North America Exocrine Pancreatic Insufficiency Epi Therapeutics And Diagnostics Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.45 Billion

USD

7.82 Billion

2024

2032

USD

4.45 Billion

USD

7.82 Billion

2024

2032

| 2025 –2032 | |

| USD 4.45 Billion | |

| USD 7.82 Billion | |

|

|

|

|

Marktsegmentierung für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika nach Diagnose (Bildgebungstests und Pankreasfunktionstest), Behandlung (Ernährungsmanagement, Pankreasenzymersatztherapie (PERT)), Arzneimitteltyp (Generika und Marken), Endverbraucher (Krankenhäuser, Fachkliniken, häusliche Pflege, Diagnosezentren, Forschungs- und akademische Institute und andere), Vertriebskanäle (Direktausschreibung, Einzelhandelsapotheke, Drittanbieter und andere) – Branchentrends und Prognose bis 2032

Nordamerika: Marktgröße für Therapeutika und Diagnostika bei exokriner Pankreasinsuffizienz (EPI)

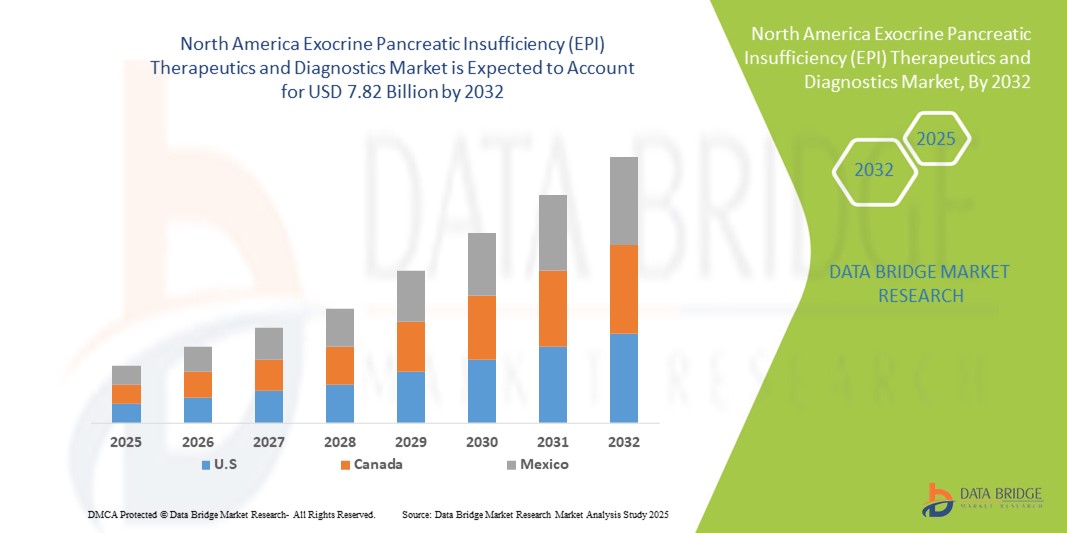

- Der nordamerikanische Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) hatte im Jahr 2024 ein Volumen von 4,45 Milliarden US-Dollar und dürfte bis 2032 ein Volumen von 7,82 Milliarden US-Dollar erreichen , bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,3 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung von chronischer Pankreatitis und Mukoviszidose , den Hauptursachen für EPI, sowie durch technologische Fortschritte bei Diagnoseinstrumenten und neuartigen Therapien vorangetrieben, die zu einem verbesserten Krankheitsmanagement führen.

- Darüber hinaus führt das steigende Patientenbewusstsein und die Nachfrage nach einer effektiven, einfach anzuwendenden Pankreasenzymersatztherapie (PERT) und verwandten Diagnoselösungen dazu, dass sich diese Behandlungen als Standardbehandlung für EPI etablieren. Diese konvergierenden Faktoren beschleunigen die Einführung von EPI-Therapeutika und -Diagnostika und fördern damit das Wachstum der Branche erheblich.

