North America Dental Implants Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.33 Billion

USD

4.16 Billion

2024

2032

USD

2.33 Billion

USD

4.16 Billion

2024

2032

| 2025 –2032 | |

| USD 2.33 Billion | |

| USD 4.16 Billion | |

|

|

|

|

North America Dental Implants Market Segmentation, By Type (Endosteal Implants, Subperiosteal Implants, Transosteal Implants, Intramucosal Implant, Accessories, Root-Form Dental Implants, and Plate-Form Dental Implants), Material (Titanium, Zirconia, and Others), Design (Tapered Implants and Parallel-Walled Implants), Procedure (Single Stage and Two Stage), Price (Premium Implants, Value Implants, Discounted Implants, and Mini Implants), End-User (Dental Clinics, Dental Hospitals, Dental Academic and Research Institutes, Dental Laboratories, and Others)- Industry Trends and Forecast to 2032

North America Dental Implants Market Size

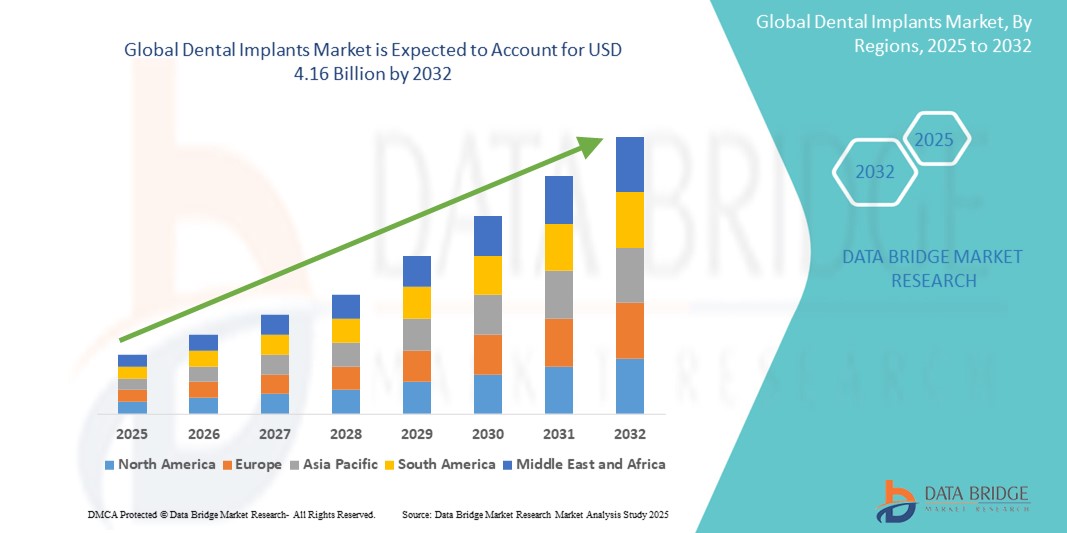

- The North America dental implants market size was valued atUSD 2.33 billion in 2024and is expected to reachUSD 4.16 billion by 2032, at aCAGR of 7.50 %during the forecast period

- This growth is driven by factors such as the increasing demand for dental implants due to an aging population, rising awareness about oral health, and advancements in dental technology

North America Dental Implants Market Analysis

- The North America dental implants market is experiencing significant growth due to increasing adoption of dental implants by both patients and professionals. The market is expected to continue expanding as more individuals opt for long-term and effective dental solutions

- Technological advancements in implant materials and techniques are playing a key role in improving the overall success rate of dental implants. This has led to enhanced patient satisfaction and wider acceptance of implants as a preferred treatment option

- U.S. is expected to dominate the North America Dental Implants market due to its advanced healthcare infrastructure, high disposable income, and a large aging population requiring dental implants increasing demand for aesthetic dental procedures, rising dental awareness, and government initiatives improving access to dental care

- Canada is expected to be the fastest growing region in the North America Dental Implants market during the forecast period due to

- Titanium segment is expected to dominate the market with a market share of 91.5 % due to its excellent biocompatibility, strength, and long-term reliability in dental implant procedures.

Report Scope and North America Dental Implants Market Segmentation

|

Attributes |

North America Dental Implants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

North America Dental Implants Market Trends

“Increasing Adoption of Digital Technologies in Implant Procedures”

- 3D printingis revolutionizing dental implant procedures by enabling rapid, precise, and cost-effective production of customized implants

- For instance, dental practices can now produce implants in-house within hours, reducing patient wait times and enhancing satisfaction

- The integration of artificial intelligence and machine learning with 3D printing is enhancing the precision of dental implants. AI algorithms analyze patient-specific data to design implants that fit better and function optimally, leading to improved clinical outcomes

- Chairside 3D printing is becoming increasingly popular among dental professionals, allowing them to fabricate dental restorations directly in the clinic. This approach eliminates the need for external laboratories, streamlining the process and reducing costs

- The adoption of digital workflows, including intraoral scanning and CAD/CAM systems, is facilitating the seamless integration of 3D printing into dental practices. These technologies enable accurate digital impressions and efficient design processes, enhancing the overall treatment experience

North America Dental Implants Market Dynamics

Driver

“Increasing Demand for Aesthetic Dental Procedures”

- One of the major drivers of the North America dental implants market is the increasing demand for aesthetic dental procedures. As more consumers focus on facial aesthetics, there’s a shift toward dental implants over traditional alternatives.

- For instance, many patients are now opting for dental implants to achieve a more natural-looking smile, which traditional dentures can't fully replicate.

- Dental implants provide a permanent, natural-looking solution to replacing missing teeth, which appeals to individuals seeking both functionality and aesthetics.

