Global Treasury Software Market

Marktgröße in Milliarden USD

CAGR :

%

USD

3.67 Billion

USD

4.68 Billion

2024

2032

USD

3.67 Billion

USD

4.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.67 Billion | |

| USD 4.68 Billion | |

|

|

|

|

Globale Marktsegmentierung für Treasury-Software nach Betriebssystem (Windows, Linux, iOS, Android und MAC), Anwendung (Liquiditäts- und Cash-Management, Investmentmanagement, Schuldenmanagement, Finanzrisikomanagement, Compliance-Management, Steuerplanung und andere), Bereitstellungsmodus (vor Ort und in der Cloud), Unternehmensgröße (Großunternehmen und kleine und mittlere Unternehmen), Branche (Banken, Finanzdienstleistungen und Versicherungen, Behörden, Fertigung, Gesundheitswesen, Konsumgüter, Chemie, Energie und andere) – Branchentrends und Prognose bis 2032

Treasury-Software Marktgröße

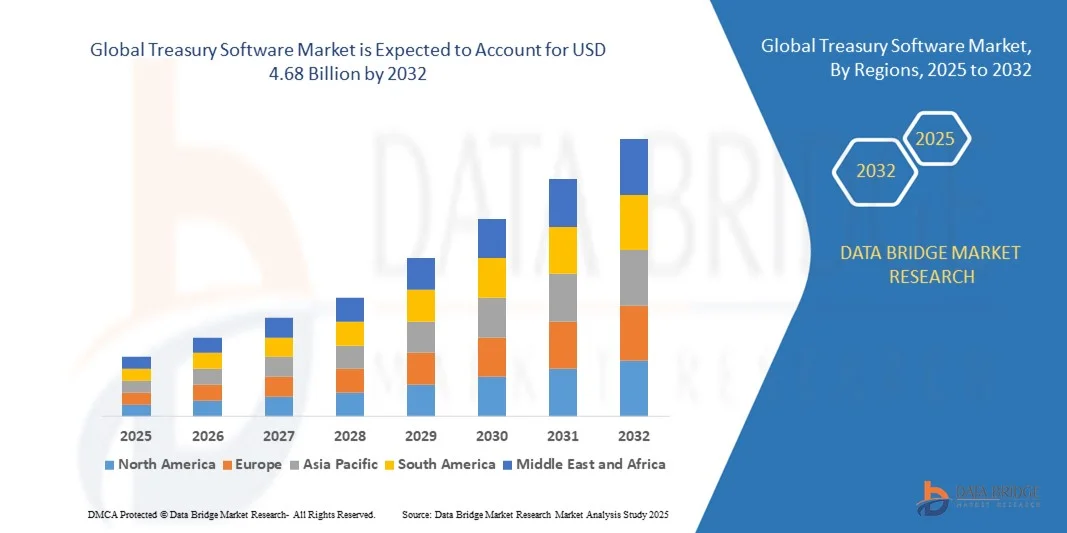

- Der globale Markt für Treasury-Software wurde im Jahr 2024 auf 3,67 Milliarden US-Dollar geschätzt und soll bis 2032 4,68 Milliarden US-Dollar erreichen , bei einer CAGR von 3,1 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Einführung digitaler Finanzmanagementlösungen und den kontinuierlichen technologischen Fortschritt im Treasury-Bereich vorangetrieben, was zu einer verbesserten Automatisierung, Echtzeit-Reporting und einer verbesserten Cashflow-Transparenz für Unternehmen führt.

- Darüber hinaus etabliert die steigende Nachfrage von Unternehmen nach sicheren, integrierten und benutzerfreundlichen Plattformen zur Verwaltung von Liquidität, Investitionen, Risiken und Compliance Treasury-Software als unverzichtbares Instrument für modernes Finanzmanagement. Diese konvergierenden Faktoren beschleunigen die Einführung von Treasury-Lösungen und treiben damit das Marktwachstum deutlich voran.

