North America Advanced Composite Market

Marktgröße in Milliarden USD

CAGR :

%

USD

10.55 Billion

USD

19.24 Billion

2025

2033

USD

10.55 Billion

USD

19.24 Billion

2025

2033

| 2026 –2033 | |

| USD 10.55 Billion | |

| USD 19.24 Billion | |

|

|

|

|

Marktsegmentierung für Hochleistungswerkstoffe in Nordamerika nach Typ (Kohlenstofffaserverbundwerkstoffe, S-Glas-Verbundwerkstoffe, Aramidfaserverbundwerkstoffe und Sonstige), Harz (Hochleistungsthermoplaste und Hochleistungsduroplaste), Herstellungsverfahren (Automatisiertes Tape-Laying (ATL) und Automatisiertes Faserablageverfahren (AFP), Handlaminieren/Sprühlaminieren, Formpressen, Harzinjektionsverfahren (RTM), Spritzgießen, Filamentwickeln, Pultrusion und Sonstige), Endverbraucher (Luft- und Raumfahrt, Energie, Automobilindustrie, Sportartikel, Bauwesen, Elektrotechnik, Gesundheitswesen und Sonstige) – Branchentrends und Prognose bis 2033

Marktgröße für hochentwickelte Verbundwerkstoffe in Nordamerika

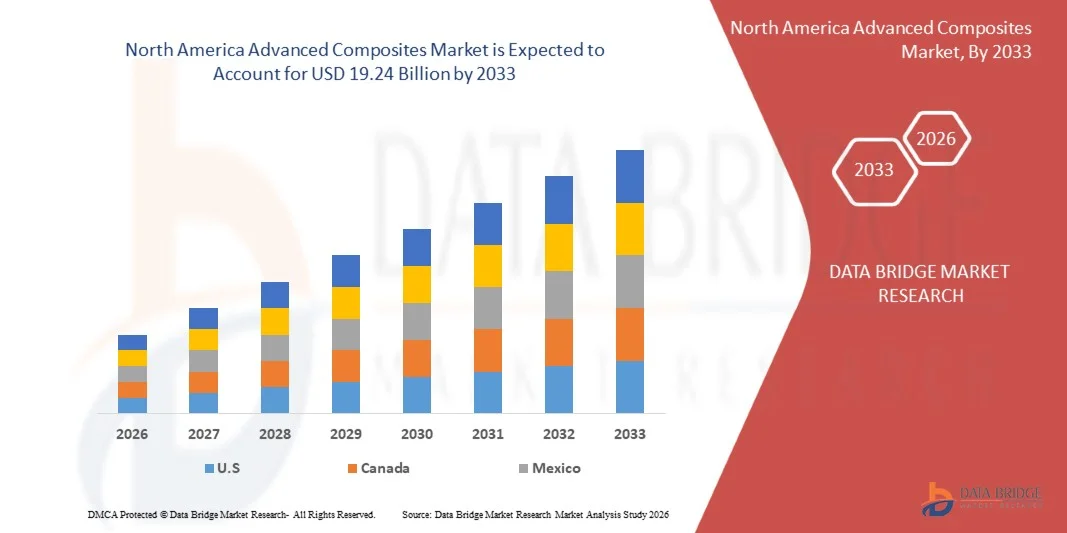

- Der nordamerikanische Markt für Hochleistungswerkstoffe hatte im Jahr 2025 einen Wert von 10,55 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 19,24 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 7,8 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die steigende Nachfrage nach leichten, hochfesten Werkstoffen in der Luft- und Raumfahrt, der Automobilindustrie, der Energiebranche und der Verteidigungsindustrie angetrieben, was die Verwendung von Hochleistungswerkstoffen für Struktur- und Hochleistungsanwendungen fördert.

- Darüber hinaus führt der zunehmende Fokus auf Kraftstoffeffizienz, Emissionsreduzierung und Nachhaltigkeit in der Automobil- und Luftfahrtindustrie dazu, dass sich moderne Verbundwerkstoffe als bevorzugtes Material für leichte und langlebige Bauteile etablieren. Diese zusammenwirkenden Faktoren beschleunigen die Verbreitung von Verbundwerkstofflösungen und tragen somit maßgeblich zum Wachstum der Branche bei.

