North America Industrial Machine Vision Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.37 Billion

USD

7.01 Billion

2024

2032

USD

3.37 Billion

USD

7.01 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 7.01 Billion | |

|

|

|

|

Marktsegmentierung für industrielle Bildverarbeitung in Nordamerika nach Komponenten (Hardware und Software), Produkten (Smart Camera/Smart Sensor Vision System, Hybrid Smart Camera Vision System und PC-basiert), Typen (2D-Vision-Systeme, 3D-Vision-Systeme und 1D-Vision-Systeme), Einsatz (Roboterzelle und allgemein), Anwendungen (Fehlererkennung, Produktinspektion, Oberflächeninspektion, Verpackungsinspektion, Identifikation, OCR/OCV, Mustererkennung, Messung, Führung und Teileverfolgung, Bahninspektion und andere), Endbenutzer (Automobilindustrie, Unterhaltungselektronik, Lebensmittel und Verpackung, Pharmazeutika, Metalle, Druck, Luft- und Raumfahrt, Glas, Gummi und Kunststoffe, Bergbau, Textilien, Holz und Papier, Maschinenbau, Herstellung von Solarmodulen und andere) – Branchentrends und Prognose bis 2032

Marktgröße für industrielle Bildverarbeitung

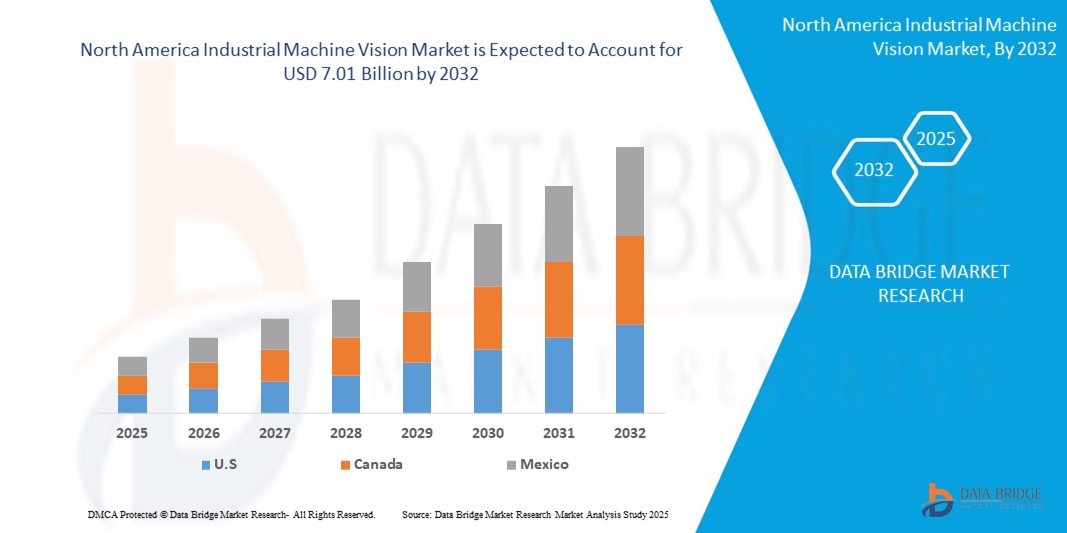

- Der nordamerikanische Markt für industrielle Bildverarbeitung wird im Jahr 2024 auf 3,37 Milliarden US-Dollar geschätzt und soll bis 2032 7,01 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 7,69 % im Prognosezeitraum entspricht.

- Dieses Wachstum wird durch Faktoren wie die zunehmende Automatisierung in der Fertigungsindustrie, die steigende Nachfrage nach Qualitätsprüfung und Fehlererkennung sowie technologische Fortschritte im Bereich des maschinellen Lernens und der Bildverarbeitung vorangetrieben.

Marktanalyse für industrielle Bildverarbeitung

- Industrielle Bildverarbeitungssysteme sind wichtige Technologien, die in Fertigungsumgebungen für automatisierte Inspektion, Qualitätssicherung und Roboterführung eingesetzt werden. Sie sorgen für Präzision und Effizienz in verschiedenen Branchen, darunter der Automobil-, Elektronik-, Pharma- sowie der Lebensmittel- und Getränkeindustrie.

- Die Nachfrage nach diesen Systemen wird maßgeblich durch den steigenden Bedarf an Automatisierung, Genauigkeit bei der Fehlererkennung und Fortschritte bei KI-integrierten Bildgebungstechnologien getrieben.

