Middle East And Africa Lithium Ion Battery Market

Marktgröße in Milliarden USD

CAGR :

%

USD

2.36 Billion

USD

6.98 Billion

2024

2032

USD

2.36 Billion

USD

6.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.36 Billion | |

| USD 6.98 Billion | |

|

|

|

|

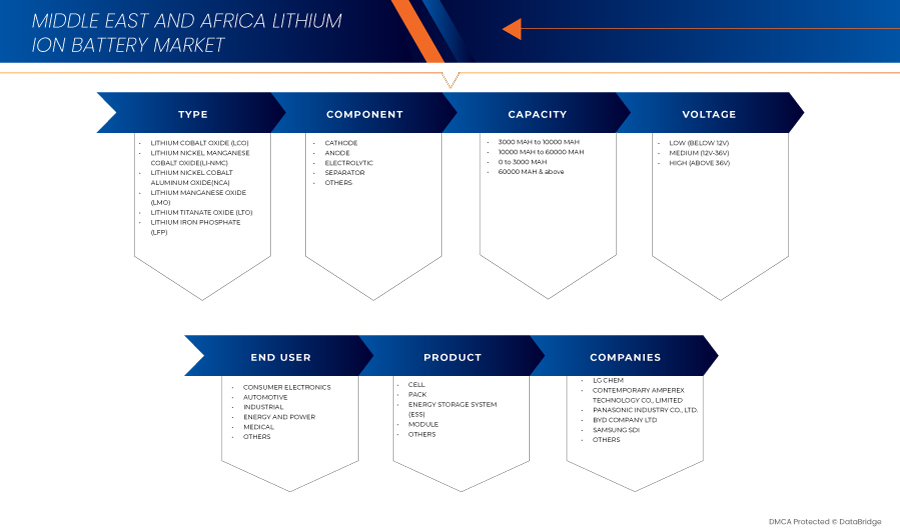

Middle East and Africa Lithium Ion Battery Market Segmentation, By Type (Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (Li-NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate Oxide (LTO), Lithium Iron Phosphate (LFP)), Components (Cathode, Anode, Electrolyte, Separator, and Others), Capacity (3000 mAh to 10000 mAh, 10000 mAh to 60000 mAh, O to 3000 mAh, and 60000 mAh & above), Voltage (Low (Below 12V), Medium (12V-36V), and High (Above 36V)), Product (Cells, Pack, Energy Storage System (ESS), Module, and Others), End User (Consumer Electronics, Automotive, Industrial, Energy and Power, Medical, and Others) – Industry Trends and Forecast to 2032

