Middle East And Africa Anti Friction Coating Market

Marktgröße in Milliarden USD

CAGR :

%

USD

62.28 Million

USD

105.42 Million

2025

2033

USD

62.28 Million

USD

105.42 Million

2025

2033

| 2026 –2033 | |

| USD 62.28 Million | |

| USD 105.42 Million | |

|

|

|

|

Der Markt für Gleitbeschichtungen im Nahen Osten und Afrika ist nach Produkt (MOS2, PTFE, Graphit, FEP, PFA und Wolframdisulfid), Art (lösungsmittelbasiert und wasserbasiert), Anwendung (Automobilteile, Kraftübertragungselemente, Lager, Munitionskomponenten, Ventilkomponenten und -antriebe und andere) und Endverbrauch (Automobil, Luft- und Raumfahrt, Schifffahrt, Bauwesen, Gesundheitswesen und andere), Land (VAE, Saudi-Arabien, Ägypten, Israel, Südafrika), Markttrends und Prognose bis 2028

Marktanalyse und Einblicke: Markt für Gleitbeschichtungen im Nahen Osten und in Afrika

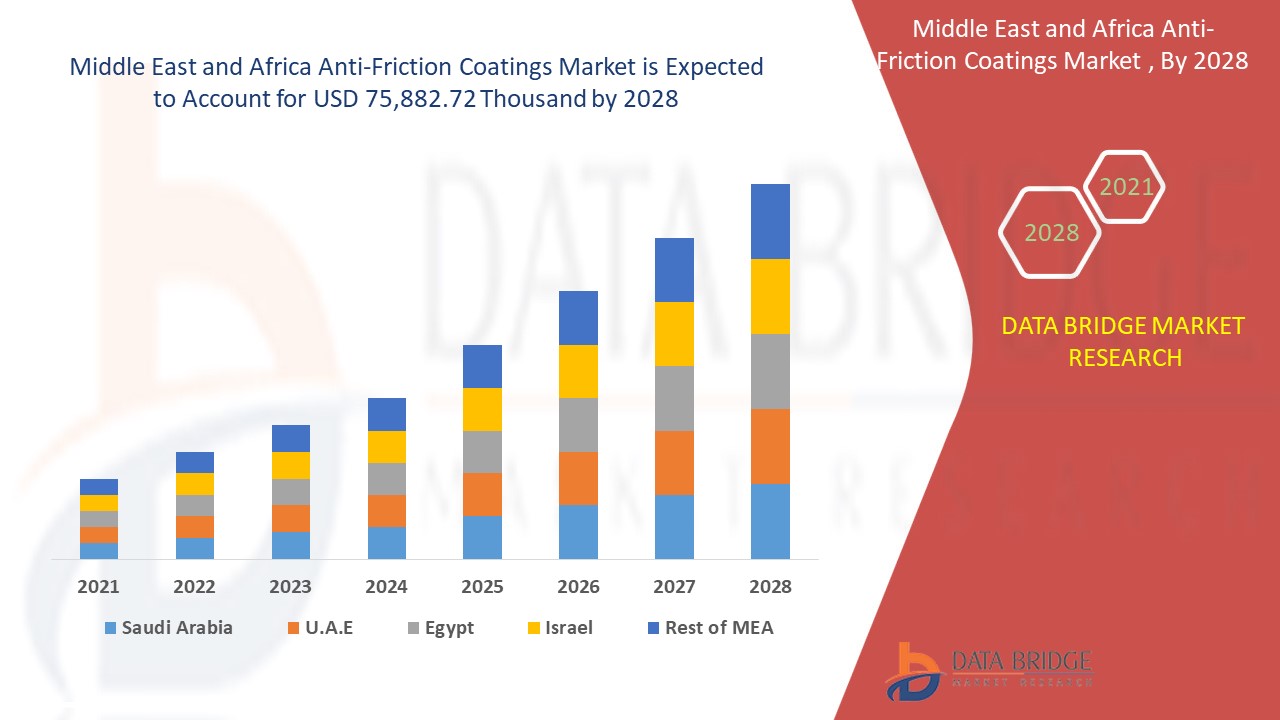

Es wird erwartet, dass der Markt für Gleitbeschichtungen im Prognosezeitraum von 2021 bis 2028 an Marktwachstum gewinnt. Data Bridge Market Research analysiert, dass der Markt im Prognosezeitraum von 2020 bis 2028 mit einer durchschnittlichen jährlichen Wachstumsrate (CAGR) von 6,8 % wächst und bis 2028 voraussichtlich 75.882,72 Tausend USD erreichen wird.

Gleitbeschichtungen sind Schmierstofflösungen, deren Zusammensetzung herkömmlichen Industrielacken ähnelt. Sie bestehen aus Festschmierstoffen und Harzen als Lösungsmittel. Die Hauptbestandteile von Festschmierstoffen sind Molybdändisulfid, Polytetrafluorethylen (PTFE) und Graphit. Gleitbeschichtungen werden in der Automobilindustrie als Trockenschmierstoffe eingesetzt.

