Middle East And Africa Fluorspot And Elispot Assay Market

Marktgröße in Milliarden USD

CAGR :

%

USD

121.31 Billion

USD

32.64 Billion

2025

2033

USD

121.31 Billion

USD

32.64 Billion

2025

2033

| 2026 –2033 | |

| USD 121.31 Billion | |

| USD 32.64 Billion | |

|

|

|

|

Marktsegmentierung für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika nach Produkttyp (Assay-Kits, Zusatz-/Hilfsprodukte und Analysegeräte), Quelle (Mensch, Maus, Affe und andere), Krankheiten (Infektionskrankheiten, Krebs, Autoimmunerkrankungen, Allergien und andere), Anwendung (Diagnostik und Forschung), Endnutzer (Krankenhäuser und klinische Labore, Forschungsinstitute, biopharmazeutische Unternehmen und andere) und Vertriebskanal (Direktvergabe, Einzelhandel und andere) – Branchentrends und Prognose bis 2033

Marktgröße für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

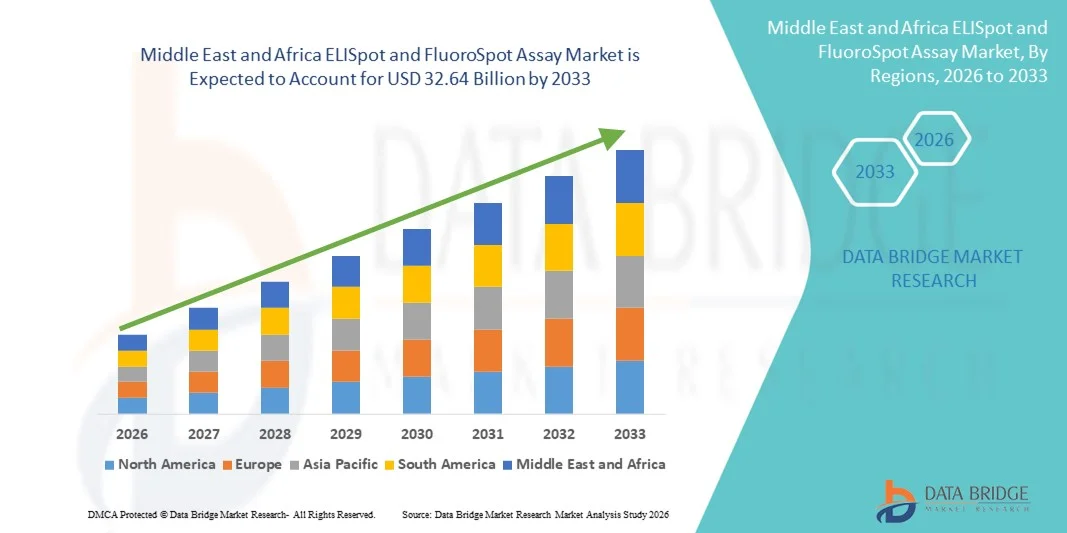

- Der Markt für ELISpot- und Fluorospot-Assays im Nahen Osten und Afrika hatte im Jahr 2025 einen Wert von 121,31 Milliarden US-Dollar und wird voraussichtlich bis 2033 auf 32,64 Milliarden US-Dollar anwachsen , was einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 8,70 % im Prognosezeitraum entspricht.

- Das Marktwachstum wird maßgeblich durch die zunehmende Anwendung fortschrittlicher immunologischer Forschungsmethoden und kontinuierliche technologische Weiterentwicklungen von Testplattformen angetrieben, was zu höherer Präzision, Sensitivität und höherem Durchsatz sowohl in der akademischen Forschung als auch in klinischen Laboren führt.

- Darüber hinaus führt die steigende Nachfrage nach präzisen, reproduzierbaren und hochempfindlichen Methoden zur Immunüberwachung in der Impfstoffentwicklung, der Infektionsforschung, der Krebsimmuntherapie und der Erforschung von Autoimmunerkrankungen dazu, dass ELISpot- und FluoroSpot-Assays sich als bevorzugte Lösungen für die Analyse zellulärer Immunantworten etablieren. Diese zusammenwirkenden Faktoren beschleunigen die Verbreitung von ELISpot- und FluoroSpot-Assays und tragen somit maßgeblich zum Marktwachstum bei.

Marktanalyse für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

- ELISpot- und FluoroSpot-Assays, die eine hochempfindliche Detektion von Zytokin-sezernierenden Zellen auf Einzelzellebene ermöglichen, sind aufgrund ihrer hohen Genauigkeit, Reproduzierbarkeit und der Fähigkeit, mehrere Immunmarker gleichzeitig zu analysieren, zunehmend unverzichtbare Werkzeuge in der Immunologieforschung, der klinischen Diagnostik und der Arzneimittelentwicklung.