Treasury-Software-Marktanalyse

- Treasury-Software umfasst digitale Plattformen, die es Unternehmen ermöglichen, Bargeld, Liquidität, Investitionen, Schulden, Finanzrisiken und die Einhaltung gesetzlicher Vorschriften effizient zu verwalten. Diese Systeme lassen sich in Enterprise-Resource-Planning- (ERP) und Banking-Plattformen integrieren und ermöglichen so eine zentrale Steuerung, Echtzeit-Einblicke und die Automatisierung von Routineprozessen.

- Die steigende Nachfrage nach Treasury-Software wird vor allem durch den Bedarf an betrieblicher Effizienz, verbesserter finanzieller Transparenz, Einhaltung gesetzlicher Vorschriften und die zunehmende Präferenz für Cloud-basierte und mobil zugängliche Lösungen angetrieben, die es Treasurern ermöglichen, Unternehmensfinanzen aus der Ferne zu überwachen und zu verwalten.

- Nordamerika dominierte den Markt für Treasury-Software mit einem Anteil von 41,55 % im Jahr 2024 aufgrund der wachsenden Nachfrage nach digitalem Finanzmanagement und Automatisierung in Unternehmen.

- Der asiatisch-pazifische Raum dürfte im Prognosezeitraum aufgrund der zunehmenden Urbanisierung, der zunehmenden Digitalisierung und des technologischen Fortschritts in Ländern wie China, Japan und Indien die am schnellsten wachsende Region im Markt für Treasury-Software sein.

- Das On-Premise-Segment dominierte den Markt mit einem Marktanteil von 52,8 % im Jahr 2024, da Unternehmen die volle Kontrolle über sensible Finanzdaten, Sicherheitskonformität und Anpassungsmöglichkeiten bevorzugen. Viele große Unternehmen investieren weiterhin in On-Premise-Lösungen, um die interne Governance aufrechtzuerhalten und eine umfassende Integration in die bestehende IT-Infrastruktur zu gewährleisten. Die Zuverlässigkeit und Stabilität von On-Premise-Implementierungen machen sie zur bevorzugten Wahl für unternehmenskritische Treasury-Operationen.

Berichtsumfang und Marktsegmentierung für Treasury-Software

|

Eigenschaften |

Wichtige Markteinblicke für Treasury-Software |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Nordamerika

Europa

Asien-Pazifik

Naher Osten und Afrika

Südamerika

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Markteinblicken wie Marktwert, Wachstumsrate, Marktsegmenten, geografischer Abdeckung, Marktteilnehmern und Marktszenario enthält der vom Data Bridge Market Research-Team kuratierte Marktbericht eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse. |

Markttrends für Treasury-Software

Steigende Akzeptanz von Cloud-basierten und mobilen Treasury-Lösungen

- Der Markt für Treasury-Software wird zunehmend durch die Integration cloudbasierter und mobilfähiger Lösungen geprägt, die den Finanzteams von Unternehmen verbesserte Zugänglichkeit, Skalierbarkeit und Sicherheit bieten. Cloud-Technologie ermöglicht es Unternehmen, Treasury-Operationen über verschiedene Regionen hinweg zu zentralisieren, Infrastrukturkosten zu senken und die operative Flexibilität zu erhöhen.

- Kyriba hat sich beispielsweise einen Namen mit Cloud-Treasury- und Risikomanagement-Plattformen gemacht und bietet Unternehmenskunden sichere Cloud-native Tools für Liquiditätsmanagement, Cash-Transparenz und mobilen Zugriff. Die Partnerschaften des Unternehmens mit Finanzinstituten zeigen, wie Anbieter Cloud-basierte Innovationen anbieten, um den wachsenden Treasury-Anforderungen gerecht zu werden.

- Durch die Einführung mobiler Treasury-Lösungen haben Führungskräfte und Finanzverantwortliche rund um die Uhr Zugriff auf wichtige Finanzdaten über Smartphones und Tablets. Dadurch können Treasury-Operationen wie die Autorisierung von Zahlungen, die Überprüfung von Liquiditätspositionen und die Überwachung von Marktrisiken ortsunabhängig in Echtzeit durchgeführt werden.