Analyse des nordamerikanischen Marktes für Hochleistungsverbundwerkstoffe

- Hochleistungswerkstoffe, die ein überlegenes Festigkeits-Gewichts-Verhältnis, Korrosionsbeständigkeit und Designflexibilität bieten, gewinnen in der Luft- und Raumfahrt, der Automobilindustrie, der Energiewirtschaft und in industriellen Anwendungen zunehmend an Bedeutung, da sie die Leistung steigern, die Wartungskosten senken und die Betriebseffizienz verbessern.

- Die steigende Nachfrage nach modernen Verbundwerkstoffen wird vor allem durch strenge regulatorische Standards für Kraftstoffeffizienz und Emissionen, die zunehmende Verbreitung von Elektrofahrzeugen und steigende Investitionen in leistungsstarke Infrastruktur angetrieben und spiegelt eine wachsende Präferenz für leichte, langlebige und nachhaltige Materialien wider.

- Die USA dominierten 2025 den nordamerikanischen Markt für Hochleistungswerkstoffe aufgrund ihrer etablierten Luft- und Raumfahrt-, Automobil- und Verteidigungsindustrie, ihrer umfassenden Forschungs- und Entwicklungskapazitäten sowie der starken Verbreitung von leichten Hochleistungsmaterialien.

- Kanada wird im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land auf dem nordamerikanischen Markt für Hochleistungsverbundwerkstoffe sein, bedingt durch zunehmende industrielle Aktivitäten in den Bereichen Luft- und Raumfahrt, Automobilindustrie und Infrastrukturentwicklung.

- Kohlenstofffaserverbundwerkstoffe dominierten den Markt mit einem Marktanteil von 66,73 % im Jahr 2025. Dies ist auf ihr überlegenes Festigkeits-Gewichts-Verhältnis, ihre außergewöhnliche Steifigkeit und ihre breite Anwendung in der Luft- und Raumfahrt, der Automobilindustrie und im Hochleistungssport zurückzuführen. Ihre weitverbreitete Verwendung in Flugzeugstrukturbauteilen, Karosserieteilen und Windkraftanlagenflügeln sorgt für eine stetige Nachfrage, und kontinuierliche Innovationen in den Kohlenstofffaser-Produktionstechniken haben die Wirtschaftlichkeit und Leistungsfähigkeit weiter verbessert. Hersteller und Endanwender bevorzugen Kohlenstofffaserverbundwerkstoffe aufgrund ihrer Langlebigkeit, Ermüdungsbeständigkeit und ihrer Fähigkeit, rauen Umgebungsbedingungen standzuhalten. Dies macht sie zur ersten Wahl für kritische Anwendungen, die leichte und dennoch hochfeste Materialien erfordern.

Berichtsgegenstand und Marktsegmentierung für hochentwickelte Verbundwerkstoffe in Nordamerika

|

Attribute |

Wichtigste Markteinblicke in den Markt für Hochleistungsverbundwerkstoffe |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Markttrends für Hochleistungsverbundwerkstoffe in Nordamerika

„Einsatz von Leichtbauverbundwerkstoffen in der Luft- und Raumfahrt sowie im Automobilbau“

- Der nordamerikanische Markt für Hochleistungsverbundwerkstoffe verzeichnet eine beschleunigte Einführung von leichten und hochfesten Verbundwerkstoffen in der Luft- und Raumfahrt- sowie der Automobilindustrie. Der Fokus auf die Reduzierung des Kraftstoffverbrauchs, die Steigerung der Effizienz und die Minimierung von Emissionen veranlasst Hersteller, Kohlenstoff- und Glasfaserverbundwerkstoffe in Flugzeugstrukturen, Karosserien von Elektrofahrzeugen und Hochleistungskomponenten zu integrieren.

- Beispielsweise haben die Hexcel Corporation und Toray Industries in die automatisierte Fertigung von Kohlenstoffverbundwerkstoffen für Flugzeugflügel, Fahrzeugchassis und Elektrofahrzeuge der nächsten Generation investiert. Ihre Entwicklungen in der Nanotechnologie und der automatisierten Fertigung verbessern Gewichtsreduzierung, Steifigkeit und Dauerfestigkeit und tragen so zur Erfüllung strenger regulatorischer und Nachhaltigkeitsziele weltweit bei.

