Middle East And Africa Mobility As A Service Market

Marktgröße in Milliarden USD

CAGR :

%

USD

29.01 Billion

USD

259.46 Billion

2025

2033

USD

29.01 Billion

USD

259.46 Billion

2025

2033

| 2026 –2033 | |

| USD 29.01 Billion | |

| USD 259.46 Billion | |

|

|

|

|

Marktsegmentierung für Mobility as a Service im Nahen Osten und Afrika nach Serviceart (Carsharing, Bus-Sharing, Zug, Fahrdienste, Fahrrad-Sharing, autonome Fahrzeuge u. a.), Lösung (Navigationslösungen, Ticketing-Lösungen, Technologieplattformen, Versicherungsdienstleistungen, Telekommunikationsanbieter und Zahlungssysteme), Transportart (öffentlich und privat), Fahrzeugtyp (Pkw, Bus, Zug und Mikromobilität), Anwendungsplattform (iOS, Android u. a.), Bedarfsart (Anbindung auf der ersten und letzten Meile, Pendelverkehr außerhalb der Stoßzeiten und Schichtarbeit, tägliches Pendeln, Fahrten zu Flughäfen oder öffentlichen Verkehrsmitteln, Überlandfahrten u. a.), Unternehmensgröße (Großunternehmen und KMU), Nutzung (gewerblich und privat) – Branchentrends und Prognose bis 2033

Marktgröße für Mobility as a Service im Nahen Osten und Afrika

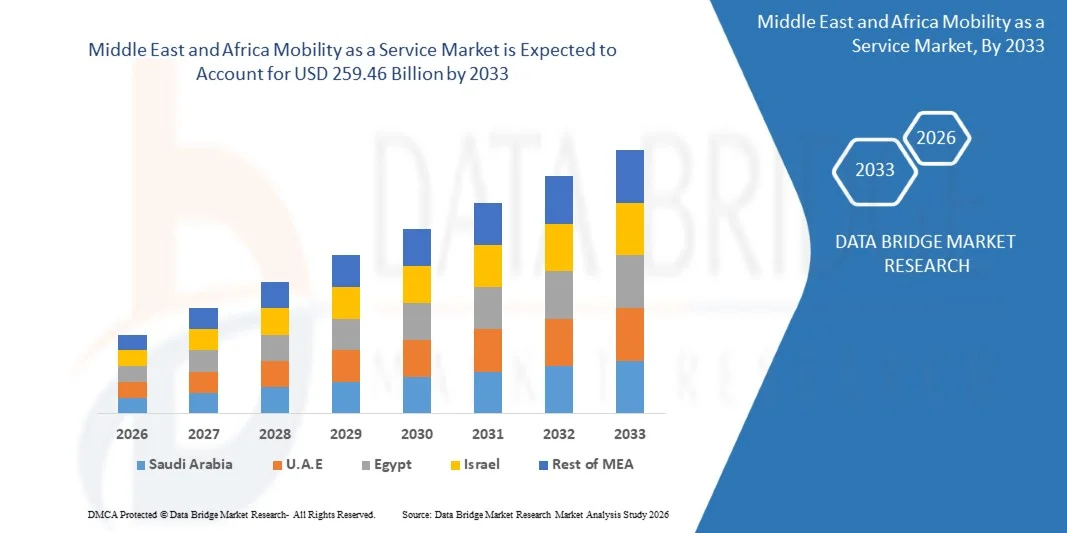

- Der Markt für Mobility as a Service im Nahen Osten und in Afrika hatte im Jahr 2025 einen Wert von 29,01 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 259,46 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 31,50 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird primär durch die zunehmende Urbanisierung, die steigende Verbreitung von Smartphones und Fortschritte bei KI- und IoT-Technologien angetrieben, die nahtlose, bedarfsgerechte und integrierte Mobilitätslösungen in der gesamten Region ermöglichen.

