Global Used Car Market

Marktgröße in Milliarden USD

CAGR :

%

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

USD

996,906.42 Billion

USD

1,700,106.13 Billion

2022

2030

| 2023 –2030 | |

| USD 996,906.42 Billion | |

| USD 1,700,106.13 Billion | |

|

|

|

|

Globaler Gebrauchtwagenmarkt, nach Anbietertyp (organisiert, unorganisiert), Antrieb (Benzin, Diesel, CNG, LPG, Elektro und andere), Hubraum (Vollgröße (über 2500 ccm), Mittelgröße (zwischen 1500 und 2499 ccm), Klein (unter 1499 ccm)), Händler (Franchise, unabhängig), Vertriebskanal (online, offline), Fahrzeugtyp (Pkw, LCV, HCV und Elektrofahrzeug) – Branchentrends und Prognose bis 2030.

Analyse und Größe des Gebrauchtwagenmarktes

Das steigende verfügbare Einkommen der arbeitenden Bevölkerung steigert das Marktwachstum, da es den Menschen ermöglicht, Fahrzeuge mit einem begrenzten Budget zu kaufen. Laut Statistics Canada stiegen die verfügbaren Einkommen in Haushalten der unteren Klasse in der Anfangsphase des Jahres 2021 um 3 % bzw. 3,3 %. Im Gegensatz dazu sanken die Einkommen in Haushalten der oberen Klasse um 6,4 % und stiegen dann im gleichen Zeitraum um 3,9 %. Das Marktwachstum für Gebrauchtwagen war in den letzten Jahren aufgrund der Kostenwettbewerbsfähigkeit neuer Marktteilnehmer und der Unfähigkeit eines Großteils der Kunden, ein neues Auto zu kaufen, erheblich.

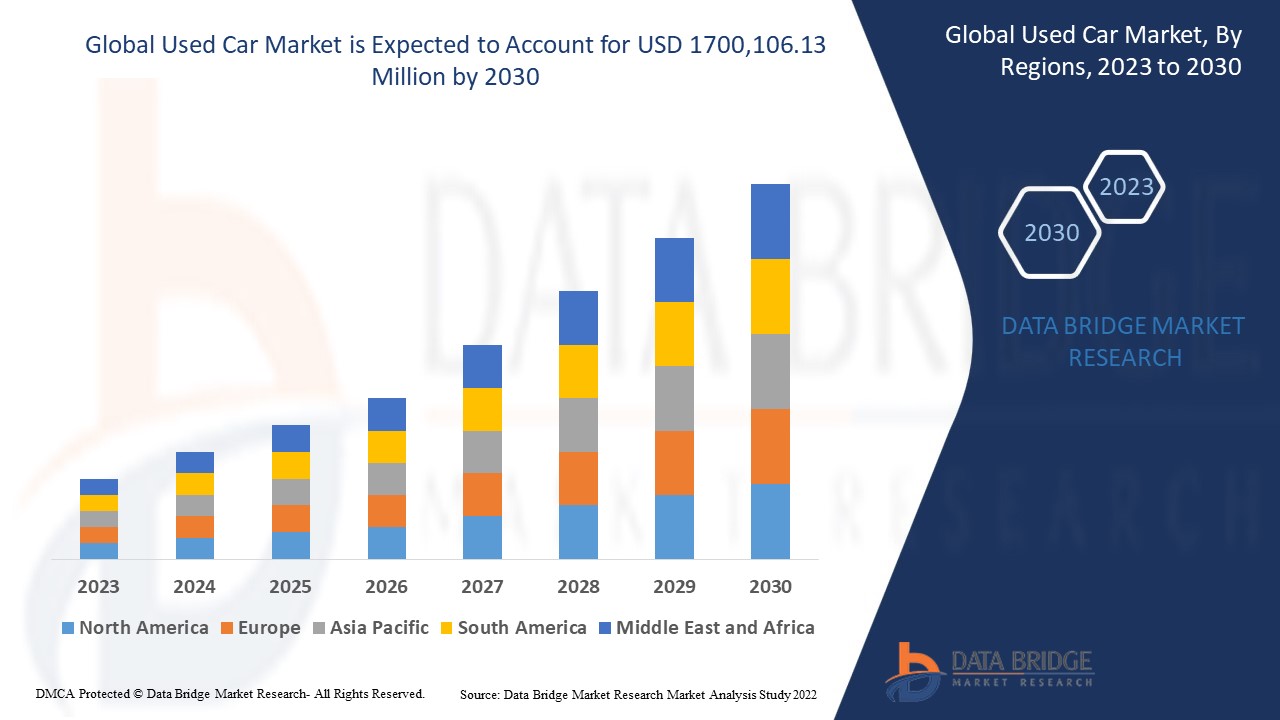

Data Bridge Market Research analysiert, dass der weltweite Gebrauchtwagenmarkt im Jahr 2022 einen Wert von 996.906,42 Millionen USD hatte und bis 2030 voraussichtlich einen Wert von 1.700.106,13 Millionen USD erreichen wird, was einer durchschnittlichen jährlichen Wachstumsrate von 6,90 % während des Prognosezeitraums entspricht. Neben Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