- Cloud-native Treasury-Plattformen bieten zudem eingebettete Analysen und maschinelles Lernen für prädiktive Liquiditätsprognosen und Szenarioanalysen und verbessern so die Entscheidungsfindung. Diese Fortschritte ermöglichen es Unternehmen, Währungsrisiken proaktiv zu identifizieren, Zinsrisiken zu managen und Liquiditätsstrategien an Marktschwankungen anzupassen.

- Die Integration von Cloud-Treasury mit digitalen Zahlungsinfrastrukturen und Blockchain steigert die Transaktionstransparenz und die Effizienz grenzüberschreitender Zahlungen weiter. Anbieter wie FIS Global integrieren Blockchain-basierte Lösungen für eine schnellere Zahlungsabwicklung und sicherere Abstimmungsprozesse und treiben so Innovationen in Finanzabläufen voran.

- Die zunehmende Nutzung von Cloud- und mobilen Treasury-Lösungen spiegelt einen umfassenden Wandel hin zur digitalen Transformation im Corporate Finance wider. Dieser Trend ermöglicht mehr Resilienz und Flexibilität im Treasury-Bereich und unterstützt strategische Ziele wie verbesserte Compliance und Risikominimierung in diversifizierten Finanznetzwerken.

Marktdynamik für Treasury-Software

Treiber

Bedarf an Echtzeit-Cashflow- und Risikomanagement

- Der Bedarf an Echtzeit-Einblicken in die Liquidität und das Risikomanagement von Unternehmen hat sich als Haupttreiber für die Einführung von Treasury-Software herausgestellt. Unternehmen sehen sich mit zunehmender Komplexität ihrer Finanzgeschäfte konfrontiert. Treasury-Teams müssen schwankende Währungsrisiken, Zinsvolatilität und globale Zahlungsherausforderungen präzise und schnell bewältigen.

- So ermöglichen beispielsweise die Treasury- und Risikomanagementmodule von SAP Unternehmen die Integration von Liquiditätspositionen, die Prognose des Liquiditätsbedarfs und die Automatisierung von Hedge-Accounting-Prozessen. Durch Transparenz und Echtzeitkontrolle helfen diese Tools Unternehmen, finanzielle Risiken zu minimieren und gleichzeitig die Einhaltung der sich entwickelnden regulatorischen Rahmenbedingungen zu gewährleisten.

- Treasury-Software ermöglicht eine zentrale Übersicht über die Liquiditätsbestände mehrerer Unternehmen und Währungen und bietet CFOs und Treasurern sofortigen Zugriff auf Barguthaben und Finanzierungsbedarf. Diese Transparenz ermöglicht es Unternehmen, die Liquiditätsallokation zu optimieren, ungenutzte Guthaben zu reduzieren und Anlagestrategien für überschüssige Mittel zu verbessern.

- Die zunehmende Globalisierung von Unternehmen und komplexe grenzüberschreitende Finanztransaktionen haben den Bedarf an robusten Risikomanagement-Tools erhöht. Treasury-Plattformen unterstützen Unternehmen mit fortschrittlichen Analysen zur Risikomessung, zum Management der Einhaltung gesetzlicher Vorschriften und zur Echtzeit-Berichterstattung an Stakeholder.

- Die wachsende Nachfrage nach kontinuierlicher Liquiditätsüberwachung und proaktiver Risikobewertung macht Treasury-Lösungen unverzichtbar. Da Unternehmen ihre Aktivitäten global ausweiten, werden Echtzeit-Treasury-Praktiken branchenübergreifend zu einem entscheidenden Faktor für Stabilität und finanzielle Effizienz.

Einschränkung/Herausforderung

Integration mit älteren ERP- und Banksystemen

- Eine entscheidende Herausforderung bei der Einführung von Treasury-Software liegt in der Schwierigkeit, fortschrittliche digitale Lösungen in bestehende ERP-Systeme (Enterprise Resource Planning) und verschiedene Bankplattformen zu integrieren. Viele multinationale Unternehmen arbeiten mit veralteten IT-Umgebungen, die eine nahtlose Datenmigration und Interoperabilität erschweren.

