Global Test And Measurement Equipment Market

Marktgröße in Milliarden USD

CAGR :

%

USD

38.91 Billion

USD

54.49 Billion

2024

2032

USD

38.91 Billion

USD

54.49 Billion

2024

2032

| 2025 –2032 | |

| USD 38.91 Billion | |

| USD 54.49 Billion | |

|

|

|

|

Globale Marktsegmentierung für Test- und Messgeräte nach Produkttyp (Allzweck-Testgeräte und mechanische Testgeräte), Servicetyp (Kalibrierungsdienste, Reparaturdienste/Kundendienst und andere Dienste), Endbenutzer (Automobil und Transport, Luft- und Raumfahrt und Verteidigung, IT und Telekommunikation, Bildung und Regierung, Halbleiter und Elektronik, Industrie und Gesundheitswesen) – Branchentrends und Prognose bis 2032

Marktanalyse für Test- und Messgeräte

Der Markt für Test- und Messgeräte verzeichnet ein starkes Wachstum, das durch technologische Fortschritte und eine gestiegene Nachfrage in verschiedenen Branchen wie Automobil, Luft- und Raumfahrt, Telekommunikation und Gesundheitswesen angetrieben wird. Diese Werkzeuge sind für die Gewährleistung der Qualität, Leistung und Zuverlässigkeit elektronischer Geräte und Systeme unerlässlich. Das Marktwachstum wird durch Innovationen in den Bereichen drahtlose Kommunikation, IoT und Automatisierung vorangetrieben, wobei sich die Unternehmen darauf konzentrieren, Lösungen für schnellere und genauere Tests anzubieten. Zu den jüngsten Entwicklungen gehört die Integration künstlicher Intelligenz und maschinellen Lernens für prädiktive Analysen, verbesserte Datengenauigkeit und Echtzeitdiagnose. Darüber hinaus erhöhen der Anstieg komplexer tragbarer elektronischer Geräte und der wachsende Bedarf an effizienten Herstellungsprozessen die Nachfrage nach hochentwickelten Testgeräten weiter. Der Markt verzeichnet auch erhebliche Investitionen führender Akteure wie Keysight Technologies, Rohde & Schwarz und Fortive, die sich auf die Erweiterung ihrer Produktportfolios und die Verbesserung ihres Serviceangebots konzentrieren, um den sich entwickelnden Anforderungen der Branchen weltweit gerecht zu werden.

Marktgröße für Test- und Messgeräte

Der weltweite Markt für Test- und Messgeräte wurde im Jahr 2024 auf 38,91 Milliarden US-Dollar geschätzt und soll bis 2032 54,49 Milliarden US-Dollar erreichen, mit einer durchschnittlichen jährlichen Wachstumsrate von 4,30 % im Prognosezeitraum von 2025 bis 2032. Neben Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch eingehende Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen.

Markttrends für Test- und Messgeräte

„ Schnelle Fortschritte in der Elektronik und Automatisierung“

Der Markt für Test- und Messgeräte erlebt rasante Fortschritte, die durch Innovationen in den Bereichen Elektronik, Automatisierung und Kommunikationstechnologien vorangetrieben werden. Da die Industrie präzisere, effizientere und Echtzeit-Testlösungen fordert, integrieren Unternehmen fortschrittliche Funktionen wie KI, maschinelles Lernen und Cloud-basierte Analysen, um die Testgenauigkeit und -leistung zu verbessern. Ein wichtiger Trend auf dem Markt ist die zunehmende Einführung tragbarer und drahtloser Testgeräte, die eine größere Flexibilität und Bequemlichkeit beim Testen in verschiedenen Umgebungen ermöglichen. Dieser Trend wird durch den wachsenden Bedarf an Vor-Ort-Tests in Branchen wie Telekommunikation, Automobil und Gesundheitswesen vorangetrieben. Mit der Expansion dieser Sektoren wächst die Nachfrage nach fortschrittlichen Test- und Messwerkzeugen weiter und treibt den Marktfortschritt voran.