Umfang und Segmentierung des Gebrauchtwagenmarktes

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2023 bis 2030 |

|

Basisjahr |

2022 |

|

Historische Jahre |

2021 (Anpassbar auf 2015 – 2020) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Anbietertyp (organisiert, unorganisiert), Antrieb (Benzin, Diesel, CNG, LPG , Elektro und andere), Hubraum (Vollgröße (über 2500 CC), Mittelgröße (zwischen 1500-2499 CC), Klein (unter 1499 CC)), Händler (Franchise, unabhängig), Vertriebskanal (online, offline), Fahrzeugtyp (Pkw, leichtes Nutzfahrzeug, schweres Nutzfahrzeug und Elektrofahrzeug) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

Group1 Automotive, Inc. (USA), AutoNation, Inc. (USA), HELLMAN & FRIEDMAN LLC (USA), PENDRAGON (Großbritannien), CarMax Business Services, LLC (USA), Manheim (USA), THE HERTZ CORPORATION (USA), Cox Automotive (USA), Sun Toyota (USA), eBay Inc. (USA), TrueCar, Inc. (USA), VROOM (USA), Asbury Automotive Group (USA), MARUTI SUZUKI INDIA LIMITED (Indien), Lithia Motors, Inc. (USA), Hendrick Automotive Group (USA) |

|

Marktchancen |

|

Marktdefinition

Ein Auto, das in der Vergangenheit einen oder mehrere Vorbesitzer hatte, wird als Gebrauchtwagen, Gebrauchtwagen oder Second-Hand-Auto bezeichnet. Franchise- und unabhängige Autohändler, Autovermietungen, Autohäuser mit Kaufoption, Leasingbüros, Auktionen und Privatverkäufe sind nur einige Orte, an denen Gebrauchtwagen gekauft werden können. Einige Autohändler bieten „Festpreise“, „zertifizierte“ Gebrauchtwagen und erweiterte Serviceverträge oder Garantien.

Dynamik des globalen Gebrauchtwagenmarktes

Treiber

- Hohe Kosten für ein neues Auto und Bedenken hinsichtlich der Erschwinglichkeit

Der Autosektor hat eine erhöhte Nachfrage nach fortschrittlichen Fahrzeugfunktionen wie Servolenkung, Klimaanlage und Antiblockiersystem beobachtet. Dadurch sind die Kosten für Neuwagen gestiegen. Darüber hinaus wird das Problem der Erschwinglichkeit auf dem Neuwagenmarkt durch den Preisanstieg im Jahr 2019 deutlich, der von den Mainstream-Pkw-Segmenten getrieben wurde. Infolgedessen sind die Gebrauchtwagenverkäufe im Vergleich zu den Neuwagenverkäufen in der Automobilindustrie stark angestiegen. Dies dürfte die Nachfrage nach alten Autos erhöhen.

- Steigende Nachfrage nach vielseitigen Fließheck-Autos

Der Gebrauchtwagenmarkt für Schräghecklimousinen in Europa wird bis 2028 voraussichtlich um über 3,5 % wachsen, was auf die steigende Nachfrage nach Schräghecklimousinen zurückzuführen ist, die Flexibilität beim Fahren auf kleinem Raum bieten. Die Entwicklung des Gebrauchtwagenmarktes wird durch die starke Präsenz führender Automobilhersteller wie Audi AG, BMW AG, Mercedes-Benz und Volkswagen unterstützt, da diese Hersteller eine große Auswahl an Schräghecklimousinen anbieten. Die Marktteilnehmer bieten Schräghecklimousinen mit hoher Dachlinie und kompaktem Design an.

Gelegenheiten

- Zunehmende Präsenz mehrerer Autohersteller und Gebrauchtwagenhändler

Aufgrund der einfachen Zugänglichkeit von Finanzierungen für den Kauf von Gebrauchtwagen überstiegen die Einnahmen auf dem europäischen Gebrauchtwagenmarkt im Jahr 2021 500 Milliarden USD und werden weiterhin stetig steigen. Die Fertigungsindustrie ist der größte private Investor in Forschung und Entwicklung in Europa, Europa ist der weltweit führende Automobilhersteller. Um die regionale Wettbewerbsfähigkeit des Automobilsektors zu steigern und seine technologische Vorherrschaft weltweit zu behaupten, fördert die Europäische Kommission die globale Technologiestandardisierung und die Finanzierung von Forschung und Entwicklung. Gebrauchtwagenhändler in der Region bieten eine Reihe von technologiegestützten Optionen zur Verfolgung der Fahrzeugleistung, darunter Smartphone -Anwendungen und virtuelle Internet-Verkaufsstellen.