Lithium Ion Battery Market Analysis

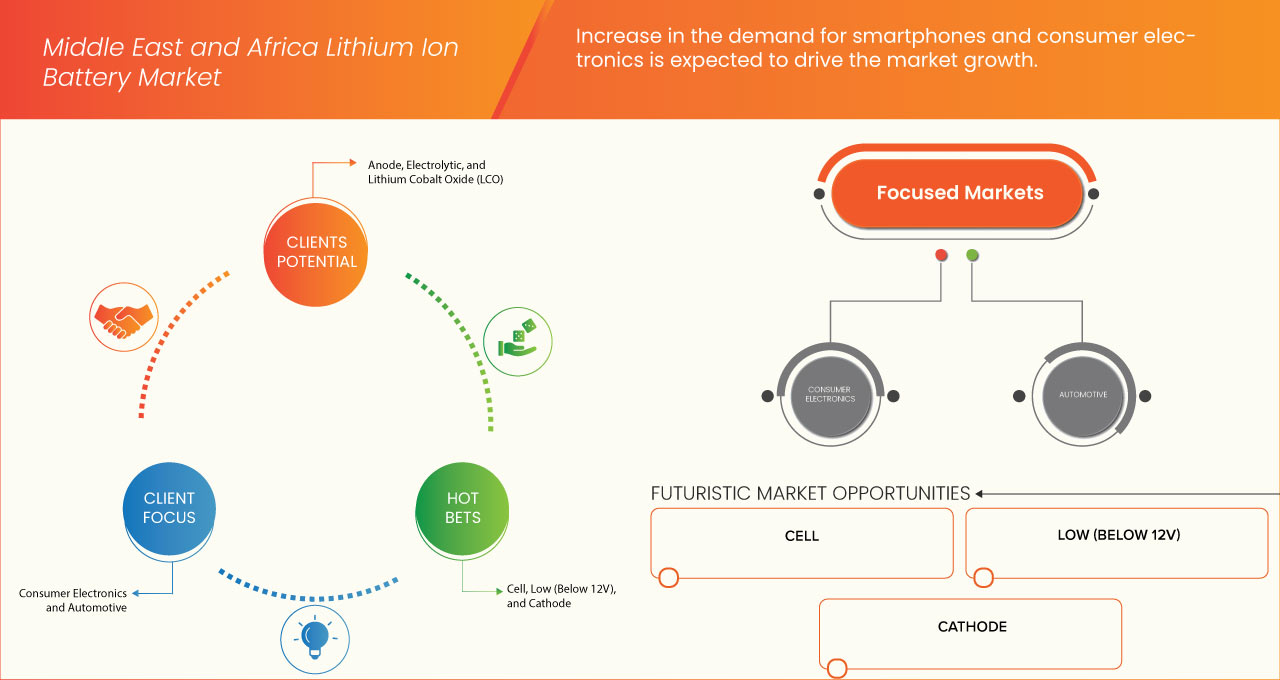

The Middle East and Africa lithium ion battery market is fragmented in nature, as it consists of many global players such as LG Chem, Contemporary Amperex Technology Co., Limited, and BYD Company Limited. among others. The presence of these companies produces competitive prices for lithium-ion battery products across the region. Due to the presence of these players at regional and international levels, suppliers and manufacturers offer products with different specifications and characteristics in all budgets. The increase in demand for smartphones and consumer electronics is driving market growth. In addition, the growing demand for smart devices and wearables is expected to drive market growth.

Safety issue related to lithium ion batteries and the availability of alternatives to lithium-ion batteries is expected to hinder the market growth. Moreover, the rapid aging and degradation of lithium-ion batteries are acting as a challenge to market growth. However, an increase in the number of R&D and manufacturing facilities, growing adoption of renewable energy in the region, and an increase in partnership, acquisitions, and collaboration among market players are estimated to provide opportunities for market growth.

Lithium Ion Battery Market Size

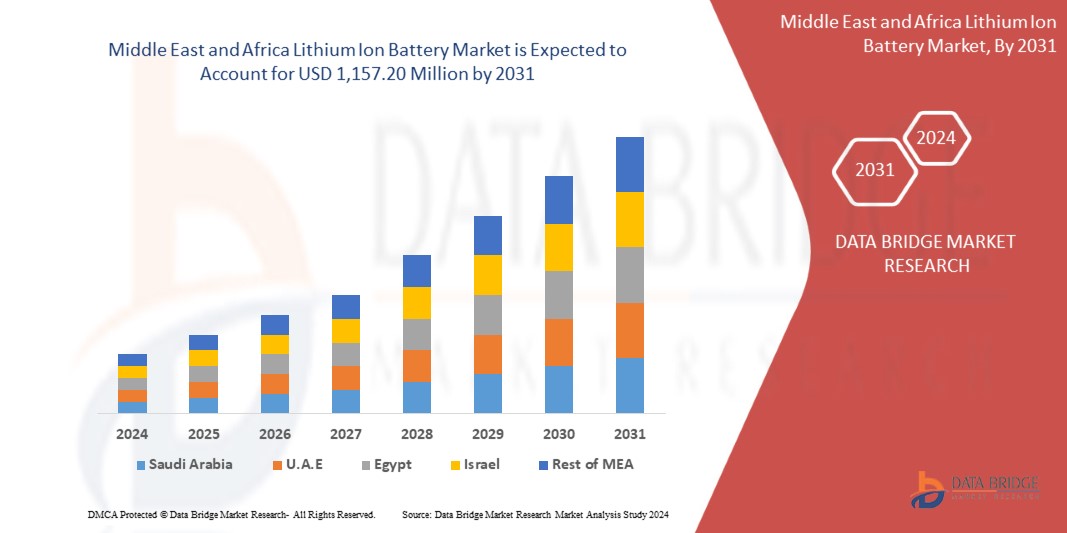

Middle East and Africa lithium ion battery market size was valued at USD 2.36 billion in 2024 and is projected to reach USD 6.98 billion by 2032, with a CAGR of 14.7% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Lithium Ion Battery Market Trends

“Increase in the Demand for Smartphones and Consumer Electronics”

Die Anforderungen und Ansprüche an Unterhaltungselektronik steigen weiterhin exponentiell. Lithium-Ionen-Batterien sind in der Unterhaltungselektronik weit verbreitet. Sie sind eine der beliebtesten Arten von wiederaufladbaren Batterien für tragbare Elektronikgeräte, mit einem guten Energie-Gewichts-Verhältnis, hoher Leerlaufspannung und geringer Selbstentladungsrate. Technologische Fortschritte haben die Größe elektronischer Geräte reduziert und sie schlanker und leichter gemacht, was den Bedarf an Lithium-Ionen-Batterien erhöht. Diese Batterien halten länger, laden schneller und haben eine höhere Leistungsdichte für eine längere Batterielebensdauer in einem leichteren Gehäuse.

Darüber hinaus kann 1 kg einer Lithium-Ionen-Batterie bis zu 150 Wattstunden Strom speichern, während eine Blei-Säure-Batterie nur 25 Wattstunden pro kg speichern kann. Die Vorteile von Lithium-Ionen-Batterien haben den Bedarf an Unterhaltungselektronik erhöht. Da die Menschen immer stärker zur Digitalisierung neigen, werden fortschrittlichere Elektronikgeräte entwickelt. Dieser Trend erhöht die Nachfrage nach Smartphones und Unterhaltungselektronik und dürfte das Marktwachstum ankurbeln.

