North America Anti Nuclear Antibody Test Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.63 Billion

USD

4.42 Billion

2025

2033

USD

1.63 Billion

USD

4.42 Billion

2025

2033

| 2026 –2033 | |

| USD 1.63 Billion | |

| USD 4.42 Billion | |

|

|

|

|

Marktsegmentierung für antinukleäre Antikörpertests in Nordamerika nach Antikörpertyp (extrahierbare nukleäre Antigene (ENA), Anti-DSDNA & Histone, Anti-DFS70-Antikörper, Anti-PM-SCL, Anti-Zentromer-Antikörper, Anti-SP100 und andere), Produkt (Instrumente, Verbrauchsmaterialien und Reagenzien sowie Dienstleistungen), Technik (ELISA, indirekte Immunfluoreszenz (IIF), Blotting-Test, Antigen-Microarray, gelbasierte Techniken, Multiplex-Assay, Durchflusszytometrie, passive Hämagglutination (PHA) und andere), Anwendung (Autoimmunerkrankungen und Infektionskrankheiten), Endnutzer (Krankenhäuser, Labore, Diagnosezentren, Forschungsinstitute und andere), Vertriebskanal (Direktvergabe, Einzelhandel, Drittanbieter und andere) – Branchentrends und Prognose bis 2033

Marktgröße für antinukleäre Antikörpertests in Nordamerika

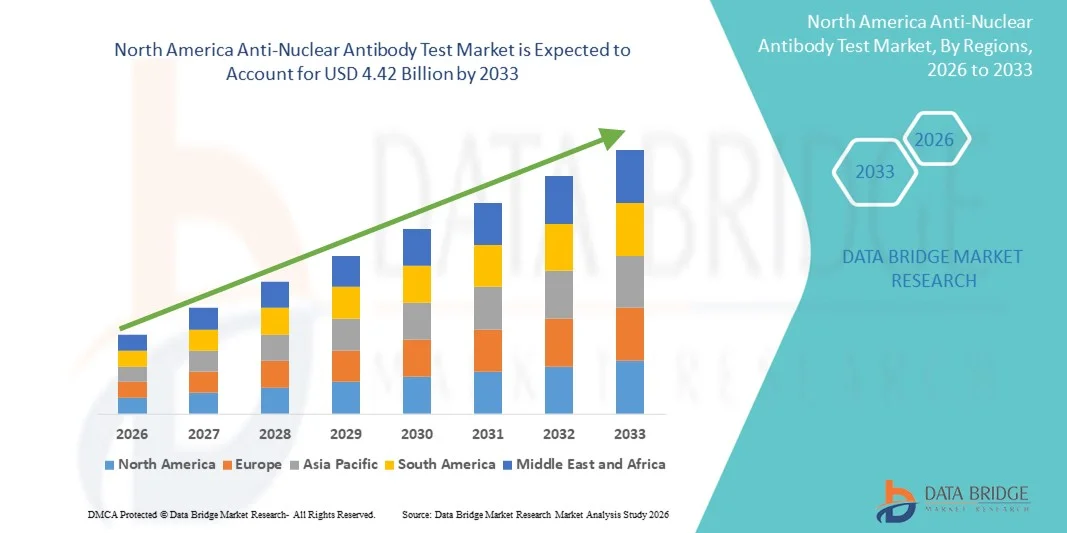

- Der nordamerikanische Markt für Antikörpertests gegen nukleare Stoffe hatte im Jahr 2025 einen Wert von 1,63 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 4,42 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,30 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung von Autoimmunerkrankungen, das wachsende Bewusstsein für eine frühzeitige und genaue Diagnose sowie die kontinuierlichen Fortschritte bei Labortesttechnologien angetrieben, was zu einer verstärkten Anwendung von Anti-Nukleären Antikörpertests (ANA-Tests) in Krankenhäusern, Diagnoselaboren und Fachkliniken führt.

- Darüber hinaus etabliert die steigende Nachfrage nach kostengünstigen, zuverlässigen und schnellen Diagnoseverfahren für Autoimmunerkrankungen wie Lupus, rheumatoide Arthritis und Sklerodermie den ANA-Test als wichtiges Screening-Instrument der ersten Wahl in der Routineversorgung und in spezialisierten Einrichtungen des Gesundheitswesens. Diese Faktoren beschleunigen die Verbreitung von ANA-Tests und tragen somit maßgeblich zum Wachstum der Branche bei.