- Darüber hinaus fördert die wachsende Präferenz der Verbraucher für kostengünstige, flexible und nachhaltige Transportmöglichkeiten die Einführung von MaaS-Plattformen, was die Marktexpansion weiter beschleunigt und die Region als wichtigen Knotenpunkt für innovative Mobilitätslösungen positioniert.

Marktanalyse für Mobility as a Service im Nahen Osten und Afrika

- Mobility as a Service (MaaS), das integrierte, bedarfsgerechte und multimodale Transportlösungen bietet, wird aufgrund seiner Bequemlichkeit, der Verfügbarkeit in Echtzeit und der nahtlosen Integration mit digitalen Plattformen zu einem unverzichtbaren Bestandteil der urbanen Mobilität im öffentlichen wie im privaten Sektor.

- Die steigende Nachfrage nach MaaS wird vor allem durch die zunehmende Urbanisierung, die wachsende Verbreitung von Smartphones, Umweltbedenken und den Trend hin zu kostengünstigen und nachhaltigen Transportmöglichkeiten angetrieben.

- Die VAE dominierten den Markt für Mobility as a Service im Nahen Osten und in Afrika mit dem größten Umsatzanteil von 32,5 % im Jahr 2025. Dies wurde durch die frühe Einführung digitaler Mobilitätslösungen, hohe verfügbare Einkommen und eine starke Präsenz wichtiger Branchenakteure begünstigt. In den USA war ein signifikantes Wachstum bei App-basierten Mitfahrdiensten und integrierten Mobilitätsplattformen zu verzeichnen, das durch Innovationen sowohl etablierter Mobilitätsanbieter als auch von Technologie-Startups vorangetrieben wurde.

- Saudi-Arabien dürfte im Prognosezeitraum aufgrund der rasanten Urbanisierung, des Ausbaus der öffentlichen Verkehrsnetze und der steigenden verfügbaren Einkommen die am schnellsten wachsende Region im Markt für Mobilität als Dienstleistung im Nahen Osten und in Afrika sein.

- Das Segment der Fahrdienstvermittlung dominierte den Markt mit dem größten Umsatzanteil von 38,6 % im Jahr 2025, was auf die weite Verbreitung von Smartphones, die Herausforderungen durch städtische Verkehrsstaus und die Bequemlichkeit von Reisen auf Abruf zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für Mobility as a Service im Nahen Osten und Afrika

|

Attribute |

Mobility as a Service – Wichtigste Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team erstellte Marktbericht detaillierte Expertenanalysen, Import-/Exportanalysen, Preisanalysen, Produktions- und Verbrauchsanalysen sowie eine PESTLE-Analyse. |

Markttrends für Mobilität als Dienstleistung im Nahen Osten und Afrika

„Mehr Komfort durch KI und vorausschauende Mobilität“

- Ein bedeutender und sich beschleunigender Trend auf dem Mobility-as-a-Service-Markt im Nahen Osten und in Afrika ist die zunehmende Integration von künstlicher Intelligenz (KI) und prädiktiver Analytik in MaaS-Plattformen, wodurch der Benutzerkomfort, die Personalisierung und die betriebliche Effizienz verbessert werden.

- Beispielsweise nutzen Apps wie Careem und Bolt KI-gestützte Routenplanung und prädiktive Nachfragealgorithmen, um die Fahrtenzuweisung zu optimieren, Wartezeiten zu verkürzen und die Effizienz der Fahrten zu verbessern und so ein nahtloses und äußerst reaktionsschnelles Mobilitätserlebnis zu bieten.

- Die Integration von KI in MaaS ermöglicht Funktionen wie das Erlernen von Reisemustern, um optimale Routen vorzuschlagen, intelligente Benachrichtigungen über Verspätungen oder Störungen bereitzustellen und Preise sowie Fahrzeugverfügbarkeit dynamisch anzupassen. Moovit nutzt beispielsweise KI, um multimodale Nahverkehrsempfehlungen in Echtzeit basierend auf Nutzergewohnheiten, Verkehrslage und Betriebsstörungen zu liefern.

