North America Cancer Supportive Care Products Market

Marktgröße in Milliarden USD

CAGR :

%

USD

13.27 Billion

USD

19.16 Billion

2024

2032

USD

13.27 Billion

USD

19.16 Billion

2024

2032

| 2025 –2032 | |

| USD 13.27 Billion | |

| USD 19.16 Billion | |

|

|

|

|

Marktsegmentierung für Produkte zur unterstützenden Krebsbehandlung in Nordamerika nach Arzneimitteltyp (Granulozytenkolonie-stimulierender Faktor (GCSF), Erythropoietin-stimulierende Mittel (ESA), Opioid-Analgetika, monoklonale Antikörper, nichtsteroidale Antirheumatika (NSAR), Bisphosphonate, Antiemetika, Antihistaminika und andere), Typ (Marken- und Generika), Krebsart (Lungenkrebs, Brustkrebs, Prostatakrebs, Leberkrebs, Blasenkrebs, Leukämie, Melanom, Eierstockkrebs und andere Krebsarten), Endverbraucher (Krankenhäuser, Kliniken, Krankenhäuser und akademische Einrichtungen und andere), Vertriebskanal (Krankenhausapotheken, Einzelhandelsapotheken und Rezepturapotheken), Land (USA, Kanada, Mexiko) – Branchentrends und Prognose bis 2032

Krebsunterstützende Pflegeprodukte Marktgröße

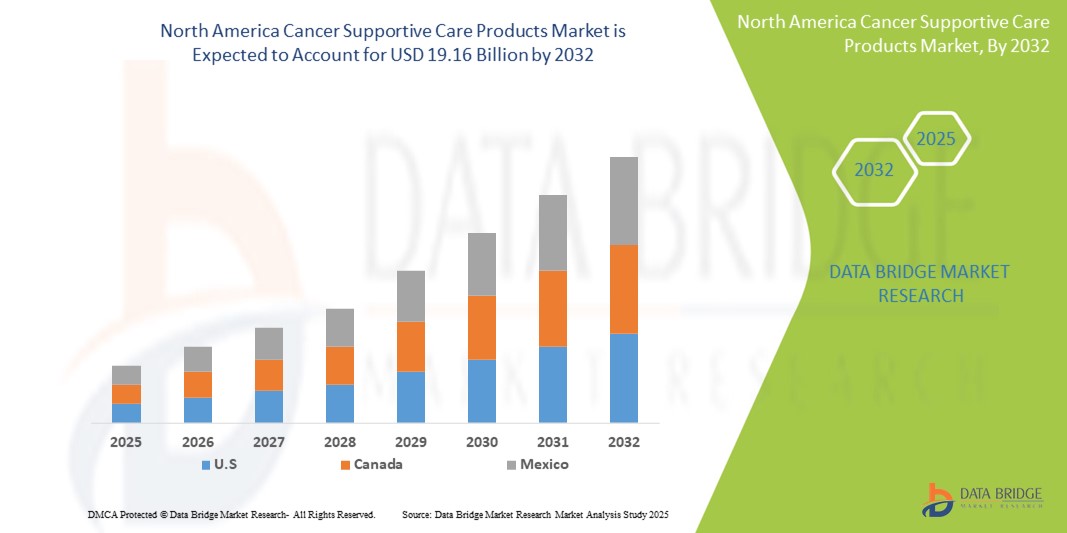

- Der nordamerikanische Markt für Produkte zur unterstützenden Krebsbehandlung wurde im Jahr 2024 auf 13,27 Milliarden US-Dollar geschätzt und soll bis 2032 19,16 Milliarden US-Dollar erreichen , bei einer CAGR von 4,70 % im Prognosezeitraum.

- Das Marktwachstum wird größtenteils durch die zunehmende Verbreitung von Krebserkrankungen und die wachsende Nachfrage nach wirksamen unterstützenden Therapien in ganz Nordamerika vorangetrieben, was zu einer verstärkten Fokussierung auf die Lebensqualität der Patienten während der Behandlung führt.

- Darüber hinaus wächst das Bewusstsein von Gesundheitsdienstleistern und Patienten für die Vorteile von Begleittherapien – wie Antiemetika, GCSFs und Schmerzmitteln – und etabliert unterstützende Pflegeprodukte als wichtigen Bestandteil einer umfassenden Krebsbehandlung. Diese zusammenlaufenden Faktoren beschleunigen die Einführung unterstützender Krebsbehandlungslösungen und fördern damit das Marktwachstum in der Region erheblich.