- Die steigende Nachfrage nach ELISpot- und FluoroSpot-Assays wird primär durch das rasante Wachstum in der Impfstoffentwicklung, der Krebsimmuntherapie, der Infektionsforschung und der Forschung zu Autoimmunerkrankungen sowie durch den zunehmenden Bedarf an zuverlässigem Immunmonitoring in präklinischen und klinischen Studien angetrieben.

- Saudi-Arabien dominierte 2025 den Markt für ELISpot- und FluoroSpot-Assays mit einem Umsatzanteil von rund 34,8 %. Unterstützt wurde dies durch starke staatliche Investitionen im Rahmen der Vision 2030, die zunehmende Förderung der Lebenswissenschaften und der biomedizinischen Forschung, den Ausbau biotechnologischer und pharmazeutischer Aktivitäten sowie die Verbesserung der Labor- und klinischen Forschungsinfrastruktur. Die rasche Einführung fortschrittlicher immunologischer Assays in akademischen Einrichtungen, Krankenhäusern und Referenzlaboren sowie der wachsende Fokus auf die Überwachung von Infektionskrankheiten und die Impfstoffforschung stärkten Saudi-Arabiens Marktposition.

- Die VAE werden im Prognosezeitraum voraussichtlich die am schnellsten wachsende Region im Markt für ELISpot- und FluoroSpot-Assays sein, mit einer prognostizierten durchschnittlichen jährlichen Wachstumsrate (CAGR) von 9,5 %. Treiber dieses Wachstums sind steigende Investitionen in Biotechnologie und Präzisionsmedizin , der Ausbau klinischer Forschung und CRO-Dienstleistungen, steigende Gesundheitsausgaben sowie die wachsende Nachfrage nach fortschrittlichen Diagnose- und Immunologie-Forschungsinstrumenten. Förderliche Regierungsinitiativen, internationale Forschungskooperationen und der Aufbau modernster Laborinfrastruktur beschleunigen das Marktwachstum in den VAE zusätzlich.

- Das Segment der Forschungsanwendungen dominierte 2025 mit einem Umsatzanteil von 62,1 %, was auf den umfangreichen Einsatz in der Immunologieforschung zurückzuführen ist.

Berichtsumfang und Marktsegmentierung für ELISpot- und FluoroSpot-Assays

|

Attribute |

Wichtigste Markteinblicke zu ELISpot- und FluoroSpot-Assays |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Naher Osten und Afrika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Mehrwertdaten-Infosets |

Zusätzlich zu den Erkenntnissen über Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und Hauptakteure enthalten die von Data Bridge Market Research erstellten Marktberichte auch detaillierte Expertenanalysen, Patientenepidemiologie, Pipeline-Analyse, Preisanalyse und regulatorische Rahmenbedingungen. |

Markttrends für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

Zunehmende Anwendung fortschrittlicher zellulärer Immunüberwachungstechniken

- Ein bedeutender und sich beschleunigender Trend auf dem globalen Markt für ELISpot- und FluoroSpot-Assays ist die zunehmende Anwendung fortschrittlicher Techniken zur Überwachung zellulärer Immunantworten in der Infektionsforschung, Onkologie und Impfstoffentwicklung. Diese Assays zeichnen sich durch ihre hohe Sensitivität beim Nachweis antigenspezifischer T-Zell- und B-Zell-Antworten auf Einzelzellebene aus.

- Beispielsweise wurden während der COVID-19-Pandemie (2021–2022) von Forschungseinrichtungen und Pharmaunternehmen weltweit ELISpot- und FluoroSpot-Assays zur Bewertung von T-Zell-Antworten und der Wirksamkeit von Impfstoffen eingesetzt, was eine beschleunigte Impfstoffentwicklung und die Überwachung der Immunantwort unterstützte.

- Technologische Fortschritte, darunter Multiparameter-FluoroSpot-Assays, ermöglichen den simultanen Nachweis mehrerer Zytokine und verbessern so die Assay-Effizienz und die Datentiefe signifikant. Dies hat die Anwendung in der translationalen Forschung und der Entwicklung von Immuntherapien verstärkt.

- Die zunehmende Verwendung von ELISpot- und FluoroSpot-Assays bei der Prüfung der Impfstoffwirksamkeit, insbesondere bei Infektionskrankheiten wie COVID-19, Tuberkulose, Hepatitis und neu auftretenden Virusinfektionen, stärkt die weltweite Marktnachfrage in akademischen und klinischen Forschungseinrichtungen zusätzlich.

