Middle East And Africa Molded Fiber Packaging Market

Marktgröße in Milliarden USD

CAGR :

%

USD

401.86 Million

USD

584.75 Million

2025

2033

USD

401.86 Million

USD

584.75 Million

2025

2033

| 2026 –2033 | |

| USD 401.86 Million | |

| USD 584.75 Million | |

|

|

|

|

Marktsegmentierung für Formfaserverpackungen im Nahen Osten und Afrika nach Typ (Dickwandig, Transfergeformt, Tiefziehfaser und Zellstoff), Quelle (Holzzellstoff und Nicht-Holzzellstoff), Produkt (Schalen, Klappverpackungen, Kartons, Endkappen und Sonstiges), Endverbraucher (Lebensmittel und Getränke, Elektronik, Körperpflege, Gesundheitswesen und Sonstiges) – Branchentrends und Prognose bis 2033

Marktgröße für Formfaserverpackungen im Nahen Osten und Afrika

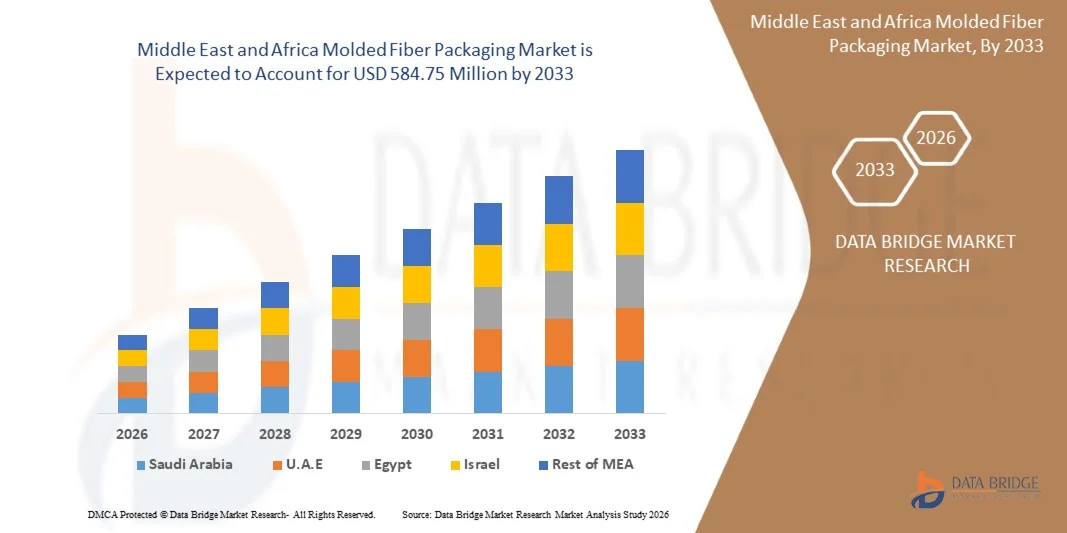

- Der Markt für Formfaserverpackungen im Nahen Osten und Afrika hatte im Jahr 2025 einen Wert von 401,86 Millionen US-Dollar und wird voraussichtlich bis 2033 auf 584,75 Millionen US-Dollar anwachsen , was einem durchschnittlichen jährlichen Wachstum von 4,80 % im Prognosezeitraum entspricht.

- Die Marktexpansion wird vor allem durch das wachsende Umweltbewusstsein und die zunehmende Nutzung nachhaltiger und umweltfreundlicher Verpackungslösungen in den Bereichen Lebensmittel und Getränke, Elektronik und Konsumgüter vorangetrieben.

- Darüber hinaus beschleunigen strenge staatliche Vorschriften, die die Verwendung biologisch abbaubarer Materialien fördern, sowie die wachsende Präferenz der Verbraucher für recycelbare und kompostierbare Verpackungen die Einführung von Formfaserverpackungslösungen und treiben so das Marktwachstum erheblich an.