Marktanalyse für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika

- Therapeutika und Diagnostika für die exokrine Pankreasinsuffizienz (EPI), einschließlich der Pankreasenzymersatztherapie (PERT) und diagnostischer Tests, sind aufgrund ihrer Wirksamkeit bei der Behandlung von Malabsorption, der Verbesserung der Lebensqualität der Patienten und der Integration in personalisierte Behandlungspläne zunehmend wichtige Bestandteile der modernen Magen-Darm-Gesundheitsversorgung im klinischen und häuslichen Umfeld.

- Die steigende Nachfrage nach EPI-Therapeutika und -Diagnostika wird vor allem durch die zunehmende Verbreitung von chronischer Pankreatitis, Mukoviszidose und anderen Pankreaserkrankungen, das wachsende Bewusstsein der Patienten und die Präferenz für einfach zu verabreichende, wirksame Enzymersatztherapien angeheizt.

- Die USA dominierten den nordamerikanischen Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) mit dem größten Umsatzanteil von 79,2 % im Jahr 2024. Dies war gekennzeichnet durch die frühe Einführung fortschrittlicher Diagnoseinstrumente, hohe Gesundheitsausgaben und eine starke Präsenz wichtiger Pharma- und Biotech-Unternehmen, mit erheblichem Wachstum in spezialisierten Kliniken und Krankenhäusern, angetrieben durch Innovationen bei PERT-Formulierungen und diagnostischen Tests.

- Kanada wird im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land auf dem nordamerikanischen Markt für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) sein, da das Bewusstsein für Pankreaserkrankungen zunimmt, die Gesundheitspolitik günstig ist und die Investitionen in die diagnostische Infrastruktur steigen.

- Das Segment der Pankreasenzymersatztherapie (PERT) dominierte den nordamerikanischen Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) mit einem Marktanteil von 62,2 % im Jahr 2024, bedingt durch die nachgewiesene Wirksamkeit bei der Behandlung von EPI-Symptomen und die weit verbreitete klinische Anwendung in Krankenhäusern und der häuslichen Pflege.

Berichtsumfang und Marktsegmentierung für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke zu Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Therapeutika und Diagnostika bei exokriner Pankreasinsuffizienz (EPI) in Nordamerika

Verbesserte Patientenversorgung durch fortschrittliche Diagnostik und personalisierte Therapie

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für EPI-Therapeutika und -Diagnostika ist die zunehmende Einführung fortschrittlicher Diagnoseinstrumente und personalisierter Pankreasenzymersatztherapien (PERT), die das Krankheitsmanagement und die Patientenergebnisse verbessern.

- So ermöglichen beispielsweise fortschrittliche Tests auf Stuhlelastase und Atemluft den Klinikern, den EPI-Verlauf genau zu überwachen und die Enzymdosierung an die individuellen Bedürfnisse des Patienten anzupassen.

- Die Integration digitaler Gesundheitsplattformen und tragbarer Überwachungsgeräte ermöglicht die Echtzeitverfolgung der Behandlungswirksamkeit und Symptomverbesserung und unterstützt so proaktivere und personalisiertere Behandlungspläne

- Diese Technologien ermöglichen eine nahtlose Koordination zwischen Gastroenterologen, Hausärzten und Patienten und erleichtern die Fernüberwachung und Anpassung der Enzymtherapie nach Bedarf.

- Dieser Trend zu präziserem, datenbasiertem und patientenzentriertem Management verändert die Erwartungen an die EPI-Versorgung grundlegend. Unternehmen wie AbbVie und Nestlé Health Science entwickeln daher Diagnosekits und Therapielösungen mit verbesserten Überwachungsmöglichkeiten und individueller Dosierung.

