North America Food Grade And Animal Feed Grade Salt Market

Marktgröße in Milliarden USD

CAGR :

%

USD

467.09 Million

USD

619.84 Million

2025

2033

USD

467.09 Million

USD

619.84 Million

2025

2033

| 2026 –2033 | |

| USD 467.09 Million | |

| USD 619.84 Million | |

|

|

|

|

Marktsegmentierung für Speisesalz und Futtermittelsalz in Nordamerika nach Produkttyp (Steinsalz, Meersalz, Sole, Vakuumsalz und Sonstige), Reinheit (98–99,5 % und über 99,5 %), Produktionsverfahren (Verdampfung, Abbau und Sonstige), Vertriebskanal (direkt und indirekt), Endverbraucher (Lebensmittel- und Getränkeindustrie sowie Gastronomie) und Anwendung (Lebensmittel, Sporternährung, Getränke und Futtermittel) – Branchentrends und Prognose bis 2033

Wie groß ist der nordamerikanische Markt für Speisesalz und Futtermittelsalz und wie hoch ist seine Wachstumsrate?

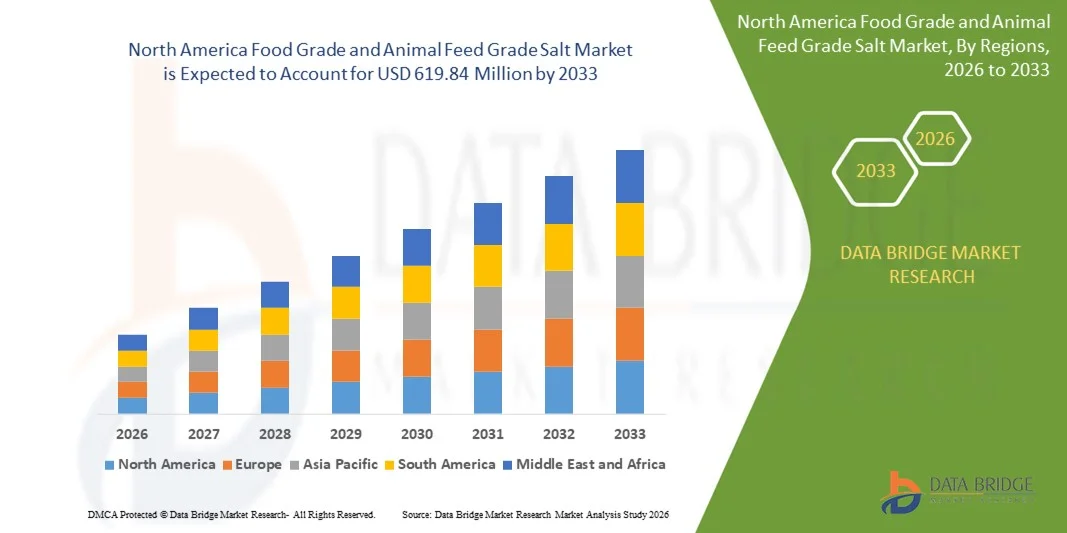

- Der nordamerikanische Markt für Speisesalz und Futtermittelsalz hatte im Jahr 2025 einen Wert von 467,09 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 619,84 Millionen US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 3,60 % im Prognosezeitraum entspricht.

- Die steigende Nachfrage nach Speisesalz in der Lebensmittel- und Getränkeindustrie führt zu einem Wachstum des Salzmarktes. Auch der vermehrte Einsatz von Salz in Tierfutter trägt zum Marktwachstum bei.

Was sind die wichtigsten Erkenntnisse über den Markt für Speisesalz und Futtermittelsalz?

- Bestimmte staatliche Initiativen und Maßnahmen zur Salzreduzierung hemmen das Wachstum des Marktes für Speisesalz. Die verschiedenen Produkteinführungen im Bereich Speisesalz treiben das Marktwachstum hingegen an.

- Die USA dominierten den nordamerikanischen Markt für Speisesalz und Futtermittelsalz mit einem geschätzten Umsatzanteil von 39,4 % im Jahr 2025, angetrieben durch die starke Nachfrage aus der Lebensmittelverarbeitung, der Fleischverarbeitung, der Bäckerei- und der Milchindustrie im ganzen Land.

- Für Kanada wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,34 % das schnellste Wachstum prognostiziert, gestützt durch die steigende Nachfrage aus den Bereichen verarbeitete Lebensmittel, Milchprodukte, Backwaren und Fleischverarbeitung.