- Unternehmen, die beispielsweise auf traditionelle ERP-Systeme wie die Oracle E-Business Suite oder ältere Bankschnittstellen setzen, sehen sich bei der Integration moderner Treasury-Anwendungen häufig mit Verzögerungen und höheren Kosten konfrontiert. Dies schränkt die Effektivität der Echtzeit-Bargeldtransparenz und des Transaktionsabgleichs ein.

- Abhängigkeiten von Altsystemen führen zu fragmentierten Datensilos, die umfassende finanzielle Einblicke behindern. Ohne optimierte Verbindungen zwischen Treasury-Software, ERP-Modulen und Banknetzwerken kämpfen Unternehmen mit manuellen Abstimmungsbemühungen, doppelten Prozessen und ineffizienter Berichterstattung.

- Die Herausforderungen der Interoperabilität reichen von der Automatisierung von Zahlungsabläufen bis hin zur Standardisierung von Formaten bei mehreren globalen Banken. Treasury-Teams stoßen häufig auf Inkonsistenzen beim Datenaustausch und bei Abrechnungsnachrichten, was die Fehlerquote und die Compliance-Risiken erhöhen kann.

- Um diese Integrationsprobleme zu lösen, sind Investitionen in Middleware-Technologie, Open-Banking-APIs und eine schrittweise Modernisierung der ERP-Frameworks erforderlich. Die Beseitigung dieser Hindernisse ist entscheidend, um sicherzustellen, dass fortschrittliche Treasury-Plattformen in vernetzten Finanzökosystemen optimal funktionieren.

Marktumfang für Treasury-Software

Der Markt ist nach Betriebssystem, Anwendung, Bereitstellungsmodus, Unternehmensgröße und Branche segmentiert.

- Nach Betriebssystem

Der Markt für Treasury-Software ist nach Betriebssystemen in Windows, Linux, iOS, Android und MAC unterteilt. Das Windows-Segment hatte 2024 den größten Marktanteil, was auf die breite Akzeptanz in Unternehmens-IT-Umgebungen und die Kompatibilität mit bestehenden Finanzsystemen zurückzuführen ist. Unternehmen bevorzugen häufig Windows-basierte Treasury-Lösungen aufgrund ihres robusten Support-Ökosystems, der benutzerfreundlichen Oberfläche und der Integrationsmöglichkeiten mit Enterprise-Resource-Planning- (ERP) und Finanzsoftware. Die Vertrautheit der IT-Teams mit Windows-Umgebungen fördert den kontinuierlichen Einsatz im Treasury-Bereich und ermöglicht nahtlose Arbeitsabläufe und ein effizientes Systemmanagement.

Das Android-Segment wird voraussichtlich von 2025 bis 2032 die schnellste Wachstumsrate verzeichnen, angetrieben durch die zunehmende Nutzung mobiler Treasury-Anwendungen und den Bedarf an Echtzeitzugriff auf Finanzdaten. Android-gestützte Treasury-Lösungen ermöglichen es Fachleuten, Liquidität, Zahlungen und Investitionen aus der Ferne zu verwalten und so die betriebliche Effizienz zu steigern. Die Skalierbarkeit der Plattform, die breite Gerätekompatibilität und die im Vergleich zu iOS geringeren Entwicklungskosten tragen zu ihrer beschleunigten Akzeptanz in Unternehmen unterschiedlicher Größe bei.

- Nach Anwendung

Der Markt ist nach Anwendungsbereichen in Liquiditäts- und Cash-Management, Investmentmanagement, Schuldenmanagement, Finanzrisikomanagement, Compliance-Management, Steuerplanung und weitere Bereiche unterteilt. Das Segment Liquiditäts- und Cash-Management hatte 2024 den größten Umsatzanteil, da Unternehmen der Echtzeitüberwachung ihrer Cash-Positionen und der Optimierung des Betriebskapitals Priorität einräumen. Diese Lösungen unterstützen Treasurer dabei, ausreichend Liquidität aufrechtzuerhalten, kurzfristige Investitionen zu verwalten und interne Cashflows zu optimieren, um die Betriebskontinuität zu gewährleisten. Die zunehmende Komplexität von Finanztransaktionen und der Bedarf an automatisierten Cash-Prognosen treiben die Einführung liquiditätsorientierter Treasury-Software weiter voran.