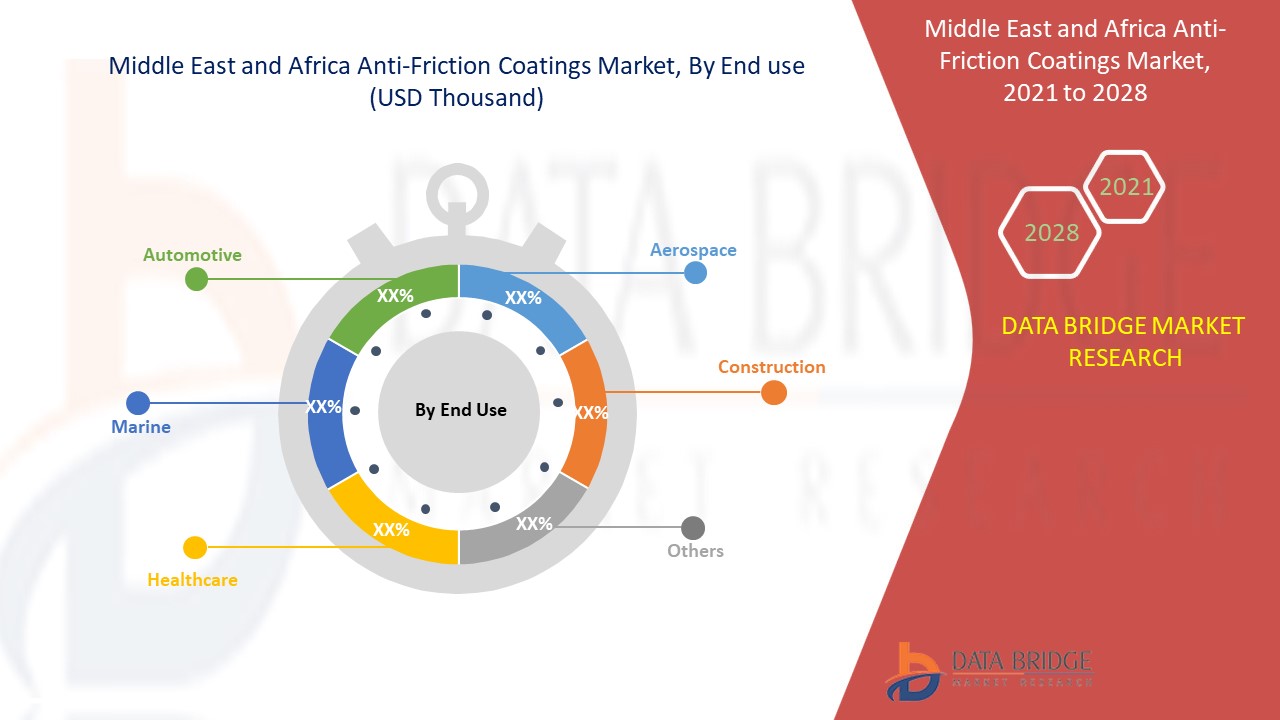

Gleitbeschichtungen haben ein breites Anwendungsspektrum. Sie werden vor allem in den Bereichen Automobil, Luft- und Raumfahrt, Gesundheitswesen, Bauwesen und Schifffahrt eingesetzt. Von allen Branchen ist die Nachfrage nach Gleitbeschichtungen in der Automobilindustrie am höchsten. Viele der in der Automobilindustrie auftretenden Probleme, darunter Korrosion, Lärm, Trockenschmierung und Abrieb, können durch den Einsatz von Gleitbeschichtungen gelöst werden. Zu den wichtigsten Anwendungsgebieten zählen Tür-/Fensterdichtungen, Magnetkomponenten, Aufhängungskomponenten, Kolbenhemden, Pleuelstangen, Kraftstoffsystemkomponenten, Montagehilfen, Verbindungselemente und Klebevorrichtungen.

Zu den Rohstoffen, die von Unternehmen hauptsächlich zur Herstellung von Gleitbeschichtungsmaterialien verwendet werden, gehören Polytetrafluorethylen, Molybdändisulfid, Fluorethylpropylen, Perfluoralkoxyalkan und Wolframdisulfid. Gleitbeschichtungen sind äußerst verschleiß- und abriebfest, was zu ihrer langen Haltbarkeit führt. Gleitbeschichtungen werden auf Objekte aufgetragen, die ständiger Reibung ausgesetzt sind, wie z. B. Bootsrümpfe, um durch Reduzierung der Reibungsgrade stets ein hohes Leistungsniveau aufrechtzuerhalten.

Der Marktbericht zu Anti-Friction-Beschichtungen enthält Einzelheiten zu Marktanteilen, neuen Entwicklungen und Produktpipeline-Analysen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Umsatzbereiche, Änderungen der Marktvorschriften, Produktzulassungen, strategische Entscheidungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um die Analyse und das Marktszenario zu verstehen, kontaktieren Sie uns für ein Analyst Briefing. Unser Team hilft Ihnen dabei, eine Umsatzauswirkungslösung zu entwickeln, mit der Sie Ihr gewünschtes Ziel erreichen.