Marktanalyse für antinukleäre Antikörpertests in Nordamerika

- Antinukleäre Antikörpertests (ANA-Tests), die zum Nachweis von Autoantikörpern im Zusammenhang mit Autoimmunerkrankungen eingesetzt werden, gewinnen aufgrund ihrer entscheidenden Rolle bei der Früherkennung und Überwachung systemischer Autoimmunerkrankungen zunehmend an Bedeutung in der modernen Diagnostik von Krankenhäusern und spezialisierten Laboren.

- Die steigende Nachfrage nach ANA-Tests wird in erster Linie durch die weltweit zunehmende Verbreitung von Erkrankungen wie systemischem Lupus erythematodes, rheumatoider Arthritis und Sklerodermie sowie durch ein gestiegenes Bewusstsein bei medizinischem Fachpersonal und Patienten für die Bedeutung eines frühzeitigen und genauen Screenings auf Autoimmunerkrankungen angetrieben.

- Die USA dominierten den Markt für antinukleäre Antikörpertests mit dem größten Umsatzanteil von 34,6 % im Jahr 2025, unterstützt durch eine fortschrittliche Gesundheitsinfrastruktur, hohe Testraten, starke Erstattungsrahmen und die Präsenz großer Diagnostikunternehmen.

- Kanada dürfte im Prognosezeitraum das am schnellsten wachsende Land auf dem Markt für Anti-Nuklear-Antikörpertests sein und eine durchschnittliche jährliche Wachstumsrate (CAGR) von 11,8 % verzeichnen. Treiber dieses Wachstums sind der verbesserte Zugang zur Gesundheitsversorgung, der Ausbau von Labornetzwerken für Diagnostik, das steigende Bewusstsein für Autoimmunerkrankungen und die zunehmenden staatlichen Investitionen in die Gesundheitsinfrastruktur.

- Das Segment der Autoimmunerkrankungen erzielte 2025 mit rund 58,9 % den größten Marktanteil, bedingt durch die weltweit zunehmende Verbreitung von Erkrankungen wie systemischem Lupus erythematodes, rheumatoider Arthritis, Sjögren-Syndrom und Sklerodermie.

Berichtsumfang und Marktsegmentierung für antinukleäre Antikörpertests

|

Attribute |

Wichtigste Markteinblicke zum Antinukleären Antikörpertest |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Markttrends für antinukleäre Antikörpertests in Nordamerika

Zunehmender Fokus auf die Früherkennung von Autoimmunerkrankungen und die Einführung fortschrittlicher Diagnoseverfahren

- Ein bedeutender und sich beschleunigender Trend auf dem nordamerikanischen Markt für antinukleäre Antikörpertests (ANA) ist die zunehmende Bedeutung der Früherkennung von Autoimmunerkrankungen und systemischen Entzündungskrankheiten wie systemischem Lupus erythematodes, rheumatoider Arthritis und Sklerodermie. Dieser wachsende klinische Fokus verstärkt die Nachfrage nach zuverlässigen und hochpräzisen ANA-Tests in der Diagnostik und Forschung erheblich.

- Beispielsweise setzen immer mehr Krankenhäuser und Diagnostiklabore in Nordamerika auf moderne Immunfluoreszenz- und ELISA-basierte ANA-Testplattformen, um die Nachweisempfindlichkeit zu verbessern und die Bearbeitungszeit zu verkürzen. Diese weitverbreitete Integration stärkt die Rolle von ANA-Tests im Rahmen des routinemäßigen Screenings auf Autoimmunerkrankungen und der Früherkennung.

- Die Einführung verbesserter Laborautomatisierung und Hochdurchsatz-Testsysteme ermöglicht es Laboren, höhere Testvolumina zu bewältigen und gleichzeitig eine gleichbleibende Ergebnisgenauigkeit zu gewährleisten. Einige fortschrittliche Plattformen sind mittlerweile in der Lage, mehrere Autoantikörpermuster gleichzeitig zu erkennen und so umfassendere Einblicke in die zugrunde liegende Autoimmunaktivität zu gewinnen und gezieltere klinische Entscheidungen zu unterstützen.

