North America Dandruff Treatment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.65 Billion

USD

3.10 Billion

2024

2032

USD

1.65 Billion

USD

3.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.65 Billion | |

| USD 3.10 Billion | |

|

|

|

|

Marktsegmentierung für Schuppenbehandlungen in Nordamerika nach Typ (Pilzschuppen, Schuppen aufgrund trockener Haut, Schuppen aufgrund fettiger Kopfhaut und krankheitsbedingte Schuppen), Verschreibungsart (rezeptfrei und verschreibungspflichtig), Produkt (nicht medikamentös und medikamentös), Arzneimitteltyp (Marken- und Generika), Altersgruppe (Erwachsene, Kinder und Neugeborene), Geschlecht (männlich und weiblich), Endverbraucher (häusliche Pflege, dermatologische Zentren, Fachkliniken und andere), Vertriebsart (Supermärkte/Hypermärkte, Convenience Stores, Apotheken, Einzelhandelsgeschäfte, Online-Shops und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Schuppenbehandlungen in Nordamerika

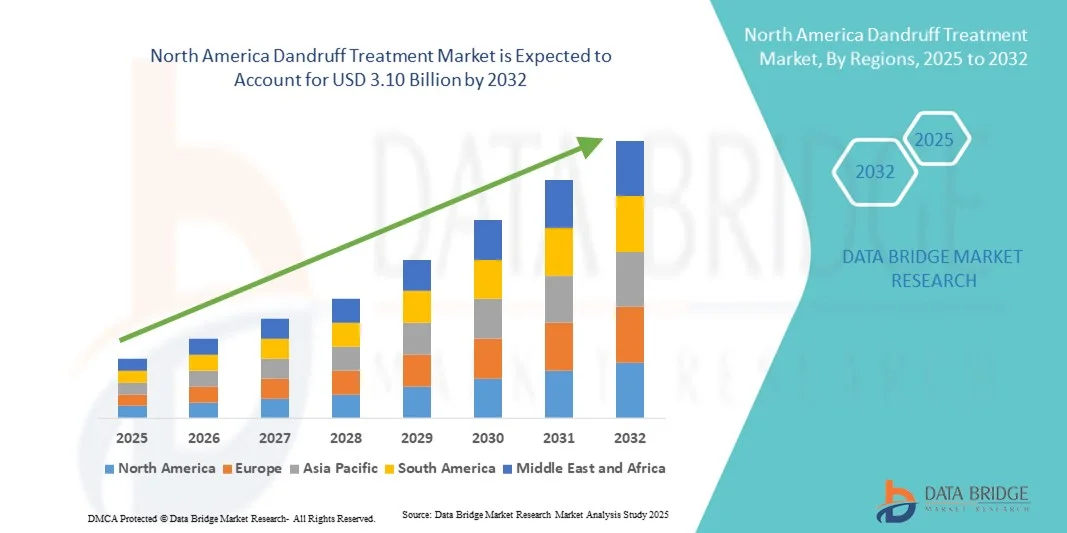

- Der nordamerikanische Markt für Schuppenbehandlungen hatte im Jahr 2024 einen Wert von 1,65 Milliarden US-Dollar und dürfte bis 2032 3,10 Milliarden US-Dollar erreichen , bei einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,19 % im Prognosezeitraum.

- Das Marktwachstum ist vor allem auf das zunehmende Bewusstsein für die Gesundheit der Kopfhaut, die zunehmende Verbreitung von Schuppen und die zunehmende Präferenz der Verbraucher für rezeptfreie und verschreibungspflichtige Anti-Schuppen-Lösungen zurückzuführen.

- Darüber hinaus stärkt die zunehmende Verbreitung natürlicher und klinisch erprobter Formulierungen sowie Innovationen bei Shampoos, Spülungen und Leave-in-Produkten die Schuppenbehandlung als Schlüsselsegment der Haarpflege. Diese Faktoren steigern gemeinsam die Marktnachfrage und beschleunigen das Branchenwachstum in Nordamerika.

Marktanalyse für Schuppenbehandlungen in Nordamerika

- Schuppenbehandlungen, einschließlich medikamentöser und nicht-medikamentöser Lösungen, werden aufgrund ihrer Wirksamkeit bei der Bekämpfung von Schuppenbildung, Juckreiz und Kopfhautreizungen zu einem wesentlichen Bestandteil der Körperpflegeroutine im privaten und beruflichen Umfeld.

- Die steigende Nachfrage nach Schuppenbehandlungen wird vor allem durch das zunehmende Bewusstsein für die Gesundheit der Kopfhaut, die zunehmende Verbreitung von Schuppen in verschiedenen Altersgruppen und die Vorliebe für klinisch erprobte, bequeme und einfach anzuwendende Haarpflegelösungen angetrieben.