- Die zunehmende Verwendung von Verbundwerkstoffen in der Windenergie, im Bauwesen und im Hochgeschwindigkeitsverkehr erweitert das Marktpotenzial zusätzlich. Unternehmen entwickeln innovative Lösungen wie selbstheilende Verbundwerkstoffe, biobasierte Harze und fortschrittliche Recyclingverfahren, die die Lebensdauer verlängern, den Wartungsaufwand minimieren und Initiativen für nachhaltiges Bauen unterstützen.

- Investitionen in intelligente Fertigungsprozesse – wie robotergestütztes Laminieren, additive Fertigung und Echtzeit-Qualitätskontrolle – ermöglichen Skalierbarkeit und Kostensenkung. Diese Automatisierung ermöglicht die Massenproduktion komplexer Bauteile und erweitert die Einsatzmöglichkeiten von Verbundwerkstoffen in Fahrzeugen und Infrastruktur für den Massenmarkt.

- Darüber hinaus beschleunigt die zunehmende Zusammenarbeit zwischen Forschungszentren, OEMs und Materiallieferanten die Entwicklung und Vermarktung nachhaltiger Verbundwerkstofflösungen. Politische Anreize und internationale Standards, die kohlenstoffarme, recycelbare Materialien fördern, treiben den Einsatz von Verbundwerkstoffen als wesentliche Strategie für sauberere Mobilität und Energie voran.

- Diese Trends spiegeln einen Marktwandel wider, der auf Effizienz, Nachhaltigkeit und Innovation ausgerichtet ist. Mit der Weiterentwicklung der regulatorischen Rahmenbedingungen und der Reife der Technologie werden hochentwickelte Verbundwerkstoffe zu einem grundlegenden Bestandteil globaler Transport- und Industrieökosysteme.

Marktdynamik für Hochleistungsverbundwerkstoffe in Nordamerika

Treiber

„Nachfrage nach kraftstoffsparenden und nachhaltigen Materialien“

- Die Nachfrage nach kraftstoffsparenden und nachhaltigen Materialien treibt das Wachstum des nordamerikanischen Marktes für Hochleistungskomposite an. Treiber dieses Wachstums ist der Bedarf, Betriebskosten und Umweltbelastung in den Bereichen Transport, Energie und Infrastruktur zu reduzieren. Verbundwerkstoffe bieten ein hervorragendes Verhältnis von Festigkeit zu Gewicht, Korrosionsbeständigkeit und Designflexibilität und eignen sich daher ideal für nachhaltige Designinitiativen.

- Beispielsweise haben Boeing und BMW den Einsatz von Kohlenstofffaserverbundwerkstoffen ausgeweitet, um leichtere und gleichzeitig stabilere Bauteile herzustellen. Diese Materialien helfen Flugzeug- und Automobilherstellern, eine verbesserte Treibstoffeffizienz, geringere Emissionen und eine höhere strukturelle Integrität zu erreichen und unterstützen so ambitionierte Programme zur Einhaltung gesetzlicher Vorschriften und zur Förderung der unternehmerischen Nachhaltigkeit.

- Die durch Verbundwerkstoffe erzielten Kraftstoffeinsparungen in der Luft- und Raumfahrt- sowie der Automobilindustrie sind erheblich: Eine Gewichtsreduzierung von 10 % ermöglicht eine Verbesserung des Treibstoffverbrauchs von Flugzeugen um bis zu 8 %. Das Wachstum in den Bereichen Elektromobilität, Windenergie und nachhaltiges Bauen verstärkt den Bedarf an modernen Verbundwerkstoffen zusätzlich, da diese die Effizienz und die Emissionen über den gesamten Lebenszyklus positiv beeinflussen.

- Initiativen mit Fokus auf nachhaltiges Bauen, erneuerbare Energien und nachhaltige Mobilität fördern den Einsatz von Verbundwerkstoffen im Struktur-, Rotor- und Modulbau. Neuartige biobasierte Verbundwerkstoffe und geschlossene Recyclingkreisläufe tragen zu den Zielen der Kreislaufwirtschaft bei und stärken das Ansehen und die Zukunftsfähigkeit fortschrittlicher Werkstoffe.

