Markt für Paketsortiersysteme im Nahen Osten und Afrika, nach Typ (lineare Paketsortiersysteme und Loop-Paketsortiersysteme), Angebot (Hardware, Software und Dienstleistungen), Fachgröße (klein, mittel und groß), Paketbearbeitungskapazität (weniger als 20000 Pakete/Std., 20000 bis 30000 Pakete/Std. und mehr als 30000 Pakete/Std.), Endbenutzer (Logistik, E-Commerce, Pharmazeutische und medizinische Versorgung, Lebensmittel und Getränke und andere), Land (VAE, Saudi-Arabien, Israel, Ägypten, Südafrika und Rest des Nahen Ostens und Afrikas), Markttrends und Prognose bis 2029

Marktanalyse und Einblicke: Markt für Paketsortiersysteme im Nahen Osten und in Afrika

Marktanalyse und Einblicke: Markt für Paketsortiersysteme im Nahen Osten und in Afrika

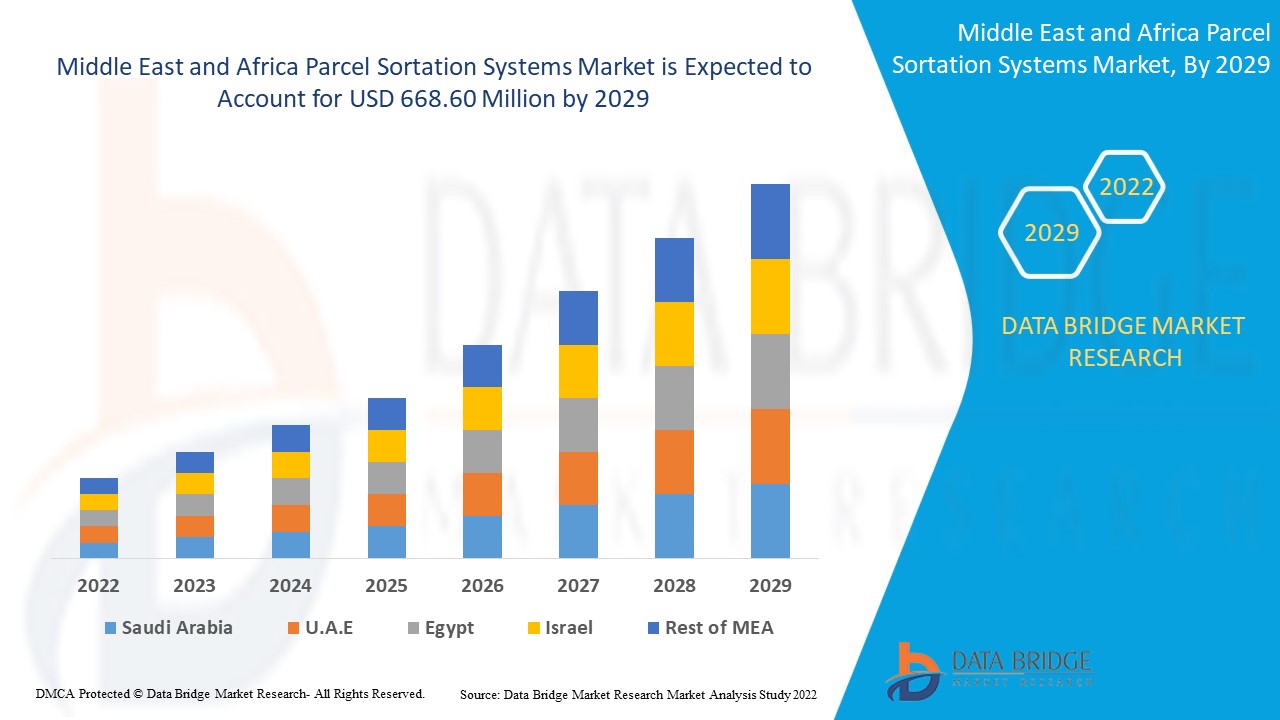

Es wird erwartet, dass der Markt für Paketsortiersysteme im Nahen Osten und Afrika im Prognosezeitraum von 2022 bis 2029 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2022 bis 2029 mit einer durchschnittlichen jährlichen Wachstumsrate von 12,4 % wächst und bis 2029 voraussichtlich 668,60 Millionen erreichen wird.

