Global Unified Communication As A Service Market

Marktgröße in Milliarden USD

CAGR :

%

USD

83.17 Billion

USD

383.44 Billion

2024

2032

USD

83.17 Billion

USD

383.44 Billion

2024

2032

| 2025 –2032 | |

| USD 83.17 Billion | |

| USD 383.44 Billion | |

|

|

|

|

Globaler Markt für Unified Communication as a Service, nach Komponente (Telefonie, Unified Messaging, Konferenzen, Kollaborationsplattformen und -anwendungen), Bereitstellung (privat, öffentlich, öffentliche Cloud), Organisationsstandort (KMU, Großunternehmen), Endnutzung (IT und Telekommunikation, BFSI , Gesundheitswesen, Automobil, Einzelhandel und Konsumgüter, öffentlicher Sektor, Transport und Logistik, Reisen und Gastgewerbe, sonstige) – Branchentrends und Prognose bis 2029.

Unified Communications as a Service – Marktanalyse und -größe

Ein typisches Bereitstellungsmodell, bei dem ein Anbieter seinen Kunden eine Vielzahl von Kommunikations- und Kollaborationsanwendungen sowie die zugehörigen Dienste über das Internet bereitstellen kann, wobei IP-Blöcke als Container für kleine Informationseinheiten verwendet werden. Single-Tenancy und Multi-Tenancy sind zwei Ansätze, mit denen das Bereitstellungsmodell seine Kunden erreicht. Organisatorische Trends in Richtung Mobilität und Bring Your Own Device (BYOD) sowie Anforderungen an kontinuierlichen Service-Support werden voraussichtlich zu Veränderungen in diesem Markt führen.

