North America Crane And Hoist Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.01 Billion

USD

5.89 Billion

2024

2032

USD

4.01 Billion

USD

5.89 Billion

2024

2032

| 2025 –2032 | |

| USD 4.01 Billion | |

| USD 5.89 Billion | |

|

|

|

|

Marktsegmentierung für Kräne und Hebezeuge in Nordamerika nach Typ (Mobilkräne und stationäre Kräne), Betrieb (Hydraulik, Elektro und Hybrid), Branche (Schifffahrt und Materialtransport, Luft- und Raumfahrt und Verteidigung, Automobil und Eisenbahn, Energie und Strom und andere), Anwendung (Bau, Transport und Logistik, Marine, Öl und Gas, Bergbau, Landwirtschaft und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Kräne und Hebezeuge in Nordamerika

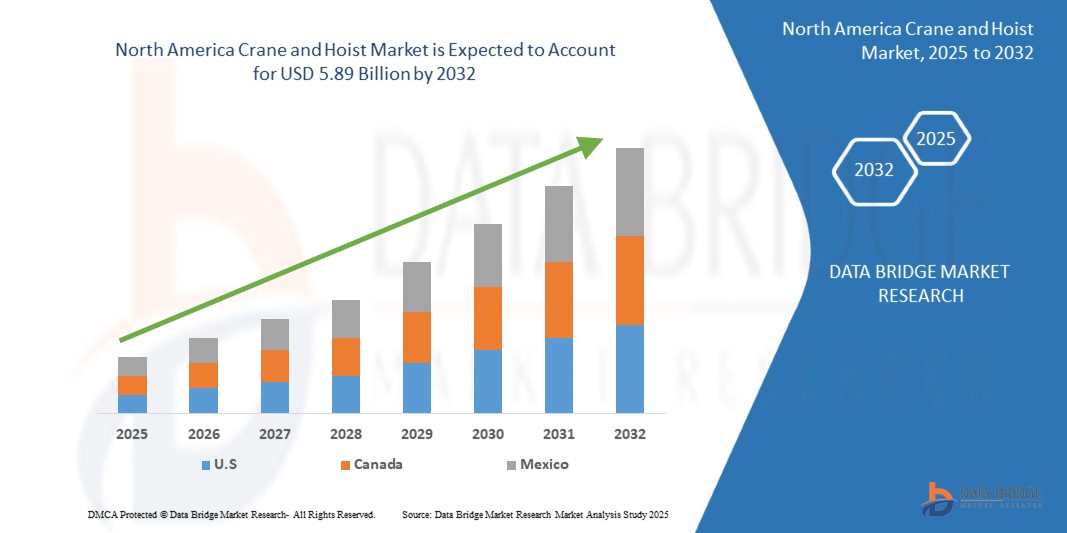

- Der nordamerikanische Markt für Kräne und Hebezeuge wurde im Jahr 2024 auf 4,01 Milliarden US-Dollar geschätzt und dürfte bis 2032 einen Wert von 5,89 Milliarden US-Dollar erreichen , was einer jährlichen Wachstumsrate von 4,90 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach modernen Hebezeugen in den Bereichen Bau, Fertigung und Logistik sowie durch zunehmende Investitionen in die Modernisierung der Infrastruktur in der gesamten Region vorangetrieben.

- Der wachsende Trend zur Automatisierung von Materialhandhabungsprozessen und die Integration des Internets der Dinge (IoT) in Hebezeuge tragen weiter zur Marktexpansion in Nordamerika bei.

Marktanalyse für Kräne und Hebezeuge in Nordamerika

- Die schnelle Industrialisierung in den USA und Kanada hat den Bedarf an effizienten Materialtransportsystemen deutlich erhöht und damit auch die Nachfrage nach Kränen und Hebezeugen beschleunigt.

- Technologische Fortschritte wie Automatisierung und die Integration intelligenter Sensoren verändern herkömmliche Kran- und Hebesysteme und ermöglichen verbesserte Sicherheit, Echtzeitdiagnose und Betriebseffizienz.