- Die nahtlose Integration von MaaS-Plattformen mit Sprachassistenten und digitalen Ökosystemen ermöglicht es Nutzern, multimodale Reisen über eine einzige Benutzeroberfläche zu planen, zu buchen und zu verwalten – einschließlich Fahrdiensten, öffentlichen Verkehrsmitteln und Mikromobilitätsoptionen. Diese einheitliche Steuerung erhöht den Komfort und fördert die breitere Akzeptanz von MaaS-Diensten.

- Dieser Trend hin zu intelligenteren, vorausschauenden und vernetzten Mobilitätslösungen verändert die Erwartungen der Nutzer an den städtischen Verkehr grundlegend. Unternehmen wie Uber und JoRide entwickeln daher KI-gestützte Funktionen, darunter die Vorhersage der Fahrgastverfügbarkeit, intelligente Routenvorschläge und die sprachgesteuerte Fahrtenverwaltung über Plattformen wie Google Assistant und Amazon Alexa.

- Die Nachfrage nach MaaS-Plattformen, die eine nahtlose KI-gestützte Optimierung und sprachgesteuerte Bedienung bieten, wächst rasant sowohl im privaten als auch im öffentlichen Verkehrssektor, da die Verbraucher zunehmend Wert auf Komfort, Effizienz und integrierte urbane Mobilitätslösungen legen.

Dynamik des Mobilitäts-als-Dienstleistungsmarktes im Nahen Osten und Afrika

Treiber

„Wachsender Bedarf aufgrund von Urbanisierung, Umweltbedenken und der zunehmenden Digitalisierung“

- Die zunehmenden Herausforderungen durch städtische Verkehrsstaus, das wachsende Umweltbewusstsein und die beschleunigte Nutzung digitaler Transportplattformen sind wesentliche Treiber für die gesteigerte Nachfrage nach Mobility as a Service (MaaS) im Nahen Osten und in Afrika.

- Anfang 2025 führte Careem beispielsweise in mehreren Städten der VAE eine KI-gestützte, vorausschauende Fahrtenzuweisung ein, um Verkehrsstaus zu reduzieren und die Flottenauslastung zu optimieren. Solche Strategien führender Unternehmen dürften das Wachstum des MaaS-Marktes im Prognosezeitraum vorantreiben.

- Da Verbraucher nach kostengünstigen, flexiblen und umweltfreundlichen Alternativen zum privaten Autobesitz suchen, bieten MaaS-Plattformen fortschrittliche Funktionen wie Echtzeit-Fahrtenverfolgung, multimodale Routenplanung und dynamische Preisgestaltung und stellen damit ein überzeugendes Upgrade gegenüber herkömmlichen Transportmöglichkeiten dar.

- Darüber hinaus macht die zunehmende Beliebtheit von Smartphone-basierten Mobilitäts-Apps und integrierten digitalen Ökosystemen MaaS zu einem unverzichtbaren Bestandteil des städtischen Verkehrs und bietet eine nahtlose Anbindung an öffentliche Verkehrsmittel, Fahrdienste und Mikromobilitätsdienste.

- Die Bequemlichkeit von On-Demand-Buchungen, bargeldlosen Zahlungen, multimodaler Reiseplanung und der Zugriff auf Services über mobile Apps sind Schlüsselfaktoren für die zunehmende Verbreitung von Mobility-as-a-Service (MaaS) im privaten und geschäftlichen Transportsektor. Der Trend zu App-basiertem Reisemanagement und die steigende Verfügbarkeit benutzerfreundlicher Plattformen tragen zusätzlich zum Marktwachstum bei.

Zurückhaltung/Herausforderung

„Bedenken hinsichtlich Datenschutz, Cybersicherheit und Infrastrukturbeschränkungen“

- Bedenken hinsichtlich Datenschutz, Cybersicherheit und einer uneinheitlichen Verkehrsinfrastruktur stellen erhebliche Herausforderungen für eine breitere Akzeptanz von Mobility-as-a-Service (MaaS) dar. Da MaaS-Plattformen auf digitaler Vernetzung und Nutzerdaten basieren, sind sie anfällig für Cyberangriffe und Datenlecks, was bei den Verbrauchern Besorgnis über die Sicherheit ihrer persönlichen Daten und Zahlungsinformationen auslöst.

