Nordamerikanischer Markt für Schrumpfschläuche, nach Typ (einwandig und doppelwandig), Produkttyp (Spulen, vorgeschnittene Länge und andere), Spannung (niedrig, mittel und hoch), Schrumpfverhältnis (2:01, 3:01, 4:01, 6:01 und andere), Material (Polyolefin, Perfluoralkoxyalkane (PFA), Polytetrafluorethylen (PTFE), Ethylentetrafluorethylen (ETFE), fluoriertes Ethylenpropylen (FEP), Polyetheretherketon (PEEK) und andere), Endverbraucher (Versorgungsunternehmen, IT und Telekommunikation, Automobil, Elektronik, Luft- und Raumfahrt, Gesundheitswesen, Öl und Gas, Marine, Lebensmittel und Getränke, Bau, Chemie und andere), Branchentrends und Prognose bis 2030.

Nordamerika: Marktanalyse und -größe für Schrumpfschläuche

Der Anstieg der Stromerzeugungskapazität weltweit treibt den nordamerikanischen Markt für Schrumpfschläuche an. Die Modernisierung von Übertragungsleitungen und Umspannwerken entlang bestehender Korridore ist jedoch eine kostengünstige Möglichkeit, die Übertragungskapazität zu erhöhen. Bestehende Leitungen können neu verlegt werden, um die Übertragungskapazität zu erhöhen (unter Verwendung von Materialien wie Verbundleitern, die höhere Ströme übertragen können). Diese Materialien sind derzeit verfügbar, werden jedoch nicht häufig verwendet, da es schwierig ist, Leitungen außer Betrieb zu nehmen, um neue Materialien zu verlegen. Darüber hinaus können bei günstigen Wetterbedingungen alle Freileitungen Strom führen, der höher ist als ihre Nennleistung, und eine Echtzeitleistung, die kontinuierlich angepasst werden könnte, würde die verfügbare Kapazität erhöhen.

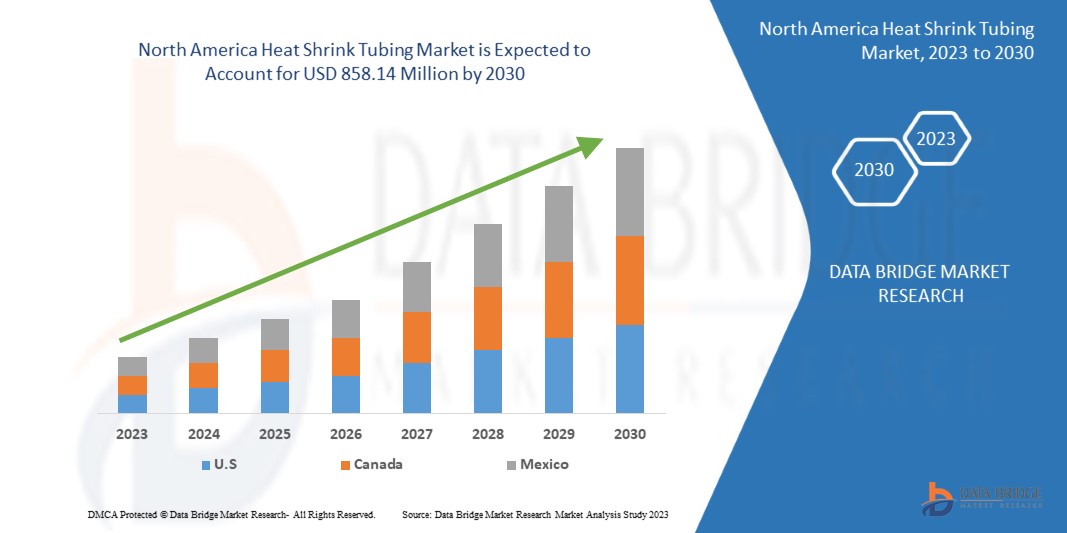

Data Bridge Market Research analysiert, dass der nordamerikanische Markt für Schrumpfschläuche im Prognosezeitraum von 2023 bis 2030 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate von 6,2 % wachsen und bis 2030 einen Wert von 858,14 Millionen USD erreichen wird. Der Bericht zum nordamerikanischen Markt für Schrumpfschläuche deckt auch umfassend Preisanalysen, Patentanalysen und technologische Fortschritte ab.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar 2015–2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD |

|

Abgedeckte Segmente |

Typ (Einwand und Doppelwand), Produkttyp (Spulen, vorgeschnittene Länge und andere), Spannung (niedrig, mittel und hoch), Schrumpfverhältnis (2:01, 3:01, 4:01, 6:01 und andere), Material (Polyolefin, Perfluoralkoxyalkane (PFA), Polytetrafluorethylen (PTFE), Ethylen-Tetrafluorethylen (ETFE), fluoriertes Ethylen-Propylen (FEP), Polyetheretherketon (PEEK) und andere), Endverbraucher (Versorgungsunternehmen, IT und Telekommunikation, Automobilindustrie, Elektronik, Luft- und Raumfahrt, Gesundheitswesen, Öl und Gas, Marine, Lebensmittel und Getränke, Bauwesen, Chemie und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

ABB (Schweiz), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Schweiz), Thermosleeve USA (USA), Techflex, Inc. (USA), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd. (China), Huizhou Guanghai Electronic Insulation Materials Co., Ltd. (China), Panduit (USA), HellermannTyton (Deutschland), Alpha Wire (USA), 3M (USA), SHAWCOR (Kanada), Zeus Industrial Products, Inc. (USA), Molex (USA), PEXCO (USA), Prysmain Group (Italien), GREMCO GmbH (Deutschland), Qualtek Electronics Corp. (USA), Hilltop (Großbritannien), Dunbar Products, LLC. (USA), cygia und Changyuan Electronics (Dongguan) Co., Ltd. (China) unter anderem |

Marktdefinition

Schrumpfschläuche werden zur Isolierung von Drähten verwendet und bieten Abriebfestigkeit und Umweltschutz für Litzenleiter mit Anschlüssen, Verbindungen und Klemmen in Elektroinstallationen. Im Allgemeinen schrumpft ein Schlauch mit niedrigerer Schrumpftemperatur schneller. Wenn Schrumpfschläuche um Drahtanordnungen und elektrische Komponenten gewickelt werden, kollabieren sie radial, um sich den Konturen des Geräts anzupassen und bilden eine Schutzschicht.

Darüber hinaus werden für die Herstellung von Schrumpfschläuchen verschiedene Materialien wie Perfluoralkoxyalkane (PFA), Polytetrafluorethylen (PTFE), Fluorethylenpropylen (FEP) und andere verwendet. Die Schrumpfschläuche aus verschiedenen Materialien bieten unterschiedliche Schutzfunktionen gegen Abrieb, Stöße, Schnitte, Feuchtigkeit und Staub, indem sie einzelne Drähte umhüllen oder ganze Arrays umhüllen. Darüber hinaus wird das Material je nach Endverwendung ausgewählt, beispielsweise in den Bereichen Elektronik, Automobil, Luft- und Raumfahrt und anderen. Kunststoffhersteller beginnen mit der Extrusion eines thermoplastischen Rohrs, um Schrumpfschläuche herzustellen. Die Materialien für Schrumpfschläuche variieren je nach beabsichtigter Anwendung.

Marktdynamik für Schrumpfschläuche in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Chancen, Beschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Rolle der Regierung bei der Unterstützung und Erweiterung von Übertragungs- und Verteilungssystemen auf dem Markt für Schrumpfschläuche in der gesamten Region

Die Übertragung und Verteilung von elektrischer Energie (T&D) spielt eine wichtige Rolle als Bindeglied zwischen Kraftwerken und Kunden. Zunehmende Belastungen und Belastungen durch die alternde Ausrüstung und das steigende Risiko großflächiger Stromausfälle sind einige der Faktoren, die den Bedarf an Schrumpfschläuchen erhöhen. Eine zuverlässige und kostengünstige Stromversorgung ist in der heutigen Gesellschaft von entscheidender Bedeutung. Die Übertragung und Verteilung (T&D) in den USA besteht aus zahlreichen wirtschaftlichen Faktoren, Organisationsstrukturen, Technologien und Formen der Regulierungsaufsicht. Bundes- und Kommunalregierungen sowie staatliche und kundeneigene Genossenschaften sind alle Teil dieser Systeme. Etwa 80 Prozent der Stromtransaktionen erfolgen jedoch über Leitungen, die investoreneigenen regulierten Versorgungsunternehmen (IOUs) gehören. Diese vollständig integrierten Versorgungsunternehmen besitzen sowohl die Kraftwerke als auch die Übertragungs- und Verteilungssysteme, die den Strom an ihre Kunden liefern. Dies war in der Vergangenheit eines der vorherrschenden Modelle, aber die Deregulierung in einigen Staaten hat die Branche verändert. Übertragung, Erzeugung und Verteilung können in deregulierten Gebieten von verschiedenen Unternehmen übernommen werden.