Berichtsumfang und Marktsegmentierung für Lithium-Ionen-Batterien

|

Eigenschaften |

Wichtige Markteinblicke zu Lithium-Ionen-Batterien |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Vereinigte Arabische Emirate, Südafrika, Saudi-Arabien, Ägypten, Türkei, Israel, Katar, Kuwait, Oman, Irak, Jordanien, Libanon, Georgien, Armenien, Jemen und Rest des Nahen Ostens und Afrikas |

|

Wichtige Marktteilnehmer |

LG Chem (Südkorea), Contemporary Amperex Technology Co., Limited (China), Panasonic Industry Co., Ltd. (Japan), BYD Company Ltd. (China), SAMSUNG SDI (Südkorea), Saft (Frankreich), Lithium Energy Japan (Japan), VARTA AG (Deutschland), Amperex Technology Limited (China), GlobTek, Inc. (USA), Leclanché SA (Schweiz), LITHIUMWERKS (Niederlande), TOSHIBA CORPORATION (Japan), Xiamen Tmax Battery Equipments Limited (China), Jiangxi JingJiu Power Science & Technology Co.,LTD. (China), Shenzhen Grepow Battery Co., Ltd. (China), Shuangdeng Group Co,Ltd (China), Codi Energy Ltd. (China), Exide Technologies (USA) und SK Inc. (Südkorea) unter anderem |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Marktdefinition für Lithium-Ionen-Batterien

Eine Lithium-Ionen-Batterie besteht aus Lithium-Ionen, die sich beim Laden durch den Elektrolyt von der negativen zur positiven Elektrode bewegen und sich beim Laden zurückbewegen. Diese Batterien sind wiederaufladbar und werden häufig in Unterhaltungselektronik und Autos verwendet. Sie bestehen aus vier Komponenten: Kathode, Anode, Separator und Elektrolyt. Die Anode hilft bei der Speicherung und Freisetzung von Lithium-Ionen aus der Kathode und ermöglicht den Stromfluss durch einen externen Stromkreis.

Marktdynamik für Lithium-Ionen-Batterien

Treiber

- Wachsende Nachfrage nach Smart Devices und Wearables

Hersteller von Lithium-Ionen-Batterien produzieren flexiblere Batterien, die gebogen und gerollt werden können. Diese von den Herstellern angebotenen Funktionen haben den Bedarf an intelligenten Geräten und Wearables erhöht. Die Verwendung von Batterien war bisher auf sperrige und starre Formen beschränkt, was durch fortschrittlichere Technologien und durch Forschung und Entwicklung geändert wurde. Darüber hinaus hat mit dem zunehmenden Wachstum im Bereich IoT und 5G die Verbreitung intelligenter Geräte zugenommen, was zu einem Marktwachstum geführt hat. Unternehmen bringen neue Batterien auf den Markt, die für Wearables und verschiedene andere intelligente Geräte geeignet sind, was zu einem Marktwachstum führt.

Zum Beispiel,

Im August 2024 eröffnete das deutsche Lithium-Schwefel-Batterieunternehmen Theion ein Büro in Dubai, um in der Golfregion zu expandieren und seine kosteneffiziente, schwefelbasierte Batterietechnologie mit hoher Energiedichte zu vermarkten. Durch die Verwendung von Schwefel, einem lokalen Nebenprodukt, reduzierte Theion die Kosten im Vergleich zu herkömmlichen Materialien um 99 %. Diese Innovation unterstützte den Lithium-Ionen-Batteriemarkt im Nahen Osten und in Afrika, begegnete der wachsenden Nachfrage nach Smartphones und Unterhaltungselektronik und förderte gleichzeitig die regionale Energiewende.

- Riesige Nachfrage nach Automobilen in der gesamten Region

Lithium-Ionen-Batterien können deutlich mehr Energie speichern und wiegen nur einen Bruchteil des Gewichts herkömmlicher Blei-Säure-Batterien. Daher eignen sie sich hervorragend für Autos, Hybridautos und Elektrofahrzeuge. Eigenschaften wie die kompakte Größe und die hohe Leistung machen sie für verschiedene Elektrofahrzeuge und E-Bikes sehr geeignet. Batterien spielen in der Automobilindustrie, insbesondere im Ersatzteilmarkt, eine dominierende Rolle. Der Bedarf an effizienten Batterien steigt mit der wachsenden Anzahl von Fahrzeugen kontinuierlich an. Die Automobilindustrie wächst und mit der wachsenden Bevölkerung werden mehr Autos benötigt, was das Marktwachstum ankurbelt.

Zum Beispiel,

Im September 2022 kurbelte die Jebel Ali Free Zone (Jafza) den Automobilmarkt mit einer Logistikinfrastruktur von Weltklasse an und ermöglichte 2021 den Handel mit über 1,2 Millionen Tonnen Fahrzeugen im Wert von 12,4 Milliarden USD. Sie verband afrikanische, asiatische und nahöstliche Märkte mit globalen Verbrauchern durch multimodale Systeme wie Häfen, Flughäfen und Schienennetze. Jafza unterstützte den Export von Gebrauchtwagen, wobei der Markt der VAE bis 2025 voraussichtlich 112 Milliarden AED erreichen wird. Die Rolle des Hubs im Automobilhandel stärkte die Nachfrage nach Lithium-Ionen-Batterien, was durch die zunehmende Verbreitung von Automobilen in der gesamten Region vorangetrieben wurde. DP World verbesserte die Effizienz der Lieferkette durch Logistik und globale Handelsnetzwerke.