- Die Nachfrage nach Therapeutika und Diagnostika, die integrierte Überwachung, präzise Dosierung und Benutzerfreundlichkeit bieten, wächst sowohl im klinischen als auch im häuslichen Pflegebereich rasant, da Patienten und Anbieter zunehmend Wert auf Wirksamkeit und Lebensqualität legen

Marktdynamik für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika

Treiber

Steigende Prävalenz von Pankreaserkrankungen und wachsendes Bewusstsein

- Die zunehmende Verbreitung von chronischer Pankreatitis, Mukoviszidose und verwandten Pankreaserkrankungen sowie das steigende Bewusstsein von Patienten und Ärzten sind ein wesentlicher Treiber für die erhöhte Nachfrage nach EPI-Therapeutika und -Diagnostika

- So wurde beispielsweise im März 2024 in einem klinischen Update auf verbesserte Ergebnisse bei Patienten hingewiesen, die eine optimierte PERT-Dosierung erhalten, und die Bedeutung einer frühzeitigen Diagnose und Therapieanpassung unterstrichen.

- Da Patienten und medizinisches Personal die Vorteile einer rechtzeitigen EPI-Diagnose und eines wirksamen Enzymersatzes erkennen, steigt die Nachfrage nach präziser Diagnostik und individualisierter Therapie erheblich.

- Darüber hinaus fördert das wachsende Netzwerk spezialisierter gastroenterologischer Kliniken und Patientenunterstützungsprogramme die Einführung von PERT und Diagnoseinstrumenten sowohl im Krankenhaus als auch im ambulanten Bereich.

- Die einfache Durchführung von PERT zusammen mit Überwachungsinstrumenten sowie zunehmende Sensibilisierungskampagnen und Bildungsprogramme fördern die Akzeptanz von Therapeutika und Diagnostika in ganz Nordamerika.

Einschränkung/Herausforderung

Hohe Behandlungskosten und eingeschränkte Patientencompliance

- Die relativ hohen Kosten für fortschrittliche Enzymformulierungen und diagnostische Tests, insbesondere für die Langzeittherapie, stellen eine erhebliche Herausforderung für eine breitere Marktakzeptanz dar.

- Beispielsweise brechen manche Patienten die PERT-Behandlung ab oder dosieren sie zu niedrig, weil sie zu hohe Kosten tragen müssen, was die Wirksamkeit und die Therapietreue der Behandlung verringert.

- Die Verbesserung der Erschwinglichkeit durch Versicherungsschutz, Patientenhilfsprogramme und kostengünstigere Enzymoptionen ist entscheidend für die Verbesserung des Zugangs und der Compliance

- Darüber hinaus können mangelnde Compliance des Patienten und unsachgemäße Enzymverabreichung die Wirksamkeit der Therapie einschränken, was die Notwendigkeit von Schulungsunterstützung und Überwachungsinstrumenten zur Sicherstellung der korrekten Anwendung unterstreicht.

- Zwar steigt das Bewusstsein und es gibt immer mehr Behandlungsmöglichkeiten, doch die wahrgenommene Komplexität und die Kosten der Therapie verhindern immer noch die Akzeptanz bei einigen Patienten, insbesondere in Regionen mit begrenzten Gesundheitsressourcen.

- Die Bewältigung dieser Herausforderungen durch Kostensenkungsstrategien, Patientenaufklärung und digitale Überwachungslösungen wird für ein nachhaltiges Marktwachstum und verbesserte Patientenergebnisse von entscheidender Bedeutung sein.

Nordamerika: Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) – Marktumfang

Der Markt ist nach Diagnose, Behandlung, Arzneimitteltyp, Endverbraucher und Vertriebskanal segmentiert.

- Nach Diagnose

Auf der Grundlage der Diagnose ist der nordamerikanische Markt für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in bildgebende Verfahren und Pankreasfunktionstests unterteilt. Das Segment der Pankreasfunktionstests dominierte den Markt mit dem größten Umsatzanteil im Jahr 2024, getrieben von seiner wesentlichen Rolle bei der genauen Diagnose von Enzyminsuffizienz und der Steuerung der Pankreasenzymersatztherapie (PERT). Kliniker bevorzugen häufig fäkale Elastase- und Sekretinstimulationstests aufgrund ihrer hohen Sensitivität und Spezifität. Das Segment profitiert vom wachsenden Bewusstsein für EPI bei Patienten und Gesundheitsdienstleistern. Nicht-invasive und Point-of-Care-Tests unterstützen die starke Akzeptanz in Krankenhäusern, Fachkliniken und Diagnosezentren zusätzlich. Die steigende Prävalenz von chronischer Pankreatitis und Mukoviszidose fördert den Einsatz von Pankreasfunktionstests. Technologische Verbesserungen bei der Testgenauigkeit und schnelle Durchlaufzeiten tragen ebenfalls zur Dominanz bei.

