Middle East And Africa Medical Device Regulatory Affairs Outsourcing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.06 Billion

USD

4.67 Billion

2025

2033

USD

2.06 Billion

USD

4.67 Billion

2025

2033

| 2026 –2033 | |

| USD 2.06 Billion | |

| USD 4.67 Billion | |

|

|

|

|

Marktsegmentierung für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte im Nahen Osten und Afrika nach Dienstleistungen (Zulassungswesen, Qualitätsberatung und medizinisches Schreiben), Produkt (Fertigprodukte, Elektronik und Rohmaterialien), Gerätetyp (Klasse I, II und III), Anwendung (Kardiologie, diagnostische Bildgebung, Orthopädie, In-vitro-Diagnostik, Ophthalmologie, Allgemein- und Plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und Sonstige), Endnutzer (kleine, mittlere und große Medizinprodukteunternehmen) – Branchentrends und Prognose bis 2033

Marktgröße für Outsourcing von regulatorischen Angelegenheiten für Medizinprodukte im Nahen Osten und Afrika

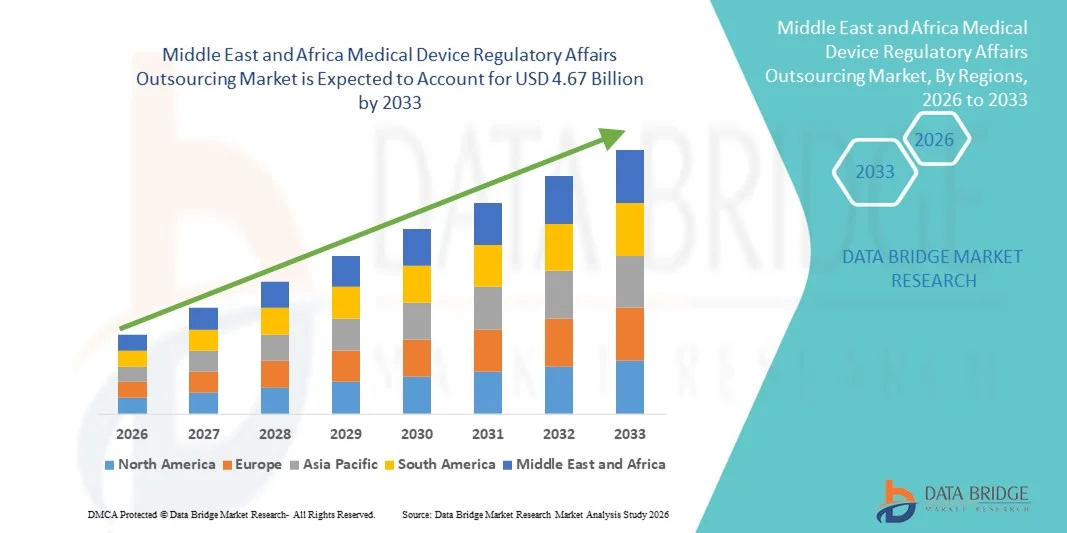

- Der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte im Nahen Osten und in Afrika hatte im Jahr 2025 einen Wert von 2,06 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 4,67 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 10,80 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Komplexität der regulatorischen Anforderungen in der Pharma-, Biotechnologie- und Medizintechnikbranche angetrieben, was Unternehmen dazu veranlasst, spezialisierte Outsourcing-Dienstleistungen für das Compliance-Management in Anspruch zu nehmen.

- Darüber hinaus treibt die steigende Nachfrage nach kostengünstigen, effizienten und zeitnahen regulatorischen Einreichungen die Nutzung von Outsourcing-Lösungen im Bereich Regulatory Affairs voran. Diese zusammenwirkenden Faktoren beschleunigen die Inanspruchnahme von Outsourcing-Dienstleistungen im Bereich Regulatory Affairs und tragen somit maßgeblich zum globalen Wachstum der Branche bei.

Marktanalyse für die Auslagerung regulatorischer Angelegenheiten für Medizinprodukte im Nahen Osten und Afrika

- Der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte, bei der regulatorische Strategien, Compliance-Dokumentation, Produktregistrierung und Marktüberwachung an spezialisierte Dienstleister delegiert werden, gewinnt für Medizinprodukteunternehmen, die im Nahen Osten unter komplexen und sich ständig weiterentwickelnden regulatorischen Rahmenbedingungen tätig sind, zunehmend an Bedeutung.

- Die zunehmende Strenge der Vorschriften für Medizinprodukte, die steigende Nachfrage nach schnelleren Zulassungen und der Bedarf an lokaler regulatorischer Expertise sind Schlüsselfaktoren für die verstärkte Nutzung von Outsourcing-Dienstleistungen im Bereich der regulatorischen Angelegenheiten für Medizinprodukte. Unternehmen setzen auf Outsourcing-Partner, um Compliance-Risiken zu minimieren, Zulassungszeiten zu verkürzen und sich auf die Kernaufgaben der Produktentwicklung und Vermarktung zu konzentrieren.