- Die USA dominierten den nordamerikanischen Markt für Schuppenbehandlungen mit dem größten Umsatzanteil von 42 % im Jahr 2024, angetrieben durch ein hohes Verbraucherbewusstsein, eine starke Kaufkraft und eine etablierte Haarpflegeindustrie. Verbraucher suchen zunehmend nach innovativen Formulierungen, darunter Antimykotika und Lösungen gegen Schuppen bei trockener Haut, die sowohl von großen Körperpflegemarken als auch von aufstrebenden Nischenanbietern unterstützt werden.

- Kanada wird im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land auf dem nordamerikanischen Markt für Schuppenbehandlungen sein, aufgrund der zunehmenden Urbanisierung, steigender verfügbarer Einkommen und der zunehmenden Akzeptanz rezeptfreier Schuppenprodukte

- Das Segment Pilz-Schuppen dominierte den nordamerikanischen Markt für Schuppenbehandlungen nach Typ mit einem Marktanteil von 48,2 % im Jahr 2024, aufgrund seiner hohen Prävalenz, der nachgewiesenen Wirksamkeit der Behandlung und der Präferenz der Verbraucher für klinisch validierte antimykotische Formulierungen

Berichtsumfang und Marktsegmentierung für Schuppenbehandlungen in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke zur Schuppenbehandlung in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Schuppenbehandlungen in Nordamerika

Steigende Popularität klinisch erprobter und natürlicher Formulierungen

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für Schuppenbehandlungen ist die zunehmende Verwendung von Produkten, die klinisch erprobte antimykotische Inhaltsstoffe mit natürlichen oder pflanzlichen Komponenten kombinieren und so sowohl Wirksamkeit als auch eine geringere Reizung der Kopfhaut bieten.

- So kombiniert beispielsweise das Nizoral Anti-Schuppen-Shampoo Ketoconazol mit milden Pflegestoffen und sorgt so für eine effektive Schuppenbekämpfung und minimiert gleichzeitig Trockenheit. Head & Shoulders Citrus Fresh enthält Zinkpyrithion und Pflanzenextrakte zur Verbesserung der Kopfhautgesundheit.

- Formulierungen mit zusätzlichen Vorteilen wie Feuchtigkeitsversorgung, Beruhigung oder Stärkung des Haares gewinnen an Bedeutung, da Verbraucher zunehmend nach multifunktionalen Haarpflegeprodukten suchen. Darüber hinaus treibt das wachsende Bewusstsein für kopfhautfreundliche und chemiefreie Inhaltsstoffe die Produktinnovation voran.

- Diese fortschrittlichen Formulierungen erfüllen die unterschiedlichsten Bedürfnisse der Verbraucher, darunter auch solche mit empfindlicher Kopfhaut, fettiger oder trockener Haut mit Schuppen sowie solche, die nicht-medikamentöse oder natürliche Lösungen bevorzugen. Dies steigert die Zufriedenheit und Treue der Verbraucher.

- Der Trend zu personalisierteren, wirksameren und sanfteren Schuppenbehandlungen prägt die Erwartungen der Verbraucher in Nordamerika und veranlasst Unternehmen wie Selsun Blue, Produkte mit klinisch validierten Inhaltsstoffen zu entwickeln, die auf bestimmte Schuppentypen abzielen.

- Die Nachfrage nach innovativen, sicheren und vielseitigen Schuppenbehandlungen steigt sowohl bei Erwachsenen als auch bei Kindern, da das Bewusstsein für die Gesundheit der Kopfhaut und das Wohlbefinden der Haare wächst.

Marktdynamik für Schuppenbehandlungen in Nordamerika

Treiber

Wachsendes Bewusstsein für die Gesundheit der Kopfhaut und zunehmende Verbreitung von Schuppen

- Das wachsende Interesse an der Körperpflege und der Gesundheit der Kopfhaut, gepaart mit der zunehmenden Häufigkeit von Schuppen in verschiedenen Altersgruppen, ist ein wesentlicher Treiber für die erhöhte Nachfrage nach Schuppenbehandlungen.

- Beispielsweise werden Nioxin Scalp Recovery-Produkte zur Behandlung von Schuppen und zur Verbesserung des Kopfhautzustands vermarktet und fördern die regelmäßige Anwendung bei Verbrauchern mit wiederkehrenden Problemen. Solche Initiativen führender Marken dürften das Marktwachstum im Prognosezeitraum vorantreiben.

- Da sich Verbraucher zunehmend der Schuppensymptome wie Schuppenbildung und Juckreiz bewusst werden, bieten Anti-Schuppen-Lösungen zuverlässige Behandlungs- und Präventionsmöglichkeiten und stellen eine deutliche Verbesserung gegenüber herkömmlichen Haarpflegeprodukten dar.