Gelegenheit

- Zunahme der Anzahl von F&E- und Produktionsstätten durch Marktteilnehmer

Lithium-Ionen-Batterien haben ein breites Anwendungsspektrum und durch verstärkte Anstrengungen in Forschung und Entwicklung werden immer fortschrittlichere Eigenschaften entwickelt. Unternehmen bauen neue Produktionsanlagen, um die steigende Nachfrage nach Lithium-Ionen-Batterien für Elektrofahrzeuge, medizinische Geräte und die Datenkommunikation zu decken. Die neuen Anlagen und die wachsende Forschung und Entwicklung schaffen neue Möglichkeiten für Marktwachstum.

Zum Beispiel,

Im Februar 2024 erweiterten Saudi-Arabien und Marokko ihre Rollen in der Lieferkette für Lithium-Ionen-Batterien, indem sie kritische Mineralien und staatlich geförderte Investitionen nutzten. Saudi-Arabien erhöhte seine Mineralressourcenschätzungen auf 2,5 Billionen USD und erweiterte die Bergbauexploration sowie die Midstream- und Downstream-Kapazitäten, einschließlich einer Graphitanodenanlage. Marokko nutzte seine Phosphatreserven, um Investitionen in EV-Batterien anzuziehen. Diese Bemühungen gingen mit der wachsenden Nachfrage nach Smartphones und Unterhaltungselektronik einher und belebten den Markt für Lithium-Ionen-Batterien im Nahen Osten und in Afrika.

Einschränkung/Herausforderung

- Schnelle Alterung und Degradation von Lithium-Ionen-Batterien

Alterung und Verschlechterung sind für Hersteller von Lithium-Ionen-Batterien ein großes Problem, da die typische geschätzte Lebensdauer einer Lithium-Ionen-Batterie etwa zwei bis drei Jahre oder 300 bis 500 Ladezyklen beträgt, je nachdem, was zuerst eintritt. Ein Ladezyklus ist ein Nutzungszeitraum von vollständiger Aufladung über vollständige Entladung bis hin zur erneuten vollständigen Aufladung. Die Batterie bietet hohe Leistung und Energieeffizienz, ist jedoch bei extremen Temperaturen sehr anfällig für Verschlechterung. Darüber hinaus wirkt sich die Alterung auf das Marktwachstum aus und stellt eine erhebliche Herausforderung für das Marktwachstum dar.

Zum Beispiel,

Laut einem Bericht der Royal Society of Chemistry ist eine Leistungsminderung während der Lebensdauer von Lithium-Ionen-Batterien unvermeidbar und letztlich auf chemische Prozesse zurückzuführen. Ihr Ausmaß wird hauptsächlich durch die Materialkomponenten der Batterie und die Betriebsbedingungen (Lade-/Entladeraten, Spannungsbetriebsgrenzen und Temperatur) bestimmt und kann auch durch das Batteriedesign beeinflusst werden. Dies kann den Verbraucher dazu zwingen, sich für andere Optionen wie AGM-Batterien zu entscheiden.

Dieser Marktbericht enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für Lithium-Ionen-Batterien

Der Markt ist in sechs wichtige Segmente unterteilt, basierend auf Typ, Komponenten, Kapazität, Spannung, Produkt und Endbenutzer. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen dabei helfen, strategische Entscheidungen zur Identifizierung der wichtigsten Marktanwendungen zu treffen.

Typ

- Lithiumkobaltoxid (LCO)

- Lithium-Nickel-Mangan-Kobaltoxid (Li-NMC)

- Lithium-Nickel-Kobalt-Aluminiumoxid (NCA)

- Lithium-Mangan-Oxid (LMO)

- Lithiumtitanatoxid (LTO)

- Lithiumeisenphosphat (LFP)

Komponenten

- Kathode

- Anode

- Elektrolytisch

- Separator

- Andere

Kapazität

- 3000 mAh bis 10000 mAh

- 10000 bis 60000 mAh

- 0 bis 3000 mAh

- 60000 mAh und mehr

Stromspannung

- Niedrig (unter 12 V)

- Mittel (12 V – 36 V)

- Hoch (über 36 V)

Produkt

- Zellen

- Zylindrische Zelle

- Prismatische Zelle

- Pouch-Zelle

- Knopfzelle

- Pack

- Energiespeichersystem (ESS)

- Modul

- Andere

Endbenutzer

- Unterhaltungselektronik

- Nach Endbenutzer

- Smartphones

- Laptops und Tablets

- Elektronische Kameras

- UPS

- Sonstiges

- Nach Endbenutzer

- Automobilindustrie

- Nach Antriebsart

- Batteriebetriebene Elektrofahrzeuge (BEV)

- Plug-In-Hybrid-Elektrofahrzeug (PHEV)

- Hybrid-Elektrofahrzeuge (HEV)