- Wachstum von Online-Technologien und E-Commerce

Technologische Entwicklungen im Telekommunikationsbereich, verbesserte Internetkonnektivität und zunehmende Urbanisierung sind einige wichtige Faktoren, aufgrund derer Menschen jetzt viel effektiver auf Informationen zugreifen können. Diese Funktionen helfen Gebrauchtwagenbesitzern, ihre Fahrzeuge schnell zu inserieren und Informationen über sie auszutauschen. Mithilfe dieser Online-Plattform können jetzt mehr Menschen Autos verkaufen und kaufen. Diese

Beschränkungen

- Probleme im Zusammenhang mit der Expansion des Gebrauchtwagenmarktes

Die Expansion des Gebrauchtwagenmarktes wird durch das Fehlen strenger Gesetze und Vorschriften für den Kauf von Gebrauchtwagen behindert. Hohe Abschreibungsraten für Gebrauchtwagen werden das Wachstum des Marktes erschweren. Der Ausbruch des Coronavirus hat sich negativ auf die weltweite Nachfrage nach Gebrauchtwagen ausgewirkt, da er die Nachfrage nach öffentlichen Verkehrsmitteln verringert hat.

Dieser Bericht zum Gebrauchtwagenmarkt enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Optimierung der Wertschöpfungskette, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Gebrauchtwagenmarkt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von Covid-19 auf den Gebrauchtwagenmarkt

Die COVID-19-Pandemie, die die Regierungen dazu zwang, strenge Eindämmungsmaßnahmen, regionale Ausgangssperren, soziale Isolation und Quarantänezeiten zu erlassen, wirkte sich 2020 negativ auf die Marktnachfrage aus. Als Folge der Lockerungen der Ausgangssperren und einer Verschiebung der Kundenpräferenzen hin zu persönlicher Mobilität. Dies inspirierte Geschäftsinhaber dazu, Internetplattformen für den Gebrauchtwagenmarkt mit flexiblen Finanzierungsalternativen zu nutzen. Aufgrund des steigenden Verbraucherwunsches nach Gebrauchtwagen in preissensiblen Gebieten wird für die Branche in naher Zukunft ein erhebliches Wachstum erwartet.

Jüngste Entwicklung

- Im Dezember 2019 hat HELLMAN & FRIEDMAN LLC einen Vertrag zur Übernahme des Unternehmens von AutoScout24 abgeschlossen. Mit dieser Übernahme will das Unternehmen Mehrwert-Marketinglösungen anbieten, da es seine Geschäftsmodelle in der Automobilbranche weiter digitalisiert.

- Im Dezember 2019 gab Group1 Automotive, Inc. die Übernahme von zwei Lexus-Händlern bekannt, um seine Geschäftspräsenz auf dem Markt in New Mexico auszubauen. Dies half dem Unternehmen, auf dem schnell wachsenden Markt in New Mexico Fuß zu fassen.

Globaler Gebrauchtwagenmarktumfang

Der Gebrauchtwagenmarkt ist nach Anbietertyp, Antrieb, Hubraum, Händler, Vertriebskanal und Fahrzeugtyp segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Anbietertyp

- Organisiert

- Unorganisiert

Antrieb

- Benzin

- Diesel

- Erdgas

- Flüssiggas

- Elektrisch

- Sonstiges

Hubraum

- Volle Größe ( über 2500 CC)

- Mittelgroß (zwischen 1500 und 2499 CC)

- Klein (unter 1499 CC)

Händler

- Franchise

- Unabhängig

Vertriebskanal

- Online

- Offline

Fahrzeugtyp

- Pkw

- Leichttransporter

- HCV

- Elektrofahrzeug

Regionale Analyse/Einblicke zum Gebrauchtwagenmarkt

Der Gebrauchtwagenmarkt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Anbietertyp, Antrieb, Hubraum, Händler, Vertriebskanal und Fahrzeugtyp wie oben angegeben bereitgestellt.

Die im Bericht zum Gebrauchtwagenmarkt abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Der asiatisch-pazifische Raum dominiert den Gebrauchtwagenmarkt hinsichtlich des Umsatzwachstums. Dies ist hauptsächlich auf das Wachstum der organisierten und halborganisierten Verkaufsbranche zurückzuführen. China dominiert den Gebrauchtwagenmarkt im asiatisch-pazifischen Raum, da es in dieser Region die meisten Gebrauchtwagenhändler gibt.