- Darüber hinaus steigt die Beliebtheit von rezeptfreien Anti-Schuppen-Lösungen und verschreibungspflichtigen Produkten, was auf ihre Bequemlichkeit, Zugänglichkeit und nachgewiesene Wirksamkeit bei der Bekämpfung von Pilz- und trockener Hautschuppen zurückzuführen ist.

- Die Vorliebe für einfach anzuwendende Shampoos, Spülungen und Leave-on-Behandlungen, die in die tägliche Routine integriert werden können, treibt die Akzeptanz sowohl in der häuslichen Pflege als auch in der professionellen Dermatologie voran.

Einschränkung/Herausforderung

Ärgernisse und Hürden bei der Einhaltung gesetzlicher Vorschriften

- Bedenken hinsichtlich möglicher Kopfhautreizungen oder allergischer Reaktionen aufgrund von Wirkstoffen wie Ketoconazol, Zinkpyrithion oder Selensulfid erschweren eine breitere Marktakzeptanz. Da Schuppenmittel direkt mit der Haut interagieren, können Empfindlichkeitsprobleme Wiederholungskäufe und das Vertrauen der Verbraucher beeinträchtigen.

- Beispielsweise haben Berichte über trockene oder gerötete Kopfhaut nach längerer Anwendung dazu geführt, dass einige Verbraucher zögern, bestimmte medizinische Shampoos oder Leave-on-Lösungen zu verwenden.

- Um Vertrauen aufzubauen, ist es entscheidend, diese Bedenken durch hypoallergene Formulierungen, Verbraucheraufklärung zur richtigen Anwendung und dermatologisch getestete Produkte auszuräumen. Unternehmen wie Neutrogena legen Wert auf sanfte und klinisch getestete Inhaltsstoffe, um potenzielle Käufer zu beruhigen. Darüber hinaus können die Einhaltung gesetzlicher Vorschriften in Bezug auf Inhaltsstoffkonzentrationen, Kennzeichnung und Marketingaussagen sowohl für etablierte als auch für neue Marken Hürden darstellen.

- Natürliche und nicht-medikamentöse Lösungen erfreuen sich zwar zunehmender Beliebtheit, doch die im Vergleich zu medikamentösen Produkten wahrgenommene eingeschränkte Wirksamkeit kann die Akzeptanz bei Verbrauchern, die schnelle Ergebnisse wünschen, ebenfalls behindern.

- Die Bewältigung dieser Herausforderungen durch sicherere Formulierungen, klare Kennzeichnung und die Einhaltung regionaler Vorschriften wird für ein nachhaltiges Marktwachstum von entscheidender Bedeutung sein

Marktumfang für Schuppenbehandlungen in Nordamerika

Der Markt ist nach Art, Verschreibungsart, Produkt, Arzneimitteltyp, Altersgruppe, Geschlecht, Endverbraucher und Vertriebsart segmentiert.

- Nach Typ

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Typ unterteilt in Pilzschuppen, Schuppen aufgrund trockener Haut, Schuppen aufgrund fettiger Kopfhaut und krankheitsbedingte Schuppen. Das Segment Pilzschuppen dominierte den Markt mit dem größten Umsatzanteil von 48,2 % im Jahr 2024, bedingt durch die hohe Prävalenz von durch Malassezia verursachten Kopfhauterkrankungen und die starke Präferenz der Verbraucher für klinisch erprobte Antimykotika. Produkte gegen Pilzschuppen, darunter medizinische Shampoos und Spülungen, sind rezeptfrei und auf Rezept erhältlich und tragen zu einer anhaltenden Marktnachfrage bei. Verbraucher empfinden Antimykotika als wirksam zur langfristigen Schuppenbekämpfung, was zu Wiederholungskäufen führt. Darüber hinaus konzentrieren sich wichtige Körperpflegemarken auf Innovationen in diesem Segment mit Formulierungen mit mehreren Vorteilen, wie z. B. juckreizstillenden und feuchtigkeitsspendenden Eigenschaften. Dermatologische Zentren empfehlen häufig Lösungen gegen Pilzschuppen, was die Akzeptanz weiter fördert. Die Dominanz des Segments wird auch durch seine Kompatibilität mit der Anwendung bei Erwachsenen und Kindern unterstützt, was seine Attraktivität auf dem breiten Markt erhöht.