Marktanalyse für Produkte zur unterstützenden Krebsbehandlung

- Produkte zur unterstützenden Krebsbehandlung, zu denen Therapien wie Antiemetika, Erythropoietin-stimulierende Mittel, GCSFs und Schmerzmanagementlösungen gehören, sind zunehmend wichtige Bestandteile umfassender onkologischer Behandlungsprotokolle sowohl im Krankenhaus als auch im ambulanten Bereich, da sie bei der Minimierung behandlungsbedingter Nebenwirkungen, der Verbesserung der Lebensqualität der Patienten und der Sicherstellung der Therapietreue eine Rolle spielen.

- Die steigende Nachfrage nach Produkten zur unterstützenden Krebsbehandlung wird vor allem durch die steigende Zahl an Krebserkrankungen in Nordamerika, die zunehmende Betonung einer wertorientierten Behandlung und das gestiegene Bewusstsein des medizinischen Fachpersonals für die Bedeutung der Symptombehandlung neben der primären Krebsbehandlung angetrieben.

- Nordamerika dominiert den Markt für unterstützende Krebstherapieprodukte und wird 2025 den größten Umsatzanteil aufweisen. Dies ist auf hohe Krebsprävalenzraten, eine fortschrittliche Gesundheitsinfrastruktur, günstige Erstattungsstrukturen und die starke Präsenz führender Pharmaunternehmen zurückzuführen. Insbesondere in den USA verzeichnet die Nutzung unterstützender Medikamente, insbesondere in akademischen Einrichtungen und spezialisierten onkologischen Zentren, ein deutliches Wachstum. Dies wird durch kontinuierliche klinische Fortschritte und Produktinnovationen zur Reduzierung der behandlungsbedingten Toxizität unterstützt.

- Auch Kanada und Mexiko tragen zum regionalen Marktwachstum bei, unterstützt durch nationale Krebsbehandlungsprogramme, den Ausbau onkologischer Dienste und einen verbesserten Zugang der Patienten zu Biosimilars und generischen unterstützenden Therapien.

- Das Segment Granulozytenkolonie-stimulierender Faktor (GCSF) wird voraussichtlich im Jahr 2025 den nordamerikanischen Markt dominieren, da es eine entscheidende Rolle bei der Behandlung von durch Chemotherapie verursachter Neutropenie spielt, ein hohes Verschreibungsvolumen aufweist und eine nachgewiesene klinische Wirksamkeit bei der Vorbeugung von Infektionen während der Behandlungszyklen aufweist.

Berichtsumfang und Marktsegmentierung für unterstützende Krebsbehandlungsprodukte

|

Eigenschaften |

Wichtige Markteinblicke zu Produkten zur unterstützenden Krebsbehandlung |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Preisanalysen, Markenanteilsanalysen, Verbraucherumfragen, demografische Analysen, Lieferkettenanalysen, Wertschöpfungskettenanalysen, eine Übersicht über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, PESTLE-Analysen, Porter-Analysen und regulatorische Rahmenbedingungen. |

Markttrends für Produkte zur unterstützenden Krebsbehandlung

„ Personalisierte unterstützende Pflege durch fortschrittliche Therapeutika und digitale Integration “

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für Produkte zur unterstützenden Krebsbehandlung ist die zunehmende Nutzung fortschrittlicher therapeutischer Formulierungen und die Integration digitaler Gesundheitstools. Diese verbessern die Patientenüberwachung, Therapietreue und das Symptommanagement während der gesamten Krebsbehandlung. Diese Entwicklung verbessert die allgemeine Versorgungsqualität und die Behandlungsergebnisse deutlich.

- So ermöglicht beispielsweise die innovative Formulierung von Antiemetika mit verzögerter Wirkstofffreisetzung wie Aponvie von Heron Therapeutics eine längere Kontrolle von chemotherapiebedingter Übelkeit und Erbrechen (CINV) und reduziert so die Belastung durch häufige Dosierungen. Ähnlich verhält es sich mit dem tragbaren Gerät Neulasta Onpro von Amgen, das am Tag nach der Chemotherapie automatisch GCSF abgibt. Dies verbessert die Therapietreue und reduziert die Zahl der Krankenhausaufenthalte.