Das Segment Finanzrisikomanagement wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, getrieben durch die zunehmende Exposition gegenüber Markt-, Kredit- und Betriebsrisiken. Unternehmen nutzen zunehmend Treasury-Lösungen, um Risiken im Zusammenhang mit Währungsschwankungen, Zinssätzen und Kontrahenten zu modellieren, zu überwachen und zu minimieren. Verbesserte Analyse-, Szenarioplanungs- und Compliance-Tools, die in diese Systeme integriert sind, stärken das Vertrauen in strategische Entscheidungen und fördern eine schnelle Einführung in allen Branchen.

- Nach Bereitstellungsmodus

Der Markt für Treasury-Software ist nach Bereitstellungsmodus in On-Premise und Cloud unterteilt. Das On-Premise-Segment dominierte den Markt mit einem Anteil von 52,8 % im Jahr 2024, was auf den Wunsch der Unternehmen nach vollständiger Kontrolle über sensible Finanzdaten, Sicherheitskonformität und Anpassungsmöglichkeiten zurückzuführen ist. Viele große Unternehmen investieren weiterhin in On-Premise-Lösungen, um die interne Governance aufrechtzuerhalten und eine umfassende Integration in die bestehende IT-Infrastruktur zu gewährleisten. Die Zuverlässigkeit und Stabilität von On-Premise-Bereitstellungen machen sie zur bevorzugten Wahl für unternehmenskritische Treasury-Operationen.

Das Cloud-Segment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die steigende Nachfrage nach skalierbaren, zugänglichen und kosteneffizienten Treasury-Lösungen. Cloud-basierte Systeme bieten Fernzugriff, Echtzeit-Reporting und nahtlose Updates und ermöglichen Unternehmen so eine schnelle Anpassung an dynamische Finanzumgebungen. Insbesondere kleine und mittelständische Unternehmen setzen zunehmend auf Cloud-Implementierungen, um den IT-Aufwand zu senken und gleichzeitig unternehmensweite Funktionalitäten zu erhalten.

- Nach Unternehmensgröße

Der Markt ist nach Unternehmensgröße in Großunternehmen sowie kleine und mittlere Unternehmen (KMU) unterteilt. Das Segment der Großunternehmen dominierte 2024 den Marktumsatz, da diese Unternehmen komplexe Treasury-Operationen über verschiedene Regionen und Währungen hinweg verwalten. Großunternehmen profitieren von fortschrittlichen Treasury-Lösungen zur Konsolidierung des Cash Managements, zur Automatisierung von Zahlungen, zur Risikominimierung und zur Einhaltung globaler Finanzvorschriften. Ihre hohe Investitionskapazität ermöglicht die Anpassung und Integration von Treasury-Software in andere Unternehmenssysteme und fördert so die Akzeptanz.

Das KMU-Segment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, getrieben durch die zunehmende Bekanntheit digitaler Treasury-Tools und den Bedarf an effizientem Cash- und Risikomanagement. KMU setzen zunehmend auf skalierbare und kostengünstige Lösungen, um die betriebliche Effizienz zu steigern, Echtzeit-Einblicke in Cashflows zu erhalten und die Entscheidungsfindung zu verbessern. Cloudbasierte Angebote und Abonnement-Preismodelle erleichtern die Einführung auch bei kleineren Unternehmen mit begrenzten IT-Ressourcen.

- Nach Vertikal

Der Markt für Treasury-Software ist branchenspezifisch in die Bereiche Banken, Finanzdienstleistungen und Versicherungen (BFSI), öffentliche Verwaltung, Fertigung, Gesundheitswesen, Konsumgüter, Chemie, Energie und andere unterteilt. Das BFSI-Segment dominierte den Markt im Jahr 2024, da der Sektor große Mengen an Finanztransaktionen, Liquidität und Compliance-Anforderungen verwalten muss. Banken und Finanzinstitute sind stark auf Treasury-Lösungen angewiesen, um ihr Cash Management, ihre Anlagegeschäfte und ihr Risikomonitoring zu optimieren und so die Einhaltung gesetzlicher Vorschriften und die betriebliche Effizienz zu gewährleisten. Fortschrittliche Analyse- und Echtzeitüberwachungsfunktionen machen diese Lösungen für die BFSI-Branche unverzichtbar.

