Global Thin And Ultra Thin Films Market

Marktgröße in Milliarden USD

CAGR :

%

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

USD

5,313.17 Million

USD

22,812.53 Million

2021

2029

| 2022 –2029 | |

| USD 5,313.17 Million | |

| USD 22,812.53 Million | |

|

|

|

|

Globaler Markt für dünne und ultradünne Filme, nach Beschichtungsverfahren (gasförmiger Zustand, Lösungszustand, geschmolzener oder halbgeschmolzener Zustand), Typ (dünn, ultradünn), Abscheidungstechniken (physikalische Abscheidung, chemische Abscheidung), Anwendung (Elektronik und Halbleiter, erneuerbare Energien, Gesundheits- und biomedizinische Anwendungen, Automobil, Luft- und Raumfahrt und Verteidigung, andere) – Branchentrends und Prognose bis 2029

Marktanalyse und Größe

Dünne und ultradünne Filme werden häufig verwendet, da sie leicht sind und sich zum Beschichten anderer Materialien, darunter Metall oder Kunststoff, verwenden lassen. Diese Filme werden in vielen Bereichen eingesetzt, unter anderem in der Photovoltaik (PV), im Korrosionsschutz, bei Batterien, Brennstoffzellen sowie in Farben und Lacken .

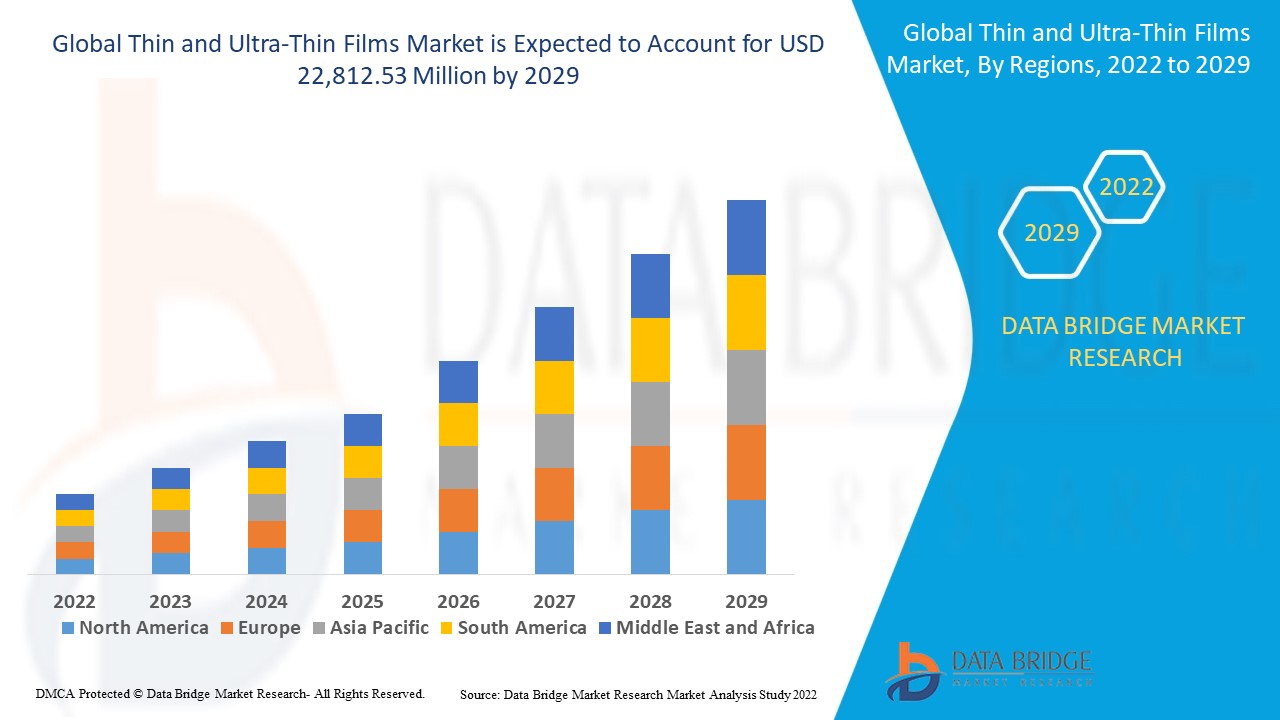

Der globale Markt für dünne und ultradünne Filme wurde im Jahr 2021 auf 5.313,17 Millionen USD geschätzt und soll bis 2029 22.812,53 Millionen USD erreichen, was einer durchschnittlichen jährlichen Wachstumsrate von 15,40 % im Prognosezeitraum 2022–2029 entspricht. Elektronik und Halbleiter machen das Anwendungssegment im jeweiligen Markt aus, da sie häufig zum Umhüllen und Beschichten von Halbleitermaterialien verwendet werden. Der vom Marktforschungsteam von Data Bridge zusammengestellte Marktbericht umfasst eine eingehende Expertenanalyse, Import-/Exportanalyse, Preisanalyse, Produktionsverbrauchsanalyse und PESTLE-Analyse.

Marktdefinition

Als dünne Filme werden Filme bezeichnet, die eine Dicke von weniger als 1 μm aufweisen. Diese Filme sind grundsätzlich Materialschichten, die auf einer beliebigen Oberfläche abgelagert werden. Ultradünne Filme sind Filme, die mithilfe komplexer chemischer und physikalischer Ablagerungstechniken, darunter Gasphasenvorläufer und Plasmaverfahren, abgelagert werden.

Berichtsumfang und Marktsegmentierung

|

Berichtsmetrik |

Details |

|

Prognosezeitraum |

2022 bis 2029 |

|

Basisjahr |

2021 |

|

Historische Jahre |

2020 (Anpassbar auf 2019 – 2014) |

|

Quantitative Einheiten |

Umsatz in Mio. USD, Mengen in Einheiten, Preise in USD |