Das Segment der bildgebenden Verfahren wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen, angetrieben durch Fortschritte in den Bereichen MRT, CT und endoskopische Ultraschalluntersuchungen. Bildgebende Verfahren helfen, strukturelle Pankreasanomalien und zugrunde liegende Ursachen wie chronische Pankreatitis zu erkennen. Die zunehmende Integration mit Telemedizinplattformen ermöglicht eine breitere Nutzung in der ambulanten und häuslichen Pflege. Die steigende Verfügbarkeit von bildgebenden Geräten und die verbesserte Auflösung beschleunigen die Akzeptanz. Ärzte verlassen sich zunehmend auf bildgebende Verfahren, um Krankheitsverlauf und Therapieerfolg zu überwachen. Das Wachstum wird zusätzlich durch die Modernisierung der diagnostischen Infrastruktur in Krankenhäusern und Fachkliniken unterstützt.

- Nach Behandlung

Der nordamerikanische Markt für Therapeutika und Diagnostika der exokrinen Pankreasinsuffizienz (EPI) ist hinsichtlich der Behandlung in die Bereiche Ernährungsmanagement und Pankreasenzymersatztherapie (PERT) unterteilt. Das PERT-Segment dominierte den Markt im Jahr 2024 mit einem Marktanteil von 62,2 % aufgrund seiner nachgewiesenen Wirksamkeit bei der Behandlung von EPI-Symptomen wie Malabsorption und Nährstoffmangel. PERT wird aufgrund seiner standardisierten Dosierung, der einfachen Verabreichung und der positiven klinischen Ergebnisse weithin bevorzugt. Krankenhäuser, Fachkliniken und die häusliche Pflege sind wichtige Endverbraucher. Innovationen wie Formulierungen mit verzögerter Freisetzung, Kapselverkleinerung und Kombinationstherapien verbessern die Patienten-Compliance. Intensive Marketing- und Patientenunterstützungsprogramme von Pharmaunternehmen stärken das Segment zusätzlich. Das wachsende Bewusstsein von Patienten und Ärzten für eine angemessene Enzymersatztherapie trägt ebenfalls zur Dominanz bei.

Das Segment Ernährungsmanagement wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen, getrieben durch die zunehmende Bedeutung diätetischer Interventionen zur Unterstützung der EPI-Behandlung. Nahrungsergänzungsmittel, kalorienreiche Diäten und fettlösliche Vitamine werden zunehmend neben PERT eingesetzt. Patientenaufklärung und von Ernährungsberatern geleitete Programme in Krankenhäusern und der häuslichen Pflege fördern die Akzeptanz. Die Integration der Ernährung in personalisierte Therapiepläne erhöht die Behandlungseffektivität. Das zunehmende Bewusstsein für den Einfluss der Ernährung auf das Symptommanagement fördert das Wachstum. Die Akzeptanz von Ernährungsmanagementlösungen in der häuslichen und ambulanten Pflege nimmt zu.

- Nach Arzneimitteltyp

Der nordamerikanische Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) ist nach Arzneimitteltyp in Generika und Markenprodukte unterteilt. Das Markensegment dominierte den Markt im Jahr 2024 aufgrund starker klinischer Validierung, behördlicher Zulassungen und Patientenvertrauen. Marken-PERT-Produkte bieten standardisierte Enzymaktivität und eine einheitliche Verpackung. Patientenunterstützungsprogramme und Aufklärungskampagnen verbessern die Therapietreue. Markenmedikamente werden häufig in Krankenhäusern, Fachkliniken und in der häuslichen Pflege eingesetzt. Pharmaunternehmen fördern diese Produkte aktiv und stärken so ihre Marktdominanz. Klinische Evidenz und die Präferenz der Ärzte stärken das Segment zusätzlich.