- Dieser Trend hin zu hochpräzisen, reproduzierbaren und skalierbaren Instrumenten zur Immunüberwachung verändert die immunologischen Forschungspraktiken weltweit und ermutigt Assay-Hersteller, ihre Produktions- und Vertriebsnetze sowie ihre technischen Supportkapazitäten in verschiedenen Regionen auszubauen.

- Infolgedessen wird erwartet, dass der globale Markt für ELISpot- und FluoroSpot-Assays im Prognosezeitraum mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von etwa 9,0 % bis 10,5 % wachsen wird, angetrieben durch die weltweit zunehmende Forschungstätigkeit und die Entwicklung von Immuntherapien.

Marktdynamik der ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

Treiber

Zunehmende immunologische Forschung und steigende Belastung durch Infektions- und chronische Krankheiten

- Die weltweit zunehmende Verbreitung von Infektionskrankheiten, Krebs und Autoimmunerkrankungen ist ein wesentlicher Treiber der Nachfrage nach ELISpot- und FluoroSpot-Assays. Diese Assays werden umfassend zur Untersuchung zellulärer Immunantworten sowohl in der klinischen Diagnostik als auch in der Forschung eingesetzt.

- Beispielsweise haben die weltweite Impfstoffforschung und klinische Studien für Infektionskrankheiten wie COVID-19, HIV und Tuberkulose die Beschaffung von ELISpot- und FluoroSpot-Testkits in Nordamerika, Europa sowie im Nahen Osten und Afrika zwischen 2021 und 2024 deutlich erhöht.

- Staatlich geförderte Forschungsinitiativen und öffentlich-private Partnerschaften zur Stärkung der biomedizinischen Forschung und der Pandemievorsorge beschleunigen die Einführung von Testverfahren in akademischen Instituten und biopharmazeutischen Unternehmen zusätzlich.

- Die zunehmende Zahl globaler klinischer Studien hat die Nachfrage nach Immunmonitoring-Assays, die bei Sicherheits- und Wirksamkeitsbewertungen eingesetzt werden, insbesondere in der Onkologie und der Entwicklung von Impfstoffen gegen Infektionskrankheiten, direkt gesteigert.

- Darüber hinaus unterstützt die zunehmende Präsenz globaler Life-Science-Unternehmen und Auftragsforschungsinstitute (CROs) weltweit ein stetiges Wachstum des Assay-Verbrauchs sowohl in der Diagnostik als auch in der Forschung.

Zurückhaltung/Herausforderung

Hohe Analysekosten und technische Komplexität

- Eine der größten Herausforderungen für das Marktwachstum sind die relativ hohen Kosten für ELISpot- und FluoroSpot-Testkits, Analysegeräte und Verbrauchsmaterialien, was die Akzeptanz in kleinen Laboren und Forschungszentren mit begrenzten Budgets einschränken kann.

- In vielen Entwicklungsländern beispielsweise führt die begrenzte Finanzierung der Forschung und die hohen Kosten spezialisierter FluoroSpot-Analysegeräte dazu, dass man weiterhin auf herkömmliche ELISA-Tests setzt, trotz der höheren Sensitivität und Datenqualität, die ELISpot/FluoroSpot-Tests bieten.

- Die Variabilität von Testprotokollen, Probenvorbereitungsanforderungen und Ergebnisinterpretation kann die Reproduzierbarkeit ebenfalls beeinträchtigen, weshalb standardisierte Arbeitsabläufe und qualifizierte technische Expertise erforderlich sind.

- Darüber hinaus schränken das begrenzte Bewusstsein und die eingeschränkte Verfügbarkeit fortschrittlicher Immunüberwachungstechnologien in abgelegenen oder unterentwickelten Regionen weiterhin eine breitere Marktdurchdringung ein.

- Die Bewältigung dieser Herausforderungen durch kostengünstige Testkits, vereinfachte Arbeitsabläufe, verbesserte Schulungsprogramme und den Ausbau der regionalen Produktion wird entscheidend für die Aufrechterhaltung des langfristigen Wachstums auf dem globalen Markt für ELISpot- und FluoroSpot-Assays sein.

Marktübersicht für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

Der Markt ist segmentiert nach Produkttyp, Quelle, Krankheit, Anwendung, Endverbraucher und Vertriebskanal.