- A growing number of people are replacing missing teeth with implants as they offer a more stable and lifelike appearance compared to bridges or dentures, enhancing their confidence in social settings.

- For instance, Dental implants also help preserve the jawbone structure, preventing bone loss that often occurs with dentures.

- The aging population in North America is driving the demand for more reliable and durable dental solutions. As people live longer, they are seeking ways to restore both function and appearance.

- For instance, many seniors are choosing dental implants over dentures to improve their quality of life, as implants provide a long-lasting and stable solution to tooth loss.

- Advancements in dental implant technologies, such as new materials and better design techniques, are making procedures more efficient and accessible.

Opportunity

“Rise of Digital Dentistry Technologies”

- A significant opportunity in the North America dental implants market lies in the rise of digital dentistry technologies. The adoption of digital tools such as 3D printing, intraoral scanning, and CAD/CAM is transforming how dental implants are designed and placed

- For instance, 3D printing allows dental professionals to create implants tailored specifically to the patient's oral structure, ensuring a better fit and appearance, which increases patient satisfaction

- These advancements are improving the precision and efficiency of dental implant procedures, leading to faster recovery times and fewer complications

- For instance, With the help of intraoral scanners, dental professionals can take digital impressions without the need for traditional molds, offering patients a more comfortable and less invasive procedure

- The use of CAD/CAM technology is streamlining the production of crowns, bridges, and other restorations, reducing both treatment time and costs for patients

- For instance, this technology allows for quicker design and fabrication of implants, leading to shorter waiting times and reducing overall treatment costs, making implants more accessible to a wider patient base

- As digital tools become more integrated into dental practices, there will be increased demand for dental implant solutions that incorporate these technologies

Restraint/Challenge

“High Cost Associated with Implant Procedures”

- One of the primary challenges in the North America dental implants market is the high cost of implant procedures. Despite the growing demand, the procedure remains significantly more expensive than alternatives such as dentures or bridges

- For instance, the cost of implants can include not just the surgery, but also expenses for follow-up visits, anesthesia, and implant-supported restorations, making it financially difficult for some patients

- The issue is exacerbated by the fact that dental insurance plans often do not fully cover the costs of implants, leaving a large financial burden on patients

- For instance, as a result, many patients may delay or forgo implant treatments in favor of cheaper alternatives, slowing the overall market adoption and growth for dental implants

- Although financing options are available in some dental practices, they may not be accessible to all patients, especially those with lower incomes

- For instance, this financial barrier can cause patients to seek more affordable treatments outside of North America, opting for dental tourism in countries such as Mexico, where the cost of implants is lower

- Patients traveling abroad for cheaper implant procedures could affect the growth of the dental implant market in North America

North America Dental Implants Market Scope

The market is segmented on the basis of type, material, design, procedure, price, end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Design |

|

|

By Procedure |

|

|

By Price |

|

|

By End-User |

|

In 2025, the titanium dental implants are projected to dominate the market with a largest share in material segment

The titanium dental implants segment is expected to dominate the North America dental implants market with the largest share of 91.5% in 2025 due to its excellent biocompatibility, strength, and long-term reliability. Titanium is widely regarded as the gold standard in dental implants because it bonds well with bone, providing a stable and durable solution for tooth replacement.

The tapered dental implants are expected to account for the largest share during the forecast period in design market

In 2025, the tapered dental implants segment is expected to dominate the market with the largest market share of 65.5% due to its enhanced primary stability, especially in patients with lower bone density. The tapered design allows for easier insertion and better adaptability to varying bone structures, making it a popular choice among dental professionals for implant procedures.

North America Dental Implants Market Regional Analysis

“U.S. Holds the Largest Share in the North America Dental Implants Market”

- The U.S. is the dominant market in North America, holding approximately 86.9% of the regional market share

- This dominance is driven by the country’s advanced healthcare infrastructure, high disposable income, and a large geriatric population, all contributing to a high demand for dental implants

- The U.S. also benefits from a well-established network of dental professionals and clinics, offering widespread access to dental implant procedures

- In addition, the availability of extensive insurance coverage for dental procedures further drives the adoption of dental implants among the population

“Canada is Projected to Register the Highest CAGR in the North America Dental Implants Market”

- Canada is the fastest-growing market in North America, with a projected growth rate of 7.00%

- This growth is fuelled by government initiatives, such as the Canada Dental Benefit, which aims to improve access to dental care and support the population’s dental health needs

- The increasing adoption of advanced dental technologies, including digital dentistry, is also contributing to faster growth in the Canadian market

- Furthermore, well-established reimbursement policies and growing public awareness about the importance of dental care are driving the demand for dental implants in Canada

North America Dental Implants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zimmer Biomet(U.S.)

- Danaher(U.S.)

- Henry Schein, Inc. (U.S.)

- Bicon (U.S.)

- Blue Sky Bio(U.S.)

- Anatomage Inc. (U.S.)

- ACE Surgical Supply Co., Inc. (U.S.)

- Implant Direct (U.S.)

- BioHorizons (U.S.)

- DentiumUSA (U.S.)

- Dentsply Sirona (U.S.)

- Proscan (U.S.)

Latest Developments in North America Dental Implants Market

- In March 2023, Dentsply Sirona introduced the DS OmniTaper Implant System at the Academy of Osseointegration Annual Meeting. This system combines the proven technologies of the Astra Tech Implant System EV and DS PrimeTaper Implant System, offering a conical EV connection for restorative clarity and compatibility with digital workflows. It features the OsseoSpeed surface for enhanced bone healing and a pre-mounted TempBase abutment for immediate restorations

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.