- Die zunehmende Zusammenarbeit zwischen klinischen Laboren, Forschungsinstituten und Pharmaunternehmen fördert die Entwicklung und den Einsatz fortschrittlicher ANA-Testkits. Durch diese Kooperationen können Gesundheitsdienstleister die Krankheitsüberwachung verbessern, das Ansprechen auf Behandlungen effektiver analysieren und die Patientenversorgung bei Autoimmunerkrankungen insgesamt optimieren.

- Diese Entwicklung hin zu effizienteren, sensitiveren und zuverlässigeren Diagnoseverfahren für Autoimmunerkrankungen verändert die Erwartungen an die Früherkennung und das langfristige Krankheitsmanagement. Daher entwickeln auf Immunodiagnostik spezialisierte Unternehmen verstärkt verbesserte ANA-Testkits, die konsistente, reproduzierbare und klinisch genaue Ergebnisse sowohl im Krankenhaus als auch in Referenzlaboren liefern sollen.

- Die Nachfrage nach fortschrittlichen ANA-Testlösungen steigt in Krankenhäusern, Diagnosezentren und Fachkliniken kontinuierlich an, da Gesundheitssysteme der präzisen Diagnose, den verbesserten Behandlungsergebnissen und dem effektiven Langzeitmanagement von Autoimmunerkrankungen höchste Priorität einräumen.

Marktdynamik für antinukleäre Antikörpertests in Nordamerika

Treiber

Zunehmende Verbreitung von Autoimmunerkrankungen und wachsendes diagnostisches Bewusstsein

- Die zunehmende Verbreitung von Autoimmunerkrankungen, verbunden mit einem wachsenden Bewusstsein für Früherkennung und Krankheitsmanagement, treibt den Markt für antinukleäre Antikörpertests (ANA-Tests) maßgeblich an. Immer mehr Menschen unterziehen sich rheumatologischen Untersuchungen, was die Nachfrage nach ANA-Tests als primäres Diagnoseinstrument erhöht.

- In den letzten Jahren haben beispielsweise Gesundheitsbehörden und Ärzteverbände die Bedeutung der Früherkennung von Autoimmunerkrankungen hervorgehoben und Hausärzte sowie Fachärzte dazu angehalten, ANA-Tests in die Diagnoseprotokolle für Patienten mit ungeklärten chronischen Symptomen wie Müdigkeit, Gelenkschmerzen und Entzündungen aufzunehmen. Solche Initiativen dürften ein stetiges Marktwachstum im Prognosezeitraum unterstützen.

- Da Patienten sich zunehmend der Problematik chronischer und langfristiger Erkrankungen bewusst werden, steigt die Nachfrage nach umfassenden Bluttests, die zugrundeliegende Anomalien des Immunsystems aufdecken können. ANA-Tests stellen einen entscheidenden ersten Schritt zur Identifizierung von Autoimmunaktivität dar und sind daher ein wesentlicher Bestandteil diagnostischer Verfahren.

- Darüber hinaus verbessert der Ausbau spezialisierter rheumatologischer Kliniken und diagnostischer Labore den Zugang zu ANA-Tests. Erhöhte Investitionen in die Gesundheitsinfrastruktur und Laborkapazitäten ermöglichen eine breitere Verfügbarkeit dieser Tests sowohl in städtischen als auch in stadtnahen Gebieten.

- Die zunehmende Verwendung von ANA-Tests in der klinischen Forschung, der Arzneimittelentwicklung und der Überwachung von Autoimmunerkrankungen trägt ebenfalls zu einem anhaltenden Marktwachstum bei. Pharmaunternehmen setzen diese Tests vermehrt in klinischen Studien ein, um die Eignung von Patienten und die Wirksamkeit von Behandlungen in immunologischen Studien zu beurteilen.