- Beispielsweise haben Berichte über Sicherheitslücken in Fahrdienst-Apps oder Plattformen zur Integration des öffentlichen Nahverkehrs einige Nutzer davon abgehalten, vollständig digitale Mobilitätslösungen einzuführen.

- Die Behebung dieser Bedenken durch sichere Verschlüsselung, robuste Authentifizierungsprotokolle und regelmäßige Systemaktualisierungen ist entscheidend für den Aufbau von Verbrauchervertrauen. Unternehmen wie Uber und Bolt betonen ihre Cybersicherheitsmaßnahmen und Datenschutzfunktionen, um Nutzern Sicherheit zu geben. Darüber hinaus können uneinheitliche öffentliche Verkehrsnetze, eine in manchen Regionen begrenzte digitale Infrastruktur und hohe Anfangskosten für App-basierte Abonnements Hindernisse für die Akzeptanz darstellen, insbesondere in Entwicklungsländern.

- Obwohl MaaS-Plattformen immer erschwinglicher und zugänglicher werden, können wahrgenommene Zuverlässigkeitsprobleme oder Bedenken hinsichtlich der Serviceabdeckung die breite Akzeptanz immer noch behindern, insbesondere bei Erstnutzern oder preissensiblen Verbrauchern.

- Die Bewältigung dieser Herausforderungen durch verbesserte Cybersicherheit, Investitionen in die digitale Infrastruktur, staatliche Unterstützung für integrierte Mobilität und Aufklärung der Verbraucher über die Sicherheit von Apps wird für ein nachhaltiges Marktwachstum in der Region von entscheidender Bedeutung sein.

Marktübersicht für Mobility-as-a-Service im Nahen Osten und Afrika

Der Markt für Mobilität als Dienstleistung ist segmentiert nach Dienstleistungsart, Lösung, Transportart, Fahrzeugtyp, Anwendungsplattform, Anforderungstyp, Organisationsgröße und Nutzung.

- Nach Serviceart

Basierend auf der Serviceart ist der Markt für Mobilitätsdienstleistungen im Nahen Osten und in Afrika in Carsharing, Bus-Sharing, Zugverkehr, Fahrdienste, Fahrradverleih, autonome Fahrzeuge und Sonstiges unterteilt. Das Segment der Fahrdienste dominierte den Markt mit dem größten Umsatzanteil von 38,6 % im Jahr 2025. Gründe hierfür waren die weitverbreitete Nutzung von Smartphones, die Herausforderungen des städtischen Verkehrs und der Komfort von On-Demand-Reisen. Verbraucher bevorzugen zunehmend App-basierte Fahrdienste für kurze und mittlere Strecken, da diese erschwinglich, zeitsparend und mit Tür-zu-Tür-Service ausgestattet sind.

Für den Fahrradverleihsektor wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 22,4 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind das wachsende Umweltbewusstsein, staatliche Initiativen zur Förderung umweltfreundlicher Mobilität und steigende Investitionen in die Mikromobilitätsinfrastruktur. Der Ausbau von Sharing-Angeboten in städtischen Gebieten, unterstützt durch entsprechende politische Maßnahmen und die steigende Nachfrage nach umweltfreundlichen Transportmitteln, treibt die rasche Verbreitung von Fahrradverleihsystemen in der gesamten Region voran.

- Durch Lösung

Basierend auf den angebotenen Lösungen ist der Markt für Mobility as a Service (MaaS) im Nahen Osten und in Afrika in Navigationslösungen, Ticketing-Lösungen, Technologieplattformen, Versicherungsdienstleistungen, Telekommunikationsanbieter und Zahlungssysteme unterteilt. Technologieplattformen dominierten den Markt mit einem Umsatzanteil von 41,3 % im Jahr 2025, da sie das entscheidende Rückgrat für MaaS-Anwendungen bilden, darunter Fahrtenmanagement, multimodale Integration und Echtzeit-Tracking.