Berichtsumfang und Marktsegmentierung für Test- und Messgeräte

|

Eigenschaften |

Wichtige Markteinblicke für Test- und Messgeräte |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika |

|

Wichtige Marktteilnehmer |

Fortive (USA), Anritsu (Japan), Rohde & Schwarz (Deutschland), Keysight Technologies (USA), Advantest Corporation (Japan), Viavi Solutions Inc. (USA), Yokogawa India Ltd. (Japan), EXFO Inc. (Kanada), Teledyne Technologies Incorporated (USA), Texas Instruments Incorporated (USA) und National Instruments Corp (USA) |

|

Marktchancen |

|

|

Wertschöpfende Dateninfosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research zusammengestellten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen von Lieferkette und Nachfrage. |

Marktdefinition für Test- und Messgeräte

Unter Test- und Messgeräten versteht man eine Reihe von Instrumenten, mit denen verschiedene physikalische und elektrische Eigenschaften elektronischer Geräte, Systeme und Komponenten gemessen, analysiert und bewertet werden. Diese Werkzeuge sind entscheidend, um die Leistung, Qualität und Zuverlässigkeit von Produkten in Branchen wie Automobil, Luft- und Raumfahrt, Telekommunikation und Gesundheitswesen sicherzustellen. Zu den gängigen Test- und Messgeräten gehören Oszilloskope, Spektrumanalysatoren , Multimeter, Signalgeneratoren und Leistungsanalysatoren. Diese Instrumente unterstützen Ingenieure und Techniker bei Aufgaben wie Fehlersuche, Qualitätskontrolle, Systemintegration sowie Forschung und Entwicklung.

Marktdynamik für Test- und Messgeräte

Treiber

- Zunehmende Nutzung der Automatisierung

Die Integration der Automatisierung in Fertigungs- und Industrieprozesse treibt die Nachfrage nach präzisen und effizienten Testgeräten voran. Da die Industrie zunehmend automatisierte Systeme einsetzt, um die Produktivität zu steigern und die Betriebskosten zu senken, wird die Gewährleistung reibungsloser Abläufe und Produktintegrität von größter Bedeutung. Test- und Messgeräte spielen eine entscheidende Rolle bei der Überwachung und Validierung der Leistung automatisierter Systeme, der frühzeitigen Erkennung potenzieller Probleme und der Gewährleistung der Einhaltung von Qualitätsstandards. Dieser Trend ist besonders ausgeprägt in Branchen wie der Automobil-, Elektronik- und Fertigungsindustrie, in denen hohe Präzision und Konsistenz unerlässlich sind. Folglich ist die zunehmende Einführung von Automatisierung ein wichtiger Treiber für den Markt für Test- und Messgeräte.

- Steigende Elektronikfertigung

Da die Industrie immer komplexere elektronische Geräte herstellt, wird der Bedarf an präzisen und zuverlässigen Testwerkzeugen zur Überprüfung der Produktqualität und -funktionalität immer wichtiger. In Branchen wie der Automobilindustrie, der Telekommunikation und der Unterhaltungselektronik, in denen die Technologie rasch voranschreitet, stellen Test- und Messgeräte sicher, dass die Produkte strenge Leistungsstandards erfüllen und wie vorgesehen funktionieren. Angesichts der zunehmenden Komplexität der Komponenten, von Mikrochips bis hin zu integrierten Schaltkreisen, sind genaue Testwerkzeuge unerlässlich, um potenzielle Defekte zu identifizieren und die Zuverlässigkeit sicherzustellen. Dieser Trend treibt die Marktnachfrage an, da Unternehmen fortschrittliche Testlösungen benötigen, um die Qualitätskontrolle aufrechtzuerhalten und die sich entwickelnden Bedürfnisse der Verbraucher und die gesetzlichen Anforderungen zu erfüllen.