Marktanalyse für Formfaserverpackungen im Nahen Osten und Afrika

- Formfaserverpackungen, die nachhaltige und biologisch abbaubare Alternativen zu herkömmlichen Verpackungen bieten, gewinnen aufgrund ihrer Umweltfreundlichkeit, Kosteneffizienz und Vielseitigkeit in den Bereichen Lebensmittel und Getränke, Elektronik und Konsumgüter sowohl für private als auch für gewerbliche Anwendungen zunehmend an Bedeutung.

- Die zunehmende Verwendung von Formfaserverpackungen wird in erster Linie durch ein wachsendes Umweltbewusstsein, strenge staatliche Vorschriften für Einwegkunststoffe und die steigende Nachfrage der Verbraucher nach recycelbaren und kompostierbaren Verpackungslösungen vorangetrieben.

- Die VAE dominierten den Markt für Formfaserverpackungen im Nahen Osten und in Afrika mit dem größten Umsatzanteil von 35,2 % im Jahr 2025. Unterstützt wurde dies durch starke Initiativen zur Förderung nachhaltiger Verpackungen, eine hohe Produktionsaktivität im Lebensmittelverarbeitungssektor und die Präsenz großer Verpackungsunternehmen, die in Innovationen im Bereich Formfaser investieren.

- Saudi-Arabien dürfte im Prognosezeitraum die am schnellsten wachsende Region auf dem Markt für Formfaserverpackungen im Nahen Osten und in Afrika sein, bedingt durch die rasche Urbanisierung, die steigende Nachfrage nach verpackten Lebensmitteln und die zunehmende Akzeptanz umweltfreundlicher Verpackungslösungen.

- Das Segment der dickwandigen Produkte dominierte den Markt mit dem größten Umsatzanteil von 41,5 % im Jahr 2025. Ausschlaggebend hierfür waren die überlegene Haltbarkeit, Stoßfestigkeit und Eignung für schwere oder empfindliche Produkte wie Elektronik und verpackte Getränke.

Berichtsumfang und Marktsegmentierung für Formfaserverpackungen im Nahen Osten und Afrika

|

Attribute |

Wichtigste Markteinblicke in Formfaserverpackungen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch Import-Export-Analysen, einen Überblick über die Produktionskapazität, eine Analyse des Produktionsverbrauchs, eine Preistrendanalyse, ein Klimawandelszenario, eine Lieferkettenanalyse, eine Wertschöpfungskettenanalyse, einen Überblick über Rohstoffe/Verbrauchsmaterialien, Kriterien für die Lieferantenauswahl, eine PESTLE-Analyse, eine Porter-Analyse und den regulatorischen Rahmen. |

Markttrends für Formfaserverpackungen im Nahen Osten und Afrika

„Fortschritte bei nachhaltigen und intelligenten Verpackungslösungen“

- Ein bedeutender und sich beschleunigender Trend auf dem Markt für Formfaserverpackungen im Nahen Osten und in Afrika ist die Einführung innovativer, umweltfreundlicher und intelligenter Verpackungslösungen, die Nachhaltigkeit mit funktionalem Design verbinden und so den Produktschutz und den Komfort für den Verbraucher verbessern.

- Unternehmen wie Huhtamaki und Smurfit Kappa entwickeln beispielsweise geformte Fasertabletts und -behälter, die vollständig biologisch abbaubar und dennoch langlebig sind und sich für empfindliche Produkte wie Frischwaren, Elektronik und Getränke eignen.

- Intelligente Verpackungsintegration ermöglicht die Nutzung von Funktionen wie QR-Codes, NFC-Tags oder integrierten Sensoren, um Produktinformationen bereitzustellen, die Frische zu verfolgen oder Lagerbedingungen zu überwachen. Beispielsweise verfügen einige Formfaser-Lebensmittelbehälter mittlerweile über Frischeindikatoren oder temperaturempfindliche Etiketten, die Verbraucher über die Qualität verderblicher Waren informieren.