- Saudi-Arabien dominierte 2025 den Markt für Outsourcing-Dienstleistungen im Bereich der regulatorischen Angelegenheiten für Medizinprodukte mit einem Umsatzanteil von rund 41,8 %. Dies ist auf die starke regulatorische Rolle der saudischen Lebensmittel- und Arzneimittelbehörde (SFDA), steigende Importe von Medizinprodukten und verstärkte Investitionen in die Gesundheitsinfrastruktur im Rahmen der Vision 2030 zurückzuführen. Der Fokus des Landes auf die Einhaltung regulatorischer Vorgaben und die Marktzulassung hat die Nachfrage nach spezialisierten Outsourcing-Dienstleistungen deutlich gesteigert.

- Es wird erwartet, dass die VAE der am schnellsten wachsende Markt sein werden und im Prognosezeitraum eine durchschnittliche jährliche Wachstumsrate (CAGR) von rund 9,6 % verzeichnen werden. Unterstützt wird dies durch die rasche Modernisierung des Gesundheitswesens, die wachsende Zahl internationaler Medizinproduktehersteller, die in den Markt eintreten, und die optimierten regulatorischen Prozesse, die von Behörden wie dem Ministerium für Gesundheit und Prävention (MOHAP) geleitet werden.

- Das Segment der Fertigprodukte hielt 2025 mit 52,1 % den größten Marktanteil, da medizinische Endprodukte strengen Zulassungs- und Überwachungsanforderungen unterliegen.

Berichtsumfang und Marktsegmentierung für das Outsourcing regulatorischer Angelegenheiten für Medizinprodukte

|

Attribute |

Outsourcing von Zulassungsangelegenheiten für Medizinprodukte: Wichtige Markteinblicke |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Markttrends im Bereich Outsourcing von Zulassungsangelegenheiten für Medizinprodukte im Nahen Osten und Afrika

Zunehmende Komplexität der Vorschriften für Medizinprodukte in verschiedenen Regionen

- Ein bedeutender und sich beschleunigender Trend im Outsourcing-Markt für regulatorische Angelegenheiten im Bereich Medizinprodukte ist die zunehmende Komplexität und ständige Weiterentwicklung der regulatorischen Rahmenbedingungen für Medizinprodukte. Länder in der gesamten Region verschärfen ihre Zulassungsverfahren, die Anforderungen an die Marktüberwachung und die Compliance-Standards, um sie stärker an internationale Standards anzugleichen.

- Beispielsweise haben die Zulassungsbehörden in den Ländern des Golf-Kooperationsrats (GCC) und in Südafrika strukturiertere Registrierungssysteme für Medizinprodukte eingeführt, was Hersteller dazu veranlasst hat, auf spezialisierte Outsourcing-Partner für regulatorische Angelegenheiten zurückzugreifen, um die lokalen Zulassungsverfahren und Dokumentationsanforderungen effizient zu bewältigen.

- Die zunehmende Anwendung internationaler Standards wie ISO 13485 und risikobasierter Klassifizierungssysteme treibt die Nachfrage nach externem Fachwissen für die Bearbeitung von Zulassungsanträgen, die Erstellung technischer Dokumentationen und die Einhaltung von Qualitätsstandards an. Outsourcing-Partner bieten regionsspezifisches Wissen, das dazu beiträgt, Genehmigungszeiten zu verkürzen und regulatorische Risiken zu minimieren.

- Zudem fördert die Expansion multinationaler Medizinprodukteunternehmen in die Märkte des Nahen Ostens und Afrikas die Nutzung ausgelagerter regulatorischer Dienstleistungen, um länderübergreifende Registrierungen zentral und kosteneffizient zu verwalten.

- Dieser Trend hin zu professionellen Dienstleistungen zur Unterstützung bei regulatorischen Angelegenheiten verändert die Art und Weise, wie Hersteller Markteintritt und Compliance angehen, wobei Outsourcing in der gesamten Region eher zu einer strategischen Notwendigkeit als zu einer optionalen Dienstleistung wird.

- Mit zunehmender behördlicher Kontrolle steigt die Nachfrage nach spezialisierten Anbietern von Dienstleistungen im Bereich regulatorischer Angelegenheiten mit regionaler Expertise sowohl bei globalen als auch bei lokalen Herstellern von Medizinprodukten stetig an.

Marktdynamik im Bereich Outsourcing von regulatorischen Angelegenheiten für Medizinprodukte im Nahen Osten und Afrika

Treiber

Steigende Marktexpansion bei Medizinprodukten und zunehmende regulatorische Strenge

- Die rasante Expansion des Medizinproduktesektors weltweit, angetrieben durch steigende Investitionen im Gesundheitswesen, Bevölkerungswachstum und die zunehmende Verbreitung chronischer Krankheiten, ist ein wichtiger Faktor für die Auslagerung von Dienstleistungen im Bereich regulatorischer Angelegenheiten.