Zurückhaltung/Herausforderung

Bedenken hinsichtlich der Testinterpretation und der hohen Diagnosekosten

- Bedenken hinsichtlich der Interpretation von ANA-Testergebnissen stellen eine erhebliche Herausforderung für eine breitere Marktakzeptanz dar. Da positive ANA-Ergebnisse mitunter auch bei gesunden Personen auftreten können, kann eine Fehlinterpretation zu unnötiger Angst, Fehldiagnosen oder zusätzlichen Untersuchungen führen und bei Ärzten und Patienten Bedenken hinsichtlich einer übermäßigen Abhängigkeit von diesem Test allein hervorrufen.

- Beispielsweise hat die Variabilität der Testergebnisse aufgrund von Labortechniken, Reagenzienqualität und subjektiver Interpretation bei Immunfluoreszenztests in einigen Fällen zu inkonsistenten Ergebnissen geführt. Diese Variabilität kann die klinische Entscheidungsfindung erschweren und das Vertrauen in die alleinige Verwendung von ANA-Tests ohne unterstützende diagnostische Evidenz mindern.

- Die Bewältigung dieser Herausforderungen durch standardisierte Testprotokolle, verbesserte Schulungen für Laborfachkräfte und eine höhere Genauigkeit der Tests ist unerlässlich, um das Vertrauen der Gesundheitsdienstleister zu stärken. Darüber hinaus können die relativ hohen Kosten fortschrittlicher ANA-Testmethoden, insbesondere für Multiplex- oder automatisierte Systeme, die Zugänglichkeit für kleinere Kliniken und kostenbewusste Gesundheitseinrichtungen, vor allem in Entwicklungsländern, einschränken. Zwar stehen grundlegende Testoptionen zur Verfügung, doch umfassendere und hochsensitive Plattformen bleiben für viele Einrichtungen finanziell oft unerschwinglich.

- Obwohl technologische Fortschritte und der Wettbewerb zwischen den Herstellern die Kosten allmählich senken, können Budgetbeschränkungen im öffentlichen Gesundheitswesen und Herausforderungen bei der Kostenerstattung die breite Anwendung weiterhin einschränken. Viele Gesundheitsdienstleister müssen daher bei der Auswahl von ANA-Testlösungen für den Routineeinsatz sorgfältig zwischen Wirtschaftlichkeit und diagnostischer Genauigkeit abwägen.

- Die Bewältigung dieser Herausforderungen durch bessere Standardisierung, kosteneffiziente Produktentwicklung, verstärkte Schulung von Klinikern und verbesserte Gesundheitsfinanzierung wird für das nachhaltige Wachstum des globalen Marktes für antinukleäre Antikörpertests unerlässlich sein.

Marktübersicht für antinukleäre Antikörpertests in Nordamerika

Der Markt ist segmentiert nach Antikörpertyp, Produkt, Technik, Anwendung, Endnutzer und Vertriebskanal.

- Nach Antikörpertyp

Basierend auf dem Antikörpertyp ist der Markt für Anti-Nukleäre-Antikörper-Tests in extrahierbare nukleäre Antigene (ENA), Anti-dsDNA & Histone, Anti-DFS70-Antikörper, Anti-PM-SCL, Anti-Zentromer-Antikörper, Anti-SP100 und Sonstige unterteilt. Das Segment Anti-dsDNA & Histone dominierte 2025 mit einem Marktanteil von ca. 36,8 % den größten Umsatzanteil. Dies ist auf seine entscheidende Rolle bei der Diagnose systemischer Autoimmunerkrankungen wie systemischem Lupus erythematodes (SLE) zurückzuführen. Diese Antikörper werden aufgrund ihrer hohen Spezifität und klinischen Relevanz häufig in Krankenhäusern und diagnostischen Laboren eingesetzt. Das gestiegene Bewusstsein der Ärzte, die hohe Testgenauigkeit und die routinemäßige Aufnahme in Autoimmunpanels haben die Dominanz dieses Segments weiter gestärkt. Die weltweit zunehmende Prävalenz von Lupus und rheumatoider Arthritis trägt ebenfalls zu höheren Anwendungsraten bei. Darüber hinaus haben Verbesserungen bei der Empfindlichkeit und Standardisierung der Tests das Vertrauen in die Ergebnisse erhöht und so eine breitere klinische Anwendung gefördert.