- Diese Innovationen ermöglichen eine zentrale Nachverfolgung und Qualitätskontrolle entlang der gesamten Lieferkette, wodurch Abfall reduziert und das Bestandsmanagement für Hersteller und Einzelhändler verbessert wird.

- Der Trend hin zu funktionaleren, nachhaltigeren und intelligenteren Verpackungen verändert grundlegend die Erwartungen der Verbraucher an umweltfreundliche Produkte. Unternehmen wie Eco-Pak und GreenPack entwickeln Formfaserlösungen mit integrierten Rückverfolgungs- und Frischeüberwachungsfunktionen, um diesen sich wandelnden Anforderungen gerecht zu werden.

- Die Nachfrage nach Formfaserverpackungen mit integrierter Nachhaltigkeit und intelligenter Funktionalität wächst rasant in den Bereichen Lebensmittel und Getränke, Konsumgüter und Elektronik, da sowohl Verbraucher als auch Unternehmen zunehmend umweltverträglichen und technologisch fortschrittlichen Verpackungslösungen Priorität einräumen.

Marktdynamik für Formfaserverpackungen im Nahen Osten und Afrika

Treiber

„Wachsende Nachfrage aufgrund von Umweltbewusstsein und regulatorischer Unterstützung“

- Die zunehmende Fokussierung von Verbrauchern und Unternehmen auf Nachhaltigkeit, gepaart mit strengeren staatlichen Vorschriften für Einwegkunststoffe und nicht biologisch abbaubare Verpackungen, ist ein wesentlicher Faktor für die gestiegene Nachfrage nach Formfaserverpackungen.

- Beispielsweise startete die Regierung der Vereinigten Arabischen Emirate im Jahr 2025 Initiativen zur schrittweisen Abschaffung nicht recycelbarer Kunststoffe in Lebensmittel- und Einzelhandelsverpackungen und ermutigte Hersteller, biologisch abbaubare Alternativen einzusetzen. Es wird erwartet, dass solche Strategien wichtiger Behörden die Einführung von Formfaserverpackungen im Nahen Osten und in Afrika im Prognosezeitraum beschleunigen werden.

- Da Verbraucher und Unternehmen zunehmend auf die Umweltauswirkungen achten, bieten Formfaserverpackungen umweltfreundliche Lösungen, die recycelbar, kompostierbar und biologisch abbaubar sind und somit eine überzeugende Alternative zu herkömmlichen Kunststoff- und Styroporverpackungen darstellen.

- Darüber hinaus führt die steigende Nachfrage nach nachhaltigen Verpackungen in den Bereichen Lebensmittel und Getränke, Konsumgüter und Elektronik dazu, dass Formfaserlösungen zur bevorzugten Wahl werden, da sie Langlebigkeit, Schutzeigenschaften und Übereinstimmung mit den Nachhaltigkeitszielen der Unternehmen bieten.

- Die Vielseitigkeit von Formfaserverpackungen für diverse Anwendungen, kombiniert mit ihrer Kompatibilität mit Branding- und Etikettierungsanforderungen, treibt deren Akzeptanz in den Lieferketten von Privatkunden und Gewerbekunden voran. Verstärkte Aufklärungskampagnen und ein umweltbewusstes Konsumverhalten tragen zusätzlich zum Marktwachstum bei.

Zurückhaltung/Herausforderung

„Hohe Produktionskosten und begrenzte Fertigungsinfrastruktur“

- Die im Vergleich zu herkömmlichen Kunststoffalternativen relativ höheren Produktionskosten von Formfaserverpackungen stellen eine erhebliche Herausforderung für eine breitere Marktakzeptanz dar, insbesondere in preissensiblen Regionen im Nahen Osten und in Afrika.

- Beispielsweise können die Kosten für Rohstoffe, Spezialmaschinen und energieintensive Prozesse die Herstellung von Formfaserprodukten für kleine und mittlere Unternehmen verteuern.