|

Abgedeckte Segmente |

Beschichtungsverfahren (gasförmiger Zustand, Lösungszustand, geschmolzener oder halbgeschmolzener Zustand), Typ (dünn, ultradünn), Abscheidungstechniken (physikalische Abscheidung, chemische Abscheidung), Anwendung (Elektronik und Halbleiter, erneuerbare Energien, Gesundheits- und biomedizinische Anwendungen, Automobil, Luft- und Raumfahrt und Verteidigung, andere) |

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Abgedeckte Marktteilnehmer |

American Elements (USA), LEW TECHNIQUES LTD (Großbritannien), Denton Vacuum (USA), KANEKA CORPORATION (Japan), Umicore (Belgien), Materion Corporation (USA), AIXTRON (Deutschland), Kurt J. Lesker Company (USA), Vital Materials Co., Limited (China), AJA INTERNATIONAL, Inc. (USA), Praxair ST Technology, Inc. (USA), PVD Products, Inc. (USA), GEOMATEC Co., Ltd. (Japan), INTEVAC, INC. (USA), Plasma-Therm (Großbritannien), Arrow Thin Films, Inc. (USA), Super Conductor Materials, Inc. (USA), Angstrom Engineering Inc. (Kanada), ThinFilms Inc. (USA), Orange Thin Films (Niederlande) und andere |

|

Marktchancen |

|

Marktdynamik für dünne und ultradünne Filme

In diesem Abschnitt geht es um das Verständnis der Markttreiber, Vorteile, Chancen, Einschränkungen und Herausforderungen. All dies wird im Folgenden ausführlich erläutert:

Treiber

- Zunahme der Miniaturisierung

Die zunehmende Miniaturisierung von Halbleitern ist einer der Hauptfaktoren, die das Wachstum des Marktes für dünne und ultradünne Filme vorantreiben. Auch die Ausweitung der Nanotechnologie in verschiedenen Bereichen der Materialwissenschaft wirkt sich positiv auf den Markt aus.

- Nachfrage aus verschiedenen Branchen

Die steigende Nachfrage nach dünnen und ultradünnen Filmen in zahlreichen Branchen wie Halbleitern, Medizin und Verpackung beschleunigt das Marktwachstum. Verschiedene Techniken zur Abscheidung dünner Filme unterstützen die Expansion des Marktes.

- Fortschritte in den Filmen

Der Anstieg der Innovation und Weiterentwicklung durch führende Unternehmen, die ihre Produkte patentieren lassen, beeinflusst den Markt zusätzlich. Die steigende Nachfrage nach diesen Folien aufgrund ihrer hohen Flexibilität treibt den Markt an.

Darüber hinaus wirken sich die schnelle Urbanisierung, veränderte Lebensstile, ein Anstieg der Investitionen und höhere Verbraucherausgaben positiv auf den Markt für dünne und ultradünne Filme aus.