- Beispielsweise hat der zunehmende Ausbau der Gesundheitsinfrastruktur in Ländern wie Saudi-Arabien, den Vereinigten Arabischen Emiraten und Südafrika zu einer höheren Nachfrage nach Medizinprodukten geführt, wodurch sich der regulatorische Arbeitsaufwand für Hersteller, die eine zeitnahe Marktzulassung anstreben, erhöht hat.

- Da die Aufsichtsbehörden immer strengere Compliance-Anforderungen einführen, lagern Hersteller regulatorische Aktivitäten zunehmend an spezialisierte Unternehmen aus, um Genauigkeit, Konsistenz und schnellere Produktzulassungen zu gewährleisten.

- Darüber hinaus fehlt es kleinen und mittelständischen Medizintechnikunternehmen häufig an internem regulatorischem Fachwissen für die vielfältigen regionalen Vorschriften, wodurch Outsourcing eine praktikable Lösung zur Kostenkontrolle und Reduzierung von Compliance-Risiken darstellt.

- Die Notwendigkeit, die Einhaltung regulatorischer Vorgaben während des gesamten Produktlebenszyklus, einschließlich Verlängerungen, Änderungen und Marktüberwachung, sicherzustellen, trägt weiterhin zur anhaltenden Nachfrage nach Outsourcing-Dienstleistungen in der Region bei.

Zurückhaltung/Herausforderung

Begrenzte Harmonisierung der Regulierungsbehörden und Mangel an Fachkräften

- Eine zentrale Herausforderung im Outsourcing-Markt für regulatorische Angelegenheiten im Bereich Medizinprodukte ist das Fehlen harmonisierter regulatorischer Rahmenbedingungen in den verschiedenen Ländern, was die Komplexität und den Ressourcenbedarf für Dienstleister und Hersteller gleichermaßen erhöht.

- Beispielsweise können unterschiedliche Einreichungsformate, Genehmigungsfristen und regulatorische Erwartungen in den afrikanischen und nahöstlichen Märkten zu Verzögerungen und erhöhten Betriebskosten führen, selbst wenn regulatorische Aktivitäten ausgelagert werden.

- Ein weiteres wesentliches Hindernis ist die begrenzte Verfügbarkeit hochqualifizierter Regulierungsfachkräfte mit fundierten Kenntnissen sowohl der lokalen Vorschriften als auch internationaler Standards, insbesondere in den aufstrebenden afrikanischen Märkten.

- Darüber hinaus könnten Bedenken hinsichtlich der Vertraulichkeit von Daten, Kommunikationslücken und der Abhängigkeit von Drittanbietern einige Hersteller dazu veranlassen, mit der vollständigen Auslagerung regulatorischer Funktionen zu zögern.

- Die Bewältigung dieser Herausforderungen durch den Aufbau regulatorischer Kapazitäten, regionale Harmonisierungsinitiativen und Investitionen in die Entwicklung qualifizierter Arbeitskräfte wird entscheidend für das langfristige Wachstum und die Effektivität des Marktes für das Outsourcing regulatorischer Angelegenheiten für Medizinprodukte im Nahen Osten und in Afrika sein.

Marktübersicht für Outsourcing von regulatorischen Angelegenheiten für Medizinprodukte im Nahen Osten und Afrika

Der Markt ist segmentiert nach Dienstleistungen, Produkten, Gerätetypen, Anwendungen und Endnutzern.

- Nach Dienstleistungen

Basierend auf den angebotenen Dienstleistungen ist der Markt für die Auslagerung regulatorischer Angelegenheiten im Medizinproduktebereich in regulatorische Dienstleistungen, Qualitätsberatung und medizinische Dokumentation unterteilt. Das Segment der regulatorischen Dienstleistungen dominierte 2025 mit einem Marktanteil von 46,8 % den größten Umsatzanteil. Dies ist auf die zunehmende Komplexität der Medizinproduktevorschriften in wichtigen Regionen wie Nordamerika, Europa und dem asiatisch-pazifischen Raum zurückzuführen. Unternehmen nutzen ausgelagerte regulatorische Dienstleistungen für die Einreichung von Zulassungsanträgen, die Erstellung technischer Dokumentationen und das Compliance-Management nach der Markteinführung. Steigende regulatorische Anforderungen für Medizinprodukte der Klassen II und III treiben die Nachfrage an. Die Globalisierung der Medizinproduktebranche und grenzüberschreitende Produktregistrierungen beflügeln das Segment zusätzlich. Die Auslagerung regulatorischer Angelegenheiten senkt die Betriebskosten und gewährleistet gleichzeitig die Einhaltung der Richtlinien von FDA, EU-MDR und IVDR. Das Segment profitiert von zunehmenden regulatorischen Audits und häufigen Aktualisierungen der Dokumentationsstandards. Lebenszyklusmanagement von Medizinprodukten, Meldungen von Verdachtsfällen und Risikominderung sind entscheidende Faktoren. Unternehmen priorisieren zunehmend die Auslagerung, um die Markteinführungszeit zu verkürzen und gleichzeitig den internen Ressourcenaufwand zu reduzieren. Die steigende Verbreitung fortschrittlicher Medizinprodukte und die rasche Produktinnovation stärken die Marktführerschaft dieses Segments weiter. Die Expansion in Schwellenländer schafft eine nachhaltige Nachfrage nach Dienstleistungen im Bereich regulatorischer Angelegenheiten.