Das Generika-Segment dürfte im Prognosezeitraum das schnellste Wachstum verzeichnen, getrieben durch Kostenbewusstsein und zunehmende Versicherungsdeckung. Generische PERT-Produkte bieten eine ähnliche Wirksamkeit wie Markenmedikamente zu niedrigeren Preisen. Die Akzeptanz in öffentlichen Krankenhäusern, der häuslichen Pflege und in Ambulanzen steigt. Staatliche Initiativen zur Förderung erschwinglicher Behandlungen unterstützen das Wachstum. Generika erweitern den Zugang für unterversorgte Bevölkerungsgruppen. Das steigende Bewusstsein für kostengünstige Alternativen beschleunigt die Akzeptanz in Nordamerika.

- Nach Endbenutzer

Der nordamerikanische Markt für Therapeutika und Diagnostika der exokrinen Pankreasinsuffizienz (EPI) ist nach Endnutzern in Krankenhäuser, Fachkliniken, häusliche Pflege, Diagnosezentren, Forschungs- und akademische Institute und weitere Bereiche unterteilt. Das Krankenhaussegment dominierte den Markt im Jahr 2024 aufgrund der Konzentration fortschrittlicher Diagnoseeinrichtungen und PERT-Verwaltungsdienste. Krankenhäuser bieten stationäre und ambulante Versorgung von EPI-Patienten an. Enge Kooperationen mit Pharmaunternehmen fördern die Akzeptanz. Krankenhäuser dienen zudem als zentrale Zentren für Patientenaufklärung und Therapieüberwachung. Das Segment profitiert von der Prävalenz chronischer Pankreatitis und Mukoviszidose. Der Ausbau gastroenterologischer Abteilungen und Fachkliniken trägt zur Dominanz bei.

Das Segment Homecare wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen, angetrieben durch patientenzentrierte Pflege und Ferntherapiemanagement. Telemedizinische Plattformen und digitale Überwachungstools erleichtern die Einführung von Homecare. Patienten können bequem von zu Hause aus PERT- und Ernährungsberatung erhalten. Homecare unterstützt die Therapietreue durch die Fernüberwachung durch einen Arzt. Das zunehmende Bewusstsein für das EPI-Management außerhalb von Krankenhäusern fördert das Wachstum. Komfort und weniger Krankenhausbesuche sind Schlüsselfaktoren für die Akzeptanz dieses Segments.

- Nach Vertriebskanal

Der nordamerikanische Markt für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) ist nach Vertriebskanälen in Direktausschreibungen, Einzelhandelsapotheken, Drittanbieter und andere unterteilt. Das Segment Einzelhandelsapotheken dominierte den Markt im Jahr 2024 aufgrund seiner Bequemlichkeit, Zugänglichkeit und starken Präsenz von Marken-PERT-Produkten. Apotheken bieten Beratungs- und Unterstützungsdienste an, um die Einhaltung der Therapie sicherzustellen. Partnerschaften zwischen Pharmaunternehmen und Einzelhandelsketten verbessern die Verfügbarkeit. Patienten profitieren von einer einfachen Rezepterfüllung und einem zeitnahen Zugang. Einzelhandelsapotheken sind in den USA und Kanada weit verbreitet. Der kontinuierliche Ausbau der Apothekennetze stärkt diese Dominanz.

Das Segment der Direktausschreibungen wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen, angetrieben durch Großbestellungen von Krankenhäusern, Fachkliniken und staatlichen Programmen. Direktausschreibungen bieten kostengünstige Lösungen für PERT und Diagnostik. Institutionelle Einkäufer können große Patientenpopulationen effizient betreuen. Optimierte Lieferketten unterstützen die Akzeptanz in Krankenhäusern und Kliniken. Die steigende Nachfrage aus öffentlichen Gesundheitsinitiativen beschleunigt das Wachstum. Das Wachstum wird auch durch langfristige Verträge gefördert, die eine konstante Produktverfügbarkeit gewährleisten.