Bei der Paketsortierung werden Artikel auf einem Fördersystem identifiziert und mithilfe verschiedener Geräte, die von aufgabenspezifischer Software gesteuert werden, an bestimmte Ziele umgeleitet . Sie können auch alle zutreffenden Etiketten lesen oder sogar neue anbringen. Diese Vorgänge sind unglaublich wichtig, um sicherzustellen, dass die Pakete ihr endgültiges Ziel erreichen, aber die Organisation der Lieferungen ist die Aufgabe, die in dieser Hinsicht den größten Nutzen bringt. Die Paketsortierung sortiert die Behälter in die richtigen Lieferbereiche, um sie auf den Weg zu ihrem endgültigen Ziel zu bringen. Die Sortierung kann einen großen Einfluss auf die Effizienz Ihrer Fulfillment-Automatisierung haben. Pakete gibt es in verschiedenen Formen und Größen und müssen entsprechend angeordnet werden. Fördersysteme und andere mechanische Prozesse können dazu beitragen, Ihre Fulfillment -Automatisierung zu optimieren und die Dinge in Bewegung zu halten. In einem Distributionszentrum kann die Paketsortierung in verschiedenen Schritten des Auftragserfüllungsprozesses angewendet werden, z. B. beim Empfang, Kommissionieren, Verpacken und Versenden. Die Auswahl der Sortiersysteme wird unter Berücksichtigung der folgenden Merkmale getroffen, z. B. der Zerbrechlichkeit des zu handhabenden Materials, der Produktgeometrie, der Materialien , der Tarifüberlegungen, der Sortierfunktion, der verfügbaren Stellfläche und anderer.

Es wird zunehmend in die Logistikinfrastruktur in der Stadtplanung investiert, was ein wichtiger Faktor für das Wachstum des Marktes ist. Die Entwicklung von Technologien wie KI und Robotern für Sortiervorgänge hat das Wachstum des Marktes angekurbelt. Die von der Regierung regulierte Einbindung von Automatisierungstechnologien kann jedoch eine erhebliche Einschränkung für die Entwicklung des Marktes darstellen. Im Nahen Osten und in Afrika werden zunehmend automatisierte Sortiersysteme an Flughäfen eingesetzt, um den zunehmenden Verkehr zu bewältigen, was Chancen auf dem Markt eröffnet. Hohe Kundenerwartungen in Bezug auf Lieferzeiten können eine große Herausforderung für das Wachstum des Marktes darstellen.

Dieser Marktbericht zu Paketsortiersystemen enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Marktumfang und Marktgröße für Paketsortiersysteme im Nahen Osten und Afrika

Marktumfang und Marktgröße für Paketsortiersysteme im Nahen Osten und Afrika

Der Markt für Paketsortiersysteme im Nahen Osten und Afrika ist basierend auf Typ, Angebot, Behältergröße, Paketbearbeitungskapazität und Endbenutzer in fünf wichtige Segmente unterteilt.

- Auf der Grundlage des Typs ist der Markt für Paketsortiersysteme im asiatisch-pazifischen Raum in lineare Paketsortiersysteme und Loop-Paketsortiersysteme unterteilt. Im Jahr 2022 wird das Segment der linearen Paketsortiersysteme voraussichtlich den Markt dominieren, da es mehrere Vorteile bietet, darunter einen höheren Durchsatz und vergleichsweise weniger Platzbedarf. Die kleinen und mittleren Fulfillment-Zentren in der Region setzen dieses System zunehmend ein, um die gestiegenen Paketmengen zu bewältigen

