North America Food Flavors Market, By Product Type (Natural Extract, Flavor Ingredient), Type (Fruit Flavors, Spice Flavors, Herbal Flavors, Citrus Flavors, Dairy Flavors, Nutty Flavors, Vegetable Extracts, Coffee Flavors, Chocolate Flavor, Date Derivatives, Vegetable Oils, Carob Derivatives, Others), Origin (Natural, Natural Identical, Artificial), Category (Clean Label, Heat Stable, Regular, Non-Allergenic, Others), Solubility (Water Soluble, Oil Soluble, Fat Dispersible, Others), Form (Liquid, Powder, Syrup), Application (Confectionery, Bakery, Convenience Food, Snacks & Extruded Snacks, Frozen Desserts Products, Meat & Poultry Products, Breakfast Cereals, Processed Food, Baby Food, Sports Nutrition, Dietary Supplements, Beverages) - Industry Trends and Forecast to 2030.

North America Food Flavors Market Analysis and Insights

Food Flavors are routinely applied to food items to enhance their flavor. The primary taste additives are synthetic and natural flavors. Perishable foods, after processing and preserving tend to lose their flavor over time, which causes the need to use flavoring substances to help retain the flavor. The food and beverage industry needs Flavors for a variety of reasons, including the creation of new products, the addition of new product offerings, and the modification of existing products' Flavors. The food and beverage industry's high demand for new Flavors and ongoing growth are just what fuel market expansion. Additionally, during the projected period, the market for food Flavors is anticipated to experience growth due to an increase in demand from the fast food sector.

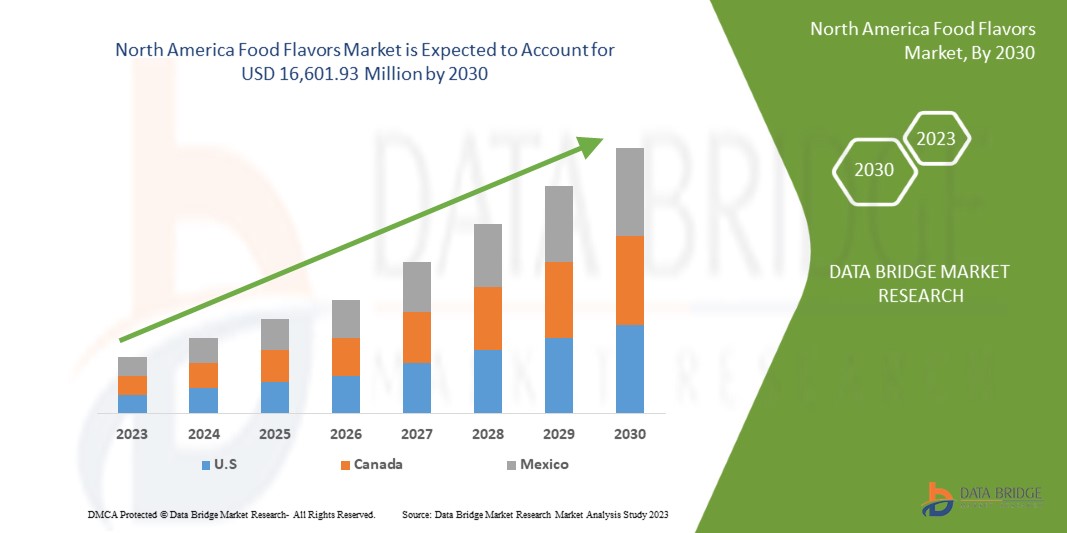

Data Bridge Market Research analyzes that the North America food flavors market is expected to reach the value of USD 16,601.93 million by 2030, at a CAGR of 6.3% during the forecast period. Natural Extracts accounts for the largest product type segment in the market due to their natural taste and health benefits whereas, natural flavors often contain a combination of isolated plant compounds to re-create the taste of fresh produce or cooked food that accelerated the demand for natural extracts or flavors in the food flavors market.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customisable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Nach Produkttyp (natürlicher Extrakt, Geschmacksstoff), Typ (Fruchtaromen, Gewürzaromen, Kräuteraromen, Zitrusaromen, Milcharomen, Nussaromen, Gemüseextrakte, Kaffeearomen, Schokoladenaroma, Dattelderivate, Pflanzenöle, Johannisbrotderivate, Sonstiges), Herkunft (natürlich, naturidentisch, künstlich), Kategorie (Clean Label, hitzebeständig, regulär, nicht allergen, Sonstiges), Löslichkeit (wasserlöslich, öllöslich, fettlöslich, Sonstiges), Form (flüssig, Pulver, Sirup), Anwendung (Süßwaren, Backwaren, Fertiggerichte, Snacks und extrudierte Snacks, gefrorene Dessertprodukte, Fleisch- und Geflügelprodukte, Frühstückszerealien, verarbeitete Lebensmittel, Babynahrung, Sporternährung, Nahrungsergänzungsmittel , Getränke) |

|

Abgedeckte Länder |

USA, Kanada, Mexiko |

|

Abgedeckte Marktteilnehmer |

McCormick & Company, Inc., MartinBauer, Prinova Group LLC., Synthite Industries Ltd., GOLD COAST INGREDIENTS, INC., HHOYA, Sensient Technologies Corporation, International Flavors & Fragrances Inc, Axxence Aromatic GmbH, Huabao International Holdings Limited, Blue Pacific Flavors, Inc, ADM, Capella Flavors, Inc., FLAVOR PRODUCERS, LLC, Firmenich SA., CUSTOM FLAVORS, FLAVORCAN INTERNATIONAL INC., Döhler, Abelei Inc, Trilogy Flavors, Givaudan, Stringer Flavor. Lt, Cargill, Incorporate, Synergy Flavor, Kerry Group plc, Taiyo Internationa, T.Hasegawa USA Inc, Flavorchem & Orchidia Fragrance, Honeyberry International LLP, San-Ei Gen FFI, Inc., MANE und unter anderem |

Marktdefinition

Lebensmittelaromen sind Zutaten, die verwendet werden, um den Geschmack oder das Aroma von Lebensmitteln und Getränken zu verbessern. Sie verändern die Wahrnehmung von Lebensmitteln und steigern das Interesse der Verbraucher. Diese Lebensmittelzusätze spielen eine wichtige Rolle bei der Produktakzeptanz und haben daher weltweit enorm an Bedeutung gewonnen.

Innovative Aromen, um den veränderten Geschmacksanforderungen der Kunden gerecht zu werden. Die Anwendung fortschrittlicher Technologien sorgt für innovative und neuartige Geschmacksrichtungen in Lebensmitteln. Der nordamerikanische Markt für Lebensmittelaromen dürfte im Prognosejahr aufgrund der Zunahme der Marktteilnehmer und der Verfügbarkeit fortschrittlicher Dienste wachsen. Darüber hinaus betreiben die Hersteller Forschungs- und Entwicklungsaktivitäten, um neue Aromastoffe auf den Markt zu bringen. Die zunehmende Forschung im Bereich der Lebensmittelindustrie dürfte das Marktwachstum weiter ankurbeln. Strenge staatliche Vorschriften und negative Auswirkungen synthetischer Aromen auf die menschliche Gesundheit dürften jedoch das Marktwachstum des nordamerikanischen Marktes für Lebensmittelaromen im Prognosezeitraum hemmen.

