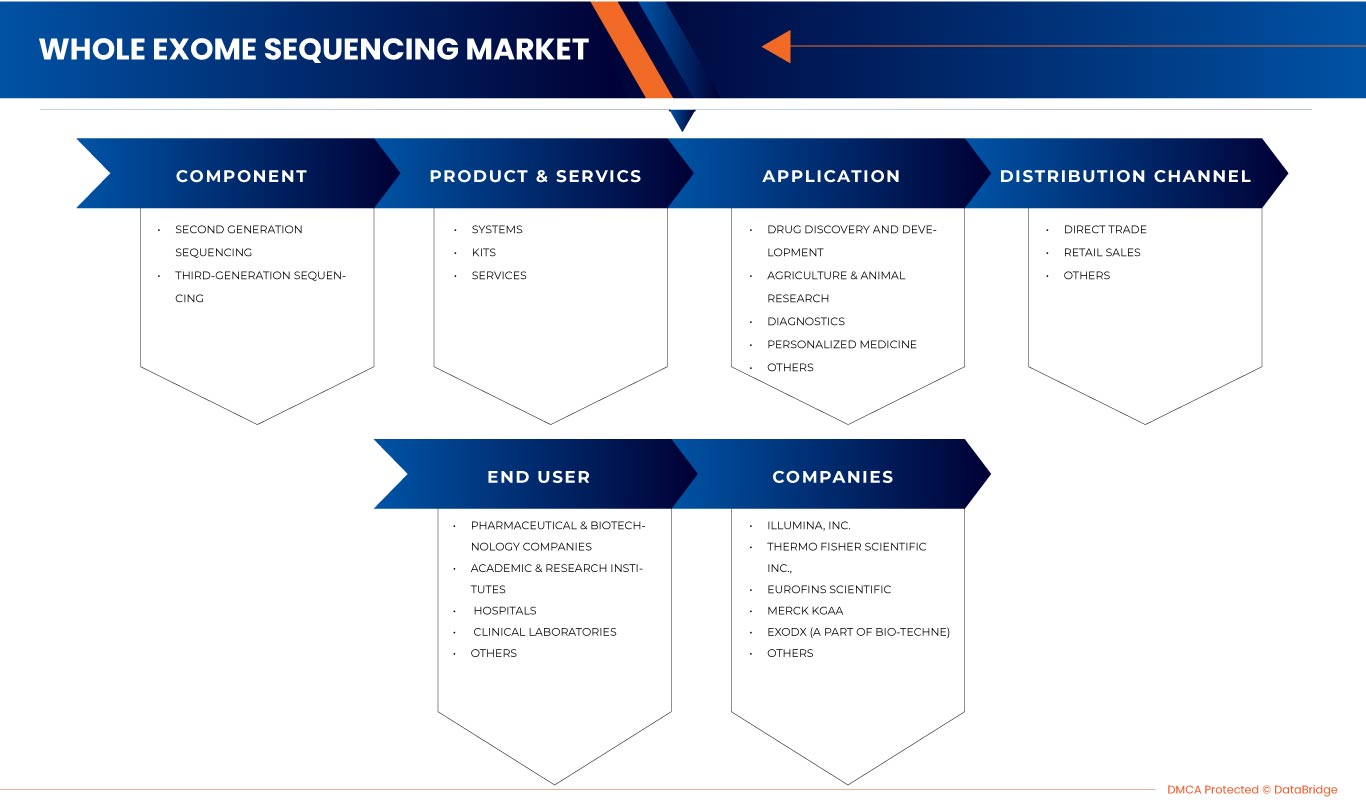

Markt für die Sequenzierung des gesamten Exoms im Nahen Osten und in Afrika, nach Komponente (Sequenzierung der zweiten und dritten Generation), Produkt und Dienstleistung (Systeme, Kits und Dienstleistungen), Anwendung (Arzneimittelforschung und -entwicklung, Agrar- und Tierforschung, Diagnostik, personalisierte Medizin und andere), Endbenutzer (Pharma- und Biotechnologieunternehmen, akademische und Forschungsinstitute, Krankenhäuser und Kliniken, klinische Labore und andere), Vertriebskanal (Direkthandel, Einzelhandelsverkäufe und andere), Branchentrends und Prognose bis 2029.