- Die Integration digitaler Gesundheitsplattformen ermöglicht die Echtzeitüberwachung von Symptomen, personalisierte Dosisanpassungen und intelligente Warnmeldungen an medizinisches Fachpersonal. Einige onkologische Kliniken in den USA nutzen beispielsweise Plattformen zur Patientenbeurteilung, um Nebenwirkungen zu erfassen und unterstützende Behandlungsschemata proaktiv anzupassen. Diese Lösungen ermöglichen frühere Interventionen und eine verbesserte Patientensicherheit.

- Die nahtlose Koordination von unterstützenden Medikamenten mit elektronischen Patientenakten (EHRs) und onkologiespezifischen digitalen Tools ermöglicht eine ganzheitlichere Behandlungsplanung. Über integrierte Plattformen können Onkologen neben Primärtherapien auch Medikamente gegen Übelkeit, Schmerzmittel und Wachstumsfaktoren verwalten und so einen koordinierten und patientenzentrierten Behandlungsansatz gewährleisten.

- Dieser Trend zu personalisierter, technologiegestützter unterstützender Pflege verändert die Erwartungen an die Onkologie. Pharma- und Biotech-Unternehmen wie Pfizer und Helsinn Healthcare konzentrieren sich daher auf unterstützende Therapien der nächsten Generation, die klinische Wirksamkeit mit innovativen Darreichungsformen kombinieren, wie z. B. langwirksamen Injektionen, subkutanen Formulierungen und patientenfreundlichen Verabreichungsgeräten.

- Die Nachfrage nach unterstützenden Pflegeprodukten, die auf eine personalisierte Krebsbehandlung und digitale Überwachungstools abgestimmt sind, wächst in Krankenhäusern, Fachkliniken und häuslichen Pflegeeinrichtungen in Nordamerika rasant, da Anbieter und Patienten der Lebensqualität und der Therapietreue zunehmend Priorität einräumen.

Marktdynamik von Produkten zur unterstützenden Krebsbehandlung

Treiber

„ Steigende Krebsprävalenz und Nachfrage nach integrierten unterstützenden Therapien “

- Die steigende Zahl an Krebserkrankungen in den USA, Kanada und Mexiko sowie die zunehmende Bedeutung der Verbesserung der Lebensqualität der Patienten während und nach der Behandlung sind wichtige Treiber der Nachfrage auf dem nordamerikanischen Markt für Produkte zur unterstützenden Krebsbehandlung.

- So erweiterte Amgen im März 2024 den Zugang zu seinem Neulasta Onpro Kit in weiteren ambulanten Onkologiezentren in den USA und bekräftigte damit sein Engagement für ein besseres Neutropenie-Management bei gleichzeitiger Reduzierung der Krankenhausaufenthalte. Solche Initiativen führender Akteure dürften das Wachstum der Krebstherapie in der Region deutlich vorantreiben.

- Da Krebsbehandlungen immer aggressiver und komplexer werden, steigt der Bedarf an wirksamen unterstützenden Therapien – wie GCSFs, Antiemetika und Schmerzmitteln – zur Linderung von Nebenwirkungen wie Übelkeit, Müdigkeit, Anämie und Infektionen. Diese Produkte bieten wichtige klinische Unterstützung, damit Patienten ihre Behandlungsprotokolle besser vertragen und einhalten können.

- Darüber hinaus steigt die Nachfrage nach integrierter onkologischer Versorgung, bei der unterstützende Medikamente im Rahmen koordinierter Versorgungsmodelle in Abstimmung mit der Primärtherapie verabreicht werden. Krankenhäuser und Fachkliniken setzen zunehmend auf Behandlungspfade, die präventive und symptomatische unterstützende Maßnahmen als Teil der Standardprotokolle beinhalten.

- Der zunehmende Fokus auf ambulante Versorgung, Patientenkomfort und die Möglichkeit der Verabreichung zu Hause – ermöglicht durch Innovationen wie langwirksame Injektionen und tragbare Verabreichungsgeräte – fördert die Akzeptanz zusätzlich. Die zunehmende Verfügbarkeit von Marken- und Generikapräparaten in Krankenhaus- und Einzelhandelsapotheken unterstützt die Marktexpansion in Nordamerika zusätzlich.

