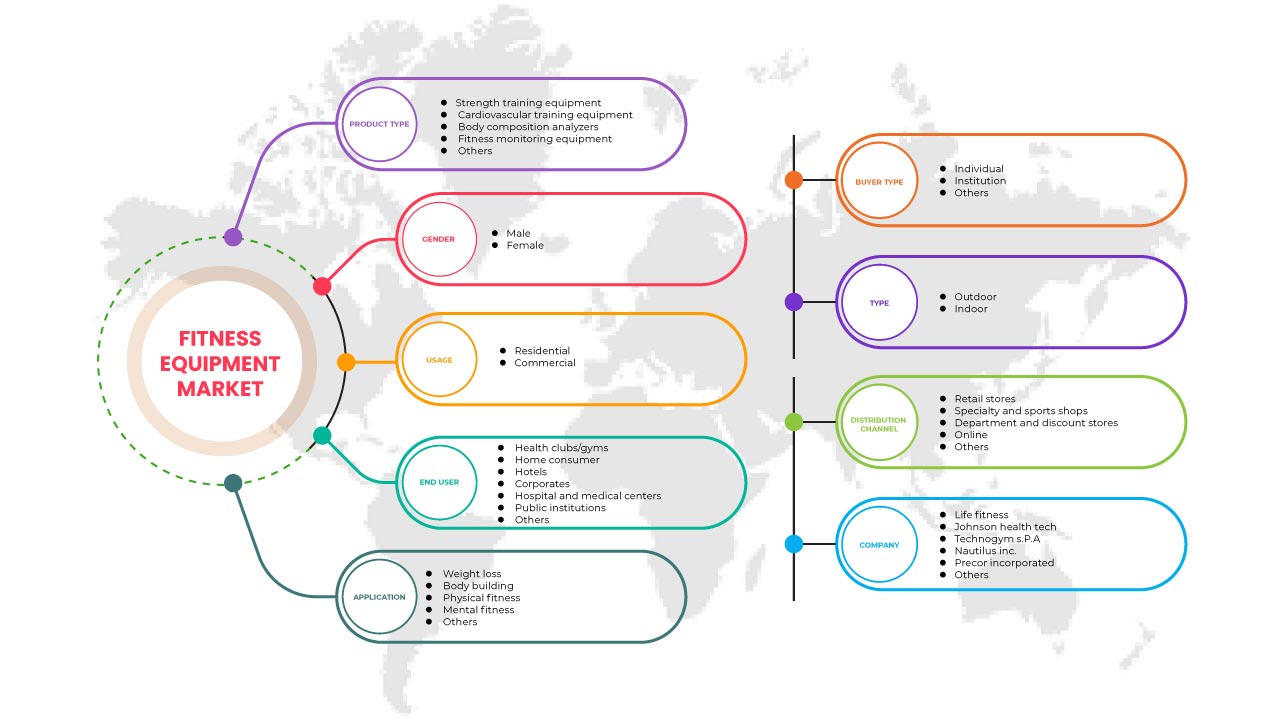

Nordamerikanischer Markt für Fitnessgeräte nach Produkttyp (Geräte für Krafttraining, Geräte für Herz-Kreislauf-Training, Geräte zur Körperanalyse , Geräte zur Fitnessüberwachung und andere), Anwendung (Gewichtsverlust, Bodybuilding, körperliche Fitness, geistige Fitness und andere), Geschlecht (männlich und weiblich), Käufertyp (Privatperson, Institution und andere), Verwendung (privat und gewerblich), Typ (außen und innen), Endbenutzer (Fitnessclubs/Fitnessstudios, Privatverbraucher, Hotels, Unternehmen, Krankenhäuser und medizinische Zentren, öffentliche Einrichtungen und andere), Vertriebskanal (Einzelhandelsgeschäfte, Fach- und Sportgeschäfte, Kaufhäuser und Discounter, Online und andere) – Branchentrends und Prognose bis 2030.

