North America Explosion Proof Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.01 Billion

USD

4.24 Billion

2024

2032

USD

3.01 Billion

USD

4.24 Billion

2024

2032

| 2025 –2032 | |

| USD 3.01 Billion | |

| USD 4.24 Billion | |

|

|

|

|

Marktsegmentierung für explosionsgeschützte Geräte in Nordamerika nach Angebot (Hardware, Software und Services), Temperaturklasse (T1 ( 450 °C), T2 ( 300 °C bis 200 °C bis 135 °C bis 100 °C bis 85 °C bis

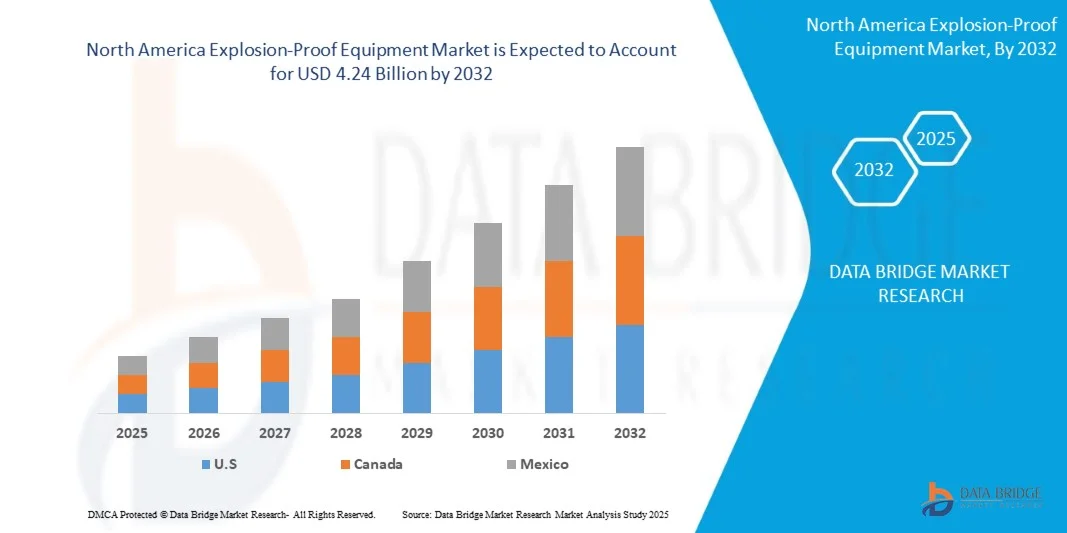

Marktgröße für explosionsgeschützte Geräte in Nordamerika

- Der nordamerikanische Markt für explosionsgeschützte Geräte hatte im Jahr 2024 einen Wert von 3,01 Milliarden US-Dollar und wird bis 2032 voraussichtlich 4,24 Milliarden US-Dollar erreichen , bei einer CAGR von 6,8 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach Sicherheitslösungen in gefährlichen Industrieumgebungen wie Öl und Gas, Bergbau und chemischer Verarbeitung vorangetrieben.

- Zunehmende staatliche Vorschriften zur Arbeitssicherheit und zum industriellen Explosionsschutz beschleunigen die Einführung explosionsgeschützter Geräte in der gesamten Region weiter.

Marktanalyse für explosionsgeschützte Geräte in Nordamerika

- Die steigende Nachfrage nach fortschrittlichen Schutzlösungen in Branchen wie Öl und Gas, Chemie, Pharma und Fertigung treibt die Marktexpansion voran

- Darüber hinaus verbessern kontinuierliche technologische Innovationen bei explosionsgeschützter Beleuchtung, Bedienfeldern und Kommunikationssystemen die Betriebssicherheit und Effizienz in gefährlichen Arbeitsumgebungen.

- Der US-Markt für explosionsgeschützte Ausrüstung verzeichnete 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch die zunehmende Umsetzung von Arbeitssicherheitsprotokollen und die Präsenz zahlreicher Öl- und Gas-, Chemie- und Produktionsanlagen

- Kanada wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im nordamerikanischen Markt für explosionsgeschützte Geräte verzeichnen . Dies ist auf steigende Investitionen in den Bereichen Bergbau, chemische Verarbeitung und Energie zurückzuführen, gepaart mit einem steigenden Bewusstsein für Arbeitssicherheit und der Einführung intelligenter, IoT-fähiger explosionsgeschützter Lösungen.

- Das Hardware-Segment hatte im Jahr 2024 den größten Marktanteil, was auf den weit verbreiteten Einsatz zertifizierter Gehäuse, Sensoren und Bedienfelder in Industrieanlagen zurückzuführen ist. Hardwarelösungen bilden das Rückgrat industrieller Sicherheitssysteme und sind entscheidend für die Unfallverhütung in gefährlichen Umgebungen.