Gelegenheiten

Darüber hinaus bietet das revolutionäre Wachstum in der Nanotechnologie den Marktakteuren im Prognosezeitraum von 2022 bis 2029 lukrative Möglichkeiten. Darüber hinaus wird ein Anstieg der Investitionen den Markt weiter ausbauen.

Einschränkungen/Herausforderungen

Andererseits wird erwartet, dass der Mangel an Umwandlungseffizienz bei Siliziumzellen das Marktwachstum behindert. Außerdem wird erwartet, dass mangelndes Bewusstsein den Markt für dünne und ultradünne Filme im Prognosezeitraum 2022-2029 vor Herausforderungen stellen wird.

Dieser Marktbericht für dünne und ultradünne Filme enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neu entstehende Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt für dünne und ultradünne Filme zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Auswirkungen von COVID-19 auf den Markt für dünne und ultradünne Filme

COVID-19 hat den Markt für dünne und ultradünne Filme beeinflusst. Die begrenzten Investitionskosten und der Mangel an Mitarbeitern behinderten den Verkauf und die Produktion von Displaytechnologie für elektronisches Papier (E-Paper). Regierung und wichtige Marktakteure ergriffen jedoch neue Sicherheitsmaßnahmen zur Entwicklung der Verfahren. Die Fortschritte in der Technologie steigerten die Verkaufszahlen der dünnen und ultradünnen Filme, da sie das richtige Publikum ansprachen. Der weltweite Anstieg der Verkäufe von Unterhaltungselektronik dürfte das Marktwachstum im Postpandemie-Szenario weiter vorantreiben.

Globaler Marktumfang und Marktgröße für dünne und ultradünne Filme

Der Markt für dünne und ultradünne Filme ist nach Beschichtungsverfahren, Typ, Abscheidungstechniken und Anwendung segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Beschichtungsverfahren

- Gasförmiger Zustand

- Lösungsstatus

- Geschmolzener oder halbgeschmolzener Zustand

Typ

- Dünn

- Ultradünn

Abscheidungstechniken

- Physikalische Ablagerung

- Chemische Abscheidung

Anwendung

- Elektronik und Halbleiter

- Erneuerbare Energien

- Gesundheitswesen und biomedizinische Anwendungen

- Automobilindustrie

- Luft- und Raumfahrt und Verteidigung

- Sonstiges

Regionale Analyse/Einblicke zum Markt für dünne und ultradünne Filme

Der Markt für dünne und ultradünne Filme wird analysiert und es werden Einblicke in die Marktgröße und -trends nach Land, Beschichtungsverfahren, Typ, Abscheidungstechniken und Anwendung wie oben angegeben bereitgestellt.

Die im Marktbericht für dünne und ultradünne Filme abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Israel, Ägypten, Südafrika, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Der asiatisch-pazifische Raum (APAC) dominiert den Markt für dünne und ultradünne Filme aufgrund der zunehmenden Akzeptanz der Technologie in der Region.

Für Nordamerika wird im Prognosezeitraum von 2022 bis 2029 ein deutliches Wachstum erwartet, was auf die Einführung neuer Technologien und den zunehmenden Druck zur Reduzierung der CO2-Emissionen in der Region zurückzuführen ist.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Bereitstellung von Prognoseanalysen der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Wettbewerbsumfeld und Markt für dünne und ultradünne Filme

Die Wettbewerbslandschaft auf dem Markt für dünne und ultradünne Filme liefert Details nach Wettbewerbern. Die enthaltenen Details sind Unternehmensübersicht, Unternehmensfinanzen, erzielter Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt für dünne und ultradünne Filme.

Einige der wichtigsten Akteure auf dem Markt für dünne und ultradünne Filme sind

- Amerikanische Elemente (USA)

- LEW TECHNIQUES LTD (Großbritannien)

- Denton Vacuum (USA)

- KANEKA CORPORATION (Japan)

- Umicore (Belgien)

- Materion Corporation (USA)

- AIXTRON (Deutschland)

- Kurt J. Lesker Company (USA)

- Vital Materials Co., Limited (China)

- AJA INTERNATIONAL, Inc. (USA)

- Praxair ST Technology, Inc. (USA)

- PVD Products, Inc. (USA)

- GEOMATEC Co., Ltd. (Japan)

- INTEVAC, INC. (USA)

- Plasma-Therm (Großbritannien)

- Arrow Thin Films, Inc. (USA)

- Super Conductor Materials, Inc. (USA)