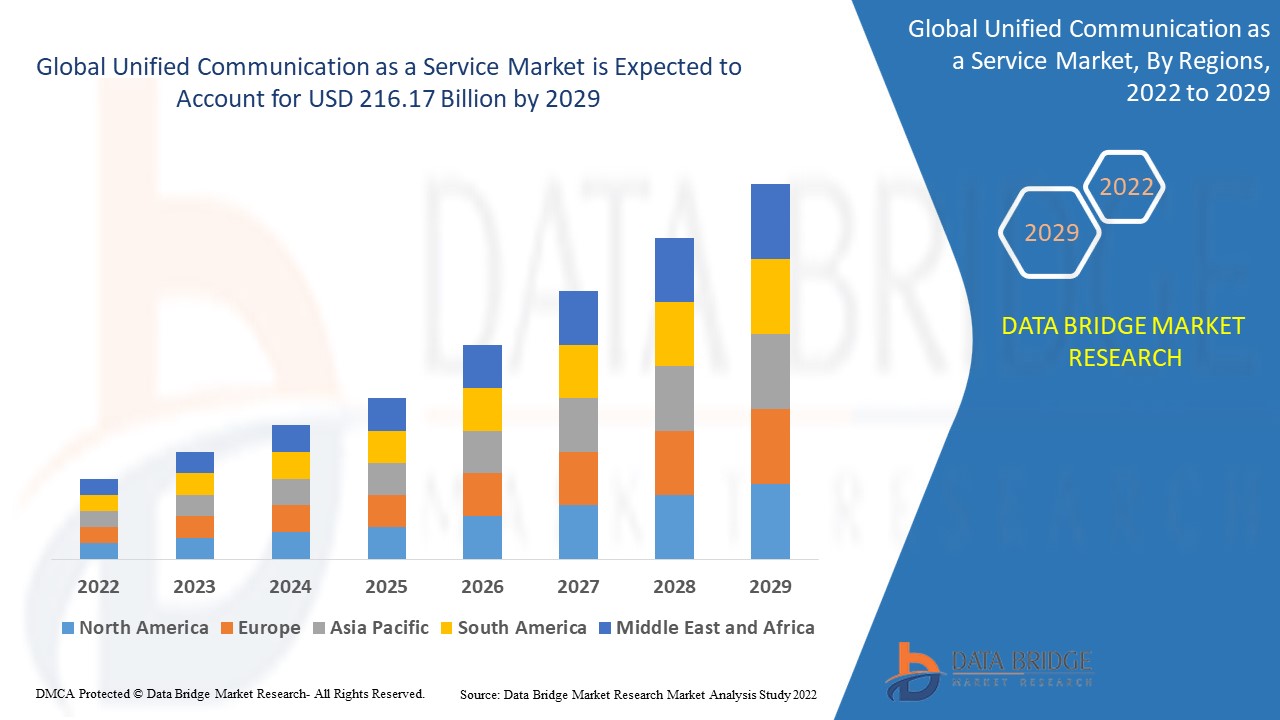

Data Bridge Market Research analysiert, dass der Markt für Unified Communications as a Service im Jahr 2021 einen Wert von 46,89 Milliarden USD hatte und bis 2029 voraussichtlich einen Wert von 216,17 Milliarden USD erreichen wird, bei einer CAGR von 21,05 % im Prognosezeitraum 2022–2029. Neben Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team zusammengestellte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

Unified Communication as a Service – Marktumfang und -segmentierung

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 (Anpassbar auf 2014 – 2019) |

|

Quantitative Einheiten |

Umsatz in Mrd. USD, Volumen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Komponente (Telefonie, Unified Messaging, Konferenzen, Kollaborationsplattformen und -anwendungen), Bereitstellung (privat, öffentlich, öffentliche Cloud), Organisationsstandort (KMU, Großunternehmen), Endverbraucher (IT und Telekommunikation, BFSI, Gesundheitswesen, Automobilindustrie, Einzelhandel und Konsumgüter, öffentlicher Sektor, Transport und Logistik, Reise- und Gastgewerbe, andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

Amazon Web Services, Inc. (USA), Cisco Systems Inc. (USA), NTT DATA Corporation (Japan), DXC Technology Company (USA), VMware, Inc. (USA), RACKSPACE TECHNOLOGY (USA), Informatica (USA), IBM Corporation (USA), Microsoft (USA), Siemens (Deutschland), ANSYS, Inc. (USA), SAP SE (Deutschland), Robert Bosch GmbH (Deutschland), NetApp (USA), Atos SE (USA), Fujitsu (Japan), CenturyLink (USA), Hewlett Packard Enterprise Development LP (USA), Dell Inc. (USA), Oracle (USA), Google LLC (USA), Atos SE (Frankreich), KELLTON TECH (Indien) |

|

Marktchancen |

|

Marktdefinition

Unified Communication-as-a-Service (UCaaS) ist ein Bereitstellungsmodell. Verschiedene Anwendungen, Zusammenarbeits- und Kommunikationsdienste werden bei diesem Modell in der Regel an einen Drittanbieter ausgelagert und dann über ein Netzwerk bereitgestellt. Dazu gehören Enterprise Messaging, Telefoniepräsenztechnologie und Videokonferenzen. Viele Unternehmen nutzen es häufig, um Geschäftsprozesse durch Optimierung der Kommunikation zu verbessern. Es verleiht zentralen Geschäftsaufgaben Skalierbarkeit und Flexibilität.

Globale Unified Communications as a Service-Marktdynamik

Treiber

- wachsender Trend von BYOD profitiert vom Marktwachstum

Die steigende Nachfrage nach BYOD-Systemen (Bring Your Own Device) im Unternehmenssektor, bei denen Mitarbeiter aufgefordert werden, ihr eigenes Gerät zur Arbeit mitzubringen, anstatt sich auf die Hardware des Unternehmens zu verlassen, wird voraussichtlich im Prognosezeitraum das Marktwachstum ankurbeln. Die Bring-Your-Own-Device-Richtlinie bietet auch eine starke zentrale Kommunikationstechnologie, die eine bequeme und einfache Kommunikation zwischen verschiedenen Teilen der Organisation ermöglicht. Ein weiterer Faktor, der das Marktwachstum voraussichtlich fördern wird, ist die zunehmende Akzeptanz von Cloud-Diensten durch große Organisationen, da diese ihren Mitarbeitern Echtzeitüberwachung und Ressourceneffizienzfunktionen bieten können.