- Nach Fahrzeugtyp

- Pkw

- Nach Typ

- Geländewagen

- Limousine

- Fließheck

- Sonstiges

- Nach Typ

- E-Bikes/ E-Scooter/Mopeds

- Leichte Nutzfahrzeuge

- Nach Typ

- Geländewagen

- Limousine

- Fließheck

- Sonstiges

- Nach Typ

- Schwere Nutzfahrzeuge

- Nach Typ

- Geländewagen

- Limousine

- Fließheck

- Sonstiges

- Nach Typ

- 3-rädriger Elektroroller

- Sonstiges

- Pkw

- Nach Antriebsart

- Industrie

- Nach Typ

- Konstruktion

- Bergbau

- Marine

- Luft- und Raumfahrt und Verteidigung

- Sonstiges

- Nach Typ

- Energie und Leistung

- Nach Typ

- Intelligentes Stromnetz

- Nach Typ

- Speicherung erneuerbarer Energien

- Speicherung nicht erneuerbarer Energie

- Nach Typ

- Netzunabhängig

- Sonstiges

- Intelligentes Stromnetz

- Nach Typ

- Medizin

- Sonstiges

Regionale Analyse des Lithium-Ionen-Batteriemarktes

Der Markt für Lithium-Ionen-Batterien im Nahen Osten und in Afrika ist, wie oben erwähnt, basierend auf Typ, Komponenten, Kapazität, Spannung, Produkt und Endbenutzer in sechs wichtige Segmente unterteilt.

Die vom Markt abgedeckten Länder sind die Vereinigten Arabischen Emirate, Südafrika, Saudi-Arabien, Ägypten, die Türkei, Israel, Katar, Kuwait, Oman, Irak, Jordanien, Libanon, Georgien, Armenien, Jemen und der Rest des Nahen Ostens und Afrikas.

Die Vereinigten Arabischen Emirate werden voraussichtlich den Markt für Lithium-Ionen-Batterien im Nahen Osten und Afrika anführen. Dieses Wachstum ist auf mehrere Faktoren zurückzuführen, darunter die schnelle Industrialisierung, die zunehmende Einführung von Automatisierung in verschiedenen Sektoren und eine zunehmende Betonung der Industrie.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lithium Ion Battery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Lithium Ion Battery Market Leaders Operating in the Market Are:

- LG Chem (South Korea)

- Contemporary Amperex Technology Co., Limited (China)

- Panasonic Industry Co., Ltd. (Japan)

- BYD Company Ltd. (China)

- SAMSUNG SDI (South Korea)

- Saft (France)

- Lithium Energy Japan (Japan)

- VARTA AG (Germany)

- Amperex Technology Limited (China)

- GlobTek, Inc. (U.S.)

- Leclanché SA (Switzerland)

- LITHIUMWERKS (Netherlands)

- TOSHIBA CORPORATION (Japan)

- Xiamen Tmax Battery Equipments Limited (China)

- Jiangxi JingJiu Power Science & Technology Co.,LTD. (China)

- Shenzhen Grepow Battery Co., Ltd. (China)

- Shuangdeng Group Co,Ltd (China)

- Codi Energy Ltd. (China)

- Exide Technologies (U.S.)

- SK Inc. (South Korea)

Latest Developments in Lithium Ion Battery Market

- In April 2023, Contemporary Amperex Technology Co., Limited condensed battery, boasting up to 500 Wh/kg energy density, revolutionizes aviation electrification, ensuring safety and efficiency. Leveraging biomimetic electrolytes and innovative materials, it overcomes previous limitations, paving the way for mass production and application in electric passenger aircrafts. This breakthrough marks a pivotal moment in achieving universal electrification across transportation sectors, advancing towards global carbon neutrality goals

- In January 2023, the LG Chem project won the FDI deal of the year award. This recognition made a significant impact on the growth of the company's image as well as the growth of the Middle East and Africa lithium ion battery market

- Im Oktober 2021 gründeten SAMSUNG SDI und Stellantis ein Joint Venture zur Produktion von Lithium-Ionen-Batterien in Nordamerika und im Nahen Osten. Dieses Unternehmen umfasst verschiedene Produktionsanlagen und Forschungszentren für Lithium-Ionen-Batterien. Diese Entwicklung wirkte sich positiv auf das Unternehmen sowie auf das Wachstum des Marktes für Lithium-Ionen-Batterien im Nahen Osten und in Afrika aus.

- Im November 2023 demonstrierte die BYD Company Ltd. ihre strategische Expansion in den Nahen Osten und nutzte Partnerschaften mit chinesischen Automobilunternehmen wie BeyonCa, Pony.ai und Nio, um lukrative Märkte in Saudi-Arabien und den Vereinigten Arabischen Emiraten zu erschließen. Gleichzeitig signalisiert die Zusammenarbeit von BYD mit Finanzinstituten im Nahen Osten wie der Mubadala Investment Company und dem Saudi Public Investment Fund das Engagement, die Wirtschaftsbeziehungen zu vertiefen und Wachstum und Innovation in der Automobilindustrie zu fördern.