Das Segment Medical Writing wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,4 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung ist die weltweit steigende Nachfrage nach qualitativ hochwertigen klinischen Bewertungsberichten, technischen Dokumentationen und regulatorischen Unterlagen. Kleine und mittelständische Medizintechnikunternehmen sind zunehmend auf externe Medical Writer angewiesen. Zulassungsbehörden fordern präzise und konforme Dokumentation für die Zulassung von Medizinprodukten, was das Wachstum zusätzlich ankurbelt. Die Nutzung elektronischer Einreichungsplattformen beschleunigt das Outsourcing. Zunehmende klinische Studien, die Erhebung von Real-World-Daten und die Berichterstattung über Daten nach der Markteinführung verstärken die Nachfrage. Digitalisierung und KI-gestützte Tools für Medical Writing tragen zu einer schnelleren Dokumentenerstellung bei. Unternehmen suchen flexible Outsourcing-Verträge, um die Belastung ihrer internen Belegschaft zu reduzieren. Die Erweiterung therapeutischer Bereiche, darunter Kardiologie, Orthopädie und In-vitro-Diagnostika, treibt das Wachstum weiter an. Die zunehmende internationale Harmonisierung der regulatorischen Rahmenbedingungen unterstützt den Bedarf an grenzüberschreitendem Outsourcing. Insgesamt profitiert das Segment von der steigenden regulatorischen Komplexität und der wachsenden Bedeutung präziser medizinischer Dokumentation.

- Nebenprodukt

Basierend auf dem Produkt ist der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte in Fertigprodukte, Elektronik und Rohstoffe unterteilt. Das Segment der Fertigprodukte erzielte 2025 mit 52,1 % den größten Marktanteil, da Medizinprodukte strengen Zulassungs- und Überwachungsanforderungen unterliegen. Unternehmen lagern regulatorische Prozesse aus, um die reibungslose Einhaltung der FDA-, EU-MDR- und anderer regionaler Vorschriften zu gewährleisten. Zu den Fertigprodukten zählen Geräte aus den Bereichen Kardiologie, Orthopädie, In-vitro-Diagnostik (IVD) und Ophthalmologie. Outsourcing trägt zur Reduzierung des internen Arbeitsaufwands bei und gewährleistet gleichzeitig die Einhaltung von Qualitäts- und Sicherheitsstandards. Hersteller suchen Expertenunterstützung für Kennzeichnung, Dokumentation, Validierung und die Erstellung klinischer Nachweise. Die verstärkte Überprüfung von Kombinationsprodukten, softwareintegrierten Geräten und vernetzten Medizinprodukten fördert die Marktführerschaft. Die globale Expansion der Medizinprodukteindustrie treibt langfristige Outsourcing-Verträge voran. Outsourcing mindert die Risiken von Audits und Sanktionen bei Nichteinhaltung. Unternehmen priorisieren eine schnelle Markteinführung ohne Kompromisse bei der Compliance. Die Überwachung nach der Markteinführung und die Meldung unerwünschter Ereignisse sind weitere wichtige Faktoren. Die Hersteller streben durch Outsourcing eine Optimierung der Ressourcenzuweisung und Kosteneffizienz an.

Das Segment Elektronik wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 10,7 % das schnellste Wachstum verzeichnen. Grund dafür ist die zunehmende Integration von Software und digitalen Komponenten in Medizinprodukte. Die Einhaltung regulatorischer Vorgaben für Software, Firmware und die Cybersicherheit vernetzter Geräte ist komplex und unterliegt einem ständigen Wandel. Outsourcing wird bevorzugt, um die regulatorische Bereitschaft und schnellere Zulassungen zu gewährleisten. Das Wachstum bei Wearables, Fernüberwachungssystemen und digitalen Gesundheitslösungen stützt dieses Segment. Startups und KMU setzen bei elektronikintensiven Geräten zunehmend auf spezialisierte Partner im Bereich der regulatorischen Beratung. Der Einsatz von KI und maschinellem Lernen in Medizinprodukten erhöht den Dokumentations- und Testaufwand. Grenzüberschreitende Vermarktung treibt die Nachfrage nach standardisierter regulatorischer Dokumentation an. Der Trend zu vernetzten Gesundheitslösungen beschleunigt das Outsourcing von Compliance-Aktivitäten. Unternehmen streben danach, den internen operativen Aufwand zu reduzieren und gleichzeitig globale regulatorische Standards einzuhalten. Die zunehmende Verbreitung von Telemedizingeräten und IoT-fähigen Medizinprodukten trägt zusätzlich zum Wachstum bei.