Marktdynamik für Lebensmittelaromen in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Steigende Nachfrage nach verschiedenen Geschmacksrichtungen in Lebensmitteln und Getränken, Backwaren und anderen Branchen aufgrund ihrer gesundheitlichen Vorteile

Lebensmittel- und Getränkehersteller verwenden seit Jahrzehnten künstliche Aromen, und diese bieten wichtige Vorteile. So können Menschen verschiedene Aromen auch dann genießen, wenn diese gerade keine Saison haben. Aromen können dazu beitragen, dass Essen weiterhin genießbar bleibt, indem es wirklich authentisch schmeckt und keine Nebennoten aufweist. Verschiedene fruchtige und natürliche Aromen erfreuen sich in der Lebensmittelindustrie aufgrund ihres unterschiedlichen Geschmacks und Duftes und ihrer gesundheitlichen Vorteile immer größerer Beliebtheit. Künstliche Aromen werden nicht aus der Natur gewonnen, sondern im Labor nachgebildet. Im Allgemeinen gilt „natürlich“ als besser, doch die Aromawissenschaft ist so weit fortgeschritten, dass viele künstliche Aromen tatsächlich genau die gleiche chemische Struktur aufweisen wie die natürlich vorkommenden. Aromen bestehen häufig nicht aus einer einzelnen Chemikalie, sondern aus einer Kombination von Chemikalien.

Fruchtige Aromen erfreuen sich in der Lebensmittel- und Getränkeindustrie großer Nachfrage, was hauptsächlich auf die chemische Verbindung Ethylpropionat zurückzuführen ist. Der Fruchtgeschmack ist eine Kombination aus Aroma und Geschmacksempfindungen. Konjugationen aus Zucker, Säuren, Phenolen und Hunderten flüchtiger Verbindungen tragen zum Fruchtgeschmack bei. Dazu gehören Zitrusaromen und Beerenaromen. Dazu gehören Grapefruit, Orange, Apfel, Banane usw. Hier möchte ich ein Beispiel für mit Fruchtgeschmack aromatisiertes Wasser nennen, das auf dem Markt erhältlich ist und sehr gefragt ist, da es verschiedene gesundheitliche Vorteile bietet:

Die steigende Nachfrage nach unterschiedlichen Aromen in allen Altersgruppen aufgrund ihrer gesundheitsfördernden Eigenschaften und ihres Geschmacks führt zu einer verstärkten Nachfrage nach Aromen auf dem Lebensmittelmarkt und dürfte daher den nordamerikanischen Markt für Lebensmittelaromen ankurbeln.

- Verbraucher bevorzugen blumige und natürliche Aromen

Den Backwaren werden verschiedene blumige und fruchtige natürliche Aromen zugesetzt, die den Verbrauchern ein natürliches Aroma und einen natürlichen Geschmack verleihen. Fruchtaromen werden normalerweise aus natürlichen Produkten hergestellt und mit pflanzlichen Aromen kombiniert, um essbaren Produkten ein natürliches Aroma zu verleihen. In den letzten Jahren haben sich die blumigen und natürlichen Aromen von einem Nischensektor zu einem großen Sektor entwickelt. Die meisten Blütenessenzen werden in Backwaren verwendet und die Wachstumsrate dieser Aromen ist hoch.

Beispiele für die in Backwaren verwendeten Aromen sind Zitronen-Lavendel-Kekse, Honig-Lavendel-Gelato, Zitronen-Violettes-Müsli, Brombeer-Rosen-Marshmallows und andere. Die Akzeptanz von Blumenaromen als Trend wird auf die Bereitschaft der Verbraucher zurückgeführt, Geld für natürliche Lebensmittel und Zutaten auszugeben.

Da die Nachfrage nach verschiedenen Geschmacksrichtungen steigt und die breite Bevölkerung unterschiedliche Geschmacksrichtungen akzeptiert, ist dies auf die Bereitschaft der Verbraucher zurückzuführen, Geld für natürliche Lebensmittel und Zutaten auszugeben. Die Nachfrage der Bevölkerung nach neuen Geschmacksrichtungen steigt umfassend und wird daher voraussichtlich den nordamerikanischen Markt für Lebensmittelaromen ankurbeln.

Gelegenheit

-

Zunahme der Einführung neuer Geschmacksrichtungen bei Lebensmitteln und Getränken

Aufgrund ihrer Geschmacksvielfalt, ihres gesundheitlichen Nutzens und ihres hervorragenden Geschmacks erfreuen sich nährstoffreiche Getränke in Nordamerika wachsender Beliebtheit. Die Marktteilnehmer auf dem nordamerikanischen Markt für Lebensmittelaromen. Darüber hinaus bringen die Akteure ständig neue Aromen für Lebensmittel auf den Markt.

Ein wesentlicher Bestandteil des Einführungsplans ist die schnelle Validierung des Produkts und seiner Vorteile. Dies geschieht mithilfe des Net Promoter Score (NPS), und der Customer Satisfaction Score (CSAT) kann verfälscht werden, wenn Sie negatives Feedback von Benutzern erhalten, die die erste Version Ihres Produkts oder Ihrer Funktion nicht testen sollen. Auf diese Weise entwickeln Hersteller neuer Aromen für Lebensmittel ständig neue Einführungsstrategien, die dem Unternehmen beim Wachstum helfen.

Daher werden die neuen Einführungsstrategien weltweit angewendet, um den Markt anzukurbeln. Dies ist eine hervorragende Gelegenheit für Hersteller, da diese Produkteinführungen den Inhalt und die Qualität der Produkte erklären und es den Verbrauchern ermöglichen, mehr Geschmacksrichtungen für Lebensmittel zu kaufen.

Daher ist zu erwarten, dass die zunehmende Einführung neuer Aromen für Nahrungsmittel und Getränke im Prognosezeitraum Chancen für den nordamerikanischen Markt für Lebensmittelaromen schaffen wird.

-

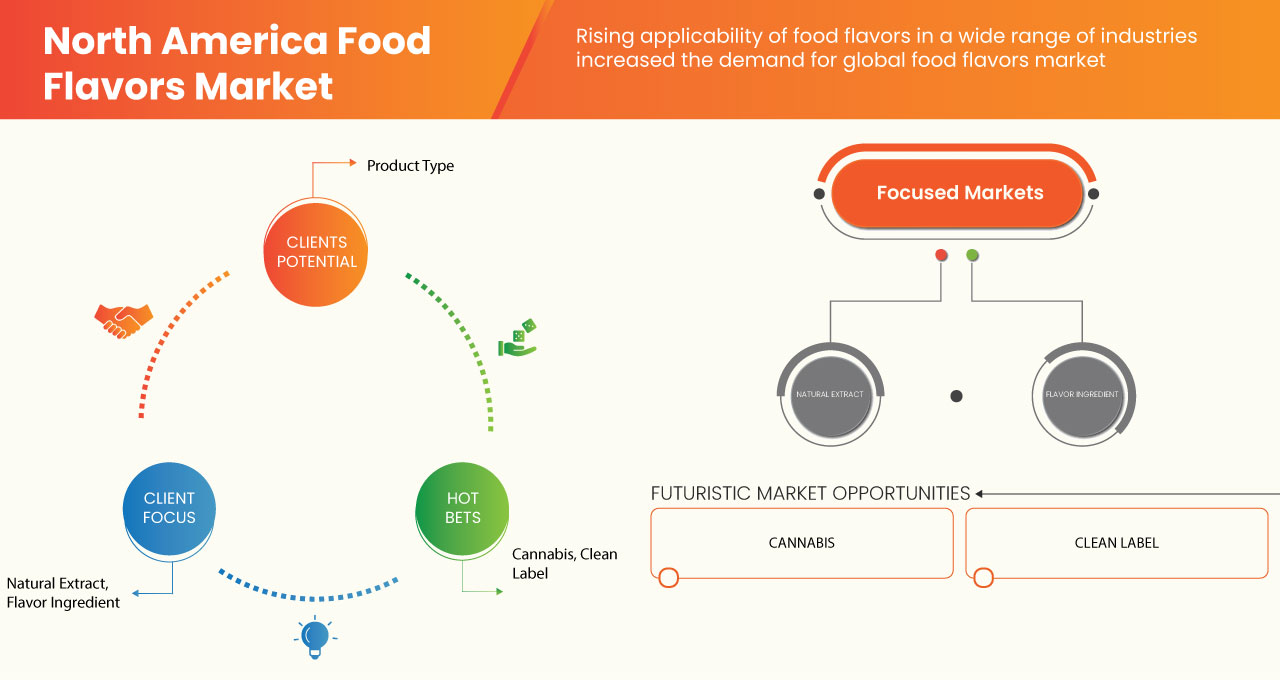

Einsatz von Cannabis als natürliche Zutat zur Geschmacksentwicklung

Terpene und Cannabinoide wie Tetrahydrocannabinol (THC) und Cannabinol (CBD) haben ein enormes Anwendungspotenzial in Medizin und Gesundheit. Darüber hinaus haben aus Cannabis gewonnene Chemikalien einzigartige Eigenschaften, die den unverwechselbaren Geschmack von Speisen und Getränken beeinflussen können. Es werden Studien durchgeführt, um zu beweisen, dass Cannabis die Geschmacksreaktion verbessern und die sensorische Attraktivität von Lebensmitteln steigern kann. Darüber hinaus entstehen durch die Kombination von Cannabis mit Pflanzenstoffen wie Ginseng, Ashwagandha und Zitrusfrüchten nicht nur neue Geschmacksprofile, sondern auch die Wirkung von Cannabis auf Konzentration, Schlaf und Stressabbau. Die Anpassung von Cannabis als Geschmackszutat könnte dem Markt für Lebensmittelaromen die Möglichkeit eröffnen, exponentiell zu wachsen.