- Angstrom Engineering Inc. (Kanada)

- ThinFilms Inc. (USA)

- Orange Thin Films (Niederlande)

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COATING METHODS TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 IMPACT ANALYSIS OF COVID-19

5.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

5.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

5.3 IMPACT ON DEMAND

5.4 IMPACT ON SUPPLY CHAIN

5.5 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN WIND ENERGY

6.1.2 GROWING DEMAND FOR CONSUMERS ELECTRONIC

6.1.3 INCREASING USE OF THIN FILM FOR MEDICAL DEVICES

6.1.4 INCREASING ADOPTION OF SOLAR ENERGY

6.2 RESTRAINT

6.2.1 LACK OF STANDARDIZATION

6.3 OPPORTUNITIES

6.3.1 GROWING ADVANCEMENT IN NANOTECHNOLOGY

6.3.2 INCREASING DEMAND FROM THE AEROSPACE AND DEFENSE INDUSTRY FOR THIN FILM APPLICATIONS

6.3.3 GOVERNMENT INITIATIVES TO REDUCE CARBON EMISSION

6.4 CHALLENGE

6.4.1 POOR CONVERSION EFFICIENCY OF THIN FILM SOLAR CELLS

7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS

7.1 OVERVIEW

7.2 GASEOUS STATE

7.3 SOLUTIONS STATE

7.4 MOLTEN OR SEMI-MOLTEN STATE

8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 THIN

8.3 ULTRA-THIN

9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES

9.1 OVERVIEW

9.2 PHYSICAL DEPOSITION

9.2.1 TYPE

9.2.1.1 Evaporation Techniques

9.2.1.2 Sputtering Deposition

9.2.1.3 Pulsed Laser Deposition (PLD)

9.2.1.4 Others

9.2.2 MATERIAL

9.2.2.1 Sputtering Targets

9.2.2.2 Pellets

9.2.2.3 Others

9.3 CHEMICAL DEPOSITION

9.3.1 TYPE

9.3.1.1 Chemical Vapor Deposition (CVD)

9.3.1.2 Sol-Gel Deposition

9.3.1.3 Plating

9.3.1.4 Others

9.3.2 MATERIAL

9.3.2.1 Metal Halides

9.3.2.2 Metal Hydrides

9.3.2.3 Reactive Gases

9.3.2.4 Organometallic Compounds

9.3.2.5 Metal Salts

9.3.2.6 Others

10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ELECTRONICS & SEMICONDUCTOR

10.2.1 FULLY TRANSPARENT ELECTRICAL CONDUCTORS

10.2.2 INTEGRATED CIRCUIT FABRICATION

10.2.3 THIN FILM BATTERIES

10.2.4 OTHERS

10.3 RENEWABLE ENERGY

10.3.1 SOLAR

10.3.2 WIND

10.4 HEALTHCARE AND BIOMEDICAL APPLICATIONS

10.5 AUTOMOTIVE

10.6 AEROSPACE & DEFENSE

10.7 OTHERS

11 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY GEOGRAPHY

11.1 OVERVIEW

11.2 ASIA-PACIFIC

11.2.1 CHINA

11.2.2 INDIA

11.2.3 SOUTH KOREA

11.2.4 JAPAN

11.2.5 AUSTRALIA

11.2.6 SINGAPORE

11.2.7 THAILAND

11.2.8 MALAYSIA

11.2.9 INDONESIA

11.2.10 PHILIPPINES

11.2.11 REST OF ASIA-PACIFIC

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 EUROPE

11.4.1 GERMANY

11.4.2 FRANCE

11.4.3 RUSSIA

11.4.4 U.K.

11.4.5 ITALY

11.4.6 SPAIN

11.4.7 NETHERLANDS

11.4.8 BELGIUM

11.4.9 SWITZERLAND

11.4.10 TURKEY

11.4.11 REST OF EUROPE

11.5 MIDDLE EAST & AFRICA

11.5.1 ISRAEL

11.5.2 SAUDI ARABIA

11.5.3 SOUTH AFRICA

11.5.4 U.A.E.

11.5.5 EGYPT

11.5.6 REST OF MIDDLE EAST & AFRICA

11.6 SOUTH AMERICA

11.6.1 BRAZIL

11.6.2 ARGENTINA

11.6.3 REST OF SOUTH AMERICA

12 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 KANEKA CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 UMICORE