Marktanalyse und Einblicke für Fitnessgeräte in Nordamerika

Der wachsende Wunsch nach Gesundheit und Fitness treibt heute die Branche der Trainingsgeräte an. Das Wachstum des Marktes für Fitnessgeräte wird von Schlüsselfaktoren wie der zunehmenden Urbanisierung, der Verbreitung von Fettleibigkeit und chronischen Krankheiten aufgrund ungesunder Lebensführung sowie wachsenden betrieblichen Gesundheitsprogrammen und der Nachfrage aus verschiedenen Branchen angetrieben. Darüber hinaus treiben das wachsende Bewusstsein über die Folgen der zunehmenden Fettleibigkeit, die wachsende geriatrische Bevölkerung und die wachsende Nachfrage nach minimalinvasiven und nichtinvasiven Operationen das Gesamtwachstum des Marktes an. Auf der anderen Seite werden die hohen Kosten für die Installation oder Einrichtung von Geräten oder Vorrichtungen und die steigende Nachfrage nach dem Wiederverkauf kostensparender Trainingsgeräte das Marktwachstum im Prognosezeitraum voraussichtlich bremsen.

Die Einführung anderer Trainingssysteme und veränderte Kundenpräferenzen bremsen jedoch das Wachstum des Marktes für Fitnessgeräte.

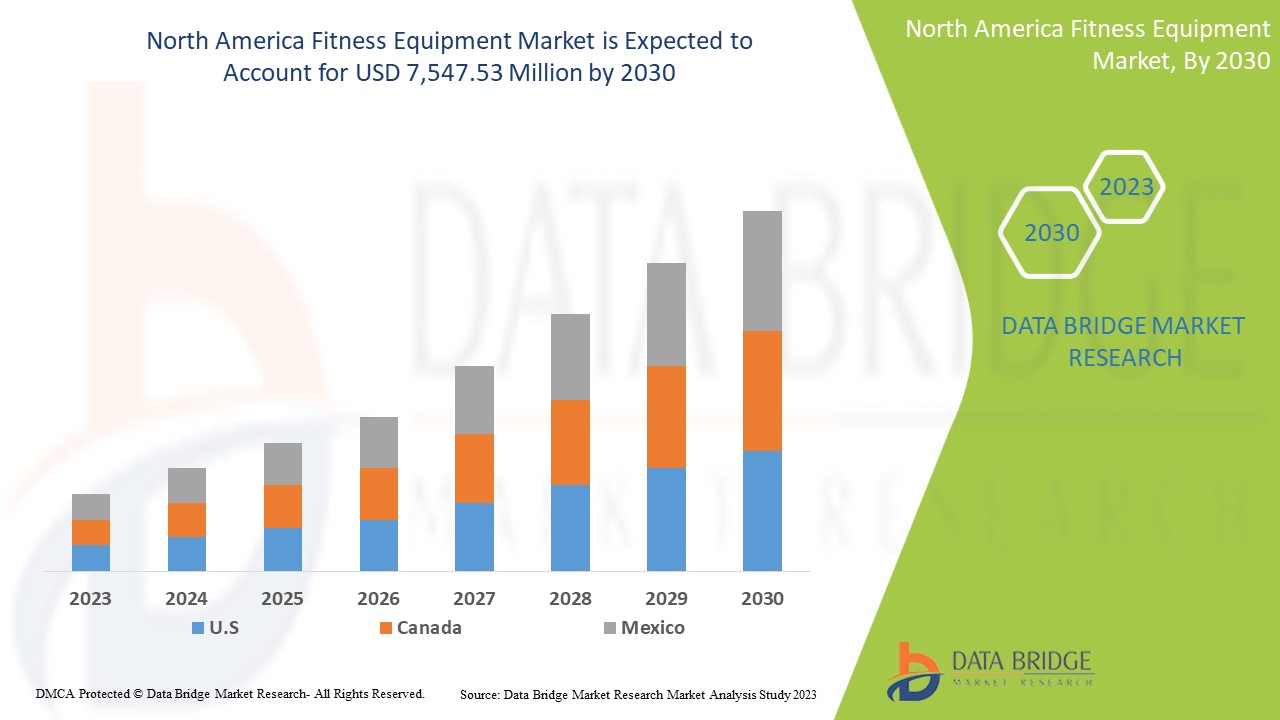

Data Bridge Market Research analysiert, dass der nordamerikanische Markt für Fitnessgeräte bis 2030 voraussichtlich einen Wert von 7.547,53 Millionen USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 7,3 % während des Prognosezeitraums entspricht. Dieser Marktbericht behandelt auch ausführlich Preisanalysen, Patentanalysen und technologische Fortschritte.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (anpassbar auf 2020–2015) |