Marktumfang und Marktgröße für Gleitbeschichtungen im Nahen Osten und in Afrika

Der Markt für Gleitbeschichtungen im Nahen Osten und Afrika ist in vier wichtige Segmente unterteilt, die auf Produkt, Art, Anwendung und Endverbrauch auf dem Markt basieren.

- Auf Produktbasis ist der Markt für Gleitbeschichtungen in MOS2, PTFE, Graphit, FEP, PFA und Wolframdisulfid unterteilt.

- Auf Grundlage der Art der Beschichtungen wird der Markt für Gleitbeschichtungen in lösemittelbasierte und wasserbasierte Beschichtungen segmentiert.

- Auf Grundlage der Anwendung ist der Markt für Gleitbeschichtungen in Automobilteile, Kraftübertragungskomponenten, Lager, Munitionskomponenten, Ventilkomponenten und -antriebe und Sonstiges segmentiert.

- Auf der Grundlage der Endverwendung kann der Markt für Gleitbeschichtungen in die Branchen Automobil, Luft- und Raumfahrt, Schifffahrt, Bau, Gesundheitswesen und Sonstige unterteilt werden.

Marktanalyse für Gleitbeschichtungen auf Länderebene

Der Markt im Nahen Osten und in Afrika wird analysiert und es werden Informationen zur Marktgröße nach Land, Produkt, Art, Anwendung und Endverbrauch auf dem Markt wie oben angegeben bereitgestellt.

Die im Marktbericht für Gleitbeschichtungen im Nahen Osten und Afrika abgedeckten Länder sind die Vereinigten Arabischen Emirate, Saudi-Arabien, Ägypten, Israel und Südafrika.

- Auf dem Markt für Gleitbeschichtungen im Nahen Osten und in Afrika dominieren die VAE den Markt aufgrund der zunehmenden Verwendung von Beschichtungen im Bausektor.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Markttrends auswirken. Datenpunkte wie Neuverkäufe, Ersatzverkäufe, demografische Daten des Landes, Regulierungsgesetze und Import-/Exportzölle sind einige der wichtigsten Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit von Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen der Vertriebskanäle berücksichtigt.

Wachstum in der Gleitbeschichtungsindustrie

Der Markt für Gleitbeschichtungen im Nahen Osten und Afrika bietet Ihnen außerdem eine detaillierte Marktanalyse für jedes Land, das Wachstum der installierten Basis verschiedener Arten von Produkten für den Markt für Gleitbeschichtungen, die Auswirkungen der Technologie anhand von Lebenslinienkurven und Änderungen der regulatorischen Szenarien für Säuglingsanfangsnahrung und deren Auswirkungen auf den Markt für Gleitbeschichtungen. Die Daten sind für den historischen Zeitraum 2010 bis 2019 verfügbar.

Wettbewerbsumfeld und Analyse der Marktanteile von Gleitbeschichtungen

Die Wettbewerbslandschaft des Marktes für Gleitbeschichtungen im Nahen Osten und Afrika bietet Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Stärken und Schwächen des Unternehmens, Produkteinführung, Pipelines für klinische Studien, Markenanalyse, Produktzulassungen, Patente, Produktbreite und -breite, Anwendungsdominanz, Technologie-Lebenslinienkurve. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus des Unternehmens in Bezug auf den Markt für Gleitbeschichtungen im Nahen Osten und Afrika.

Wichtige Marktteilnehmer auf dem Markt für Gleitbeschichtungen im Nahen Osten und Afrika sind Parker Hannifin Corp, DuPont, CARL BECHEM GMBH, ASV Mutichemie Private Limited und andere. Die Analysten von DBMR kennen die Stärken der Konkurrenz und erstellen für jeden Wettbewerber eine separate Wettbewerbsanalyse.

Zum Beispiel,

- Im Mai 2021 kündigte DuPont die Einführung des Schmierfetts MOLYKOTE G-1079 an, ein geräuschreduzierendes Schmierfett, das speziell für Gleitkontaktanwendungen mit schnellen Bewegungen und hohen Lasten oder langsamen Bewegungen und niedrigen Lasten, insbesondere Aktuatoren, entwickelt wurde. Die Gleitbeschichtung MOLYKOTE G-1079 wird in Elektrofahrzeugen der nächsten Generation verwendet. Somit wird sie dazu beitragen, den Marktumsatz des Unternehmens zu steigern.

- Im April 2021 stellte Whitmore Manufacturing, LLC eine skalierbare Lösung für Schmierstofflager- und -abgabesysteme vor, nämlich Lustor. Die neue Lustor-Linie hilft Unternehmen, ihre Stärken zu verstehen und Wettbewerbsanalysen für jeden Wettbewerber separat bereitzustellen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.