- Darüber hinaus kann die begrenzte Verfügbarkeit von Produktionsanlagen und technologischem Know-how in einigen Regionen eine schnelle Ausweitung und Verbreitung behindern und somit die Marktdurchdringung einschränken.

- Die Bewältigung dieser Herausforderungen durch Investitionen in kosteneffiziente Produktionstechnologien, den Ausbau regionaler Produktionskapazitäten und die Entwicklung öffentlich-privater Partnerschaften zur Unterstützung nachhaltiger Verpackungsinitiativen ist entscheidend für die Förderung des Marktwachstums.

- Während das Bewusstsein für die ökologischen Vorteile zunimmt, stellen Preissensibilität und Infrastrukturbeschränkungen weiterhin wesentliche Hindernisse für die Akzeptanz dar, insbesondere für kleinere Unternehmen und Entwicklungsländer in der Region.

- Die Bewältigung dieser Herausforderungen durch technologische Innovationen, Skaleneffekte und staatliche Anreize wird für ein nachhaltiges Wachstum auf dem Markt für Formfaserverpackungen von entscheidender Bedeutung sein.

Marktübersicht für Formfaserverpackungen im Nahen Osten und Afrika

Der Markt für Formfaserverpackungen ist nach Art, Herkunft, Produkt und Endverbraucher segmentiert.

• Nach Typ

Der Markt für Formfaserverpackungen im Nahen Osten und Afrika ist nach Verpackungsart in dickwandige, transfergeformte, tiefgezogene Faser- und Zellstoffverpackungen unterteilt. Das Segment der dickwandigen Verpackungen dominierte den Markt mit einem Umsatzanteil von 41,5 % im Jahr 2025. Dies ist auf die überlegene Haltbarkeit, Stoßfestigkeit und Eignung für schwere oder empfindliche Produkte wie Elektronik und verpackte Getränke zurückzuführen. Hersteller, die einen zuverlässigen Schutz bei Lagerung und Transport wünschen und gleichzeitig Wert auf Umweltverträglichkeit legen, bevorzugen dickwandige Formfaserverpackungen.

Für das Segment der Transferformverpackungen wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 19,8 % das schnellste Wachstum erwartet, angetrieben durch die steigende Nachfrage im Gastronomie- und Liefergewerbe. Transferformverpackungen bieten Designflexibilität, geringes Gewicht und schnelle Produktionsmöglichkeiten und erfreuen sich daher zunehmender Beliebtheit bei gewerblichen und industriellen Anwendern, die individuelle und nachhaltige Verpackungslösungen benötigen.

• Nach Quelle

Basierend auf der Rohstoffquelle ist der Markt für Formfaserverpackungen im Nahen Osten und Afrika in Holzfaser- und Nicht-Holzfaserverpackungen unterteilt. Das Segment Holzfaser dominierte den Markt mit einem Umsatzanteil von 62,3 % im Jahr 2025, was auf die Verfügbarkeit, biologische Abbaubarkeit und hervorragenden Formeigenschaften zurückzuführen ist. Verpackungen auf Holzfaserbasis werden in der Lebensmittel- und Getränkeindustrie sowie in der Konsumgüterindustrie häufig für Schalen, Klappverpackungen und Kartons eingesetzt.

Für das Segment der Nicht-Holzzellstoffe wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,1 % das schnellste Wachstum erwartet. Treiber dieses Wachstums ist die zunehmende Verwendung von Agrarabfällen, Bagasse und Bambus als nachhaltige Alternativen zu herkömmlichem Holzzellstoff. Verpackungen aus Nicht-Holzzellstoff bieten umweltfreundliche Lösungen mit geringerer Umweltbelastung und sind daher für Hersteller und Verbraucher attraktiv, die Wert auf kreislaufwirtschaftliche Produkte legen.