-

Daher ist zu erwarten, dass die Nutzung von Cannabis als natürliche Zutat für die Geschmacksentwicklung das Geschäft in vielerlei Hinsicht ankurbelt und das Wachstum des Marktes für Lebensmittelaromen vorantreibt.

Einschränkung/Herausforderung

- Nebenwirkungen durch synthetische Aromen

Künstliche Substanzen, sogenannte synthetische Aromen, werden Lebensmitteln zugesetzt, um deren Geschmack, Haltbarkeit, Frische und Nährwert zu verbessern. Sie sind nicht nur in Joghurt, Chips, Brot, Salatdressings und Backwaren enthalten, sondern auch in vielen anderen Lebensmitteln. Zahlreiche wissenschaftliche Studien deuten jedoch darauf hin, dass künstliche Lebensmittelzusätze Krebs verursachen können. Insbesondere Nitrite und Nitrate, die häufig in verarbeitetem Fleisch enthalten sind, werden mit einem erhöhten Risiko für Dickdarmkrebs in Verbindung gebracht, wenn sie in größeren Mengen konsumiert werden. Derzeit werden Untersuchungen durchgeführt, die sich mit den Auswirkungen künstlicher Lebensmittelzusätze auf Verhaltensprobleme oder neurologische Entwicklungsstörungen bei Kindern befassen. Die schädlichen Auswirkungen synthetischer Aromen können daher das Wachstum des Marktes für Lebensmittelaromen bremsen.

Zu den weiteren Risiken künstlicher Aromen gehört, dass sie unser Gehirn dazu verleiten können, ihren Geschmack dem von Vollwertkost vorzuziehen. Der Verzicht auf nährstoffreiche Lebensmittel kann zu einer Reihe von Nährstoffmängeln führen, die mit einer ganzen Reihe von Gesundheitsproblemen in Verbindung gebracht werden.

Die schädlichen Nebenwirkungen können in der Bevölkerung Angst vor Lebensmittelaromen auslösen. Darüber hinaus beeinträchtigt es die Glaubwürdigkeit der Hersteller synthetischer Lebensmittelaromen, was sich auf den Produktverkauf auswirkt. Die durch synthetische Aromen verursachten Nebenwirkungen können daher das Wachstum des Marktes für Lebensmittelaromen behindern.

Jüngste Entwicklungen

- Im Februar 2022 gab Kerry bekannt, dass es zwei bedeutende Akquisitionen im Bereich Biotechnologie getätigt hat, die sein Fachwissen, sein Technologieportfolio und seine Produktionskapazitäten erweitern werden. Das Unternehmen gab bekannt, dass es eine Vereinbarung zur Übernahme des führenden Biotechnologie-Innovationsunternehmens c-LEcta getroffen hat, und bestätigte gleichzeitig die Übernahme des in Mexiko ansässigen Enzymherstellers Enmex. Diese strategisch attraktive Kombination mit Kerry wird die Innovationskapazitäten in den Bereichen Enzymtechnik, Fermentation und Bioprozessentwicklung beschleunigen

- Im Mai 2022 kündigt Givaudan die Entwicklung von Customer Foresight an. Die Kombination der fortschrittlichsten Datentechnologien mit den Erkenntnissen und dem Wissen der Givaudan-Experten hilft Kunden dabei, zukünftige Verbraucherbedürfnisse zu erfüllen.

- Im Mai 2022 gibt Symrise einen Überblick über aktuelle und zukünftige Entwicklungen bei Lebensmitteln und Getränken. Die Studie kombiniert qualitative und quantitative Forschungsmethoden und dient als wichtige Grundlage für die Entwicklung von verbraucherfreundlichen Geschmacks-, Ernährungs- und Gesundheitslösungen. Sie identifiziert die aktuellen Kundentrends bei Lebensmitteln und Getränken

- Im November 2022 kündigte Mane die Einrichtung eines neuen Geschmacksinnovationszentrums in Hyderabad an. Das Innovationszentrum erstreckt sich über 13.900 Quadratmeter im Hightech-Stadtgebiet und wird sich auf die End-to-End-Geschmacksentwicklung konzentrieren, um den Lebensmittel- und Getränkemarkt in Indien und anderen Märkten im asiatisch-pazifischen Raum zu bedienen.

Marktumfang für Lebensmittelaromen in Nordamerika

Der nordamerikanische Markt für Lebensmittelaromen ist in sechs wichtige Segmente unterteilt, basierend auf Produkttyp, Typ, Herkunft, Kategorie, Löslichkeit und Anwendung. Das Wachstum zwischen den Segmenten hilft Ihnen dabei, Nischenwachstumsbereiche und Strategien zur Marktansprache zu analysieren und Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten zu bestimmen.

NACH PRODUKTTYP

- Natürlicher Extrakt

- Geschmackszutat

Auf der Grundlage des Produkttyps ist der nordamerikanische Markt für Lebensmittelaromen in natürliche Extrakte und Aromazutaten segmentiert.

NACH TYP

- Fruchtaromen

- Gewürzaromen

- Kräuteraromen

- Zitrusaromen

- Milcharomen

- Nussige Aromen

- Pflanzenextrakte

- Kaffeearomen

- Schokoladengeschmack

- Datumsableitungen

- Pflanzenöle

- Johannisbrot-Derivate

- Sonstiges

Auf der Grundlage des Typs ist der nordamerikanische Markt für Lebensmittelaromen in Fruchtaromen, Gewürzaromen, Kräuteraromen, Zitrusaromen, Milcharomen, Nussaromen, Gemüseextrakte, Kaffeearomen, Schokoladenaromen, Dattelderivate, Pflanzenöle, Johannisbrotderivate und andere unterteilt.

NACH HERKUNFT

- Natürlich

- Natürlich identisch

- Künstlich

Auf der Grundlage der Herkunft wird der nordamerikanische Markt für Lebensmittelaromen in natürlich, naturidentisch und künstlich unterteilt.

NACH KATEGORIE

- Sauberes Etikett

- Hitzebeständig

- Regulär

- Nicht allergen

- Sonstiges

Auf der Grundlage der Kategorien ist der nordamerikanische Markt für Lebensmittelaromen in die Kategorien „Clean Label“, „hitzebeständig“, „normal“, „nicht allergen“ und „sonstige“ unterteilt.

NACH LÖSLICHKEIT

- Wasserlöslich

- Öllöslich

- Fettdispergierbar

- Sonstiges

Auf der Grundlage der Löslichkeit wird der nordamerikanische Markt für Lebensmittelaromen in wasserlöslich, öllöslich, fettlöslich und andere unterteilt.