|

Quantitative Einheiten |

Umsatz in Millionen USD, Preise in USD |

|

Abgedeckte Segmente |

Nach Produkttyp (Krafttrainingsgeräte, Herz-Kreislauf-Trainingsgeräte, Körperanalysegeräte, Fitnessüberwachungsgeräte und andere), Anwendung (Gewichtsverlust, Bodybuilding, körperliche Fitness, geistige Fitness und andere), Geschlecht (männlich und weiblich), Käufertyp (Privatperson, Institution und andere), Verwendung (privat und gewerblich), Typ (Außen- und Innenbereich), Endbenutzer (Fitnessclubs/Fitnessstudios, Privatverbraucher, Hotels, Unternehmen, Krankenhäuser und medizinische Zentren, öffentliche Einrichtungen und andere), Vertriebskanal (Einzelhandelsgeschäfte, Fachgeschäfte und Sportgeschäfte, Kaufhäuser und Discounter, Online und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS und Fitline India. |

Definition des nordamerikanischen Fitnessgerätemarktes

Fitnessgeräte sind im Wesentlichen Geräte, die bei körperlichen oder fitnessbezogenen Aktivitäten verwendet werden. Sie helfen dabei, die Kraft zu steigern oder die körperliche Fitness zu verbessern. Im Allgemeinen umfassen Fitnessgeräte verschiedene Geräte wie Hanteln, Rudergeräte, Laufbänder, Kraftmaschinen, Heimtrainer, Crosstrainer und Stepper. Trainingsgeräte sind Maschinen, die einer Person Widerstand leisten, während sie körperliche Übungen durchführt, um Kraft und Ausdauer zu steigern, Gewicht zu kontrollieren und die Flexibilität zu verbessern. Sie helfen dabei, die Persönlichkeit und das Aussehen zu verbessern. Laufbänder, Crosstrainer, Kraftmaschinen, Hanteln und andere Trainingsgeräte sind erhältlich. Diese Geräte werden in Fitnesscentern, Fitnessstudios, von Privatanwendern und in Firmenbüros verwendet. Laut (VA.gov) gelten Cardiogeräte mit voreingestellten Programmen als kommerziell. Verwenden Sie Programme für Personen mit einem breiten Spektrum an aeroben Fähigkeiten.

Marktdynamik für Fitnessgeräte in Nordamerika

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Immer mehr Menschen nehmen an Sportwettkämpfen teil

Körperliche Betätigung hat erhebliche gesundheitliche Vorteile für Herz, Körper und Geist und hilft bei der Vorbeugung und Bewältigung nicht übertragbarer Krankheiten wie Herz-Kreislauf-Erkrankungen, Krebs und Diabetes. Heutzutage können Menschen auf der ganzen Welt ihre Ergebnisse aus hartem Fitnesstraining zu Wettkämpfen mitnehmen und ihre Fähigkeiten bei verschiedenen Veranstaltungen für funktionelle Fitness testen. Es gibt viele Wettbewerbe im Bereich Fitness, wie Powerlifting, Bodybuilding, Langstreckenlauf, Fun Runs und Cross-Fit-Wettbewerbe. Viele Unternehmen und Fitnessorganisationen haben die Initiative ergriffen und verschiedene Fitnesswettbewerbe und Outdoor-Aktivitäten organisiert. Die Teilnahmequote der Männer war höher (20,7 Prozent) als die der Frauen (18 Prozent). Dazu gehörten Sport, Bewegung und andere aktive Freizeitaktivitäten.

Somit ist die steigende Zahl körperlich aktiver Menschen der Wachstumsmotor des Marktes.