- Die Zusammenarbeit von Wirtschaft und Politik beschleunigt Innovation und Marktdurchdringung, da Hersteller ihre Produktportfolios an die Ziele hinsichtlich Kraftstoffverbrauch, Emissionen und Recycling anpassen. Der Wandel hin zu nachhaltigen Materialien dürfte ein zentraler Treiber für das zukünftige Wachstum des Verbundwerkstoffmarktes sein.

Zurückhaltung/Herausforderung

„Hohe Produktions- und Rohstoffkosten“

- Hohe Produktions- und Rohstoffkosten stellen eine erhebliche Herausforderung für die Expansion des nordamerikanischen Marktes für Hochleistungskomposite dar. Die Herstellung von Verbundwerkstoffen, insbesondere von Kohlenstofffaserverbundwerkstoffen, umfasst energieintensive Prozesse, die hochreine Ausgangsstoffe und Spezialausrüstung erfordern, was die Betriebskosten erhöht.

- Unternehmen wie SGL Carbon und die Mitsubishi Chemical Group sehen sich beispielsweise mit hohen Kosten für Kohlenstofffaser-Vorprodukte, komplexen Verarbeitungsschritten und strengen Qualitätskontrollen konfrontiert. Diese Kosten führen häufig zu Preisaufschlägen, die die Wettbewerbsfähigkeit von Verbundwerkstoffen in preissensiblen Produktkategorien einschränken.

- Anpassung, Zertifizierung und Konformität erhöhen die Kosten, insbesondere in der Luft- und Raumfahrt sowie im Verteidigungsbereich, da jede Komponente strenge regulatorische und Leistungsstandards erfüllen muss. Obwohl technologische Fortschritte in den Bereichen Automatisierung und Recycling Kosteneinsparungspotenzial bieten, stellen die hohen Vorabinvestitionen für viele Neueinsteiger und kleine Hersteller weiterhin eine Hürde dar.

- Begrenzte Recyclingmöglichkeiten, insbesondere für duroplastische Verbundwerkstoffe, stellen zusätzliche Herausforderungen für Umwelt und Entsorgung dar und erhöhen die Gesamtkosten über den gesamten Lebenszyklus. Angesichts strengerer Vorschriften und sich weiterentwickelnder Nachhaltigkeitsstandards wird die Entwicklung kosteneffizienter, recycelbarer Verbundwerkstofflösungen immer dringlicher.

- Die Überwindung dieser Hürden erfordert den Ausbau von Innovationen bei biobasierten Rohstoffen, automatisierter Fertigung und Recyclingverfahren der nächsten Generation. Strategische Industriepartnerschaften, politische Unterstützung und Investitionen in Massenproduktionstechnologien sind unerlässlich für ein nachhaltiges und kostengünstiges Wachstum des weltweiten Marktes für Hochleistungswerkstoffe.

Marktübersicht für hochentwickelte Verbundwerkstoffe in Nordamerika

Der Markt ist segmentiert nach Typ, Harz, Herstellungsverfahren und Endverbraucher.

• Nach Typ

Basierend auf dem Materialtyp ist der nordamerikanische Markt für Hochleistungskomposite in Kohlenstofffaserverbundwerkstoffe, S-Glas-Verbundwerkstoffe, Aramidfaserverbundwerkstoffe und Sonstige unterteilt. Das Segment der Kohlenstofffaserverbundwerkstoffe dominierte den Markt mit einem Umsatzanteil von 66,73 % im Jahr 2025. Dies ist auf das hervorragende Verhältnis von Festigkeit zu Gewicht, die außergewöhnliche Steifigkeit und die breite Anwendung in der Luft- und Raumfahrt, der Automobilindustrie und im Hochleistungssport zurückzuführen. Die weitverbreitete Verwendung in Flugzeugstrukturbauteilen, Karosserieteilen und Windkraftanlagenflügeln sorgt für eine stetige Nachfrage, und kontinuierliche Innovationen in den Kohlenstofffaser-Produktionstechniken haben die Wirtschaftlichkeit und Leistungsfähigkeit weiter verbessert. Hersteller und Endanwender bevorzugen Kohlenstofffaserverbundwerkstoffe aufgrund ihrer Langlebigkeit, Ermüdungsbeständigkeit und Beständigkeit gegenüber rauen Umgebungsbedingungen. Dies macht sie zur ersten Wahl für kritische Anwendungen, die leichte und gleichzeitig hochfeste Materialien erfordern.