Das Fertigungssegment wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, getrieben durch die zunehmende Komplexität von Lieferketten, internationalen Transaktionen und Anforderungen an das Cashflow-Management. Hersteller setzen Treasury-Software ein, um das Betriebskapital zu optimieren, das Wechselkursrisiko zu steuern und die Finanzplanung insgesamt zu verbessern. Die Integration in ERP-Systeme und die automatisierte Zahlungsabwicklung steigern die Effizienz zusätzlich und fördern die schnelle Akzeptanz in der gesamten Branche.

Regionale Analyse des Treasury-Softwaremarktes

- Nordamerika dominierte den Markt für Treasury-Software mit dem größten Umsatzanteil von 41,55 % im Jahr 2024, angetrieben durch eine wachsende Nachfrage nach digitalem Finanzmanagement und Automatisierung in Unternehmen

- Unternehmen in der Region legen großen Wert auf die Echtzeit-Überwachung des Cashflows, das Risikomanagement und die optimierte Compliance, die Treasury-Lösungen bieten.

- Die breite Akzeptanz wird durch technologisch fortschrittliche Infrastruktur, hohe IT-Ausgaben und die Präsenz großer Finanzinstitute weiter unterstützt, die Treasury-Software als Schlüsselinstrument für effiziente Finanzgeschäfte von Unternehmen etablieren.

Markteinblick in die US-Finanzsoftware

Der US-Markt für Treasury-Software erzielte 2024 den größten Umsatzanteil in Nordamerika, angetrieben durch die schnelle digitale Transformation und die Einführung automatisierter Treasury-Lösungen. Unternehmen legen zunehmend Wert auf Liquiditätsoptimierung, Investitionsüberwachung und Risikominimierung durch integrierte Softwareplattformen. Die steigende Nachfrage nach Cloud-basierten Lösungen, mobilem Zugriff und fortschrittlicher Analytik für Echtzeit-Entscheidungen treibt das Marktwachstum weiter voran. Darüber hinaus tragen die Präsenz führender Softwareanbieter und der Fokus des Landes auf Fintech-Innovationen erheblich zum Marktwachstum bei.

Einblicke in den europäischen Treasury-Softwaremarkt

Der europäische Markt für Treasury-Software wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen, vor allem aufgrund regulatorischer Anforderungen und des steigenden Bedarfs an mehr finanzieller Transparenz in Unternehmen. Unternehmen setzen Treasury-Lösungen ein, um ihr Cash Management zu optimieren, finanzielle Risiken zu managen und die Investitionskontrolle zu verbessern. Der Anstieg grenzüberschreitender Transaktionen und die zunehmende Digitalisierung im Unternehmenssektor fördern den Einsatz von Treasury-Software. Europäische Unternehmen integrieren Treasury-Systeme zudem in ERP- und Finanzberichterstattungsplattformen, um Effizienz und Compliance zu gewährleisten.

Markteinblick in die britische Treasury-Software

Der britische Markt für Treasury-Software wird im Prognosezeitraum voraussichtlich mit einer bemerkenswerten jährlichen Wachstumsrate wachsen, angetrieben durch die Nachfrage nach robustem Finanzrisikomanagement und automatisierten Liquiditätslösungen. Unternehmen konzentrieren sich auf Echtzeit-Cash-Transparenz, Einhaltung gesetzlicher Vorschriften und effiziente Mittelzuweisung, was die Akzeptanz von Treasury-Software fördert. Das starke britische Fintech-Ökosystem, die digitale Bankinfrastruktur und die weit verbreitete Nutzung von Cloud-Lösungen unterstützen das Marktwachstum bei Großunternehmen und KMU zusätzlich.