Nordamerika: Regionale Analyse des Marktes für Therapeutika und Diagnostika bei exokriner Pankreasinsuffizienz (EPI)

- Die USA dominierten den nordamerikanischen Markt für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) mit dem größten Umsatzanteil von 79,2 % im Jahr 2024. Dies war gekennzeichnet durch die frühe Einführung fortschrittlicher Diagnoseinstrumente, hohe Gesundheitsausgaben und eine starke Präsenz wichtiger Pharma- und Biotech-Unternehmen, mit erheblichem Wachstum in spezialisierten Kliniken und Krankenhäusern, angetrieben durch Innovationen bei PERT-Formulierungen und diagnostischen Tests.

- Patienten und Gesundheitsdienstleister in der Region schätzen die Verfügbarkeit der Pankreasenzymersatztherapie (PERT), fortschrittlicher diagnostischer Tests wie Stuhlelastase und bildgebender Verfahren sowie integrierter Behandlungspläne, die die Ergebnisse und die Lebensqualität der Patienten verbessern.

- Diese breite Akzeptanz wird durch eine gut ausgebaute Gesundheitsinfrastruktur, hohe Gesundheitsausgaben, eine technologisch fortgeschrittene Bevölkerung und eine wachsende Präferenz für patientenzentrierte Pflegemodelle weiter unterstützt, wodurch sich EPI-Therapeutika und -Diagnostika als wesentliche Lösungen sowohl im Krankenhaus als auch in der häuslichen Pflege etablieren.

Markteinblicke für Therapeutika und Diagnostika bei exokriner Pankreasinsuffizienz (EPI) in den USA

Der US-Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) erzielte 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch die hohe Prävalenz von chronischer Pankreatitis, Mukoviszidose und anderen Pankreaserkrankungen. Patienten und Gesundheitsdienstleister legen zunehmend Wert auf eine frühzeitige Diagnose und eine wirksame Pankreasenzymersatztherapie (PERT), um die Behandlungsergebnisse und die Lebensqualität zu verbessern. Die wachsende Nachfrage nach integrierten Diagnoseinstrumenten, Patientenüberwachungssystemen und Heimtherapien treibt den Markt zusätzlich an. Darüber hinaus tragen eine fortschrittliche klinische Infrastruktur, ein umfassender Versicherungsschutz und die Präsenz führender Pharma- und Biotechunternehmen maßgeblich zum Marktwachstum bei. Die Einführung von Telemedizin und digitalen Gesundheitsplattformen für das Fernmanagement von Therapien verbessert zudem die Zugänglichkeit und Therapietreue.

Markteinblicke für Therapeutika und Diagnostika bei exokriner Pankreasinsuffizienz (EPI) in Kanada

Der kanadische Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies ist vor allem auf das zunehmende Bewusstsein für Pankreaserkrankungen und steigende Investitionen in die Gesundheitsinfrastruktur zurückzuführen. Staatliche Gesundheitsprogramme und günstige Erstattungsrichtlinien fördern die Akzeptanz von Diagnostika und Therapeutika. Kanadische Patienten und Ärzte profitieren von den Vorteilen von PERT, fortschrittlichen Pankreasfunktionstests und Lösungen zum Ernährungsmanagement. Der Markt wächst in Krankenhäusern, Fachkliniken und der häuslichen Pflege, wobei Frühdiagnose und personalisierte Therapie im Mittelpunkt stehen. Zunehmende Aufklärungsinitiativen und Patientenunterstützungsprogramme fördern die Marktakzeptanz zusätzlich.