Marktanalyse und Einblicke

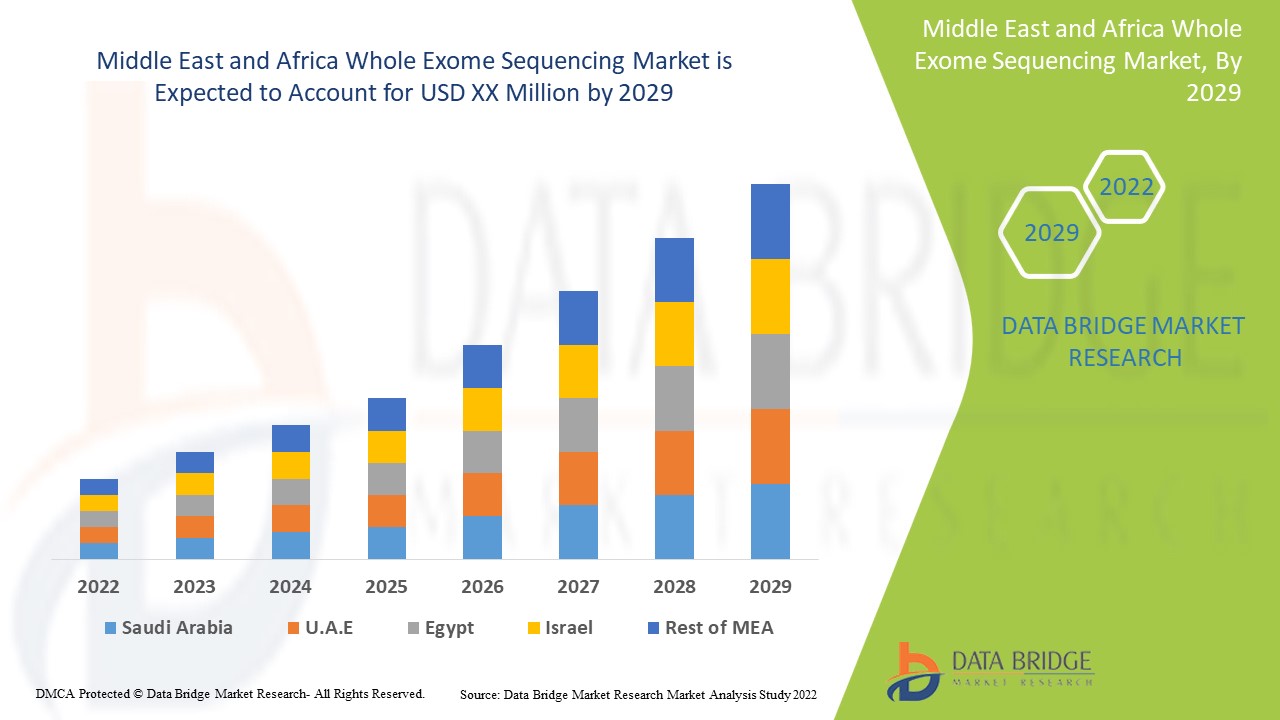

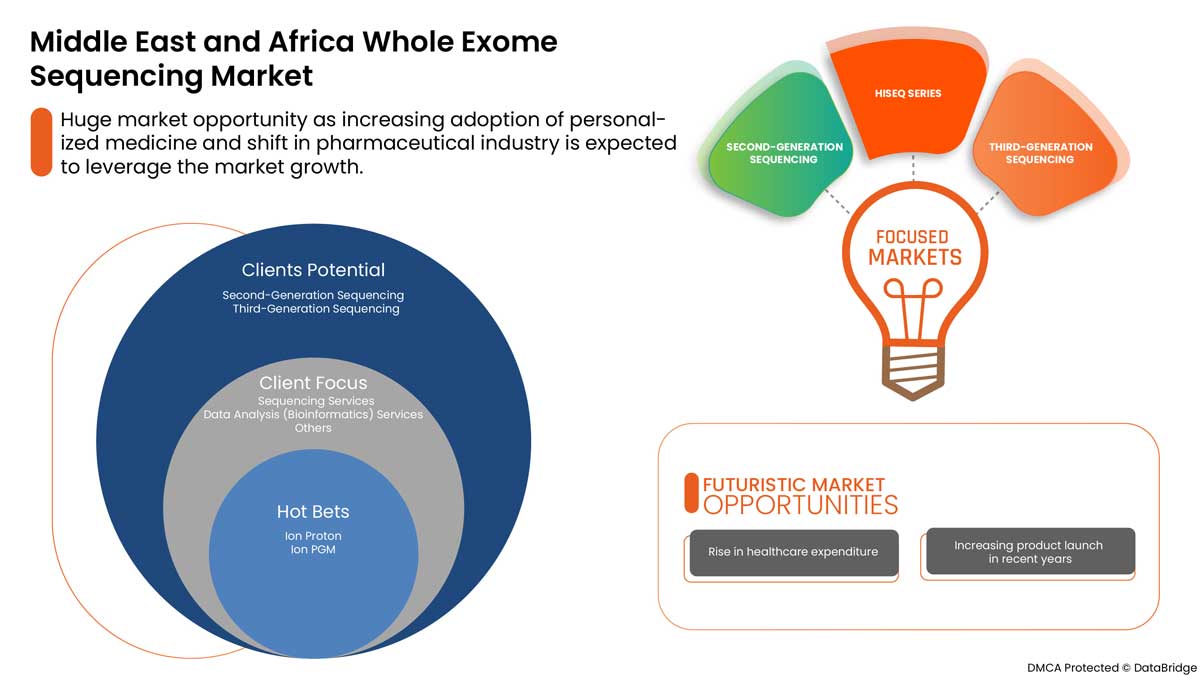

Es wird erwartet, dass der Markt für Exomsequenzierung im Nahen Osten und Afrika im Prognosezeitraum von 2022 bis 2029 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,2 % wächst. Der Anstieg der Gesundheitsausgaben und -finanzierung sind die Haupttreiber, die die Nachfrage des Marktes im Prognosezeitraum ankurbelten.

Nebenwirkungen, die mit der Behandlung der Exomsequenzierung verbunden sind, können jedoch das zukünftige Wachstum des Marktes für die Exomsequenzierung behindern. Die Annahme strategischer Allianzen wie Partnerschaften und Übernahmen durch wichtige Marktteilnehmer bietet Chancen für das Wachstum des Marktes für die Exomsequenzierung.

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 |

|

Quantitative Einheiten |

Umsatz in Millionen USD, Preise in USD |

|

Abgedeckte Segmente |

Nach Komponente (Sequenzierung der zweiten und dritten Generation ), Produkt und Service (Systeme, Kits und Services), Anwendung (Arzneimittelforschung und -entwicklung, Landwirtschaft und Tierforschung, Diagnostik, personalisierte Medizin und andere), Endbenutzer (Pharma- und Biotechnologieunternehmen, akademische und Forschungsinstitute, Krankenhäuser und Kliniken, klinische Labore und andere), Vertriebskanal (Direkthandel, Einzelhandel und andere) |

|

Abgedeckte Länder |

Saudi-Arabien, Südafrika, Vereinigte Arabische Emirate, Israel, Ägypten, Rest des Nahen Ostens und Afrikas |

|

Abgedeckte Marktteilnehmer |

Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx (ein Teil von Bio-Techne), FOUNDATION MEDICINE, INC. (Eine Tochtergesellschaft von F. Hoffmann-La Roche Ltd), GeneFirst Limited, CeGaT GmbH, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta US Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics (Eine Tochtergesellschaft von PerkinElmer Inc.), GeneDx, LLC, Psomagen, Integrated DNA Technologies, Inc. und andere. |