NACH ANWENDUNG

- Süßwaren

- Bäckerei

- Fertiggerichte

- Snacks & extrudierte Snacks

- Gefrorene Desserts Produkte

- Fleisch- und Geflügelprodukte

- Frühstückscerealien

- Verarbeitete Lebensmittel

- Babynahrung

- Sporternährung

- Nahrungsergänzungsmittel

- Getränke

Auf der Grundlage der Anwendung ist der nordamerikanische Markt für Lebensmittelaromen in die Bereiche Süßwaren, Backwaren, Fertiggerichte, Snacks und extrudierte Snacks, Tiefkühldesserts, Fleisch- und Geflügelprodukte, Frühstückszerealien, verarbeitete Lebensmittel, Babynahrung, Sporternährung, Nahrungsergänzungsmittel und Getränke unterteilt.

Regionale Analyse/Einblicke zum nordamerikanischen Markt für Lebensmittelaromen

Der nordamerikanische Markt für Lebensmittelaromen ist basierend auf Produkttyp, Typ, Herkunft, Kategorie, Löslichkeit und Anwendung in sechs wichtige Segmente unterteilt.

Einige der in diesem nordamerikanischen Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko.

Aufgrund der zunehmenden Vorliebe der Kunden für natürliche und authentische Aromen dominieren die USA die Region Nordamerika aufgrund der starken Präsenz wichtiger Akteure.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Lebensmittelaromen in Nordamerika

The North America food flavors market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breath, application dominance, product type lifeline curve. The above data points provided are only related to the company’s focus on the North America food flavors market.

Some of the major players operating in the market are McCormick & Company, Inc., MartinBauer, Prinova Group LLC. , Synthite Industries Ltd., GOLD COAST INGREDIENTS, INC., HHOYA, Sensient Technologies Corporation, International Flavors & Fragrances Inc, Axxence Aromatic GmbH, Huabao International Holdings Limited, Blue Pacific Flavors, Inc, ADM, Capella Flavors, Inc., FLAVOR PRODUCERS, LLC, Firmenich SA., CUSTOM FLAVORS, FLAVORCAN INTERNATIONAL INC., Döhler, Abelei Inc, Trilogy Flavors, Givaudan, Stringer Flavor. Lt, Cargill, Incorporate, Synergy Flavor, Kerry Group plc, Taiyo Internationa, T.Hasegawa USA Inc, Flavorchem & Orchidia Fragrance, Honeyberry International LLP, San-Ei Gen F.F.I.,Inc., MANE and among others and among others.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA FOOD FLAVORS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET END COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 VALUE CHAIN ANALYSIS

4.2 SUPPLY CHAIN ANALYSIS

4.2.1 MAJOR FUNCTIONARIES INVOLVED IN THE SUPPLY CHAIN OF SPICES.

4.2.1.1 PRODUCER:

4.2.1.2 COMMISSION AGENT:

4.2.1.3 TRADER/EXPORTER:

4.2.1.4 WHOLESALER:

4.2.1.5 PROCESSOR:

4.2.1.6 RETAILER:

4.2.1.7 FINAL USERS:

4.3 IMPORT-EXPORT ANALYSIS

4.3.1 IMPORT (AUGUST 2022)

4.3.1.1 VIETNAM (FEBRUARY 2023)

4.3.1.2 INDIA (FEBRUARY 2023)

4.3.1.3 PHILIPPINES (FEBRUARY 2023)

4.3.2 EXPORT (TILL AUGUST 2022)

4.3.2.1 THAILAND (FEBRUARY 2023)

4.3.2.2 INDONESIA (FEBRUARY 2023)

4.3.2.3 SINGAPORE (FEBRUARY 2023)

4.4 PORTER’S FIVE FORCES

4.4.1 BARGAINING POWER OF BUYERS/CONSUMERS

4.4.2 BARGAINING POWER OF SUPPLIERS

4.4.3 THREAT OF NEW ENTRANTS

4.4.4 THREAT OF SUBSTITUTES

4.4.5 RIVALRY AMONG EXISTING COMPETITORS

4.5 RAW MATERIAL SOURCING ANALYSIS

4.5.1 FLAVOR INDUSTRY

4.5.1.1 NATURAL FLAVORING MATERIALS

4.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USER

4.9.1 NEW FLAVOURS

4.9.2 ONLINE PLATFORMS

4.9.3 QUALITY INGREDIENTS

4.1 LIST OF COMPANIES PRODUCING NATURAL EXTRACT

4.11 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.12 OVERVIEW

4.12.1 IMPACT ON PRICE

4.12.2 IMPACT ON SUPPLY CHAIN

4.12.3 IMPACT ON SHIPMENT

4.12.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.13 LIST OF KEY CUSTOMERS BY GEOGRAPHY

4.13.1 NORTH AMERICA

4.13.2 EUROPE

4.13.3 ASIA- PACIFIC

4.13.4 MIDDLE EAST AND AFRICA

4.13.5 SOUTH AFRICA

5 NATURAL INGREDIENTS USED AS FOOD FLAVORS CAN ALSO BE USED IN FEED FLAVORS

5.1 OVERVIEW

5.2 PRICING INDEX

5.3 OVERVIEW

5.4 PRICE AT B2B

5.5 PRICE AT FOB

5.6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

5.7 OVERVIEW

6 REGULATORY FRAMEWORK AND GUIDELINES

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING DEMAND FOR DIFFERENT FLAVORS IN FOOD AND BEVERAGE, BAKERY AND OTHER SEVERAL INDUSTRIES DUE TO THEIR HEALTH BENEFITS

7.1.2 CONSUMER INCLINATION TOWARD FLORAL AND NATURAL FLAVOURS

7.1.3 EXPANSION OF FOOD & BEVERAGE, BAKERY, AMONG OTHER INDUSTRIES

7.1.4 INCREASING DEMAND FOR FLAVOR-BASED VEGAN OR PLANT-BASED NUTRITIONAL FOOD AND BEVERAGES

7.2 RESTRAINTS

7.2.1 INCREASING REGULATION ON FLAVORED FORTIFIED FOOD

7.2.2 HIGHER PRICES OF FLAVORED NUTRITIONAL PRODUCTS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE NUMBER OF LAUNCHES OF NEW FLAVOURS IN NUTRITIONAL FOOD AND BEVERAGES