Europa wird im Prognosezeitraum 2023–2030 voraussichtlich die am schnellsten wachsende Region sein, da es dort reichlich Rohstoffe und billige Arbeitskräfte gibt. Darüber hinaus sind die zunehmende Internetnutzung, Garantien für Gebrauchtwagen, Online-Tools zum Kauf oder zur Recherche von Gebrauchtwagen und verschiedene Kaufalternativen einige der anderen wichtigen Faktoren, die das Marktwachstum wahrscheinlich ankurbeln werden.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Analyse der Marktanteile von Gebrauchtwagen

Die Wettbewerbslandschaft des Gebrauchtwagenmarkts liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Gebrauchtwagenmarkt.

Zu den wichtigsten Akteuren auf dem Gebrauchtwagenmarkt zählen:

- Group1 Automotive, Inc. (USA)

- AutoNation, Inc. (USA)

- HELLMAN & FRIEDMAN LLC (USA)

- PENDRAGON (Großbritannien)

- CarMax Business Services, LLC (USA)

- Mannheim (USA)

- DIE HERTZ CORPORATION (USA)

- Cox Automotive (USA)

- Sun Toyota (USA)

- eBay Inc. (USA)

- TrueCar, Inc. (USA)

- VROOM (USA)

- Asbury Automotive Group (USA)

- Lithia Motors, Inc. (USA)

- Hendrick Automotive Group (USA)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF GLOBAL USED CAR MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- vendor type timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- DRIVERS

- EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM

- INCREASE IN TRANSPARENCY & SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

- RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

- RISE IN DEMAND FOR THE PERSONAl TRANSPORT MOBILITY

- UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

- RESTRAINTS

- EVER INCREASE IN COST OF OWNERSHIP

- STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

- HIGHER MAINTENANCE AND SERVICE COST

- OPPORTUNITIES

- RISE IN STRATEGIC PARTNERSHIP AND ACquisitions BETWEEN TWO COMPANIES

- Original equipment manufacturers (oems) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

- RISE IN THE INVESTMENT BY GOVERNMENT IN AUTOMOBILE SECTOR

- AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

- CHALLENGES

- LACK OF POST-Sale SERVICES OF USED CAR

- INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

- IMPACT OF COVID ON THE GLOBAL USED CAR MARKET

- IMPACT ON SUPPLY CHAIN & DEMAND ON USED CAR MARKET

- STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID 19 TO GAIN COMPETITIVE MARKET SHARE

- CONCLUSION

- GLOBAL used car MARKET, BY vendor TYPE

- overview

- ORGANIZED

- UNORGANIZED

- GLOBAL used car MARKET, BY PROPULSION TYPE

- overview

- PETROL

- Diesel

- ELECTRIC

- LPG

- CNG

- others

- GLOBAL used car MARKET, BY engine capacity

- overview

- SMALL (BELOW 1499 CC)

- MID-SIZE (BETWEEN 1500-2499 CC)

- FULL SIZE (ABOVE 2500 CC)

- GLOBAL used car MARKET, BY dealership

- overview

- franchised

- independent

- GLOBAL used car MARKET, BY sales channel

- overview

- offline

- online

- GLOBAL used car MARKET, BY vehicle type

- overview

- passenger cars

- SUV

- SEDAN

- CROSSOVER

- Coupe

- HATCHBACK

- MPV

- CONVERTIBLE

- OTHERS

- lcv

- PICKUP TRUCKS

- VANS

- CARGO VANS

- PASSENGER VANS

- MINI BUS

- COACHES

- OTHERS

- ELECTRIC VEHICLE

- BATTERY OPERATED VEHICLES

- PLUGIN VEHICLES

- HYBRID VEHICLES

- HCV

- TRUCKS

- DUMP TRUCKS

- TOW TRUCKS

- CEMENT TRUCKS

- BUSES

- Global Used Car Market, by REGION

- overview

- EUROPE

- GERMANY

- FRANCE

- U.K.

- ITALY

- SPAIN

- RUSSIA

- TURKEY

- BELGIUM

- NETHERLANDS

- SWITZERLAND

- REST OF EUROPE

- ASIA-PACIFIC

- CHINA

- JAPAN

- SOUTH KOREA

- INDIA

- AUSTRALIA

- SINGAPORE

- THAILAND

- MALAYSIA

- INDONESIA

- PHILIPPINES

- REST OF ASIA -PACIFIC

- MIDDLE EAST & AFRICA

- SOUTH AFRICA

- EGYPT

- SAUDI ARABIA

- U.A.E

- ISRAEL

- REST OF MIDDLE EAST AND AFRICA

- NORTH AMERICA

- U.S.