Dem Segment der Aramidfaserverbundwerkstoffe wird von 2026 bis 2033 das schnellste Wachstum prognostiziert, angetrieben durch den zunehmenden Einsatz in ballistischen Schutzsystemen, der Luft- und Raumfahrt sowie im Verteidigungsbereich. Unternehmen wie DuPont entwickeln beispielsweise innovative Aramid-basierte Verbundwerkstoffe für Helme, Körperschutzwesten und Paneele für die Luft- und Raumfahrt und nutzen dabei die hohe Schlagfestigkeit und thermische Stabilität des Materials. Das wachsende Bewusstsein für Schutzausrüstung in der Verteidigungs- und Sicherheitsbranche sowie der zunehmende Einsatz in der Automobil- und Industriebranche treiben die starke Nachfrage an. Das geringe Gewicht, die hohe Zugfestigkeit und die Beständigkeit gegen Abrieb und chemische Zersetzung machen Aramidverbundwerkstoffe zu einer immer attraktiveren Wahl für vielfältige Hochleistungsanwendungen.

• Durch Harz

Basierend auf dem verwendeten Harz wird der Markt in hochentwickelte Thermoplaste und hochentwickelte Duroplaste unterteilt. Das Segment der hochentwickelten Duroplaste dominierte den Markt mit dem größten Umsatzanteil im Jahr 2025. Dies ist auf die hervorragende thermische und chemische Beständigkeit, die strukturelle Stabilität und die mechanische Festigkeit unter extremen Bedingungen zurückzuführen. Die Luft- und Raumfahrt-, Automobil- und Windenergiebranche setzen Duroplast-Verbundwerkstoffe in großem Umfang für hochbelastende und hochtemperaturintensive Anwendungen ein und gewährleisten so langfristige Zuverlässigkeit. Beispielsweise fertigen Hexcel und Cytec Duroplast-Prepregs und Laminate für Flugzeugstrukturen und Industriemaschinen und unterstreichen damit die zentrale Rolle des Harzes in Hochleistungsverbundanwendungen.

Das Segment der hochentwickelten thermoplastischen Kunststoffe wird voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen. Treiber dieses Wachstums ist die zunehmende Verwendung in der Automobil-, Medizin- und Konsumgüterindustrie, wo leichte, recycelbare und leistungsstarke Bauteile benötigt werden. Thermoplastische Verbundwerkstoffe bieten im Vergleich zu Duroplasten schnellere Fertigungszyklen und eine höhere Zähigkeit und eignen sich daher ideal für die Massenproduktion. Unternehmen wie Solvay treiben die Marktentwicklung mit innovativen thermoplastischen Verbundwerkstoffen für Strukturbauteile im Automobilbereich und leichte Komponenten für die Luft- und Raumfahrt voran. Die Möglichkeit der Wiederaufbereitung und Thermoformung thermoplastischer Verbundwerkstoffe verbessert die Nachhaltigkeit und Kosteneffizienz und ist daher besonders für umweltbewusste Hersteller attraktiv.