Berichtsumfang und Marktsegmentierung für explosionsgeschützte Geräte in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke zu explosionsgeschützten Geräten in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Markttrends für explosionsgeschützte Geräte in Nordamerika

„Aufstieg intelligenter explosionsgeschützter Lösungen in der Arbeitssicherheit“

- Der zunehmende Einsatz intelligenter explosionsgeschützter Geräte verändert die industrielle Sicherheit durch Echtzeitüberwachung und vorausschauende Wartung. Diese Systeme ermöglichen die frühzeitige Erkennung gefährlicher Zustände, minimieren Ausfallzeiten und verhindern Unfälle. Unternehmen integrieren zunehmend KI-gestützte Analysen, um potenzielle Ausfälle vorherzusagen, während Cloud-basierte Plattformen die Zentralisierung von Sicherheitsdaten für mehrere Anlagen unterstützen.

- Die Nachfrage nach automatisierten und IoT-integrierten explosionsgeschützten Geräten steigt in Branchen wie Öl und Gas, Chemie und Bergbau und trägt zu sichereren Abläufen und höherer Betriebseffizienz bei. Diese Geräte tragen dazu bei, menschliche Fehler zu reduzieren, eine schnellere Reaktion auf Gefahrenereignisse zu gewährleisten und die Einhaltung von Sicherheitsstandards an komplexen Industriestandorten zu verbessern.

- Die Entwicklung modularer und skalierbarer Anlagenlösungen vereinfacht Installation und Wartung, senkt die Betriebskosten und erhöht die Sicherheit am Arbeitsplatz. Diese Lösungen ermöglichen eine einfache Nachrüstung bestehender Systeme, bieten Flexibilität bei Erweiterungen und reduzieren Ausfallzeiten bei Anlagenupgrades.

- So wurden beispielsweise im Jahr 2024 in mehreren petrochemischen Anlagen in den USA explosionsgeschützte Sensoren mit IoT-Unterstützung in den Verarbeitungseinheiten installiert. Dies ermöglichte eine frühzeitige Erkennung von Gaslecks und eine Reduzierung von Sicherheitsvorfällen. Der Einsatz ermöglichte zudem eine kontinuierliche Überwachung, prädiktive Warnmeldungen und eine verbesserte Berichterstattung an die Aufsichtsbehörden.

- Intelligente explosionsgeschützte Lösungen verbessern zwar die Gefahrenprävention und die Betriebssicherheit, ihre Wirksamkeit hängt jedoch von kontinuierlicher technologischer Innovation, angemessener Mitarbeiterschulung und der Einhaltung gesetzlicher Standards ab. Unternehmen müssen sich zudem auf Datensicherheit und Systemintegration konzentrieren, um den Nutzen intelligenter Sicherheitslösungen zu maximieren.

Marktdynamik für explosionsgeschützte Geräte in Nordamerika

Treiber

„Verschärfte Arbeitsschutzvorschriften und Fokus auf Arbeitnehmerschutz“

- Strenge Sicherheitsvorschriften von Behörden wie OSHA und NEC fördern den Einsatz explosionsgeschützter Geräte, um Arbeitsunfälle zu vermeiden und die Einhaltung der Vorschriften zu gewährleisten. Unternehmen führen strengere Sicherheitsprüfungen durch, modernisieren ältere Geräte und investieren in zertifizierte Sicherheitssysteme, um die gesetzlichen Anforderungen zu erfüllen.

- Industrieunternehmen legen zunehmend Wert auf die Sicherheit ihrer Mitarbeiter und die Risikominimierung. Dies führt zu einer steigenden Nachfrage nach zertifizierten explosionsgeschützten Beleuchtungs-, Bedien- und Überwachungssystemen. Dieser Wandel wird auch durch Versicherungsanforderungen, die Erwartungen der Stakeholder und die steigenden Kosten von Arbeitsunfällen und Ausfallzeiten beeinflusst.

- Darüber hinaus ermutigen Fortschritte in der Sensortechnologie, der Echtzeitüberwachung und der Automatisierung Unternehmen, in zuverlässige explosionsgeschützte Lösungen zu investieren, die Betriebsrisiken reduzieren. Vorausschauende Wartung, Fernüberwachung und automatisierte Warnmeldungen erhöhen die Geräteakzeptanz und die Betriebseffizienz zusätzlich.