Für das Segment der Anti-ENA-Tests wird aufgrund seiner zunehmenden Anwendungsmöglichkeiten bei der Erkennung verschiedener Bindegewebserkrankungen wie dem Sjögren-Syndrom, Sklerodermie und Polymyositis von 2026 bis 2033 das schnellste jährliche Wachstum von rund 10,7 % erwartet. ENA-Panels ermöglichen die Früherkennung und Differenzierung komplexer Autoimmunerkrankungen und sind daher in der modernen Diagnostik von großem Wert. Die zunehmende Nutzung von Multiplex-Plattformen und die Verfügbarkeit umfassender ENA-Testpanels treiben das Wachstum an. Darüber hinaus beschleunigen steigende Investitionen im Gesundheitswesen, der Ausbau der diagnostischen Infrastruktur und verstärkte Screening-Programme in Entwicklungsländern die Nachfrage. Die Integration von ENA-Tests in automatisierte Plattformen verbessert ebenfalls die Effizienz und trägt so zusätzlich zu diesem rasanten Wachstum bei.

- Nebenprodukt

Basierend auf den Produkten ist der Markt in Instrumente, Verbrauchsmaterialien & Reagenzien sowie Dienstleistungen unterteilt. Das Segment Verbrauchsmaterialien & Reagenzien erzielte 2025 mit rund 47,3 % den größten Umsatzanteil, da diese Produkte für jeden durchgeführten Test benötigt werden. Der wiederkehrende Bedarf an Reagenzien, Puffern, Antikörpern und Testkits macht dieses Segment zu einer beständigen Einnahmequelle für Hersteller. Steigende Testvolumina, die zunehmende Prävalenz von Autoimmunerkrankungen und der Ausbau von Labornetzwerken haben die Nachfrage deutlich gesteigert. Darüber hinaus haben kontinuierliche Verbesserungen bei den Reagenzienformulierungen und der Zuverlässigkeit der Kits deren Einsatz in der Routinediagnostik gestärkt. Die Verlagerung hin zu Inhouse-Tests in Krankenhäusern und Laboren fördert das langfristige Wachstum dieses Segments zusätzlich.

Das Dienstleistungssegment wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von rund 11,2 % das schnellste Wachstum verzeichnen. Treiber dieses Wachstums ist der zunehmende Trend, diagnostische Tests an spezialisierte Labore auszulagern. Die begrenzte interne Infrastruktur kleinerer Krankenhäuser und Kliniken begünstigt die Inanspruchnahme externer Dienstleister. Der Ausbau diagnostischer Dienstleistungsketten und Investitionen in Labore mit hohem Probendurchsatz treiben das rasante Wachstum weiter an. Darüber hinaus spielen der Aufstieg der personalisierten Medizin und die steigende Nachfrage nach fortschrittlichen Testinterpretationsdiensten eine entscheidende Rolle. Digitale Integration und Ferntestmodelle verbessern zudem die Zugänglichkeit und das Wachstum dieses Segments.

- Durch Technik

Basierend auf den angewandten Techniken ist der Markt in ELISA, indirekte Immunfluoreszenz (IIF), Blotting-Test, Antigen-Microarray, gelbasierte Verfahren, Multiplex-Assay, Durchflusszytometrie, passive Hämagglutination (PHA) und weitere Verfahren unterteilt. Das Segment der indirekten Immunfluoreszenz (IIF) dominierte den Markt mit einem Umsatzanteil von fast 41,5 % im Jahr 2025 und gilt weiterhin als Goldstandard für ANA-Tests weltweit. IIF bietet eine hohe Sensitivität für den Nachweis einer Vielzahl von Autoantikörpern und ermöglicht die klare Visualisierung von Testmustern, was für die diagnostische Interpretation entscheidend ist. Die meisten klinischen Leitlinien empfehlen IIF weiterhin als primäre Screening-Methode. Ihre weite Verbreitung in Krankenhauslaboren und die hohe Kostenerstattung stärken ihre führende Position zusätzlich.

