Nordamerikanischer Markt für CBCT-Zahnbildgebung nach Typ (Systeme, Detektoren und Software), Sichtfeld (groß, mittel und klein), Gerätetyp (Patientenposition) (stehend, sitzend und liegend), Anwendung ( Zahnimplantate , Endodontie, allgemeine Zahnmedizin, Mund-, Kiefer- und Gesichtschirurgie, Kieferorthopädie, Kiefergelenkserkrankungen, Parodontologie, forensische Zahnmedizin und andere), Endbenutzer (Krankenhäuser und Zahnkliniken, Hochschulen und Forschungsinstitute und andere) – Branchentrends und Prognose bis 2030.

Marktanalyse und Einblicke für CBCT-Dentalbildgebung in Nordamerika

Die zunehmende Verbreitung von Zahninfektionen und -erkrankungen in der Region und der Anstieg der Bevölkerung aller Altersgruppen steigern die Nachfrage auf dem Markt. Die steigenden Gesundheitsausgaben für bessere Gesundheitsdienstleistungen werden ebenfalls dem Marktwachstum zugeschrieben. Die wichtigsten Marktteilnehmer konzentrieren sich in dieser entscheidenden Zeit stark auf Produkteinführungen. Darüber hinaus unterstützen Regierung und Aufsichtsbehörden die Marktteilnehmer aufgrund der steigenden Zahl an neuen Produkten bei der Produktzulassung. Der Markt wächst im Prognosejahr aufgrund der Zunahme der Marktteilnehmer und der Verfügbarkeit von Verbrauchsmaterialien für die Bildgebung. Der Markt ist unterstützend und zielt darauf ab, das Fortschreiten von Zahnerkrankungen zu verlangsamen.

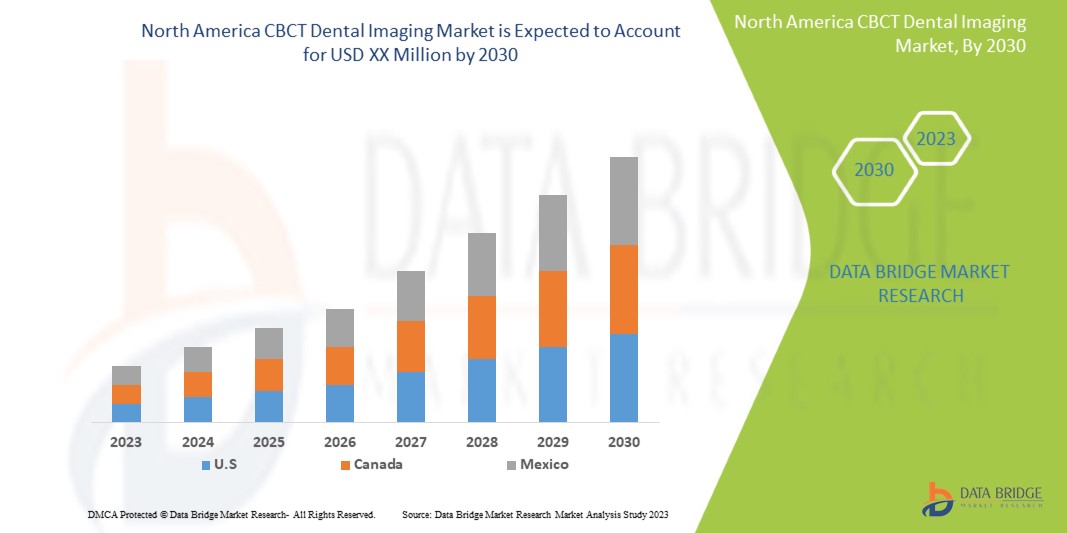

Laut einer Analyse von Data Bridge Market Research wird für den nordamerikanischen Markt für CBCT-Zahnbildgebung im Prognosezeitraum von 2023 bis 2030 ein durchschnittliches jährliches Wachstum von 11,0 % erwartet.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historisches Jahr |