Marktdefinition für die Sequenzierung des gesamten Exoms

Whole Exome ist eine genomische Technik zur Sequenzierung aller proteinkodierenden Regionen von Genen in einem Genom. Die Whole Exome-Sequenzierung steht Patienten zur Verfügung, die nach einer einheitlichen Diagnose für mehrere Erkrankungen suchen. Ein Laborverfahren, das zur Bestimmung der Nukleotidsequenz hauptsächlich der exonischen (oder proteinkodierenden) Regionen des Genoms einer Person und verwandter Sequenzen verwendet wird, die etwa 1 % der vollständigen DNA-Sequenz ausmachen, auch WES genannt. Whole Exome-Sequenzierung ist eine weit verbreitete Methode zur Sequenzierung des gesamten Exoms, bei der die proteinkodierenden Regionen des Genoms sequenziert werden. Das menschliche Exom macht weniger als 2 % des Genoms aus, enthält jedoch ~85 % der bekannten krankheitsbezogenen Varianten, was diese Methode zu einer kostengünstigen Alternative zur Whole Genome-Sequenzierung macht.

Die Exomsequenzierung mittels Exomanreicherung kann codierende Varianten in einer Vielzahl von Anwendungen effizient erkennen, darunter Populationsgenetik, genetische Krankheiten und Krebsforschung. Das Wachstum des globalen Marktes für die vollständige Exomsequenzierung ist auf die Reduzierung von Zeit und Kosten für die Sequenzierung zurückzuführen. Mit der Entwicklung neuer Technologien und der Behandlung von Krebsheilmitteln hat der Markt für die vollständige Exomsequenzierung in der klinischen Onkologie in den kommenden Jahren ein enormes Potenzial.

Marktdynamik für die Sequenzierung des gesamten Exoms im Nahen Osten und Afrika

Treiber

- Zunehmende Nutzung der Sequenzierung der nächsten Generation (NGS)

Da die Genomik-fokussierte Pharmakologie bei der Behandlung verschiedener chronischer Krankheiten, insbesondere von Krebs, eine immer größere Rolle spielt, entwickelt sich die Sequenzierung der nächsten Generation (NGS) zu einem leistungsfähigen Instrument, das tiefere und präzisere Einblicke in die molekularen Grundlagen einzelner Tumore und spezifischer Rezeptoren bietet.

NGS bietet im Vergleich zu herkömmlichen Methoden Vorteile in puncto Genauigkeit, Sensibilität und Geschwindigkeit, die das Potenzial haben, die Onkologie erheblich zu verändern. Da NGS mehrere Gene in einem einzigen Test untersuchen kann, ist es nicht mehr erforderlich, mehrere Tests anzuordnen, um die ursächliche Mutation zu identifizieren.

- Zunehmender Einsatz gezielter Sequenzierungsmethoden

Da die Genomik-fokussierte Pharmakologie bei der Behandlung verschiedener chronischer Krankheiten, insbesondere von Krebs, eine immer größere Rolle spielt, entwickelt sich die Sequenzierung der nächsten Generation (NGS) zu einem leistungsfähigen Instrument, das tiefere und präzisere Einblicke in die molekularen Grundlagen einzelner Tumore und spezifischer Rezeptoren bietet.

NGS bietet im Vergleich zu herkömmlichen Methoden Vorteile in puncto Genauigkeit, Sensibilität und Geschwindigkeit, die das Potenzial haben, die Onkologie erheblich zu verändern. Da NGS mehrere Gene in einem einzigen Test untersuchen kann, ist es nicht mehr erforderlich, mehrere Tests anzuordnen, um die ursächliche Mutation zu identifizieren.

Zurückhaltung

-

Weniger umfassende Abdeckung von Exons

Nicht alle Exons werden vollständig erfasst. Das wichtige Exon ist möglicherweise nicht in den aktuellen Standardannotationen des menschlichen Genoms enthalten; und mit der aktuellen WES-Technologie ist es äußerst mühsam, 100 % des Exoms abzudecken. Folglich bleiben krankheitsverursachende Varianten in diesen „fehlenden“ Exons unentdeckt.