Markteinblick in Treasury-Software in Deutschland

Der deutsche Markt für Treasury-Software wird im Prognosezeitraum voraussichtlich mit einer deutlichen jährlichen Wachstumsrate wachsen. Dies wird durch die Einführung fortschrittlicher digitaler Finanzlösungen und den Fokus auf Risikomanagement und Compliance vorangetrieben. Unternehmen setzen zunehmend Treasury-Software ein, um ihre Liquidität zu optimieren, Anlageportfolios zu überwachen und Berichtsprozesse zu automatisieren. Deutschlands starke industrielle Basis, der Schwerpunkt auf Digitalisierung und strenge Finanzvorschriften fördern den Einsatz von Treasury-Lösungen sowohl im Unternehmens- als auch im öffentlichen Sektor.

Markteinblicke für Treasury-Software im asiatisch-pazifischen Raum

Der Markt für Treasury-Software im asiatisch-pazifischen Raum wird im Prognosezeitraum von 2025 bis 2032 voraussichtlich die höchste jährliche Wachstumsrate aufweisen. Dies ist auf die zunehmende Urbanisierung, die zunehmende Digitalisierung und den technologischen Fortschritt in Ländern wie China, Japan und Indien zurückzuführen. Unternehmen in der Region setzen zunehmend auf cloudbasierte und mobil zugängliche Treasury-Lösungen, um ihr Liquiditätsmanagement und ihre finanzielle Risikokontrolle zu verbessern. Regierungsinitiativen zur Förderung des digitalen Finanzwesens sowie das Aufkommen regionaler Softwareanbieter treiben die Einführung von Treasury-Software branchenübergreifend voran.

Markteinblick in die japanische Treasury-Software

Der japanische Markt für Treasury-Software gewinnt dank der fortschrittlichen technologischen Infrastruktur des Landes und der zunehmenden Automatisierung von Finanzgeschäften an Dynamik. Unternehmen nutzen Treasury-Lösungen zur Cashflow-Optimierung, Investitionsüberwachung und Einhaltung gesetzlicher Vorschriften. Die Integration von Treasury-Software in Enterprise-Resource-Planning- und Finanzberichterstattungssysteme treibt das Wachstum voran, während die Nachfrage nach benutzerfreundlichen und sicheren Lösungen sowohl bei Großunternehmen als auch bei KMU weiter steigt.

Markteinblick in die chinesische Treasury-Software

Der chinesische Markt für Treasury-Software erzielte 2024 den größten Umsatzanteil im asiatisch-pazifischen Raum. Dies ist auf die rasante Urbanisierung, den technologischen Wandel und das Wachstum der Finanzgeschäfte von Unternehmen zurückzuführen. Unternehmen implementieren Treasury-Software für effizientes Liquiditätsmanagement, Investitionsüberwachung und Risikominimierung. Der starke Trend hin zum digitalen Finanzwesen, gepaart mit der Verfügbarkeit kostengünstiger Lösungen nationaler und globaler Anbieter, treibt das Marktwachstum in verschiedenen Sektoren voran, darunter Fertigung, Finanz- und Finanzdienstleistungen sowie Konsumgüter.

Marktanteil von Treasury-Software

Die Treasury-Softwarebranche wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Finastra (Großbritannien)

- ZenTreasury Ltd (Finnland)

- Emphasys Software (USA)

- SS&C Technologies, Inc. (USA)

- CAPIX (Australien)

- Adenza (Großbritannien und USA)

- Coupa Software Inc. (USA)

- DataLog Finance (Frankreich und Singapur)

- FIS (USA)

- Access Systems (UK) Limited (Großbritannien)

- Treasury Software Corp. (USA)

- MUREX SAS (Frankreich)

- EdgeVerve Systems Limited (Indien)

- Financial Sciences Corp. (USA)

- Broadridge Financial Solutions, Inc. (USA)

- CashAnalytics (Irland)

- Oracle (USA)

- Fiserv, Inc. (USA)

- ION (Großbritannien)

- SAP (Deutschland)

- Solomon Software (USA)

- ABM CLOUD (Georgien)