- Die USA sind das dominierende Land im nordamerikanischen Markt für industrielle Bildverarbeitung und halten rund 75 % des gesamten regionalen Marktanteils. Diese Dominanz ist auf die starke industrielle Basis des Landes, die frühzeitige Einführung fortschrittlicher Fertigungstechnologien und erhebliche Investitionen in Automatisierung und KI-gestützte Produktionslinien zurückzuführen.

- Kanada ist das am schnellsten wachsende Land im Markt für industrielle Bildverarbeitung. Zwar hält das Land derzeit einen geringeren Marktanteil von schätzungsweise rund 20 %, doch beschleunigt sich das Wachstum aufgrund der verstärkten Fokussierung auf fortschrittliche Fertigung, staatlicher Initiativen zur Steigerung der industriellen Produktivität und der zunehmenden Automatisierung in der Lebensmittelverarbeitung und der Automobilindustrie.

- Es wird erwartet, dass der Automobilbau im Jahr 2025 den Markt für industrielle Bildverarbeitung mit einem Anteil von 48,75 % dominieren wird. Grund dafür ist der hohe Bedarf an Automatisierung und Qualitätskontrolle in den Produktionslinien. Als kritische Komponente im modernen Automobilbau erhöhen Bildverarbeitungssysteme die Präzision in Prozessen wie Inspektion, Montage und Teileidentifikation.

Berichtsumfang und Marktsegmentierung für industrielle Bildverarbeitung

|

Eigenschaften |

Wichtige Markteinblicke in die industrielle Bildverarbeitung |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch Import-Export-Analysen, eine Übersicht über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Szenario des Klimawandels, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und regulatorische Rahmenbedingungen. |

Markttrends für industrielle Bildverarbeitung

„Integration von KI, Deep Learning und 3D-Vision-Systemen in der industriellen Automatisierung“

- Ein wichtiger Trend auf dem Markt für industrielle Bildverarbeitung ist die zunehmende Integration von künstlicher Intelligenz (KI), Deep-Learning-Algorithmen und 3D-Bildverarbeitungssystemen für Echtzeit-Entscheidungen und Präzisionsautomatisierung in Fertigungsprozessen.

- Diese Innovationen verbessern die Leistung der Bildverarbeitung erheblich, indem sie es den Systemen ermöglichen, komplexe Muster zu erkennen, Defekte zu klassifizieren und sich an variable Bedingungen anzupassen, die herkömmliche regelbasierte Systeme möglicherweise nicht effektiv bewältigen können.

- Moderne 3D-Vision-Technologien bieten beispielsweise Tiefenwahrnehmung und volumetrische Analyse und ermöglichen so Anwendungen wie Bin Picking, Roboterführung und Qualitätskontrolle unregelmäßig geformter Objekte mit hoher Genauigkeit.

- Diese Fortschritte verändern die Landschaft der industriellen Automatisierung, reduzieren Fehlerquoten, steigern die Produktionseffizienz und treiben die Nachfrage nach intelligenten Bildverarbeitungssystemen in der Automobil-, Elektronik-, Verpackungs- und Logistikbranche voran.

Marktdynamik für industrielle Bildverarbeitung

Treiber

„Steigende Nachfrage nach Qualitätsprüfung und Automatisierung in der Fertigung“

- Die zunehmende Bedeutung von Qualitätssicherung, Prozessoptimierung und Fehlererkennung in der modernen Fertigung trägt maßgeblich zur steigenden Nachfrage nach industriellen Bildverarbeitungssystemen bei.

- Mit der zunehmenden Automatisierung in der Industrie spielt die industrielle Bildverarbeitung eine entscheidende Rolle bei der Ermöglichung von Echtzeitprüfungen, Präzisionsmessungen und Roboterführung und gewährleistet so Konsistenz und Zuverlässigkeit in Produktionslinien.

- Branchen wie die Automobil-, Elektronik-, Pharma- sowie Lebensmittel- und Getränkeindustrie sind in hohem Maße auf Bildverarbeitungssysteme angewiesen, um strenge gesetzliche Vorschriften und Qualitätsstandards einzuhalten.

Zum Beispiel,

- Im Oktober 2023 meldete die Cognex Corporation einen Anstieg der Nachfrage nach Bildverarbeitungssystemen in der Elektronik- und Logistikbranche, bedingt durch die steigenden Erwartungen der Verbraucher an Produktzuverlässigkeit und schnelle Auftragsabwicklung.