WES hat eine geringe Sensitivität für strukturelle Variationen, daher ist die Erkennung begrenzt. Obwohl einige CNVs, einschließlich Indels und Duplikationen, durch WES erkannt werden können, bedeutet die technische Einschränkung, dass andere wahrscheinlich übersehen werden.

Gelegenheit

-

Strategische Initiativen des wichtigsten Marktteilnehmers

Die Nachfrage nach Exomsequenzierung steigt auf dem Markt aufgrund der zunehmenden Häufigkeit genetischer Erkrankungen und der zunehmenden geriatrischen Bevölkerung in der gesamten Region. Daher haben die führenden Marktteilnehmer die Strategie der Zusammenarbeit mit anderen Marktteilnehmern umgesetzt, um den Geschäftsbetrieb und die Rentabilität zu verbessern.

Herausforderung

- Ethische und rechtliche Fragen im Zusammenhang mit der Sequenzierung des gesamten Exoms

Schnelle Fortschritte bei Hochdurchsatz-Genomtechnologien und Next-Generation-Sequenzierung machen medizinische Genomforschung leichter zugänglich und erschwinglicher, einschließlich der Sequenzierung des gesamten Genoms und Exoms von Patienten und Kontrollpersonen, um genetische Faktoren aufzuklären, die Krankheiten zugrunde liegen. Die Fortschritte bei Hochdurchsatz-Genomtechnologien und Next-Generation-Sequenzierungsmethoden (NGS) in den letzten Jahren haben den Umfang menschlicher Genomstudien verändert. Diese Fortschritte haben es möglich gemacht, routinemäßig Studien zur Sequenzierung des gesamten Exoms (WES) durchzuführen.

Aufgrund des groß angelegten, kollaborativen Charakters der Studien sind ethische und rechtliche Fragen zunehmend besorgniserregend und haben wichtige Auswirkungen auf Afrika. Die afrikanischen Bevölkerungen sind von besonderem Interesse, denn obwohl sie die höchste genetische Vielfalt aufweisen, in einer Vielzahl von Umwelt- und Kulturumgebungen leben und unter einer hohen Krankheitslast leiden, die mit genomischen Ansätzen untersucht werden könnte, sind sie im WES mit rechtlichen Problemen konfrontiert.

Auswirkungen von COVID-19 auf den Markt für vollständige Exomsequenzierung

COVID-19 hat zu einem erheblichen Anstieg der Nachfrage nach medizinischem Bedarf sowohl bei medizinischem Fachpersonal als auch bei der breiten Öffentlichkeit als Vorsorgemaßnahme geführt. Hersteller dieser Artikel haben die Möglichkeit, von der gestiegenen Nachfrage nach medizinischem Bedarf zu profitieren, indem sie eine stetige Versorgung des Marktes mit persönlicher Schutzausrüstung sicherstellen. Es wird erwartet, dass COVID-19 große Auswirkungen auf den gesamten Markt für Exomsequenzierung haben wird.

Jüngste Entwicklung

- Im Mai 2022 haben sich Thermo Fisher Scientific, der weltweit führende Anbieter im Dienste der Wissenschaft, und das Qatar Genome Program (QGP), ein Mitglied der Qatar Foundation (QF), zusammengeschlossen, um die Genomforschung und die klinischen Anwendungen der prädiktiven Genomik in Katar zu beschleunigen und so die Vorteile der Präzisionsmedizin auf die arabische Bevölkerung weltweit auszuweiten. Dies hat dem Unternehmen geholfen, seine Präsenz auszubauen.

- Im März 2022 gründeten mehrere führende Genomikunternehmen und -labore, darunter Illumina, Fulgent Genetics, Invitae, GeneDx und PerkinElmer Genomics, die CardioGenomic Testing Alliance (CGTA), eine kollaborative Gruppe, deren Ziel darin besteht, das Bewusstsein für Genomtests in der Kardiologie zu schärfen und deren Nutzung zu fördern. Die CGTA möchte Gesundheitsdienstleister und andere Interessenvertreter über den Wert solcher Tests aufklären, um die Einhaltung bestehender Richtlinien professioneller medizinischer Gesellschaften sicherzustellen, das medizinische Management und Kaskadentests zu verbessern und die klinischen Ergebnisse zu verbessern. Dies hat dem Unternehmen geholfen, die Richtlinien einzuhalten.