2021 (Anpassbar auf 2015 – 2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD |

|

Abgedeckte Segmente |

Typ (Systeme, Detektoren und Software), Sichtfeld (groß, mittel und klein), Gerätetyp (Patientenposition) (stehend, sitzend und liegend), Anwendung (Zahnimplantate, Endodontie, allgemeine Zahnmedizin, Mund-, Kiefer- und Gesichtschirurgie, Kieferorthopädie, Erkrankungen des Kiefergelenks, Parodontologie, forensische Zahnmedizin und andere), Endbenutzer (Krankenhäuser und Zahnkliniken, Hochschulen und Forschungsinstitute und andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko |

|

Abgedeckte Marktteilnehmer |

Carestream Health., Cefla sc, Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, (Tochtergesellschaft Dental Imaging Technologies Corporation, VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl, ASAHIROENTGEN IND.CO.,LTD., Owandy Radiology und PINGSENG Healthcare unter anderem |

Marktdefinition

Die Cone-Beam-Computertomographie (CBCT) in der zahnärztlichen Bildgebung ist ein spezieller Röntgentyp, der in Situationen eingesetzt wird, in denen normale zahnärztliche Röntgenaufnahmen nicht ausreichen. Sie wird nicht häufig verwendet, da die Strahlenbelastung durch diesen Scanner deutlich höher ist als bei normalen zahnärztlichen Röntgenaufnahmen. Dabei wird eine spezielle Technologie verwendet, um in einem einzigen Scan dreidimensionale (3D-)Bilder von Zahnstrukturen, Weichgewebe und Nervenbahnen zu erzeugen.