• Durch den Herstellungsprozess

Basierend auf dem Fertigungsprozess ist der Markt in automatisiertes Tape Laying (ATL) und automatisiertes Faserablageverfahren (AFP), Handlaminieren/Sprühlaminieren, Formpressen, Harzinjektionsverfahren (RTM), Spritzgießen, Filamentwickeln, Pultrusion und Sonstige unterteilt. Das Segment des automatisierten Faserablageverfahrens (AFP) dominierte den Markt mit dem größten Umsatzanteil im Jahr 2025. Ausschlaggebend hierfür waren die Präzision, Automatisierung und Effizienz der AFP-Technologie bei der Herstellung großflächiger, hochleistungsfähiger Verbundstrukturen für die Luft- und Raumfahrt sowie die Verteidigungsindustrie. AFP ermöglicht eine gleichmäßige Faserablage, optimierte Materialnutzung und reduzierte Arbeitskosten und fördert so den Einsatz im Flugzeugbau, bei Flügelkomponenten und in Raumfahrzeugen. Beispielsweise setzen Boeing und Lockheed Martin AFP umfassend für kohlenstofffaserverstärkte Paneele ein und unterstreichen damit die entscheidende Rolle des Verfahrens in der modernen Fertigung.

Das Segment des Harzinjektionsverfahrens (RTM) wird voraussichtlich von 2026 bis 2033 das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die Kosteneffizienz, die hohe Reproduzierbarkeit und die Eignung für mittelgroße bis große Bauteile in der Automobil-, Energie- und Industriebranche. RTM bietet eine exzellente Oberflächengüte, einen hohen Faservolumenanteil und Designflexibilität und ist daher attraktiv für die Massenproduktion von Verbundbauteilen. Unternehmen wie Gurit entwickeln innovative RTM-Verfahren für Windkraftanlagenflügel und Strukturbauteile für die Automobilindustrie und treiben so die Verbreitung des Verfahrens voran. Das ausgewogene Verhältnis von Produktionseffizienz, Strukturleistung und Skalierbarkeit trägt maßgeblich zum rasanten Wachstum von RTM bei.

• Vom Endbenutzer

Basierend auf den Endnutzern ist der nordamerikanische Markt für Hochleistungswerkstoffe in die Segmente Luft- und Raumfahrt/Verteidigung, Energie/Strom, Automobilindustrie, Sportartikel, Bauwesen, Elektrotechnik/Elektronik, Gesundheitswesen und Sonstige unterteilt. Das Segment Luft- und Raumfahrt/Verteidigung dominierte den Markt mit dem größten Umsatzanteil im Jahr 2025. Treiber dieser Entwicklung war die hohe Nachfrage nach leichten, hochfesten und ermüdungsbeständigen Werkstoffen für Flugzeuge, Raumfahrzeuge und Verteidigungsausrüstung. Strenge Sicherheitsstandards, Ziele zur Steigerung der Treibstoffeffizienz und der Bedarf an Hochleistungskomponenten in Militärflugzeugen und Satelliten verstärken die Marktführerschaft. Airbus beispielsweise verwendet Kohlenstofffaserverbundwerkstoffe in großem Umfang für Rumpfsegmente und Flügelstrukturen, was die strategische Bedeutung dieses Segments unterstreicht.

Der Automobilsektor dürfte von 2026 bis 2033 das schnellste Wachstum verzeichnen, angetrieben durch den globalen Trend zu leichten, kraftstoffsparenden und elektrischen Fahrzeugen. Verbundwerkstoffe bieten eine signifikante Gewichtsreduzierung, verbesserte Energieeffizienz und erhöhte Crashsicherheit und erfüllen damit sowohl regulatorische als auch Verbraucheranforderungen. Unternehmen wie BMW und Tesla integrieren fortschrittliche Verbundwerkstoffe in Fahrgestelle und Strukturbauteile von Elektrofahrzeugen und beschleunigen so deren Verbreitung. Auch die zunehmende Anwendung in Nutzfahrzeugen, Sportwagen und urbanen Mobilitätslösungen trägt zum rasanten Wachstum des Automobilsektors bei.

Regionale Analyse des nordamerikanischen Marktes für Hochleistungsverbundwerkstoffe

- Die USA dominierten 2025 den nordamerikanischen Markt für Hochleistungsverbundwerkstoffe mit dem größten Umsatzanteil. Dies ist auf ihre etablierten Industrien in den Bereichen Luft- und Raumfahrt, Automobil und Verteidigung, ihre umfassenden Forschungs- und Entwicklungskapazitäten sowie die starke Verbreitung von leichten Hochleistungsmaterialien zurückzuführen.