- CANADA

- MEXICO

- SOUTH AMERICA

- BRAZIL

- ARGENTINA

- COLOMBIA

- PERU

- CHILE

- VENEZUeLA

- ECUADOR

- REST OF SOUTH AMERICA

- GLOBAL Used car market: COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: NORTH AMERICA

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- swot

- company profile

- CARMAX BUSINESS SERVICES, LLC

- COMPANY SNAPSHOT

- REVENNUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AUTONATION, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LITHIA MOTORS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SONIC AUTOMOTIVE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GROUP1 AUTOMOTIVE, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTTFOLIO

- RECENT DEVELOPMENTS

- ALIBABA GROUP HOLDING LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ASBURY AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIG BOY TOYZ

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CARS24

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- CHEHAODUOJIAO MOTOR VEHICLE BROKER (BEIJING) CO., LTD.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- HELLMAN & FRIEDMAN LLC

- COMPANY SNAPSHOT

- BRAND PORTFOLIO

- RECENT DEVELOPMENTS

- HENDRICK AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KAIXIN AUTO HOLDINGS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LEITHCARS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MAHINDRA FIRST CHOICE

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MARUTI SUZUKI INDIA LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OLX GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PENDRAGON

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TRUECAR, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- UXIN GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Tabellenverzeichnis

TABLE 1 Scale of Used Vehicle Exports in the Year 2017 (USD Million)

TABLE 2 Comparison of the Brand and Estimated Maintenance Cost over 10 Years (approx.)

TABLE 3 GLOBAL USED CAR MARKET, BY VENDOR TYPE, 2019-2028 (USD MILLION)

TABLE 4 Global organized in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 5 Global UNORgANIZED in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 6 GLOBAL USED CAR MARKET, BY propulsion TYPE, 2019-2028 (USD MILLION)

TABLE 7 Global petrol in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 8 Global diesel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 9 Global electric in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 10 Global lpg in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 11 Global cng in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 12 Global others in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 13 GLOBAL USED CAR MARKET, BY ENGINE CAPACITY, 2019-2028 (UsD MILLION)

TABLE 14 Global small (below 1499 CC) engine capacity in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 15 Global mid-size (between 1500-2499 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 16 Global full size (above 2500 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 17 GLOBAL USED CAR MARKET, BY dealership, 2019-2028 (USD MILLION)

TABLE 18 Global franchised in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 19 Global independent in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 20 GLOBAL USED CAR MARKET, BY sales channel, 2019-2028 (USD MILLION)

TABLE 21 Global offline sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 22 Global online sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 23 GLOBAL used car market, BY vehicle type, 2019-2028 (USD million)

TABLE 24 Global passenger cars in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 25 Global passenger cars in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 26 GLOBAL lcv in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 27 Global LCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 28 Global Vans in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 29 Global ELECTRIC VEHICLE IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 30 Global electric vehicle in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 31 Global HCV IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 32 Global HCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 33 Global Trucks in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 34 GLOBAL used car Market, By REGION, 2019-2028 (USD million)