Gelegenheiten

- Nachfrage nach tragbaren und drahtlosen Geräten

Die wachsende Nachfrage nach tragbaren und drahtlosen Testgeräten bietet eine große Marktchance, insbesondere in Branchen, in denen Tests vor Ort erforderlich sind. Da Branchen wie Telekommunikation, Automobilindustrie und Außendienst effiziente und flexible Testlösungen benötigen, sind tragbare und drahtlose Geräte die ideale Lösung. Diese kompakten, mobilen Tools ermöglichen es Technikern, Tests an abgelegenen oder schwierigen Standorten durchzuführen, ohne dass sperrige Aufbauten erforderlich sind. Dies verbessert die Effizienz und reduziert Ausfallzeiten. Da Mobilität, Geschwindigkeit und Komfort in den Branchen weiterhin an erster Stelle stehen, wird die Nachfrage nach tragbaren Testgeräten voraussichtlich steigen. Dies bietet Herstellern eine starke Marktchance, Innovationen zu entwickeln und diese Anforderungen zu erfüllen.

- Ausbau des Elektrofahrzeugs

Die Expansion des Marktes für Elektrofahrzeuge (EV) führt zu einer erheblichen Nachfrage nach spezialisierten Test- und Messgeräten, insbesondere für Komponenten wie Batterien, Ladesysteme und Leistungselektronik. Da Elektrofahrzeuge immer mehr zum Mainstream werden, benötigen Hersteller fortschrittliche Testlösungen, um die Leistung, Sicherheit und Zuverlässigkeit dieser kritischen Systeme sicherzustellen. Dies schafft neue Möglichkeiten für Geräteanbieter, innovative Testwerkzeuge zu entwickeln, die den besonderen Anforderungen der EV-Branche gerecht werden, wie z. B. Hochspannungstests, Batteriemanagementsysteme und Bewertungen der Ladeinfrastruktur. Da der EV-Markt weiter wächst, wird die Nachfrage nach solchen Spezialgeräten voraussichtlich steigen, was Anbietern in diesem Sektor erhebliches Wachstumspotenzial bietet.

Einschränkungen/Herausforderungen

- Komplexität der Integration

Da die Industrien immer weiter auf fortschrittliche Technologien setzen, wird die Integration von Test- und Messgeräten in bestehende Systeme immer komplexer und zeitaufwändiger. Die vielfältigen Technologien, von Automatisierungssystemen bis hin zu IoT-Netzwerken, erfordern Testgeräte, die sich nahtlos mit Altsystemen verbinden und mit diesen funktionieren. Diese Integration erfordert oft Fachkenntnisse, sowohl in Bezug auf Hardwarekompatibilität als auch Softwarekonfiguration. Infolgedessen können die Kosten und technischen Herausforderungen im Zusammenhang mit der Bereitstellung neuer Testgeräte erheblich steigen. Unternehmen müssen in qualifiziertes Personal und Ressourcen investieren, um eine ordnungsgemäße Integration sicherzustellen, was die Implementierung verzögern und die Gesamtkosten erhöhen kann, was eine erhebliche Herausforderung für den Markt darstellt.

- Begrenzte Verfügbarkeit qualifizierter Arbeitskräfte

Aufgrund der Spezialisierung von Test- und Messgeräten müssen Unternehmen qualifiziertes Personal beschäftigen, das diese hochentwickelten Geräte bedienen, kalibrieren und warten kann. In vielen Regionen herrscht jedoch ein Mangel an qualifizierten Arbeitskräften, insbesondere in Schwellenländern, wo das erforderliche technische Fachwissen möglicherweise begrenzt ist. Diese Qualifikationslücke stellt eine erhebliche Einschränkung für Unternehmen dar, die neue Test- und Messtechnologien einführen und effektiv nutzen möchten. Ohne geschulte Fachkräfte haben Unternehmen möglicherweise Schwierigkeiten, die Geräte effizient einzusetzen, was zu Unterauslastung oder Betriebsfehlern führt. Folglich kann dieser Mangel an qualifizierten Arbeitskräften das Wachstum und die Einführung von Test- und Messgeräten behindern, insbesondere in Entwicklungsländern.