- Als Folge dieses wachsenden Fokus auf automatisierte Qualitätskontrolle kommt es zu einem deutlichen Anstieg der Nutzung industrieller Bildverarbeitungssysteme, um die Produktivität zu steigern, Fehler zu minimieren und die Arbeitskosten in globalen Fertigungsökosystemen zu senken.

Gelegenheit

„Weiterentwicklung der industriellen Bildverarbeitung durch Integration künstlicher Intelligenz“

- KI-gestützte industrielle Bildverarbeitungssysteme können die Objekterkennung, Automatisierung und Qualitätskontrolle in Fertigungsprozessen verbessern und so die betriebliche Effizienz und Präzision steigern.

- KI-Algorithmen können Echtzeitbilder analysieren, um Defekte zu identifizieren, Produktionslinien zu überwachen und die Produktqualität zu verfolgen. So erhalten Hersteller sofortiges Feedback, um Probleme zu beheben, bevor sie eskalieren.

- KI-gestützte Bildverarbeitungssysteme können auch bei der vorausschauenden Wartung helfen, indem sie die Leistung der Geräte analysieren und potenzielle Fehler identifizieren, wodurch Ausfallzeiten und Wartungskosten reduziert werden.

Zum Beispiel,

- Im Dezember 2024 führte eine Partnerschaft zwischen Siemens und einem KI-Softwareunternehmen zur Integration von KI-gestützter industrieller Bildverarbeitung in die Siemens-Produktionsanlagen. Das KI-System ermöglicht eine Echtzeit-Qualitätskontrolle, indem es Produktfehler erkennt und Produktionsparameter automatisch anpasst, um eine gleichbleibende Qualität zu gewährleisten. Diese Integration führte zu einer Steigerung der Produktionseffizienz um 15 % und einer Reduzierung der Produktfehler um 20 %.

- Die Integration von KI in industrielle Bildverarbeitungssysteme kann zudem zu einer besseren Ressourcennutzung, schnelleren Produktionszyklen und weniger Abfall führen. Durch die Nutzung der Fähigkeit der KI, große Mengen visueller Daten zu analysieren, können Hersteller Produktionslinien optimieren, menschliche Fehler reduzieren und eine höhere Produktqualität gewährleisten.

Einschränkung/Herausforderung

„Hohe Ausrüstungskosten behindern die Marktdurchdringung“

- Die hohen Kosten industrieller Bildverarbeitungssysteme stellen ein erhebliches Hindernis für ihre breite Einführung dar, insbesondere für kleine und mittlere Unternehmen (KMU) mit begrenzten Budgets.

- Diese fortschrittlichen Bildverarbeitungssysteme, die für die Automatisierung der Qualitätskontrolle und die Verbesserung von Fertigungsprozessen unerlässlich sind, können je nach Komplexität und Leistungsfähigkeit des Systems zwischen Zehntausenden und mehreren Hunderttausend Dollar kosten.

- Die erheblichen finanziellen Investitionen, die für diese Systeme erforderlich sind, können kleinere Unternehmen davon abhalten, ihre Ausrüstung aufzurüsten, was dazu führt, dass sie auf manuelle Inspektionen oder veraltete Bildverarbeitungslösungen angewiesen sind.

Zum Beispiel,

- Im Oktober 2024 hob ein Bericht der International Society of Automation (ISA) die Herausforderungen hervor, vor denen kleine Fertigungsunternehmen bei der Einführung KI-gestützter industrieller Bildverarbeitungssysteme stehen. Der Bericht betonte, dass sich Großunternehmen zwar die hohen Anfangsinvestitionen leisten können, viele KMU jedoch mit den Kosten für die Integration KI-gestützter Systeme in ihren Betrieb zu kämpfen haben, was die Einführungsrate in der gesamten Branche verlangsamt.

- Infolgedessen kann dieses finanzielle Hindernis zu einem langsameren Marktwachstum führen und eine breitere Einführung fortschrittlicher Bildverarbeitungssysteme verhindern, insbesondere in kostensensiblen Branchen wie der Kleinserienfertigung oder Unternehmen in Schwellenländern.

Marktumfang für industrielle Bildverarbeitung

Der Markt ist nach Komponente, Produkt, Typ, Bereitstellung, Anwendung und Endbenutzer segmentiert.

|

Segmentierung |

Untersegmentierung |

|

Nach Komponente |

|

|

Nach Produkt |

|

|

Nach Typ |

|

|

Nach Bereitstellung |

|

|

Nach Anwendungen |

|

|

Nach Endbenutzer |

|

Im Jahr 2025 wird das Segment der Automobilherstellung voraussichtlich den Markt dominieren und den größten Anteil am Endverbrauchersegment haben.