- Nach Gerätetyp

Basierend auf dem Gerätetyp ist der Markt für die Auslagerung regulatorischer Angelegenheiten für Medizinprodukte in Klasse I, Klasse II und Klasse III unterteilt. Das Segment der Klasse II dominierte den Markt mit einem Umsatzanteil von 41,6 % im Jahr 2025, bedingt durch die hohe Anzahl moderat regulierter Geräte, die auf den Markt kamen. Die Zulassungsanträge für Klasse-II-Geräte umfassen Dokumentation, technische Unterlagen und die Einhaltung der FDA-510(k)- oder CE-Kennzeichnungsrichtlinien. Outsourcing unterstützt Hersteller bei der Beschleunigung von Zulassungsverfahren und der Reduzierung des internen Arbeitsaufwands. Orthopädische, diagnostische und Überwachungsgeräte bilden einen Großteil der Klasse-II-Produkte. Unternehmen nutzen ausgelagertes Know-how für das Produktlebenszyklusmanagement, die Marktbeobachtung und regulatorische Audits. Die Globalisierung der Medizinproduktebranche und zunehmende Innovationen treiben die Nachfrage weiter an. Kostensenkung, Effizienz und ein zeitnaher Markteintritt sind entscheidende Vorteile. Die regulatorische Komplexität in verschiedenen Regionen verstärkt die Abhängigkeit von Outsourcing. Aktivitäten im Bereich des Lebenszyklusmanagements, einschließlich Gerätemodifikationen, -aktualisierungen und -berichterstattung, sind die Wachstumstreiber dieses Segments. Die zunehmende Verbreitung von Medizinprodukten in Schwellenländern trägt zur Marktführerschaft bei. Bei Medizinprodukten der Klasse II stellt sich ein ausgewogenes Verhältnis zwischen Innovation und regulatorischer Komplexität ein, weshalb Outsourcing unerlässlich ist.

Das Segment der Medizinprodukte der Klasse III wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 12,8 % am schnellsten wachsen. Treiber dieses Wachstums ist die zunehmende Entwicklung implantierbarer, lebenserhaltender und risikoreicher Medizinprodukte. Diese Produkte erfordern umfangreiche klinische Studien, Validierungsuntersuchungen und behördliche Zulassungen. Die Auslagerung der Zulassungsprozesse minimiert Verzögerungen und gewährleistet die Einhaltung globaler Standards. Die Prüfung risikoreicher Medizinprodukte, darunter Herzimplantate und Neuromodulationsgeräte, treibt das Marktwachstum an. Hersteller sind auf Partner im Bereich der Zulassungsprozesse angewiesen, um Dokumentationen, klinische Bewertungsberichte und technische Unterlagen zu erhalten. Der zunehmende Trend zu Kombinationsprodukten erhöht die Nachfrage nach Outsourcing-Dienstleistungen. Die kontinuierliche Marktbeobachtung und die Meldepflichten für unerwünschte Ereignisse unterstützen die Expansion zusätzlich. Regulatorische Aktualisierungen im Rahmen der MDR und IVDR fördern das Wachstum dieses Segments. Kleine und mittlere Unternehmen lagern die Einhaltung der Vorschriften für Medizinprodukte der Klasse III aufgrund der Komplexität zunehmend aus. Innovationen bei biokompatiblen Materialien und intelligenten Implantaten tragen zur Beschleunigung des Segmentwachstums bei. Die hochwertigen Produkte und das regulatorische Risiko dieses Segments treiben die anhaltende Nachfrage nach Outsourcing-Dienstleistungen an.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte in Kardiologie, diagnostische Bildgebung, Orthopädie, In-vitro-Diagnostik (IVD), Ophthalmologie, Allgemein- und Plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und Sonstige unterteilt. Das IVD-Segment erzielte 2025 mit 30,2 % den größten Marktanteil, getrieben durch die steigende Nachfrage nach diagnostischen Tests und personalisierter Medizin. Die Auslagerung von Dienstleistungen ist aufgrund der strengen Anforderungen der EU-IVDR und der FDA unerlässlich. Hersteller sind für die Zulassung, Validierung, Kennzeichnung und Marktbeobachtung ihrer Produkte auf Experten im Bereich der regulatorischen Angelegenheiten angewiesen. Der Ausbau von Diagnosezentren, klinischen Laboren und molekulardiagnostischen Einrichtungen fördert das Wachstum. Die zunehmende Verbreitung chronischer Krankheiten steigert die Nachfrage nach präzisen Diagnosegeräten. Unternehmen streben danach, Betriebskosten zu senken und regulatorische Risiken zu minimieren. Die Globalisierung des Vertriebs von IVD-Geräten verstärkt den Bedarf an Auslagerung von Dienstleistungen zusätzlich. Schnelle Produktinnovationen erfordern zeitnahe Unterstützung durch die Regulierungsbehörden. Die risikobasierte Klassifizierung von IVD-Produkten führt zu einer verstärkten Abhängigkeit von Auslagerungsdienstleistungen. Regulatorische Audits, CE-Kennzeichnung und FDA-Zulassungen erhöhen die Marktaktivität. Das Segment profitiert von steigenden Investitionen in die Früherkennung von Krankheiten und die Präzisionsmedizin.

