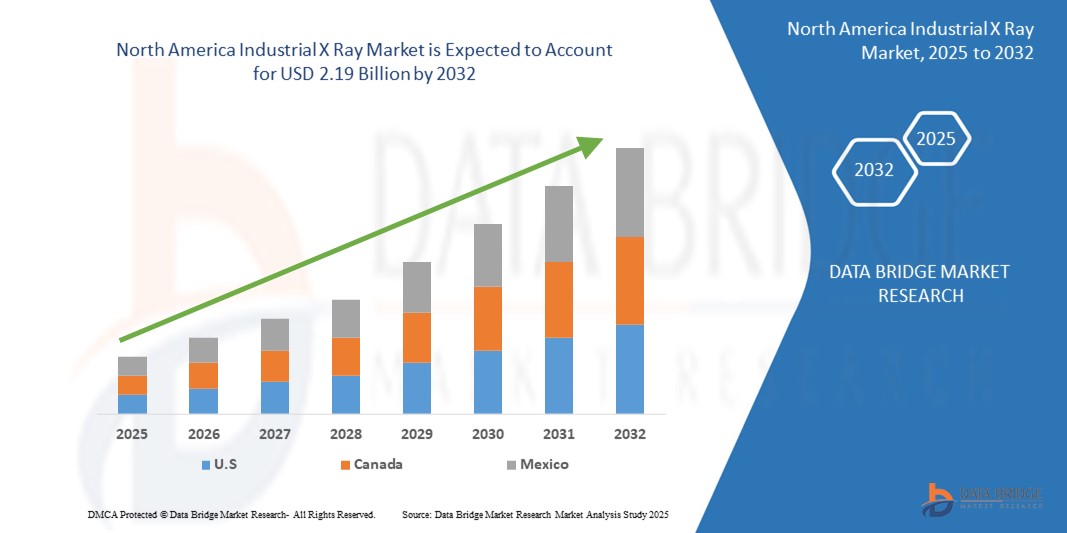

- Der nordamerikanische Markt für industrielle Röntgenstrahlen wurde im Jahr 2024 auf 1,18 Milliarden US-Dollar geschätzt und dürfte bis 2032 2,19 Milliarden US-Dollar erreichen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,10 % im Prognosezeitraum entspricht.

- Dieses Wachstum wird durch Faktoren wie die steigende Nachfrage nach zerstörungsfreien Prüfungen (ZfP) in kritischen Branchen wie der Luft- und Raumfahrt, der Automobilindustrie sowie der Öl- und Gasindustrie, steigende Sicherheits- und Qualitätsstandards und die zunehmende Einführung fortschrittlicher Bildgebungstechnologien zur Fehlererkennung und vorbeugenden Wartung vorangetrieben.

Marktanalyse für industrielle Röntgenstrahlen in Nordamerika

- Der derzeitige Markt für industrielle Röntgenstrahlen in Nordamerika verzeichnet ein stetiges Wachstum, angetrieben durch die weit verbreitete Verwendung in der zerstörungsfreien Prüfung während der Fertigung

- Marktanalysen zeigen einen klaren Trend hin zur Einführung digitaler Röntgensysteme, die im Vergleich zu herkömmlichen Systemen eine höhere Präzision und schnellere Verarbeitung bieten.

- Es wird erwartet, dass die USA den nordamerikanischen Markt für industrielle Röntgenstrahlen mit einem Anteil von 30,05 % dominieren werden, da ihr robuster Verteidigungssektor und ihre fortschrittlichen Fertigungskapazitäten

- Mexiko dürfte im Prognosezeitraum die am schnellsten wachsende Region auf dem nordamerikanischen Markt für industrielle Röntgenstrahlen sein, da der Fertigungssektor des Landes expandiert, insbesondere in Branchen wie der Automobil-, Luft- und Raumfahrt- sowie der Öl- und Gasindustrie.

- Es wird erwartet, dass das Segment der digitalen Radiographie den nordamerikanischen Markt für industrielle Röntgenstrahlen mit einem Anteil von 70,12 % im Jahr 2025 dominieren wird. Dies liegt an seinen Vorteilen bei der schnelleren Bilderfassung, der verbesserten Bildqualität und der Möglichkeit, Daten einfach digital zu speichern und zu übertragen.