- Der US-Markt für Kräne und Hebezeuge hatte im Jahr 2024 mit 78 % den größten Umsatzanteil in Nordamerika, angetrieben durch eine robuste Infrastrukturentwicklung und die Wiederbelebung des Bau- und Fertigungssektors.

- Kanada wird voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im nordamerikanischen Kran- und Hebezeugmarkt verzeichnen, aufgrund der steigenden Bautätigkeit, der Modernisierung bestehender Industrieanlagen und der verstärkten Betonung der Arbeitssicherheit.

- Das Segment der Mobilkrane erzielte 2024 den größten Marktanteil, was auf ihre Flexibilität, ihren einfachen Transport und ihre Eignung für unterschiedliches Gelände bei Bau- und Infrastrukturprojekten zurückzuführen ist. Diese Krane werden häufig im Außenbereich eingesetzt, wo feste Installationen unpraktisch sind, wie beispielsweise im Straßen- und Brückenbau. Der hohe Nutzen von Mobilkranen für kurzfristige Hebevorgänge mit hoher Kapazität macht sie zur bevorzugten Wahl für Bauunternehmen.

Berichtsumfang und Marktsegmentierung für Kräne und Hebezeuge in Nordamerika

|

Eigenschaften |

Wichtige Markteinblicke für Kräne und Hebezeuge in Nordamerika |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für Kräne und Hebezeuge in Nordamerika

„Integration von Automatisierung und intelligenten Technologien in Kransysteme“

- Kräne und Hebezeuge werden zunehmend mit Automatisierungssystemen wie speicherprogrammierbaren Steuerungen (SPS) und Ferndiagnosesystemen integriert, um die Betriebseffizienz und die Echtzeitsteuerung zu verbessern.

- Hersteller setzen auf IoT-fähige Hebezeuge, die Daten zu Last, Betriebsstunden und Leistung erfassen können, um Strategien zur vorausschauenden Wartung zu unterstützen.

- Intelligente Kräne mit Antikollisionssensoren, Überlastwarnungen und drahtloser Kommunikation erfreuen sich in der Logistik, der Automobilindustrie und in Fertigungsanlagen zunehmender Beliebtheit.

- Der Wandel hin zur Industrie 4.0 beschleunigt die Nachfrage nach intelligenten Hebesystemen, die sich nahtlos mit anderen automatisierten Infrastrukturen koordinieren lassen.

- So hat Columbus McKinnon beispielsweise Kransteuerungen der Marke Magnetek eingeführt, die eine Fernüberwachung und erweiterte Sicherheitsdiagnose in US-Stahlverarbeitungsanlagen ermöglichen.

Marktdynamik für Kräne und Hebezeuge in Nordamerika

Treiber

„Schwung bei Projekten zur Modernisierung der Infrastruktur und zur industriellen Expansion“

- Die zunehmende Zahl staatlicher Infrastrukturinvestitionen in Straßen, Brücken und Häfen führt zu einem großflächigen Einsatz von Kränen und Hebezeugen in ganz Nordamerika.

- Die rasante Industrialisierung in Branchen wie der Automobil-, Luft- und Raumfahrt- sowie der Öl- und Gasindustrie steigert die Nachfrage nach Hebe- und Handhabungssystemen mit hoher Kapazität.

- Der Bau von Smart Cities und großen Wohnkomplexen führt zu einem verstärkten Einsatz von Turmdrehkränen und Brückenaufzügen für einen effizienten Materialtransport.

- Das Wachstum in der Lager- und Logistikbranche, angetrieben durch den E-Commerce, führt zu einer zunehmenden Installation von Kränen für die Bestandsverwaltung und Auftragsabwicklung

- Beispielsweise nutzen große Amazon-Vertriebszentren in den USA elektrische Brückenkräne für den internen Materialtransport.

Einschränkung/Herausforderung

„Hohe Installations- und Wartungskosten für moderne Kräne“

- Moderne Kransysteme, insbesondere solche mit integrierter Automatisierung, erfordern hohe Anfangsinvestitionen, die kleine und mittlere Unternehmen abschrecken können.

- Laufende Wartung, einschließlich Inspektionen, Schmierung und Kalibrierung, führt zu hohen Lebenszykluskosten für die Betreiber

- Die begrenzte Verfügbarkeit qualifizierter Techniker für die Installation, Bedienung und Wartung moderner Kräne kann zu Projektverzögerungen und höheren Arbeitskosten führen.