- Zunehmender Fokus auf die Integration von Geräten mit fortschrittlichen Analysetools

Mit dem Aufkommen des Internets der Dinge (IoT) konzentrieren sich Unternehmen zunehmend auf die Integration von Geräten und Daten mit fortschrittlichen Analysetools, was zu einer autarken Arbeitsumgebung führt. Darüber hinaus umfassen laufende technologische Entwicklungen ein erweitertes Produktportfolio von Anbietern mobiler Unified-Communications-Infrastrukturen, die dem Markt Fixed Mobile Convergence (FMC)- und SIP- Apps von Drittanbietern zur Verfügung stellen. Darüber hinaus hat die Allgegenwärtigkeit von Smartphones Unified-Communications-Anbieter dazu veranlasst, mobile Unified-Communications-Apps zu entwickeln, die mit Smartphones kompatibel sind.

Darüber hinaus ist in vielen Teilen der Welt die weitverbreitete Nutzung von IP-Telefonen zur Erleichterung der Echtzeit-Unternehmenskommunikation zu beobachten. IP-Telefone fungieren als Multimedia-Endpunkte und bieten verschiedene Systemfunktionen wie Sprachkommunikation, Videokommunikation und synchrone Kommunikation, was das Wachstum des globalen Marktes für einheitliche Kommunikation beschleunigt.

Gelegenheit

Der Aufstieg von Cloud- und As-a-Service-Modellen sowie die zunehmende Zahl von Pay-as-you-go-Modellen für Endbenutzer, die niedrigen Betriebskosten von UCaaS-Modellen und die technologische Verbreitung von UCaaS-Systemen sind Schlüsselfaktoren, die den Markt für Unified Communications als Service vorantreiben.

Beschränkungen

Zunehmende Sicherheitsbedenken hinsichtlich der Cloud-basierten Bereitstellung und mangelnde Interoperabilität zählen jedoch zu den Hauptfaktoren, die das Marktwachstum begrenzen und den Markt für Unified Communications as a Service im Prognosezeitraum vor weitere Herausforderungen stellen.

Dieser Marktbericht zu Unified Communications as a Service enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für Unified Communications as a Service zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analyst Brief zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von COVID-19 auf den Markt für Unified Communications as a Service

Die COVID-19-Pandemie hat jede Branche betroffen, und aufgrund der Vorschriften zur sozialen Distanzierung setzen Unternehmen auf Digitalisierung, um die Sicherheit ihrer Mitarbeiter zu gewährleisten. Die Beschränkungen, die eingeführt wurden, um die Ausbreitung des Virus zu stoppen, haben die Unternehmen gezwungen, die Zukunft der Arbeit und wie sie für die Mitarbeiter aussehen könnte, zu überdenken. Viele Unternehmen, die keine Homeoffice-Richtlinien hatten, haben sich nach COVID-19 beeilt, diese umzusetzen, und viele Experten gehen davon aus, dass dies auch in der Zeit nach COVID-19 so bleiben wird. Aufgrund der aktuellen Vorschriften zur Fernarbeit hat die Einführung integrierter UCaaS-Plattformen während der Pandemie zugenommen. Daher wird erwartet, dass die Nachfrage nach UCaaS zwischen 2019 und 2021 im Jahresvergleich um 10,3 % bis 12,8 % steigen wird. Aufgrund von COVID-19, Videokonferenzen und Webkonferenzen haben viele Mitarbeiter begonnen, von zu Hause aus zu arbeiten.

Jüngste Entwicklung

- Um sein Mobilfunkgeschäft zu einem Unternehmen auszubauen, erwarb Ericsson im Juli 2022 Vonage Holdings Corp., einen Anbieter von Unified Communications-as-a-Service (UCaaS) und Contact Center as a Service (CCaaS). Durch die Übernahme kann Ericsson eine vollständige Suite von Kommunikationslösungen anbieten, darunter Communications Platform as a Service (CPaaS), CCaaS und UCaaS.

- Im März 2022 übernahm Sangoma Technologies Corporation, ein Anbieter von Cloud-basierten UcaaS-Lösungen, NetFortris Corporation, einen Anbieter von UCaaS und Cloud-basierten MSP-Lösungen. Sangoma erwartet, dass die Übernahme ihm dabei helfen wird, seine Cloud-basierten Dienste durch die Integration neuer MSP-Funktionen zu erweitern.