- Steigerung der Stromerzeugungskapazität weltweit

Zur Herstellung von Schrumpfschläuchen wird ein zweistufiger Prozess verwendet. Der erste Schritt ist eine Standardextrusion, gefolgt von einem zweiten Prozess, der den Schlauch schrumpfbar macht. Obwohl die Einzelheiten dieses zweiten Prozesses vertraulich behandelt werden, wird der Durchmesser des Schlauchs durch Hitze und Kraft erweitert. Während der Schlauch noch erweitert ist, wird er auf Raumtemperatur abgekühlt. Wenn der Schlauch starr ist, schrumpft er auf seine ursprüngliche Größe. Die Aufrüstung von Übertragungsleitungen und Umspannwerken entlang bestehender Korridore ist eine kostengünstige Möglichkeit, die Übertragungskapazität zu erhöhen. Bestehende Leitungen können neu verlegt werden, um die Übertragungskapazität zu erhöhen (unter Verwendung von Materialien wie Verbundleitern, die höhere Ströme übertragen können).

Gelegenheit

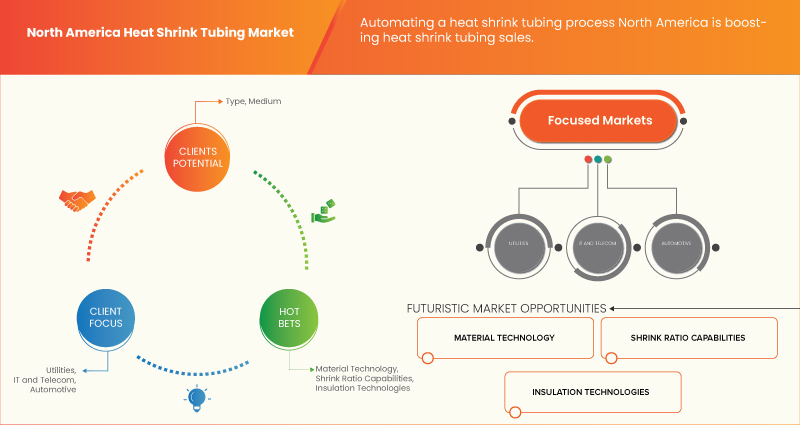

- Breiter Einsatz von Schrumpfschläuchen in verschiedenen Branchen

AI Die Schrumpfschlauchprodukte werden aus einzigartig formulierten Materialien hergestellt, die durch Strahlenvernetzung verbessert wurden, eine Technologie mit Produktdesign, die eine wiederholbare, zuverlässige und passgenaue Schrumpfinstallation ermöglicht, die mit vielen Herstellungsprozessen kompatibel ist. Diese Produkte werden weltweit in den Bereichen Automobil, Telekommunikation, Energieverteilung, Luft- und Raumfahrt, Verteidigung sowie in industriellen und kommerziellen Anwendungen eingesetzt. Die Schlauchanwendung in Kabelschutz unter der Motorhaube, Schläuchen, Bremsleitungen, Klimaanlagen, Dieseleinspritzgruppen, Steckverbindern, Inline-Verbindungen, Kabelbündeln, Ringkabelschuhen, Sicherheitsgurthaltern, Gasfedern, Antennen und anderen verbessert die Anwendungsmöglichkeiten in der Automobilindustrie weiter. Die Schlauchprodukte werden aus einzigartig formulierten Materialien hergestellt, die durch Strahlenvernetzung verbessert wurden, eine Technologie. Die einfach zu verwendenden Produkte bieten kostengünstige, bewährte Lösungen für verschiedene Automobilanwendungen, vom Abdichten und Schützen elektrischer Verbindungen bis zum mechanischen Schutz von Flüssigkeitsmanagementsystemen in rauen Umgebungen.