Das Segment Schuppenbildung bei trockener Haut wird voraussichtlich zwischen 2025 und 2032 mit 19,5 % das höchste Wachstum verzeichnen. Grund dafür ist das steigende Bewusstsein für Feuchtigkeitsversorgung der Kopfhaut und sanfte Formulierungen. Probleme mit trockener Kopfhaut hängen oft mit jahreszeitlichen Veränderungen und aggressiven Haarpflegepraktiken zusammen, weshalb Verbraucher nach nicht reizenden, medikamentösen und nicht-medikamentösen Lösungen suchen. Die steigende Nachfrage nach natürlichen und pflanzlichen Inhaltsstoffen in Behandlungen gegen trockene Kopfhaut treibt das Marktwachstum weiter voran. Aufklärung über Kopfhautpflege durch soziale Medien und Influencer steigert das Interesse der Verbraucher an gezielten Lösungen. Produkte gegen Schuppenbildung bei trockener Haut bieten oft zusätzlich feuchtigkeitsspendende Eigenschaften und sprechen damit gesundheitsbewusste Verbraucher an. Das Wachstum des Segments wird auch durch die zunehmende Akzeptanz bei Kindern und Erwachsenen mit empfindlicher Kopfhaut unterstützt.

- Nach Verschreibungsart

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Verschreibungsart in rezeptfreie und verschreibungspflichtige Produkte unterteilt. Das OTC-Segment dominierte den Markt mit dem größten Umsatzanteil von 62,4 % im Jahr 2024, was auf die leichte Verfügbarkeit, Erschwinglichkeit und die wachsende Präferenz der Verbraucher für Selbstpflegelösungen zurückzuführen ist. OTC-Anti-Schuppen-Produkte werden in großem Umfang über Apotheken, Einzelhandelsgeschäfte und Online-Plattformen vertrieben, was die Zugänglichkeit verbessert. Regelmäßige Werbeaktionen, Produktbündelung und Markentreueprogramme tragen zu nachhaltigen Umsätzen bei. OTC-Produkte richten sich zudem an Erwachsene und Kinder und sind daher eine vielseitige Wahl für die häusliche Pflege und den Einsatz in dermatologischen Zentren. Darüber hinaus fördert das Vertrauen der Verbraucher in rezeptfreie medizinische Shampoos gegen leichte Schuppen Wiederholungskäufe. Das Segment profitiert von kontinuierlichen Produktinnovationen, wie beispielsweise 2-in-1-Shampoo- und Spülungsformeln.

Das Segment der verschreibungspflichtigen Medikamente wird voraussichtlich zwischen 2025 und 2032 mit 17,8 % das höchste Wachstum verzeichnen. Dies ist auf das steigende Bewusstsein der Dermatologen und die zunehmende Zahl schwerer oder krankheitsbedingter Schuppen zurückzuführen. Verschreibungspflichtige Produkte werden aufgrund ihrer höheren Wirksamkeit, zielgerichteten Formulierungen und stärkeren antimykotischen oder entzündungshemmenden Inhaltsstoffe bevorzugt. Diese Lösungen werden häufig Patienten empfohlen, die nicht auf rezeptfreie Behandlungen ansprechen, was die Akzeptanz fördert. Das wachsende Bewusstsein für Kopfhauterkrankungen bei Erwachsenen und Kindern erhöht die Nachfrage nach professioneller Beratung. Verschreibungspflichtige Produkte werden zudem zunehmend in dermatologische Behandlungspläne integriert, was das Marktwachstum unterstützt. Teledermatologische Dienste erleichtern den Zugang zu verschreibungspflichtigen Behandlungen zusätzlich und beschleunigen das Wachstum in diesem Segment.

- Nach Produkt

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Produkten segmentiert in medikamentöse und nicht-medikamentöse Produkte. Das medikamentöse Segment dominierte den Markt mit dem größten Umsatzanteil von 55,6 % im Jahr 2024, angetrieben durch die hohe Wirksamkeit von Wirkstoffen wie Ketoconazol, Zinkpyrithion und Selensulfid bei der Bekämpfung von Schuppen und der Vorbeugung von Neubildungen. Medizinische Shampoos, Spülungen und Leave-on-Behandlungen werden von Dermatologen empfohlen und häufig in der häuslichen Pflegeroutine eingesetzt. Das Vertrauen der Verbraucher in klinisch getestete Produkte fördert Wiederholungskäufe, während Innovationen bei Rezepturen mit mehreren Vorteilen für mehr Komfort sorgen. Medizinische Produkte sind auf Pilz-, fettige und krankheitsbedingte Schuppen ausgerichtet und erhöhen ihre Vielseitigkeit. Ihre Dominanz wird durch die breite Verfügbarkeit über rezeptfreie, Apotheken- und Online-Kanäle weiter unterstützt. Marketingkampagnen, die die Wirksamkeit hervorheben, und Empfehlungen von Dermatologen stärken die Präferenz der Verbraucher.