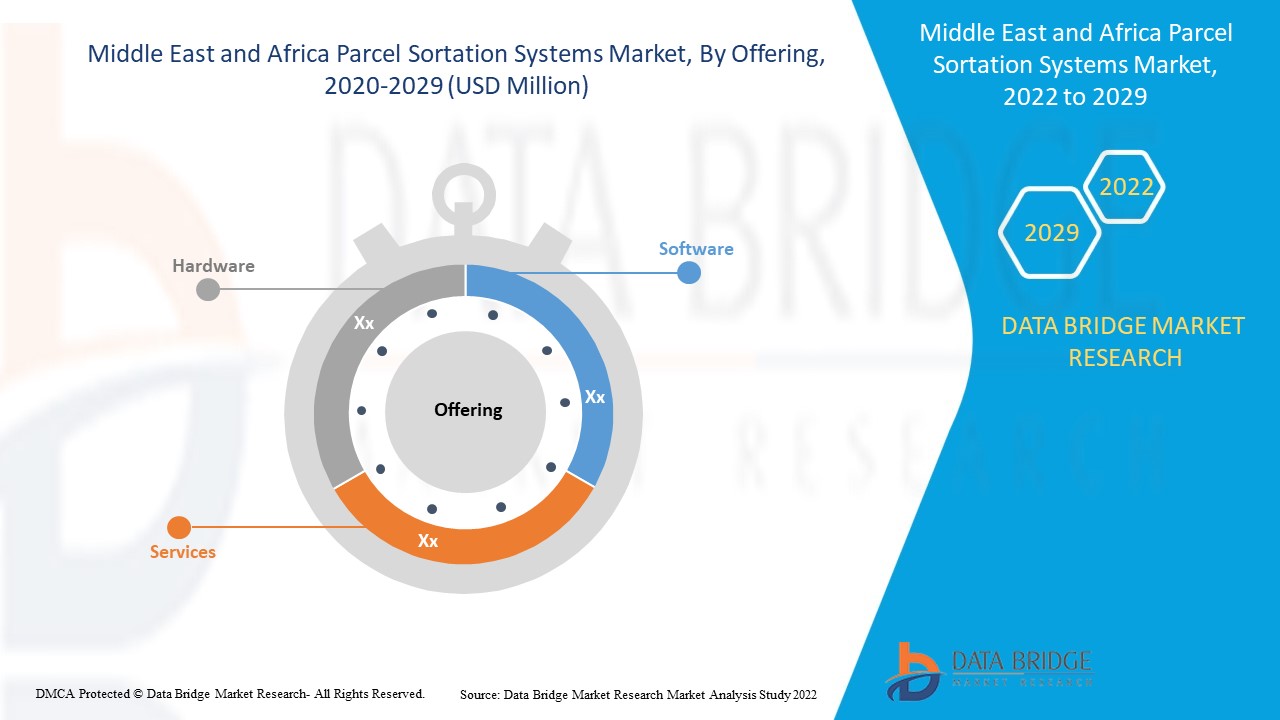

- Auf der Grundlage des Angebots ist der globale Markt für Paketsortiersysteme in Hardware, Software und Dienstleistungen unterteilt. Im Jahr 2022 wird das Hardwaresegment voraussichtlich den Markt dominieren, da hardwarebasierte Sortiersysteme die Sortiereffizienz erhöhen. Darüber hinaus kann die Hardwareimplementierung Sortieranwendungen beschleunigen und nutzt in großem Umfang gleichzeitige Datenvergleiche und -austausche in jedem Taktzyklus.

- Auf der Grundlage der Behältergröße wird der globale Markt für Paketsortiersysteme in klein, mittel und groß unterteilt. Im Jahr 2022 wird das mittlere Segment voraussichtlich den Markt dominieren, da die Anzahl der mittelgroßen Pakete in den Logistikzentren aufgrund des zunehmenden E-Commerce-Handels zunimmt, der mittelgroße Behälter erfordert und die Einführung mittlerer Behältergröße auf dem Markt für Paketsortiersysteme vorantreibt.

- Auf der Grundlage der Paketabfertigungskapazität ist der globale Markt für Paketsortiersysteme in weniger als 20.000 Pakete/Std., 20.000 bis 30.000 Pakete/Std. und mehr als 30.000 Pakete/Std. unterteilt. Im Jahr 2022 wird erwartet, dass weniger als 20.000 Pakete/Std. den Markt dominieren werden, da die Einführung von Sortiersystemen bei kleinen und mittleren Unternehmen zunimmt, die ein geringeres Paketvolumen zu bewältigen haben und über eine begrenzte Kaufkraft verfügen.