Es wird erwartet, dass der Automobilbau aufgrund seines hohen Bedarfs an Automatisierung und Qualitätskontrolle in den Produktionslinien im Jahr 2025 mit 48,75 % den Markt für industrielle Bildverarbeitung dominieren wird. Als kritische Komponente im modernen Automobilbau erhöhen Bildverarbeitungssysteme die Präzision in Prozessen wie Inspektion, Montage und Teileidentifikation. Die steigende Nachfrage nach Fahrzeugsicherheitsfunktionen, gepaart mit Fortschritten in der Bildverarbeitungstechnologie, treibt den Einsatz dieser Systeme in der Automobilproduktion voran. Die zunehmende Automatisierung in Automobilfabriken und die zunehmende Komplexität der Fahrzeugdesigns tragen zusätzlich zur Dominanz dieses Segments im Markt für industrielle Bildverarbeitung bei.

Die Mustererkennung wird voraussichtlich im Prognosezeitraum den größten Anteil in den Anwendungssegmenten ausmachen

Im Jahr 2025 wird das Segment Mustererkennung voraussichtlich den Markt für industrielle Bildverarbeitung mit einem Marktanteil von 50,62 % dominieren, da es die Qualitätskontrolle, Inspektion und Automatisierung in Fertigungsprozessen verbessern kann. Mustererkennungssysteme sind entscheidend für die Echtzeit-Identifizierung und -Klassifizierung von Objekten, Defekten und Anomalien und ermöglichen es Herstellern, eine gleichbleibende Produktqualität sicherzustellen und die Produktionseffizienz zu optimieren. Da die Industrie höhere Präzision und Geschwindigkeit fordert, treiben Mustererkennungssysteme, insbesondere in Kombination mit KI- und Deep-Learning-Technologien, das Marktwachstum voran. Die zunehmende Komplexität der Produkte und der Bedarf an hohen Qualitätsstandards in Branchen wie der Automobil-, Elektronik- und Pharmaindustrie tragen zusätzlich zur Dominanz mustererkennungsbasierter Bildverarbeitungssysteme auf dem Markt bei.

Regionale Analyse des Marktes für industrielle Bildverarbeitung

„Die USA halten den größten Anteil am nordamerikanischen Markt für industrielle Bildverarbeitung“

- Die USA profitieren von einer starken industriellen Basis und der frühen Einführung intelligenter Fertigungstechnologien, was zu ihrer Dominanz auf dem Markt für industrielle Bildverarbeitung beiträgt und einen Marktanteil von etwa 75 % in Nordamerika hält.

- Der zunehmende Einsatz von Automatisierung und Robotik in US-Produktionsstätten unterstützt die Integration von Bildverarbeitungssystemen und ermöglicht so eine Qualitätskontrolle in Echtzeit und betriebliche Effizienz.

- Die steigende Nachfrage nach Hochgeschwindigkeits- und Hochpräzisionsprüfungen in Branchen wie der Automobil-, Elektronik- und Pharmaindustrie führt zu einer starken Verbreitung von IMV-Lösungen in den USA.

- Robuste Investitionen in industrielle Forschung und Entwicklung, zusammen mit der starken Präsenz wichtiger Marktteilnehmer und staatlicher Unterstützung für Initiativen zur fortschrittlichen Fertigung, stärken die Führungsposition der USA im Markt für industrielle Bildverarbeitung weiter.

„Kanada wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) auf dem nordamerikanischen Markt für industrielle Bildverarbeitung verzeichnen. “

- Kanadas zunehmender Fokus auf industrielle Automatisierung und intelligente Fertigung treibt die Einführung von Bildverarbeitungstechnologien voran und trägt zum erwarteten Marktwachstum bei. In Nordamerika wird ein Marktanteil von schätzungsweise 20 % erwartet.

- Staatlich geförderte Programme zur Modernisierung der Fertigungsinfrastruktur und zur Einführung von Industrie 4.0-Technologien beschleunigen die Integration industrieller Bildverarbeitungssysteme im Land

- Die wachsende Nachfrage nach Qualitätsprüfungen, insbesondere in Branchen wie der Lebensmittelverarbeitung, der Automobilindustrie und der Pharmaindustrie, fördert den Einsatz von Bildverarbeitungslösungen in ganz Kanada.