Das Segment Diabetesversorgung wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,3 % das schnellste Wachstum verzeichnen. Treiber dieser Entwicklung sind die weltweit steigende Diabetesprävalenz und die zunehmende Verbreitung vernetzter Glukosemesssysteme. Die regulatorischen Anforderungen für kontinuierliche Glukosemessgeräte und intelligente Insulinabgabesysteme sind komplex und erhöhen die Nachfrage nach Outsourcing. Startups und mittelständische Hersteller sind auf Expertenpartner für Dokumentation, technische Unterlagen und Compliance angewiesen. KI-integrierte Diabetesmanagement-Geräte benötigen zusätzliche regulatorische Unterstützung. Das Wachstum bei Wearables und Lösungen für die häusliche Pflege fördert die Segmentexpansion. Der Markteintritt über Ländergrenzen hinweg erfordert harmonisierte regulatorische Einreichungen. Digitale Therapien und die Integration von Telemedizin treiben das Outsourcing weiter voran. Marktüberwachung und Risikomanagement sind entscheidende Faktoren. Der Fokus von Regierungen und Gesundheitsdienstleistern auf das Diabetesmanagement stärkt den Markt. Steigende Risikokapitalinvestitionen in digitale Diabeteslösungen beschleunigen das Wachstum. Kleinere Hersteller profitieren von reduzierten internen Compliance-Kosten. Wissenslücken im regulatorischen Bereich bei neuen Unternehmen fördern die hohe Inanspruchnahme von Outsourcing.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte in kleine, mittlere und große Medizinprodukteunternehmen unterteilt. Das Segment der großen Medizinprodukteunternehmen dominierte den Markt mit einem Umsatzanteil von 44,9 % im Jahr 2025 aufgrund umfangreicher Produktportfolios und globaler Geschäftstätigkeit. Outsourcing unterstützt die Einreichung von Zulassungsanträgen in verschiedenen Ländern und gewährleistet die Einhaltung unterschiedlicher Standards. Häufige Produkteinführungen und Aktivitäten im Rahmen des Lebenszyklusmanagements erfordern Expertenunterstützung. Unternehmen nutzen Outsourcing, um die Ressourcenzuweisung zu optimieren und den internen Aufwand für die Einhaltung regulatorischer Vorgaben zu reduzieren. Große Unternehmen unterliegen bei Medizinprodukten der Klassen II und III einer strengen regulatorischen Prüfung, was das Wachstum dieses Segments fördert. Marktbeobachtung, klinische Bewertungen und die Erstellung technischer Dokumentationen werden an spezialisierte Unternehmen ausgelagert. Regulatorische Audits, CE-Kennzeichnung und FDA-510(k)-Zulassungen erhöhen die Akzeptanz von Outsourcing. Risikominimierung, Kosteneffizienz und ein schnellerer Markteintritt sind die Triebkräfte für die Marktführerschaft. Die Expansion in Schwellenländer erfordert Outsourcing-Expertise. Die Integration von Software und vernetzten Geräten steigert die Nachfrage zusätzlich. Outsourcing ermöglicht es großen Unternehmen, sich auf Forschung und Entwicklung zu konzentrieren und gleichzeitig die Einhaltung regulatorischer Vorgaben sicherzustellen.

Das Segment der kleinen Medizinproduktehersteller wird voraussichtlich von 2026 bis 2033 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,1 % am schnellsten wachsen. Treiber dieses Wachstums ist die begrenzte interne Expertise im Bereich regulatorischer Angelegenheiten. Startups und junge Unternehmen sind stark auf Outsourcing-Dienstleistungen angewiesen, um globale Compliance-Anforderungen zu erfüllen. Outsourcing trägt dazu bei, Zulassungszeiten und Betriebskosten zu reduzieren. Zunehmende Innovationen bei tragbaren Geräten, Diagnosegeräten und Geräten für die häusliche Pflege fördern das Wachstum. Komplexe Dokumentationen, klinische Bewertungen und Anforderungen nach der Markteinführung machen Outsourcing unerlässlich. Venture-finanzierte Unternehmen suchen nach kosteneffizienten regulatorischen Lösungen. Die globale Marktexpansion erfordert Expertise in regionalen Vorschriften. Die sich rasch entwickelnden Anforderungen der MDR und IVDR beschleunigen die Nutzung von Outsourcing. KI-gestützte regulatorische Tools unterstützen kleine Unternehmen bei der effizienten Dokumentation. Die Minimierung von Compliance-Risiken ist ein wichtiger Wachstumstreiber für dieses Segment. Startups nutzen Outsourcing, um schneller auf den Markt zu kommen und den internen Arbeitsaufwand zu reduzieren. Verstärkte Partnerschaften mit CROs und regulatorischen Beratern stärken die Wachstumsaussichten.