- Nach Produkttyp

Basierend auf dem Produkttyp ist der Markt für ELISpot- und FluoroSpot-Assays in Assay-Kits, ergänzende Produkte und Analysegeräte unterteilt. Das Segment der Assay-Kits dominierte den Markt mit einem Umsatzanteil von 56,8 % im Jahr 2025, was auf den hohen Verbrauch in Forschung und Klinik zurückzuführen ist. Assay-Kits enthalten voroptimierte Reagenzien, beschichtete Platten und Detektionsantikörper und gewährleisten so konsistente Ergebnisse und hohe Reproduzierbarkeit. Sie werden umfassend in der Impfstoffentwicklung, der Überwachung von Infektionskrankheiten und der Immuntherapieforschung eingesetzt. Pharma- und Biopharmaunternehmen bevorzugen Assay-Kits zur Standardisierung in verschiedenen Laboren. Das Segment profitiert von einer starken Nachfrage in Schwellenländern aufgrund steigender Forschungsgelder. Zudem trägt es zu kontinuierlichen Produkteinführungen und verbesserter Kit-Sensitivität bei. Viele Labore bevorzugen Kits, um die Einrichtungszeit und die Komplexität der Assays zu reduzieren. Assay-Kits werden sowohl in der akademischen als auch in der industriellen Forschung breit eingesetzt. Die Präsenz führender globaler Hersteller stärkt die Marktführerschaft zusätzlich. Das Wachstum wird durch die zunehmende Bedeutung von Immunprofiling und T-Zell-Reaktionsstudien unterstützt. Es wird erwartet, dass dieses Segment seine führende Position aufgrund der anhaltenden Nachfrage nach standardisierten Testverfahren behaupten wird.

Das Segment der Analysegeräte wird voraussichtlich am schnellsten wachsen und von 2026 bis 2033 eine durchschnittliche jährliche Wachstumsrate (CAGR) von 12,9 % verzeichnen. Treiber dieses Wachstums ist die steigende Nachfrage nach automatisierter Spotzählung und Multiplexanalyse. Analysegeräte verbessern die Workflow-Effizienz und reduzieren menschliche Fehler bei der manuellen Zählung. Sie unterstützen das für große klinische Studien und Impfstoffstudien notwendige Hochdurchsatz-Screening. Fortschrittliche Bildgebungssysteme ermöglichen zudem eine bessere Datenanalyse und digitale Speicherung. Die zunehmende Verbreitung von FluoroSpot-Assays, die hochentwickelte Analysegeräte erfordern, treibt das Wachstum zusätzlich an. Steigende Trends zur Laborautomatisierung in entwickelten Volkswirtschaften beschleunigen die Akzeptanz. Darüber hinaus erhöhen wachsende Investitionen in die immunonkologische Forschung die Nachfrage nach präzisem Immunmonitoring. Analysegeräte werden zunehmend in zentralisierten Laboren zur Unterstützung mehrerer Forschungsprojekte eingesetzt. Ihre Integrationsfähigkeit mit Laborinformationssystemen (LIMS) steigert die betriebliche Effizienz. Kontinuierliche technologische Weiterentwicklungen und KI-basierte Spoterkennung tragen zum rasanten Wachstum bei.

- Nach Quelle

Basierend auf der Probenquelle ist der Markt in Mensch, Maus, Affe und Sonstige unterteilt. Das Segment der Proben mit humanen Proben dominierte 2025 mit einem Umsatzanteil von 48,3 %, was durch die breite klinische Anwendung gestützt wird. Assays mit humanen Proben sind unerlässlich für Impfstoffstudien, die Überwachung von Infektionskrankheiten und die Immuntherapieforschung. Die steigende Prävalenz von Krebs, Autoimmunerkrankungen und Infektionskrankheiten erhöht die Nachfrage nach Profilen der menschlichen Immunantwort. Pharmaunternehmen bevorzugen Assays mit humanen Proben aufgrund ihrer besseren Übertragbarkeit auf klinische Studien. Das Segment profitiert von einer starken Finanzierung der klinischen Forschung und einer Zunahme klinischer Studien. Zusätzlich wird es durch den regulatorischen Fokus auf humanrelevante Daten unterstützt. Assays mit humanen Proben werden in diagnostischen Laboren häufig zur Immunüberwachung eingesetzt. Das Wachstum der personalisierten Medizin und der Immuntherapie fördert die Akzeptanz. Darüber hinaus steigert der verbesserte Zugang zu klinischen Proben das Wachstum des Segments. Die Präsenz moderner klinischer Labore in Industrieländern trägt zusätzlich zur Marktführerschaft bei.

