Markt für Middle-Office-Outsourcing im Nahen Osten und in Afrika, nach Angebot (Devisen- und Handelsmanagement , Portfoliomanagement, Investmentgeschäfte, Liquiditätsmanagement, Asset Class Servicing und andere), Bereitstellungsmodell (Cloud und vor Ort), Endbenutzer (Investmentbanking und -verwaltungsfirmen, Vermögensverwaltungsgesellschaften, Börsen, Broker-Dealer, Banken, Industrie und andere), Land (Südafrika, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten und restlicher Naher Osten und Afrika), Branchentrends und Prognose bis 2028.

Marktanalyse und Einblicke: Middle Office Outsourcing-Markt im Nahen Osten und in Afrika

Marktanalyse und Einblicke: Middle Office Outsourcing-Markt im Nahen Osten und in Afrika

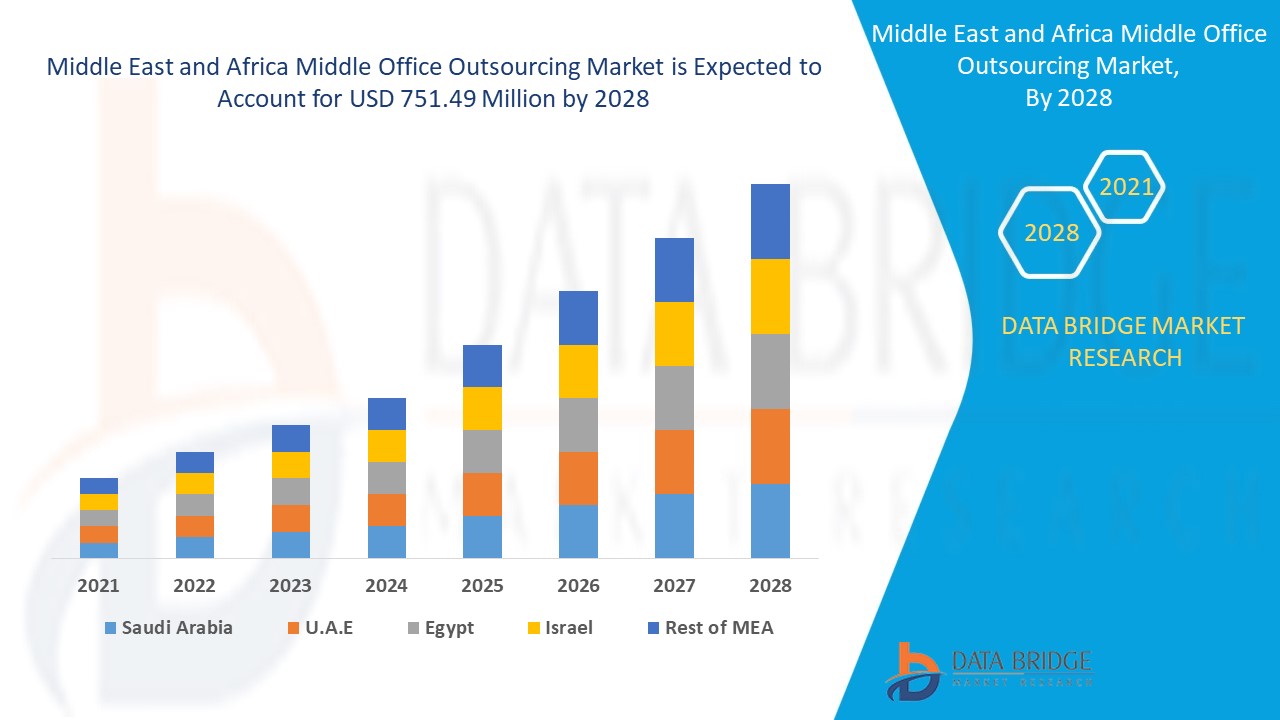

Es wird erwartet, dass der Markt für Middle-Office-Outsourcing im Prognosezeitraum von 2021 bis 2028 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2021 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,9 % wächst und bis 2028 voraussichtlich 751,49 Millionen USD erreichen wird. Die zunehmende Nutzung von Middle-Office-Outsourcing wird voraussichtlich das Wachstum des Marktes für Middle-Office-Outsourcing vorantreiben.