- Auf der Grundlage der Endnutzer ist der globale Markt für Paketsortiersysteme in Logistik, E-Commerce, Pharmazeutik, medizinische Versorgung, Lebensmittel und Getränke und andere unterteilt. Im Jahr 2022 wird der E-Commerce voraussichtlich den Markt dominieren, da die E-Commerce-Branche in den letzten Jahren exponentiell wächst, was auch die Anzahl der Pakete erhöht, die sortiert und an Kunden weltweit ausgeliefert werden müssen

Naher Osten und Afrika: Markt für Paketsortiersysteme – Länderebeneanalyse

Der Markt für Paketsortiersysteme im Nahen Osten und Afrika wird analysiert und Informationen zur Marktgröße werden nach Land, Typ, Angebot, Behältergröße, Paketbearbeitungskapazität und Endbenutzer bereitgestellt.

Die im Marktbericht zu Paketsortiersystemen für den Nahen Osten und Afrika abgedeckten Länder sind die Vereinigten Arabischen Emirate, Saudi-Arabien, Israel, Ägypten, Südafrika und der Rest des Nahen Ostens und Afrikas.

Israel dominiert den Markt im Nahen Osten und in Afrika aufgrund der zunehmenden Automatisierung im Logistiksektor und der Einbindung technologischer Technologien wie IoT zur Prozessüberwachung und Datenerfassung, um geschäftliche Erkenntnisse über Sortiersysteme zur Steigerung der Lieferketteneffizienz zu gewinnen.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die die aktuellen und zukünftigen Markttrends beeinflussen. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund erheblicher oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle werden bei der Bereitstellung einer Prognoseanalyse der Länderdaten berücksichtigt.

Steigende Nachfrage nach Paketsortiersystemen

Der Markt für Paketsortiersysteme im Nahen Osten und Afrika bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Branchenwachstum in jedem Land mit Umsatz, Komponentenverkäufen, den Auswirkungen der technologischen Entwicklung bei Paketsortiersystemen und Änderungen der regulatorischen Szenarien mit ihrer Unterstützung für den Markt für Paketsortiersysteme. Die Daten sind für den historischen Zeitraum 2012 bis 2020 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile von Paketsortiersystemen im Nahen Osten und Afrika

Die Wettbewerbslandschaft des Marktes für Paketsortiersysteme im Nahen Osten und Afrika bietet Details nach Wettbewerbern. Zu den Details gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -einrichtungen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Paketsortiersysteme im Nahen Osten und Afrika.

Die wichtigsten im Bericht behandelten Akteure sind Siemens Logistics GmbH (eine Tochtergesellschaft der Siemens AG), BEUMER GROUP, FIVES, Dematic, Murata Machinery, Ltd., Interroll Group, BOWE SYSTEC GMBH und Honeywell International Inc. sowie weitere inländische Akteure. Die Analysten von DBMR kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Viele Produktentwicklungen werden auch von Unternehmen weltweit initiiert, die auch das Wachstum des Marktes für Paketsortiersysteme im Nahen Osten und Afrika beschleunigen.

Zum Beispiel,

- Im September 2019 kündigte BOWE SYSTEC GMBH auf der Parcel+Post Expo in Amsterdam die Einführung des Double Split-Tray-Sorters an. Das neue System wurde für die Sortierung von leichten Artikeln mit einem Gewicht von bis zu 5 Kilogramm entwickelt. Es konnte Produkte wie Kleidung, Bücher, Arzneimittel, Polybeutel, Multimedia und flache Artikel oder Schmuck sortieren. Damit konnte das Unternehmen Sorter anbieten, die Pakete unterschiedlicher Formen und Größen verarbeiten können, was das Produktportfolio des Unternehmens auf dem Markt für Paketsortiersysteme erweiterte.

- Im Juni 2021 gab die Interroll Group die Markteinführung des vertikalen Quergurtsortierers MX 018V bekannt. Das neue Produkt ist kostensparend, energieeffizient, wartungsfreundlich und erleichtert Systemintegratoren und ihren Endkunden den Einstieg in die Welt der automatisierten Quergurtsortierlösungen. Es ermöglicht Kurier- und Paketdiensten, E-Commerce-Anbietern und Logistikdienstleistern, eine große Vielfalt an Waren platzsparend, schonend und energieeffizient über eine einzige technische Infrastruktur mit einer erhöhten Anzahl von Endpunkten abzuwickeln. Dies erweiterte das Produktportfolio des Unternehmens.