Das Segment der Mausquellen wird voraussichtlich am schnellsten wachsen, mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,7 % von 2026 bis 2033. Mausmodelle werden in der präklinischen Immunologieforschung und der Wirkstoffentwicklung häufig eingesetzt. Sie liefern wichtige Daten zu Immunmechanismen vor klinischen Studien am Menschen. Das Wachstum wird durch steigende Investitionen in präklinische Studien und Tiermodellforschung gestützt. Akademische Einrichtungen und Auftragsforschungsinstitute (CROs) nutzen Maus-Assays für die frühe Arzneimittelbewertung. Der zunehmende Fokus auf translationale Immunologie und Impfstoffforschung steigert die Nachfrage. Maus-Assays werden zur Bewertung neuartiger Therapeutika und Immunantworten eingesetzt. Das Segment profitiert von einer starken Forschungstätigkeit in Nordamerika und Europa. Die zunehmende Verwendung gentechnisch veränderter Mausmodelle fördert das Wachstum zusätzlich.

- Durch Krankheit

Basierend auf den Krankheitsbildern ist der Markt in Infektionskrankheiten, Krebs, Autoimmunerkrankungen, Allergien und Sonstiges unterteilt. Das Segment der Infektionskrankheiten dominierte 2025 mit einem Umsatzanteil von 34,9 %, bedingt durch die weltweit steigende Krankheitslast. ELISpot-Assays sind unerlässlich für den Nachweis antigenspezifischer T-Zell-Antworten. Sie werden häufig bei Tuberkulose, HIV, Hepatitis und neu auftretenden Infektionskrankheiten eingesetzt. Staatliche Screening-Programme und Initiativen im Bereich der öffentlichen Gesundheit fördern die Anwendung. Auch die Impfstoffentwicklung und -überwachung tragen maßgeblich dazu bei. Das Segment profitiert von steigenden Forschungsgeldern für Infektionskrankheiten. Schnelle Reaktionen auf Ausbrüche und die Vorbereitung auf Pandemien stärken die Nachfrage zusätzlich. Diagnostische Labore nutzen ELISpot zunehmend für das Immunmonitoring. Das Segment wird durch das wachsende Bewusstsein für die Analyse von Immunantworten unterstützt. Die Präsenz führender Assay-Hersteller verbessert die Produktverfügbarkeit. Kontinuierliche Innovationen in der Assay-Sensitivität erhöhen die diagnostische Zuverlässigkeit.

Der Krebssektor wird voraussichtlich am schnellsten wachsen, mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,6 % von 2026 bis 2033. Dieses Wachstum wird durch den zunehmenden Einsatz von Immuntherapie und personalisierter Krebsbehandlung angetrieben. ELISpot- und FluoroSpot-Assays werden zur Beurteilung tumorspezifischer Immunantworten eingesetzt. Sie helfen, das Ansprechen von Patienten auf Immuntherapien und Impfstoffe zu überwachen. Steigende Ausgaben für klinische Studien in der Onkologie und Forschung und Entwicklung unterstützen das rasante Wachstum. Biopharma-Unternehmen nutzen diese Assays zur Biomarker-Entdeckung und zur Erstellung von Immunprofilen. Die weltweit steigende Krebsinzidenz verstärkt die Nachfrage zusätzlich. Auch der zunehmende Fokus auf Früherkennung und Therapiekontrolle trägt zum Wachstum bei.

- Durch Bewerbung

Basierend auf der Anwendung ist der Markt in diagnostische und Forschungsanwendungen unterteilt. Das Segment der Forschungsanwendungen dominierte 2025 mit einem Umsatzanteil von 62,1 %, getrieben durch den umfangreichen Einsatz in der Immunologieforschung. Akademische Einrichtungen und Pharmaunternehmen nutzen ELISpot- und FluoroSpot-Assays für die Impfstoffentwicklung und die Erstellung von Immunprofilen. Das Segment profitiert von weltweit steigenden Forschungsgeldern. Es unterstützt die präklinische und klinische Forschung in den Bereichen Infektionskrankheiten, Krebs und Autoimmunerkrankungen. Der Bedarf an Analysen zellulärer Immunantworten treibt die starke Nachfrage an. Forschungslabore bevorzugen standardisierte Assays und Kits für reproduzierbare Ergebnisse. Das Segment wird durch Kooperationen zwischen Universitäten und Biotechnologieunternehmen gestützt und profitiert zudem von der steigenden Anzahl immunologischer Publikationen und Forschungsergebnisse.