Marktsegmentierung für die vollständige Exomsequenzierung im Nahen Osten und Afrika

Der Markt für Exomsequenzierung im Nahen Osten und Afrika ist nach Komponenten, Produkten und Dienstleistungen, Anwendungen, Endnutzern und Vertriebskanälen segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

Komponente

- Sequenzierung der zweiten Generation

- Sequenzierung der dritten Generation

Auf der Grundlage der Komponenten ist der Markt für die Exomsequenzierung im Nahen Osten und in Afrika in Sequenzierung der zweiten Generation und Sequenzierung der dritten Generation segmentiert.

Produkte und Dienstleistungen

- Systeme

- Bausätze

- Dienstleistungen

Auf der Grundlage von Produkt und Service ist der Markt für die Exomsequenzierung im Nahen Osten und Afrika in Systeme, Kits und Services segmentiert.

Anwendung

- Diagnose

- Arzneimittelforschung und -entwicklung

- Personalisierte Medizin

- Landwirtschaft und Tierforschung

- Sonstiges

Auf der Grundlage der Anwendung ist der Markt für die Exomsequenzierung im Nahen Osten und Afrika in die Bereiche Arzneimittelforschung und -entwicklung, Agrar- und Tierforschung, Diagnostik, personalisierte Medizin und andere unterteilt.

Endbenutzer

- Krankenhäuser und Kliniken

- Pharma- und Biotechnologieunternehmen

- Akademische und Forschungsinstitute

- Klinische Labore

- Sonstiges

Auf der Grundlage des Endbenutzers ist der Markt für die Exomsequenzierung im Nahen Osten und in Afrika in Pharma- und Biotechnologieunternehmen, Hochschul- und Forschungsinstitute, Krankenhäuser und Kliniken, klinische Labore und andere unterteilt.

Vertriebskanal

- Direkthandel

- Einzelhandelsumsätze

- Sonstiges

Auf der Grundlage der Vertriebskanäle ist der Markt für die gesamte Exomsequenzierung im Nahen Osten und Afrika in Direkthandel, Einzelhandelsverkäufe und Sonstiges segmentiert.

Gesamtexomsequenzierung Markt – Länderebene Analyse

Der gesamte Markt für Exomsequenzierung wird analysiert und Informationen zur Marktgröße werden nach Komponente, Produkt und Service, Anwendung, Endbenutzer und Vertriebskanal bereitgestellt.

Die im gesamten Marktbericht zur Exomsequenzierung abgedeckten Länder sind Saudi-Arabien, Südafrika, die Vereinigten Arabischen Emirate, Israel, Ägypten und der Rest des Nahen Ostens und Afrikas.

