Middle East And Africa Medical Device Outsourcing Market

Marktgröße in Milliarden USD

CAGR :

%

USD

8.43 Billion

USD

21.47 Billion

2025

2033

USD

8.43 Billion

USD

21.47 Billion

2025

2033

| 2026 –2033 | |

| USD 8.43 Billion | |

| USD 21.47 Billion | |

|

|

|

|

Markt für das Outsourcing medizinischer Geräte im Nahen Osten und in Afrika, nach Dienstleistungen (Qualitätssicherung, Zulassungsdienstleistungen, Dienstleistungen für Produktdesign und -entwicklung, Dienstleistungen für Produkttests und -sterilisation, Dienstleistungen für Produktimplementierung, Dienstleistungen für Produktupgrades, Dienstleistungen für Produktwartung, Dienstleistungen für Rohstoffe, Dienstleistungen für medizinische elektrische Geräte, Auftragsfertigung, Materialien und chemische Charakterisierung), Produkt (Fertigerzeugnisse, Elektronik, Rohstoffe), Gerätetyp (Klasse I, Klasse II, Klasse III), Anwendung (Kardiologie, diagnostische Bildgebung, Orthopädie, IVD, Augenheilkunde, allgemeine und plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und andere), Endbenutzer (kleine Medizingerätehersteller, mittlere Medizingerätehersteller, große Medizingerätehersteller und andere), Land (Südafrika, Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten und restlicher Naher Osten und Afrika), Branchentrends und Prognose bis 2028.

Marktanalyse und Einblicke: Markt für das Outsourcing medizinischer Geräte im Nahen Osten und in Afrika

Marktanalyse und Einblicke: Markt für das Outsourcing medizinischer Geräte im Nahen Osten und in Afrika