Regionale Analyse des Outsourcing-Marktes für regulatorische Angelegenheiten im Bereich Medizinprodukte im Nahen Osten und Afrika

- Der Markt für die Auslagerung regulatorischer Angelegenheiten im Bereich Medizinprodukte im Nahen Osten und in Afrika wird im Prognosezeitraum voraussichtlich stetig wachsen, unterstützt durch die Stärkung regulatorischer Rahmenbedingungen, steigende Importe von Medizinprodukten und den Ausbau der Gesundheitsinfrastruktur in der gesamten Region.

- Regierungen legen zunehmend Wert auf die Einhaltung gesetzlicher Bestimmungen, die Produktregistrierung und die Marktüberwachung, um Patientensicherheit und Qualitätsstandards zu gewährleisten. Daher lagern Hersteller von Medizinprodukten ihre regulatorischen Aktivitäten vermehrt an spezialisierte Dienstleister aus, um die komplexen und sich ständig ändernden regulatorischen Anforderungen effizient zu erfüllen.

- Wachsende Investitionen in die Modernisierung des Gesundheitswesens, verbunden mit der zunehmenden Nutzung fortschrittlicher Medizintechnologien, beschleunigen die Nachfrage nach Outsourcing-Dienstleistungen im Bereich regulatorischer Angelegenheiten in der MEA-Region zusätzlich.

Markteinblicke für Outsourcing-Dienstleistungen im Bereich der regulatorischen Angelegenheiten für Medizinprodukte in Saudi-Arabien:

Saudi-Arabien dominierte den Markt für Outsourcing-Dienstleistungen im Bereich der regulatorischen Angelegenheiten für Medizinprodukte in der Region Naher Osten und Afrika und erzielte 2025 einen Umsatzanteil von rund 41,8 %. Diese Dominanz ist primär auf die strenge regulatorische Aufsicht der saudischen Lebensmittel- und Arzneimittelbehörde (SFDA) zurückzuführen, die die Einhaltung strenger Vorschriften für die Zulassung, Registrierung und Markteinführung von Medizinprodukten vorschreibt. Die steigenden Importe von Medizinprodukten in das Land sowie die erheblichen Investitionen in die Gesundheitsinfrastruktur im Rahmen der Vision 2030 haben den Bedarf an spezialisierter regulatorischer Unterstützung erhöht. Darüber hinaus hat die zunehmende Präsenz internationaler Medizinproduktehersteller, die in den saudischen Markt eintreten wollen, die Nachfrage nach ausgelagerten Dienstleistungen im Bereich der regulatorischen Angelegenheiten weiter angekurbelt, um zeitnahe Zulassungen und die dauerhafte Einhaltung der Vorschriften zu gewährleisten.

Markteinblicke für die Auslagerung von Zulassungsangelegenheiten für Medizinprodukte in den VAE:

Der Markt für die Auslagerung von Zulassungsangelegenheiten für Medizinprodukte in den VAE wird voraussichtlich das schnellste Wachstum in der MEA-Region verzeichnen, mit einer prognostizierten durchschnittlichen jährlichen Wachstumsrate (CAGR) von rund 9,6 % im Prognosezeitraum. Dieses Wachstum wird durch die rasche Modernisierung des Gesundheitswesens, steigende private und öffentliche Investitionen im Gesundheitswesen sowie die Rolle des Landes als regionales Drehkreuz für den Vertrieb von Medizinprodukten begünstigt. Der zunehmende Markteintritt internationaler Medizinproduktehersteller in den VAE hat die Nachfrage nach regulatorischer Expertise zur Bewältigung der lokalen Zulassungsverfahren erhöht. Optimierte und transparente regulatorische Verfahren, die von Behörden wie dem Ministerium für Gesundheit und Prävention (MOHAP) durchgeführt werden, haben Hersteller zusätzlich dazu ermutigt, regulatorische Angelegenheiten an spezialisierte Dienstleister auszulagern und so ein nachhaltiges Marktwachstum zu fördern.

Marktanteil im Bereich Outsourcing von regulatorischen Angelegenheiten für Medizinprodukte im Nahen Osten und Afrika

Die Outsourcing-Branche für regulatorische Angelegenheiten im Bereich Medizinprodukte wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Accell Clinical Research, LLC (USA)

- Genpact (USA)

- CRITERIUM, INC. (USA)

- Promedica International (USA)

- WuXiAppTec (China)

- Medpace (USA)

- PPD Inc. (USA)

- Charles River Laboratories (USA)

- ICON plc (USA)

- Covance (USA)

- Parexel International Corporation (USA)

- Freyr

- Navitas Clinical Research, Inc. (USA)

- Medelis, Inc. (USA)

- Sciformix (USA)

- Tech Tammina (USA)

- Acorn Regulatory Consultancy Services Ltd. (Irland)

- BIOMAPAS (Litauen)

- REGULATORISCHE FACHKRÄFTE (Australien)

- CompareNetworks, Inc. (USA)