- Covid-19-Pandemie führte zu einer steigenden Nachfrage nach Heimfitnessgeräten

Die COVID-19-Pandemie hatte erhebliche positive Auswirkungen auf den Fitnessgerätesektor. Die Pandemie hat neue Normen und Vorschriften wie soziale Distanzierung und Ausgangssperren eingeführt, um die Ausbreitung des Virus zu verhindern. Infolgedessen waren die Menschen weltweit gezwungen, zu Hause zu bleiben, was zu neuen Trends wie der Arbeit von zu Hause aus führte. Die wachsende Beliebtheit von Heimtraining hat die Nachfrage nach Trainingsgeräten während der Pandemie erhöht. Der verstärkte Fokus auf Selbstpflege, Bewegung und Gesundheit hat dazu beigetragen, dass Fitness-Apps und -Plattformen im Zuge der Pandemie deutlich an Zugkraft gewonnen haben. Darüber hinaus hat die Pandemie auch Nicht-Fitnessbegeisterte dazu veranlasst, der Erhaltung ihrer Gesundheit und Fitness mehr Bedeutung beizumessen, was wiederum zur Zugkraft beiträgt.

Darüber hinaus hat die COVID-19- Pandemie auch die Nachfrage nach Fitnessgeräten und Fitness-Apps für den Heimgebrauch so stark erhöht, dass die Zahl der online ausverkauften Fitnessgeräte und der Downloads von Fitness-Apps im Jahr 2020 um fast 30 % gestiegen ist.

Zurückhaltung

- Hohe Kosten im Zusammenhang mit Fitnessgeräten

Einige Fitnessgeräte sind zu sehr hohen Preisen erhältlich, insbesondere für Menschen mit mittlerem und niedrigem Einkommen in Entwicklungs- und unterentwickelten Ländern, was ein begrenzender Faktor für das Wachstum ist. Mit dem technologischen Fortschritt ist der Preisanstieg bei Hightech-Fitnessgeräten und tragbaren Fitnessgeräten offensichtlich. Die Integration mehrerer Funktionen wie ein hochwertiges Display, eine verbesserte Energieeffizienz, die Verfolgung zusätzlicher Vitalwerte, drahtlose Konnektivität und aktualisierte Software usw. erhöht direkt die Anschaffungskosten der Fitnessgeräte und Fitnessgeräte. Die Verwendung tragbarer Geräte durch verschiedene Verbraucher erhöht ihre Ausgaben für Fitnessgesundheit. Eine zunehmende Anwendungsabdeckung durch tragbare Geräte erhöht deren Nachfrage, was direkt zu ihren hohen Kosten beiträgt.

Daher hemmen die hohen Kosten für Fitnessgeräte das Marktwachstum.

Gelegenheit

- Zunehmende Verbreitung von E-Commerce-Plattformen, Internet und Smartphones

Die Menschen in der heutigen Welt benötigen ein Smartphone zur Kommunikation, zum Einkaufen von Lebensmitteln, für Arztbesuche und um sich ihrer Fitness bewusst zu sein. Viele Menschen können sich ein Leben ohne Smartphones nicht vorstellen. Die Menschen möchten sich lieber zu Hause in Form bringen, als in Fitnessstudios und Fitnessclubs zu gehen. Die Fitness-App fungiert also als Brücke zwischen den Menschen, die unter anderem Fitnesspläne, Diätpläne und Übungen erhalten, indem sie einfach ihre Fitness-App verwenden. Mit dem technologischen Fortschritt und der Entwicklung in den Ländern verwenden immer mehr Menschen Smartphones in ihrem täglichen Leben.