Das Middle Office ist die Abteilung in einem Finanzdienstleistungsunternehmen, einer Investmentbank oder einem Hedgefonds, die zwischen Front- und Backoffice liegt. Sie verwaltet typischerweise Risiken und berechnet Gewinne und Verluste. Unter Middle-Office-Outsourcing versteht man die Durchführung dieser nicht zum Kerngeschäft gehörenden Middle-Office-Funktionen mit Hilfe eines Dritten.

Der steigende Bedarf an Produktivitäts-, Effizienz- und Verantwortlichkeitsverbesserungen hat die Einführung von Middle-Office-Outsourcing gefördert, was voraussichtlich das Wachstum des Middle-Office-Outsourcing-Marktes vorantreiben wird. Unerwartete Betriebs- und Integrationskosten sowie Kapitalinvestitionen werden das Wachstum des Middle-Office-Outsourcing-Marktes in den kommenden Jahren voraussichtlich bremsen. Die zunehmende Betonung der Marktteilnehmer auf Forschungs- und Entwicklungsaktivitäten wird voraussichtlich lukrative Möglichkeiten für das Wachstum des Middle-Office-Outsourcing-Marktes schaffen. Die Einführung fortschrittlicher Technologien ohne technisches Fachwissen wird das Wachstum des Middle-Office-Outsourcing-Marktes im Prognosezeitraum voraussichtlich herausfordern.

Dieser Bericht zum Middle-Office-Outsourcing-Markt liefert Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, den Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Middle-Office-Outsourcing-Marktszenario zu verstehen, wenden Sie sich an Data Bridge Market Research, um ein Analyst Briefing zu erhalten. Unser Team wird Ihnen helfen, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Middle Office Outsourcing – Marktumfang und Marktgröße

Middle Office Outsourcing – Marktumfang und Marktgröße

Der Middle-Office-Outsourcing-Markt ist nach Angebot, Bereitstellungsmodell und Endbenutzer segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage des Angebots wurde der Middle-Office-Outsourcing-Markt in Devisen- und Handelsmanagement, Portfoliomanagement, Anlagegeschäfte, Liquiditätsmanagement, Asset-Class-Servicing und andere segmentiert. Im Jahr 2021 wird das Segment Devisen- und Handelsmanagement voraussichtlich den Markt dominieren, vor allem aufgrund der Notwendigkeit, Kosten zu sparen, regulatorische Anforderungen zu erfüllen, Zugang zu kontinuierlicher Handelsunterstützung zu erhalten und operativem Druck ausgesetzt zu sein.

- Auf der Grundlage des Bereitstellungsmodells wurde der Middle-Office-Outsourcing-Markt in Cloud und On-Premises segmentiert. Im Jahr 2021 wird das On-Premises-Segment voraussichtlich den Markt dominieren, da Asset Manager die Verwaltung von Daten im On-Premises-Bereitstellungsmodell bevorzugen.

- Auf der Grundlage des Endnutzers wurde der Markt für Middle-Office-Outsourcing in Investmentbanking- und Verwaltungsfirmen, Vermögensverwaltungsgesellschaften, Börsen, Broker-Dealer, Banken, Industrie und andere segmentiert. Im Jahr 2021 wird das Segment der Investmentbanking- und Verwaltungsfirmen voraussichtlich den Markt dominieren, da die Nachfrage nach Outsourcing von Anlagegeschäften steigt.