• Nebenprodukt

Basierend auf den Produkten ist der Markt für Formfaserverpackungen im Nahen Osten und Afrika in Trays, Klappverpackungen, Kartons, Endkappen und Sonstiges unterteilt. Das Segment der Trays dominierte den Markt mit einem Umsatzanteil von 39,7 % im Jahr 2025, vor allem aufgrund seiner weitverbreiteten Verwendung im Lebensmittel- und Getränkesektor für Backwaren, Molkereiprodukte und Frischwaren. Trays bieten Stabilität, erhalten die Frische der Produkte und unterstützen Nachhaltigkeitsziele.

Für das Segment der Klappverpackungen wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,5 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage im Bereich Take-away, Fertiggerichte und Fast Food. Klappverpackungen zeichnen sich durch ihre praktische Handhabung, ihren manipulationssicheren Verschluss und ihre Kompatibilität mit den Anforderungen des Einzelhandels-Brandings aus und sind daher eine bevorzugte Wahl für moderne Lebensmittelverpackungen.

• Vom Endbenutzer

Basierend auf den Endverbrauchern ist der Markt für Formfaserverpackungen im Nahen Osten und Afrika in die Segmente Lebensmittel & Getränke, Elektronik, Körperpflege, Gesundheitswesen und Sonstige unterteilt. Das Segment Lebensmittel & Getränke dominierte den Markt mit dem größten Umsatzanteil von 51,2 % im Jahr 2025. Treiber dieses Wachstums sind der steigende Konsum von verpackten Lebensmitteln und Speisen zum Mitnehmen sowie strenge Lebensmittelsicherheitsvorschriften, die hygienische und schützende Verpackungslösungen erfordern.

Für den Elektroniksektor wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,3 % das schnellste Wachstum erwartet. Treiber dieses Wachstums sind die steigenden Lieferungen empfindlicher Unterhaltungselektronik, Smartphones und Haushaltsgeräte in der gesamten Region. Formgepresste Faserverpackungen bieten Schutz, Stoßfestigkeit und nachhaltige Alternativen zu Schaumstoff- oder Kunststoffeinlagen und tragen so der wachsenden Nachfrage nach umweltfreundlichen Elektronikverpackungen Rechnung.

Regionale Analyse des Marktes für Formfaserverpackungen im Nahen Osten und Afrika

- Die Vereinigten Arabischen Emirate dominierten den Markt für Formfaserverpackungen im Nahen Osten und Afrika mit dem größten Umsatzanteil von 35,2 % im Jahr 2025, angetrieben durch die steigende Nachfrage nach nachhaltigen und umweltfreundlichen Verpackungslösungen in den Bereichen Lebensmittel und Getränke, Konsumgüter und Elektronik.

- Hersteller und Verbraucher in der Region legen zunehmend Wert auf biologisch abbaubare, recycelbare und kompostierbare Verpackungen, um Umweltauflagen und Nachhaltigkeitsziele zu erfüllen, was die Verwendung von Formfaserverpackungen fördert.

- Diese breite Akzeptanz wird zusätzlich durch staatliche Initiativen zur Förderung von Kunststoffalternativen, wachsende Industrie- und Einzelhandelsaktivitäten sowie ein steigendes Bewusstsein für umweltverträgliche Praktiken bei Verbrauchern und Unternehmen unterstützt. Infolgedessen etabliert sich Formfaserverpackung als bevorzugte Wahl zum Schutz von Produkten und trägt gleichzeitig zu den Nachhaltigkeitszielen der Region bei. Sie gilt als wichtige Verpackungslösung in den Lieferketten von Privathaushalten und Unternehmen.