Berichtsumfang und Marktsegmentierung für industrielle Röntgenstrahlen in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke für industrielle Röntgenstrahlen in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für industrielle Röntgenstrahlen in Nordamerika

„Digitale Röntgensysteme nehmen immer mehr zu“

- Der aktuelle Markt für industrielle Röntgensysteme verlagert sich zunehmend in Richtung des Einsatzes digitaler Systeme zur Verbesserung der Prüfgenauigkeit und -effizienz

- Unternehmen ersetzen filmbasierte Röntgenmethoden durch digitale Echtzeit-Bildgebung, um Qualitätskontrollprozesse zu beschleunigen

- Dieser Trend unterstützt schnellere Entscheidungsfindung in der Fertigung durch klarere Bilder und sofortige Ergebnisse

- Die Präferenz für digitale Systeme wächst auch aufgrund ihrer Kompatibilität mit automatisierten Produktionsumgebungen

- Zusammenfassend lässt sich sagen, dass dieser Trend auf eine umfassendere Transformation der Inspektionsmethoden hindeutet, da die Industrie auf präzisere, zeitsparendere Technologien umsteigt, um hohe Produktionsstandards zu erfüllen.

Marktdynamik für industrielle Röntgenstrahlen in Nordamerika

Treiber

„Wachsender Bedarf an hochpräzisen Inspektionen in kritischen Branchen“

- Der Bedarf an hochpräzisen Inspektionen in Branchen wie der Luft- und Raumfahrt und der Automobilindustrie führt zu einem zunehmenden Einsatz industrieller Röntgensysteme

- Diese Systeme ermöglichen eine interne Inspektion, ohne die Komponenten während des Herstellungsprozesses zu beschädigen.

- Komplexe und leichte Teile erfordern eine detaillierte Prüfung, die Röntgensysteme effizient durchführen können

- Strenge Qualitätsvorschriften machen industrielle Röntgensysteme für eine Null-Fehler-Produktion unerlässlich

- Zusammenfassend lässt sich sagen, dass industrielle Röntgensysteme heute ein wichtiger Bestandteil der Qualitätskontrolle in modernen Fertigungsumgebungen sind.

Gelegenheit

„Ausbau der industriellen Automatisierung und intelligenten Fertigung“

- Der rasante Fortschritt in der industriellen Automatisierung und intelligenten Fertigung eröffnet erhebliche Möglichkeiten für die Integration industrieller Röntgensysteme in automatisierte Arbeitsabläufe.

- Durch die Kombination von Röntgentechnologie mit intelligenten Datenanalysetools und Robotersystemen können Hersteller die Produktivität steigern und manuelle Fehler minimieren

- Industrielle Röntgengeräte, die mit automatisierten Systemen kommunizieren, können rund um die Uhr mit minimalem menschlichen Eingriff arbeiten, was Branchen wie der Elektronik- und Automobilindustrie zugutekommt.

- Beispielsweise können Röntgensysteme in einer automatisierten Montagelinie Defekte erkennen und sofort Korrekturmaßnahmen einleiten, ohne den Produktionsprozess zu unterbrechen.

- Der Trend zur Fernüberwachung und Cloud-basierten Speicherung ermöglicht vorausschauende Wartung und Echtzeitdiagnose und erhöht die Skalierbarkeit von Röntgensystemen.

- Zusammenfassend lässt sich sagen, dass die Integration von Röntgensystemen in die intelligente Fertigung eine große Wachstumschance darstellt, da die Industrie nach effizienteren, automatisierten und vernetzten Lösungen für die Qualitätskontrolle sucht.

Einschränkung/Herausforderung

„Hohe Gerätekosten und Wartungskomplexität“

- Eine der größten Herausforderungen im industriellen Röntgenmarkt sind die hohen Anfangsinvestitionen und laufenden Wartungskosten für moderne Röntgensysteme.

- Die komplexe Technologie dieser Systeme erfordert erhebliches Kapital, was sie für kleinere Unternehmen mit begrenztem Budget unzugänglich macht

- Der Betrieb und die Wartung dieser Maschinen erfordern Fachpersonal für Aufgaben wie Strahlenschutz, Bildinterpretation und Fehlerbehebung, was die Gesamtkosten erhöht.

- Die Einhaltung gesetzlicher Vorschriften erhöht die Komplexität, da regelmäßige Audits, Zertifizierungen und Sicherheitsmaßnahmen durchgeführt werden müssen, was die Betriebskosten weiter erhöht.

- Der rasante technologische Fortschritt bei Röntgensystemen erfordert häufige Aktualisierungen und neue Modelle, was den Druck erhöht, erneut zu investieren und wettbewerbsfähig zu bleiben.