- Im März 2022 kündigte Microsoft Pläne zur Einführung gemeinsamer Microsoft Teams Connect-Kanäle mit der Integration von Microsoft 365 Business-, Enterprise- und Education-Abonnements an. In Microsoft Teams Connect hat das Unternehmen den bestehenden Standard- und privaten Kanälen neue Kanäle hinzugefügt. Benutzer können einen gemeinsam genutzten Kanal verwenden, um andere zu einem bestimmten Kanal einzuladen, ohne sie einem Team hinzuzufügen.

Globaler Marktumfang für Unified Communications als Service

Der Markt für Unified Communications as a Service ist nach Komponenten, Bereitstellung, Organisationsstandort und Endverbrauch segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Komponente

- Telefonie

- Einheitliche Nachrichtenübermittlung

- Konferenzen

- Kollaborationsplattformen und -anwendungen

Einsatz

- Private Cloud-Dienste

- Öffentliche Cloud-Dienste

Größe der Organisation

- Kleine und mittlere Unternehmen

- Große Unternehmen

Endverbrauch

- Banken, Finanzdienstleistungen und Versicherungen (BFSI)

- Gesundheitspflege

- IT-gestützte Dienste und Telekommunikation

- Einzelhandel und Konsumgüter

- Transport und Logistik

- Reisen und Gastgewerbe

- Automobilindustrie

- Öffentlicher Sektor

- Sonstiges

Regionale Analyse/Einblicke zum Unified Communication as a Service-Markt

Der Markt für Unified Communications als Service wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Komponente, Bereitstellung, Organisationsstandort und Endnutzung wie oben angegeben bereitgestellt.

Die im Marktbericht für Unified Communications as a Service abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika

Nordamerika dürfte den größten Anteil am Markt für Unified Communication-as-a-Service (UCaaS) haben. Das Wachstum des Marktes ist auf die zunehmende Nutzung von Telepräsenzsystemen, fortschrittlichen Geschäftslösungen und Bring Your Own Device (BYOD) in der Region zurückzuführen. Unternehmen in der gesamten Region implementieren fortschrittliche Unified-Communication-Dienste wie Konferenzen, Unified Messaging, Unternehmenstelefonie und Instant Messaging. In Nordamerika nimmt auch die Nutzung von Contact-Center-Funktionen wie automatischer Vermittlung, Anrufweiterleitung, interaktiver Sprachantwort und CRM-Integrationen zu.

Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der steigenden Nachfrage nach internetbasierten Kommunikationsdiensten unter den KMU in der Region die höchste durchschnittliche jährliche Wachstumsrate (CAGR) im Markt für Unified Communication-as-a-Service (UCaaS) aufweisen. Zu den Trends der UCaaS-Branche im asiatisch-pazifischen Raum zählen die Einführung von Unified Communication-Diensten und Cloud-Technologien wie VoIP Unified Communications sowie Sprach- und Videokonferenzen.

Der Länderabschnitt des Berichts enthält auch individuelle marktbeeinflussende Faktoren und Änderungen der Marktregulierung, die die aktuellen und zukünftigen Trends des Marktes beeinflussen. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Unified Communications as a Service Marktanteilsanalyse

Die Wettbewerbslandschaft des Marktes für Unified Communications as a Service liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für Unified Communications as a Service.

Zu den wichtigsten Akteuren auf dem Markt für Unified Communications als Service zählen:

- Amazon Web Services, Inc. (USA)

- Cisco Systems Inc., (USA)

- NTT DATA Corporation (Japan)

- DXC Technology Company (USA)

- VMware, Inc. (USA)

- RACKSPACE-TECHNOLOGIE (USA)

- Informatica (USA)

- IBM Corporation (USA)

- Microsoft (US)

- Siemens (Deutschland)

- ANSYS, Inc. (USA)

- SAP SE (Deutschland)

- Robert Bosch GmbH (Deutschland)

- NetApp (USA)

- Atos SE (USA)

- Fujitsu (Japan)

- CenturyLink (USA)

- Hewlett Packard Enterprise Development LP (USA)

- Dell Inc., (USA)

- Oracle (USA)

- Google LLC (USA)

- Atos SE (Frankreich)

- KELLTON TECH (Indien)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.