Einschränkungen/Herausforderungen

- Regierungsverordnung zur Emission giftiger Gase

Die Umweltauswirkungen der raschen Industrialisierung haben dazu geführt, dass unzählige Luft-, Land- und Wasserressourcen mit giftigen Stoffen und anderen Schadstoffen verunreinigt wurden, was Menschen und Ökosystemen ernsthafte gesundheitliche Risiken birgt. Der umfangreichere und intensivere Einsatz von Materialien und Energie hat zu einem kumulativen Druck auf die Qualität lokaler, regionaler und nordamerikanischer Ökosysteme geführt. Bevor es konzertierte Anstrengungen zur Begrenzung der Auswirkungen der Umweltverschmutzung gab, ging das Umweltmanagement kaum über eine Laissez-faire-Toleranz hinaus, die durch die Entsorgung von Abfällen gemildert wurde, um störende lokale Belästigungen zu vermeiden, die kurzfristig betrachtet wurden. Die Notwendigkeit einer Sanierung wurde ausnahmsweise in Fällen anerkannt, in denen der Schaden als inakzeptabel eingestuft wurde. Als das Tempo der industriellen Aktivität zunahm und das Verständnis der kumulativen Auswirkungen wuchs, wurde ein Paradigma der Umweltverschmutzungskontrolle zur vorherrschenden Methode des Umweltmanagements.

- Steigende Preise für Rohrrohstoffe

Die Preisschwankungen wirken sich auf die gekauften Kabel-, Draht- und Verbindungsprodukte und -materialien aus oder beeinflussen die Aussichten auf Budgetprognosen in den Bereichen Beschaffung, Finanzen, Lieferkettenmanagement oder Produktentwicklung. Dank steigender Industrieproduktion und aggressiver Initiativen für nachhaltige Energie ist China der weltweit größte Kupferverbraucher. Europa, die USA und China verfolgen aggressive Initiativen für erneuerbare Energien, um eine grünere Wirtschaft aufrechtzuerhalten, und die hohe thermische und elektrische Leitfähigkeit von Kupfer wird ihnen dabei helfen, dieses Ziel zu erreichen. Die größten Kupfer produzierenden Länder wie Chile, Peru, China und die Vereinigten Staaten haben Mühe, die hohe Nachfrage der Länder zu decken, um ihre Initiativen für eine grüne Wirtschaft umzusetzen, was zu einem rasanten Anstieg des Kupferpreises beiträgt. Es gibt auch Spekulationen, dass sich mit der Schwächung des US-Dollars gegenüber anderen nordamerikanischen Währungen für Benutzer anderer Währungen mehr Möglichkeiten ergeben werden, ihre Kaufkraft mit Kupfer und anderen Rohstoffen zu erhöhen.

Jüngste Entwicklungen

- Im April 2023 kündigte TE Connectivity das neue EV Single Wall (EVSW)-Rohr an, das speziell für Hochspannungsanwendungen entwickelt wurde und leitfähige Komponenten und Kabel sicher isoliert und schützt. Bei diesem Produkt handelt es sich um ein einwandiges Rohr, dessen Hauptaugenmerk auf der elektrischen Isolierung und dem Schutz von Hochspannungskomponenten in Elektrofahrzeugen liegt. Dies wird dem Unternehmen helfen, sein Produktportfolio zu diversifizieren und den einzigartigen Herausforderungen von EV-Anwendungen gerecht zu werden.

- Im Februar 2023 veröffentlichte Molex einen Miniaturisierungsbericht, in dem Experteneinblicke und Innovationen in der Produktdesigntechnik und in modernster Konnektivität dargelegt wurden. Durch diese Miniaturisierung hat das Unternehmen die Wirksamkeit und Sicherheit der Produkte erhöht. Diese Entwicklung erweiterte die Produktlinie des Unternehmens und wirkte sich positiv auf das Wachstum des nordamerikanischen Marktes für Schrumpfschläuche aus.

Nordamerika Schrumpfschlauch Marktumfang

Der nordamerikanische Markt für Schrumpfschläuche ist in sechs wichtige Segmente unterteilt, basierend auf Typ, Produkttyp, Material, Spannung, Schrumpfverhältnis und Endverbraucher. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Typ

- Einzelwand

- Doppelwandig

Auf der Grundlage des Typs ist der nordamerikanische Markt für Schrumpfschläuche in einwandige und doppelwandige Schläuche segmentiert.

Produkttyp

- Spulen

- Vorgeschnittene Längen

- Sonstiges

Auf der Grundlage des Produkttyps ist der nordamerikanische Markt für Schrumpfschläuche in Spulen, vorgeschnittene Längen und Sonstiges segmentiert.

Stromspannung

- Niedrig

- Medium

- Hoch

Auf der Grundlage der Spannung ist der nordamerikanische Markt für Schrumpfschläuche in niedrig, mittel und hoch segmentiert.