TABLE 35 EUROPE Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 36 EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 37 EUROPE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 38 EUROPE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 39 EUROPE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 40 EUROPE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 41 EUROPE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 42 EUROPE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 43 EUROPE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 44 EUROPE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 45 EUROPE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 46 EUROPE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 47 EUROPE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 48 GERMANY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 49 GERMANY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 50 GERMANY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 51 GERMANY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 52 GERMANY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 53 GERMANY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 54 GERMANY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 55 GERMANY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 56 GERMANY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 57 GERMANY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 58 GERMANY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 59 GERMANY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 62 FRANCE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 63 FRANCE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 64 FRANCE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 65 FRANCE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 66 FRANCE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 67 FRANCE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 68 FRANCE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 69 FRANCE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 70 FRANCE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 71 FRANCE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 72 U.K. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 73 U.K. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 74 U.K. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 75 U.K. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 76 U.K. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 77 U.K. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 78 U.K. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 79 U.K. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 80 U.K. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 81 U.K. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 82 U.K. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 83 U.K. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 84 ITALY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 85 ITALY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 86 ITALY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 87 ITALY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 88 ITALY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 89 ITALY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 90 ITALY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 91 ITALY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 92 ITALY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 93 ITALY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 94 ITALY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 95 ITALY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 96 SPAIN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 97 SPAIN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 98 SPAIN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 99 SPAIN Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 100 SPAIN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 101 SPAIN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 102 SPAIN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 103 SPAIN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 104 SPAIN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 105 SPAIN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 106 SPAIN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 107 SPAIN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 108 RUSSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 109 RUSSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 110 RUSSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 111 RUSSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 112 RUSSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 113 RUSSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 114 RUSSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 115 RUSSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 116 RUSSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 117 RUSSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 118 RUSSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 119 RUSSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 120 TURKEY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 121 TURKEY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 122 TURKEY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 123 TURKEY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 124 TURKEY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 125 TURKEY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 126 TURKEY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 127 TURKEY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 128 TURKEY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 129 TURKEY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 130 TURKEY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 131 TURKEY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 132 BELGIUM Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 133 BELGIUM Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 134 BELGIUM Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 135 BELGIUM Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 136 BELGIUM Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 137 BELGIUM Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 138 BELGIUM Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 139 BELGIUM LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 140 BELGIUM Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 141 BELGIUM HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 142 BELGIUM Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 143 BELGIUM Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 144 NETHERLANDS Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 145 NETHERLANDS Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 146 NETHERLANDS Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 147 NETHERLANDS Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 148 NETHERLANDS Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 149 NETHERLANDS Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 150 NETHERLANDS Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 151 NETHERLANDS LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 152 NETHERLANDS Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 153 NETHERLANDS HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 154 NETHERLANDS Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 155 NETHERLANDS Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 156 SWITZERLAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 157 SWITZERLAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 158 SWITZERLAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 159 SWITZERLAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 160 SWITZERLAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 161 SWITZERLAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 162 SWITZERLAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 163 SWITZERLAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 164 SWITZERLAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 165 SWITZERLAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 166 SWITZERLAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 167 SWITZERLAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 168 Rest of EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 169 ASIA-PACIFIC Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 170 ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 171 ASIA-PACIFIC Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 172 ASIA-PACIFIC Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 173 ASIA-PACIFIC Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 174 ASIA-PACIFIC Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 175 ASIA-PACIFIC Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 176 ASIA-PACIFIC Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 177 ASIA-PACIFIC LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 178 ASIA-PACIFIC Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 179 ASIA-PACIFIC HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 180 ASIA-PACIFIC Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 181 ASIA-PACIFIC Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 182 CHINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 183 CHINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 184 CHINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 185 CHINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 186 CHINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 187 CHINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 188 CHINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 189 CHINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 190 CHINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 191 CHINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 192 CHINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 193 CHINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 194 JAPAN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 195 JAPAN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 196 JAPAN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 197 JAPAN Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 198 JAPAN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 199 JAPAN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 200 JAPAN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 201 JAPAN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 202 JAPAN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 203 JAPAN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 204 JAPAN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 205 JAPAN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 206 SOUTH KOREA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 207 SOUTH KOREA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 208 SOUTH KOREA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 209 SOUTH KOREA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 210 SOUTH KOREA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 211 SOUTH KOREA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 212 SOUTH KOREA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 213 SOUTH KOREA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 214 SOUTH KOREA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 215 SOUTH KOREA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 216 SOUTH KOREA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 217 SOUTH KOREA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 218 INDIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 219 INDIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 220 INDIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 221 INDIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 222 INDIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 223 INDIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 224 INDIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 225 INDIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 226 INDIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 227 INDIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 228 INDIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 229 INDIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 230 AUSTRALIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 231 AUSTRALIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 232 AUSTRALIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 233 AUSTRALIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 234 AUSTRALIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 235 AUSTRALIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 236 AUSTRALIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 237 AUSTRALIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 238 AUSTRALIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 239 AUSTRALIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 240 AUSTRALIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 241 AUSTRALIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 242 SINGAPORE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 243 SINGAPORE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 244 SINGAPORE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 245 SINGAPORE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 246 SINGAPORE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 247 SINGAPORE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 248 SINGAPORE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 249 SINGAPORE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 250 SINGAPORE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 251 SINGAPORE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 252 SINGAPORE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 253 SINGAPORE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 254 THAILAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 255 THAILAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 256 THAILAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 257 THAILAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 258 THAILAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 259 THAILAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 260 THAILAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 261 THAILAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 262 THAILAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 263 THAILAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 264 THAILAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 265 THAILAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 266 MALAYSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 267 MALAYSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 268 MALAYSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 269 MALAYSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 270 MALAYSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 271 MALAYSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 272 MALAYSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 273 MALAYSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 274 MALAYSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 275 MALAYSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 276 MALAYSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 277 MALAYSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 278 TABLE 86: INDONESIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 279 INDONESIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 