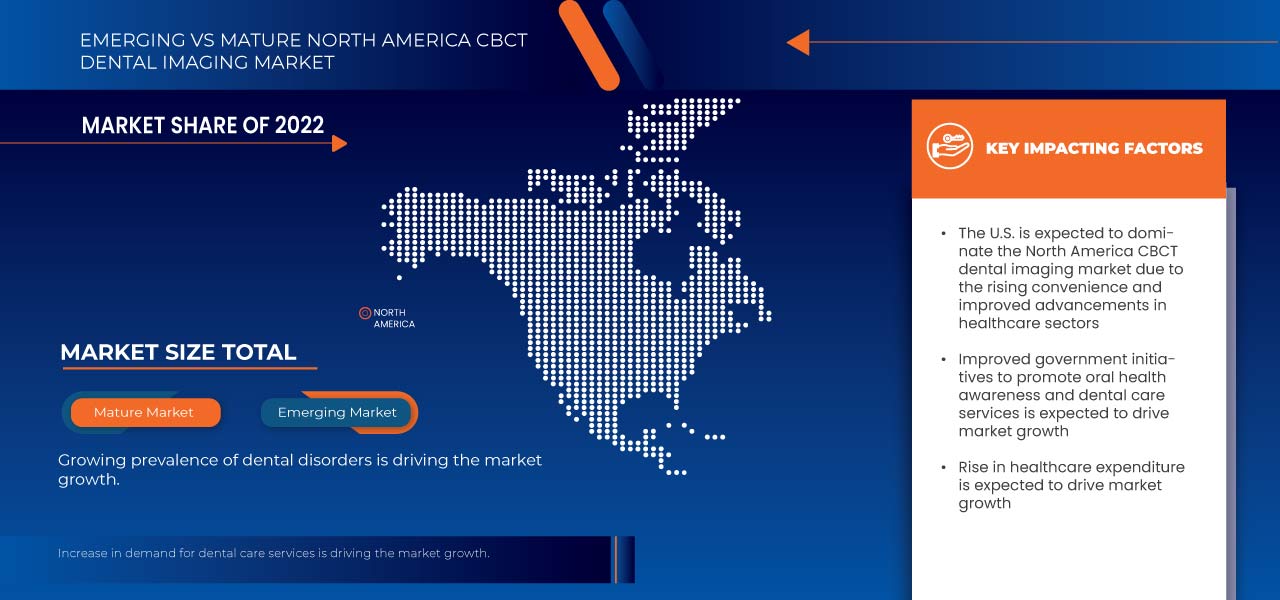

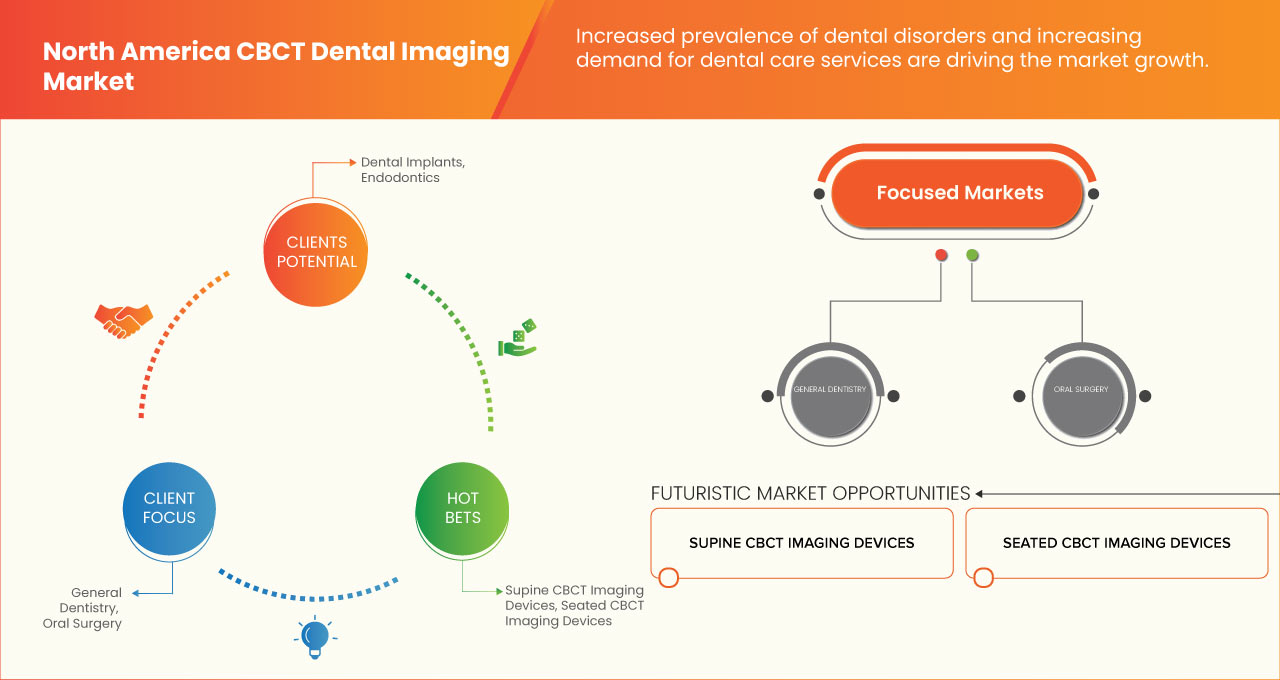

Die zunehmende Verbreitung von Zahnerkrankungen und die steigende Nachfrage nach zahnärztlichen Dienstleistungen sowie Fortschritte bei CBCT-Zahnbildgebungstechnologien und -Software sind die Hauptfaktoren, die das Marktwachstum vorantreiben. Darüber hinaus treiben staatliche Initiativen zur Förderung des Bewusstseins für Mundgesundheit und zahnärztlicher Dienstleistungen das Marktwachstum voran.

Nordamerika CBCT Dental Imaging Marktdynamik

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

TREIBER

- Zunehmende Verbreitung von Zahnerkrankungen und steigende Nachfrage nach zahnärztlichen Dienstleistungen

In den letzten Jahren hat die Zahl der Zahnerkrankungen zugenommen, was wiederum die Nachfrage nach zahnärztlichen Leistungen erhöht hat. Dieser Trend wird durch mehrere Faktoren vorangetrieben, wie z. B. eine alternde Bevölkerung, schlechte Mundhygiene, Ernährung, Lebensstil, gesteigertes Bewusstsein und Fortschritte in Technologie und Innovation.

Mit zunehmendem Alter sind Menschen anfälliger für Zahnprobleme wie Karies, Zahnfleischerkrankungen und Zahnverlust. Dies wird durch mehrere Faktoren verursacht, darunter Veränderungen des Hormonspiegels, verringerte Speichelproduktion und ein geschwächtes Immunsystem. Die alternde Bevölkerung hat die Nachfrage nach zahnärztlichen Leistungen, insbesondere nach restaurativen und kosmetischen Eingriffen, erhöht.

Schlechte Mundhygiene ist ein weiterer wichtiger Faktor, der die Häufigkeit von Zahnerkrankungen beeinflusst. Trotz Fortschritten in der Mundhygiene vernachlässigen viele Menschen ihre Mundhygiene. Wenn man die Zähne nicht regelmäßig putzt und Zahnseide verwendet, kann sich Plaque bilden, was wiederum zu Karies, Zahnfleischerkrankungen und Mundgeruch führen kann.