Einschränkung/Herausforderung

„ Hohe Kostenbelastung und begrenzte Erstattung für unterstützende Therapien “

- Eine der größten Herausforderungen, die das Wachstum des nordamerikanischen Marktes für unterstützende Krebsbehandlungsprodukte bremsen, sind die hohen Kosten, die mit vielen unterstützenden Therapien verbunden sind, insbesondere mit Biologika wie GCSFs und monoklonalen Antikörpern, die die finanzielle Gesamtbelastung der Krebsbehandlung erheblich erhöhen können.

- Beispielsweise benötigen Patienten, die sich einer Chemotherapie unterziehen, möglicherweise langfristige unterstützende Maßnahmen zur Behandlung von Anämie, Neutropenie und Übelkeit, und die Gesamtkosten dieser Zusatztherapien können beträchtlich sein, insbesondere für Patienten ohne umfassenden Versicherungsschutz.

- Darüber hinaus können eingeschränkte Erstattungsrichtlinien für bestimmte unterstützende Medikamente – insbesondere neuere Markenpräparate oder Off-Label-Anwendungen – den Zugang für Patienten mit niedrigem Einkommen oder unterversicherten Gruppen einschränken. Kostenträger priorisieren häufig zentrale onkologische Therapien, während unterstützende Medikamente einer vorherigen Genehmigung oder Kostenobergrenzen unterliegen.

- Um dieser Herausforderung zu begegnen, ist eine umfassendere Einbeziehung der unterstützenden Pflege in die Erstattungsmodelle für die Krebsbehandlung sowie politische Initiativen zur Verbesserung der Erschwinglichkeit und des Zugangs durch wertorientierte Preisstrategien und Patientenhilfsprogramme erforderlich.

- Darüber hinaus bestehen trotz der zunehmenden Verfügbarkeit von Generika in Teilen ländlicher oder unterversorgter Gemeinden der USA und Mexikos weiterhin Ungleichheiten beim Zugang zu einer qualitativ hochwertigen Krebsbehandlung, da die onkologische Infrastruktur und der Zugang zu Fachärzten begrenzt sind.

- Die Überwindung dieser Hindernisse durch eine erweiterte Abdeckung, Preisreformen und gezielte Unterstützungsinitiativen wird von entscheidender Bedeutung sein, um einen gleichberechtigten und einheitlichen Zugang zur unterstützenden Pflege in ganz Nordamerika zu gewährleisten.

Marktumfang für unterstützende Krebsbehandlungsprodukte

Der Markt ist nach Arzneimitteltyp, Art (Marken- und Generika), Krebsart, Endverbraucher und Vertriebskanal segmentiert.

Nach Arzneimitteltyp

Der nordamerikanische Markt für Produkte zur unterstützenden Krebsbehandlung ist nach Wirkstofftyp segmentiert in Granulozyten-Kolonie-stimulierende Faktoren (G-CSFs), Erythropoietin-stimulierende Substanzen (ESAs), Opioid-Analgetika, monoklonale Antikörper, nichtsteroidale Antirheumatika (NSAR), Bisphosphonate, Antiemetika, Antihistaminika und weitere. Das G-CSF-Segment dominiert 2025 den größten Marktumsatz, getrieben von seiner entscheidenden Rolle bei der Reduzierung des Infektionsrisikos bei chemotherapieinduzierter Neutropenie. Die hohe Frequenz der Chemotherapiezyklen und die klinische Wirksamkeit von G-CSFs bei der Minimierung von Behandlungsunterbrechungen unterstützen weiterhin ihre weit verbreitete Anwendung in onkologischen Praxen.

Das Antiemetika-Segment wird voraussichtlich von 2025 bis 2032 die schnellste Wachstumsrate verzeichnen, angetrieben durch den zunehmenden Fokus auf die Verbesserung der Lebensqualität von Patienten während der Krebsbehandlung. Diese Medikamente spielen eine zentrale Rolle bei der Behandlung von Chemotherapie-induzierter Übelkeit und Erbrechen (CINV), einer häufigen und belastenden Nebenwirkung. Zunehmende Zulassungen neuer Formulierungen sowie die zunehmende Anwendung bei verschiedenen Krebsarten und Behandlungsschemata tragen zum rasanten Wachstum dieses Segments in Nordamerika bei.