Herausforderung

- Veränderte Kundenpräferenzen

Digitales Fitnesstraining hat sich schnell zum Retter der Branche entwickelt, da sich immer mehr Menschen daran gewöhnen. Realistisch betrachtet wird der aktuelle Boom des digitalen Fitnesstrainings mit der Lockerung der Lockdown-Beschränkungen abebben. Während des Lockdowns bot das Onlinetraining den Menschen Struktur, Fitness, ein Gemeinschaftsgefühl und Kommunikation. Es hielt die Menschen gesund. Onlinetraining wird bleiben, da die Verbraucher in Zukunft hybride Angebote erwarten. Während viele schließlich zu ihrem normalen Studioalltag zurückkehren, ist ein Fitnessstudio, das Onlinetraining anbietet, für Mitglieder zugänglicher. Angesichts der vielen Fitnessoptionen, die heute online verfügbar sind, und der wettbewerbsfähigen Preise werden Fitnessstudiomitglieder preisbewusster. Und da sich Fitnessstudios und Studios darauf vorbereiten, in Zukunft in den Online- und Studiobereich zu diversifizieren, ist der Wettbewerb hart. Nach dem Erstkauf sind die Leute bereit, mehr für einen Service zu zahlen, der ihren Bedürfnissen entspricht und einen Mehrwert bietet. Sie suchen nicht unbedingt nach der billigsten oder qualitativ hochwertigsten Option; sie suchen nach einem Mehrwert.

Auswirkungen von COVID-19 auf den nordamerikanischen Markt für Fitnessgeräte

Die COVID-19-Pandemie hatte einen eher positiven Einfluss auf den Markt für Fitnessgeräte. Die Pandemie hat neue Normen und Vorschriften wie soziale Distanzierung und Ausgangssperren eingeführt, um die Ausbreitung des Virus zu verhindern. Infolgedessen waren die Menschen auf der ganzen Welt gezwungen, zu Hause zu bleiben, was zu neuen Trends wie der Arbeit zu Hause führte. Die wachsende Beliebtheit von Heimtraining hat die Nachfrage nach Trainingsgeräten während der Pandemie erhöht. Der verstärkte Fokus auf Selbstpflege, Bewegung und Gesundheit hat Fitness-Apps und -Plattformen im Zuge der Pandemie zu deutlichem Aufschwung verholfen.

Die Hersteller treffen verschiedene strategische Entscheidungen, um nach COVID-19 wieder auf die Beine zu kommen. Die Akteure führen zahlreiche F&E-Aktivitäten und Produktanläufe durch und gehen strategische Partnerschaften ein, um die Technologie und die Testergebnisse auf dem Markt zu verbessern.

Jüngste Entwicklungen

- Im September 2022 kündigte Nautilus, Inc., ein Innovationsführer im Bereich Heimfitness, die Markteinführung des Laufbands Bowflex BXT8J mit Kompatibilität mit der adaptiven Fitness-App JRNY bei ausgewählten Online- und Ladenpartnern an und bietet Kunden damit eine komplette Fitnesslösung zu einem erschwinglichen Preis. Das Laufband Bowflex BXT8J bietet leistungsstarkes Cardio und die Möglichkeit, das Gerät des Benutzers mit der adaptiven Fitness-App JRNY zu koppeln. Dies hat dem Unternehmen geholfen, sein Produktportfolio zu erweitern

- Im Juni 2022 gab Johnson Health Tech die Übernahme der Fitnessabteilung von Cravatex Brands Limited bekannt, einem früheren Vertriebshändler von Johnson Health Tech. Damit ist das Unternehmen das erste Fitnessgeräteunternehmen mit einer hundertprozentigen Tochtergesellschaft in Indien. Mit seinen kontinuierlichen Investitionen in Produktentwicklung und Fertigungskompetenz hat Johnson Health Tech die Fitnessbranche aufgewertet. Dies hat dem Unternehmen geholfen, sein Geschäft auszubauen

Umfang des nordamerikanischen Fitnessgerätemarktes

Der nordamerikanische Markt für Fitnessgeräte ist nach Produkttyp, Anwendung, Geschlecht, Käufertyp, Nutzung, Typ, Endbenutzer und Vertriebskanal segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktansprache sowie bei der Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH PRODUKTTYP

- Krafttrainingsgeräte

- Herz-Kreislauf-Trainingsgeräte

- Körperzusammensetzungsanalysatoren

- Fitness-Überwachungsgeräte

- Sonstiges

Auf der Grundlage des Produkttyps ist der nordamerikanische Markt für Fitnessgeräte in Krafttrainingsgeräte, Herz-Kreislauf-Trainingsgeräte, Körperzusammensetzungsanalysatoren, Fitnessüberwachungsgeräte und andere unterteilt.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH ANWENDUNG