Neueste Entwicklungen auf dem globalen Markt für Treasury-Software

- Im Juni 2023 führte ZenTreasury wesentliche Verbesserungen seiner IFRS 16 Lease Accounting Software ein und optimierte damit die Compliance-Prozesse für Unternehmen. Die aktualisierte Software bietet erweiterte Automatisierungsfunktionen und ermöglicht die Echtzeitverfolgung und -berichterstattung von Leasingverpflichtungen. Diese Verbesserung reduziert die manuelle Dateneingabe und minimiert das Fehlerrisiko, wodurch eine präzise Finanzberichterstattung gewährleistet wird. Durch die nahtlose Integration in bestehende Enterprise-Resource-Planning-Systeme (ERP) ermöglicht die Software reibungslosere Audits und steigert die allgemeine Betriebseffizienz. Das Upgrade positioniert ZenTreasury als führenden Anbieter umfassender Lösungen für die Leasingbuchhaltung, die den sich entwickelnden regulatorischen Anforderungen gerecht werden.

- Im Mai 2023 erweiterten Treasury Intelligence Solutions (TIS) und Delega ihre Zusammenarbeit, um die Funktionalitäten des elektronischen Bankkontomanagements (eBAM) zu verbessern. Die Integration bietet nun erweiterte Funktionen für die Verwaltung von Zeichnungsrechten über mehrere Bankverbindungen hinweg. Diese Entwicklung ermöglicht es Unternehmens-Treasurern, die Erstellung, Änderung und Löschung von Zeichnungsdatensätzen zu automatisieren und so manuelle Eingriffe und die damit verbundenen Risiken deutlich zu reduzieren. Die erweiterten eBAM-Funktionen gewährleisten die Einhaltung globaler Bankvorschriften und verbessern die Effizienz der Treasury-Operationen. Diese strategische Erweiterung unterstreicht das Engagement von TIS und Delega, innovative Lösungen für modernes Treasury Management anzubieten.

- Im April 2023 führte ZenTreasury ein Multiwährungsmodul in seiner IFRS 16 Lease Accounting Software ein, um die komplexen Herausforderungen multinationaler Konzerne zu bewältigen. Diese neue Funktion ermöglicht es Unternehmen, Leasingverpflichtungen in verschiedenen Währungen auf einer einzigen Plattform zu verwalten. Das Modul automatisiert Währungsumrechnungen und gewährleistet eine präzise Finanzberichterstattung gemäß internationalen Rechnungslegungsstandards. Durch die Zentralisierung von Leasingdaten und die Bereitstellung von Echtzeit-Einblicken verbessert das Multiwährungsmodul Entscheidungsprozesse und unterstützt die globale Finanzkonsolidierung. Diese Erweiterung unterstreicht ZenTreasurys Engagement, skalierbare Lösungen für Unternehmen in unterschiedlichen Finanzumfeldern anzubieten.

- Im März 2022 stellten ZenTreasury und sein lokaler Partner MCA Redington Gulf eine Leasingbuchhaltungssoftware für IFRS-16 zur Verfügung. Kunden müssen keine Daten mehr aus mehreren Quellen importieren und auf mehreren Plattformen speichern. Alles wird mit einer einzigen Software erledigt. Diese Integration vereinfacht Arbeitsabläufe, reduziert Datenredundanz und erhöht die Datengenauigkeit, was zu effizienteren Leasingbuchhaltungsprozessen führt. Der umfassende Ansatz der Lösung rationalisiert Compliance- und Berichtsaufgaben und ermöglicht es Unternehmen, sich stärker auf das strategische Finanzmanagement zu konzentrieren.

- Im September 2022 haben TIS und Delega zusammengearbeitet, um Kunden ein automatisiertes Multi-Bank-Unterschriftsberechtigungsmanagement der nächsten Generation bereitzustellen. Dank der Vereinbarung können Kunden von TIS und Delega die Vorteile der elektronischen Bankkontoverwaltung (eBAM) der nächsten Generation nutzen. Diese Zusammenarbeit ermöglicht es Unternehmen, die Verwaltung von Bankkontounterzeichnern zu automatisieren und zu zentralisieren, was die Effizienz steigert und das Fehlerrisiko reduziert. Durch die Optimierung des Prozesses können Unternehmen die Einhaltung von Bankvorschriften verbessern und die Sicherheit ihrer Finanzgeschäfte erhöhen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.