Dieser Marktbericht enthält Einzelheiten zu neuen Entwicklungen, Handelsvorschriften, Import-Export-Analysen, Produktionsanalysen, Wertschöpfungskettenoptimierungen, Marktanteilen, Auswirkungen inländischer und lokaler Marktteilnehmer, analysiert Chancen in Bezug auf neue Einnahmequellen, Änderungen der Marktvorschriften, strategische Marktwachstumsanalysen, Marktgröße, Kategoriemarktwachstum, Anwendungsnischen und -dominanz, Produktzulassungen, Produkteinführungen, geografische Expansionen und technologische Innovationen auf dem Markt. Um weitere Informationen zum Markt zu erhalten, wenden Sie sich an Data Bridge Market Research, um einen Analystenbericht zu erhalten. Unser Team hilft Ihnen dabei, eine fundierte Marktentscheidung zu treffen, um Marktwachstum zu erzielen.

Marktumfang für Test- und Messgeräte

Der Markt ist nach Produkttyp, Servicetyp und Endbenutzer segmentiert. Das Wachstum dieser Segmente hilft Ihnen bei der Analyse schwacher Wachstumssegmente in den Branchen und bietet den Benutzern einen wertvollen Marktüberblick und Markteinblicke, die ihnen bei der strategischen Entscheidungsfindung zur Identifizierung der wichtigsten Marktanwendungen helfen.