Das Segment der diagnostischen Anwendungen wird voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 12,4 % von 2026 bis 2033 am schnellsten wachsen. Treiber dieses Wachstums ist der zunehmende Einsatz in der klinischen Diagnostik von Infektionskrankheiten und im Immunmonitoring. ELISpot-Tests werden in diagnostischen Laboren vermehrt zum Krankheits-Screening eingesetzt. Verbesserte Validierung und behördliche Zulassungen fördern die klinische Anwendung. Der Aufstieg der personalisierten Medizin steigert die Nachfrage nach Immunmonitoring-Tests. Der Ausbau klinischer Labore in Schwellenländern unterstützt das Wachstum. Steigende Gesundheitsausgaben und die verbesserte diagnostische Infrastruktur tragen ebenfalls dazu bei.

- Vom Endbenutzer

Basierend auf den Endnutzern ist der Markt in Krankenhäuser und klinische Labore, Forschungsinstitute, biopharmazeutische Unternehmen und Sonstige unterteilt. Das Segment der Forschungsinstitute dominierte den Markt mit einem Umsatzanteil von 41,7 % im Jahr 2025, was auf umfangreiche akademische Forschung und starke Fördermittel zurückzuführen ist. Forschungsinstitute sind wichtige Zentren für Immunologie und Impfstoffentwicklung und treiben die Nachfrage nach ELISpot- und FluoroSpot-Assays an. Sie nutzen diese Assays für die Profilierung von Immunantworten, Studien zur Impfstoffwirksamkeit und translationale Forschung. Das Segment wird durch staatlich geförderte Programme und Kooperationen mit Biotechnologieunternehmen unterstützt. Forschungsinstitute führen häufig groß angelegte präklinische Studien durch, die große Mengen an Assay-Kits erfordern. Zunehmende Publikationen und das wachsende wissenschaftliche Interesse an der T-Zell-Immunität beflügeln das Wachstum zusätzlich. Spezialisierte Immunologielabore an Universitäten tragen zu einer anhaltenden Nachfrage bei. Diese Einrichtungen bevorzugen standardisierte Kits, um Reproduzierbarkeit und laborübergreifende Konsistenz zu gewährleisten. Rahmenverträge für die Beschaffung erhöhen ebenfalls den Umsatzanteil. Das Segment profitiert von langfristigen Forschungsprojekten und Fördergeldern. Der kontinuierliche Ausbau von Immunologieabteilungen sichert die zukünftige Nachfrage. Forschungsinstitute fungieren zudem als Vorreiter bei der Einführung fortschrittlicher Analysegeräte und stärken so ihre Marktführerschaft.

Das Segment der biopharmazeutischen Unternehmen wird voraussichtlich am schnellsten wachsen, mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 13,2 % von 2026 bis 2033. Treiber dieses Wachstums sind steigende Investitionen in Biologika und Immuntherapien. Biopharma-Unternehmen nutzen ELISpot- und FluoroSpot-Assays für die Wirkstoffforschung, die Validierung von Biomarkern und das Monitoring klinischer Studien. Der zunehmende Fokus auf Immunonkologie und Impfstoffentwicklung treibt die Nachfrage an. Das Segment profitiert von der steigenden Anzahl klinischer Studien und beschleunigten Zulassungsverfahren für Medikamente. Biopharma-Unternehmen bevorzugen Hochdurchsatz-Analysegeräte für schnelles Screening und konsistente Ergebnisse. Sie kooperieren häufig mit Auftragsforschungsinstituten (CROs) für groß angelegte Immunogenitätsstudien. Auch die zunehmende Anzahl von Medikamenten in der Entwicklung von Infektionskrankheiten und Krebs trägt zum schnellen Wachstum bei. Der Bedarf an robusten Immunprofilen in der personalisierten Medizin fördert die Akzeptanz. Biopharma-Unternehmen priorisieren die Standardisierung von Assays, um regulatorische Anforderungen zu erfüllen. Das Segment wird durch kontinuierliche Innovation und Automatisierung in der Assay-Technologie gestärkt. Verstärkte Kooperationen mit akademischen Einrichtungen beschleunigen das Wachstum zusätzlich.