Nach Vertriebskanal

Der nordamerikanische Markt für Produkte zur unterstützenden Krebsbehandlung ist nach Vertriebskanälen in Krankenhausapotheken, Einzelhandelsapotheken und Rezepturapotheken unterteilt. Das Segment Krankenhausapotheken hatte 2025 den größten Marktanteil, was auf die hohe Anzahl onkologischer Behandlungen in Krankenhäusern und die sofortige Verfügbarkeit von Medikamenten zur unterstützenden Behandlung für stationäre Patienten zurückzuführen ist. Die zentralisierte Krankenhausbeschaffung gewährleistet eine konsistente Versorgung und klinische Überwachung und unterstützt so die Therapietreue und -sicherheit der Patienten.

Das Segment Einzelhandelsapotheken wird voraussichtlich zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, angetrieben durch die zunehmende Verlagerung hin zu ambulanten Krebsbehandlungen und den verbesserten Zugang zu unterstützenden Medikamenten über öffentliche Apotheken. Komfort, erweiterter Versicherungsschutz und die Präferenz der Patienten für eine lokale Auftragsabwicklung treiben die Akzeptanz voran. Einzelhandelsketten investieren zudem in von Apothekern geleitete Unterstützungsprogramme, um Krebspatienten bei der Bewältigung von Nebenwirkungen zu unterstützen und tragen so zum Segmentwachstum in ganz Nordamerika bei.

Nach Verabreichungsweg

Der nordamerikanische Markt für Krebsunterstützungsprodukte ist nach Verabreichungsweg in orale, parenterale und sonstige Verabreichungswege unterteilt. Das orale Segment hatte 2025 den größten Marktanteil, was auf die Präferenz der Patienten für nicht-invasive Behandlungsmethoden und die bequeme Verabreichung zu Hause zurückzuführen ist. Orale Unterstützungsmedikamente, darunter Antiemetika, Analgetika und Erythropoese-stimulierende Wirkstoffe, ermöglichen eine bessere Compliance und reduzieren die Notwendigkeit häufiger Arztbesuche, was sie in der gesamten Region zu einer weit verbreiteten Option macht.

Das parenterale Segment wird voraussichtlich zwischen 2025 und 2032 die schnellste durchschnittliche jährliche Wachstumsrate verzeichnen, unterstützt durch seine schnelle therapeutische Wirkung und die Notwendigkeit bestimmter unterstützender Behandlungen wie G-CSFs und monoklonaler Antikörper. Die parenterale Verabreichung wird in der Akutversorgung und bei Patienten unter intensiver Chemotherapie bevorzugt, da eine sofortige und kontrollierte Medikamentenverabreichung für die Behandlung behandlungsbedingter Komplikationen unerlässlich ist.

Nach Krebsart

Der nordamerikanische Markt für Produkte zur unterstützenden Krebsbehandlung ist nach Krebsart in Lungenkrebs, Brustkrebs, Prostatakrebs, Leberkrebs, Blasenkrebs, Leukämie, Melanom, Eierstockkrebs und andere Krebsarten unterteilt. Das Segment Brustkrebs erzielte 2024 den größten Marktanteil, bedingt durch die hohe Brustkrebsrate bei Frauen in den USA und Kanada sowie den Bedarf an umfassenden unterstützenden Therapien wie Antiemetika, koloniestimulierenden Faktoren und Schmerzmitteln zur Behandlung behandlungsbedingter Komplikationen. Die starke Präsenz von Aufklärungskampagnen und Früherkennungsprogrammen hat ebenfalls zu einer erhöhten Behandlungsaufnahme beigetragen und die Nachfrage nach unterstützender Pflege gesteigert.

Das Segment Lungenkrebs wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, angetrieben durch die steigende Prävalenz, Diagnosen im Spätstadium und den zunehmenden Einsatz aggressiver Chemotherapie und zielgerichteter Therapien, die eine begleitende unterstützende Pflege erfordern. Eine verstärkte Forschungsorientierung und unterstützende Erstattungsrahmen tragen zusätzlich dazu bei, den Zugang zu unterstützenden Medikamenten für Lungenkrebspatienten in ganz Nordamerika zu verbessern.