Produkttyp

- Allgemeine Prüfgeräte

- Mechanische Prüfgeräte

Diensttyp

- Kalibrierungsdienste

- Reparaturdienste/Kundendienst

- Andere Dienstleistungen

Endbenutzer

- Automobil und Transport

- Luft- und Raumfahrt und Verteidigung

- IT und Telekommunikation

- Bildung und Regierung

- Halbleiter und Elektronik

- Industrie

- Gesundheitspflege

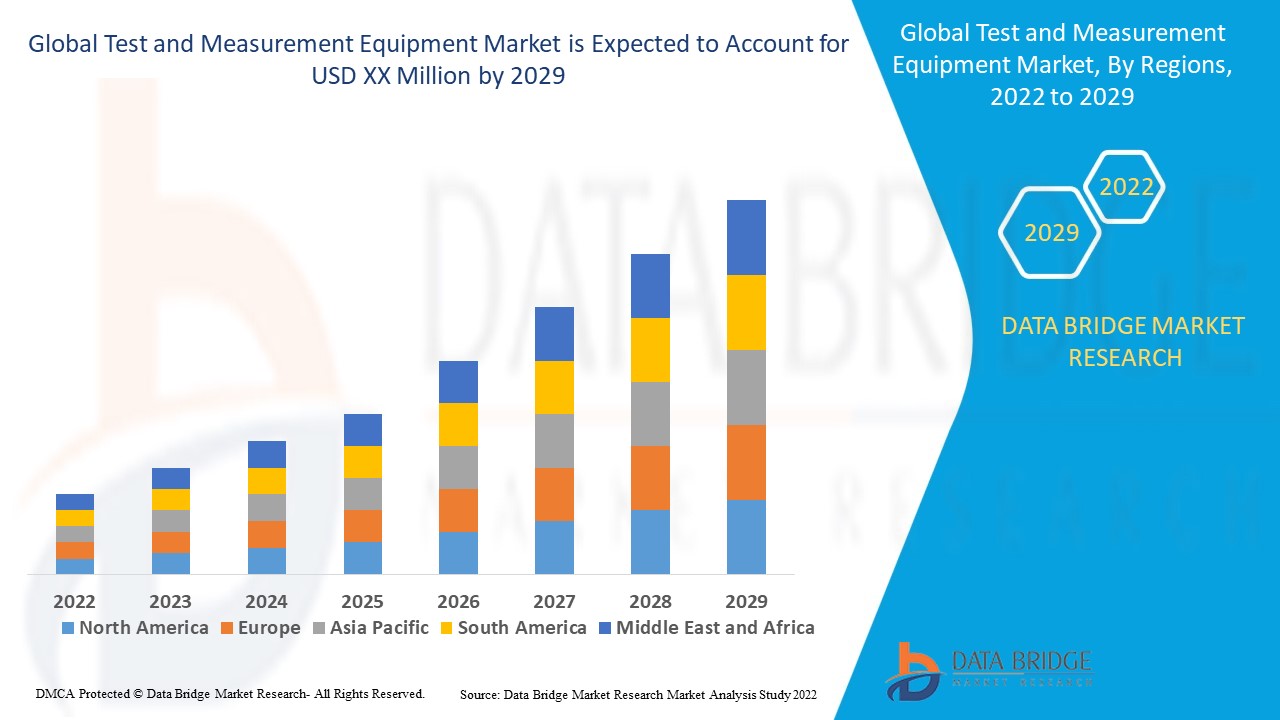

Regionale Analyse des Marktes für Prüf- und Messgeräte

Der Markt wird analysiert und es werden Einblicke in die Marktgröße und Trends nach Land, Produkttyp, Servicetyp und Endbenutzer wie oben angegeben bereitgestellt.

Die im Marktbericht abgedeckten Länder sind die USA, Kanada und Mexiko in Nordamerika, Deutschland, Frankreich, Großbritannien, Niederlande, Schweiz, Belgien, Russland, Italien, Spanien, Türkei, Restliches Europa in Europa, China, Japan, Indien, Südkorea, Singapur, Malaysia, Australien, Thailand, Indonesien, Philippinen, Restlicher Asien-Pazifik-Raum (APAC) in Asien-Pazifik (APAC), Saudi-Arabien, Vereinigte Arabische Emirate, Südafrika, Ägypten, Israel, Restlicher Naher Osten und Afrika (MEA) als Teil von Naher Osten und Afrika (MEA), Brasilien, Argentinien und Restliches Südamerika als Teil von Südamerika.

Nordamerika ist Marktführer für Prüf- und Messgeräte, angetrieben durch die steigende Nachfrage in Schlüsselindustrien wie der Automobil-, Elektronik- und Elektroindustrie. Die starke technologische Infrastruktur der Region und Innovationen in den Herstellungsprozessen treiben dieses Wachstum zusätzlich an. Darüber hinaus tragen die Präsenz wichtiger Branchenakteure und hohe Investitionen in Forschung und Entwicklung zur Marktdominanz Nordamerikas bei.

Der asiatisch-pazifische Raum dürfte in diesem Zeitraum die höchste durchschnittliche jährliche Wachstumsrate (CAGR) aufweisen, was auf die steigende Nachfrage nach leistungsstarken und energieeffizienten elektronischen Geräten zurückzuführen ist. Die wachsende Produktionsbasis der Region und die technologischen Fortschritte beschleunigen dieses Wachstum zusätzlich. Darüber hinaus tragen der gestiegene Konsum von Unterhaltungselektronik und Investitionen in die Halbleiterindustrie zum Anstieg der Nachfrage nach Test- und Messgeräten bei.

Der Länderabschnitt des Berichts enthält auch Angaben zu einzelnen marktbeeinflussenden Faktoren und Änderungen der Regulierung auf dem Inlandsmarkt, die sich auf die aktuellen und zukünftigen Trends des Marktes auswirken. Datenpunkte wie Downstream- und Upstream-Wertschöpfungskettenanalysen, technische Trends und Porters Fünf-Kräfte-Analyse sowie Fallstudien sind einige der Anhaltspunkte, die zur Prognose des Marktszenarios für einzelne Länder verwendet werden. Bei der Prognoseanalyse der Länderdaten werden auch die Präsenz und Verfügbarkeit globaler Marken und ihre Herausforderungen aufgrund großer oder geringer Konkurrenz durch lokale und inländische Marken sowie die Auswirkungen inländischer Zölle und Handelsrouten berücksichtigt.