Für Zahlungsplattformen wird im Prognosezeitraum mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,8 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung sind die steigende Nachfrage nach reibungslosen bargeldlosen Transaktionen und die Integration digitaler Geldbörsen. Die rasche Verbreitung kontaktloser Zahlungen und die zunehmende Nutzung von Smartphone-basierten Zahlungslösungen in der Region ermöglichen ein optimiertes Nutzererlebnis, fördern die Nutzung von Mobility-as-a-Service (MaaS) und unterstützen Partnerschaften zwischen Mobilitätsanbietern und Fintech-Unternehmen.

- Nach Transportart

Basierend auf der Art des Transports ist der Markt für Mobilitätsdienstleistungen im Nahen Osten und in Afrika in öffentlichen und privaten Verkehr unterteilt. Das Segment des privaten Verkehrs dominierte den Markt mit dem größten Umsatzanteil von 57,2 % im Jahr 2025, vor allem aufgrund der Beliebtheit von Fahrdiensten, Carsharing-Plattformen und App-basierten Taxidiensten, die flexible und bequeme Reisemöglichkeiten bieten.

Der öffentliche Nahverkehr dürfte im Prognosezeitraum mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 18,9 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind staatliche Initiativen zur Modernisierung städtischer Verkehrssysteme, die Integration mit Mobility-as-a-Service-Plattformen (MaaS) und die zunehmende Bevölkerungsdichte in Städten. Investitionen in digitale Tickets, Echtzeit-Tracking und multimodale Transport-Apps ermöglichen es den Betreibern des öffentlichen Nahverkehrs, die Zugänglichkeit und den Komfort zu verbessern und die Akzeptanz von MaaS bei Pendlern, die auf Busse, Züge und U-Bahnen angewiesen sind, zu beschleunigen.

- Nach Fahrzeugtyp

Basierend auf dem Fahrzeugtyp ist der Markt für Mobilitätsdienstleistungen im Nahen Osten und in Afrika in Pkw, Busse, Züge und Mikromobilitätsfahrzeuge unterteilt. Pkw dominierten den Markt mit einem Umsatzanteil von 52,5 % im Jahr 2025, was auf die Verbreitung von App-basierten Mietwagen, Fahrdiensten und Mobilitätslösungen für Unternehmen zurückzuführen ist.

Mikromobilitätsfahrzeuge wie E-Scooter und Fahrräder werden voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 23,1 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind ein steigendes Umweltbewusstsein, staatliche Förderprogramme für nachhaltigen Verkehr und die zunehmende Verkehrsdichte in Städten. Die Nutzung von Mikromobilitätslösungen nimmt in verkehrsreichen Städten rasant zu und bietet flexible Anbindungen auf der letzten Meile sowie eine sinnvolle Ergänzung bestehender öffentlicher und privater Verkehrsnetze.

- Nach Anwendungsplattform

Basierend auf der Anwendungsplattform ist der Markt für Mobility-as-a-Service im Nahen Osten und in Afrika in iOS, Android und Sonstige unterteilt. Das Android-Segment dominierte den Markt mit dem größten Umsatzanteil von 63,4 % im Jahr 2025, was auf die höhere Verbreitung von Android-Smartphones in der Region, insbesondere in Entwicklungsländern, zurückzuführen ist.

Für das iOS-Segment wird im Prognosezeitraum das schnellste jährliche Wachstum von 19,7 % erwartet. Treiber dieser Entwicklung sind die zunehmende Nutzung durch Premium-Smartphone-Nutzer und die Integration mit fortschrittlichen MaaS-Anwendungen. Plattformübergreifende Kompatibilität und benutzerfreundliche Oberflächen sind für die Akzeptanz von MaaS unerlässlich und ermöglichen es Pendlern, Fahrdienste, Ticketing und multimodale Planungsdienste nahtlos auf ihren bevorzugten Geräten zu nutzen.