- Im Dezember 2023 kooperierten Panasonic Corporation und Sila bei der Versorgung mit Siliziumanoden, die für Lithium-Ionen-Batterien, die Elektrofahrzeuge antreiben, von entscheidender Bedeutung sind. Angesichts des Plans von Panasonic, die Batterieproduktion bis 2030-31 auf 200 GWh zu steigern, unterstreicht diese Zusammenarbeit die entscheidende Rolle von Lithium-Ionen-Batterien in der Elektrofahrzeugindustrie. Als wichtiger Tesla-Lieferant unterstreicht die Partnerschaft von Panasonic das Bestreben der Branche nach nachhaltigem Transport

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 END USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 TYPE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY FRAMEWORK

4.2 TECHNOLOGICAL TRENDS

4.3 LIST OF KEY BUYERS IN MIDDLE EAST AND AFRICA REGION

4.4 VALUE CHAIN ANALYSIS

4.5 VENDOR SELECTION CRITERIA

4.6 PESTEL ANALYSIS

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 RAW MATERIAL OUTLOOK

4.9 PRICING ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS

5.1.2 GROWING DEMAND FOR SMART DEVICES AND WEARABLE

5.1.3 HUGE DEMAND FOR AUTOMOTIVE ACROSS THE REGION

5.1.4 RISE IN REQUIREMENT FOR LITHIUM ION BATTERIES IN INDUSTRIAL AND MEDICAL APPLICATIONS

5.2 RESTRAINTS

5.2.1 SAFETY ISSUES RELATED TO LITHIUM ION BATTERIES

5.2.2 AVAILABILITY OF ALTERNATIVES OF LITHIUM ION BATTERIES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN THE NUMBER OF R&D AND MANUFACTURING FACILITIES BY MARKET PLAYERS

5.3.2 GROWING ADOPTION OF RENEWABLE ENERGY IN THE REGION

5.3.3 INCREASE IN PARTNERSHIP, ACQUISITION, AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 RAPID AGING AND DEGRADATION OF LITHIUM ION BATTERIES

6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE

6.1 OVERVIEW

6.2 LITHIUM COBALT OXIDE (LCO)

6.3 LITHIUM NICKEL MANGANESE COBALT OXIDE (LI-NMC)

6.4 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA)

6.5 LITHIUM MANGANESE OXIDE (LMO)

6.6 LITHIUM TITANATE OXIDE (LTO)

6.7 LITHIUM IRON PHOSPHATE (LFP)

7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 CATHODE

7.3 ANODE

7.4 ELECTROLYTIC

7.5 SEPARATOR

7.6 OTHERS

8 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY,

8.1 OVERVIEW

8.2 3000 MAH TO 10000 MAH

8.3 10000 MAH TO 60000 MAH

8.4 0 TO 3000 MAH

8.5 60000 MAH & ABOVE

9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE

9.1 OVERVIEW

9.2 LOW (BELOW 12V)

9.3 MEDIUM (12V-36V)

9.4 HIGH (ABOVE 36V)

10 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT

10.1 OVERVIEW

10.2 CELL

10.2.1 CYLINDRICAL CELL

10.2.2 PRISMATIC CELL

10.2.3 POUCH CELL

10.2.4 BUTTON CELL

10.3 PACK

10.4 ENERGY STORAGE SYSTEM (ESS)

10.5 MODULE

10.6 OTHERS

11 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 SMARTPHONES

11.2.2 LAPTOPS & TABLETS

11.2.3 ELECTRONIC CAMERAS

11.2.4 UPS

11.2.5 OTHERS

11.3 AUTOMOTIVE

11.3.1 AUTOMOTIVE, PROPULSION TYPE

11.3.1.1 BATTERY ELECTRIC VEHICLES (BEV)

11.3.1.2 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

11.3.1.3 HYBRID ELECTRIC VEHICLES (HEV)

11.3.2 AUTOMOTIVE, VEHICLE TYPE

11.3.2.1 PASSENGER CARS

11.3.2.1.1 PASSENGER CARS,TYPE

11.3.2.1.1.1 SUV

11.3.2.1.1.2 SEDAN

11.3.2.1.1.3 HATCHBACK

11.3.2.1.1.4 OTHERS

11.3.2.2 E-BIKES/ E-SCOOTER/MOPEDS

11.3.2.3 LIGHT COMMERCIAL VEHICLES

11.3.2.3.1 LIGHT COMMERCIAL VEHICLES,TYPE

11.3.2.3.1.1 SUV

11.3.2.3.1.2 SEDAN

11.3.2.3.1.3 HATCHBACK

11.3.2.3.1.4 OTHERS

11.3.2.4 HEAVY COMMERCIAL VEHICLES

11.3.2.4.1 HEAVY COMMERCIAL VEHICLES,TYPE

11.3.2.4.1.1 SUV

11.3.2.4.1.2 SEDAN

11.3.2.4.1.3 HATCHBACK

11.3.2.4.1.4 OTHERS

11.3.2.5 3-WHEELED ELECTRIC SCOOTER

11.3.2.6 OTHERS

11.4 INDUSTRIAL

11.4.1 CONSTRUCTION

11.4.2 MINING

11.4.3 MARINE

11.4.4 AEROSPACE AND DEFENSE

11.4.5 OTHERS

11.5 ENERGY AND POWER

11.5.1 SMART GRID

11.5.1.1 RENEWABLE ENERGY STORAGE

11.5.1.2 NON-RENEWABLE ENERGY STORAGE

11.5.2 OFF GRID

11.5.3 OTHERS

11.6 MEDICAL

11.7 OTHERS

12 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY

12.1 MIDDLE EAST AND AFRICA

12.1.1 U.A.E

12.1.2 SOUTH AFRICA

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 TURKEY

12.1.6 ISRAEL

12.1.7 QATAR

12.1.8 KUWAIT

12.1.9 OMAN

12.1.10 IRAQ

12.1.11 JORDAN

12.1.12 LEBANON

12.1.13 GEORGIA

12.1.14 ARMENIA

12.1.15 YEMEN

12.1.16 REST OF MIDDLE EAST AND AFRICA

13 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 SOLUTION PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 LG CHEM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 SAMSUNG SDI

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 BYD COMPANY LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 PANASONIC INDUSTRY CO., LTD.