Schrumpfverhältnis

- 2:01

- 3:01

- 4:01

- 6:01

- Sonstiges

Auf der Grundlage der Schrumpfrate ist der nordamerikanische Markt für Schrumpfschläuche in 2:01, 3:01, 4:01, 6:01 und andere segmentiert.

Material

- Polyolefin

- Perfluoralkoxyalkan (PFA)

- Polytetrafluorethylen (PTFE)

- Ethylen-Tetrafluorethylen (ETFE)

- Fluoriertes Ethylenpropylen (FEP)

- Polyetheretherketon (PEEK)

- Sonstiges

Auf der Grundlage des Materials ist der nordamerikanische Markt für Schrumpfschläuche in Polyolefin, Perfluoralkoxyalkan (PFA), Polytetrafluorethylen (PTFE), Ethylentetrafluorethylen (ETFE), Fluorethylenpropylen (FEP), Polyetheretherketon (PEEK) und andere unterteilt.

Endbenutzer

- Hilfsmittel

- IT und Telekommunikation

- Automobilindustrie

- Elektronik

- Luft- und Raumfahrt

- Gesundheitspflege

- Öl und Gas

- Marine

- Essen und Trinken

- Konstruktion

- Chemisch

- Sonstiges

Auf Grundlage der Anwendung ist der nordamerikanische Markt für Schrumpfschläuche in die Branchen Versorgungswirtschaft, IT und Telekommunikation, Automobil, Elektronik, Luft- und Raumfahrt, Gesundheitswesen, Öl und Gas, Schifffahrt, Lebensmittel und Getränke, Bau, Chemie und Sonstige unterteilt.

Nordamerika: Regionale Analyse/Einblicke zum Markt für Schrumpfschläuche

Der nordamerikanische Markt für Schrumpfschläuche wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Typ, Produkttyp, Spannung, Schrumpfverhältnis, Material und Endbenutzer wie oben angegeben bereitgestellt.

Die im nordamerikanischen Marktbericht für Schrumpfschläuche abgedeckten Länder sind die USA, Kanada und Mexiko.

Aufgrund ihres hochentwickelten Softwaresektors dominieren die USA die Region Nordamerika.

Der regionale Abschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie die Analyse der nachgelagerten und vorgelagerten Wertschöpfungskette, technische Trends und die Fünf-Kräfte-Analyse von Porter sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung einer Prognoseanalyse der regionalen Daten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken, die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Schrumpfschläuchen in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Marktes für Schrumpfschläuche liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz in Nordamerika, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den nordamerikanischen Markt für Schrumpfschläuche.

Some of the major players operating in North America heat shrink tubing market are ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd. (China) among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ROLE OF THE GOVERNMENT IN SUPPORTING AND EXPANSION OF TRANSMISSION & DISTRIBUTION SYSTEMS IN THE HEAT SHRINK TUBING MARKET ACROSS THE REGION