Einblick in den Markt für Formfaserverpackungen in Saudi-Arabien

Der Markt für Formfaserverpackungen in Saudi-Arabien erzielte 2025 mit 41 % den größten Umsatzanteil, angetrieben durch das rasante Wachstum in den Bereichen Lebensmittel und Getränke, Konsumgüter und E-Commerce. Verstärkte staatliche Initiativen zur Förderung nachhaltiger Verpackungen und zur Reduzierung von Einwegplastik ermutigen Hersteller, umweltfreundliche Formfaserlösungen einzusetzen. Die zunehmende Urbanisierung, das Wachstum des Einzelhandels und des Gastgewerbes sowie die Expansion von Lieferdiensten und Take-away-Angeboten kurbeln die Nachfrage zusätzlich an. Investitionen lokaler und internationaler Verpackungsunternehmen in innovative Formfaserprodukte fördern zudem deren Akzeptanz in den gesamten kommerziellen und industriellen Lieferketten.

Einblick in den Markt für Formfaserverpackungen in den VAE

Der Markt für Formfaserverpackungen in den VAE wird im Prognosezeitraum voraussichtlich ein signifikantes Wachstum verzeichnen. Treiber dieser Entwicklung sind das hohe Umweltbewusstsein der Verbraucher und staatliche Vorschriften, die nicht biologisch abbaubare Verpackungen einschränken. Der boomende Einzelhandel, die Gastronomie und die Logistikbranche des Landes tragen maßgeblich zum Marktwachstum bei. Hersteller setzen zunehmend auf Formfaserschalen, Klappverpackungen und Kartons, die Langlebigkeit mit Umweltfreundlichkeit verbinden. Darüber hinaus ermöglicht die Position der VAE als regionales Handelszentrum eine schnelle Distribution nachhaltiger Verpackungslösungen im gesamten Nahen Osten.

Einblick in den südafrikanischen Markt für Formfaserverpackungen

Der südafrikanische Markt dürfte ein beachtliches jährliches Wachstum verzeichnen, angetrieben durch die zunehmende Verwendung umweltfreundlicher Verpackungen in den Bereichen Lebensmittel und Getränke, Körperpflege und Gesundheitswesen. Wachsende Stadtbevölkerungen, steigende verfügbare Einkommen und staatliche Initiativen zur Förderung von Recycling und nachhaltigen Materialien unterstützen die Marktexpansion. Lokale Hersteller investieren in kosteneffiziente Formfasertechnologien, um die steigende Nachfrage zu decken, während Einzelhändler und Gastronomiebetriebe biologisch abbaubare und recycelbare Verpackungslösungen priorisieren, um den Verbraucherpräferenzen und Nachhaltigkeitszielen gerecht zu werden.

Einblick in den ägyptischen Markt für Formfaserverpackungen

Der ägyptische Markt für Formfaserverpackungen gewinnt aufgrund des rasanten Wachstums der Lebensmittel-, E-Commerce- und Einzelhandelsbranche zunehmend an Bedeutung. Staatliche Vorschriften zur Reduzierung von Plastikmüll sowie ein steigendes Umweltbewusstsein bei Verbrauchern und Unternehmen fördern die Nutzung von Formfaserverpackungen. Hersteller setzen vermehrt auf Schalen, Klappverpackungen und Kartons, um ihre Produkte zu schützen und gleichzeitig Nachhaltigkeitsanforderungen zu erfüllen. Der Markt verzeichnet eine starke Nachfrage sowohl im gewerblichen als auch im privaten Bereich, insbesondere in der Gastronomie, im Einzelhandel und in der Logistik.

Marktanteil für Formfaserverpackungen im Nahen Osten und Afrika

Die Branche der Formfaserverpackungen wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Huhtamaki (Finnland)

- Tetra Pak (Schweiz)

- Smurfit Kappa (Irland)

- Berry Global (USA)

- International Paper (USA)

- Eco-Pak (Südafrika)

- WestRock (USA)

- GreenPack (VAE)

- Futamura (Japan)

- Biopak (Australien)

- Stora Enso (Finnland)

- Mondi Group (Österreich)

- Huhtamaki PPL (Indien)

- Cascades (Kanada)

- DS Smith (GB)

- Evergreen Packaging (USA)

- Sonoco-Produkte (USA)

- Beijing Huaduo Packaging (China)

- Packaging Corporation of Africa (Südafrika)

- Oji Holdings (Japan)

Welche aktuellen Entwicklungen gibt es auf dem Markt für Formfaserverpackungen im Nahen Osten und in Afrika?