Marktanteil von Test- und Messgeräten

Die Wettbewerbslandschaft des Marktes liefert Einzelheiten zu den einzelnen Wettbewerbern. Die enthaltenen Einzelheiten umfassen Unternehmensübersicht, Unternehmensfinanzen, erzielten Umsatz, Marktpotenzial, Investitionen in Forschung und Entwicklung, neue Marktinitiativen, globale Präsenz, Produktionsstandorte und -anlagen, Produktionskapazitäten, Stärken und Schwächen des Unternehmens, Produkteinführung, Produktbreite und -umfang, Anwendungsdominanz. Die oben angegebenen Datenpunkte beziehen sich nur auf den Fokus der Unternehmen in Bezug auf den Markt.

Die auf dem Markt tätigen Marktführer für Test- und Messgeräte sind:

- Fortive (USA)

- Anritsu (Japan)

- Rohde & Schwarz (Deutschland)

- Keysight Technologies (USA)

- ADVANTEST CORPORATION (Japan)

- VIAVI Solutions Inc. (USA)

- Yokogawa India Ltd. (Japan)

- EXFO Inc. (Kanada)

- Teledyne Technologies Incorporated. (USA)

- Texas Instruments Incorporated (USA)

- NATIONAL INSTRUMENTS CORP (USA)

Neueste Entwicklungen auf dem Markt für Test- und Messgeräte

- In July 2024, VIAVI Solutions Inc. introduced NITRO Fiber Sensing, a comprehensive real-time asset monitoring and analytics solution. This innovative platform is designed to enhance the security and performance of critical infrastructure, including oil, gas, and water pipelines, as well as electrical power transmission and border security systems. The solution also optimizes data center interconnects, offering advanced monitoring capabilities for a variety of industries

- In July 2024, VIAVI Solutions Inc. partnered with the Telecom Infra Project (TIP) to enhance the testing capabilities of its Automated Lab-as-a-Service for Open RAN (VALOR). This collaboration, supported by a USD 21.7 million grant from the US National Telecommunications and Information Administration (NTIA) Public Wireless Supply Chain Innovation Fund (PWSCIF), aims to provide automated, transparent testing and integration for Open RAN. VALOR will support certification for new entrants, startups, and academia in the US, ensuring the interoperability, security, and performance of Open RAN components

- In May 2024, Rohde & Schwarz launched the MXO 5C series, a new line of compact oscilloscopes with bandwidths of up to 2 GHz. This 2U-high oscilloscope/digitizer is designed for rack-mounted setups and applications requiring a low-profile form factor. The MXO 5C series delivers the same high performance as the MXO 5 series, but without an integrated display and with a reduced vertical height, offering more flexible installation options

- In May 2024, Anritsu Corporation launched the Site Master MS2085A cable and antenna analyzer, along with the MS2089A, which integrates a spectrum analyzer. These advanced tools are designed to improve maintenance and installation processes, meeting a wide range of needs within the general-purpose market. The new products are aimed at enhancing testing efficiency and supporting diverse applications in the field

- In May 2024, ADVANTEST CORPORATION introduced the DC Scale XHC32 power supply, equipped with 32 channels and a total current capacity of up to 640A. This ultra-high-current power supply is designed for the V93000 EXA Scale SoC test system to meet the growing power requirements of advanced technologies such as artificial intelligence accelerators, high-performance computing chips (HPCs), GPUs, network switches, and high-end application processors. The new solution addresses the increasing power demands of cutting-edge electronic devices and systems

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.