5.1.2 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE

5.1.3 RISING USAGE OF PRODUCTS WITH ADVANCED INFRASTRUCTURE AND TECHNOLOGY

5.1.4 INCREASING PENETRATION OF ELECTRIC VEHICLES

5.2 RESTRAINTS

5.2.1 GOVERNMENT REGULATION ON THE EMISSION OF TOXIC GASES

5.2.2 PRODUCTION CHALLENGES IN THE LEAST DEVELOPED COUNTRIES

5.2.3 INVOLVEMENT OF PLASTIC HAS A DIRECT IMPACT ON THE COST AS WELL AS THE ENVIRONMENT

5.3 OPPORTUNITIES

5.3.1 WIDE ADOPTION OF HEAT SHRINK TUBES IN VARIOUS INDUSTRIES

5.3.2 EASY PRODUCTION OF THE HEAT-SHRINKABLE TUBING

5.3.3 AUTOMATING A HEAT SHRINK TUBING PROCESS

5.4 CHALLENGES

5.4.1 RISING PRICES OF RAW MATERIALS FOR TUBING

5.4.2 POOR INSTALLATION OF HEAT-SHRINK TUBES

5.4.3 AVAILABILITY OF ALTERNATIVE AND INEXPENSIVE PRODUCTS IN THE MARKET

6 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE WALL

6.3 DUAL WALL

7 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOOLS

7.3 PRE-CUT LENGTH

7.4 OTHERS

8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 POLYOLEFIN

9.3 PERFLUOROALKOXY ALKANES (PFA)

9.4 POLYTETRAFLUOROETHYLENE (PTFE)

9.5 FLUORINATED ETHYLENE PROPYLENE (FEP)

9.6 ETHYLENE TETRAFLUOROETHYLENE (ETFE)

9.7 POLYETHER ETHER KETONE (PEEK)

9.8 OTHERS

10 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO

10.1 OVERVIEW

10.2 12/30/1899 2:01:00 AM

10.3 12/30/1899 3:01:00 AM

10.4 12/30/1899 4:01:00 AM

10.5 12/30/1899 6:01:00 AM

10.6 OTHERS

11 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER

11.1 OVERVIEW

11.2 UTILITIES

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.5.1 COMMERCIAL/INDUSTRIAL

11.5.2 CONSUMER PRODUCT

11.6 AEROSPACE

11.7 HEALTHCARE

11.8 OIL AND GAS

11.9 MARINE

11.1 FOOD AND BEVERAGES

11.11 CONSTRUCTION

11.11.1 COMMERCIAL

11.11.2 RESIDENTIAL

11.12 CHEMICAL

11.13 OTHERS

12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SUMITOMO ELECTRIC INDUSTRIES, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MOLEX

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ABB

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 PRYSMIAN GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ALPHA WIRE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CHANGYUAN ELECTRONICS (DONGGUAN) CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DASHENG GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 COMPANY PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DUNBAR PRODUCTS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GREMCO GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HELLERMANNTYTON

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HILLTOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANDUIT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEXCO

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 QUALTEK ELECTRONICS CORP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SHAWCOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TECHFLEX, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 THERMOSLEEVE USA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 ZEUS INDUSTRIAL PRODUCTS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SINGLE WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA DUAL WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPOOLS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA PRE-CUT LENGTH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LOW IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MEDIUM IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA HIGH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA POLYOLEFIN IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PERFLUOROALKOXY ALKANES (PFA) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA POLYTETRAFLUOROETHYLENE (PTFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLUORINATED ETHYLENE PROPYLENE (FEP) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ETHYLENE TETRAFLUOROETHYLENE (ETFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA POLYETHERETHERKETONE (PEEK) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA 2:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA 3:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA 4:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA 6:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA UTILITIES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA IT AND TELECOMMUNICATION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA AUTOMOTIVE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA AEROSPACE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA HEALTHCARE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OIL AND GAS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA MARINE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FOOD AND BEVERAGES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA CHEMICAL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 U.S. HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 U.S. HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 53 U.S. HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 54 U.S. HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 55 U.S. HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 56 U.S. ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 CANADA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 62 CANADA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 CANADA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 64 CANADA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 CANADA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 MEXICO HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 69 MEXICO HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 70 MEXICO HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 MEXICO HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 72 MEXICO ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 MEXICO CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEAT SHRINK TUBING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA HEAT SHRINK TUBING MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA HEAT SHRINK TUBING MARKET: TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA HEAT SHRINK TUBING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE IS EXPECTED TO DRIVE THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE SINGLE WALL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEAT SHRINK TUBING MARKET

FIGURE 16 GOVERNMENT INITIATIVES TO ENHANCE POWER TRANSMISSION

FIGURE 17 GENERATION OF RENEWABLE ELECTRICITY

FIGURE 18 ELECTRICITY GENERATION IN VARIOUS COUNTRIES

FIGURE 19 NORTH AMERICA SALES VOLUME OF ELECTRIC VEHICLES

FIGURE 20 MANUFACTURING PROCESS FOR HEAT SHRINK TUBING

FIGURE 21 SILVER PRICING (SEPTEMBER 2022 TO MARCH 2023)

FIGURE 22 ALTERNATIVES FOR HEAT SHRINK TUBING

FIGURE 23 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE, 2022

FIGURE 24 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY PRODUCT TYPE, 2022

FIGURE 25 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2022

FIGURE 26 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY MATERIAL, 2022

FIGURE 27 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY SHRINK RATIO, 2022

FIGURE 28 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY END-USER, 2022

FIGURE 29 NORTH AMERICA HEAT SHRINK TUBING MARKET: SNAPSHOT (2022)

FIGURE 30 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022)

FIGURE 31 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 NORTH AMERICA HEAT SHRINK TUBING MARKET: BY TYPE (2023-2030)

FIGURE 34 NORTH AMERICA HEAT SHRINK TUBING MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.