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 MATERION CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 PRAXAIR S.T. TECHNOLOGY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 INTEVAC, INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AIXTRON

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 AJA INTERNATIONAL, INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 AMERICAN ELEMENTS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 ANGSTROM ENGINEERING INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 ARROW THIN FILMS, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 DENTON VACUUM

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 GEOMATEC CO., LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 KURT J. LESKER COMPANY

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENT

14.14 LEW TECHNIQUES LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 ORANGE THIN FILMS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENT

14.16 PLASMA-THERM

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENT

14.17 PVD PRODUCTS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENT

14.18 SUPER CONDUCTOR MATERIALS, INC.

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENT

14.19 THINFILMS INC.

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENT

14.2 VITAL MATERIALS CO., LIMITED

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Tabellenverzeichnis

LIST OF TABLES

TABLE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, MARKET FORECAST 2020-2027 (USD MILLION) 65

TABLE 2 GLOBAL GASEOUS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 65

TABLE 3 GLOBAL SOLUTIONS STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 66

TABLE 4 GLOBAL MOLTEN OR SEMI-MOLTEN STATE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 67

TABLE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, MARKET FORECAST 2020-2027 (USD MILLION) 70

TABLE 6 GLOBAL THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 70

TABLE 7 GLOBAL ULTRA-THIN IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 71

TABLE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, MARKET FORECAST 2020-2027 (USD MILLION) 74

TABLE 9 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 74

TABLE 10 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 74

TABLE 11 GLOBAL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 75

TABLE 12 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 76

TABLE 13 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE,2018-2027, (USD MILLION) 76

TABLE 14 GLOBAL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL,2018-2027, (USD MILLION) 78

TABLE 15 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, MARKET FORECAST 2020-2027 (USD MILLION) 82

TABLE 16 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 82

TABLE 17 GLOBAL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 83

TABLE 18 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 84

TABLE 19 GLOBAL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION,2018-2027, (USD MILLION) 84

TABLE 20 GLOBAL HEALTHCARE AND BIOMEDICAL APPLICATIONS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 21 GLOBAL AUTOMOTIVE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 85

TABLE 22 GLOBAL AEROSPACE & DEFENSE IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 23 GLOBAL OTHERS IN THIN AND ULTRA-THIN FILMS MARKET, BY REGION,2018-2027, (USD MILLION) 86

TABLE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET, BY REGION, 2018-2027 (USD MILLION) 92

TABLE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 96

TABLE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 96

TABLE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 96

TABLE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 97

TABLE 29 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 30 ASIA-PACIFIC PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 97

TABLE 31 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 97

TABLE 32 ASIA-PACIFIC CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 98

TABLE 33 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 34 ASIA-PACIFIC ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 98

TABLE 35 ASIA-PACIFIC RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 99

TABLE 36 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 100

TABLE 37 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 100

TABLE 38 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 100

TABLE 39 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 40 CHINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 101

TABLE 41 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 101

TABLE 42 CHINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 102

TABLE 43 CHINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 44 CHINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 45 CHINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 102

TABLE 46 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 104

TABLE 47 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 104

TABLE 48 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 104

TABLE 49 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 50 INDIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 105

TABLE 51 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 105

TABLE 52 INDIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 106

TABLE 53 INDIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 54 INDIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 55 INDIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 106

TABLE 56 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 108

TABLE 57 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 108

TABLE 58 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 108

TABLE 59 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 60 SOUTH KOREA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 109

TABLE 61 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 109

TABLE 62 SOUTH KOREA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 110

TABLE 63 SOUTH KOREA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 64 SOUTH KOREA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 110

TABLE 65 SOUTH KOREA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 111

TABLE 66 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 112

TABLE 67 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 112

TABLE 68 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 112

TABLE 69 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 70 JAPAN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 113

TABLE 71 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 113

TABLE 72 JAPAN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 114

TABLE 73 JAPAN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 74 JAPAN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 75 JAPAN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 114

TABLE 76 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 116

TABLE 77 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 116

TABLE 78 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 116

TABLE 79 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 80 AUSTRALIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 117

TABLE 81 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 117

TABLE 82 AUSTRALIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 118

TABLE 83 AUSTRALIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 84 AUSTRALIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 118

TABLE 85 AUSTRALIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 119

TABLE 86 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 120

TABLE 87 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 120

TABLE 88 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 120

TABLE 89 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 90 SINGAPORE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 121