7.3.2 ADOPTION OF CANNABIS AS A NATURAL INGREDIENT FOR FLAVOR DEVELOPMENT

7.4 CHALLENGES

7.4.1 SIDE EFFECTS CAUSED BY SYNTHETIC FLAVORS

8 NORTH AMERICA FOOD FLAVORS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 NATURAL EXTRACT

8.3 FLAVOR INGREDIENT

9 NORTH AMERICA FOOD FLAVORS MARKET, BY TYPE

9.1 OVERVIEW

9.2 FRUIT FLAVORS

9.2.1 TYPE

9.2.1.1 BERRIES

9.2.1.1.1 STRAWBERRY

9.2.1.1.2 BLUEBERRY

9.2.1.1.3 RASPBERRY STRAWBERRY

9.2.1.1.4 BLACKCURRANT

9.2.1.1.5 RED RASPBERRY

9.2.1.1.6 BLACK RASPBERRY

9.2.1.1.7 GRAPES

9.2.1.1.8 CRANBERRY

9.2.1.1.9 GOOSEBERRY

9.2.1.1.10 ACAI BERRY

9.2.1.1.11 GOJI BERRY

9.2.1.1.12 MARIONBERRY

9.2.1.1.13 MULBERRY

9.2.1.1.14 ARONIA BERRY

9.2.1.1.15 CITRUS BERRY

9.2.1.2 APPLE

9.2.1.3 BANANA

9.2.1.4 MANGO

9.2.1.5 PLUM

9.2.1.6 NECTARINES

9.2.1.7 PAPAYA

9.2.1.8 CANTALOUPE

9.2.1.9 HONEYDEW

9.2.1.10 APRICOT

9.2.1.11 PASSIONFRUIT

9.2.2 PRODUCT TYPE

9.2.2.1 NATURAL EXTRACT

9.2.2.2 FLAVOR INGREDIENT

9.2.3 SPICE FLAVORS

9.2.3.1 GINGER

9.2.3.2 PEPPER

9.2.3.3 CINNAMON

9.2.3.4 MUSTARD

9.2.3.5 TURMERIC

9.2.3.6 CARDAMOM

9.2.3.7 CUMIN

9.2.3.8 CORIANDER

9.2.3.9 CLOVES

9.2.3.10 NUTMEG

9.2.3.11 FENNEL

9.2.3.12 FENUGREEK

9.2.3.13 SAFFRON

9.2.3.14 OTHERS

9.2.4 PRODUCT TYPE

9.2.4.1 NATURAL EXTRACT

9.2.4.2 FLAVOR INGREDIENT

9.2.5 HERBAL FLAVORS

9.2.5.1 MINT

9.2.5.2 PEPPERMINT

9.2.5.3 SPEARMINT

9.2.5.4 WINTERGREEN

9.2.5.5 MENTHOL

9.2.5.6 BASIL

9.2.5.7 OREGANO

9.2.5.8 THYM

9.2.5.9 SAGE

9.2.5.10 ROSE ROSEMARY

9.2.5.11 LAVENDER

9.2.5.12 CHAMOMILE

9.2.5.13 GREEN TEA

9.2.5.14 HIBISCUS JASMINE

9.2.5.15 BERGAMOT

9.2.5.16 ORANGE BLOSSOM

9.2.5.17 VERBENA

9.2.5.18 SARSAPARILLA

9.2.5.19 SASSAFRAS

9.2.5.20 ALOE VERA

9.2.5.21 BLACK TEA

9.2.5.22 EUCALYPTUS

9.2.5.23 OTHERS

9.2.6 PRODUCT TYPE

9.2.6.1 NATURAL EXTRACT

9.2.6.2 FLAVOR INGREDIENT

9.2.7 CITRUS FLAVORS

9.2.7.1 ORANGE

9.2.7.2 LEMON

9.2.7.3 LIME MANDARIN ORANGE

9.2.7.4 TANGERINE

9.2.7.5 GRAPEFRUIT

9.2.7.6 BLOOD ORANGE

9.2.7.7 KEY LIMEKUMQUAT

9.2.7.8 OTHERS

9.2.8 PRODUCT TYPE

9.2.8.1 NATURAL EXTRACT

9.2.8.2 FLAVOR INGREDIENT

9.2.9 DAIRY FLAVORS

9.2.9.1 CREAM

9.2.9.2 BUTTER FLAVOR

9.2.9.2.1 MEDIUM BUTTERY FLAVOR NOTES

9.2.9.2.2 MEDIUM STRONG BUTTERY FLAVOR NOTES

9.2.9.2.3 STRONG BUTTERY FLAVOR NOTES

9.2.9.2.4 OTHERS

9.2.9.3 WHIPPED CREAM

9.2.9.4 BAVARIAN CREAM

9.2.9.5 CREAM CHEESE ICE CREAM

9.2.9.6 NUTELLA TYPE SWEET CREAM

9.2.9.7 YOGURT TYPE

9.2.9.8 WHITE CHOCOLATE

9.2.9.9 IRISH CREAM

9.2.9.10 MOCHA

9.2.9.11 OTHERS

9.2.10 PRODUCT TYPE

9.2.10.1 NATURAL EXTRACT

9.2.10.2 FLAVOR INGREDIENT

9.2.11 NUTTY FLAVORS

9.2.11.1 ALMOND

9.2.11.2 CASHEW

9.2.11.3 HAZELNUT MACADAMIA NUT

9.2.11.4 PEANUT

9.2.11.5 PISTACHIO

9.2.11.6 WALNUT

9.2.11.7 PECAN PINE NUT

9.2.11.8 OTHERS

9.2.12 PRODUCT TYPE

9.2.12.1 NATURAL EXTRACT

9.2.12.2 FLAVOR INGREDIENT

9.2.13 VEGETABLE FLAVORS

9.2.13.1 GARLIC

9.2.13.2 TOMATO

9.2.13.3 MUSHROOM

9.2.13.4 ONION

9.2.13.5 CUCUMBER

9.2.13.6 WATERMELON

9.2.13.7 CHERRY TOMATO

9.2.13.8 TOMATO BASIL

9.2.13.9 OTHERS

9.2.14 PRODUCT TYPE

9.2.14.1 NATURAL EXTRACT

9.2.14.2 FLAVOR INGREDIENT

9.3 COFFEE FLAVORS

9.3.1 PRODUCT TYPE

9.3.1.1 NATURAL EXTRACT

9.3.1.2 FLAVOR INGREDIENT

9.4 CHOCOLATE FLAVORS

9.4.1 PRODUCT TYPE

9.4.1.1 NATURAL EXTRACT

9.4.1.2 FLAVOR INGREDIENT

9.5 DATE DERIVATIVES

9.5.1 PRODUCT TYPE

9.5.1.1 NATURAL EXTRACT

9.5.1.2 FLAVOR INGREDIENT

9.5.2 VEGETABLE OILS

9.5.2.1 CULINARY ARGON OIL

9.5.2.2 POMEGRANATE SEED OIL

9.5.2.3 NIGELLA SEEDS OIL

9.5.2.4 MELON SEEDS OIL

9.5.3 PRODUCT TYPE

9.5.3.1 NATURAL EXTRACT

9.5.3.2 FLAVOR INGREDIENT

9.5.4 CANOB DERIVATIVES

9.5.5 OTHERS

9.5.5.1 FLORAL HYDROLATES

9.5.5.2 OTHERS

10 NORTH AMERICA FOOD FLAVORS MARKET, BY ORIGIN

10.1 OVERVIEW

10.2 NATURAL

10.3 NATURAL IDENTICAL

10.4 ARTIFICIAL

11 NORTH AMERICA FOOD FLAVORS MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 CLEAN LABEL

11.3 HEAT STABLE

11.4 REGULAR

11.5 NON-ALLERGIC

11.6 OTHERS

12 NORTH AMERICA FOOD FLAVORS MARKET, BY SOLUBILITY

12.1 OVERVIEW

12.2 WATER SOLUBLE

12.3 OIL SOLUBLE

12.4 FAT SOLUBLE

12.5 OTHERS

13 NORTH AMERICA FOOD FLAVORS MARKET, BY FORM

13.1 OVERVIEW

13.2 LIQUID

13.3 POWDER

13.4 SYRUP

14 NORTH AMERICA FOOD FLAVORS MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 CONFECTIONERY

14.2.1 TYPE

14.2.1.1 HARD-BOILED SWEETS

14.2.1.2 GUMS & JELLIES

14.2.1.3 CHOCOLATE

14.2.1.4 MINTS

14.2.1.5 CARAMELS & TOFFEES

14.2.1.6 CHOCOLATE SYRUPS

14.2.1.7 OTHERS

14.2.2 FLAVOR TYPE

14.2.2.1 FRUIT FLAVORS

14.2.2.2 CITRUS FLAVORS

14.2.2.3 CHOCOLATE FLAVORS

14.2.2.4 DAIRY FLAVORS

14.2.2.5 SPICE FLAVORS

14.2.2.6 HERABL FLAVORS

14.2.2.7 NUTTY FLAVORS

14.2.2.8 COFFEE FLAVORS

14.2.2.9 DATE DERIVATIVES

14.2.2.10 VEGETABLE EXTRACTS

14.2.2.11 VEGETABLE OILS

14.2.2.12 OTHERS

14.2.3 PRODUCT TYPE

14.2.3.1 NATURAL EXTRACT