280 INDONESIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 281 INDONESIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 282 INDONESIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 283 INDONESIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 284 INDONESIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 285 INDONESIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 286 INDONESIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 287 INDONESIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 288 INDONESIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 289 INDONESIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 290 PHILIPPINES Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 291 PHILIPPINES Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 292 PHILIPPINES Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 293 PHILIPPINES Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 294 PHILIPPINES Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 295 PHILIPPINES Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 296 PHILIPPINES Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 297 PHILIPPINES LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 298 PHILIPPINES Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 299 PHILIPPINES HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 300 PHILIPPINES Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 301 PHILIPPINES Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 302 Rest of ASIA-PACIFIC Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 303 Middle East & Africa Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 304 MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 305 mIDDLE EAST AND AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 306 MIDDLE EAST AND AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 307 MIDDLE EAST AND AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 308 MIDDLE EAST AND AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 309 MIDDLE EAST AND AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 310 MIDDLE EAST AND AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 311 MIDDLE EAST AND AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 312 MIDDLE EAST AND AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 313 MIDDLE EAST AND AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 314 MIDDLE EAST AND AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 315 MIDDLE EAST AND AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 316 SOUTH AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 317 SOUTH AFRICA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 318 SOUTH AFRICA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 319 SOUTH AFRICA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 320 SOUTH AFRICA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 321 SOUTH AFRICA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 322 SOUTH AFRICA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 323 SOUTH AFRICA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 324 SOUTH AFRICA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 325 SOUTH AFRICA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 326 SOUTH AFRICA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 327 SOUTH AFRICA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 328 EGYPT Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 329 EGYPT Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 330 EGYPT Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 331 EGYPT Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 332 EGYPT Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 333 EGYPT Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 334 EGYPT Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 335 EGYPT LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 336 EGYPT Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 337 EGYPT HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 338 EGYPT Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 339 EGYPT Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 340 SAUDI ARABIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 341 SAUDI ARABIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 342 SAUDI ARABIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 343 SAUDI ARABIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 344 SAUDI ARABIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 345 SAUDI ARABIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 346 SAUDI ARABIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 347 SAUDI ARABIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 348 SAUDI ARABIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 349 SAUDI ARABIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 350 SAUDI ARABIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 351 SAUDI ARABIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 352 U.A.E. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 353 U.A.E. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 354 U.A.E. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 355 U.A.E. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 356 U.A.E. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 357 U.A.E. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 358 U.A.E. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 359 U.A.E. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 360 : U.A.E. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 361 U.A.E. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 362 U.A.E. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 363 U.A.E. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 364 ISRAEL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 365 ISRAEL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 366 ISRAEL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 367 ISRAEL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 368 ISRAEL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 369 ISRAEL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 370 ISRAEL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 371 ISRAEL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 372 ISRAEL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 373 ISRAEL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 374 ISRAEL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 375 ISRAEL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 376 Rest of MIDDLE EAST AND AFRICA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 377 North America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 378 North America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 379 North America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 380 North America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 381 North America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 382 North America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 383 North America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 384 North America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 385 North America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 386 North America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 387 North America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 388 North America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 389 North America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 390 U.S. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 391 U.S. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 392 U.S. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 393 U.S. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 394 U.S. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 395 U.S. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 396 U.S. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 397 U.S. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 398 U.S. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 399 U.S. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 400 U.S. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 401 U.S. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 402 CANADA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 403 CANADA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 404 CANADA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 405 CANADA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 406 CANADA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 407 CANADA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 408 CANADA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 409 CANADA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 410 CANADA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 411 CANADA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 412 CANADA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 413 CANADA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 414 MEXICO Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 415 MEXICO Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 416 MEXICO Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 417 MEXICO Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 418 MEXICO Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 419 MEXICO Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 420 MEXICO Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 421 MEXICO LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 422 MEXICO Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 423 MEXICO HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 424 MEXICO Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 425 MEXICO Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 426 South America Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 427 South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 428 South America Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 429 South America Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 430 South America Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 431 South America Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 432 South America Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 433 South America Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 434 South America LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 435 South America Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 436 South America HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 437 South America Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 438 South America Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 439 BRAZIL Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 440 BRAZIL Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 441 BRAZIL Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 442 BRAZIL Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 443 BRAZIL Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 444 BRAZIL Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 445 BRAZIL Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 446 BRAZIL LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 447 BRAZIL Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 448 BRAZIL HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 449 BRAZIL Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 450 BRAZIL Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 451 ARGENTINA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 452 ARGENTINA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 453 ARGENTINA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 454 ARGENTINA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 455 ARGENTINA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 456 ARGENTINA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 457 ARGENTINA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 458 ARGENTINA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 459 ARGENTINA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 460 ARGENTINA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 461 ARGENTINA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 462 ARGENTINA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 463 COLOMBIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 464 COLOMBIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 465 COLOMBIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 466 COLOMBIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 467 COLOMBIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 468 COLOMBIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 469 COLOMBIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 470 COLOMBIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 471 COLOMBIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 472 COLOMBIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 473 COLOMBIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 474 COLOMBIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 475 PERU Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 476 PERU Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 477 PERU Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 478 PERU Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 479 PERU Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 480 PERU Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 481 PERU Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 482 PERU LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 483 PERU Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 484 PERU HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 485 PERU Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 486 PERU Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 487 CHILE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 488 CHILE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 489 CHILE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 490 CHILE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 491 CHILE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 492 CHILE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 493 CHILE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 494 CHILE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 495 CHILE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 496 CHILE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 497 CHILE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 498 CHILE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 499 VENEZUELA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 500 VENEZUELA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 501 VENEZUELA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 502 VENEZUELA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 503 VENEZUELA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 504 VENEZUELA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 505 VENEZUELA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 506 VENEZUELA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 507 VENEZUELA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 508 VENEZUELA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 509 VENEZUELA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 510 VENEZUELA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 511 ECUADOR Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 512 ECUADOR Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 513 ECUADOR Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 514 ECUADOR Used Car Market, By DEALERSHIP, 2019-2028 (USD Million)