- Fortschritte bei CBCT-Dentalbildgebungstechnologien und -Software

Einer der wichtigsten Fortschritte in der CBCT-Bildgebungstechnologie ist die höhere Auflösung der Bilder. Bilder mit höherer Auflösung ermöglichen eine genauere und präzisere Diagnose von Erkrankungen der Zähne und des Kiefers. Dies ist insbesondere in der Implantologie nützlich, da es eine bessere Visualisierung der Knochenstruktur und der Zahnposition ermöglicht, was bei der Bestimmung der optimalen Platzierung von Zahnimplantaten helfen kann.

Eine weitere Verbesserung ist die erhöhte Schussrate. Mit neueren CBCT-Geräten werden Bilder in 5-10 Sekunden aufgenommen, wodurch die Strahlenbelastung des Patienten verringert und die Effizienz der Zahnarztpraxis verbessert wird. Dies ist insbesondere für Patienten nützlich, denen es schwerfällt, lange still zu sitzen, oder die mehrere Scans benötigen.

Darüber hinaus haben neue Softwareentwicklungen die Verarbeitung und Analyse von CBCT-Bildern erleichtert. 3D-Bildgebungssoftware ermöglicht eine bessere Visualisierung von Bildern und Messgeräte können Bildstrukturen und -abstände präzise messen. Dies erleichtert Zahnärzten die Diagnose und Behandlungsplanung für verschiedene Krankheiten.

GELEGENHEIT

- Zunehmende Nutzung der digitalen Zahnheilkunde

Unter digitaler Zahnheilkunde versteht man den Einsatz digitaler Technologien in der Zahnarztpraxis, von der Diagnose und Behandlungsplanung bis hin zur Herstellung von Zahnfüllungen. Mit dem Fortschritt der Technologie ist die digitale Zahnheilkunde in den letzten Jahren immer üblicher geworden.

Zu den Vorteilen der Einführung der digitalen Zahnmedizin gehören unter anderem:

- Verbesserte Genauigkeit: Digitale Technologien wie Intraoralscanner, 3D-Bildgebung und CAD-Software (Computer-Aided Design) ermöglichen Zahnärzten hochgenaue und präzise Messungen der Zähne und des Zahnfleisches eines Patienten. Dies trägt dazu bei, die Qualität der Behandlungsplanung und der Herstellung von Zahnfüllungen zu verbessern.

- Bessere Patientenerfahrung: Die digitale Zahnheilkunde reduziert den Bedarf an herkömmlichen Zahnabdrücken, die für Patienten unangenehm und verwirrend sein können. Intraorale Scanner ermöglichen eine schnelle und bequeme digitale Reproduktion und machen die Erfahrung für Patienten angenehmer.

Daher ist zu erwarten, dass die zunehmende Verbreitung der digitalen Zahnheilkunde eine Chance für Marktwachstum darstellt.

ZURÜCKHALTUNG/HERAUSFORDERUNG

- Mangel an qualifizierten Fachkräften zur Bedienung von CBCT-Dentalbildgebungssystemen

Der Fachkräftemangel wirkt sich bereits jetzt auf das Land aus, da immer mehr Menschen mehr als sechs Monate auf ihre Zahnbehandlung warten müssen. Aufgrund des technischen Fortschritts, der grundlegenden Infrastruktur und mehrerer anderer Faktoren herrscht in Schwellen- oder Entwicklungsländern ein Mangel an qualifizierten Fachkräften im Bereich der CBCT-Zahnbildgebung.

Der Mangel an qualifizierten Fachkräften ist teilweise auf die strenge Ausbildung und das Training zurückzuführen, die erforderlich sind, um ein Zahnarzt zu werden, sowie auf den wettbewerbsintensiven Arbeitsmarkt. Darüber hinaus benötigen qualifizierte Zahnärzte mehr offiziell ausgebildete, zugelassene Zahnarzthelfer, um den Zugang zur Zahnpflege aufrechtzuerhalten und zu verbessern und fortschrittliche technologische Systeme wie CBCT-Dentalbildgebungssysteme zu bedienen und auszuführen.