- Gewichtsverlust

- Bodybuilding

- Körperliche Fitness

- Mentale Fitness

- Sonstiges

Auf der Grundlage der Anwendung ist der nordamerikanische Markt für Fitnessgeräte in die Bereiche Gewichtsabnahme, Bodybuilding, körperliche Fitness, geistige Fitness und Sonstiges segmentiert.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH GESCHLECHT

- Männlich

- Weiblich

Auf der Grundlage des Geschlechts ist der nordamerikanische Markt für Fitnessgeräte in männlich und weiblich segmentiert.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH KÄUFERTYP

- Person

- Institution

- Sonstiges

Auf der Grundlage des Käufertyps ist der nordamerikanische Markt für Fitnessgeräte in Privatpersonen, Institutionen und Sonstige segmentiert.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH VERWENDUNG

- Wohnen

- Kommerziell

Auf Grundlage der Nutzung ist der nordamerikanische Markt für Fitnessgeräte in private und gewerbliche Bereiche segmentiert.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH TYP

- Im Freien

- Innenbereich

Der nordamerikanische Markt für Fitnessgeräte ist nach Typ in Indoor- und Outdoor-Geräte unterteilt.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE, NACH ENDVERWENDER

- Fitnessstudios

- Privatkunden

- Hotels

- Firmenkunden

- Krankenhäuser und medizinische Zentren

- Öffentliche Einrichtungen

- Sonstiges

Auf der Grundlage des Endbenutzers ist der nordamerikanische Markt für Fitnessgeräte in Fitnessstudios/Fitnessstudios, Privatanwender, Hotels, Unternehmen, Krankenhäuser und medizinische Zentren, öffentliche Einrichtungen und andere unterteilt.

NORDAMERIKANISCHER MARKT FÜR FITNESSGERÄTE NACH VERTRIEBSKANAL

- Einzelhandelsgeschäfte

- Fachgeschäfte & Sportgeschäfte

- Kaufhäuser und Discounter

- Online

- Sonstiges

Auf der Grundlage der Vertriebskanäle ist der nordamerikanische Markt für Fitnessgeräte in Einzelhandelsgeschäfte, Fach- und Sportgeschäfte, Kaufhäuser und Discounter, Online-Shops und andere unterteilt.

Regionale Analyse/Einblicke zum nordamerikanischen Fitnessgerätemarkt

Der nordamerikanische Markt für Fitnessgeräte wird analysiert und Informationen zur Marktgröße werden basierend auf Land, Produkttyp, Anwendung, Geschlecht, Käufertyp, Verwendung, Typ, Endbenutzer und Vertriebskanal bereitgestellt.

Der nordamerikanische Markt für Fitnessgeräte umfasst die Länder USA, Kanada und Mexiko. In den USA wird aufgrund steigender Investitionen in Forschung und Entwicklung sowie der neuesten Spitzentechnologie und Erfindungen im Bereich Fitnessgeräte ein Wachstum erwartet.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit nordamerikanischer Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wettbewerbsumfeld und Marktanteilsanalyse für Fitnessgeräte in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen Fitnessgerätemarkts bietet Details nach Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens auf den nordamerikanischen Fitnessgerätemarkt.

Zu den wichtigsten Akteuren auf dem nordamerikanischen Markt für Fitnessgeräte zählen unter anderem Nautilus, Inc., Life Fitness, Johnson Health Tech, TECHNOGYM SpA, TRUE, Impulse (QingDao) Health Tech CO., LTD, iFIT, Torque Fitness., Body-Solid Inc., Core Health & Fitness, LLC., Precor Incorporated, Afton, Fitness World, Shanghai Define Health Tech CO LTD, REALLEADER FITNESS CO., LTD, Shandong Aoxinde Fitness Equipment Co., Ltd., BFT Fitness, Yanre Fitness, FITKING FITNESS und Fitline India.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FITNESS EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTE’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF PEOPLE INVOLVED IN PHYSICAL ACTIVITIES COMPETITIONS