15.5.1 SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 AMPEREX TECHNOLOGY LIMITED

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 CODI ENERGY LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 EXIDE TECHNOLOGIES

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 GLOBTEK, INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 JIANGXI JINGJIU POWER SCIENCE& TECHNOLOGY CO.LTD.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 LECLANCHÉ SA

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 LITHIUM ENERGY JAPAN

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LITHIUMWERKS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 SAFT

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SHENZHEN GREPOW BATTERY CO., LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SHUANGDENG GROUP CO,LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SK INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 TOSHIBA CORPORATION

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 VARTA AG

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XIAMEN TMAX BATTERY EQUIPMENTS LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 CERTIFICATION/RULE/ APPENDIX

TABLE 2 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 3 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 4 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND

TABLE 6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY, 2022-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COUNTRY, 2022-2032 (THOUSAND UNITS)

TABLE 21 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 23 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 38 U.A.E LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 39 U.A.E LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 40 U.A.E LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 41 U.A.E LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 42 U.A.E LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 43 U.A.E LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 44 U.A.E CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 45 U.A.E LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 46 U.A.E CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 47 U.A.E AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 48 U.A.E AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 49 U.A.E PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 50 U.A.E LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 51 U.A.E HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 52 U.A.E INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 53 U.A.E ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 54 U.A.E SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 55 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 56 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 57 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 58 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 59 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 60 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 61 SOUTH AFRICA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 62 SOUTH AFRICA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 63 SOUTH AFRICA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 64 SOUTH AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 65 SOUTH AFRICA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 66 SOUTH AFRICA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 67 SOUTH AFRICA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 68 SOUTH AFRICA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 69 SOUTH AFRICA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 70 SOUTH AFRICA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 71 SOUTH AFRICA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 72 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 73 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 74 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 75 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 76 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 77 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 78 SAUDI ARABIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 79 SAUDI ARABIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 80 SAUDI ARABIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 81 SAUDI ARABIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 82 SAUDI ARABIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 83 SAUDI ARABIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 84 SAUDI ARABIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 85 SAUDI ARABIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 86 SAUDI ARABIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 87 SAUDI ARABIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 88 SAUDI ARABIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 89 EGYPT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 90 EGYPT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 91 EGYPT LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 92 EGYPT LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 93 EGYPT LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 94 EGYPT LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 95 EGYPT CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 96 EGYPT LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 97 EGYPT CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 98 EGYPT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 99 EGYPT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 100 EGYPT PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 101 EGYPT LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 102 EGYPT HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 103 EGYPT INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 104 EGYPT ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 105 EGYPT SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 106 TURKEY LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 107 TURKEY LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 108 TURKEY LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 109 TURKEY LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 110 TURKEY LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 111 TURKEY LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 112 TURKEY CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 113 TURKEY LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 114 TURKEY CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 115 TURKEY AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 116 TURKEY AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 117 TURKEY PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 118 TURKEY LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 119 TURKEY HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 120 TURKEY INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 121 TURKEY ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 122 TURKEY SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 123 ISRAEL LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 124 ISRAEL LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 125 ISRAEL LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 126 ISRAEL LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 127 ISRAEL LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 128 ISRAEL LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 129 ISRAEL CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 130 ISRAEL LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 131 ISRAEL CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 132 ISRAEL AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 133 ISRAEL AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 134 ISRAEL PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 135 ISRAEL LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 136 ISRAEL HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 137 ISRAEL INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 138 ISRAEL ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 139 ISRAEL SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 140 QATAR LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 141 QATAR LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 142 QATAR LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 143 QATAR LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 144 QATAR LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 145 QATAR LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 146 QATAR CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 147 QATAR LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 148 QATAR CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 149 QATAR AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 150 QATAR AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 151 QATAR PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 152 QATAR LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 153 QATAR HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 154 QATAR INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 155 QATAR ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 156 QATAR SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 157 KUWAIT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 158 KUWAIT LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 159 KUWAIT LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 160 KUWAIT LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 161 KUWAIT LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 162 KUWAIT LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 163 KUWAIT CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 164 KUWAIT LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 165 KUWAIT CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 166 KUWAIT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 167 KUWAIT AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 168 KUWAIT PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 169 KUWAIT LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 170 KUWAIT HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 171 KUWAIT INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 172 KUWAIT ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 173 KUWAIT SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 174 OMAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 175 OMAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 176 OMAN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 177 OMAN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 178 OMAN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 179 OMAN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 180 OMAN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 181 OMAN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 182 OMAN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 183 OMAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 184 OMAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 185 OMAN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 186 OMAN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 187 OMAN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 188 OMAN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 189 OMAN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 190 OMAN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 191 IRAQ LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 192 IRAQ LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 193 IRAQ LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 194 IRAQ LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 195 IRAQ LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 196 IRAQ LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 197 IRAQ CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 198 IRAQ LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 199 IRAQ CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 200 IRAQ AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 201 IRAQ AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 202 IRAQ PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 203 IRAQ LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 204 IRAQ HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 205 IRAQ INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 206 IRAQ ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 207 IRAQ SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 208 JORDAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 209 JORDAN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 210 JORDAN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 211 JORDAN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 212 JORDAN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 213 JORDAN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 214 JORDAN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 215 JORDAN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 216 JORDAN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 217 JORDAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 218 JORDAN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 219 JORDAN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 220 JORDAN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 221 JORDAN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 222 JORDAN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 223 JORDAN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 224 JORDAN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 225 LEBANON LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 226 LEBANON LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 227 LEBANON LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 228 LEBANON LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 229 LEBANON LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 230 LEBANON LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 231 LEBANON CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 232 LEBANON LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 233 LEBANON CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 234 LEBANON AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 235 LEBANON AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 236 LEBANON PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 237 LEBANON LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 238 LEBANON HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 239 LEBANON INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 240 LEBANON ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 241 LEBANON SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 242 GEORGIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 243 GEORGIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 244 GEORGIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 245 GEORGIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 246 GEORGIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 247 GEORGIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 248 GEORGIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 249 GEORGIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 250 GEORGIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 251 GEORGIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 252 GEORGIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 253 GEORGIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 254 GEORGIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 255 GEORGIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 256 GEORGIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 257 GEORGIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 258 GEORGIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 259 ARMENIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 260 ARMENIA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 261 ARMENIA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 262 ARMENIA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 263 ARMENIA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 264 ARMENIA LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 265 ARMENIA CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 266 ARMENIA LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 267 ARMENIA CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 268 ARMENIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 269 ARMENIA AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 270 ARMENIA PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 271 ARMENIA LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 272 ARMENIA HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 273 ARMENIA INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 274 ARMENIA ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 275 ARMENIA SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 276 YEMEN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 277 YEMEN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (THOUSAND UNITS)