Middle-Office-Outsourcing-Markt im Nahen Osten und Afrika – Länderebeneanalyse

Der Middle-Office-Outsourcing-Markt im Nahen Osten und in Afrika wird analysiert und Informationen zur Marktgröße werden wie oben angegeben nach Land, Angebot, Bereitstellungsmodell und Endbenutzer bereitgestellt.

Die im Marktbericht zum Outsourcing von Middle Offices im Nahen Osten und Afrika abgedeckten Länder sind Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Israel, Ägypten und der Rest des Nahen Ostens und Afrikas.

Die Vereinigten Arabischen Emirate werden voraussichtlich den Middle-Office-Outsourcing-Markt im Nahen Osten und in Afrika dominieren, was auf Faktoren wie den Fokus auf Cloud-basierte Finanztransaktionen und die zunehmende Nutzung technologischer Innovationen im Middle-Office-Outsourcing zurückzuführen ist.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken aus dem Nahen Osten und Afrika sowie ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken und die Auswirkungen der Vertriebskanäle berücksichtigt.

Steigender Bedarf an Effizienz- und Produktivitätsverbesserungen dürfte das Wachstum des Middle-Office-Outsourcing-Marktes vorantreiben

Der Middle-Office-Outsourcing-Markt bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Branchenwachstum in jedem Land mit Umsatz, Komponentenverkäufen, Auswirkungen der technologischen Entwicklung auf das Middle-Office-Outsourcing und Änderungen der regulatorischen Szenarien mit ihrer Unterstützung für den Middle-Office-Outsourcing-Markt. Die Daten sind für den historischen Zeitraum 2010 bis 2019 verfügbar.

Wettbewerbsumfeld und Middle-Office-Outsourcing Marktanteilsanalyse

Die Wettbewerbslandschaft des Middle-Office-Outsourcing-Marktes liefert Details nach Wettbewerbern. Zu den enthaltenen Details gehören Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Präsenz im Nahen Osten und in Afrika, Produktionsstandorte und -einrichtungen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -umfang, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Middle-Office-Outsourcing-Markt im Nahen Osten und in Afrika.

Die wichtigsten Akteure, die im Bericht zum Middle-Office-Outsourcing-Markt im Nahen Osten und Afrika behandelt werden, sind Accenture, BNP Paribas, JPMorgan Chase & Co., SS&C Technologies, Inc., State Street Corporation, Citigroup, Inc., THE BANK OF NEW YORK MELLON CORPORATION, CACEIS, Apex Group Ltd., Northern Trust Corporation, Societe Generale, BROWN BROTHERS HARRIMAN, Genpact und andere inländische Akteure. Die Analysten von DBMR kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Darüber hinaus werden viele Produktentwicklungen von Unternehmen weltweit initiiert, die das Wachstum des Middle-Office-Outsourcing-Marktes ebenfalls beschleunigen.

Zum Beispiel,

- Im Dezember 2020 ging State Street Corporation eine Partnerschaft mit SimCorp ein, um eine erstklassige, vollständig integrierte Front-to-Back-Investment-Outsourcing-Lösung für Versicherungsunternehmen in Europa, dem Nahen Osten und Afrika bereitzustellen. Dadurch konnte das Unternehmen seine Präsenz auf dem Markt stärken und wachsen.

Partnerschaften, Joint Ventures und andere Strategien steigern den Marktanteil des Unternehmens durch größere Reichweite und Präsenz. Darüber hinaus bieten sie Unternehmen den Vorteil, ihr Angebot für das Middle Office Outsourcing durch eine größere Größenspanne zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 OFFERING TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN ADOPTION OF MIDDLE OFFICE OUTSOURCING SOLUTIONS