- Die fortschrittliche Fertigungsinfrastruktur und das technologische Know-how des Landes im Bereich der Verbundwerkstoffproduktion sichern eine stetige Nachfrage nach Luft- und Raumfahrtkomponenten, Strukturbauteilen für die Automobilindustrie und industriellen Anwendungen.

- Die Präsenz bedeutender inländischer Verbundwerkstoffhersteller, kontinuierliche Innovationen bei Harzsystemen und Fasertechnologien sowie strategische Kooperationen mit OEMs sichern die führende Position des Landes. Steigende Investitionen in Kapazitätserweiterung, Automatisierung und nachhaltige Produktionsverfahren verbessern die betriebliche Effizienz und stärken das Marktwachstum.

Markteinblicke in den Markt für hochentwickelte Verbundwerkstoffe in Kanada und Nordamerika

Kanada wird im nordamerikanischen Markt für Hochleistungswerkstoffe voraussichtlich von 2026 bis 2033 das schnellste jährliche Wachstum verzeichnen. Unterstützt wird dies durch die zunehmende industrielle Aktivität in den Bereichen Luft- und Raumfahrt, Automobilindustrie und Infrastrukturentwicklung. Der Fokus des Landes auf Leichtbaumaterialien für kraftstoffsparende und energieeffiziente Anwendungen treibt die Marktnachfrage an. Kanadische Hersteller von Verbundwerkstoffen setzen verstärkt auf fortschrittliche Fasertechnologien, Harzsysteme und nachhaltige Produktionsverfahren, um den industriellen Anforderungen gerecht zu werden. Strategische Partnerschaften mit globalen OEMs und staatlich geförderte Initiativen zur Innovationsförderung im Bereich Hochleistungswerkstoffe stärken Kanadas Wettbewerbsposition. Der Fokus des Landes auf Ressourcenoptimierung und die Modernisierung von Produktionsanlagen dürfte im gesamten Prognosezeitraum ein signifikantes Marktwachstum bewirken.

Markteinblicke für hochentwickelte Verbundwerkstoffe in Mexiko und Nordamerika

Für Mexiko wird zwischen 2026 und 2033 ein stetiges Wachstum erwartet, angetrieben durch die Expansion der Automobil-, Luft- und Raumfahrt- sowie der industriellen Fertigung. Diese Branchen setzen zunehmend auf fortschrittliche Verbundwerkstoffe für leichte und hochfeste Anwendungen. Die Integration des Landes in nordamerikanische Lieferketten stützt die Nachfrage nach kosteneffizienten, leistungsstarken Verbundwerkstoffen. Steigende Investitionen in inländische Produktionsanlagen für Verbundwerkstoffe und die Einführung automatisierter und energieeffizienter Fertigungstechnologien tragen zur Marktexpansion bei. Kooperationen zwischen mexikanischen Herstellern und internationalen OEMs verbessern die Materialqualität, die Produktionskapazität und das technologische Know-how. Mexikos Fokus auf industrielle Effizienz, Infrastrukturentwicklung und nachhaltige Produktion untermauert seinen stabilen Wachstumskurs auf dem regionalen Markt.

Marktanteil von Hochleistungsverbundwerkstoffen in Nordamerika

Die Industrie für hochentwickelte Verbundwerkstoffe wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- TORAY INDUSTRIES, INC. (Japan)

- Teijin Aramid BV (Niederlande)

- Mitsubishi Chemical Group Corporation (Japan)

- Huntsman International LLC. (USA)

- BASF SE (Deutschland)

- Solvay (Belgien)

- Akzo Nobel NV (Niederlande)

- DuPont (USA)

- Hexion (USA)

- Honeywell International Inc. (USA)

- Owens Corning (USA)

- Formosa Plastics Corporation (Taiwan)

- Henkel AG & Co. KGaA (Deutschland)

- Lyondellbasell Industries Holdings BV (Niederlande)

- Hanwha Solutions (Südkorea)

- SGL Carbon (Deutschland)

- Kemira (Finnland)

- HB Fuller (USA)

- Evonik Industries AG (Deutschland)

Neueste Entwicklungen auf dem nordamerikanischen Markt für Hochleistungsverbundwerkstoffe