5.1.2 COVID-19 PANDEMIC RESULTED IN A RISING DEMAND FOR HOME FITNESS EQUIPMENT

5.1.3 INCREASING POPULARITY OF FITNESS GEAR AROUND THE GLOBE

5.1.4 INCREASED TECHNOLOGICAL ADVANCEMENT IN THE FITNESS SECTOR

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH FITNESS EQUIPMENT

5.2.2 LACK OF SKILLED FITNESS PROFESSIONALS

5.3 OPPORTUNITIES

5.3.1 GROWING PENETRATION OF E-COMMERCE PLATFORMS, THE INTERNET, AND SMARTPHONES

5.3.2 MULTIPLE APPLICATION COVERAGE

5.3.3 INCREASING NUMBER OF GYMS & FITNESS CLUBS

5.4 CHALLENGES

5.4.1 PATIENT INFORMATION PRIVACY POLICIES

5.4.2 SHIFTING OF CUSTOMER PREFERENCES

6 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 STRENGTH TRAINING EQUIPMENTS

6.2.1 DUMBBELLS

6.2.1.1 FIXED

6.2.1.2 ADJUSTABLE

6.2.2 BARBELLS

6.2.2.1 STRAIGHT BARBELLS

6.2.2.2 SAFETY SQUAT BARS

6.2.2.3 EZ CURL BARS

6.2.2.4 TRICEPS BARS

6.2.2.5 TRAP BARS

6.2.2.6 AXEL BARS

6.2.2.7 SWISS BARS

6.2.2.8 FARMERS WALK HANDLES

6.2.2.9 THICK GRIP BARS

6.2.2.10 OTHERS

6.2.3 BACHES AND RACKS

6.2.4 FREE WEIGHTS

6.2.5 PLATE LOADED

6.2.6 CABLE MACHINES

6.2.7 MULTISTATIONS

6.2.8 SINGLE STATIONS

6.2.9 RESISTANCE BANDS

6.2.9.1 POWER RESISTANCE BANDS

6.2.9.2 TUBE RESISTANCE BANDS WITH HANDLES

6.2.9.3 MINI-BANDS

6.2.9.4 LIGHT THERAPY RESISTANCE BANDS

6.2.9.5 BANDS

6.2.9.6 OTHERS

6.2.10 TRX SUSPENSION TRAINER

6.2.11 KETTLEBELLS

6.2.12 ACCESSORIES

6.2.13 OTHERS

6.3 CARDIOVASCULAR TRAINING EQUIPMENTS

6.3.1 TREADMILLS

6.3.2 ELLIPTICAL CROSS TRAINER

6.3.3 STATIONARY BIKES

6.3.4 ROWING MACHINES

6.3.5 STAIR STEPPER

6.3.6 OTHERS

6.4 FITNESS MONITORING EQUIPMENTS

6.4.1 SMART WATCH

6.4.2 FITNESS BANDS

6.4.3 PATCHES

6.4.4 OTHERS

6.5 BODY COMPOSITION ANALYZERS

6.5.1 BIO-IMPEDANCE ANALYSERS

6.5.2 DUAL ENERGY X-RAY ABSORPTIOMETRY EQUIPMENT

6.5.3 SKINFOLD CALLIPERS

6.5.4 AIR DISPLACEMENT PLETHYSMOGRAPHY EQUIPMENT

6.5.5 HYDROSTATIC WEIGHING EQUIPMENT

6.5.6 OTHERS

6.6 OTHERS

7 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 BODY BUILDING

7.3 WEIGHT LOSS

7.4 PHYSICAL FITNESS

7.5 MENTAL FITNESS

7.6 OTHERS

8 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER

8.1 OVERVIEW

8.2 MALE

8.3 FEMALE

9 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE

9.1 OVERVIEW

9.2 INDIVIDUALS

9.3 INSTITUTION

9.4 OTHERS

10 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE

10.1 OVERVIEW

10.2 COMMERCIAL

10.3 RESIDENTIAL

11 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE

11.1 OVERVIEW

11.2 OUTDOOR

11.3 INDOOR

12 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER

12.1 OVERVIEW

12.2 HEALTH CLUBS/GYMS

12.3 PUBLIC INSTITUTIONS

12.4 HOTELS

12.5 HOME CONSUMERS

12.6 CORPORATES

12.7 HOSPITAL & MEDICAL CENTERS

12.8 OTHERS

13 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 RETAIL STORES

13.3 ONLINE

13.4 SPECIALTY & SPORTS SHOPS

13.5 DEPARTMENTAL & DISCOUNT STORES

13.6 OTHERS

14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 LIFE FITNESS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 IFIT