5.1.2 INTRODUCTION OF VARIOUS DATA ANALYTICS SERVICES

5.1.3 RISE IN ADOPTION OF NEW TECHNOLOGIES SUCH AS AI, MACHINE LEARNING

5.1.4 RISE IN NEED TO IMPROVE EFFICIENCY AND PRODUCTIVITY

5.1.5 IMPROVED FOCUS TOWARDS REDUCING COST OF CONDUCTING BUSINESS

5.2 RESTRAINTS

5.2.1 UNEXPECTED OPERATIONAL AND INTEGRATION COSTS

5.2.2 DELAY IN OUTSOURCING PROCESS

5.3 OPPORTUNITIES

5.3.1 INCREASE IN EMPHASIS ON RESEARCH AND DEVELOPMENT ACTIVITIES

5.3.2 EMERGENCE OF BIG DATA ANALYTICS

5.3.3 ACCELERATED GROWTH IN THE FINANCIAL SECTOR

5.3.4 RISE IN ADOPTION OF CLOUD TECHNOLOGY

5.3.5 INCREASE IN DIGITIZATION AND AUTOMATION OF BUSINESS PROCESSES

5.4 CHALLENGES

5.4.1 LEGAL CONCERNS AND DATA PRIVACY ISSUES

5.4.2 LACK OF DOMAIN KNOWLEDGE AND TECHNICAL EXPERTISE

6 IMPACT OF COVID-19 ON THE MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND AND SUPPLY CHAIN

6.6 CONCLUSION

7 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING

7.1 OVERVIEW

7.2 FOREIGN EXCHANGE AND TRADE MANAGEMENT

7.3 PORTFOLIO MANAGEMENT

7.3.1 PORTFOLIO MANAGEMENT

7.3.2 PRE-TRADE COMPLIANCE

7.3.3 ORDER MANAGEMENT

7.4 INVESTMENT OPERATIONS

7.4.1 RECONCILIATION

7.4.2 INVESTMENT RECORD-KEEPING

7.4.3 CASH ADMINISTRATION

7.4.4 DERIVATIVES PROCESSING

7.4.5 HEDGE SOLUTIONS

7.4.6 COLLATERAL MANAGEMENT SERVICES

7.4.6.1 DATA MANAGEMENT, DATA CAPTURE, ONBOARDING

7.4.6.2 VALUATION AND CALCULATION

7.4.6.3 DAILY CALL ADMINISTRATION

7.4.6.4 COLLATERAL SERVICING

7.4.7 EMIR REPORTING

7.5 LIQUIDITY MANAGEMENT

7.6 ASSET CLASS SERVICING

7.7 OTHERS

8 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISE

9 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY END USER

9.1 OVERVIEW

9.2 INVESTMENT BANKING AND MANAGEMENT FIRMS

9.3 ASSET MANAGEMENT COMPANIES

9.4 STOCK EXCHANGES

9.5 BROKER- DEALERS

9.6 BANKS

9.7 OTHERS

10 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 U.A.E.

10.1.2 SAUDI ARABIA

10.1.3 ISRAEL

10.1.4 EGYPT

10.1.5 SOUTH AFRICA

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 JPMORGAN CHASE & CO.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 SOLUTION PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CITIGROUP, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 STATE STREET CORPORATION

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 SOLUTION PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ACCENTURE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 SERVICE PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 THE BANK OF NEW YORK MELLON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 SOLUTION PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ADEPA MIDDLE EAST AND AFRICA SERVICES S.A.

13.6.1 COMPANY SNAPSHOT

13.6.2 SERVICE PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 APEX GROUP LTD.

13.7.1 COMPANY SNAPSHOT

13.7.2 SERVICE PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BNP PARIBAS

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BROWN BROTHERS HARRIMAN

13.9.1 COMPANY SNAPSHOT

13.9.2 SERVICE PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CACEIS

13.10.1 COMPANY SNAPSHOT

13.10.2 SERVICE PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 EMPAXIS DATA MANAGEMENT, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 SOLUTION PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 GBST

13.12.1 COMPANY SNAPSHOT

13.12.2 SOLUTION PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 GENPACT

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 HEDGEGUARD

13.14.1 COMPANY SNAPSHOT

13.14.2 SERVICE PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 INDUS VALLEY PARTNERS

13.15.1 COMPANY SNAPSHOT

13.15.2 SERVICE PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 LINEDATA

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 NORTHERN TRUST CORPORATION

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 ROYAL BANK OF CANADA

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT & SERVICE PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 SOCIETE GENERALE