In den Schwellenländern mangelt es an qualifizierten Fachkräften, die die neuen Technologien nicht effektiv einsetzen können. Dies könnte zu einer Herausforderung auf dem Markt für neue Technologien führen, da diese Länder den Beginn technologisch getriebener Fortschritte auf dem Markt verzögern.

Auswirkungen von COVID-19 auf den nordamerikanischen Markt für CBCT-Dentalbildgebung

Die hohe Belastung der Gesundheitssysteme durch COVID-19 weltweit hat bei medizinischen Onkologen Bedenken hinsichtlich der Auswirkungen von COVID-19 auf die CBCT-Zahnbildgebung geweckt. In dieser retrospektiven Kohortenstudie haben wir die Auswirkungen von COVID-19 auf die CBCT-Zahnbildgebung vor und nach der COVID-19-Ära untersucht. Während der Pandemie nahm die CBCT-Zahnbildgebung mit etwas fortgeschritteneren Stadien der Zahnerkrankungen ab, und es gab einen signifikanten Anstieg der Zahnchirurgie und -bildgebung als erste definitive Behandlung sowie einen Rückgang sowohl der systemischen Behandlung als auch der Chirurgie im Vergleich zur Zeit vor COVID-19. Im Vergleich zur Zeit vor COVID-19 gab es während der Pandemie keine signifikante Verzögerung beim Beginn der Zahnbildgebung und -behandlung.

Während der Pandemie haben wir jedoch eine Verzögerung bei der Zahnchirurgie beobachtet. COVID-19 scheint einen erheblichen Einfluss auf die Diagnosen und Behandlungsmuster der CBCT-Zahnbildgebung gehabt zu haben. Viele Zahnärzte sind besorgt, dass die Zahl der neu diagnostizierten Patienten mit Zahnerkrankungen im kommenden Jahr steigen wird. Diese Forschung ist noch im Gange, und es werden weitere Informationen gesammelt und analysiert, um die allgemeinen Auswirkungen der COVID-19-Pandemie auf die CBCT-Zahnbildgebungspatienten besser zu verstehen.

Jüngste Entwicklungen

- Im Oktober 2022 gab Carestream Dental LLC. seine Partnerschaft mit Overjet bekannt, dem Branchenführer für künstliche Intelligenz (KI) in der Zahnmedizin. Durch die Partnerschaft erhalten die Kunden von Carestream Dental LLC. Zugriff auf das KI-gestützte Röntgenanalysetool von Overjet, das Karies erkennt, Knochenschwund quantifiziert und andere Problembereiche hervorhebt. Diese Partnerschaft erweiterte das Produktportfolio und trug zur Umsatzsteigerung des Unternehmens bei.

- Im März 2021 gab Air Techniques seine Partnerschaft mit SICAT bekannt, die eine Softwarepartnerschaft für Benutzer von ProVecta 3D Prime CBCT und FlowStar Nitrous Oxide Nasal Hoods/FlowStar Scavenging Circuits umfasst. Das Unternehmen ist davon überzeugt, dass dies dazu beitragen würde, eine echte digitale Hybridlösung für den brandneuen SensorX Intraoral Sensor und die ScanX Duo Touch Scanner bereitzustellen.

Marktsegmentierung für CBCT-Dentalbildgebung in Nordamerika

Der nordamerikanische Markt für CBCT-Dentalbildgebung ist in fünf wichtige Segmente unterteilt, basierend auf Typ, Sichtfeld, Gerätetyp (Patientenposition), Anwendung und Endbenutzer. Das Wachstum zwischen den Segmenten hilft Ihnen dabei, Nischenwachstumsbereiche und Strategien zur Marktansprache zu analysieren und Ihre wichtigsten Anwendungsbereiche und die Unterschiede in Ihren Zielmärkten zu bestimmen.

Typ

- Systeme

- Detektoren

- Software

Auf der Grundlage des Typs ist der Markt in Systeme, Detektoren und Software segmentiert.

Sichtfeld

- Klein

- Medium

- Groß

Auf der Grundlage des Sichtfelds wird der Markt in groß, mittel und klein unterteilt.

Gerätetyp (Patientenposition)

- Stehen

- Sitzend

- Rückenlage

Auf der Grundlage des Gerätetyps (Patientenposition) wird der Markt in Stehen, Sitzen und Liegen segmentiert.