- Schwankende Kosten für Rohstoffe wie Stahl und elektronische Komponenten können die Erschwinglichkeit von Kranlösungen beeinträchtigen

- So verzögerte beispielsweise ein Logistikunternehmen in Texas die Modernisierung seiner Lagerkrane aufgrund eines 20-prozentigen Anstiegs der Stahlpreise und der Wartungsverträge.

Umfang des nordamerikanischen Marktes für Kräne und Hebezeuge

Der Markt ist nach Typ, Betrieb, Branche und Anwendung segmentiert.

• Nach Typ

Der nordamerikanische Markt für Krane und Hebezeuge ist nach Typ in Mobilkrane und stationäre Krane unterteilt. Das Segment der Mobilkrane erzielte 2024 den größten Marktanteil, was auf ihre Flexibilität, ihren einfachen Transport und ihre Eignung für unterschiedliches Gelände bei Bau- und Infrastrukturprojekten zurückzuführen ist. Diese Krane werden häufig im Außenbereich eingesetzt, wo stationäre Installationen unpraktisch sind, wie beispielsweise im Straßen- und Brückenbau. Der hohe Nutzen von Mobilkranen für kurzfristige Hebevorgänge mit hoher Kapazität macht sie zur bevorzugten Wahl für Bauunternehmen.

Das Segment der stationären Krane wird voraussichtlich von 2025 bis 2032 die höchste Wachstumsrate verzeichnen, unterstützt durch steigende Investitionen in stationäre Industrieanlagen. Stationäre Krane bieten Stabilität, Präzision und hohe Tragfähigkeit und eignen sich daher ideal für Produktionsanlagen, Lagerhallen und Werften, die routinemäßige Hebevorgänge mit minimaler Mobilität erfordern.

• Nach Betrieb

Der Markt ist betriebswirtschaftlich in Hydraulik-, Elektro- und Hybridkräne unterteilt. Das Elektrosegment war 2024 aufgrund seiner Energieeffizienz, geringeren Emissionen und einfachen Steuerung in Innenräumen und regulierten Umgebungen marktführend. Elektrokräne sind besonders in Fabriken und Lagerhallen verbreitet, wo Nachhaltigkeitsziele und die Integration von Automatisierung im Vordergrund stehen.

Das Hybridsegment dürfte zwischen 2025 und 2032 aufgrund der steigenden Nachfrage nach umweltfreundlicher Ausrüstung ohne Leistungseinbußen die schnellste Wachstumsrate verzeichnen. Hybridkrane kombinieren elektrische und hydraulische Systeme und bieten so einen geringeren Kraftstoffverbrauch und mehr Flexibilität unter unterschiedlichen Betriebsbedingungen, insbesondere in Branchen wie Bergbau sowie Öl und Gas.

• Nach Branche

Der Markt ist branchenübergreifend in Schifffahrt und Materialumschlag, Luft- und Raumfahrt und Verteidigung, Automobil und Eisenbahn, Energie und Strom sowie weitere Branchen unterteilt. Das Segment Schifffahrt und Materialumschlag erzielte 2024 den höchsten Umsatzanteil, angetrieben durch die wachsende Hafeninfrastruktur und die Logistikanlagen in der Region. Kräne und Hebezeuge sind für den Containerumschlag, den Güterumschlag und den Schüttguttransport zwischen Terminals und Lagern unerlässlich.

Im Energie- und Stromsegment wird aufgrund der fortschreitenden Umstellung auf eine Infrastruktur für erneuerbare Energien, bei der Kräne für die Installation von Windturbinen, Solarmodulen und Stromanlagen eingesetzt werden, von 2025 bis 2032 voraussichtlich die höchste Wachstumsrate verzeichnet.

• Nach Anwendung

Der Markt ist nach Anwendungsbereichen in Bauwesen, Transport und Logistik, Schifffahrt, Öl und Gas, Bergbau, Landwirtschaft und weitere Branchen unterteilt. Das Bausegment dominierte den Markt im Jahr 2024, unterstützt durch zunehmende Wohn- und Gewerbebauaktivitäten in den USA und Kanada. Kräne sind für den Materialtransport, das Heben von Strukturen und die Montage großer Fertigteile unerlässlich.