TABLE 91 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 121

TABLE 92 SINGAPORE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 122

TABLE 93 SINGAPORE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 94 SINGAPORE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 122

TABLE 95 SINGAPORE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 123

TABLE 96 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 124

TABLE 97 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 124

TABLE 98 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 124

TABLE 99 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 100 THAILAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 125

TABLE 101 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 125

TABLE 102 THAILAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 126

TABLE 103 THAILAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 104 THAILAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 126

TABLE 105 THAILAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 127

TABLE 106 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 128

TABLE 107 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 128

TABLE 108 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 128

TABLE 109 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 110 MALAYSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 129

TABLE 111 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 129

TABLE 112 MALAYSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 130

TABLE 113 MALAYSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 114 MALAYSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 130

TABLE 115 MALAYSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 131

TABLE 116 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 132

TABLE 117 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 132

TABLE 118 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 132

TABLE 119 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 120 INDONESIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 133

TABLE 121 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 133

TABLE 122 INDONESIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 134

TABLE 123 INDONESIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 124 INDONESIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 134

TABLE 125 INDONESIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 135

TABLE 126 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 136

TABLE 127 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 136

TABLE 128 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 136

TABLE 129 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 130 PHILIPPINES PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 137

TABLE 131 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 137

TABLE 132 PHILIPPINES CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 138

TABLE 133 PHILIPPINES THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 134 PHILIPPINES ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 138

TABLE 135 PHILIPPINES RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 139

TABLE 136 REST OF ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 140

TABLE 137 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 144

TABLE 138 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 144

TABLE 139 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 144

TABLE 140 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 144

TABLE 141 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 142 NORTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 145

TABLE 143 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 145

TABLE 144 NORTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 146

TABLE 145 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 146 NORTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 146

TABLE 147 NORTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 147

TABLE 148 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 148

TABLE 149 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 148

TABLE 150 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 148

TABLE 151 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 152 U.S. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 149

TABLE 153 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 149

TABLE 154 U.S. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 150

TABLE 155 U.S. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 156 U.S. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 150

TABLE 157 U.S. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 151

TABLE 158 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 152

TABLE 159 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 152

TABLE 160 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 152

TABLE 161 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 162 CANADA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 153

TABLE 163 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 153

TABLE 164 CANADA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 154

TABLE 165 CANADA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 166 CANADA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 167 CANADA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 154

TABLE 168 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 156

TABLE 169 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 156

TABLE 170 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 156

TABLE 171 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 172 MEXICO PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 157

TABLE 173 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 157

TABLE 174 MEXICO CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 158

TABLE 175 MEXICO THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 176 MEXICO ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 177 MEXICO RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 158

TABLE 178 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 163

TABLE 179 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 163

TABLE 180 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 163

TABLE 181 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 164

TABLE 182 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 164

TABLE 183 EUROPE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 164

TABLE 184 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 165

TABLE 185 EUROPE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 165

TABLE 186 EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 187 EUROPE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 165

TABLE 188 EUROPE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 166

TABLE 189 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 167

TABLE 190 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 167

TABLE 191 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 167

TABLE 192 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 193 GERMANY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 168

TABLE 194 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 168

TABLE 195 GERMANY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 169

TABLE 196 GERMANY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 197 GERMANY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 169

TABLE 198 GERMANY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 170

TABLE 199 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 171

TABLE 200 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 171

TABLE 201 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 171

TABLE 202 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 203 FRANCE PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 172

TABLE 204 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 172

TABLE 205 FRANCE CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 173

TABLE 206 FRANCE THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 207 FRANCE ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 208 FRANCE RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 173

TABLE 209 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 175

TABLE 210 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 175

TABLE 211 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 175

TABLE 212 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 213 RUSSIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 176

TABLE 214 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 176

TABLE 215 RUSSIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 177

TABLE 216 RUSSIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 217 RUSSIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 218 RUSSIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 177

TABLE 219 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 179

TABLE 220 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 179

TABLE 221 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 179

TABLE 222 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 223 U.K. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 180

TABLE 224 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 180

TABLE 225 U.K. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 181

TABLE 226 U.K. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 227 U.K. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 181

TABLE 228 U.K. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 182

TABLE 229 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 183

TABLE 230 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 183

TABLE 231 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 183

TABLE 232 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 233 ITALY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 184

TABLE 234 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 184

TABLE 235 ITALY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 185

TABLE 236 ITALY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 237 ITALY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 238 ITALY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 185