Das Segment der nicht-medikamentösen Produkte wird voraussichtlich zwischen 2025 und 2032 mit 18,9 % das höchste Wachstum verzeichnen, angetrieben durch das steigende Interesse der Verbraucher an natürlichen, pflanzlichen und chemiefreien Lösungen. Nicht-medikamentöse Produkte sprechen gesundheitsbewusste Verbraucher und Verbraucher mit empfindlicher Haut an, die eine sanfte Schuppenbekämpfung suchen. Innovative Rezepturen, die beruhigende Pflanzenstoffe mit der Wirkung von Kopfhautpflege kombinieren, fördern die Akzeptanz. Aufklärung über natürliche Alternativen in den sozialen Medien und die Werbung von Influencern für diese Produkte fördern das Bewusstsein zusätzlich. Nicht-medikamentöse Produkte sind besonders bei Kindern und Erwachsenen mit leichtem Schuppen oder trockener Kopfhaut beliebt. Der wachsende Trend zur DIY-Haarpflege und die Vorliebe für nachhaltige Inhaltsstoffe unterstützen das beschleunigte Wachstum.

- Nach Arzneimitteltyp

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Medikamententyp in Marken- und Generikaprodukte unterteilt. Das Markensegment dominierte den Markt mit dem größten Umsatzanteil von 63,2 % im Jahr 2024, angetrieben durch hohe Markenbekanntheit, Verbrauchervertrauen und umfangreiches Marketing durch führende Haarpflegeunternehmen. Markenprodukte profitieren von forschungsbasierten Formulierungen und dermatologischen Empfehlungen, wodurch sie Generika vorgezogen werden. Die Verfügbarkeit in Apotheken, Einzelhandelsgeschäften und Online-Kanälen stärkt die Marktdurchdringung. Markentreue bei erwachsenen und pädiatrischen Verbrauchern sorgt für Wiederholungskäufe. Kontinuierliche Innovationen, wie die Kombination von Antischuppenwirkung mit haarstärkenden oder feuchtigkeitsspendenden Eigenschaften, stärken die Kundenbindung. Markenangebote nutzen zudem Influencer-Kampagnen und Sensibilisierungsprogramme, um Verbraucher über die richtige Anwendung und die Vorteile aufzuklären.

Das Generika-Segment wird voraussichtlich zwischen 2025 und 2032 mit 16,7 % das höchste Wachstum verzeichnen. Grund dafür sind kostenbewusste Verbraucher, die nach wirksamen Alternativen zu Markenprodukten suchen. Generika bieten ähnliche Wirkstoffe zu niedrigeren Preisen und sprechen damit eine breite Bevölkerungsgruppe an. Die steigende Verfügbarkeit in Apotheken und über E-Commerce -Plattformen verbessert die Zugänglichkeit. Digitale Kampagnen und professionelle Empfehlungen stärken das Bewusstsein der Verbraucher für die Wirksamkeit von Generika. Generika werden auch im OTC- und verschreibungspflichtigen Bereich angeboten, was die Marktreichweite weiter ausbaut. Die zunehmende Kostensensibilität im Gesundheitswesen und die Nachfrage nach preiswerten Lösungen treiben das Wachstum in diesem Segment voran.

- Nach Altersgruppe

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Altersgruppen in Erwachsene, Kinder und Neugeborene unterteilt. Das Segment Erwachsene dominierte den Markt mit dem größten Umsatzanteil von 68,5 % im Jahr 2024, was auf die hohe Prävalenz von Schuppen, das zunehmende Bewusstsein für Körperpflege und die Präferenz für professionelle Behandlungen zurückzuführen ist. Erwachsene Verbraucher investieren eher in medizinische und Markenlösungen, was zu nachhaltigen Umsätzen beiträgt. Häufiger Einfluss in sozialen Medien und professionelle Empfehlungen bestimmen die Produktauswahl. Erwachsene profitieren zudem vom einfachen Zugang zu rezeptfreien Produkten, dermatologischer Beratung und Online-Kaufkanälen. Das Segment deckt sowohl männliche als auch weibliche Verbraucher ab und erweitert so seine Reichweite weiter. Marketingkampagnen mit Fokus auf Lifestyle, Komfort und Produkten mit Mehrfachnutzen stärken die Akzeptanz.

Das Segment Pädiatrie wird voraussichtlich von 2025 bis 2032 mit 20,3 % das höchste Wachstum verzeichnen. Dies ist auf das steigende Bewusstsein für die Gesundheit der Kopfhaut bei Kindern und die Vorliebe der Eltern für sanfte, sichere und klinisch getestete Produkte zurückzuführen. Spezielle Formulierungen für Kinder mit milden Antimykotika und hypoallergenen Inhaltsstoffen finden zunehmend Anklang. Die zunehmende Verbreitung des E-Commerce und die Verfügbarkeit der Produkte in Supermärkten und Apotheken verbessern die Verfügbarkeit. Aufklärungskampagnen zur Kinderdermatologie und Empfehlungen von Kinderärzten fördern die Akzeptanz zusätzlich. Das Segment profitiert zudem von Innovationen bei tränenfreien und parfümfreien Formulierungen.