Für das Segment der Multiplex-Assays wird aufgrund der Fähigkeit, mehrere Antikörper gleichzeitig nachzuweisen, von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von ca. 12,4 % das schnellste Wachstum erwartet. Diese Technik verkürzt die Bearbeitungszeiten erheblich, optimiert die Arbeitsabläufe und senkt die Gesamtkosten der Tests. Die zunehmende Verbreitung automatisierter Plattformen und die steigende Nachfrage nach Hochdurchsatztests in großen Laboren beschleunigen dieses Wachstum. Darüber hinaus verbessern technologische Fortschritte und die Integration KI-basierter Analysetools die Genauigkeit und erhöhen die Akzeptanz bei Klinikern.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt für antinukleäre Antikörpertests (ANA-Tests) in Autoimmunerkrankungen und Infektionskrankheiten unterteilt. Das Segment der Autoimmunerkrankungen erzielte 2025 mit rund 58,9 % den größten Marktanteil, bedingt durch die weltweit zunehmende Prävalenz von Erkrankungen wie systemischem Lupus erythematodes, rheumatoider Arthritis, Sjögren-Syndrom und Sklerodermie. ANA-Tests spielen eine entscheidende Rolle bei der Diagnose und der klinischen Überwachung dieser Erkrankungen und werden daher routinemäßig in Krankenhäusern und spezialisierten Kliniken verordnet. Ein wachsendes Bewusstsein bei Patienten und Ärzten, ein verbesserter Zugang zu Früherkennungsprogrammen und ein stärkerer Fokus auf die frühzeitige Erkennung von Erkrankungen steigern die Nachfrage deutlich. Darüber hinaus haben kontinuierliche Fortschritte in der Biomarkerforschung und die laufende Forschung zu Autoimmunerkrankungen den klinischen Nutzen von ANA-Tests für die Verlaufskontrolle, die Beurteilung des Therapieansprechens und das langfristige Patientenmanagement erweitert.

Das Segment Infektionskrankheiten wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von rund 9,6 % am schnellsten wachsen. Grund dafür ist, dass aktuelle Forschungsergebnisse die komplexe Beziehung zwischen Infektionen und Dysregulation des Immunsystems immer deutlicher hervorheben. Ein verstärkter Fokus auf das Verständnis von Immunreaktionen, insbesondere nach weitverbreiteten Virusausbrüchen und postinfektiösen Komplikationen, hat die klinische Relevanz von ANA-Tests erweitert. Darüber hinaus trägt die Integration von ANA-Tests in umfassende immunologische und diagnostische Panels sowie die weltweit gestiegenen Investitionen in die Forschung und Überwachung von Infektionskrankheiten zum rasanten Wachstum dieses Segments bei.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Krankenhäuser, Labore, Diagnosezentren, Forschungsinstitute und Sonstige unterteilt. Das Segment der Krankenhäuser dominierte den Markt mit einem Anteil von rund 39,4 % im Jahr 2025. Dies ist auf die hohe Patientenfrequenz und die Verfügbarkeit integrierter Diagnosesysteme innerhalb der Krankenhäuser zurückzuführen. ANA-Tests werden häufig im Rahmen der routinemäßigen klinischen Untersuchungen bei Autoimmunerkrankungen und chronischen Entzündungskrankheiten durchgeführt. Qualifiziertes medizinisches Fachpersonal, moderne Laborausstattung und multidisziplinäre Behandlungsumgebungen gewährleisten präzise Testergebnisse und deren Interpretation. Darüber hinaus stärken kontinuierliche staatliche Investitionen in die Gesundheitsinfrastruktur, die Modernisierung von Krankenhäusern und den Ausbau von Fachabteilungen die führende Position dieses Segments zusätzlich.