- Im April 2024 startete Huhtamaki, ein weltweit führender Anbieter nachhaltiger Verpackungslösungen, eine strategische Initiative in Saudi-Arabien, um sein Portfolio an Formfaserprodukten für die Lebensmittel- und Konsumgüterbranche zu erweitern. Im Fokus der Initiative steht die Einführung langlebiger, biologisch abbaubarer Schalen und Klappverpackungen, die den lokalen gesetzlichen Bestimmungen entsprechen und gleichzeitig umweltfreundliche Praktiken fördern. Durch die Nutzung seiner globalen Expertise und fortschrittlichen Fertigungskompetenz begegnet Huhtamaki regionalen Herausforderungen im Bereich Nachhaltigkeit und stärkt seine Präsenz auf dem schnell wachsenden Markt für Formfaserverpackungen im Nahen Osten und in Afrika.

- Im März 2024 führte Smurfit Kappa in den VAE eine innovative Produktlinie formgepresster Faserverpackungen ein, die speziell für Frischwaren und verderbliche Produkte entwickelt wurde. Die neue Verpackung vereint Langlebigkeit mit kompostierbaren Materialien und verbessert so den Produktschutz und die Haltbarkeit. Diese Entwicklung unterstreicht das Engagement von Smurfit Kappa für nachhaltige und leistungsstarke Verpackungen, die den sich wandelnden Bedürfnissen von Lebensmittelhändlern und -herstellern in der Region gerecht werden.

- Im März 2024 implementierte Eco-Pak, ein führendes Unternehmen für nachhaltige Verpackungen, erfolgreich eine großflächige Formfaserverpackungslösung für einen großen Lebensmittelliefer- und E-Commerce-Anbieter in Südafrika. Ziel des Projekts ist die Reduzierung von Plastikmüll bei gleichzeitiger Bereitstellung langlebiger und hygienischer Verpackungen für Lieferungen. Diese Initiative unterstreicht die wachsende Bedeutung umweltverträglicher Verpackungen in der urbanen Logistik und die Rolle des Unternehmens bei der Förderung von Kreislaufwirtschaftspraktiken in der Region.

- Im Februar 2024 gab GreenPack eine strategische Partnerschaft mit einer führenden ägyptischen Lebensmittel- und Einzelhandelskette bekannt. Ziel der Partnerschaft ist die Einführung von Formfaser-Klappverpackungen und -Schalen für Frischwaren. Diese Zusammenarbeit soll die Nachhaltigkeit verbessern, die Abhängigkeit von Einwegplastik reduzieren und die Verpackungsprozesse des Einzelhändlers optimieren. Die Initiative unterstreicht GreenPacks Fokus auf Innovation und operative Effizienz und fördert gleichzeitig die Nutzung umweltfreundlicher Verpackungen im Nahen Osten und in Afrika.

- Im Januar 2024 präsentierte Tetra Pak auf der Gulfood Manufacturing Expo 2024 in den Vereinigten Arabischen Emiraten eine neue Produktreihe tiefgezogener Formfaserschalen und -boxen. Die innovativen Produkte vereinen Stabilität, geringes Gewicht und vollständige biologische Abbaubarkeit und ermöglichen Lebensmittelverarbeitern und -herstellern so mehr Produktsicherheit und Nachhaltigkeit. Mit dieser Produkteinführung unterstreicht Tetra Pak sein Engagement für die Integration fortschrittlicher, umweltverträglicher Lösungen in Verpackungssysteme und bedient damit den Handel und die Gastronomie in der gesamten Region.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.