- Das Segment Vakuumsalz dominierte den Markt mit einem geschätzten Anteil von 41,8 % im Jahr 2025, was auf seine hohe Reinheit, die einheitliche Kristallgröße und die Eignung für die Lebensmittelverarbeitung und Tierfutterformulierungen zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Salz in Lebensmittel- und Futtermittelqualität

|

Attribute |

Wichtige Markteinblicke in Lebensmittel- und Futtermittelsalz |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und den regulatorischen Rahmen. |

Was ist der wichtigste Trend auf dem Markt für Speisesalz und Futtermittelsalz?

Zunehmender Trend hin zu reineren, angereicherten und anwendungsspezifischen Salzprodukten

- Der Markt für Speisesalz und Futtermittelsalz verzeichnet eine zunehmende Verlagerung hin zu hochreinen, schadstoffkontrollierten und standardisierten Salzprodukten, um den strengen Vorschriften für Lebensmittelsicherheit und Tierernährung gerecht zu werden.

- Hersteller bringen angereicherte und funktionelle Salzvarianten auf den Markt, darunter jodangereicherte, mineralstoffausgewogene und mit Spurenelementen versetzte Salze, sowohl für den menschlichen Verzehr als auch für Tierfutter.

- Die steigende Nachfrage nach gleichbleibender Qualität, einheitlicher Granulierung und zuverlässiger Mineralstoffzusammensetzung treibt die Akzeptanz in Lebensmittelverarbeitungsbetrieben und Futtermittelwerken voran.

- Beispielsweise erweitern Unternehmen wie Cargill, Morton Salt, K+S und Windsor Salt die Produktion von raffinierten, lebensmittelsicheren und futtermitteloptimierten Salzsorten mit verbesserten Verarbeitungs- und Verpackungsstandards.

- Der zunehmende Fokus auf Tiergesundheit, Futterverwertung und Nährstoffergänzung beschleunigt die Nachfrage nach Futtermittelsalzlösungen.

- Da die Einhaltung gesetzlicher Vorschriften und die Optimierung der Nährstoffversorgung immer wichtiger werden, bleiben Salze in Lebensmittel- und Futtermittelqualität unverzichtbare Rohstoffe für die Lebensmittelverarbeitung und die Tierhaltung.

Was sind die wichtigsten Einflussfaktoren auf den Markt für Speisesalz und Futtermittelsalz?

- Steigende Nachfrage nach sicheren, hygienischen und ernährungsphysiologisch konformen Zutaten in verpackten Lebensmitteln, der Fleischverarbeitung, Milchprodukten und Tierfutterrezepturen

- Beispielsweise erhöhten führende Salzproduzenten wie Cargill, Morton Salt und K+S im Zeitraum 2024–2025 ihre Kapazitäten für lebensmitteltaugliche und angereicherte Salzprodukte, um die steigende Nachfrage von Lebensmittel- und Futtermittelherstellern zu decken.

- Das Wachstum des Konsums von verarbeiteten Lebensmitteln, der Fleischproduktion und der kommerziellen Tierhaltung in den USA, Nordamerika und im asiatisch-pazifischen Raum treibt die Salznachfrage an.

- Fortschritte bei Raffinerietechnologien, Reinigungsverfahren und Kontaminationskontrolle haben die Produktqualität und die Einhaltung gesetzlicher Vorschriften verbessert.

- Zunehmender Einsatz von Futtersalz zur Optimierung des Elektrolythaushalts, der Verdauung und des Wachstums bei Rindern, Geflügel und in der Aquakultur

- Unterstützt durch die expandierende Lebensmittelverarbeitungsindustrie und den steigenden Proteinkonsum in Nordamerika wird für den Markt für Speisesalz und Futtermittelsalz ein stetiges langfristiges Wachstum erwartet.

Welcher Faktor beeinträchtigt das Wachstum des Marktes für Speisesalz und Futtermittelsalz?

- Strenge Vorschriften in Bezug auf Lebensmittelsicherheit, Reinheitsstandards und die Einhaltung der Vorschriften für Zusatzstoffe erhöhen die Produktions- und Zertifizierungskosten für Hersteller.

- Beispielsweise wirkten sich im Zeitraum 2024–2025 steigende Energiepreise, Transportkosten und Umweltauflagen auf die Gewinnmargen der Salzproduzenten aus.