- Nach Anforderungstyp

Basierend auf der Art der Anforderungen ist der Markt für Mobilitätsdienstleistungen im Nahen Osten und in Afrika in folgende Segmente unterteilt: Anbindung auf der ersten und letzten Meile, Pendelverkehr außerhalb der Stoßzeiten und Schichtarbeit, tägliches Pendeln, Fahrten zu Flughäfen oder öffentlichen Verkehrsmitteln, Fernreisen und Sonstiges. Tägliches Pendeln dominierte den Markt mit dem größten Umsatzanteil von 44,1 % im Jahr 2025, bedingt durch den Bedarf an zuverlässigen, kostengünstigen und flexiblen Lösungen für den täglichen Stadtverkehr.

Die Anbindung an das Nah- und Fernverkehrsnetz wird im Prognosezeitraum voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 21,5 % am schnellsten wachsen. Unterstützt wird dies durch den Ausbau von Mikromobilitätsnetzen, Fahrradverleihsystemen und die Integration in öffentliche Verkehrsknotenpunkte. Dieses Segment ist entscheidend für mehr Komfort für Pendler und nahtlose multimodale Reiseerlebnisse.

- Nach Organisationsgröße

Der Markt für Mobility-as-a-Service im Nahen Osten und Afrika ist nach Unternehmensgröße in Großunternehmen und kleine und mittlere Unternehmen (KMU) unterteilt. Großunternehmen dominierten den Markt mit einem Umsatzanteil von 59,3 % im Jahr 2025. Treiber dieses Wachstums waren Programme zur betrieblichen Mobilität, Lösungen für den Mitarbeitertransport und Flottenmanagement-Dienstleistungen zur Steigerung der betrieblichen Effizienz.

Für KMU wird im Prognosezeitraum das schnellste jährliche Wachstum von 22,0 % erwartet. Treiber dieser Entwicklung sind die zunehmende Nutzung flexibler Mobilitätsdienstleistungen, kosteneffizienter Lösungen und digitaler Plattformen, die kleineren Unternehmen helfen, ihren Transportbedarf effizient zu decken. Die steigende Verfügbarkeit skalierbarer MaaS-Lösungen, die speziell auf KMU zugeschnitten sind, beschleunigt die Marktdurchdringung in verschiedenen Geschäftssegmenten.

- Nach Verwendung

Basierend auf der Nutzung ist der Markt für Mobility-as-a-Service im Nahen Osten und Afrika in gewerbliche und private Nutzung unterteilt. Die private Nutzung dominierte den Markt mit dem größten Umsatzanteil von 54,6 % im Jahr 2025, was auf die weitverbreitete Nutzung von Fahrdiensten, Carsharing und Mikromobilitätslösungen für Pendler zurückzuführen ist.

Für den kommerziellen Bereich wird von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 20,9 % das schnellste Wachstum erwartet. Treiber dieser Entwicklung ist die steigende Nachfrage nach Mitarbeitertransporten, Flottenmanagement und Logistiklösungen. Unternehmen setzen zunehmend auf Mobility-as-a-Service-Plattformen (MaaS), um Kosten zu optimieren, die Mitarbeiterzufriedenheit zu steigern und die Transportplanung in umfassendere Betriebsstrategien zu integrieren. Dies trägt zu einem starken Wachstum im kommerziellen Segment bei.

Regionale Analyse des Mobility-as-a-Service-Marktes im Nahen Osten und Afrika

- Die VAE dominierten den Markt für Mobility as a Service im Nahen Osten und in Afrika mit dem größten Umsatzanteil von 32,5 % im Jahr 2025. Treiber dieser Entwicklung waren die zunehmende Nutzung digitaler Mobilitätslösungen, die hohe Urbanisierung und das gestiegene Bewusstsein für App-basierte Transportplattformen.

- Die Verbraucher in der Region schätzen den Komfort, die Echtzeit-Verfolgung und die nahtlose Integration, die MaaS-Plattformen mit anderen digitalen Diensten wie Navigations-Apps, Zahlungslösungen und Fahrplänen des öffentlichen Nahverkehrs bieten.