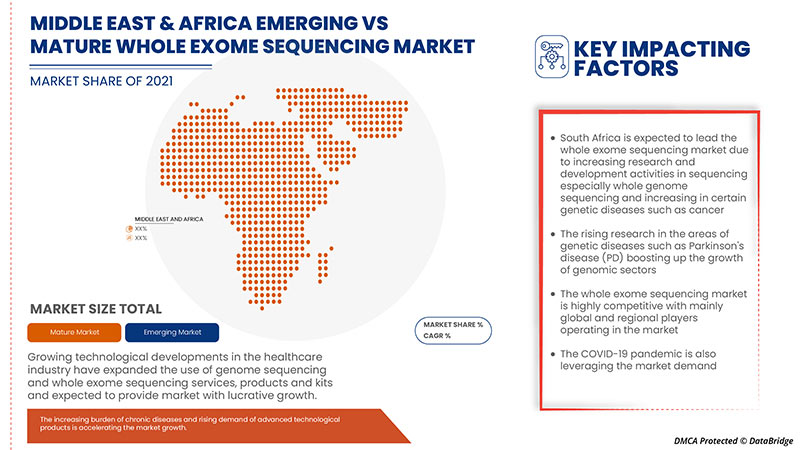

Südafrika wird im Prognosezeitraum dominieren, da die Akzeptanz von Sequenzierungsmethoden der nächsten Generation zur Vorhersage und Behandlung zunimmt. Südafrika wird voraussichtlich aufgrund der Überwachung verschiedener chronischer Krankheiten wie Krebs wachsen.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Middle East & Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Whole exome sequencing market also provides you with detailed market analysis for every country growth in healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, impact of regulatory scenarios, and trending parameters regarding whole exome sequencing market.

Competitive Landscape and Whole Exome Sequencing Market Share Analysis

Whole exome sequencing market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to Whole exome sequencing market.

The major companies which are dealing in the s Whole exome sequencing market are Thermo Fisher Scientific Inc., QIAGEN, Illumina, Inc., Beckman Coulter, Inc., Eurofins Scientific, BIONEER CORPORATION, ExoDx (a part of Bio-Techne), FOUNDATION MEDICINE, INC. (A subsidiary of F. Hoffmann-La Roche Ltd), GeneFirst Limited, CeGaT GmbH, Meridian, Merck KGaA, SOPHiA GENETICS, Azenta U.S. Inc., CD Genomics, Twist Bioscience, PerkinElmer Genomics (A Subsidiary of PerkinElmer Inc.), GeneDx, LLC, Psomagen, Integrated DNA Technologies, Inc., among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRIAL INSIGHTS:

4.4 CONCLUSION

5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USAGE OF TARGETED SEQUENCING METHODS

6.1.2 INCREASE IN THE ADOPTION OF NEXT GENERATION SEQUENCING

6.1.3 INCREASING DIAGNOSTICS APPLICATIONS OF WHOLE EXOME SEQUENCING

6.1.4 INCREASE TREND TOWARD PERSONALIZED MEDICATION

6.2 RESTRAINTS

6.2.1 LESS COMPREHENSIVE COVERAGE OF EXONS

6.2.2 CYBER SECURITY CONCERNS IN GENOMICS

6.3 OPPORTUNITIES

6.3.1 STRATEGIC INITIATIVES BY THE KEY MARKET PLAYER

6.3.2 INCREASING PRODUCT LAUNCHES IN RECENT YEARS

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 ETHICAL AND LEGAL ISSUES RELATED TO WHOLE EXOME SEQUENCING

7 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SECOND-GENERATION SEQUENCING

7.2.1 SEQUENCING BY SYNTHESIS (SBS)

7.2.2 SEQUENCING BY HYBRIDIZATION (SBH) AND SEQUENCING BY LIGATION (SBL)

7.3 THIRD-GENERATION SEQUENCING

8 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE

8.1 OVERVIEW

8.2 SYSTEMS

8.2.1 HISEQ SERIES

8.2.1.1 HISEQ 2500

8.2.1.2 HISEQ 1500

8.2.2 MISEQ SERIES

8.2.3 ION TORRENT PLATFORMS

8.2.3.1 ION PROTON

8.2.3.2 ION PGM

8.2.4 OTHERS

8.3 KITS

8.3.1 DNA FRAGMENTATION, END REPAIR, A-TAILING, AND SIZE SELECTION KITS

8.3.2 LIBRARY PREPARATION KITS

8.3.3 TARGET ENRICHMENT KITS

8.3.4 OTHERS

8.4 SERVICES

8.4.1 SEQUENCING SERVICES

8.4.2 DATA ANALYSIS (BIOINFORMATICS) SERVICES

8.4.3 OTHERS

9 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISCOVERY AND DEVELOPMENT

9.3 AGRICULTURE & ANIMAL RESEARCH

9.4 DIAGNOSTICS

9.5 PERSONALIZED MEDICINE

9.6 OTHERS

10 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER

10.1 OVERVIEW

10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

10.3 ACADEMIC & RESEARCH INSTITUTES

10.4 HOSPITALS AND CLINICS

10.5 CLINICAL LABORATORIES

10.6 OTHERS

11 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TRADE

11.3 RETAIL SALES

11.4 OTHERS

12 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 SAUDI ARABIA

12.1.3 U.A.E

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 COMPANY PROFILE

14.1 PERKINELMER GENOMICS (A SUBSIDIARY OF PERKINELMER INC.)

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COM PANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MERCK KGAA