Partnerschaften, Joint Ventures und andere Strategien steigern den Marktanteil des Unternehmens durch größere Reichweite und Präsenz. Darüber hinaus bietet es einem Unternehmen den Vorteil, sein Angebot an Paketsortiersystemen durch eine größere Größenauswahl zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 END USER COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TRENDS

4.1.1 INTERNET BUYING CONTINUES TO GROW EXPONENTIALLY

4.1.2 SAME DAY DELIVERY TREND

4.1.3 FREE SHIPPING IS A COMMON INCENTIVE TO SELL PRODUCT

4.1.4 LARGE ITEMS BROUGHT ONLINE

4.1.5 INCREASE IN DEMAND FOR HOME DELIVERY ITEMS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 CONTINUOUS DEVELOPMENT IN THE MIDDLE EAST & AFRICA E-COMMERCE INDUSTRY

5.1.2 MINIMIZING MANUAL INTERVENTION AND REDUCING LABOR COSTS

5.1.3 DEVELOPMENTS IN TECHNOLOGIES SUCH AS AI AND ROBOTS FOR SORTING OPERATIONS

5.1.4 INCREASING NEED TO REDUCE THE LAST MILE DELIVERY COSTS

5.1.5 LOGISTICS INFRASTRUCTURE DEVELOPMENTS WITH URBAN PLANNING

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS

5.2.2 GOVERNMENT REGULATIONS IMPOSED ON AUTOMATION TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 WIDESPREAD ADOPTION OF IOT TECHNOLOGY

5.3.2 INTEGRATION OF AUTOMATIC PARCEL SINGULATOR IN SORTATION SYSTEM

5.3.3 INCREASING ADOPTION OF AUTOMATED SORTATION SYSTEMS AT AIRPORTS TO HANDLE THE INCREASING TRAFFIC

5.3.4 HIGH INVESTMENTS IN SUPPLY CHAIN AUTOMATION

5.4 CHALLENGES

5.4.1 HIGH VARIETY IN PARCEL SIZES AND VOLUME

5.4.2 SHORTAGE OF SKILLED PROFESSIONAL AND TECHNICAL EXPERTISE

5.4.3 HIGH CUSTOMER EXPECTATIONS ABOUT DELIVERY TIMELINES

5.4.4 COMPLEXITIES IN AUTOMATION INTEGRITY

5.4.5 PROPER UTILIZATION OF SPACE

6 IMPACT ON COVID-19 ON THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON SUPPLY CHAIN

6.6 IMPACT ON PRICE

6.7 CONCLUSION

7 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE

7.1 OVERVIEW

7.2 LINEAR PARCEL SORTATION SYSTEMS

7.2.1 SHOE SORTER

7.2.2 PUSHER SORTERS

7.2.3 POP-UP/NARROW BELT SORTERS

7.2.4 ARB SORTERS

7.2.5 PADDLE SORTERS

7.2.6 LINEAR/VERTICAL BELT SORTERS

7.2.7 SMALL PARCEL SORTERS

7.3 LOOP PARCEL SORTATION SYSTEMS

7.3.1 CROSS-BELT SORTERS (HORIZONTAL)

7.3.2 TILT TRAY SORTERS

7.3.3 FLAT SORTERS/BOMB BAY SORTERS

8 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 ELECTRICAL AND MECHANICAL COMPONENTS