- Nach Geschlecht

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Geschlecht in männliche und weibliche Produkte unterteilt. Das männliche Segment dominierte den Markt mit dem größten Umsatzanteil von 54,1 % im Jahr 2024, was auf die höhere Schuppenprävalenz bei Männern und die starke Vermarktung gezielter Antischuppenlösungen zurückzuführen ist. Männliche Verbraucher bevorzugen häufig praktische Shampoos und Haarpflegelösungen mit mehreren Vorteilen, was zu Wiederholungskäufen beiträgt. OTC- und verschreibungspflichtige Produkte sind überall erhältlich, was eine konsequente Anwendung gewährleistet. Professionelle Empfehlungen und Online-Aufklärungskampagnen erhöhen das Bewusstsein und die Akzeptanz. Auf Männer ausgerichtete Produktinnovationen, darunter speziell auf die Kopfhaut abgestimmte medizinische Shampoos, stärken die Dominanz weiter. Markenkampagnen, die die männliche Körperpflege und das Selbstbewusstsein in den Vordergrund stellen, steigern den Marktanteil.

Das weibliche Segment wird voraussichtlich von 2025 bis 2032 mit 19,2 % die höchste Wachstumsrate verzeichnen. Dies ist auf das wachsende Bewusstsein für Haar- und Kopfhautpflege, steigende verfügbare Einkommen und die Vorliebe für sanfte und vielseitige Formulierungen zurückzuführen. Frauen greifen neben medikamentösen Lösungen zunehmend auch zu nicht-medikamentösen und natürlichen Produkten. Empfehlungen von Social Media, Influencern und Dermatologen fördern die Bekanntheit und das Ausprobieren. Weibliche Konsumenten schätzen zudem kosmetische Vorteile wie Glanz, Weichheit und Duft sowie die Schuppenbekämpfung. Der wachsende weibliche E-Commerce-Kundenstamm unterstützt die schnelle Akzeptanz.

- Nach Endbenutzer

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Endverbrauchern segmentiert und umfasst die Bereiche Heimpflege, Hautkliniken, Fachkliniken und weitere. Das Segment Heimpflege dominierte den Markt mit dem größten Umsatzanteil von 61,8 % im Jahr 2024, was auf Komfort, Erschwinglichkeit und die breite Verfügbarkeit von OTC-Produkten zurückzuführen ist. Verbraucher bevorzugen Shampoos, Spülungen und Leave-on-Produkte in ihrer täglichen Pflegeroutine zur konsequenten Schuppenbekämpfung. Online-Shops und Einzelhandelsgeschäfte verbessern die Verfügbarkeit zusätzlich. Heimpflegeprodukte werden von Erwachsenen, Kindern und Neugeborenen eingesetzt, was die Marktabdeckung erweitert. Marketingkampagnen, die die Benutzerfreundlichkeit und die Multi-Nutzen-Formulierungen betonen, unterstützen nachhaltiges Wachstum. Das Segment Heimpflege profitiert zudem von der durch Influencer und soziale Medien geförderten Produktbekanntheit.

Das Segment der Dermatologiezentren wird voraussichtlich von 2025 bis 2032 mit 18,5 % das höchste Wachstum verzeichnen. Dies ist auf das zunehmende Bewusstsein der Dermatologen, die steigende Zahl schwerer Schuppenfälle und die Empfehlung verschreibungspflichtiger Produkte zurückzuführen. Dermatologiezentren bieten professionelle Beratung bei der optimalen Behandlungsauswahl und sorgen so für bessere Compliance und bessere Ergebnisse. Teledermatologische Dienste und Klinikpartnerschaften mit Marken erweitern die Reichweite. Das Segment ist besonders wichtig für die Behandlung von Pilz- und krankheitsbedingtem Schuppen. Das Vertrauen der Verbraucher in professionelle Beratung fördert Wiederholungsbesuche und die Akzeptanz der Produkte.

- Nach Verteilungstyp

Der nordamerikanische Markt für Schuppenbehandlungen ist nach Vertriebsart in Supermärkte/Hypermärkte, Convenience Stores, Apotheken, Einzelhandelsgeschäfte, Online-Shops und weitere segmentiert. Das Apothekensegment dominierte den Markt mit dem größten Umsatzanteil von 44,7 % im Jahr 2024, was auf die einfache Verfügbarkeit von rezeptfreien und verschreibungspflichtigen Produkten, professionelle Beratung und fundierte Empfehlungen der Apotheker zurückzuführen ist. Apotheken dienen als vertrauenswürdige Verkaufsstelle für Erwachsene, Kinder und Neugeborene und stärken das Kaufvertrauen. Werbekampagnen, Produktbündelung und Sichtbarkeit im Geschäft steigern den Umsatz. Die Produktverfügbarkeit in verschiedenen Preisklassen gewährleistet eine breite Kundenreichweite. Die starke Präsenz von Marken- und Generikaprodukten stärkt die Akzeptanz.