Im Transport- und Logistiksegment wird von 2025 bis 2032 voraussichtlich die höchste Wachstumsrate verzeichnet, unterstützt durch den Aufstieg des E-Commerce und die Entwicklung moderner Lager- und Vertriebszentren, die für eine effiziente Warenbewegung auf Kräne und Hebezeuge angewiesen sind.

Regionale Analyse des nordamerikanischen Kran- und Hebezeugmarktes

- Der US-Markt für Kräne und Hebezeuge hatte im Jahr 2024 mit 78 % den größten Umsatzanteil in Nordamerika, angetrieben durch eine robuste Infrastrukturentwicklung und die Wiederbelebung des Bau- und Fertigungssektors.

- Der anhaltende Ausbau städtischer Projekte, Lagerhallen und Industrieanlagen führt zu einer starken Nachfrage nach modernen Hebegeräten

- Darüber hinaus beschleunigt die Einführung von Elektro- und Hybridkränen zur Verbesserung der Betriebseffizienz und zur Senkung der Emissionen das Marktwachstum.

- Der zunehmende Fokus auf Sicherheit und Automatisierung im Materialtransport sowie erhöhte Investitionen in intelligente Fertigung fördern die Verbreitung technologisch fortschrittlicher Kräne und Hebezeuge in Schlüsselindustrien wie dem Baugewerbe, der Automobilindustrie und der Logistik.

Einblicke in den kanadischen Kran- und Hebezeugmarkt

Der kanadische Markt für Krane und Hebezeuge wird voraussichtlich von 2025 bis 2032 sein schnellstes Wachstum verzeichnen, unterstützt durch anhaltende Investitionen in öffentliche Infrastruktur, Bergbau und Energieprojekte. Die umfangreichen Bergbau- und Rohstoffaktivitäten des Landes, insbesondere in Provinzen wie Alberta und British Columbia, treiben die stetige Nachfrage nach Schwerlasthebelösungen voran. Staatlich geförderte Infrastrukturverbesserungen, einschließlich Verkehrsnetzen und öffentlichen Versorgungseinrichtungen, fördern zudem den Einsatz von Mobil- und Festkranen. Die zunehmende Bedeutung von Arbeitssicherheit und Automatisierung ermutigt die Industrie zudem, in moderne, effiziente Hebesysteme zu investieren. Kanadas Fokus auf Nachhaltigkeit und Elektrifizierung trägt zusätzlich zum Wachstum energieeffizienter und emissionsarmer Kran- und Hebezeugtechnologien bei.

Marktanteil von Kränen und Hebezeugen in Nordamerika

Die nordamerikanische Kran- und Hebezeugbranche wird hauptsächlich von etablierten Unternehmen geführt, darunter:

• Terex Corporation (USA)

• The Manitowoc Company, Inc. (USA)

• Columbus McKinnon Corporation (USA)

• Konecranes, Inc. (USA)

• Ingersoll Rand Inc. (USA)

• American Crane & Equipment Corporation (USA)

• Gorbel Inc. (USA)

• Shuttlelift, LLC (USA)

Neueste Entwicklungen auf dem nordamerikanischen Kran- und Hebezeugmarkt

- Im November 2023 lieferte Konecranes, ein Anbieter von Materialumschlaglösungen, zwei Hafenmobilkrane der 6. Generation für eine Hafenerweiterung in Brasilien und stärkte damit den lokalen Containerumschlag. Diese bedeutende Investition unterstreicht die strategische Positionierung des Unternehmens im globalen Kran- und Hebezeugmarkt.

- Im Februar 2023 brachte ACE einen Elektrokran mit einer Tragkraft von 180 Tonnen auf den Markt und markierte damit einen Meilenstein bei der Integration von Elektrofahrzeugen (EVs) in die Baumaschinenbranche. Diese Innovation spiegelt den wachsenden Trend zur Nachhaltigkeit im Kran- und Hebezeugmarkt wider.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.