Regionale Analyse des Marktes für unterstützende Krebsbehandlungsprodukte

- Die Vereinigten Staaten dominieren den nordamerikanischen Markt für Produkte zur unterstützenden Krebsbehandlung und werden im Jahr 2024 den größten Umsatzanteil erzielen. Grund hierfür sind die hohe Krebsprävalenz, steigende Behandlungsraten und die gut ausgebaute Gesundheitsinfrastruktur, die fortschrittliche unterstützende Therapien unterstützt.

- Patienten und Gesundheitsdienstleister in der Region legen Wert auf eine umfassende unterstützende Betreuung zur Bewältigung der Nebenwirkungen von Chemotherapie, Strahlentherapie und gezielten Krebsbehandlungen. Dies führt zu einer starken Nachfrage nach Produkten wie Antiemetika, koloniestimulierenden Faktoren und Schmerzmitteln.

- Diese weitverbreitete Verwendung wird außerdem durch solide Erstattungsrichtlinien, ein hohes Maß an Bewusstsein und die Verfügbarkeit neuer Biologika und Biosimilars unterstützt, wodurch die unterstützende Krebsbehandlung zu einem wesentlichen Bestandteil onkologischer Behandlungsschemata in Krankenhäusern, Kliniken und Fachzentren wird.

Markteinblick in die USA für unterstützende Krebsbehandlungsprodukte

Der US-Markt für Produkte zur unterstützenden Krebsbehandlung erzielte 2024 mit rund 85 % den größten Umsatzanteil in Nordamerika, was auf die fortschrittliche Gesundheitsinfrastruktur des Landes und die hohe Zahl an Krebsdiagnosen zurückzuführen ist. Patienten und Gesundheitsdienstleister legen zunehmend Wert auf ein umfassendes Management der Nebenwirkungen von Krebsbehandlungen, was die Nachfrage nach unterstützenden Therapien wie Granulozyten-koloniestimulierenden Faktoren (GCSFs), Antiemetika und Opioid-Analgetika steigert. Die zunehmende Akzeptanz innovativer Biologika und Biosimilars sowie starke Erstattungsrahmen und Sensibilisierungskampagnen treiben das Marktwachstum weiter voran. Darüber hinaus tragen die wachsende Zahl von Onkologiepatienten und steigende Investitionen in die Krebsforschung maßgeblich zum anhaltenden Marktwachstum in den USA bei.

Markteinblick in Kanada für unterstützende Krebsbehandlungsprodukte

Der kanadische Markt für Produkte zur unterstützenden Krebsbehandlung dürfte im Prognosezeitraum stetig wachsen, angetrieben durch steigende Krebsfälle und steigende Investitionen in die Gesundheitsinfrastruktur. Regierungsinitiativen zur Verbesserung der Behandlungsergebnisse von Krebspatienten sowie der breite Zugang zu fortschrittlichen Therapien wie Granulozyten-koloniestimulierenden Faktoren und Opioid-Analgetika unterstützen das Marktwachstum. Das wachsende Bewusstsein für unterstützende Therapien und der zunehmende Fokus auf die Palliativversorgung fördern die Akzeptanz in Krankenhäusern und Fachkliniken. Die starken Erstattungsstrukturen im Gesundheitswesen des Landes und die steigende Nachfrage nach personalisierten unterstützenden Behandlungen tragen zusätzlich zum Marktwachstum in städtischen und ländlichen Gebieten bei.

Markteinblick in Produkte zur unterstützenden Krebsbehandlung in Mexiko

Der mexikanische Markt für Produkte zur unterstützenden Krebsbehandlung wird im Prognosezeitraum voraussichtlich mit einer signifikanten jährlichen Wachstumsrate wachsen, getrieben durch die steigende Krebsprävalenz und den verbesserten Zugang zur Gesundheitsversorgung im ganzen Land. Regierungsinitiativen zum Ausbau onkologischer Leistungen und zur Verbesserung der unterstützenden Behandlung beschleunigen die Marktakzeptanz. Die steigende Verfügbarkeit generischer unterstützender Medikamente sowie das wachsende Bewusstsein für den Umgang mit krebsbedingten Symptomen und Nebenwirkungen fördern die Nachfrage in Krankenhäusern, Kliniken und Fachzentren. Darüber hinaus dürften steigende Investitionen in die Gesundheitsinfrastruktur und öffentlich-private Partnerschaften das Marktwachstum in Mexiko stärken.