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COM PANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 EXODX (A PART OF BIO-TECHNE)

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COM PANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 THERMO FISHER SCIENTIFIC INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COM PANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 FOUNDATION MEDICINE, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COM PANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AZENTA US, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 BECKMAN COULTER, INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BIONEER CORPORATION

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 CD GENOMICS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 CEGAT GMBH

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 EUROFINS SCIENTIFIC

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 GENEDX, LLC

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 GENEFIRST LIMITED.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 ILLUMINA, INC

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 INTEGRATED DNA TECHNOLOGIES, INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 MERIDIAN BIOSCIENCE, INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 PSOMAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 QIAGEN

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 SOPHIA GENETICS

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TWIST BIOSCIENCE

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA THIRD-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA DRUG DISCOVERY AND DEVELOPMENT IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA AGRICULTURE & ANIMAL RESEARCH IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DIAGNOSTICS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PERSONALIZED MEDICINE IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA ACADEMIC & RESEARCH INSTITUTES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA HOSPITALS AND CLINICS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA CLINICAL LABORATORIES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA DIRECT TRADE IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RETAIL SALES IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN WHOLE EXOME SEQUENCING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST AND AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST AND AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST AND AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 43 SOUTH AFRICA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 44 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 45 SOUTH AFRICA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 46 SOUTH AFRICA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 47 SOUTH AFRICA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 48 SOUTH AFRICA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 49 SOUTH AFRICA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 50 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 54 SAUDI ARABIA SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 55 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 56 SAUDI ARABIA SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 64 U.A.E WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 65 U.A.E SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 66 U.A.E WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 70 U.A.E KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 71 U.A.E SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 72 U.A.E WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 73 U.A.E WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 74 U.A.E WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 76 ISRAEL SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 78 ISRAEL SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 79 ISRAEL HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 80 ISRAEL ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 81 ISRAEL KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 82 ISRAEL SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 83 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 84 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 ISRAEL WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 EGYPT WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 EGYPT SECOND-GENERATION SEQUENCING IN WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 88 EGYPT WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT SYSTEMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT HISEQ SERIES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT ION TORRENT PLATFORMS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT KITS IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SERVICES IN WHOLE EXOME SEQUENCING MARKET, BY PRODUCT AND SERVICE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT WHOLE EXOME SEQUENCING MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 EGYPT WHOLE EXOME SEQUENCING MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 96 EGYPT WHOLE EXOME SEQUENCING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 97 REST OF MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASE IN USE OF WES TECHNOLOGY FOR NEW SCIENTIFIC APPLICATIONS AND INCREASING THE PREFERENCE OF WES OVER WHOLE-GENOME SEQUENCING IS ITS LOW-COST SEQUENCING CAPABILITY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 THE INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING (WES) MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET

FIGURE 15 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2021

FIGURE 16 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 17 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 18 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 19 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2021

FIGURE 20 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, 2022-2029 (USD MILLION)

FIGURE 21 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, CAGR (2022-2029)

FIGURE 22 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY PRODUCT AND SERVICE, LIFELINE CURVE

FIGURE 23 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2021

FIGURE 24 LOBAL WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 25 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 26 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2021

FIGURE 28 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, CAGR (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: SNAPSHOT (2021)

FIGURE 36 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2021)

FIGURE 37 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 MIDDLE EAST AND AFRICA WHOLE EXOME SEQUENCING MARKET: BY COMPONENT (2022-2029)

FIGURE 40 MIDDLE EAST & AFRICA WHOLE EXOME SEQUENCING MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.