- Kontinuierliche Investitionen des öffentlichen und privaten Sektors in Automatisierungstechnologien und fortschrittliche Produktionssysteme unterstützen die schnelle Verbreitung industrieller Bildverarbeitungsanwendungen in ganz Kanada.

Marktanteile der industriellen Bildverarbeitung

Die Wettbewerbslandschaft des Marktes liefert detaillierte Informationen zu den einzelnen Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben genannten Datenpunkte beziehen sich ausschließlich auf die Marktausrichtung der Unternehmen.

Die wichtigsten Marktführer auf dem Markt sind:

- KEYENCE CORPORATION (Japan)

- OMRON Corporation (Japan)

- Sony Semiconductor Solutions Corporation (Japan)

- Cognex Corporation (USA)

- SICK AG (USA)

- Teledyne FLIR LLC (USA)

- NATIONAL INSTRUMENTS CORP. (USA)

- BASLER AG (Deutschland)

- ISRA VISION (Deutschland)

- Intel Corporation (USA)

- Texas Instruments Incorporated (USA)

- Cadence Design Systems, Inc. (USA)

- Automatic Identification Systems (UK) Limited (Großbritannien)

- MV ASIA Infomatrix Pte Ltd (Singapur)

- Ceva Inc. (USA)

- Soda Vision (Singapur),

- The Imaging Source, LLC (USA)

- Kalypso: Ein Unternehmen von Rockwell Automation (USA)

- Qualitas Technologies (Indien)

- Integro Technologies Corp. (USA)

Neueste Entwicklungen auf dem nordamerikanischen Markt für industrielle Bildverarbeitung

- Im Juli 2024 veröffentlichte die OMRON Corporation ein Software-Update für ihr FH Vision System und die FHV7 Smart Camera. Dieses Update integriert die Digimarc-Dekodiertechnologie zur Verbesserung der digitalen Produktidentifikation. Es ermöglicht eine schnelle Verpackungsverifizierung mit digitalen Wasserzeichen und erreicht über 2.000 Teile pro Minute. Die Integration verbessert die Erkennungsgenauigkeit, Verarbeitungsgeschwindigkeit, Kameraflexibilität, Redundanz und Prüffunktionen und unterstreicht OMRONs Engagement für Innovationen in der industriellen Automatisierung. Diese für Konsumgüterhersteller konzipierte Weiterentwicklung steigert die Qualitätssicherung und Effizienz in der Produktion.

- Am 6. Mai 2025 gab AMETEK die Übernahme von FARO Technologies für rund 920 Millionen US-Dollar bekannt. FARO, ein führender Anbieter von 3D-Mess- und Bildgebungslösungen, erzielte 2024 einen Umsatz von 340 Millionen US-Dollar. Dieser strategische Schritt zielt darauf ab, den Geschäftsbereich elektronische Instrumente von AMETEK auszubauen und seine Präsenz in den Bereichen Luft- und Raumfahrt, Medizin, Forschung, Energie und Industrie zu stärken. Die Übernahme erweitert das Portfolio von AMETEK um Lösungen für Präzisionsfertigung und digitale Realität und ergänzt das bestehende Creaform-Geschäft.

- Im April 2024 stellte die Cognex Corporation das In-Sight L38 3D-Vision-System vor, das weltweit erste KI-gestützte 3D-Vision-System für schnelle Implementierung und zuverlässige Prüfungen in der Fertigungsautomatisierung. Das System integriert KI-, 2D- und 3D-Vision-Technologien und erzeugt einzigartige Projektionsbilder, die das Training vereinfachen und Merkmale aufdecken, die mit herkömmlicher 2D-Bildgebung nicht erkennbar sind. Dank integrierter KI-Tools verbessert es die Prüfgenauigkeit, Messpräzision und Betriebseffizienz und setzt neue Maßstäbe in der industriellen Automatisierung.

- Im Mai 2023 begann Teledyne DALSA mit der Produktion der Linea 2 4k Multispectral 5GigE Zeilenkamera – ein Durchbruch in der Bildverarbeitungstechnologie. Diese fortschrittliche Kamera verfügt über eine 5GigE-Schnittstelle und bietet die fünffache Bandbreite ihres Vorgängers, der Linea GigE Kamera. Mit hochauflösender RGB- und Nahinfrarot-Multispektralbildgebung (NIR) verbessert sie die Fehlererkennung, Materialklassifizierung und optische Sortierung in industriellen Anwendungen. Der quadlineare CMOS-Sensor sorgt für minimales spektrales Übersprechen und verbessert so die Prüfgenauigkeit.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.