TABLE 515 ECUADOR Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 516 ECUADOR Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 517 ECUADOR Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 518 ECUADOR LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 519 ECUADOR Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 520 ECUADOR HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 521 ECUADOR Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 522 ECUADOR Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 523 Rest of South America Used Car Market, By Vendor Type, 2019-2028 (USD Million)

Abbildungsverzeichnis

FIGURE 1 GLOBAL USED CAR MARKET segmentation

FIGURE 2 GLOBAL used car MARKET: data triangulation

FIGURE 3 GLOBAL used car MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL used car MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL used car MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL used car MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL used car MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL used car MARKET: vendor share analysis

FIGURE 9 GLOBAL used car market SEGMENTATION

FIGURE 10 THE Emergence of different ecommerce platformS is EXPECTED TO DRIVE THE GLOBAL used car market THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 ORGANIZED segment is expected to account for the largest share of THE Global used car market IN 2021 & 2028

FIGURE 12 asia-pacific is expected to DOMINATE and is the fastest-growing region in THE Global used car market IN the forecast period of 2021 to 2028

FIGURE 13 asia-pacific is the fastest growing market for used car market in the forecast period of 2021 to 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GLOBAL USED CAR MARKET

FIGURE 15 Monthly Passenger Car Sales in Europe between August 2020 and June 2021 (1,000 Units)

FIGURE 16 Vehicle share per month in the year 2019 (%)

FIGURE 17 Global USEd CAR MARKET: BY VENDOR TYPE, 2020

FIGURE 18 Global USED CAR MARKET: BY PROPULSION TYPE, 2020

FIGURE 19 Global USEd CAR MARKET: BY ENGINE capacity, 2020

FIGURE 20 Global USEd CAR MARKET: BY DEALERSHIP, 2020

FIGURE 21 Global USEd CAR MARKET: BY sales channel, 2020

FIGURE 22 Global used car MARKET: BY VEHICLE type, 2020

FIGURE 23 GLOBAL USED CAR Market: SNAPSHOT (2020)

FIGURE 24 GLOBAL USED CAR Market: by Region (2020)

FIGURE 25 GLOBAL USED CAR Market: by Region (2021 & 2028)

FIGURE 26 GLOBAL Used car Market: by Region (2020 & 2028)

FIGURE 27 GLOBAL used car Market: by Vendor TYPE (2021-2028)

FIGURE 28 EUROPE USED CAR MARKET: SNAPSHOT (2020)

FIGURE 29 EUROPE USED CAR MARKET: by Country (2020)

FIGURE 30 EUROPE USED CAR MARKET: by Country (2021 & 2028)

FIGURE 31 EUROPE USED CAR MARKET: by Country (2020 & 2028)

FIGURE 32 EUROPE USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 33 ASIA-PACIFIC USED CAR MARKET: SNAPSHOT (2020

FIGURE 34 ASIA-PACIFIC USED CAR MARKET: by Country (2020)

FIGURE 35 ASIA-PACIFIC USED CAR MARKET: by Country (2021 & 2028)

FIGURE 36 ASIA-PACIFIC USED CAR MARKET: by Country (2020 & 2028)

FIGURE 37 ASIA-PACIFIC USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 38 Middle East & Africa USED CAR MARKET: SNAPSHOT (2020)

FIGURE 39 Middle East & Africa USED CAR MARKET: by Country (2020)

FIGURE 40 Middle East & Africa USED CAR MARKET: by Country (2021 & 2028)

FIGURE 41 Middle East & Africa USED CAR MARKET: by Country (2020 & 2028)

FIGURE 42 Middle East & Africa USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 43 NORTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 44 NORTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 45 NORTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 46 NORTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 47 NORTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 48 SOUTH AMERICA USED CAR MARKET: SNAPSHOT (2020)

FIGURE 49 SOUTH AMERICA USED CAR MARKET: by Country (2020)

FIGURE 50 SOUTH AMERICA USED CAR MARKET: by Country (2021 & 2028)

FIGURE 51 SOUTH AMERICA USED CAR MARKET: by Country (2020 & 2028)

FIGURE 52 SOUTH AMERICA USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 53 global used car Market: company share 2020 (%)

FIGURE 54 NORTH AMERICA used car Market: company share 2020 (%)

FIGURE 55 Europe used car Market: company share 2020 (%)

FIGURE 56 Asia-Pacific used car Market: company share 2020 (%)

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.