TABLE 278 YEMEN LITHIUM ION BATTERY MARKET, BY COMPONENT, 2022-2032 (USD THOUSAND)

TABLE 279 YEMEN LITHIUM ION BATTERY MARKET, BY CAPACITY, 2022-2032 (USD THOUSAND)

TABLE 280 YEMEN LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2022-2032 (USD THOUSAND)

TABLE 281 YEMEN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 282 YEMEN CELL IN LITHIUM ION BATTERY MARKET, BY PRODUCT, 2022-2032 (USD THOUSAND)

TABLE 283 YEMEN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 284 YEMEN CONSUMER ELECTRONICS IN LITHIUM ION BATTERY MARKET, BY END USER, 2022-2032 (USD THOUSAND)

TABLE 285 YEMEN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY PROPULSION TYPE, 2022-2032 (USD THOUSAND)

TABLE 286 YEMEN AUTOMOTIVE IN LITHIUM ION BATTERY MARKET, BY VEHICLE TYPE, 2022-2032 (USD THOUSAND)

TABLE 287 YEMEN PASSENGER CARS IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 288 YEMEN LIGHT COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 289 YEMEN HEAVY COMMERCIAL VEHICLES IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 290 YEMEN INDUSTRIAL IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 291 YEMEN ENERGY AND POWER IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 292 YEMEN SMART GRID IN LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

TABLE 293 REST OF MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2022-2032 (USD THOUSAND)

Abbildungsverzeichnis

FIGURE 1 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: MULTIVARIATE MODELLING

FIGURE 11 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: TYPE TIMELINE CURVE

FIGURE 12 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SEGMENTATION

FIGURE 13 SIX SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE (2024)

FIGURE 14 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 THE INCREASE IN DEMAND FOR SMARTPHONES AND CONSUMER ELECTRONICS IS EXPECTED TO BE A KEY DRIVER FOR THE GROWTH OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET IN THE FORECAST PERIOD OF 2025 AND 2032

FIGURE 17 THE LITHIUM COBALT OXIDE (LCO) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET FROM 2025 TO 2032

FIGURE 18 TECHNOLOGICAL TRENDS IN AUTOMOTIVE BATTERY MANAGEMENT

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET

FIGURE 20 PROJECTION OF STEADY GROWTH IN DEMAND FOR CONSUMER ELECTRONICS (2015-2025)

FIGURE 21 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY COMPONENT, 2024

FIGURE 23 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY CAPACITY, 2024

FIGURE 24 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET, BY VOLTAGE, 2024

FIGURE 25 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: BY PRODUCT, 2024

FIGURE 26 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: BY END USER, 2024

FIGURE 27 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: SNAPSHOT (2024)

FIGURE 28 MIDDLE EAST AND AFRICA LITHIUM ION BATTERY MARKET: COMPANY SHARE 2024 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.