- So rüsteten beispielsweise im Jahr 2023 mehrere Produktionsstätten in Nordamerika ihre Kontrollräume und Gefahrenbereiche mit druckfesten Gehäusen und intelligenten Überwachungssystemen auf, was zu einer verbesserten Einhaltung der Sicherheitsvorschriften führte. Diese Modernisierungen verbesserten auch die Datenerfassung für die vorbeugende Wartung und verkürzten die Reaktionszeiten im Notfall.

- Regulatorische Unterstützung und technologischer Fortschritt sind zwar wichtige Treiber, doch kontinuierliche Investitionen in Innovation und Mitarbeiterschulung sind unerlässlich, um die Sicherheit zu maximieren. Unternehmen arbeiten zunehmend mit Technologieanbietern zusammen, um maßgeschneiderte Lösungen für komplexe Industrieumgebungen zu entwickeln.

Einschränkung/Herausforderung

„Hoher Kapitalinvestitions- und Wartungsaufwand“

- Die hohen Anschaffungskosten moderner explosionsgeschützter Geräte schränken die Akzeptanz bei kleinen und mittleren Industriebetrieben ein und erschweren den großflächigen Einsatz. Die Kosten umfassen den Kauf, die Installation, die Zertifizierung und die Integration der Geräte in bestehende Sicherheitssysteme, was für kleinere Unternehmen unerschwinglich sein kann.

- Darüber hinaus erfordern spezialisierte Installation und laufende Wartung geschultes Personal, was die Betriebskosten erhöht und die Zugänglichkeit für kleinere Anlagen einschränkt. Kontinuierliche Überwachung, regelmäßige Tests und Konformitätsprüfungen erhöhen die betriebliche Komplexität und die Kosten für die Aufrechterhaltung hoher Sicherheitsstandards zusätzlich.

- Herausforderungen in der Lieferkette und Logistik für Geräte, Komponenten und Ersatzteile an abgelegenen Industriestandorten können Implementierungs- und Wartungspläne verzögern. Die Abhängigkeit von spezialisierten Lieferanten, längere Lieferzeiten und regionale Verfügbarkeitsprobleme können Projektzeitpläne stören und die Gesamtkosten erhöhen.

- So meldeten beispielsweise mehrere Chemiewerke im Jahr 2023 Verzögerungen bei der Anlageninstallation aufgrund der begrenzten Verfügbarkeit zertifizierter explosionsgeschützter Komponenten und geschulter Dienstleister. Diese Verzögerungen beeinträchtigten die Projektpläne, erhöhten die Arbeitskosten und setzten die Anlagen vorübergehend höheren Sicherheitsrisiken aus.

- Während sich Zuverlässigkeit und Leistung der Ausrüstung kontinuierlich verbessern, ist die Bewältigung von Kosten- und Wartungsproblemen entscheidend für eine breitere Marktdurchdringung und nachhaltiges Wachstum. Unternehmen prüfen Leasingmodelle, modulare Lösungen und lokale Servicepartnerschaften, um hochwertige Sicherheitsausrüstung einem breiteren Anwenderkreis zugänglich zu machen.

Marktumfang für explosionsgeschützte Geräte in Nordamerika

Der Markt ist nach Angebot, Temperaturklasse, Zone und Konnektivitätsdienst segmentiert

• Durch das Anbieten

Der Markt für explosionsgeschützte Geräte ist nach Angebot in Hardware, Software und Dienstleistungen unterteilt. Das Hardwaresegment hatte im Jahr 2024 den größten Marktanteil, was auf den weit verbreiteten Einsatz zertifizierter Gehäuse, Sensoren und Bedienfelder in Industrieanlagen zurückzuführen ist. Hardwarelösungen bilden das Rückgrat industrieller Sicherheitssysteme und sind entscheidend für die Unfallverhütung in gefährlichen Umgebungen.

Das Softwaresegment wird voraussichtlich von 2025 bis 2032 die schnellste Wachstumsrate verzeichnen, angetrieben durch die zunehmende Nutzung von IoT-fähigen Überwachungsplattformen, Tools für die vorausschauende Wartung und Cloud-basierten Analysen. Softwarelösungen steigern die Effizienz explosionsgeschützter Systeme durch Echtzeitwarnungen, zentrale Steuerung und datenbasierte Erkenntnisse für ein proaktives Gefahrenmanagement.

• Nach Temperaturklasse

Basierend auf der Temperaturklasse ist der Markt in T1 bis T6 segmentiert. Das T4-Segment hatte im Jahr 2024 einen signifikanten Anteil, bedingt durch seine Eignung für eine breite Palette industrieller Anwendungen mit moderaten Oberflächentemperaturgrenzen. Geräte der T4-Klasse werden aufgrund ihrer Zuverlässigkeit und Sicherheitskonformität häufig in der Chemie-, Öl- und Gasindustrie sowie im verarbeitenden Gewerbe eingesetzt.