Marktanteil von Produkten zur unterstützenden Krebsbehandlung

Die Branche der Produkte zur unterstützenden Krebsbehandlung wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- Amgen Inc. (USA)

- Janssen Pharmaceuticals, Inc. (eine Tochtergesellschaft von Johnson & Johnson Services, Inc.) (USA)

- Pfizer Inc. (USA)

- APR (USA)

- Novartis AG (Schweiz)

- F. Hoffmann-La Roche Ltd. (Schweiz)

- Acacia Pharma Group Plc. (Großbritannien)

- Baxter (USA)

- Bayer AG (Deutschland)

- Helsinn Healthcare SA (Schweiz)

- Heron Therapeutics, Inc. (USA)

- Kyowa Kirin Co., Ltd. (Japan)

- Acrotech Biopharma (USA)

- Spectrum Pharmaceuticals, Inc. (USA)

- Oxford Pharmascience Ltd (Großbritannien)

- Merck Sharp & Dohme Corp. (eine Tochtergesellschaft von Merck & Co., Inc.) (USA)

- Teva (eine Tochtergesellschaft von Teva Pharmaceutical Industries Ltd.) (Israel)

- Tersera Therapeutics LLC (USA)

- Mylan NV (USA/Niederlande – Mylan hatte ursprünglich seinen Sitz in den USA und ist heute Teil von Viatris mit Hauptsitz in den USA)

- Sun Pharmaceutical Industries Ltd. (Indien)

- Dr. Reddy's Laboratories (Indien)

- Fresenius Kabi (Deutschland)

- Tolmar Inc. (USA)

- AbbVie Inc. (USA)

- Sanofi (Frankreich)

Neueste Entwicklungen auf dem nordamerikanischen Markt für Produkte zur unterstützenden Krebsbehandlung

- Im April 2025 gab der deutsche Konzern Merck die Übernahme des US-amerikanischen Biotech-Unternehmens SpringWorks Therapeutics für 3,9 Milliarden US-Dollar bekannt. Dieser strategische Schritt zielt darauf ab, Mercks Onkologie-Portfolio, insbesondere im Bereich seltener Tumore, zu stärken und die Präsenz des Unternehmens auf dem US-Markt zu stärken.

- Im März 2024 vereinbarte AstraZeneca die Übernahme des kanadischen Unternehmens Fusion Pharmaceuticals für 2,4 Milliarden US-Dollar. Fusion ist auf Radiokonjugate spezialisiert, eine Krebstherapie der nächsten Generation, die Krebszellen mit radioaktiven Isotopen angreift und so die Schädigung gesunder Zellen minimiert. Die Übernahme soll AstraZenecas Onkologie-Pipeline erweitern und die Präsenz des Unternehmens in Kanada ausbauen.

- Im September 2023 gab Cardinal Health die Übernahme des Integrated Oncology Network für 1,12 Milliarden US-Dollar bekannt. Diese Übernahme ist Teil der Strategie von Cardinal Health, in den Bereich der onkologischen Versorgung zu expandieren. Dazu fusioniert Cardinal Health seine auf Krebs spezialisierte Einheit Navista mit dem umfangreichen Netzwerk des Integrated Oncology Network, das über 100 Gesundheitsdienstleister in zehn Bundesstaaten und mehr als 50 Praxisstandorte umfasst.

- Im November 2023 gab AbbVie die Übernahme von ImmunoGen, einschließlich des führenden Krebstherapeutikums ELAHERE® (Mirvetuximab Soravtansine-Gynx), für rund 10,1 Milliarden US-Dollar bekannt. Die Übernahme soll das Portfolio von AbbVie im Bereich solider Tumore erweitern und die Position des Unternehmens im Onkologiemarkt stärken.

- Im Dezember 2022 erteilte die US-amerikanische Food and Drug Administration (FDA) die Zulassung für Atezolizumab (Tecentriq), ein von F. Hoffmann-La Roche Ltd. entwickeltes Immuntherapeutikum, zur Behandlung von Alveolar-Weichteilsarkomen (ASPS) bei Erwachsenen und Kindern ab 2 Jahren, sofern die Erkrankung metastasiert oder inoperabel ist. Diese Zulassung stellt einen bedeutenden Fortschritt in der unterstützenden Krebstherapie dar.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.