- Zusammenfassend lässt sich sagen, dass diese finanziellen und betrieblichen Herausforderungen die breite Einführung industrieller Röntgensysteme, insbesondere bei kleineren Unternehmen, behindern.

Umfang des nordamerikanischen Marktes für industrielle Röntgenstrahlen

Der Markt ist nach Bildgebungstechnik, Anwendung, Modalität, Reichweite, Quelle, Vertriebskanal und Produkttyp segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Bildgebungstechnik |

|

|

Nach Anwendung |

|

|

Nach Modalität |

|

|

Nach Sortiment

|

|

|

Nach Quelle |

|

|

Nach Vertriebskanal |

|

|

Nach Produkttyp |

|

Im Jahr 2025 wird das Segment der digitalen Radiographie voraussichtlich den Markt dominieren, mit dem größten Anteil im Segment der Bildgebungstechnik

Das Segment der digitalen Radiographie wird voraussichtlich den nordamerikanischen Markt für industrielle Röntgenstrahlen mit einem Marktanteil von 70,12 % im Jahr 2025 dominieren. Dies ist auf die Vorteile einer schnelleren Bilderfassung, verbesserten Bildqualität und der einfachen digitalen Speicherung und Übertragung von Daten zurückzuführen. Die Umstellung von herkömmlichen filmbasierten Systemen auf die digitale Radiographie senkt die Betriebskosten, minimiert die Umweltbelastung und verbessert die Arbeitsabläufe, was sie äußerst attraktiv macht.

Das Segment Röntgeninstrumente wird voraussichtlich im Prognosezeitraum den größten Anteil im Produkttypsegment ausmachen

Im Jahr 2025 wird das Segment der Röntgengeräte voraussichtlich mit einem Marktanteil von 25,05 % den Markt dominieren. Grund dafür ist die steigende Nachfrage nach fortschrittlichen, hochpräzisen Prüfsystemen in verschiedenen Branchen wie der Luft- und Raumfahrt, der Automobilindustrie und der Elektronik. Röntgengeräte bieten detaillierte interne Bildgebungsmöglichkeiten und ermöglichen die Erkennung kleinster Defekte und struktureller Probleme, die für die Gewährleistung von Produktqualität und -sicherheit entscheidend sind.

Regionale Analyse des nordamerikanischen industriellen Röntgenmarktes

„Die USA halten den größten Anteil am nordamerikanischen Markt für industrielle Röntgenstrahlen“

- Die USA sind mit einem Marktanteil von 30,05 % führend auf dem nordamerikanischen Markt für industrielle Röntgenstrahlen. Dies ist auf den starken Verteidigungssektor und die fortschrittlichen Fertigungskapazitäten zurückzuführen.

- Die Luft- und Raumfahrtindustrie sowie die Automobilindustrie in den USA verlassen sich bei der Qualitätskontrolle und Fehlererkennung stark auf industrielle Röntgensysteme

- Die Präsenz großer Akteure wie North Star Imaging und Varex Imaging stärkt die Marktdominanz des Landes

- Staatliche Vorschriften und Sicherheitsstandards fördern die Einführung zerstörungsfreier Prüfverfahren

- Laufende Investitionen in technologischen Fortschritt und Infrastruktur unterstützen nachhaltige Marktführerschaft

„Der asiatisch-pazifische Raum wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem nordamerikanischen Markt für industrielle Röntgenstrahlen verzeichnen“

- Mexiko erlebt aufgrund seines expandierenden Fertigungssektors ein schnelles Wachstum im industriellen Röntgenmarkt

- Die strategische Lage des Landes und Handelsabkommen erhöhen seine Attraktivität für ausländische Investitionen in Industrietechnologien

- Die Automobil- und Elektronikindustrie in Mexiko setzt zunehmend industrielle Röntgensysteme zur Qualitätssicherung ein

- Regierungsinitiativen zur Förderung der industriellen Modernisierung tragen zur steigenden Nachfrage nach fortschrittlichen Inspektionstechnologien bei

- Die Zusammenarbeit mit internationalen Unternehmen erleichtert den Technologietransfer und die Entwicklung von Fähigkeiten und beschleunigt die Marktexpansion

Marktanteil industrieller Röntgenstrahlen in Nordamerika

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- Teledyne Technologies Incorporated (USA)

- Carl Zeiss AG (Deutschland)

- FUJIFILM Holdings Corporation (Japan)