14.2.3.2 FLAVOR INGREDIENT

14.3 BAKERY

14.3.1 TYPE

14.3.1.1 BREAD & ROLLS

14.3.1.2 CAKES, PASTRIES & TRUFFLE

14.3.1.3 BISCUIT

14.3.1.4 TART & PIES

14.3.1.5 BROWNIES

14.3.1.6 COOKIES & CRACKERS

14.3.1.7 TORTILLA

14.3.1.8 OTHERS

14.3.2 FLAVORS TYPE

14.3.2.1 FRUIT FLAVORS

14.3.2.2 CHOCOLATE FLAVOR

14.3.2.3 SPICE FLAVORS

14.3.2.4 CITRUS FLAVORS

14.3.2.5 NUTTY FLAVORS

14.3.2.6 COFFEE FLAVORS

14.3.2.7 HERBAL FLAVORS

14.3.2.8 DAIRY FLAVORS

14.3.2.9 VEGETABLE EXTRACTS

14.3.2.10 DATE DERIVATIVES

14.3.2.11 VEGETABLE OILS

14.3.2.12 OTHERS

14.3.3 PRODUCT TYPE

14.3.3.1 NATURAL EXTRACT

14.3.3.2 FLAVOR INGREDIENT

14.4 CONVENIENCE FOOD

14.4.1 TYPE

14.4.1.1 INSTANT NOODLES

14.4.1.2 PIZZA & PASTA

14.4.1.3 FRENCH FRIES

14.4.1.4 NUGGETS

14.4.1.5 WEDGES

14.4.1.6 OTHERS

14.4.2 FLAVOR TYPE

14.4.2.1 DAIRY FLAVORS

14.4.2.2 FRUIT FLAVORS

14.4.2.3 CHOCOLATE FLAVOR

14.4.2.4 COFFEE FLAVORS

14.4.2.5 SPICE FLAVORS

14.4.2.6 CITRUS FLAVORS

14.4.2.7 HERBAL FLAVORS

14.4.2.8 NUTTY FLAVORS

14.4.2.9 VEGETABLE EXTRACTS

14.4.2.10 DATE DERIVATIVES

14.4.2.11 VEGETABLE OILS

14.4.2.12 OTHERS

14.4.3 PRODUCT TYPE

14.4.3.1 NATURAL EXTRACT

14.4.3.2 FLAVOR INGREDIENT

14.5 SNACKS & EXTRUDED SNACKS

14.5.1 FLAVOR TYPE

14.5.1.1 SPICE FLAVORS

14.5.1.2 DAIRY FLAVORS

14.5.1.3 VEGETABLE EXTRACTS

14.5.1.4 FRUIT FLAVORS

14.5.1.5 NUTTY FLAVORS

14.5.1.6 CITRUS FLAVORS

14.5.1.7 HERBAL FLAVORS

14.5.1.8 CHOCOLATE FLAVOR

14.5.1.9 COFFEE FLAVORS

14.5.1.10 DATE DERIVATIVES

14.5.1.11 VEGETABLE OILS

14.5.1.12 OTHERS

14.5.2 PRODUCT TYPE

14.5.2.1 NATURAL EXTRACT

14.5.2.2 FLAVOR INGREDIENT

14.6 FROZEN DESSERTS

14.6.1 TYPE

14.6.1.1 GELATO

14.6.1.2 FROZEN CUSTARD

14.6.1.3 SHERBETS

14.6.1.4 OTHERS

14.6.2 FLAVOR TYPE

14.6.2.1 FRUIT FLAVORS

14.6.2.2 DAIRY FLAVORS

14.6.2.3 CHOCOLATE FLAVOR

14.6.2.4 NUTTY FLAVORS

14.6.2.5 CITRUS FLAVORS

14.6.2.6 VEGETABLE EXTRACTS

14.6.2.7 COFFEE FLAVORS

14.6.2.8 SPICE FLAVORS

14.6.2.9 HERBAL FLAVORS

14.6.2.10 DATE DERIVATIVES

14.6.2.11 VEGETABLE OILS

14.6.2.12 OTHERS

14.6.3 PRODUCT TYPE

14.6.3.1 NATURAL EXTRACT

14.6.3.2 FLAVOR INGREDIENT

14.7 MEAT & POULTRY PRODUCTS

14.7.1 TYPE

14.7.1.1 CHICKEN

14.7.1.2 BEEF

14.7.1.3 PORK

14.7.1.4 SEAFOOD

14.7.1.5 LAMB

14.7.1.6 OTHERS

14.7.2 FLAVOR TYPE

14.7.2.1 SPICE FLAVORS

14.7.2.2 CITRUS FLAVORS

14.7.2.3 DAIRY FLAVORS

14.7.2.4 VEGETABLE EXTRACTS

14.7.2.5 NUTTY FLAVORS

14.7.2.6 CHOCOLATE FLAVOR

14.7.2.7 HERBAL FLAVORS

14.7.2.8 COFFEE FLAVORS

14.7.2.9 FRUIT FLAVORS

14.7.2.10 DATE DERIVATIVES

14.7.2.11 VEGETABLE OILS

14.7.2.12 OTHERS

14.7.3 PRODUCT TYPE

14.7.3.1 NATURAL EXTRACT

14.7.3.2 FLAVOR INGREDIENT

14.8 BREAKFAST CEREALS

14.8.1 FLAVOR TYPE

14.8.1.1 FRUIT FLAVORS

14.8.1.2 SPICE FLAVORS

14.8.1.3 DAIRY FLAVORS

14.8.1.4 NUTTY FLAVORS

14.8.1.5 HERBAL FLAVORS

14.8.1.6 CITRUS FLAVORS

14.8.1.7 VEGETABLE EXTRACTS

14.8.1.8 COFFEE FLAVORS

14.8.1.9 CHOCOLATE FLAVOR

14.8.1.10 DATE DERIVATIVES

14.8.1.11 VEGETABLE OILS

14.8.1.12 OTHERS

14.8.2 PRODUCT TYPE

14.8.2.1 NATURAL EXTRACT

14.8.2.2 FLAVOR INGREDIENT

14.9 PROCESSED FOOD

14.9.1 TYPE

14.9.1.1 READY MEALS

14.9.1.2 SAUCES, DRESSINGS AND CONDIMENTS

14.9.1.3 SOUPS

14.9.1.4 JAMS, PRESERVES & MARMALADES

14.9.1.5 CANNED FRUITS & VEGETABLES

14.9.1.6 FRUIT & VEGETABLE PUREE

14.9.1.7 PICKLES

14.9.1.8 OTHERS

14.9.2 FLAVOR TYPE

14.9.2.1 FRUIT FLAVORS

14.9.2.2 DAIRY FLAVORS

14.9.2.3 VEGETABLE EXTRACTS

14.9.2.4 SPICE FLAVORS

14.9.2.5 CITRUS FLAVORS

14.9.2.6 CHOCOLATE FLAVOR

14.9.2.7 COFFEE FLAVORS

14.9.2.8 NUTTY FLAVORS

14.9.2.9 HERBAL FLAVORS

14.9.2.10 DATE DERIVATIVES

14.9.2.11 VEGETABLE OILS

14.9.2.12 OTHERS

14.9.3 PRODUCT TYPE

14.9.3.1 NATURAL EXTRACT

14.9.3.2 FLAVOR INGREDIENT

14.1 BABY FOOD

14.10.1 FLAVOR TYPE

14.10.1.1 FRUIT FLAVORS

14.10.1.2 VEGETABLE EXTRACTS

14.10.1.3 DAIRY FLAVORS

14.10.1.4 SPICE FLAVORS

14.10.1.5 HERBAL FLAVORS

14.10.1.6 CITRUS FLAVORS

14.10.1.7 NUTTY FLAVORS

14.10.1.8 CHOCOLATE FLAVOR

14.10.1.9 COFFEE FLAVORS

14.10.1.10 DATE DERIVATIVES

14.10.1.11 VEGETABLE OILS

14.10.1.12 OTHERS

14.10.2 PRODUCT TYPE

14.10.2.1 NATURAL EXTRACT

14.10.2.2 FLAVOR INGREDIENT

14.11 SPORTS NUTRITION

14.11.1 TYPE

14.11.1.1 PROTEIN POWDERS

14.11.1.2 SPORT DRINKS

14.11.1.3 OTHERS

14.11.2 FLAVOR TYPE

14.11.2.1 CHOCOLATE FLAVOR

14.11.2.2 FRUIT FLAVORS

14.11.2.3 NUTTY FLAVORS

14.11.2.4 COFFEE FLAVORS

14.11.2.5 SPICE FLAVORS

14.11.2.6 CITRUS FLAVORS

14.11.2.7 DAIRY FLAVORS

14.11.2.8 HERBAL FLAVORS

14.11.2.9 DATE DERIVATIVES

14.11.2.10 VEGETABLE OILS

14.11.2.11 VEGETABLE EXTRACTS

14.11.2.12 OTHERS

14.11.3 PRODUCT TYPE

14.11.3.1 NATURAL EXTRACT

14.11.3.2 FLAVOR INGREDIENT

14.12 DIETARY SUPPLEMENTS

14.12.1 TYPE

14.12.1.1 CAPSULES

14.12.1.2 TABLETS

14.12.1.3 POWDER SUPPLEMENTS

14.12.1.4 GUMMIES

14.12.1.5 OTHERS

14.12.2 FLAVOR TYPE