- Schwankungen in der Verfügbarkeit von Rohsalz aufgrund klimatischer Bedingungen, Einschränkungen im Salzabbau und logistischer Störungen beeinträchtigen die Versorgungsstabilität.

- Die wachsende Verbraucherpräferenz für natriumarme Ernährung und Initiativen zur Salzreduktion begrenzt das Mengenwachstum in bestimmten Lebensmittelkategorien.

- Der Wettbewerb durch Salzersatzstoffe, Mineralstoffmischungen und alternative Nahrungsergänzungsmittel erzeugt Preis- und Nachfragedruck.

- Um diese Herausforderungen zu bewältigen, konzentrieren sich die Unternehmen auf Prozessoptimierung, Produktdifferenzierung, nachhaltige Beschaffung und die Entwicklung von angereicherten Salzprodukten mit Mehrwert.

Wie ist der Markt für Speisesalz und Futtermittelsalz segmentiert?

Der Markt ist segmentiert nach Produkttyp, Reinheit, Produktionsprozessen, Vertriebskanal, Endverbraucher und Anwendung .

- Nach Produkttyp

Basierend auf der Produktart ist der Markt für Speisesalz und Futtermittelsalz in Steinsalz, Meersalz, Sole, Vakuumsalz und Sonstige unterteilt. Vakuumsalz dominierte den Markt mit einem geschätzten Anteil von 41,8 % im Jahr 2025. Dies ist auf seine hohe Reinheit, die einheitliche Kristallgröße und seine Eignung für die Lebensmittelverarbeitung und die Herstellung von Futtermitteln zurückzuführen. Aufgrund seines geringen Verunreinigungsgrades und seiner gleichbleibenden Mineralzusammensetzung findet Vakuumsalz breite Anwendung in Bäckereien, Molkereien, der Fleischverarbeitung und der Futtermittelherstellung.

Das Segment Meersalz wird voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen. Treiber dieser Entwicklung ist die steigende Nachfrage nach minimal verarbeitetem Salz natürlichen Ursprungs, sowohl in Lebensmitteln als auch in Spezialfuttermitteln. Die zunehmende Beliebtheit von Meersalz in Premium-Lebensmitteln und das wachsende Bewusstsein für die Vorteile von Spurenelementen begünstigen dieses rasante Wachstum.

- Durch Reinheit

Basierend auf dem Reinheitsgrad ist der Markt in zwei Segmente unterteilt: Reinheit 98–99,5 % und Reinheit über 99,5 %. Das Segment mit einer Reinheit über 99,5 % dominierte den Markt im Jahr 2025 mit einem Anteil von 57,3 %. Dies ist auf strenge Lebensmittelsicherheitsvorschriften und die steigende Nachfrage von Herstellern verarbeiteter Lebensmittel und Futtermittelproduzenten zurückzuführen. Hochreines Salz gewährleistet Konsistenz, Hygiene und die Einhaltung gesetzlicher Standards und ist daher in der großindustriellen Lebensmittelproduktion die bevorzugte Wahl.

Das Segment mit einem Reinheitsgrad von 98 % bis 99,5 % wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Treiber dieser Entwicklung ist der zunehmende Einsatz in Tierfutter, Aquakultur und kostensensiblen Lebensmittelanwendungen. Ausgewogene Preise und ein angemessener Mineralstoffgehalt machen diesen Reinheitsgradbereich attraktiv für die Herstellung von Futtermitteln in großen Mengen.

- Durch Produktionsprozesse

Auf Basis der Produktionsverfahren ist der Markt in Verdampfungsverfahren, Abbauverfahren und Sonstige unterteilt. Das Segment der Verdampfungsverfahren dominierte den Markt mit einem geschätzten Anteil von 46,5 % im Jahr 2025, da es die Herstellung von hochreinem Salz mit kontrollierter Kristallisation ermöglicht. Dieses Verfahren findet breite Anwendung in der Lebensmittel- und Futtermittelindustrie, wo Konsistenz und Kontaminationskontrolle von entscheidender Bedeutung sind.