Markteinblicke für Therapeutika und Diagnostika zur exokrinen Pankreasinsuffizienz (EPI) in Mexiko

Der mexikanische Markt für Therapeutika und Diagnostika zur Behandlung der exokrinen Pankreasinsuffizienz (EPI) wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen, getrieben durch steigende Gesundheitsausgaben und ein zunehmendes Patientenbewusstsein für EPI. Bemühungen, den Zugang zu diagnostischen Tests und erschwinglichen PERT-Formulierungen zu erweitern, unterstützen das Marktwachstum. Krankenhäuser und Fachkliniken setzen zunehmend auf fortschrittliche Diagnose- und Behandlungsmöglichkeiten, während sich die häusliche Pflege als praktische Lösung für Patienten in abgelegenen Gebieten etabliert. Die Zusammenarbeit mit Pharmaunternehmen und Aufklärungskampagnen fördern eine frühzeitige Diagnose und Therapietreue. Darüber hinaus dürften staatliche Initiativen zur Stärkung der Gesundheitsinfrastruktur das Marktwachstum weiter ankurbeln.

Marktanteile der Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) in Nordamerika

Die nordamerikanische Branche der Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI) wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- AbbVie Inc. (USA)

- Entero Therapeutics, Inc. (USA)

- Axovant Gene Therapies Ltd. (USA)

- Cumberland Pharmaceuticals Inc. (USA)

- Protalix BioTherapeutics, Inc. (USA)

- Prometic Life Sciences Inc. (Kanada)

- Aptalis Pharma Inc. (Kanada)

- Enzo Biochem, Inc. (USA)

- Thermo Fisher Scientific Inc. (USA)

- Bio-Rad Laboratories, Inc. (USA)

- Abbott (USA)

- F. Hoffmann-La Roche Ltd (US)

- Siemens Healthineers AG (Deutschland)

- Bio-Techne Corporation (USA)

- PerkinElmer (USA)

- lumina, Inc. (USA)

- Agilent Technologies, Inc. (USA)

- Merck & Co., Inc. (USA)

Was sind die jüngsten Entwicklungen auf dem nordamerikanischen Markt für Therapeutika und Diagnostika für exokrine Pankreasinsuffizienz (EPI)?

- Im Mai 2024 wurde von einer Patienteninitiative ein neues Symptombewertungstool, der EPI/PEI-SS, entwickelt, um das Screening auf exokrine Pankreasinsuffizienz zu unterstützen. Dieses Tool, das auf der Grundlage einer Literaturrecherche und patientengenerierter Symptomlisten erstellt wurde, soll eine umfassendere Methode zur Bewertung der Häufigkeit und Schwere häufiger EPI-Symptome bieten.

- Im Dezember 2023 schlossen Codexis und Nestlé Health Science einen Kaufvertrag für CDX-7108, eine neuartige orale Enzymtherapie für EPI. Gemäß den Vertragsbedingungen ist Nestlé Health Science für die weitere Entwicklung und Vermarktung von CDX-7108 verantwortlich, einschließlich aller damit verbundenen Kosten.

- Im Mai 2023 schloss First Wave BioPharma das Patientenscreening für seine klinische Phase-2-SPAN-Studie mit Adrulipase zur Behandlung von EPI bei Mukoviszidose-Patienten ab. Dieser Meilenstein stellt einen wichtigen Schritt in der Evaluierung des Potenzials von Adrulipase als Behandlungsoption für EPI dar. Die Ergebnisse werden voraussichtlich zukünftige Therapiestrategien beeinflussen.

- Im Februar 2023 gaben Codexis und Nestlé Health Science Zwischenergebnisse einer klinischen Phase-1-Studie mit CDX-7108 bekannt, einer neuartigen oralen Enzymtherapie zur Behandlung von EPI. Ziel der Studie war es, die Sicherheit, Verträglichkeit und Pharmakokinetik von CDX-7108 bei gesunden Probanden zu untersuchen. Diese Zusammenarbeit markiert einen bedeutenden Schritt in der Entwicklung nicht-porciner Enzymtherapien für EPI-Patienten.

- Im August 2021 gab AzurRx Biopharma, Inc. (jetzt First Wave BioPharma, Inc.) den Abschluss der Rekrutierung für seine klinische Phase-2-Studie mit MS1819 in Kombination mit einer Pankreasenzymersatztherapie (PERT) zur Behandlung schwerer exokriner Pankreasinsuffizienz (EPI) bei Mukoviszidose-Patienten bekannt.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.