- Nach Vertriebskanal

Basierend auf dem Vertriebskanal ist der Markt in Direktvergabe, Einzelhandel und Sonstige unterteilt. Das Segment Direktvergabe dominierte den Markt mit einem Umsatzanteil von 52,6 % im Jahr 2025, getrieben durch Großeinkäufe von Krankenhäusern, Forschungsinstituten und Behörden. Direktvergabe bietet Kostenvorteile durch langfristige Verträge und wettbewerbsfähige Preise. Große Institutionen bevorzugen diesen Kanal aufgrund der zuverlässigen Versorgung und der gleichbleibenden Qualität. Staatlich geförderte Forschungsprojekte und Programme des öffentlichen Gesundheitswesens beschaffen häufig über Ausschreibungen. Ausschreibungsbasierte Beschaffung sichert zudem den Zugang zu den neuesten Testkits und Analysegeräten. Dieser Kanal unterstützt große klinische Studien und landesweite Initiativen im Bereich der Immunologie. Große Hersteller bevorzugen Ausschreibungsverträge aufgrund der planbaren Nachfrage und der stabilen Umsätze. Dies reduziert den Vertriebsaufwand und verbessert die Effizienz der Lieferkette. Krankenhäuser und große Labore profitieren von standardisierten Beschaffungsprozessen. Der Direktvergabekanal ist in entwickelten Regionen mit etablierter Gesundheitsinfrastruktur dominant. Er unterstützt auch groß angelegte öffentliche Gesundheits-Screening-Programme. Es wird erwartet, dass das Segment aufgrund der anhaltenden institutionellen Nachfrage weiterhin stark bleibt.

Das Segment der Einzelhandelsumsätze wird voraussichtlich am schnellsten wachsen, mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 11,3 % von 2026 bis 2033. Treiber dieses Wachstums sind expandierende kleine Labore und CROs, die Testkits über Distributoren beziehen. Unterstützt wird das Wachstum durch die steigende Nachfrage aus Schwellenländern mit wachsender Forschungsinfrastruktur. Online-Marktplätze und verbesserte Logistik erleichtern und beschleunigen den Einkauf im Einzelhandel. Der Einzelhandel ermöglicht es kleineren Institutionen, ohne lange Beschaffungszyklen auf fortschrittliche Testkits zuzugreifen. Distributoren bieten lokalen Support und Schulungen und fördern so die Akzeptanz. Das Segment profitiert von wachsenden privaten Forschungseinrichtungen und Biotech-Startups. Der Einzelhandel ermöglicht zudem flexible Bestellungen für saisonale Forschungsbedürfnisse. Die verbesserte Verfügbarkeit von Testkits in regionalen Märkten stärkt diesen Vertriebskanal. Der Einzelhandel trägt zur schnellen Einführung neuer Testtechnologien bei. Das Wachstum wird außerdem durch die steigende Nachfrage nach patientennahen Laboren und dezentralen Forschungslaboren unterstützt. Das Segment dürfte aufgrund des zunehmenden Bewusstseins und der besseren Zugänglichkeit weiter expandieren.

Regionale Analyse des ELISpot- und FluoroSpot-Assay-Marktes im Nahen Osten und Afrika

- Der Markt für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika wird im Prognosezeitraum von 2026 bis 2033 voraussichtlich mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 10,6 % wachsen. Treiber dieses Wachstums sind steigende Investitionen in Biotechnologie, lebenswissenschaftliche Forschung und die Gesundheitsinfrastruktur in den Schwellenländern der Region. Zunehmende Gesundheitsausgaben und die wachsende Belastung durch Infektionskrankheiten, darunter Tuberkulose, HIV und Virusinfektionen, treiben die Nachfrage nach fortschrittlichen immunologischen Assays an.

- Die Region profitiert von der Ausweitung klinischer Forschungsaktivitäten und dem stetigen Wachstum von CRO-Dienstleistungen, insbesondere im Nahen Osten. Staatliche Initiativen zur Stärkung der Gesundheitssysteme und Forschungskapazitäten fördern die Marktentwicklung. Die zunehmende Nutzung fortschrittlicher Diagnoseverfahren in Krankenhäusern, akademischen Einrichtungen und Referenzlaboren steigert die Nachfrage nach Testverfahren.

- Der zunehmende Fokus auf Impfstoffforschung, Immuntherapie und Immunmonitoringprogramme stärkt das Marktwachstum. Verbesserungen der Laborinfrastruktur, die steigende Verfügbarkeit von Fachkräften und das wachsende Bewusstsein für immunbasierte Diagnostik fördern die Akzeptanz der Tests zusätzlich. Kooperationen zwischen akademischen Einrichtungen und globalen Pharmaunternehmen beschleunigen den Technologietransfer und die Marktdurchdringung.