Das Segment der Abbaumethoden wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Unterstützt wird dies durch den Ausbau des Untertage- und Laugungsbergbaus, verbesserte Raffinerietechnologien und die steigende Nachfrage nach Rohsalz in großen Mengen. Zusätzlich fördern verstärkte Investitionen in nachhaltige Abbaupraktiken das Wachstum dieses Segments.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt für Speisesalz und Futtermittelsalz in direkte und indirekte Kanäle unterteilt. Der direkte Vertriebskanal dominierte den Markt mit einem Anteil von 52,6 % im Jahr 2025. Treiber dieser Entwicklung war die starke Nachfrage großer Lebensmittelverarbeiter, Fleischproduzenten und Futtermittelhersteller, die eine stabile Versorgung, kundenspezifische Spezifikationen und Kosteneffizienz suchten. Die direkte Beschaffung gewährleistet Qualitätssicherung, Rückverfolgbarkeit und langfristige Lieferantenbeziehungen.

Der indirekte Vertriebskanal dürfte von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, unterstützt durch die Expansion von Großhändlern, Distributoren und Einzelhandelsnetzen, die kleine und mittlere Lebensmittelproduzenten, Gastronomiebetriebe und regionale Futtermittelwerke beliefern.

- Vom Endbenutzer

Basierend auf den Endverbrauchern ist der Markt in die Lebensmittel- und Getränkeindustrie sowie den Gastronomiesektor unterteilt. Das Segment Lebensmittel- und Getränkeindustrie dominierte den Markt mit einem geschätzten Anteil von 64,9 % im Jahr 2025, was auf die breite Verwendung in verarbeiteten Lebensmitteln, Backwaren, Molkereiprodukten, Fleischverarbeitung und verpackten Snacks zurückzuführen ist. Große Produktionsmengen und strenge Qualitätsanforderungen treiben die anhaltende Nachfrage an.

Es wird erwartet, dass das Segment Food Service von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen wird. Treiber dieser Entwicklung sind die Expansion von Schnellrestaurants, Catering-Services und Großküchen sowie der steigende Konsum von Fertiggerichten.

- Durch Bewerbung

Basierend auf den Anwendungsgebieten ist der Markt für Speisesalz und Futtermittelsalz in die Segmente Lebensmittel, Sporternährung, Getränke und Tierfutter unterteilt. Das Segment Lebensmittel dominierte den Markt mit einem Anteil von 48,7 % im Jahr 2025, was auf den hohen Verbrauch in verarbeiteten Lebensmitteln, Backwaren, Milchprodukten und der Fleischkonservierung zurückzuführen ist. Salz bleibt ein wichtiger Bestandteil zur Geschmacksverbesserung, Texturoptimierung und Verlängerung der Haltbarkeit.

Das Segment Tierfutter wird voraussichtlich von 2026 bis 2033 die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen. Treiber dieser Entwicklung sind die steigende Tierproduktion, der zunehmende Fokus auf die Tiergesundheit und die wachsende Verwendung von Salz als essentielles Mineralzusatzmittel in Futtermittelrezepturen.

Welche Region hält den größten Anteil am Markt für Speisesalz und Futtermittelsalz?

- Die USA dominierten den nordamerikanischen Markt für Speisesalz und Futtermittelsalz mit einem geschätzten Umsatzanteil von 39,4 % im Jahr 2025. Treiber dieser Entwicklung war die starke Nachfrage aus der Lebensmittel-, Fleisch-, Bäckerei- und Milchindustrie im ganzen Land. Der hohe Konsum von verpackten Lebensmitteln, fortschrittliche Lebensmittelsicherheitsstandards und eine gut etablierte Vieh- und Futtermittelproduktion tragen weiterhin zu einer robusten Salznachfrage bei.

- Führende Salzproduzenten und Lebensmittelzutatenlieferanten in Nordamerika investieren in hochreine Raffinationstechnologien, angereicherte und jodierte Salzprodukte sowie nachhaltige Produktionsmethoden und stärken damit die Führungsposition der USA. Der Ausbau der industriellen Lebensmittelverarbeitungskapazitäten und starke inländische Vertriebsnetze festigen die regionale Marktpräsenz zusätzlich.

- Strenge regulatorische Rahmenbedingungen, eine effiziente Logistikinfrastruktur und die hohe Akzeptanz qualitätskontrollierter Lebensmittelzutaten festigen die Vormachtstellung Nordamerikas auf dem Markt für Speisesalz und Futtermittelsalz.