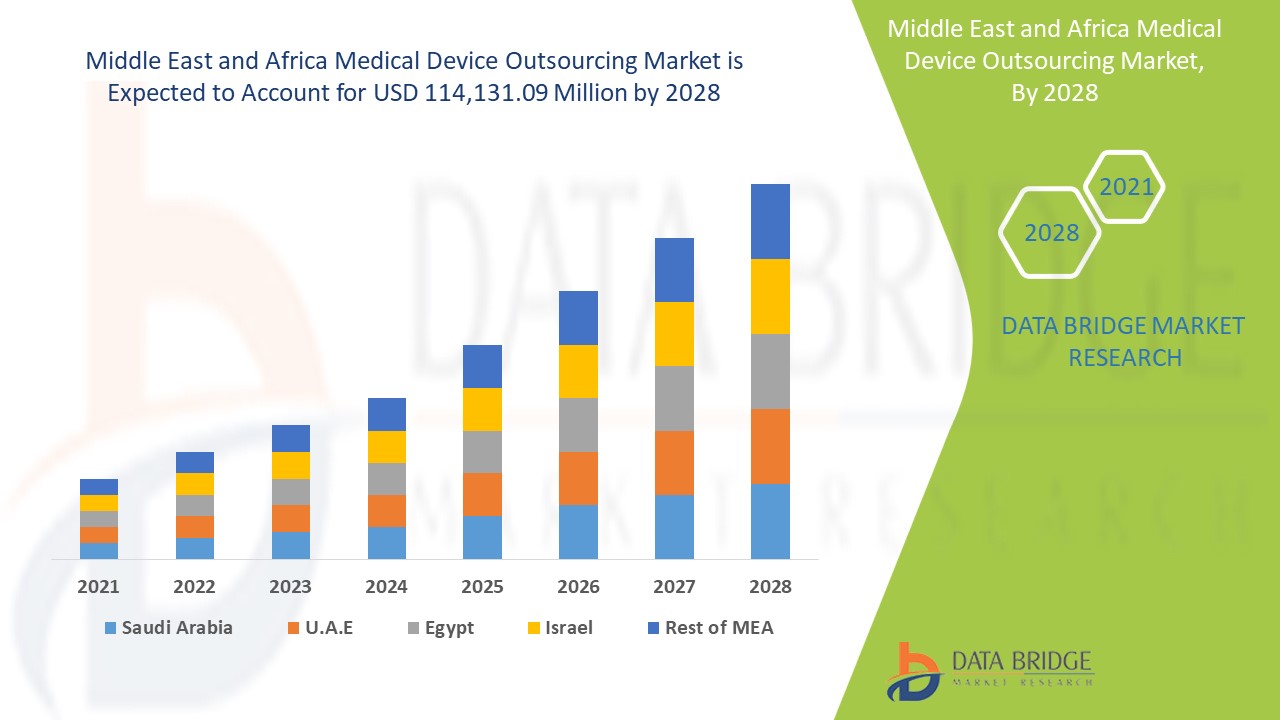

Der Markt für das Outsourcing medizinischer Geräte wird im Prognosezeitraum 2020 bis 2028 voraussichtlich an Marktwachstum gewinnen. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum 2021 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 12,4 % wächst und von 46.676,11 Millionen USD im Jahr 2020 auf 114.131,09 Millionen USD im Jahr 2028 ansteigen dürfte. Die steigende Zahl chronischer Infektionen, die Akzeptanz der Verwendung nicht-invasiver Geräte und die steigenden Gesundheitsausgaben dürften die Haupttreiber sein, die die Nachfrage des Marktes im Prognosezeitraum ankurbeln.

Der steigende Bedarf an hochwertigen Gesundheitsdienstleistungen wird durch den globalen Outsourcing-Markt für Medizinprodukte vorangetrieben. Die Auftragsfertigung von Medizinprodukten ist die ausgelagerte Montage eines Medizinprodukts für den medizinischen Markt. Um eine wiederkehrende Fertigung zu gewährleisten, können Medizinproduktehersteller auf Auftragsfertigungspartner zurückgreifen und von Kosteneffizienz, optimierter Lieferkette, logistischer Ausrichtung und vielem mehr profitieren. All dies stellt sicher, dass alle Branchenanforderungen erfüllt werden, während sie gleichzeitig kommerzielle Produkte auf den Markt bringen können.

Da die Produktlebenszyklen kurz sind, sind Hersteller medizinischer Geräte stark auf Innovationen und fortschrittliche Technologien angewiesen, um in diesem Supertrendmarkt zu wachsen. Zu den Innovationen in den Märkten für das Outsourcing medizinischer Geräte gehören die Ausgliederung von Forschung und Entwicklung in der Medizintechnik, tragbare medizinische Geräte, patientenzentrierte Ansätze, robotergestützte Untersuchungen und robotergestützte Operationen, die häufig zu verbesserter Effektivität, Ertragssteigerung, verbesserter Qualität und reduzierter WIP (Work in Progress) führen, während gleichzeitig Geschäftsrisiken verringert und die Markteinführung von Produkten beschleunigt wird. Der Markt für das Outsourcing medizinischer Geräte wuchs rasant, was zu einer verbesserten organisatorischen Effektivität, kürzeren Produktentwicklungszyklen und einem besseren Zugang zu Spitzentechnologie führte.

Faktoren wie die Änderungen der International Standard Organization (ISO): 13485, ein strenger regulatorischer Rahmen und Störungen im Lieferkettenmanagement aufgrund einer Pandemie hemmen jedoch das Wachstum des globalen Marktes für das Outsourcing von Medizinprodukten. Andererseits bieten der Anstieg der geriatrischen Bevölkerung und der zunehmende Einsatz interventioneller medizinischer Geräte (IMDs) Chancen für das Wachstum des globalen Marktes für das Outsourcing von Medizinprodukten. Der Anstieg der Servicealternativen und die Compliance-Probleme beim Outsourcing sind die Herausforderungen, denen sich der globale Markt für das Outsourcing von Medizinprodukten gegenübersieht.

Der Marktbericht zum Outsourcing medizinischer Geräte enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Marktumfang und Marktgröße für das Outsourcing medizinischer Geräte im Nahen Osten und in Afrika

Marktumfang und Marktgröße für das Outsourcing medizinischer Geräte im Nahen Osten und in Afrika

Der Outsourcing-Markt für medizinische Geräte ist nach Dienstleistungen, Produkten, Gerätetypen, Anwendungen und Endnutzern segmentiert. Das Wachstum zwischen den Segmenten hilft Ihnen bei der Analyse von Wachstumsnischen und Strategien zur Marktbearbeitung und zur Bestimmung Ihrer wichtigsten Anwendungsbereiche und der Unterschiede in Ihren Zielmärkten.

- Auf der Grundlage der Dienstleistungen ist der Outsourcing-Markt für Medizinprodukte segmentiert in Qualitätssicherung, Zulassungsdienstleistungen, Produktdesign- und -entwicklungsdienstleistungen, Produkttests und Sterilisationsdienstleistungen, Produktimplementierungsdienstleistungen, Produktupgradedienstleistungen, Produktwartungsdienstleistungen, Rohstoffdienstleistungen, Dienstleistungen für medizinische elektrische Geräte, Auftragsfertigung und Material- und chemische Charakterisierung. Im Jahr 2021 wird das Segment Auftragsfertigung voraussichtlich den globalen Outsourcing-Markt für Medizinprodukte dominieren, da in verschiedenen Regionen der Welt Maschinen, Arbeitskräfte und Einrichtungen nicht verfügbar sind und die Herstellung von Medizinprodukten hohe Kosten verursacht.