TABLE 239 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 187

TABLE 240 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 187

TABLE 241 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 187

TABLE 242 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 243 SPAIN PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 188

TABLE 244 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 188

TABLE 245 SPAIN CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 189

TABLE 246 SPAIN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 247 SPAIN ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 248 SPAIN RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 189

TABLE 249 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 191

TABLE 250 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 191

TABLE 251 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 191

TABLE 252 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 253 NETHERLANDS PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 192

TABLE 254 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 192

TABLE 255 NETHERLANDS CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 193

TABLE 256 NETHERLANDS THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 257 NETHERLANDS ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 193

TABLE 258 NETHERLANDS RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 194

TABLE 259 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 195

TABLE 260 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 195

TABLE 261 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 195

TABLE 262 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 263 BELGIUM PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 196

TABLE 264 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 196

TABLE 265 BELGIUM CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 197

TABLE 266 BELGIUM THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 267 BELGIUM ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 197

TABLE 268 BELGIUM RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 198

TABLE 269 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 199

TABLE 270 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 199

TABLE 271 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 199

TABLE 272 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 273 SWITZERLAND PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 200

TABLE 274 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 200

TABLE 275 SWITZERLAND CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 201

TABLE 276 SWITZERLAND THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 277 SWITZERLAND ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 201

TABLE 278 SWITZERLAND RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 202

TABLE 279 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 203

TABLE 280 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 203

TABLE 281 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 203

TABLE 282 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 283 204

TABLE 284 TURKEY PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 204

TABLE 285 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 204

TABLE 286 TURKEY CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 205

TABLE 287 TURKEY THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 288 TURKEY ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 289 TURKEY RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 205

TABLE 290 REST OF EUROPE THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 207

TABLE 291 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 211

TABLE 292 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 211

TABLE 293 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 211

TABLE 294 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 211

TABLE 295 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 296 MIDDLE EAST & AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 212

TABLE 297 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 212

TABLE 298 MIDDLE EAST & AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 213

TABLE 299 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 300 MIDDLE EAST & AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 213

TABLE 301 MIDDLE EAST & AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 214

TABLE 302 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 215

TABLE 303 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 215

TABLE 304 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 215

TABLE 305 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 306 ISRAEL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 216

TABLE 307 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 216

TABLE 308 ISRAEL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 217

TABLE 309 ISRAEL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 310 ISRAEL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 311 ISRAEL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 217

TABLE 312 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 219

TABLE 313 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 219

TABLE 314 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 219

TABLE 315 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 316 SAUDI ARABIA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 220

TABLE 317 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 220

TABLE 318 SAUDI ARABIA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 221

TABLE 319 SAUDI ARABIA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 320 SAUDI ARABIA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 221

TABLE 321 SAUDI ARABIA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 222

TABLE 322 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 223

TABLE 323 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 223

TABLE 324 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 223

TABLE 325 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 326 SOUTH AFRICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 224

TABLE 327 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 224

TABLE 328 SOUTH AFRICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 225

TABLE 329 SOUTH AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 330 SOUTH AFRICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 225

TABLE 331 SOUTH AFRICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 226

TABLE 332 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 227

TABLE 333 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 227

TABLE 334 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 227

TABLE 335 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 336 U.A.E. PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 228

TABLE 337 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 228

TABLE 338 U.A.E. CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 229

TABLE 339 U.A.E. THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 340 U.A.E. ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 341 U.A.E. RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 229

TABLE 342 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 231

TABLE 343 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 231

TABLE 344 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 231

TABLE 345 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 346 EGYPT PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 232

TABLE 347 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 232

TABLE 348 EGYPT CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 233

TABLE 349 EGYPT THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 350 EGYPT ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 351 EGYPT RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 233

TABLE 352 REST OF MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 235

TABLE 353 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COUNTRY, 2018-2027 (USD MILLION) 239

TABLE 354 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 239

TABLE 355 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 239

TABLE 356 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 239

TABLE 357 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 358 SOUTH AMERICA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 240

TABLE 359 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 240

TABLE 360 SOUTH AMERICA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 241

TABLE 361 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 362 SOUTH AMERICA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 241

TABLE 363 SOUTH AMERICA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 242

TABLE 364 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 243

TABLE 365 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 243

TABLE 366 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 243

TABLE 367 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 368 BRAZIL PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 244