Anwendung

- Zahnimplantate

- Kieferorthopädie

- Endodontie

- Mund-, Kiefer- und Gesichtschirurgie

- Allgemeine Zahnheilkunde

- Erkrankungen des Kiefergelenks

- Parodontologie

- Forensische Zahnheilkunde

- Sonstiges

Auf der Grundlage der Anwendung ist der Markt in Zahnimplantate, Endodontie, allgemeine Zahnmedizin, Mund- und Kieferchirurgie, Kieferorthopädie, Erkrankungen des Kiefergelenks (TMJ), Parodontologie, forensische Zahnmedizin und andere unterteilt.

Endbenutzer

- Krankenhäuser und Zahnkliniken

- Akademiker und Forschungsinstitute

- Sonstiges

Auf der Grundlage des Endbenutzers ist der Markt in Krankenhäuser und Zahnkliniken, Hochschulen und Forschungsinstitute usw. segmentiert.

Nordamerika CBCT Dental Imaging Markt Regionale Analyse/Einblicke

Der nordamerikanische Markt für zahnärztliche CBCT-Bildgebung wird analysiert und es werden Einblicke und Trends in die Marktgröße basierend auf Typ, Sichtfeld, Gerätetyp (Patientenposition), Anwendung und Endbenutzer bereitgestellt.

Die in diesem Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko.

Aufgrund der steigenden Gesundheitsausgaben und der hohen Prävalenz von Zahnerkrankungen im Land werden die USA voraussichtlich den nordamerikanischen Markt für CBCT-Zahnbildgebung dominieren.

Der Länderabschnitt des Berichts enthält auch einzelne marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie die Analyse der nachgelagerten und vorgelagerten Wertschöpfungskette, technische Trends, Porters Fünf-Kräfte-Analyse und Fallstudien sind einige der Hinweise, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung einer Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit regionaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile für CBCT-Dentalbildgebung in Nordamerika

Die Wettbewerbslandschaft des nordamerikanischen CBCT-Marktes für zahnärztliche Bildgebung liefert Einzelheiten zu den Wettbewerbern. Zu den enthaltenen Einzelheiten gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, regionale Präsenz, Produktionsstandorte und -einrichtungen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang sowie Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen auf den Markt.

Zu den wichtigsten Marktteilnehmern auf dem Markt zählen unter anderem Carestream Health., Cefla sc, Midmark Corporation, Dentsply Sirona, PLANMECA OY, Carestream Dental LLC., KaVo Dental, GENORAY CO., LTD., J. MORITA TOKYO MFG. CORP., acteon, Air Techniques, DEXIS (Tochtergesellschaft der Dental Imaging Technologies Corporation), VATECH, DÜRR DENTAL SE, TAKARA BELMONT Corp., PreXion, FONA srl., ASAHIROENTGEN IND.CO., LTD., Owandy Radiology, SORDEX und PINGSENG Healthcare.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 PATENT ANALYSIS

4.4 STRATEGIC INITIATIVES

5 NORTH AMERICA CBCT DENTAL IMAGING MARKET, REGULATIONS

5.1 REGULATORY SCENARIO IN THE U.S

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING PREVALENCE OF DENTAL DISORDERS AND INCREASING DEMAND FOR DENTAL CARE SERVICES

6.1.2 ADVANCEMENTS IN CBCT DENTAL IMAGING TECHNOLOGIES AND SOFTWARE

6.1.3 GOVERNMENT INITIATIVES TO PROMOTE ORAL HEALTH AWARENESS AND DENTAL CARE SERVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF CBCT DENTAL IMAGING SYSTEMS AND PROCEDURES

6.2.2 LIMITED REIMBURSEMENT POLICIES FOR CBCT DENTAL IMAGING PROCEDURES

6.2.3 STRINGENT REGULATIONS AND GUIDELINES FOR THE USE OF CBCT DENTAL IMAGING

6.3 OPPORTUNITIES

6.3.1 GROWING ADOPTION OF DIGITAL DENTISTRY

6.3.2 INCREASING INVESTMENTS IN RESEARCH AND DEVELOPMENT OF CBCT DENTAL IMAGING SYSTEMS AND SOFTWARE

6.3.3 EXPANSION OF DENTAL CARE SERVICES IN REMOTE AND UNDERSERVED AREAS THROUGH MOBILE CBCT DENTAL IMAGING UNITS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS TO OPERATE CBCT DENTAL IMAGING SYSTEMS