Das Segment der Online-Shops wird voraussichtlich von 2025 bis 2032 mit 21,1 % das höchste Wachstum verzeichnen. Dies wird durch die zunehmende Verbreitung des E-Commerce, die bequeme Lieferung an die Haustür und das zunehmende digitale Bewusstsein vorangetrieben. Verbraucher können auf eine breite Palette von Marken-, Generika-, Arzneimittel- und Nicht-Arzneimitteln zugreifen. Abonnementmodelle, Rabatte und Lieferdienste fördern Wiederholungskäufe. Online-Bewertungen, Empfehlungen von Influencern und Produktvergleiche unterstützen fundierte Entscheidungen. Das Segment profitiert von der zunehmenden Akzeptanz bei technikaffinen Erwachsenen und Betreuern von Kindern.

Regionale Analyse des nordamerikanischen Marktes für Schuppenbehandlungen

- Die USA dominierten den nordamerikanischen Markt für Schuppenbehandlungen mit dem größten Umsatzanteil von 42 % im Jahr 2024, angetrieben durch ein hohes Verbraucherbewusstsein, eine starke Kaufkraft und eine gut etablierte Haarpflegeindustrie

- Verbraucher in der Region legen Wert auf wirksame, klinisch erprobte Behandlungen, die bequem, sicher und für den täglichen Gebrauch geeignet sind, darunter Shampoos, Spülungen und Leave-on-Lösungen gegen Pilzbefall und Schuppen aufgrund trockener Haut.

- Diese breite Akzeptanz wird durch hohe verfügbare Einkommen, den einfachen Zugang zu Apotheken und Online-Shops sowie die starke Präsenz wichtiger Körperpflegemarken weiter unterstützt. Empfehlungen von Dermatologen und von Influencern geleitete Aufklärungskampagnen tragen ebenfalls zur Popularität von Anti-Schuppen-Produkten bei Erwachsenen und Kindern bei und etablieren Schuppenbehandlungen als bevorzugte Lösung sowohl in der häuslichen Pflege als auch im professionellen Umfeld.

Markteinblick in die Schuppenbehandlung in den USA und Nordamerika

Der US-Markt für Schuppenbehandlungen erzielte 2024 mit 81 % den größten Umsatzanteil innerhalb Nordamerikas. Dies ist auf das wachsende Bewusstsein für die Gesundheit der Kopfhaut und die steigende Prävalenz von Schuppen bei Erwachsenen und Kindern zurückzuführen. Verbraucher bevorzugen zunehmend klinisch erprobte Lösungen, darunter rezeptfreie und verschreibungspflichtige Shampoos, Spülungen und Leave-in-Produkte, um Schuppen, Juckreiz und Kopfhautreizungen wirksam zu behandeln. Die wachsende Vorliebe für sanfte, vielseitige Formulierungen, die antimykotische Wirkung mit feuchtigkeitsspendenden oder beruhigenden Eigenschaften kombinieren, treibt den Markt zusätzlich an. Darüber hinaus trägt die breite Verfügbarkeit der Produkte in Apotheken, Online-Shops und im Einzelhandel sowie Empfehlungen von Dermatologen erheblich zum Marktwachstum bei. Kontinuierliche Innovationen wichtiger Marken, gepaart mit Marketing- und Sensibilisierungskampagnen, stärken die Akzeptanz und Loyalität der Verbraucher.

Markteinblick in Kanada zur Schuppenbehandlung

Der kanadische Markt für Schuppenbehandlungen wird im Prognosezeitraum voraussichtlich mit einer deutlichen durchschnittlichen jährlichen Wachstumsrate (CAGR) wachsen, vor allem aufgrund der zunehmenden Fokussierung der Verbraucher auf Körper- und Kopfhautpflege. Das steigende Bewusstsein für die Wirksamkeit und Sicherheit von Produkten sowie die Nachfrage nach natürlichen und nicht-medikamentösen Formulierungen fördern die Akzeptanz von Schuppenbehandlungen. Der Markt verzeichnet eine zunehmende Nutzung bei Erwachsenen und Kindern, unterstützt durch professionelle Beratung durch Dermatologen und die Verfügbarkeit im Einzelhandel, in Apotheken und im Internet. Staatliche Vorschriften und Sicherheitsstandards für Haarpflegeprodukte stärken das Verbrauchervertrauen zusätzlich. Darüber hinaus profitiert der Markt von der zunehmenden Verbreitung des E-Commerce, die einen bequemen Zugang zu Marken- und Generikaprodukten ermöglicht.