TABLE 369 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 244

TABLE 370 BRAZIL CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 245

TABLE 371 BRAZIL THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 372 BRAZIL ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 373 BRAZIL RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 245

TABLE 374 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 247

TABLE 375 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 247

TABLE 376 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY DEPOSITION TECHNIQUES, 2018-2027 (USD MILLION) 247

TABLE 377 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 378 ARGENTINA PHYSICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 248

TABLE 379 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY TYPE, 2018-2027 (USD MILLION) 248

TABLE 380 ARGENTINA CHEMICAL DEPOSITION IN THIN AND ULTRA-THIN FILMS MARKET, BY MATERIAL, 2018-2027 (USD MILLION) 249

TABLE 381 ARGENTINA THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 382 ARGENTINA ELECTRONICS & SEMICONDUCTOR IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 249

TABLE 383 ARGENTINA RENEWABLE ENERGY IN THIN AND ULTRA-THIN FILMS MARKET, BY APPLICATION, 2018-2027 (USD MILLION) 250

TABLE 384 REST OF SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET, BY COATING METHODS, 2018-2027 (USD MILLION) 251

Abbildungsverzeichnis

LIST OF FIGURES

FIGURE 1 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 38

FIGURE 2 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DATA TRIANGULATION 41

FIGURE 3 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DROC ANALYSIS 42

FIGURE 4 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS 43

FIGURE 5 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY RESEARCH ANALYSIS 43

FIGURE 6 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: INTERVIEW DEMOGRAPHICS 44

FIGURE 7 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: DBMR MARKET POSITION GRID 45

FIGURE 8 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: VENDOR SHARE ANALYSIS 46

FIGURE 9 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: MARKET APPLICATION COVERAGE GRID 48

FIGURE 10 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SEGMENTATION 51

FIGURE 11 GROWING DEMAND FOR CONSUMERS ELECTRONIC IS EXPECTED TO DRIVE THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 52

FIGURE 12 GASEOUS STATE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN 2020 & 2027 52

FIGURE 13 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST GROWING REGION IN THE GLOBAL THIN AND ULTRA-THIN FILMS MARKET IN THE FORECAST PERIOD OF 2020 TO 2027 53

FIGURE 14 ASIA-PACIFIC IS THE FASTEST GROWING MARKET FOR THIN AND ULTRA-THIN FILMS MANUFACTURERS IN THE FORECAST PERIOD OF 2020 TO 2027 54

FIGURE 15 DRIVERS, RESTRAINT, OPPORTUNITIES AND CHALLENGE OF GLOBAL THIN AND ULTRA-THIN FILMS MARKET 58

FIGURE 16 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS, 2019 64

FIGURE 17 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY TYPE, 2019 69

FIGURE 18 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY DEPOSITION TECHNIQUES, 2019 73

FIGURE 19 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY APPLICATION, 2019 81

FIGURE 20 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 89

FIGURE 21 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019) 90

FIGURE 22 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2020 & 2027) 90

FIGURE 23 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY GEOGRAPHY (2019 & 2027) 91

FIGURE 24 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 91

FIGURE 25 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 93

FIGURE 26 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 94

FIGURE 27 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 94

FIGURE 28 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 95

FIGURE 29 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 95

FIGURE 30 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 141

FIGURE 31 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 142

FIGURE 32 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 142

FIGURE 33 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 143

FIGURE 34 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 143

FIGURE 35 EUROPE THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 160

FIGURE 36 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 161

FIGURE 37 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 161

FIGURE 38 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 162

FIGURE 39 EUROPE THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 162

FIGURE 40 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 208

FIGURE 41 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 209

FIGURE 42 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 209

FIGURE 43 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 210

FIGURE 44 MIDDLE EAST & AFRICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 210

FIGURE 45 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: SNAPSHOT (2019) 236

FIGURE 46 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019) 237

FIGURE 47 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2020 & 2027) 237

FIGURE 48 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COUNTRY (2019 & 2027) 238

FIGURE 49 SOUTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: BY COATING METHODS (2020-2027) 238

FIGURE 50 GLOBAL THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 252

FIGURE 51 NORTH AMERICA THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 253

FIGURE 52 EUROPE THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 254

FIGURE 53 ASIA-PACIFIC THIN AND ULTRA-THIN FILMS MARKET: COMPANY SHARE 2019 (%) 255

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.