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 SOLUTION PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 SS&C TECHNOLOGIES, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 SOLUTION & SERVICE PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 2 MIDDLE EAST AND AFRICA FOREIGN EXCHANGE AND TRADE MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 MIDDLE EAST AND AFRICA PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 MIDDLE EAST AND AFRICA PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 5 MIDDLE EAST AND AFRICA INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 6 MIDDLE EAST AND AFRICA INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 7 MIDDLE EAST AND AFRICA COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 8 MIDDLE EAST AND AFRICA LIQUIDITY MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 MIDDLE EAST AND AFRICA ASSET CLASS SERVICING IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 MIDDLE EAST AND AFRICA OTHERS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 12 MIDDLE EAST AND AFRICA CLOUD IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 MIDDLE EAST AND AFRICA ON-PREMISE IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 15 MIDDLE EAST AND AFRICA INVESTMENT BANKING AND MANAGEMENT FIRMS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 MIDDLE EAST AND AFRICA ASSET MANAGEMENT COMPANIES IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 17 MIDDLE EAST AND AFRICA STOCK EXCHANGES IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 MIDDLE EAST AND AFRICA BROKER- DEALERS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 MIDDLE EAST AND AFRICA BANKS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 MIDDLE EAST AND AFRICA OTHERS IN MIDDLE OFFICE OUTSOURCING MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 22 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 23 MIDDLE EAST AND AFRICA INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 28 U.A.E. MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 29 U.A.E. INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 30 U.A.E. COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 31 U.A.E. PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 32 U.A.E. MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 33 U.A.E. MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 34 SAUDI ARABIA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 35 SAUDI ARABIA INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 36 SAUDI ARABIA COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 SAUDI ARABIA PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 SAUDI ARABIA MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 39 SAUDI ARABIA MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 40 ISRAEL MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 41 ISRAEL INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 42 ISRAEL COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 43 ISRAEL PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 44 ISRAEL MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 45 ISRAEL MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 46 EGYPT MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 47 EGYPT INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 48 EGYPT COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 49 EGYPT PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 50 EGYPT MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 51 EGYPT MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 52 SOUTH AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

TABLE 53 SOUTH AFRICA INVESTMENT OPERATIONS IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 54 SOUTH AFRICA COLLATERAL MANAGEMENT SERVICES IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 SOUTH AFRICA PORTFOLIO MANAGEMENT IN MIDDLE OFFICE OUTSOURCING MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 56 SOUTH AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY DEPLOYMENT MODEL, 2019-2028 (USD MILLION)

TABLE 57 SOUTH AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 58 REST OF MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2019-2028 (USD MILLION)

Abbildungsverzeichnis

FIGURE 1 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: SEGMENTATION

FIGURE 11 RISING ADOPTION OF MIDDLE OFFICE OUTSOURCING SOLUTIONS IS EXPECTED TO DRIVE MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 FOREIGN EXCHANGE AND TRADE MANAGEMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET IN 2021 & 2028

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET

FIGURE 14 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET, BY OFFERING, 2020

FIGURE 15 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY DEPLOYMENT MODEL, 2020

FIGURE 16 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY END USER, 2020

FIGURE 17 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: SNAPSHOT (2020)

FIGURE 18 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY COUNTRY (2020)

FIGURE 19 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY COUNTRY (2021 & 2028)

FIGURE 20 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY COUNTRY (2020 & 2028)

FIGURE 21 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: BY OFFERING (2021-2028)

FIGURE 22 MIDDLE EAST AND AFRICA MIDDLE OFFICE OUTSOURCING MARKET: COMPANY SHARE 2020 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.