Markteinblicke für ELISpot- und FluoroSpot-Assays in Saudi-Arabien

Der Markt für ELISpot- und FluoroSpot-Assays in Saudi-Arabien dominierte 2025 mit einem Umsatzanteil von rund 34,8 % den Markt im Nahen Osten. Unterstützt wurde dieser Erfolg durch hohe staatliche Investitionen in die Modernisierung des Gesundheitswesens und die lebenswissenschaftliche Forschung im Rahmen der Vision 2030. Die wachsende Krankenhausinfrastruktur des Landes und der zunehmende Fokus auf die Überwachung von Infektionskrankheiten und die Impfstoffforschung fördern die Anwendung dieser Assays. Die steigende Anzahl moderner Diagnostiklabore und Forschungszentren stützt die Nachfrage. Staatlich geförderte Forschungsprogramme und Kooperationen mit internationalen Biotechnologieunternehmen stärken die Marktpräsenz. Zunehmende klinische Forschungstätigkeit und die Anwendung immunologischer Assays in akademischen Einrichtungen tragen zusätzlich zur Marktführerschaft bei. Die Verfügbarkeit moderner Laborgeräte und die sich verbessernde technische Expertise fördern die Nutzung der Assays kontinuierlich.

Einblick in den Markt für ELISpot- und FluoroSpot-Assays in den VAE

Der Markt für ELISpot- und FluoroSpot-Assays in den VAE verzeichnet ein stetiges Wachstum, angetrieben durch steigende Investitionen in biomedizinische Forschung und fortschrittliche Diagnostik. Der starke Fokus des Landes auf Innovationen im Gesundheitswesen, medizinische Forschungszentren und öffentlich-private Partnerschaften fördert die Akzeptanz dieser Assays. Der Ausbau spezialisierter Labore und Diagnosezentren steigert die Nachfrage nach Instrumenten zur Immunüberwachung. Die zunehmende Beteiligung an klinischen Studien und translationaler Forschung trägt zusätzlich zum Marktwachstum bei. Die Rolle der VAE als regionales Zentrum für Gesundheitswesen und Forschung verbessert den Zugang zu fortschrittlichen immunologischen Assays. Das wachsende Bewusstsein für Immuntherapie und Wirksamkeitstests von Impfstoffen unterstützt die breitere Anwendung in Forschungsinstituten und Krankenhäusern.

Marktanteil von ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

Die ELISpot- und FluoroSpot-Assay-Branche wird hauptsächlich von etablierten Unternehmen dominiert, darunter:

- Mabtech (Schweden)

- Cellular Technology Limited (USA)

- BD (USA)

- Merck KGaA (Deutschland)

- Oxford Immunotec (UK)

- ImmunoSpot (USA)

- Bio-Rad Laboratories (USA)

- F&E-Systeme (USA)

- Tecan Group (Schweiz)

- Agilent Technologies (USA)

- PerkinElmer (USA)

- Lonza (Schweiz)

- Thermo Fisher Scientific (USA)

- Sartorius AG (Deutschland)

- Becton Dickinson (USA)

- Nexcelom Bioscience (USA)

- ELISpot.com (USA)

- CTL (Cellular Technology Limited) (USA)

- Cytiva (USA)

- AID GmbH (Deutschland)

Neueste Entwicklungen auf dem Markt für ELISpot- und FluoroSpot-Assays im Nahen Osten und Afrika

- Im März 2023 stellte Medline Industries eine neue Produktlinie ergonomischer Krücken vor, die für mehr Komfort, Stabilität und Benutzerfreundlichkeit bei Rehabilitation und Mobilitätsunterstützung entwickelt wurden und den Bedürfnissen der Anwender nach längerfristigen Hilfsmitteln gerecht werden.

- Im Juni 2023 kündigte das Medizinprodukteunternehmen Canes and Crutches (per Pressemitteilung) ein bahnbrechendes Mobilitätshilfsmittel als neues Mobilitätsgerät auf dem Weltmarkt an, das die Möglichkeiten traditioneller Mobilitätshilfen erweitern und die Unabhängigkeit von Nutzern mit Mobilitätseinschränkungen fördern soll.

- Im August 2023 startete Cool Crutches & Walking Sticks in Großbritannien in Zusammenarbeit mit der Wohltätigkeitsorganisation PhysioNet das erste Recyclingprogramm für Gehhilfen, um gebrauchte Mobilitätshilfen aufzuarbeiten und weiterzuverteilen und so weltweit Nachhaltigkeit und verbesserte Barrierefreiheit zu fördern.

- Im Juli 2024 schloss Cardinal Health die Übernahme eines Herstellers medizinischer Geräte ab und erweiterte damit sein Produktportfolio an Mobilitätshilfen – darunter Gehstöcke und Krücken – sowie seine globale Marktpräsenz im Bereich therapeutischer Mobilitätslösungen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.