6.4.2 LACK OF AWARENESS REGARDING DENTAL HEALTH IN EMERGING COUNTRIES

7 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE

7.1 OVERVIEW

7.2 SYSTEMS

7.3 DETECTORS

7.3.1 IMAGE INTENSIFIER DETECTOR (IID)

7.3.2 FLAT PANEL DETECTOR (FPD)

7.3.2.1 CAESIUM IODIDE (CSI-TL)

7.3.2.2 GADOLINIUM OXYSULFIDE

7.4 SOFTWARES

8 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY FIELD OF VIEW

8.1 OVERVIEW

8.2 LARGE

8.3 MEDIUM

8.4 SMALL

9 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY DEVICE TYPE (PATIENT POSITION)

9.1 OVERVIEW

9.2 STANDING

9.3 SEATED

9.4 SUPINE

10 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 DENTAL IMPLANTS

10.3 ENDODONTICS

10.4 GENERAL DENTISTRY

10.5 ORAL AND MAXILLOFACIAL SURGERY

10.6 ORTHODONTICS

10.7 TEMPOROMANDIBULAR JOINT (TMJ) DISORDERS

10.8 PERIODONTICS

10.9 FORENSIC DENTISTRY

10.1 OTHERS

11 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & DENTAL CLINICS

11.3 ACADEMIC AND RESEARCH INSTITUTES

11.4 OTHERS

12 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 CARESTREAM HEALTH.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 CEFLA S.C.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 MIDMARK CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 DENTSPLY SIRONA

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 PLANMECA OY

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ACTEON

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 ASAHIROENTGEN IND.CO.,LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 AIRTECHNIQUES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CARESTREAM DENTAL LLC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DENTAL IMAGING TECHNOLOGIES CORPORATION.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DURR DENTAL SE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FONA SRL

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 GENORAY CO. LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 J. MORITA TOKYO MFG. CORP.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 KEVO DENTAL

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 OWANDY RADIOLOGY

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PINGSENG HEALTHCARE

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PREXION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TAKARA BELMONT CORP

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 VATECH

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (VOLUME)

TABLE 3 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (ASP)

TABLE 4 NORTH AMERICA SYSTEMS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA DETECTORS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA DETECTORS IN CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA FLAT PANEL DETECTORS (FPD) IN CBCT DENTAL IMAGING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SOFTWARES IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY FIELD OF VIEW, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA LARGE IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA MEDIUM IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SMALL IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY DEVICE TYPE (PATIENT POSITION), 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA STANDING IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SEATED IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA SUPINE IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DENTAL IMPLANTS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA ENDODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA GENERAL DENTISTRY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL AND MAXILLOFACIAL SURGERY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA ORTHODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA TEMPOROMANDIBULAR JOINT (TMJ) DISORDERS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA PERIODONTICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FORENSIC DENTISTRY IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CBCT DENTAL IMAGING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA HOSPITALS & DENTAL CLINICS IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA ACADEMIC AND RESEARCH INSTITUTES IN CBCT DENTAL IMAGING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN LIVER CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA CBCT DENTAL IMAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA CBCT DENTAL IMAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA CBCT DENTAL IMAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA CBCT DENTAL IMAGING MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA CBCT DENTAL IMAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SEGMENTATION

FIGURE 11 THE GROWING PREVALENCE OF DENTAL DISORDERS AND INCREASING DEMAND FOR DENTAL CARE SERVICES IS EXPECTED TO DRIVE THE NORTH AMERICA CBCT DENTAL IMAGING MARKET

FIGURE 12 THE SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA CBCT DENTAL IMAGING MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA CBCT DENTAL IMAGING MARKET

FIGURE 14 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, 2022

FIGURE 15 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 17 LOBAL CBCT DENTAL IMAGING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, 2022

FIGURE 19 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY FIELD OF VIEW, LIFELINE CURVE

FIGURE 22 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), 2022

FIGURE 23 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), CAGR (2023-2030)

FIGURE 25 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY DEVICE TYPE (PATIENT POSITION), LIFELINE CURVE

FIGURE 26 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, 2022

FIGURE 27 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA CBCT DENTAL IMAGING MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA CBCT DENTAL IMAGING MARKET: BY TYPE (2023-2030)

FIGURE 39 NORTH AMERICA CBCT DENTAL IMAGING MARKET: COMPANY SHARE 2022 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.