Markteinblick in Mexiko zur Schuppenbehandlung

Der mexikanische Markt für Schuppenbehandlungen wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten durchschnittlichen jährlichen Wachstumsrate wachsen, getrieben durch die zunehmende Urbanisierung, steigende verfügbare Einkommen und ein gesteigertes Bewusstsein für die Gesundheit von Haar und Kopfhaut. Verbraucher suchen nach effektiven und dennoch erschwinglichen Lösungen zur Schuppenbekämpfung, darunter rezeptfreie Shampoos und Spülungen gegen Pilz- und trockenheitsbedingte Schuppen. Die wachsende Einzelhandelsinfrastruktur, darunter Supermärkte, Apotheken und Online-Plattformen, erleichtert die Produktverfügbarkeit. Darüber hinaus tragen Marketingkampagnen führender Körperpflegemarken und die Verfügbarkeit kinderfreundlicher Formulierungen zu einer erhöhten Akzeptanz bei. Die Präferenz der Verbraucher für praktische Lösungen zur häuslichen Pflege unterstützt das Marktwachstum zusätzlich.

Marktanteil der Schuppenbehandlung in Nordamerika

Die nordamerikanische Schuppenbehandlungsbranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Procter & Gamble (USA)

- Unilever (Großbritannien)

- Johnson & Johnson und seine Tochtergesellschaften (USA)

- L'Oréal (Frankreich)

- Henkel AG & Co. KGaA (Deutschland)

- Church & Dwight Co., Inc. (USA)

- Shiseido Co., Ltd. (Japan

- BEIERSDORF (Deutschland)

- Kao Corporation (Japan)

- Himalaya Wellness Company (Indien)

- Jupiter (USA)

- Numé Hair (USA)

- Better Scalp Company (Kanada)

- Hadley Dermatology (USA)

- Dermatology Associates (USA)

- Fortgeschrittene Dermatologie und Hautkrebsspezialisten (USA)

- Forefront Dermatology (USA)

Was sind die jüngsten Entwicklungen auf dem nordamerikanischen Markt für Schuppenbehandlungen?

- Im Juli 2025 brachte OLAPLEX sein Pro Scalp Rebalancing Concentrate auf den Markt, eine professionelle Kopfhautbehandlung, die Anzeichen von Kopfhautstress durch Alltagsfaktoren oder Friseurbesuche reduziert. Das Produkt hilft gegen beschleunigte Kopfhautalterung und fördert gesundes Haar. Es bietet eine spezielle Lösung gegen Schuppen und für gesunde Kopfhaut.

- Im Juni 2025 wurden Briogeo Scalp Treatment Drops als Top-Produkt für trockene Kopfhaut hervorgehoben. Diese Tropfen spenden der Kopfhaut effektiv Feuchtigkeit und beruhigen sie und lindern so Trockenheit und Juckreiz im Zusammenhang mit Schuppen. Ihre Beliebtheit unterstreicht die wachsende Nachfrage nach gezielten Kopfhautpflegelösungen auf dem nordamerikanischen Markt.

- Im Juni 2025 stellte Head & Shoulders sein Scalp Elixir Treatment vor, ein Produkt gegen trockene und juckende Kopfhaut. Die Behandlung kombiniert die Anti-Schuppen-Wirkung der Marke mit beruhigenden Inhaltsstoffen und richtet sich an Verbraucher, die Linderung von Kopfhautbeschwerden suchen.

- Im April 2025 stellte Unilevers Premium-Marke für professionelle Anti-Schuppen, CLEAR, auf der TANK Shanghai ihre weltweit erste SCALPCEUTICALS PRO RANGE vor. Diese Serie verkörpert 50 Jahre wissenschaftliche Forschung der Marke und vereint die Anstrengungen von fünf globalen Laboren und über 200 Dermatologen. Die Produktreihe zielt auf Fett, Schuppen und empfindliche Kopfhaut ab und stellt einen bedeutenden Fortschritt in der Anti-Schuppen-Behandlung dar.

- Im November 2024 brachte die französische Drogeriemarke Vichy ihre Haarpflegelinie Dercos in den USA auf den Markt. Die Linie behandelt häufige Kopfhautprobleme wie Schuppen und Trockenheit und bietet ein 3-Stufen-System mit Selensulfid-Anti-Schuppen-Shampoo, feuchtigkeitsspendender Haar- und Kopfhautspülung und Salicylsäure-Anti-Schuppen-Serum. Diese Produkte bieten Ergebnisse in Salonqualität zu Drogeriepreisen und erweitern so die Verfügbarkeit wirksamer Schuppenbehandlungen in den USA.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.