Für das Segment der Diagnosezentren wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von rund 10,9 % das schnellste Wachstum erwartet. Treiber dieses Wachstums ist die steigende Nachfrage nach spezialisierten, zuverlässigen und kosteneffizienten Diagnosedienstleistungen. Diese Zentren konzentrieren sich auf schnellere Bearbeitungszeiten durch den Einsatz automatisierter Technologien und fortschrittlicher Testplattformen. Ihre zunehmende Präsenz in urbanen, vorstädtischen und auch unterversorgten Regionen verbessert den Zugang zu ANA-Tests deutlich. Strategische Kooperationen mit Krankenhäusern, Kliniken und Forschungseinrichtungen stärken zudem ihre Marktposition und beschleunigen das Wachstum in diesem Segment.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvertrieb, Einzelhandel, Drittanbieter und Sonstige unterteilt. Das Segment Direktvertrieb hielt 2025 mit rund 44,6 % den größten Marktanteil, getrieben durch Großeinkäufe von staatlichen Krankenhäusern, öffentlichen Gesundheitsorganisationen und großen Gesundheitskonzernen. Dieser Kanal gewährleistet Kosteneffizienz, langfristige Lieferverträge und eine kontinuierliche Produktverfügbarkeit. Hersteller profitieren von einer stabilen Nachfrage, während Gesundheitseinrichtungen bessere Preise und Qualitätssicherung erhalten. Darüber hinaus reduzieren Direktvertriebsaufträge die Margen der Zwischenhändler und helfen den Einrichtungen, Ressourcen effizienter einzusetzen. Die zunehmende Anzahl staatlich finanzierter Diagnoseprogramme und nationaler Initiativen zur Krankheitsvorsorge stärkt die Vormachtstellung dieses Segments zusätzlich.

Das Segment der Drittanbieter-Distributoren wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von rund 11,5 % am schnellsten wachsen, da Distributoren ihre regionale Reichweite kontinuierlich ausbauen und die Effizienz ihrer Lieferkette insgesamt verbessern. Ihre etablierten lokalen Netzwerke ermöglichen eine schnellere Produktverfügbarkeit und einen verbesserten Service in ländlichen und unterentwickelten Gebieten, die zuvor von den Herstellern nicht ausreichend versorgt wurden. Die zunehmende Abhängigkeit von Distributoren in den Bereichen Bestandsmanagement, Kühlkettensicherung und Zustellung bis zum Endkunden stärkt deren Rolle im Markt für ANA-Tests erheblich. Darüber hinaus bieten Drittanbieter-Distributoren häufig Komplettlösungen inklusive technischem Support, Schulungen und Kundendienst an, was die Kundenzufriedenheit und -bindung erhöht. Auch die wachsende Zahl kleiner und mittelständischer Diagnostiklabore, denen die Möglichkeit zur direkten Beschaffung fehlt, trägt zur Abhängigkeit von diesen Distributoren bei.

Regionale Analyse des nordamerikanischen Marktes für antinukleäre Antikörpertests

- Nordamerika dominierte den Markt für antinukleäre Antikörpertests mit dem größten Umsatzanteil von 41,8 % im Jahr 2025, unterstützt durch eine fortschrittliche Gesundheitsinfrastruktur, ein hohes Volumen an diagnostischen Tests, starke Erstattungsrahmen und die Präsenz großer Diagnostikunternehmen.

- Die Region profitiert von der weitverbreiteten Anwendung fortschrittlicher ANA-Testmethoden, darunter indirekte Immunfluoreszenz (IIF) und ELISA-basierte Assays. Die zunehmende Prävalenz von Autoimmunerkrankungen wie Lupus, rheumatoider Arthritis und Sjögren-Syndrom hat die Nachfrage nach routinemäßigem und frühzeitigem ANA-Screening weiter erhöht.

- Die führende Rolle der Region wird zudem durch ein hohes Bewusstsein bei Ärzten und Patienten, etablierte Labornetzwerke und kontinuierliche technologische Fortschritte in der Immunologie gestärkt. Nordamerikas integrierte Krankenhaus- und Diagnostiklaborsysteme gewährleisten einen schnellen Testzugang und eine präzise Krankheitsüberwachung, wodurch ANA-Tests zu einem routinemäßigen Bestandteil der Behandlung von Autoimmunerkrankungen geworden sind.

Einblick in den US-Markt für antinukleäre Antikörpertests

Der US-amerikanische Markt für antinukleäre Antikörpertests (ANA-Tests) erzielte 2025 den größten Umsatzanteil. Treiber dieser Entwicklung sind die zunehmende Belastung durch Autoimmunerkrankungen und die starke Präsenz moderner Diagnoseeinrichtungen. Der weitverbreitete Einsatz von Immunfluoreszenz- und ELISA-Technologien, kombiniert mit hohen Gesundheitsausgaben und günstigen Erstattungspolitiken, fördert weiterhin die breite Akzeptanz von ANA-Tests. Darüber hinaus tragen die laufende Forschung zu Autoimmun-Biomarkern, der verstärkte Fokus auf Früherkennung und die Ausweitung personalisierter Medizinansätze maßgeblich zum anhaltenden Marktwachstum in den USA bei.