- Im Mai 2025 präsentierte Solvay ein vollständig recycelbares thermoplastisches Verbundharz, das speziell für Batteriegehäuse von Elektrofahrzeugen entwickelt wurde. Diese Innovation reduziert das Gesamtgewicht der Fahrzeuge deutlich und erfüllt gleichzeitig strenge Brandschutz- und Strukturnormen. Die Entwicklung fördert den Einsatz von Verbundwerkstoffen im schnell wachsenden Markt für Elektrofahrzeuge und erfüllt die Anforderungen der Hersteller an leichte, langlebige und umweltverträgliche Materialien. Durch die Kombination von Leistungsfähigkeit und Recyclingfähigkeit treibt Solvay den Wandel hin zu umweltfreundlicheren, leistungsstarken Lösungen in der Automobilindustrie und anderen energieintensiven Anwendungen voran.

- Im Januar 2025 brachte Mallinda sein Vitrimax VHM (Versatile Hot Melt)-Harz auf den Markt, ein Vitrimer-basiertes System, das die hohe mechanische Festigkeit von Duroplasten mit der Recyclingfähigkeit von Thermoplasten vereint. Dieser Durchbruch ermöglicht das wirtschaftliche Recycling und die Wiederverwendung von Verbundwerkstoffabfällen, reduziert Abfall und unterstützt Kreislaufwirtschaft. Die Einführung von Vitrimax VHM stärkt die Nachhaltigkeit von modernen Verbundwerkstoffen und spricht Hersteller in der Automobil-, Luft- und Raumfahrt- sowie Industriebranche an, die umweltfreundliche und leistungsstarke Materialien suchen.

- Im Juni 2022 gab die Hexcel Corporation bekannt, dass Sikorsky, ein Unternehmen von Lockheed Martin, einen langfristigen Vertrag zur Lieferung fortschrittlicher Verbundwerkstoffstrukturen für das Schwerlasthubschrauberprogramm CH-53K King Stallion vergeben hat. Dieser Vertrag unterstreicht die zunehmende Bedeutung von leichten, hochfesten Verbundwerkstoffen in kritischen Anwendungen der Luft- und Raumfahrt, wo Leistung und Langlebigkeit von höchster Wichtigkeit sind. Die Zusammenarbeit verdeutlicht zudem die strategische Bedeutung fortschrittlicher Verbundwerkstoffe in Verteidigungsprogrammen und deren Beitrag zur Steigerung der Flugzeugeffizienz, der Nutzlastkapazität und der Betriebssicherheit.

- Im März 2022 erweiterte die Hexcel Corporation ihre Fertigungsstätte für technische Kernkomponenten in Marokko, um der steigenden Nachfrage nach leichten, hochentwickelten Verbundwerkstoffen aus der Luft- und Raumfahrtindustrie gerecht zu werden. Die Erweiterung stärkt die globale Lieferkette von Hexcel und ermöglicht schnellere Lieferungen sowie eine bessere Unterstützung von Großprojekten in der Luft- und Raumfahrt. Dieser Schritt spiegelt auch den branchenweiten Trend zu verstärkten Investitionen in Produktionskapazitäten wider, um die wachsende Nachfrage nach Materialien zu befriedigen, die das Gewicht reduzieren, die Treibstoffeffizienz verbessern und die strukturelle Integrität von Flugzeugen und Raumfahrzeugen gewährleisten.

- Im Februar 2022 eröffnete Teijin Automotive Technologies, die wichtigste Einheit des Teijin-Konzerns im Bereich Automobilverbundwerkstoffe, eine neue, 39.000 Quadratmeter große Produktionsstätte in Changzhou, Provinz Jiangsu, China, innerhalb der Wujin National Hi-Tech Industrial Zone. Das Unternehmen kündigte außerdem den Bau einer dritten, 13.000 Quadratmeter großen Anlage an, deren Fertigstellung für Sommer 2023 geplant ist. Diese Erweiterungen stärken die Produktionskapazitäten von Teijin, unterstützen den wachsenden Markt für Automobilverbundwerkstoffe in China und ermöglichen es dem Unternehmen, leichte, hochfeste Materialien für Fahrzeugstrukturbauteile zu liefern und so die Leistung und Kraftstoffeffizienz im Automobilsektor zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.