14.12.2.1 CHOCOLATE FLAVOR

14.12.2.2 FRUIT FLAVORS

14.12.2.3 CITRUS FLAVORS

14.12.2.4 HERBAL FLAVORS

14.12.2.5 NUTTY FLAVORS

14.12.2.6 SPICE FLAVORS

14.12.2.7 DAIRY FLAVORS

14.12.2.8 VEGETABLE EXTRACTS

14.12.2.9 COFFEE FLAVORS

14.12.2.10 DATE DERIVATIVES

14.12.2.11 VEGETABLE OILS

14.12.2.12 OTHERS

14.12.3 PRODUCT TYPE

14.12.3.1 NATURAL EXTRACT

14.12.3.2 FLAVOR INGREDIENT

14.13 BEVERAGES

14.13.1 TYPE

14.13.1.1 CARBONATED DRINKS

14.13.1.2 TEA

14.13.1.3 COFFEE

14.13.1.4 PLANT-BASED MILK

14.13.1.5 JUICES

14.13.1.6 SMOOTHIES

14.13.1.7 SOFT DRINKS

14.13.1.8 OTHERS

14.13.2 FLAVOR TYPE

14.13.2.1 FRUIT FLAVORS

14.13.2.2 CITRUS FLAVORS

14.13.2.3 HERBAL FLAVORS

14.13.2.4 SPICE FLAVORS

14.13.2.5 CHOCOLATE FLAVOR

14.13.2.6 COFFEE FLAVORS

14.13.2.7 NUTTY FLAVORS

14.13.2.8 DAIRY FLAVORS

14.13.2.9 VEGETABLE EXTRACTS

14.13.2.10 DATE DERIVATIVES

14.13.2.11 VEGETABLE OILS

14.13.2.12 OTHERS

14.13.3 PRODUCT TYPE

14.13.3.1 NATURAL EXTRACT

14.13.3.2 FLAVOR INGREDIENT

15 NORTH AMERICA FOOD FLAVORS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA FOOD AND FLAVORS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GIVAUDAN (2022)

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.2 SYMRISE (2022)

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENT

18.3 MANE

18.3.1 COMPANY SNAPSHOT

18.3.2 COMPANY SHARE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENTS

18.4 FIRMENISCH SA

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 KERRY GROUP PLC (2022)

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENT

18.6 ABELEI INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 ADM (2022)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 AROMATICA

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 AXXENCE AROMATIC GMBH

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 BLUE PACIFIC FLAVORS INC

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 CARGILL, INCORPORATED.

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 CAPELLA FLAVORS

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENT

18.13 CUSTOM FLAVORS

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 DÖHLER

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 ESSENTIAL FLAVORS

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 FLAVORCAN INTERNATIONAL INC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 FLAVOR PRODUCERS, LLC

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENTS

18.18 FLAVORCHEM & ORCHIDIA FRAGRANCES

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 GOLD COAST INGREDIENTS

18.19.1 COMPANY SNAPSHOT

18.19.2 PRODUCT PORTFOLIO

18.19.3 RECENT DEVELOPMENT

18.2 HHOYA

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 HONEYBERRY INTERNATIONAL LLP

18.21.1 COMPANY SNAPSHOT

18.21.2 PRODUCT PORTFOLIO

18.21.3 RECENT DEVELOPMENT

18.22 HUABAO INTERNATIONAL HOLDING LIMITED.

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 INTERNATIONAL FLAVORS & FRAGRANCES INC.

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENTS

18.24 KANEGRADE.

18.24.1 COMPANY SNAPSHOT

18.24.2 PRODUCT PORTFOLIO

18.24.3 RECENT DEVELOPMENT

18.25 KEVA FLAVOURS PVT. LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENTS

18.26 MARTINBAUER

18.26.1 COMPANY SNAPSHOT

18.26.2 PRODUCT PORTFOLIO

18.26.3 RECENT DEVELOPMENT

18.27 MCCORMICK & COMPANY, INC.

18.27.1 COMPANY SNAPSHOT

18.27.2 REVENUE ANALYSIS

18.27.3 PRODUCT PORTFOLIO

18.27.4 RECENT DEVELOPMENT

18.28 NUTRADRY

18.28.1 COMPANY SNAPSHOT

18.28.2 PRODUCT PORTFOLIO

18.28.3 RECENT DEVELOPMENTS

18.29 PRINOVA GROUP LLC.

18.29.1 COMPANY SNAPSHOT

18.29.2 PRODUCT PORTFOLIO

18.29.3 RECENT DEVELOPMENTS

18.3 SYNTHITE INDUSTRIES

18.30.1 COMPANY SNAPSHOT

18.30.2 PRODUCT PORTFOLIO

18.30.3 RECENT DEVELOPMENT

18.31 SYNERGY FLAVORS, INC.,

18.31.1 COMPANY SNAPSHOT

18.31.2 PRODUCT PORTFOLIO

18.31.3 RECENT DEVELOPMENTS

18.32 SAN-EI GEN F.F.I, INC.

18.32.1 COMPANY SNAPSHOT

18.32.2 PRODUCT PORTFOLIO

18.32.3 RECENT DEVELOPMENT

18.33 STRINGER FLAVOR LTD.

18.33.1 COMPANY SNAPSHOT

18.33.2 PRODUCT PORTFOLIO

18.33.3 RECENT DEVELOPMENT

18.34 SENSIENT TECHNOLOGIES CORPORATION

18.34.1 COMPANY SNAPSHOT

18.34.2 REVENUE ANALYSIS

18.34.3 PRODUCT PORTFOLIO

18.34.4 RECENT DEVELOPMENT

18.35 T.HASEGAWA USA INC.

18.35.1 COMPANY SNAPSHOT

18.35.2 PRODUCT PORTFOLIO

18.35.3 RECENT DEVELOPMENTS

18.36 TAIYO INTERNATIONAL

18.36.1 COMPANY SNAPSHOT

18.36.2 PRODUCT PORTFOLIO

18.36.3 RECENT DEVELOPMENT

18.37 TAKASAGO INTERNATIONAL CORPORATION

18.37.1 COMPANY SNAPSHOT

18.37.2 REVENUE ANALYSIS

18.37.3 PRODUCT PORTFOLIO

18.37.4 RECENT DEVELOPMENT

18.38 TRILOGY FLAVORS

18.38.1 COMPANY SNAPSHOT

18.38.2 PRODUCT PORTFOLIO

18.38.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 COMPANY LIST FOR FEED FLAVORS

TABLE 2 COMPANY LIST FOR FOOD FLAVORS

TABLE 3 FREE ON BOARD (FOB)