- Diese breite Akzeptanz wird zusätzlich durch hohe verfügbare Einkommen, eine technikaffine Bevölkerung und die Vorliebe für flexible, kostengünstige und nachhaltige Transportmöglichkeiten unterstützt, wodurch sich MaaS als bevorzugte Mobilitätslösung sowohl für Privat- als auch für Firmenkunden etabliert.

Einblick in den MaaS-Markt in Saudi-Arabien

Der Markt für Mobility-as-a-Service (MaaS) in Saudi-Arabien verzeichnet ein signifikantes Wachstum, angetrieben durch die rasante Urbanisierung, staatliche Initiativen zur Modernisierung der Verkehrsinfrastruktur und die zunehmende Verbreitung von Smartphones. Verbraucher nutzen vermehrt App-basierte Fahrdienste, Carsharing und multimodale Transportlösungen, um sich in verkehrsreichen Städten fortzubewegen. Der Markt wird zusätzlich durch die Vision 2030 unterstützt, die die Entwicklung intelligenter Städte, nachhaltige Mobilität und die Digitalisierung des Verkehrswesens in den Vordergrund stellt. Mobilitätsprogramme für Unternehmen und Investitionen in integrierte MaaS-Plattformen fördern die Nutzung im gewerblichen und privaten Sektor.

Einblick in den MaaS-Markt der VAE

Der Markt für Mobilitätsdienstleistungen (MaaS) in den VAE verzeichnet ein starkes Wachstum, angetrieben von einer technikaffinen Bevölkerung, hohen verfügbaren Einkommen und der weitverbreiteten Nutzung von Smartphones. Die Beliebtheit von Fahrdiensten, kombiniert mit staatlichen Investitionen in Smart-City-Initiativen und die Integration des öffentlichen Nahverkehrs, fördert die Akzeptanz von MaaS. Dubai und Abu Dhabi sind führende Zentren für App-basierte Mobilitätslösungen und bieten eine nahtlose Integration mit Taxis, U-Bahnen und Bussen. Der Einsatz von KI-gestützten Funktionen, Echtzeitnavigation und bargeldlosen Zahlungsmethoden erhöht den Komfort zusätzlich und ermutigt sowohl Privatpersonen als auch Unternehmen, auf MaaS-Plattformen zurückzugreifen.

Einblick in den MaaS-Markt in Südafrika

Der südafrikanische Markt für Mobilitätsdienstleistungen wächst stetig. Gründe hierfür sind die zunehmende Urbanisierung, der steigende Bedarf an flexiblen Pendelmöglichkeiten und die Expansion von App-basierten Fahrdiensten und Carsharing-Angeboten. Verbraucher legen Wert auf erschwingliche, bequeme und zuverlässige Mobilitätslösungen, insbesondere in Ballungszentren wie Johannesburg und Kapstadt. Zusätzlich wird der Markt durch die Nutzung mobiler Zahlungsplattformen, die Integration in den öffentlichen Nahverkehr und das wachsende Bewusstsein für umweltfreundliche Transportalternativen beflügelt. Auch die Nachfrage von Unternehmen, die Flottenmanagement und Lösungen für den Arbeitsweg ihrer Mitarbeiter suchen, steigt.

Einblicke in den ägyptischen MaaS-Markt

Der ägyptische Markt für Mobilitätsdienstleistungen (MaaS) steht aufgrund der wachsenden städtischen Bevölkerung, der Verkehrsprobleme und der zunehmenden Smartphone-Nutzung vor einem rasanten Wachstum. Verbraucher nutzen Fahrdienste, Bus-Sharing und multimodale Transportlösungen, um sich in verkehrsreichen Städten wie Kairo und Alexandria fortzubewegen. Die staatlichen Initiativen für intelligente Städte, Investitionen in die Infrastruktur des öffentlichen Nahverkehrs und digitale Zahlungslösungen beflügeln den Markt zusätzlich. Die Integration von Echtzeit-Routenplanung, multimodalen Tickets und App-basierten Flottenmanagement-Diensten erhöht den Komfort für Privat- und Geschäftskunden und fördert die breite Akzeptanz von MaaS im ganzen Land.