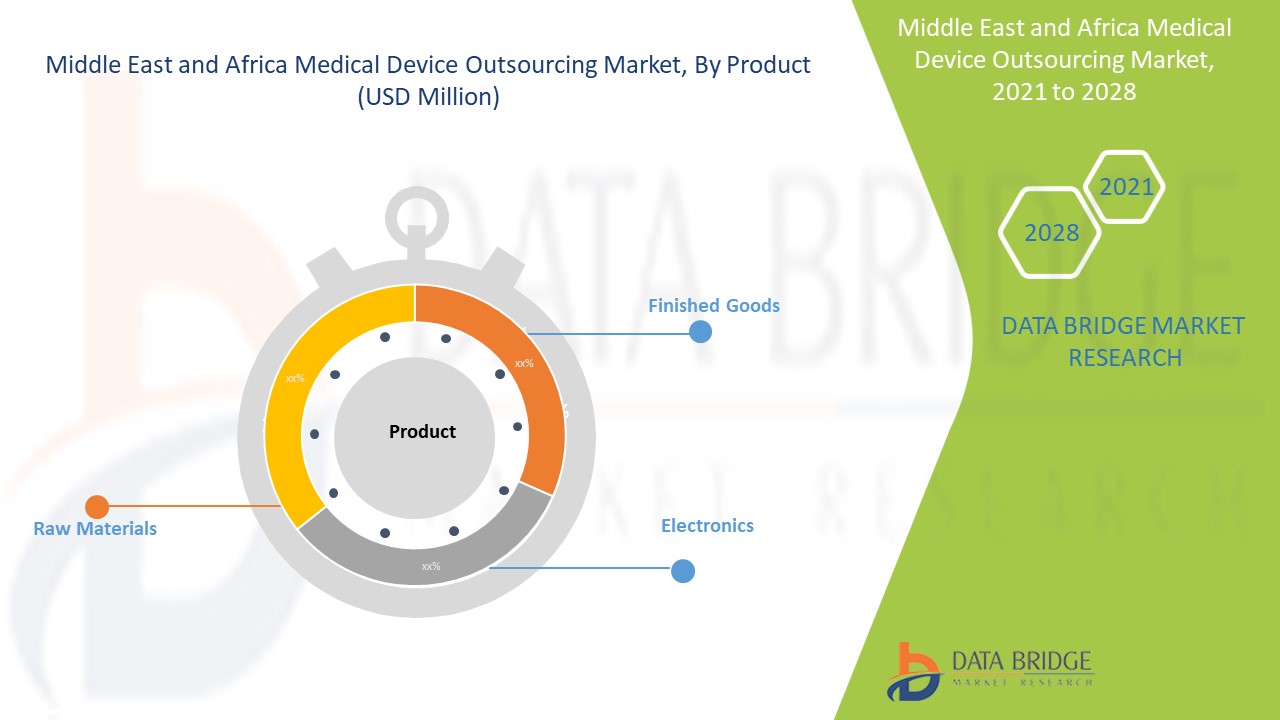

- Auf der Grundlage des Produkts ist der Outsourcing-Markt für Medizinprodukte in Fertigprodukte, Elektronik und Rohstoffe segmentiert. Im Jahr 2021 wird das Segment Fertigprodukte voraussichtlich den globalen Outsourcing-Markt für Medizinprodukte dominieren, da die Nachfrage nach Medizinprodukten zur Behandlung der Patienten weltweit steigt.

- Auf der Grundlage des Gerätetyps ist der Markt für das Outsourcing von Medizinprodukten in Klasse I, Klasse II und Klasse III unterteilt. Im Jahr 2021 wird das Segment Klasse I voraussichtlich den globalen Outsourcingmarkt für Medizinprodukte dominieren, da die Nachfrage nach Medizinprodukten zur Behandlung von Patienten mit chronischen Krankheiten weltweit steigt.