TABLE 4 PRODUCTION CAPACITY OF KEY MARKET PLAYERS IN THE FOOD FLAVOR INDUSTRY

TABLE 5 NORTH AMERICA FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA NATURAL EXTRACT IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA FLAVOR INGREDIENTS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SPICES FLAVOS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BUTTER FLAVOR IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA VEGETABLE FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA VEGETABLE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA VEGETABLE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA CANOB DERIVATIVES IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OTHERS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA OTHERS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA FOOD FLAVORS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA NATURAL IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA NATURAL IDENTICAL IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA ARTIFICIAL IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FOOD FLAVORS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA CLEAN LABEL IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA HEAT STABLE IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA REGULAR IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA NON-ALLERGIC IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FOOD FLAVORS MARKET, BY SOLUBILITY, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA WATER SOLUBLE IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA OIL SOLUBLE IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FAT DISPERSIBLE IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FOOD FLAVORS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA LIQUID IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA POWDER IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA SYRUP IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA FOOD FLAVORS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY FLAVORS TYPE, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA FROZEN DESSERTS PRODUCTS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA MEAT & POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA BABY FOOD IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA BABY FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 96 NORTH AMERICA BABY FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA FOOD FLAVORS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 114 NORTH AMERICA BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 116 NORTH AMERICA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 119 NORTH AMERICA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 122 NORTH AMERICA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 125 NORTH AMERICA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 128 NORTH AMERICA BUTTER FLAVOR IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 132 NORTH AMERICA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA VEGETABLE EXTRACT IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 135 NORTH AMERICA VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 138 NORTH AMERICA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 140 NORTH AMERICA DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 NORTH AMERICA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 143 NORTH AMERICA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 144 NORTH AMERICA OTHERS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 145 NORTH AMERICA FOOD FLAVORS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 146 NORTH AMERICA FOOD FLAVORS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 147 NORTH AMERICA FOOD FLAVORS MARKET, BY SOLUBILITY, 2021-2030 (USD MILLION)

TABLE 148 NORTH AMERICA FOOD FLAVORS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 149 NORTH AMERICA FOOD FLAVORS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 150 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 152 NORTH AMERICA CONFECTIONERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 153 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 155 NORTH AMERICA BAKERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 156 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 158 NORTH AMERICA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 159 NORTH AMERICA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 160 NORTH AMERICA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 161 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 163 NORTH AMERICA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 164 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 166 NORTH AMERICA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 167 NORTH AMERICA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 168 NORTH AMERICA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 169 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 171 NORTH AMERICA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 172 NORTH AMERICA BABY FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 173 NORTH AMERICA BABY FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 174 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 176 NORTH AMERICA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 177 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 178 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 179 NORTH AMERICA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 180 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 182 NORTH AMERICA BEVERAGES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 187 U.S. FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 188 U.S. BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 189 U.S. BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 190 U.S. BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 191 U.S. FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 192 U.S. SPICE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 U.S. SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 194 U.S. SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 195 U.S. SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 196 U.S. HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 U.S. HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 198 U.S. HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 199 U.S. HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 200 U.S. CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 U.S. CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 202 U.S. CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 203 U.S. CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 204 U.S. DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 U.S. DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 206 U.S. DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 207 U.S. BUTTER FLAVOR IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 208 U.S. DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 209 U.S. NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 210 U.S. NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 211 U.S. NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 212 U.S. NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 213 U.S. VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 U.S. VEGETABLE EXTRACT IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 215 U.S.VEGETABLE EXTRACT IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 216 U.S. VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 217 U.S. COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 218 U.S. COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 219 U.S. COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 220 U.S. CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 221 U.S. CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 222 U.S. CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 223 U.S. DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 224 U.S. VEGETABLE OILS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 U.S. VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 226 U.S. VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 227 U.S. VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 228 U.S. OTHERS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 U.S. FOOD FLAVORS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 230 U.S. FOOD FLAVORS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 231 U.S. FOOD FLAVORS MARKET, BY SOLUBILITY, 2021-2030 (USD MILLION)

TABLE 232 U.S. FOOD FLAVORS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 233 U.S. FOOD FLAVORS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 234 U.S. CONFECTIONERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 U.S. CONFECTIONERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 236 U.S. CONFECTIONERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 237 U.S. BAKERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 U.S. BAKERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 239 U.S. BAKERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 240 U.S. CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 U.S. CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 242 U.S. CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 243 U.S. SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 244 U.S. SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 245 U.S. FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 246 U.S. FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 247 U.S. FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 248 U.S. MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 U.S. MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 250 U.S. MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 251 U.S. BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 252 U.S. BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 253 U.S. PROCESSED FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 U.S. PROCESSED FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 255 U.S. PROCESSED FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 256 U.S. BABY FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 257 U.S. BABY FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 258 U.S. SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 259 U.S. SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 260 U.S. SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 U.S. DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 262 U.S. DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 263 U.S. DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 264 U.S. BEVERAGES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 U.S. BEVERAGES IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 266 U.S. BEVERAGES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 267 CANADA FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 268 CANADA FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 269 CANADA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 270 CANADA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 271 CANADA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 272 CANADA BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 CANADA BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 CANADA BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 275 CANADA FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 276 CANADA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 CANADA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 278 CANADA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 279 CANADA SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 280 CANADA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 CANADA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 282 CANADA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 283 CANADA HERBAL FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 284 CANADA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 CANADA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 286 CANADA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 287 CANADA CITRUS FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 288 CANADA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 289 CANADA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 290 CANADA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 291 CANADA BUTTER FLAVOR IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 CANADA DAIRY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 293 CANADA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 CANADA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 295 CANADA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 296 CANADA NUTTY FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 297 CANADA VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 CANADA VEGETABLE EXTRACT IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 299 CANADA VEGETABLE EXTRACT IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 300 CANADA VEGETABLE EXTRACTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 301 CANADA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 302 CANADA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 303 CANADA COFFEE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 304 CANADA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 305 CANADA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 306 CANADA CHOCOLATE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 307 CANADA DATE DERIVATIVES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 308 CANADA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 309 CANADA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 310 CANADA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (ASP)

TABLE 311 CANADA VEGETABLE OILS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 312 CANADA OTHERS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 CANADA FOOD FLAVORS MARKET, BY ORIGIN, 2021-2030 (USD MILLION)

TABLE 314 CANADA FOOD FLAVORS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 315 CANADA FOOD FLAVORS MARKET, BY SOLUBILITY, 2021-2030 (USD MILLION)

TABLE 316 CANADA FOOD FLAVORS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 317 CANADA FOOD FLAVORS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 318 CANADA CONFECTIONERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 CANADA CONFECTIONERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 320 CANADA CONFECTIONERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 321 CANADA BAKERY IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 322 CANADA BAKERY IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 323 CANADA BAKERY IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 CANADA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 CANADA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 326 CANADA CONVENIENCE FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 327 CANADA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 328 CANADA SNACKS & EXTRUDED SNACKS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 329 CANADA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 330 CANADA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 331 CANADA FROZEN DESSERTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 332 CANADA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 333 CANADA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 334 CANADA MEAT AND POULTRY PRODUCTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 335 CANADA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 336 CANADA BREAKFAST CEREALS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 337 CANADA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 338 CANADA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 339 CANADA PROCESSED FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 340 CANADA BABY FOOD IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 341 CANADA BABY FOOD IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 342 CANADA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 CANADA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 344 CANADA SPORTS NUTRITION IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 345 CANADA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 346 CANADA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 347 CANADA DIETARY SUPPLEMENTS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 348 CANADA BEVERAGES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 349 CANADA BEVERAGES IN FOOD FLAVORS MARKET, BY FLAVOR TYPE, 2021-2030 (USD MILLION)

TABLE 350 CANADA BEVERAGES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 351 MEXICO FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 352 MEXICO FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 353 MEXICO FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 354 MEXICO FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 355 MEXICO FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 356 MEXICO BERRIES IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 MEXICO BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 358 MEXICO BERRIES IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)

TABLE 359 MEXICO FRUIT FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 360 MEXICO SPICE FLAVORS IN FOOD FLAVORS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 MEXICO SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (KILO LITERS)

TABLE 362 MEXICO SPICE FLAVORS IN FOOD FLAVORS MARKET, BY PRODUCT TYPE, 2021-2030, VOLUME (ASP)