Marktanteil von Mobility as a Service im Nahen Osten und Afrika

Die Mobility-as-a-Service-Branche wird vorwiegend von etablierten Unternehmen angeführt, darunter:

- Uber (USA)

- Careem (VAE)

- Bolt (Estland)

- Ola (Indien)

- Didi Chuxing (China)

- Moovit (Israel)

- Jetzt kostenlos (Deutschland)

- Via (USA)

- BlaBlaCar (Frankreich)

- LeCab (Frankreich)

- MAX (Südafrika)

- Karhoo (UK)

- CleverShuttle (Deutschland)

- Heetch (Frankreich)

- Transit (USA)

- JoRide (VAE)

- Yango (Russland)

- Grab (Singapur)

- Terra Mobility (Südafrika)

- Swvl (Ägypten)

Welche aktuellen Entwicklungen gibt es auf dem Markt für Mobilität als Dienstleistung im Nahen Osten und in Afrika?

- Im April 2025 führte Careem, eine führende Fahrdienstplattform im Nahen Osten, in Riad, Saudi-Arabien, ein KI-gestütztes System zur vorausschauenden Fahrtenzuweisung ein. Ziel ist es, Verkehrsstaus zu reduzieren und die Effizienz der städtischen Mobilität zu verbessern. Diese Initiative unterstreicht Careems Engagement für innovative, datenbasierte Transportlösungen, die auf die Bedürfnisse der Pendler vor Ort zugeschnitten sind, und stärkt die Führungsposition des Unternehmens im schnell wachsenden Markt für Mobilitätsdienstleistungen im Nahen Osten und in Afrika.

- Im März 2025 führte Uber in Dubai seine multimodale MaaS-Integration ein, die es Nutzern ermöglicht, Fahrten nahtlos zu planen und dabei Fahrdienste, U-Bahn und Bus zu kombinieren. Die Funktion erhöht den Fahrkomfort durch Echtzeit-Routenoptimierung, Fahrpreisvergleich und einheitliche Zahlungsmöglichkeiten. Mit dieser Einführung unterstreicht Uber sein Engagement für umfassende Mobilitätslösungen, die mit den Smart-City-Initiativen in den VAE im Einklang stehen.

- Im März 2025 erweiterte Bolt seine Aktivitäten in Kapstadt, Südafrika, durch den Einsatz von Elektrofahrzeugflotten und die Integration nachhaltiger Fahrdienstleistungen in seine Plattform. Diese Expansion unterstreicht Bolts Engagement für umweltfreundliche urbane Verkehrslösungen, fördert grünere Mobilität und unterstützt regionale Bemühungen zur Reduzierung von CO₂-Emissionen.

- Im Februar 2025 ging JoRide, ein in den VAE ansässiger Anbieter von Mobility-as-a-Service (MaaS), eine Partnerschaft mit der Straßen- und Verkehrsbehörde (RTA) von Dubai ein, um Lösungen für die Anbindung an den öffentlichen Nahverkehr anzubieten. Dabei werden Fahrräder, E-Scooter und Sharing-Angebote integriert. Diese Zusammenarbeit unterstreicht JoRides Bestreben, nahtlose, multimodale urbane Mobilitätserlebnisse zu schaffen und gleichzeitig die Erreichbarkeit für Pendler zu verbessern.

- Im Januar 2025 führte Moovit, eine israelische MaaS-Technologieplattform, eine einheitliche Ticket- und Navigationslösung in den wichtigsten Städten Ägyptens ein. Nutzer können damit über eine einzige mobile App auf Busse, U-Bahnen und Fahrdienste zugreifen. Diese Initiative unterstreicht Moovits Engagement für den Einsatz fortschrittlicher Technologien für effiziente, benutzerfreundliche und vernetzte städtische Verkehrssysteme im Nahen Osten und in Afrika.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.