- General Electric Company (USA)

- Applus+ (Spanien)

- Comet Group (Schweiz)

- Minebea Intec GmbH (Deutschland)

- Hamamatsu Photonics KK (Japan)

- Varex Imaging (USA)

- Hitachi, Ltd. (Japan)

- Carestream Health (USA)

- Nordson Corporation (USA)

- Rigaku Corporation (Japan)

- Shimadzu Corporation (Japan)

- Eastman Kodak Company (USA)

- Canon Electron Tubes & Devices Co., Ltd. (Japan)

- North Star Imaging Inc. (USA)

- VJ X-Ray (Indien)

- Avonix Imaging (USA)

- PROTEC GmbH & Co. KG (Deutschland)

- Oehm und Rehbein GmbH (Deutschland)

- Lucky Healthcare Co., Ltd. (China)

Neueste Entwicklungen auf dem nordamerikanischen Markt für industrielle Röntgenstrahlen

- Im August 2024 startete DocGo gemeinsam mit MinXray ein mobiles Röntgenprogramm in New York City. Ziel ist es, gefährdeten Bevölkerungsgruppen schnelle Röntgenaufnahmen des Brustkorbs zu ermöglichen und aktive Tuberkulosefälle (TB) zu identifizieren. Das Programm nutzt die tragbaren, batteriebetriebenen Röntgensysteme und künstliche Intelligenz von MinXray, um Bilder umgehend zu analysieren und eine sofortige Versorgung der Betroffenen zu gewährleisten.

- Im Dezember 2024 kooperierte Konica Minolta Healthcare Americas mit Gleamer, um die KI-gestützte BoneView-Technologie in seine Röntgensysteme zu integrieren. Die von der FDA zugelassene Lösung verbessert die muskuloskelettale Bildgebung durch die Erkennung von Frakturen, die Verbesserung der Diagnosegenauigkeit und die Optimierung von Arbeitsabläufen. Sie ist im gesamten DR-Portfolio von Konica Minolta verfügbar und rationalisiert radiologische Prozesse und steigert die Effizienz der Patientenversorgung.

- Im August 2023 verlegte und erweiterte die Rigaku Corporation ihre Geschäftstätigkeit in Singapur und stärkte so ihre Kapazitäten für optimierte Betriebsabläufe und Wachstumsinitiativen. Dieser Schritt ermöglichte eine breitere Ansprache verschiedener Branchen und Kundensegmente und festigte die Position des Unternehmens für kontinuierlichen technologischen Fortschritt und verbesserte Serviceleistungen. Der Umzug in ein größeres Büro im geschäftigen zentralen Geschäftsviertel Singapurs stärkte Rigakus Fähigkeit, den wachsenden Kundenstamm in der Region effizient zu bedienen. Dieser strategische Schritt ermöglichte verbesserte Support- und Serviceleistungen, unterstrich Rigakus Engagement für seine Kunden und Partner und förderte nachhaltiges Wachstum sowie die Anerkennung als nordamerikanischer Technologieführer.

- Im August 2021 arbeiteten die Carl Zeiss AG und das Oak Ridge National Laboratory (ORNL) gemeinsam an einem vom Technology Commercialization Fund des US-Energieministeriums geförderten Projekt. Ziel des Projekts ist es, künstliche Intelligenz (KI) und Röntgen-CT-Technologie zu nutzen, um eine zuverlässige, zerstörungsfreie Charakterisierung additiv gefertigter (AM) Bauteile zu ermöglichen. Die Partnerschaft wird eine umfassende Pulver-zu-Teil-Charakterisierungsmethode für die additive Fertigung entwickeln, die die Qualität und Genauigkeit von Messungen verbessert und möglicherweise die zerstörungsfreie Prüfung und Messtechnik über die AM-Branche hinaus revolutioniert.

- Im Mai 2023 präsentierte die Minebea Intec GmbH ihre neuesten innovativen Wäge- und Inspektionslösungen und unterstrich damit ihr Engagement für Spitzentechnologien in der Verpackungsindustrie. Zu den Produkthighlights des Unternehmens zählten der Mitus-Metalldetektor mit bahnbrechender MiWave-Technologie, die Essentus-Kontrollwaage mit optimierter Benutzeroberfläche und das Dypipe-Röntgeninspektionssystem. Diese innovativen Lösungen stießen bei Branchenexperten auf großes Interesse und festigten Minebea Intecs Position als führender Anbieter von Wäge- und Inspektionstechnologien.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.