8.2.2 SENSOR

8.2.2.1 PROXIMITY SENSOR

8.2.2.2 OPTICAL SENSOR

8.2.2.3 DISPLACEMENT SENSOR

8.2.2.4 PRESSURE SENSOR

8.2.2.5 ANALOG FLOW SENSOR

8.2.3 DIVERTERS

8.2.4 CAMERAS

8.2.5 PROCESSORS

8.2.6 DISPLAYS

8.3 SOFTWARE

8.4 SERVICES

9 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE

9.1 OVERVIEW

9.2 MEDIUM

9.3 SMALL

9.4 LARGE

10 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY

10.1 OVERVIEW

10.2 LESS THAN 20000/HR

10.3 20000 TO 30000 PARCELS/HR

10.4 MORE THAN 30000 PARCEL/HR

11 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER

11.1 OVERVIEW

11.2 E COMMERCE

11.2.1 AIRPORTS

11.2.2 INTERNATIONAL AIRPORTS

11.3 LOGISTICS

11.3.1 STORAGE AND WAREHOUSING

11.3.2 COURIER

11.3.3 POSTAL SERVICES

11.3.4 FREIGHT FORWARDING

11.4 PHARMACEUTICALS AND MEDICAL SUPPLY

11.4.1 DISTRIBUTORS

11.4.2 DRUG MANUFACTURERS

11.4.3 ACTIVE PHARMACEUTICAL INGREDIENT SUPPLIERS

11.5 FOOD & BEVERAGES

11.5.1 PROCESSED FOOD

11.5.2 PROCESSED CULINARY INGREDIENTS

11.5.3 UNPROCESSED OR MINIMALLY PROCESSED FOOD

11.6 OTHERS

12 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 ISRAEL

12.1.2 U.A.E

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 SOUTH AFRICA

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 DAIFUKU CO., LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 DEMATIC

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 VANDERLANDE INDUSTRIES B.V.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 PITNEY BOWES INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SIEMENS LOGISTICS GMBH (A SUBSIDIARY OF SIEMENS AG)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BASTIAN SOLUTIONS, LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 BEUMER GROUP

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 BOWE SYSTEC GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EQUINOX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FIVES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GBI INTRALOGISTICS, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 HONEYWELL INTERNATIONAL INC

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 INTERROLL GROUP

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 INTRALOX

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 INVATA INTRALOGISTICS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 MHS MIDDLE EAST & AFRICA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 MURATA MACHINERY, LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 OKURA YUSOKI CO., LTD.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 SOLYSTIC SAS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 VIASTORE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA SENSOR IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SOFTWARE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA SERVICES IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA MEDIUM IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SMALL IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA LARGE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA LESS THAN 20000 PARCELS/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA 20000 TO 30000 PARCELS/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MORE THAN 30000 PARCEL/HR IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA OTHERS IN PARCEL SORTATION SYSTEMS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 ISRAEL LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 ISRAEL LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 48 ISRAEL HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ISRAEL SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 51 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 52 ISRAEL PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 53 ISRAEL E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 ISRAEL LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 ISRAEL PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 ISRAEL FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.A.E LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.A.E LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 61 U.A.E HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 U.A.E SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 64 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 65 U.A.E PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 U.A.E E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 U.A.E LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 U.A.E PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 U.A.E FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SAUDI ARABIA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 77 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 SAUDI ARABIA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SAUDI ARABIA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 SAUDI ARABIA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 EGYPT LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 87 EGYPT HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 EGYPT SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 90 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 91 EGYPT PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 EGYPT E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 EGYPT PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 EGYPT FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH AFRICA LINEAR PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA LOOP PARCEL SORTATION SYSTEMS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA HARDWARE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA SENSORS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2020-2029 (USD MILLION)

TABLE 104 SOUTH AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA E-COMMERCE IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA LOGISTICS IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA PHARMACEUTICALS AND MEDICAL SUPPLY IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA FOOD & BEVERAGES IN PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 REST OF MIDDLE EAST AND AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2020-2029 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SEGMENTATION

FIGURE 11 CONTINUOUS DEVELOPMENT IN MIDDLE EAST & AFRICA E-COMMERCE INDUSTRY IS THE MAJOR FACTOR BOOSTING THE GROWTH OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 LINEAR PARCEL SORTATION SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGER SHARE OF THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN 2022 & 2029

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 WORLDWIDE RETAIL E-COMMERCE SALES, FROM 2014 TO 2023

FIGURE 15 SHARE OF CONSUMERS CHOOSING DIFFERENT DELIVERY OPTIONS, PERCENT OF X2C VOLUME

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGE OF MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET

FIGURE 17 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TYPE, 2021

FIGURE 18 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY OFFERING, 2021

FIGURE 19 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY TRAY SIZE, 2021

FIGURE 20 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY PARCEL HANDLING CAPACITY, 2021

FIGURE 21 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET, BY END USER, 2021

FIGURE 22 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: SNAPSHOT (2021)

FIGURE 23 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2021)

FIGURE 24 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: BY TYPE (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA PARCEL SORTATION SYSTEMS MARKET: COMPANY SHARE 2021 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.