Das T6-Segment wird voraussichtlich zwischen 2025 und 2032 ein starkes Wachstum verzeichnen, angetrieben durch die Nachfrage nach Geräten, die in hochsensiblen Bereichen mit sehr niedrigen maximalen Oberflächentemperaturen eingesetzt werden können. Explosionsgeschützte Geräte der Klasse T6 werden bevorzugt in Anwendungen eingesetzt, die höchste Sicherheitsstandards erfordern, insbesondere im Bergbau und in gefährlichen chemischen Verarbeitungsumgebungen.

• Nach Zone

Der Markt ist zonenweise in die Zonen 0 bis 22 unterteilt. Der größte Anteil entfiel im Jahr 2024 auf die Zone 1, da dort im Normalbetrieb mit dem Auftreten explosiver Gasatmosphären zu rechnen ist. Diese Zonen umfassen die meisten Industrieanlagen und Einrichtungen mit brennbaren Gasen oder Dämpfen.

Das Segment Zone 0 wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen, getrieben durch den steigenden Bedarf an Sicherheitslösungen in hochgefährlichen Umgebungen, in denen ständig explosive Atmosphären vorhanden sind. Geräte der Zone 0 gewährleisten maximalen Schutz und die Einhaltung strenger Arbeitsschutzvorschriften.

• Durch Konnektivitätsdienst

Auf der Grundlage des Konnektivitätsdienstes ist der Markt in kabelgebundene und kabellose Dienste unterteilt. Das kabelgebundene Segment hatte im Jahr 2024 den größten Marktanteil, bedingt durch seine Zuverlässigkeit, stabile Datenübertragung und Eignung für kritische Industrieabläufe, bei denen eine unterbrechungsfreie Konnektivität unerlässlich ist.

Das Wireless-Segment wird voraussichtlich von 2025 bis 2032 die schnellste Wachstumsrate verzeichnen, angetrieben durch den zunehmenden Einsatz von IoT-fähigen explosionsgeschützten Geräten, Fernüberwachungslösungen und intelligenten Sicherheitssystemen. Drahtlose Konnektivität ermöglicht flexible Installation, Echtzeitwarnungen und eine einfachere Integration in zentrale Sicherheitsmanagementplattformen.

Regionale Analyse des nordamerikanischen Marktes für explosionsgeschützte Geräte

- Der US-Markt für explosionsgeschützte Ausrüstung verzeichnete 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch die zunehmende Umsetzung von Arbeitssicherheitsprotokollen und die Präsenz zahlreicher Öl- und Gas-, Chemie- und Produktionsanlagen

- Unternehmen legen Wert auf die Verbesserung der Sicherheit am Arbeitsplatz durch zertifizierte explosionsgeschützte Geräte und IoT-fähige Überwachungslösungen

- Der wachsende Trend zur industriellen Automatisierung, kombiniert mit der Nachfrage nach Echtzeit-Gefahrenerkennung und vorausschauenden Wartungssystemen, treibt das Marktwachstum weiter voran

- Darüber hinaus trägt die Integration explosionsgeschützter Systeme mit intelligenten Industrieplattformen erheblich zur Expansion des Marktes bei.

Markteinblicke für explosionsgeschützte Geräte in Kanada

Der kanadische Markt für explosionsgeschützte Ausrüstung wird voraussichtlich von 2025 bis 2032 stetig wachsen, angetrieben durch Investitionen in den Bergbau, die Ölsandindustrie und die chemische Verarbeitungsindustrie, die hohe Sicherheitsstandards erfordern. Der Einsatz moderner Überwachungssysteme und IoT-fähiger Schutzvorrichtungen nimmt zu, unterstützt durch staatliche Sicherheitsvorschriften. Industrieunternehmen in Kanada konzentrieren sich auf die Reduzierung von Unfallrisiken und Betriebsausfällen, was den Einsatz explosionsgeschützter Ausrüstung weiter fördert.

Marktanteil explosionsgeschützter Geräte in Nordamerika

Die nordamerikanische Branche für explosionsgeschützte Geräte wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- R. STAHL Inc. (US)

- RAE Systems (Honeywell) (USA)

- Intertek Group PLC (USA)

- Adalet Inc. (USA)

- EX Industries (USA)

- Larson Electronics LLC (USA)

- Miretti Americas (USA)

- North American Industries (NAI) (USA)

- MSA Safety Incorporated (USA)

- Applus+ QPS (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.