Kanadischer Salzmarkt für Lebensmittel- und Futtermittelqualität

Für Kanada wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,34 % das schnellste Wachstum prognostiziert. Dies wird durch die steigende Nachfrage aus den Bereichen verarbeitete Lebensmittel, Milchprodukte, Backwaren und Fleischverarbeitung begünstigt. Der zunehmende Konsum verpackter Lebensmittel, wachsende Lebensmittelexporte und der verstärkte Einsatz von standardisiertem Futtersalz in der Tier- und Aquakulturernährung treiben das Marktwachstum an.

Einblick in den mexikanischen Markt für Speisesalz und Futtermittelsalz

Mexiko trägt dank der starken Nachfrage aus den Bereichen Lebensmittelverarbeitung, Backwaren und Snacks stetig zum Marktwachstum bei. Die Ausweitung der Vieh- und Geflügelzucht, das Wachstum der Tierfutterproduktion und der zunehmende Fokus auf die Einhaltung der Lebensmittelsicherheitsbestimmungen unterstützen die nachhaltige Marktentwicklung.

Welche sind die führenden Unternehmen auf dem Markt für Speisesalz und Futtermittelsalz?

Die Salzindustrie für Lebensmittel und Tierfutter wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Cargill, Incorporated (USA)

- Morton Salt, Inc. (USA)

- K+S Aktiengesellschaft (Deutschland)

- Ciech SA (Polen)

- Windsor Salt Ltd. (Kanada)

- United Salt Corporation (USA)

- SaltWorks (USA)

- Die Cope Company Salt (USA)

- SAN FRANCISCO SALT CO (USA)

- ZOUTMAN NV (Belgien)

- Salinen Austria Aktiengesellschaft (Österreich)

- WA Salt Group (Australien)

- Cimsal Indústria Salineira (Brasilien)

- Cheetham Salt (Australien)

- Britisches Salz (UK)

- Mozyrsalt, JSC (Belarus)

- Sifto Canada (Kanada)

- Midwest Salt (USA)

- ROCK (UK)

- Ahir Salt Industries (Indien)

- Donald Brown Group (UK)

Welche aktuellen Entwicklungen gibt es auf dem nordamerikanischen Markt für Speisesalz und Futtermittelsalz?

- Im Mai 2023 ging Cargill eine strategische Kooperation mit der CIECH Group ein, um seine Spezial- und Verdampfungssalzlösungen in Nordamerika auszubauen. Ziel dieser Entwicklung ist es, das Produktangebot von Cargill für Lebensmittelhersteller zu diversifizieren und die Marktpräsenz in der Region zu stärken. Dieser Schritt positioniert Cargill, um die steigende Nachfrage nach Spezialsalzen in der Lebensmittelverarbeitung zu bedienen und seine innovationsgetriebene Führungsrolle auf dem nordamerikanischen Salzmarkt zu festigen.

- Im Dezember 2022 unterzeichnete CIECH Soda Polska einen langfristigen Liefervertrag mit den Salzbergwerken Inowrocław „Solino“, um eine kontinuierliche Soleversorgung zu sichern. Diese Initiative verbessert die Produktionsstabilität und die betriebliche Effizienz von CIECH und gewährleistet eine unterbrechungsfreie Produktion. Der Vertrag stärkt die Position von CIECH als bedeutender Akteur auf dem nordamerikanischen Salzmarkt durch zuverlässige Beschaffung und nachhaltiges Wachstum.

- Im April 2022 brachte Tata Salt in Indien Tata Salt Immuno auf den Markt, ein mit Zink angereichertes Speisesalz zur Unterstützung des Immunsystems. Diese Produktinnovation trägt dem wachsenden Gesundheits- und Ernährungsbewusstsein der Verbraucher Rechnung und geht über die herkömmliche Jodierung hinaus. Die Markteinführung stärkt das Produktportfolio von Tata und unterstreicht den zunehmenden Trend zu funktionellem Salz auf dem indischen Markt.

- Im Mai 2021 führte Tanteo Tequila aromatisierte Margarita-Salze ein, um sein Tequila-Sortiment zu ergänzen und das Premium-Cocktailsegment anzusprechen. Diese Salze intensivieren das Geschmacksprofil und ermöglichen ein individuelles Trinkerlebnis, ganz im Sinne der sich wandelnden Vorlieben in der Getränkeindustrie. Die Markteinführung unterstreicht die Erweiterung der Anwendungsmöglichkeiten von Salz in Lifestyle- und Nischenmärkten und eröffnet neue Wachstumschancen jenseits der traditionellen Verwendung in Lebensmitteln.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.