Neueste Entwicklungen auf dem Markt für die Auslagerung regulatorischer Angelegenheiten für Medizinprodukte im Nahen Osten und in Afrika

- Im Januar 2023 führte Medistri SA, ein in der Schweiz ansässiger Medizintechnik-Dienstleister, eine integrierte Beratungslösung für regulatorische Angelegenheiten und Qualitätsmanagement ein, die speziell auf kleine und mittelständische Hersteller von Medizinprodukten zugeschnitten ist. Dieses Angebot vereinfacht die Wege zur Konformität durch kosteneffiziente Unterstützung bei der CE-Kennzeichnung, der Erstellung technischer Dokumentationen und der Marktbeobachtung und deckt damit einen zentralen Bedarf von Unternehmen ohne eigene Zulassungsabteilung.

- Im März 2023 brachte ICON plc eine neue Plattform für regulatorische Informationen auf den Markt, die Medizinproduktehersteller bei der Verfolgung sich entwickelnder globaler Vorschriften, der Verwaltung von Einreichungsstrategien und dem Zugriff auf Compliance-Vorlagen unterstützen soll. Ziel der Plattform war die Verbesserung der regulatorischen Strategie und der operativen Effizienz bei komplexen, mehrere Jurisdiktionen betreffenden Einreichungen.

- Im März 2023 eröffnete Freyr Solutions ein neues globales Zentrum für regulatorische Dienstleistungen im asiatisch-pazifischen Raum und erweiterte damit seine Kapazitäten zur Unterstützung von Medizintechnikunternehmen bei der umfassenden Einhaltung länderspezifischer Zulassungsvorschriften. Dieses verbesserte regionale Serviceangebot unterstreicht das rasante Wachstum der Nachfrage nach regulatorischem Outsourcing in Schwellenländern.

- Im April 2023 erweiterte Parexel International Corporation ihre globalen Beratungsleistungen im Bereich regulatorischer Angelegenheiten, um Entwickler von Medizinprodukten und Kombinationsprodukten bei der Bewältigung der zunehmend komplexen Anforderungen der EU-Medizinprodukteverordnung (MDR) und der Verordnung über In-vitro-Diagnostika (IVDR) besser zu unterstützen. Diese strategische Erweiterung spiegelte die gestiegene Nachfrage der Branche nach spezialisierter MDR/IVDR-Expertise wider.

- Im März 2024 eröffnete Emergo by UL in Singapur ein neues Beratungszentrum für regulatorische Angelegenheiten. Dieses konzentriert sich auf die Betreuung des wachsenden asiatisch-pazifischen Marktes für Medizinprodukte und unterstützt insbesondere die regulatorischen Harmonisierungsinitiativen der ASEAN-Staaten sowie länderübergreifende Zulassungsverfahren. Dieser Schritt unterstreicht die starke geografische Expansion im Bereich ausgelagerter regulatorischer Dienstleistungen.

- Im Juli 2024 brachte Parexel International seine digitale Regulierungsplattform auf den Markt, die künstliche Intelligenz und maschinelles Lernen integriert, um die regulatorischen Einreichungen für Medizinprodukte zu optimieren, eine cloudbasierte Dokumentenverwaltung bereitzustellen und die Zusammenarbeit zwischen Sponsoren und Regulierungsbehörden zu verbessern.

- Im September 2024 erweiterte IQVIA seine Kompetenzen im Bereich Regulatory Affairs durch die Übernahme der Regulatory-Consulting-Sparte von Pharm-Olam. Dadurch stärkte das Unternehmen seine globale Expertise im Bereich der Zulassung von Medizinprodukten und verbesserte seine Dienstleistungen in Asien-Pazifik und Lateinamerika – insbesondere im Hinblick auf regulatorische Strategien in Schwellenländern.

- Im Januar 2025 ging die ProPharma Group eine Partnerschaft mit MedTech Europe ein, um spezialisierte Schulungsprogramme für Fachkräfte im Bereich der Zulassung von Medizinprodukten zu entwickeln und so kritische Qualifikationslücken zu schließen, die durch die Einführung strengerer regulatorischer Rahmenbedingungen wie der MDR entstanden sind.

- Im Februar 2025 gab IQVIA eine strategische Partnerschaft mit einem europäischen Medizinproduktehersteller bekannt, um die Erstellung von Zulassungsdossiers und die Berichterstattung über klinische Bewertungen gemäß EU-Medizinprodukteverordnung (MDR) zu unterstützen. Dies unterstreicht die zunehmende Bedeutung von externen Experten für die Erstellung komplexer Compliance-Dokumentationen in der Branche.

- Im März 2025 deuteten Marktanalysen darauf hin, dass ICON plc seine Outsourcing-Dienstleistungen im Bereich regulatorischer Angelegenheiten in der Asien-Pazifik-Region ausgebaut hat, um der steigenden lokalen Nachfrage nach regulatorischer Beratung und Unterstützung klinischer Studien in wachstumsstarken Märkten wie China und Indien gerecht zu werden.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.