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 JOHNSON HEALTH TECH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 TECHNOGYM S.P.A

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 NAUTILUS, INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 AFTON

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BFT FITNESS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 BODY-SOLID INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 CORE HEALTH & FITNESS, LLC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 FITKING FITNESS

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 FITLINE INDIA

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 FITNESS WORLD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 IMPULSE (QINGDAO) HEALTH TECH CO., LTD

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 PRECOR INCORPORATED.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 REALLEADER FITNESS CO., LTD

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 SHANDONG AOXINDE FITNESS EQUIPMENT CO., LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHANDONG LIZHIXING FITNESS TECHNOLOGY CO., LTD.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHANGHAI DEFINE HEALTH TECH CO LTD,

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TORQUE FITNESS.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 True

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 YANRE FITNESS

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA STRENGTH TRAINING EQUIPMENT IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA BODY COMPOSITION ANALYZER IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA BODY BUILDING IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA WEIGHT LOSS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA PHYSICAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA MENTAL FITNESS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FEMALE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA INDIVIDUALS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA COMMERCIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA RESIDENTIAL IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OUTDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA INDOOR IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HEALTH CLUBS/GYMS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PUBLIC INSTITUTION IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA HOTELS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA HOME CONSUMERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA CORPORATES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA HOSPITAL AND MEDICAL CENTERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA RETAIL STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPECIALTY AND SPORTS SHOP IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA DEPARTMENTAL & DISCOUNT STORES IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN FITNESS EQUIPMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 63 U.S. FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 U.S. CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 69 U.S. FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 U.S. BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 U.S. FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 U.S. FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 73 U.S. FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 75 U.S. FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 U.S. FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 78 CANADA FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 CANADA FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 85 CANADA BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 CANADA FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 CANADA FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 88 CANADA FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 89 CANADA FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 90 CANADA FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 CANADA FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 92 CANADA FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 93 MEXICO FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO STRENGTH TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO DUMBBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BARBELLS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO RESISTANCE BANDS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO CARDIOVASCULAR TRAINING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO FITNESS MONITORING EQUIPMENTS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO BODY COMPOSITION ANALYSERS IN FITNESS EQUIPMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 MEXICO FITNESS EQUIPMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 102 MEXICO FITNESS EQUIPMENT MARKET, BY GENDER, 2021-2030 (USD MILLION)

TABLE 103 MEXICO FITNESS EQUIPMENT MARKET, BY BUYER TYPE, 2021-2030 (USD MILLION)

TABLE 104 MEXICO FITNESS EQUIPMENT MARKET, BY USAGE, 2021-2030 (USD MILLION)

TABLE 105 MEXICO FITNESS EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 MEXICO FITNESS EQUIPMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 107 MEXICO FITNESS EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FITNESS EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FITNESS EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FITNESS EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FITNESS EQUIPMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FITNESS EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FITNESS EQUIPMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA FITNESS EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA FITNESS EQUIPMENT MARKET: SEGMENTATION

FIGURE 11 THE GROWING PRVALENCE OF CARDIOVASCULAR DISEASES AND RISING DEMAND FOR FITNESS EQUIPMENT IN VARIOUS INDUSTRIES ARE EXPECTED TO DRIVE THE NORTH AMERICA FITNESS EQUIPMENT MARKET FROM 2023 TO 2030

FIGURE 12 STRENGTH TRAINING EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FITNESS EQUIPMENT MARKET

FIGURE 14 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2022

FIGURE 19 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2022

FIGURE 23 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY GENDER, LIFELINE CURVE

FIGURE 26 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2022

FIGURE 27 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY BUYER TYPE, LIFELINE CURVE

FIGURE 30 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2022

FIGURE 31 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY USAGE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2022

FIGURE 35 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2022

FIGURE 39 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 44 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA FITNESS EQUIPMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA FITNESS EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA FITNESS EQUIPMENT MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 51 NORTH AMERICA FITNESS EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.