- Auf der Grundlage der Anwendung ist der Markt für das Outsourcing von Medizinprodukten in Kardiologie, diagnostische Bildgebung, Orthopädie, IVD, Augenheilkunde, allgemeine und plastische Chirurgie, Arzneimittelverabreichung, Zahnmedizin, Endoskopie, Diabetesversorgung und andere unterteilt. Im Jahr 2021 wird das Kardiologiesegment voraussichtlich den globalen Outsourcingmarkt für Medizinprodukte dominieren, da die Nachfrage nach kardiologischen Medizinprodukten zur Behandlung von Patienten mit Herz-Kreislauf-Erkrankungen weltweit steigt.

- Auf der Grundlage des Endnutzers ist der Markt für das Outsourcing von Medizinprodukten in kleine Medizinprodukteunternehmen, mittlere Medizinprodukteunternehmen, große Medizinprodukteunternehmen und andere segmentiert. Im Jahr 2021 wird das Segment der kleinen Medizinprodukteunternehmen voraussichtlich den globalen Markt für das Outsourcing von Medizinprodukten dominieren, da die Zahl kleiner Medizinprodukteunternehmen in einem Entwicklungsland steigt.

Outsourcing von Medizingeräten Markt – Länderebene Analyse

Der Outsourcing-Markt für medizinische Geräte wird analysiert und Informationen zur Marktgröße werden nach Land, Diensten, Produkt, Gerätetyp, Anwendung und Endbenutzer bereitgestellt.

Die im Marktbericht zum Outsourcing medizinischer Geräte abgedeckten Länder sind Südafrika, Saudi-Arabien, die Vereinigten Arabischen Emirate, Israel, Ägypten, Kuwait und der Rest des Nahen Ostens.

Aufgrund der steigenden Zahl chronischer Infektionen und der steigenden Gesundheitsausgaben dürfte Südafrika den Markt im Nahen Osten und in Afrika dominieren.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Das Wachstumspotenzial für das Outsourcing medizinischer Geräte in Schwellenländern und die strategischen Initiativen der Marktteilnehmer schaffen neue Möglichkeiten auf dem Markt für das Outsourcing medizinischer Geräte

Der Markt für Medizingeräte-Outsourcing bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das in einer bestimmten Branche wächst, mit Angaben zum Verkauf von Wunddebridementgeräten, den Auswirkungen des Fortschritts im Bereich des Medizingeräte-Outsourcings und Änderungen der regulatorischen Szenarien mit ihrer Unterstützung für den Markt für Medizingeräte-Outsourcing. Die Daten sind für den historischen Zeitraum von 2011 bis 2020 verfügbar.

Wettbewerbsumfeld und Outsourcing von Medizinprodukten Marktanteilsanalyse

Die Wettbewerbslandschaft des Outsourcing-Marktes für medizinische Geräte liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, Produktionsstandorte und -einrichtungen, Stärken und Schwächen des Unternehmens, Produkteinführung, Produkttestpipelines, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den Outsourcing-Markt für medizinische Geräte.

Die wichtigsten Unternehmen, die sich mit dem Outsourcing von Medizingeräten befassen, sind SGS SA, TOXIKON, Pace Analytical, Intertek Group plc, WuXi AppTec, North American Science Associates, Inc., American Preclinical Services, LLC., Sterigenics US, LLC – A Sotera Health company, Charles River Laboratories, Celestica Inc., Creganna, FLEX LTD., Heraeus Holding, Integer Holdings Corporation, Nortech Systems, Inc., Plexus Corp., Sanmina Corporation, EUROFINS SCIENTIFIC, TE Connectivity, ICON plc, Parexel International Corporation, Labcorp Drug Development, Tecomet, Inc., IQVIA, Jabil Inc. Syneos Health, PROVIDIEN LLC., Cekindo Business International East/West Industries, Inc., TÜV SÜD und andere.

Viele Produktentwicklungen werden auch von Unternehmen weltweit initiiert, die auch das Wachstum des Outsourcing-Marktes für medizinische Geräte beschleunigen.

Zum Beispiel,

- Im Juli 2021 haben BREATHE und IQVIA zusammengearbeitet, um die Frühdiagnose und Behandlung von Atemwegserkrankungen zu beschleunigen. Dieser strategische Schritt der Zusammenarbeit zur Verbesserung der Gesundheitsergebnisse und der Lebensqualität von Menschen mit Atemwegserkrankungen in Großbritannien würde den Markt ankurbeln.

Zusammenarbeit, Joint Ventures und andere Strategien der Marktteilnehmer stärken das Unternehmen auf dem Markt für das Outsourcing medizinischer Geräte und bieten den Unternehmen auch den Vorteil, ihr Angebot an Behandlungsprodukten zu verbessern.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.