Einblick in den kanadischen Markt für antinukleäre Antikörpertests

Der kanadische Markt für Antinukleäre-Antikörper-Tests (ANA-Tests) wird im Prognosezeitraum voraussichtlich das schnellste Wachstum verzeichnen und eine durchschnittliche jährliche Wachstumsrate (CAGR) von 11,8 % erreichen. Dieses Wachstum ist auf den verbesserten Zugang zur Gesundheitsversorgung, den Ausbau der Laborinfrastruktur, das steigende Bewusstsein für Autoimmunerkrankungen und die zunehmenden staatlichen Investitionen in die Gesundheitsentwicklung zurückzuführen. Der wachsende Fokus des Landes auf die Früherkennung von Krankheiten, verbunden mit verstärkten Forschungsaktivitäten und der besseren Verfügbarkeit fortschrittlicher immunodiagnostischer Technologien, beschleunigt die Einführung von ANA-Tests in Krankenhäusern, Diagnosezentren und Forschungseinrichtungen.

Marktanteil des Tests auf antinukleäre Antikörper in Nordamerika

Die Branche der Anti-Nukleären-Antikörper-Tests wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

• F. Hoffmann-La Roche AG (Schweiz)

• Abbott (USA)

• Siemens Healthineers (Deutschland)

• Danaher Corporation (USA)

• bioMérieux SA (Frankreich)

• Thermo Fisher Scientific Inc. (USA)

• Becton, Dickinson and Company (USA)

• QuidelOrtho Corporation (USA)

• Werfen (Spanien)

• EUROIMMUN AG (Deutschland)

• Bio-Rad Laboratories, Inc. (USA)

• Inova Diagnostics (USA)

• Trinity Biotech (Irland)

• Genway Biotech, Inc. (USA)

• Arlington Scientific, Inc. (USA)

• Erba Diagnostics (Deutschland)

• Hycor Biomedical LLC (USA)

• Diagnostic Automation, Inc. (USA)

• Creative Diagnostics (USA)

• Snibe Diagnostic (China)

Neueste Entwicklungen auf dem nordamerikanischen Markt für antinukleäre Antikörpertests

- Im März 2021 verzeichnete der globale Markt für ANA-Tests eine verstärkte Nutzung automatisierter ELISA- und indirekter Immunfluoreszenz-(IIF)-Plattformen in Krankenhäusern und diagnostischen Laboren, wodurch die Genauigkeit verbessert und menschliche Fehler beim Screening auf Autoimmunerkrankungen reduziert wurden.

- Im Juli 2022 erweiterten mehrere führende Diagnostikunternehmen ihre Produktionskapazitäten für ANA-Testkits, angetrieben durch das wachsende Bewusstsein für Autoimmunerkrankungen wie systemischen Lupus erythematodes, rheumatoide Arthritis und Sklerodermie, insbesondere in Nordamerika und Europa.

- Im April 2023 führte EUROIMMUN verbesserte ANA-Testprofile ein, die es Laboren ermöglichen, ein breiteres Spektrum an Autoantikörpern präziser nachzuweisen und so eine frühere Diagnose und ein verbessertes Patientenmanagement bei Autoimmunerkrankungen zu unterstützen.

- Im August 2024 brachte Thermo Fisher Scientific verbesserte automatisierte ANA-Testplattformen auf den Markt, die sich durch eine höhere Sensitivität und optimierte Laborabläufe auszeichnen und so schnellere Bearbeitungszeiten für Testzentren mit hohem Durchsatz ermöglichen.

- Im Januar 2025 berichteten Branchenanalysten von einem anhaltenden Anstieg der ANA-Test-Nutzung, bedingt durch die weltweit zunehmende Verbreitung von Autoimmunerkrankungen und den steigenden Fokus auf Früherkennung und Krankheitsüberwachung.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.